by Bryan Perry

August 29, 2023

Following Fed Chair Powell’s speech in Jackson Hole last Friday, stocks initially traded off but were able to grind out a positive close to finish the week, with the S&P and Nasdaq posting gains while the Dow ended fractionally lower. Powell’s preface to his concluding comment – that “we are navigating by the stars under cloudy skies” – was a bit poetic, but also confusing, considering the reams of real-time, backward-looking and forward-looking data that the Fed’s 400 PhD economists collect 24/7/365.

Some of the key economic reports of late suggest that the 11 rate hikes that began March 17, 2022 are having their effect on several areas of the economy. Existing home sales decreased 2.2% month-over-month in July. Home sales were down 16.5% from the same period a year ago. Inventory for existing homes for sale remains tight and affordability is adversely impacted by high prices and mortgage rates.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

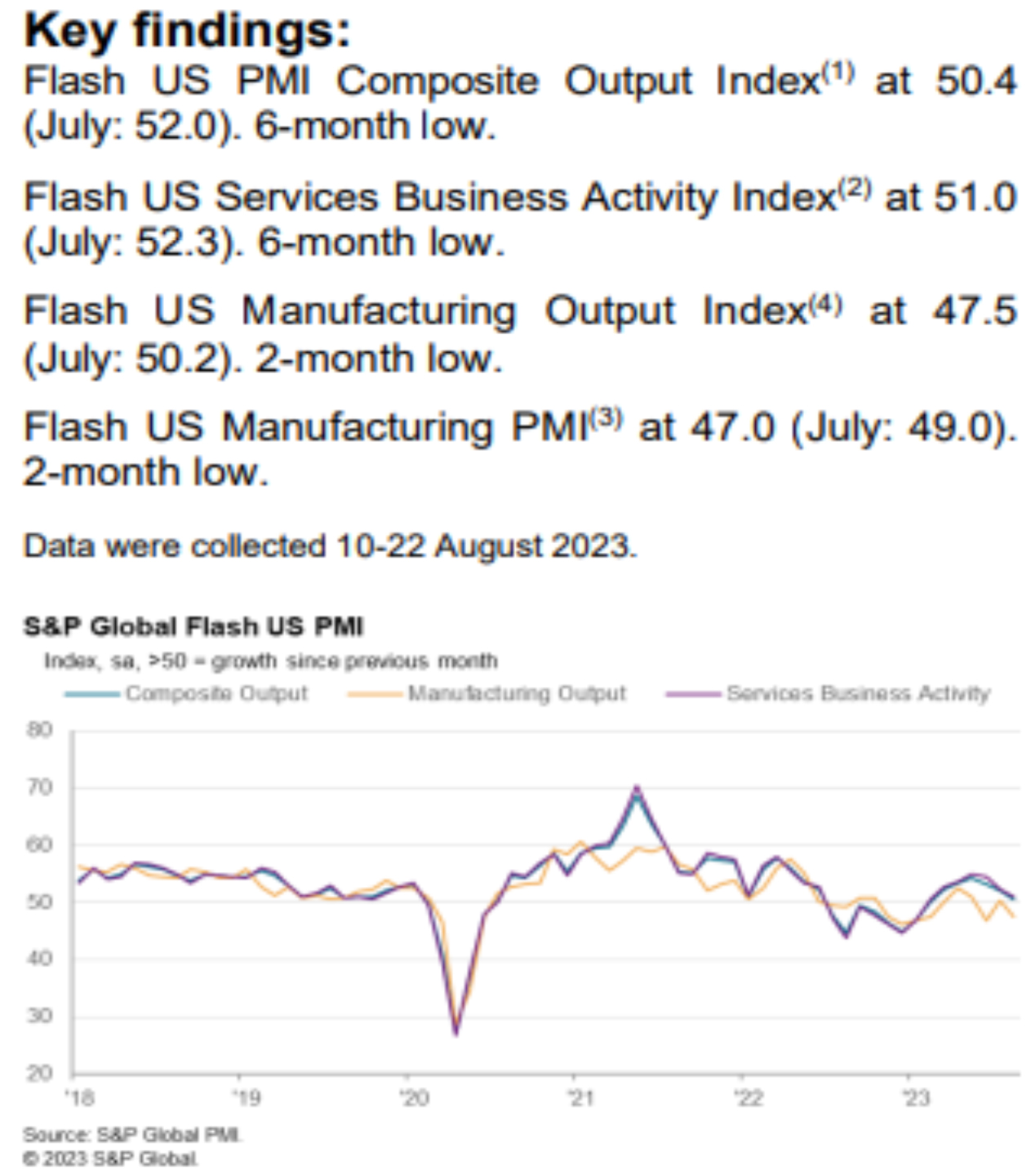

The August S&P Global Flash U.S. Composite Purchasing Managers Index (PMI) is stagnant, reflecting lower demand: “Softer demand conditions were evidenced by the first decrease in new orders at U.S. firms since February. Manufacturers faced greater challenges driving demand as new orders fell at a quicker pace, while service providers saw the fastest drop in new business since the start of the year.”

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

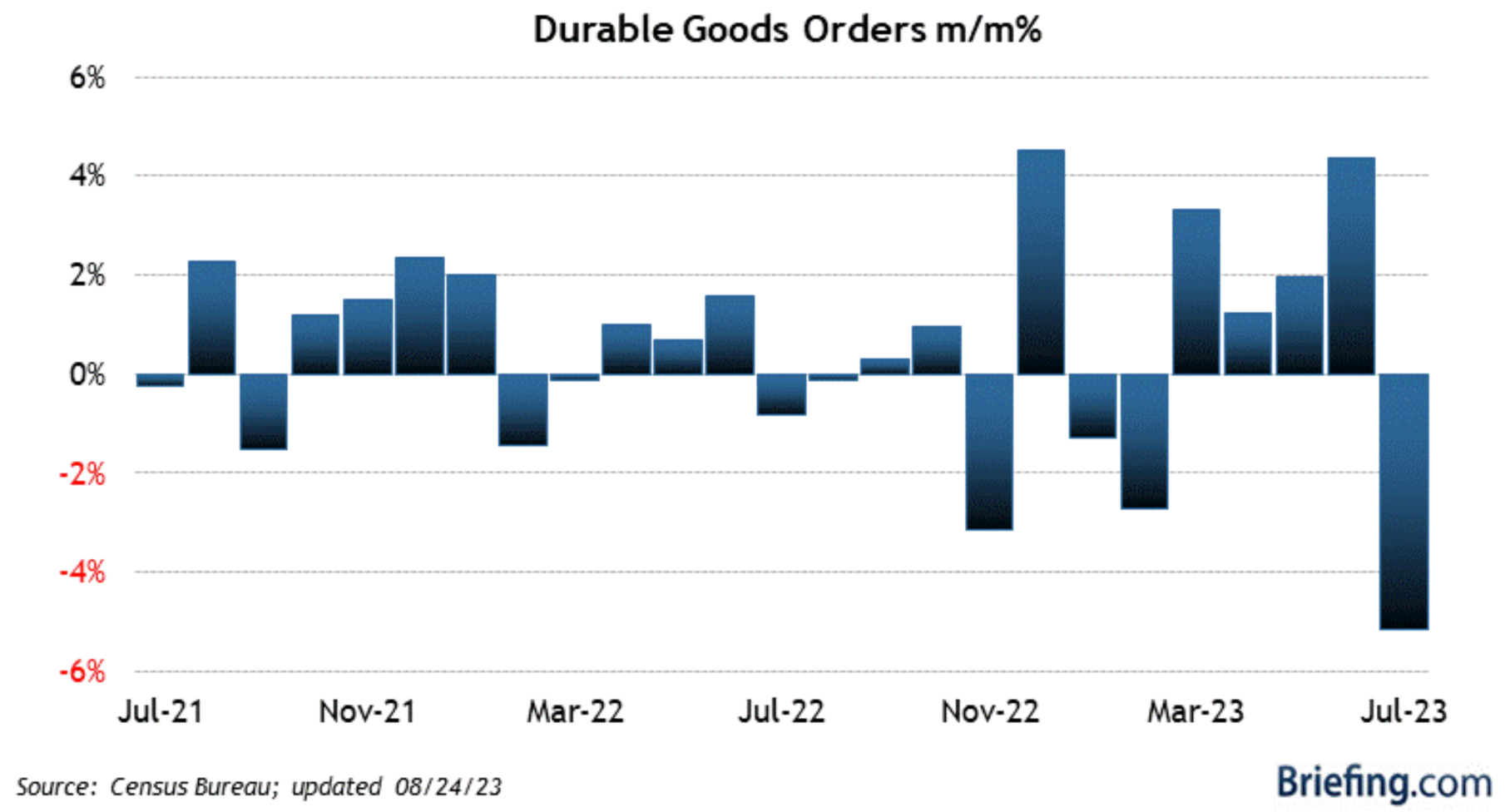

Durable goods orders declined 5.2% (month-over-month) in July, led by a 14.3% drop in transportation equipment. Even stripping out the transportation component, business spending happened at a slow pace, evidenced by the 0.1% increase in new orders for all other non-defense capital goods.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

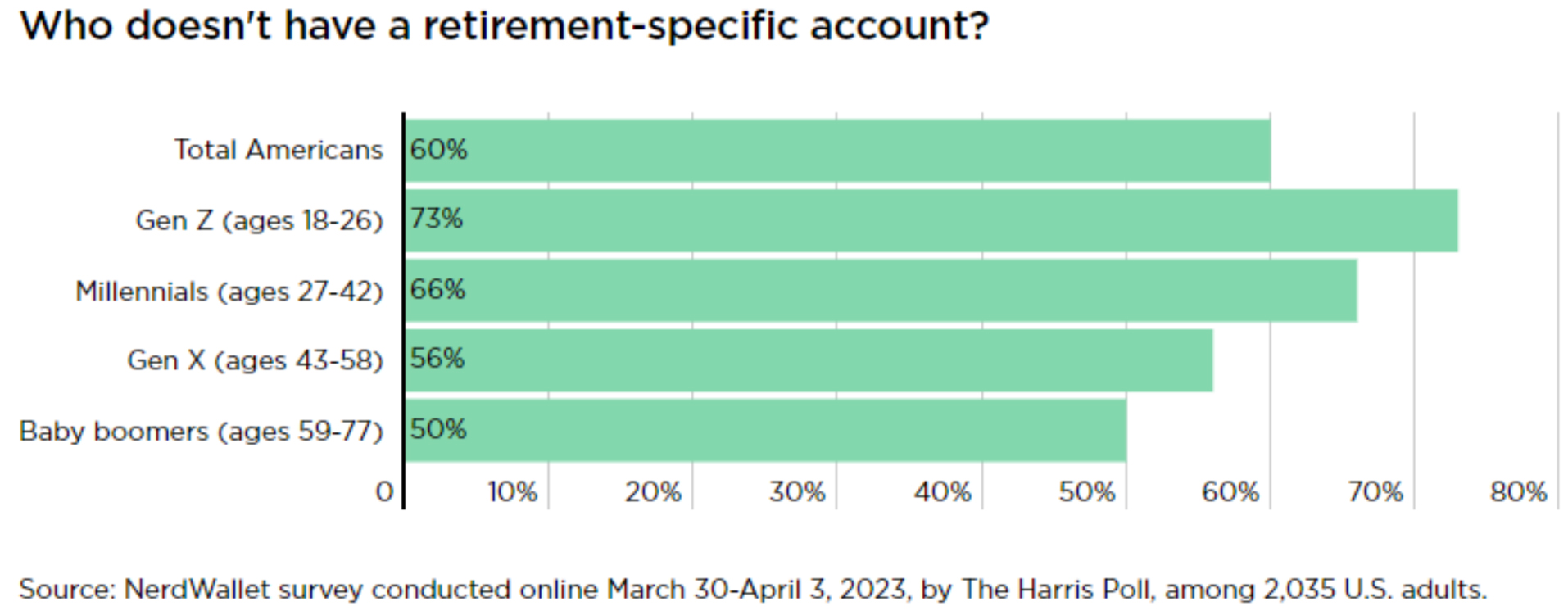

The August University of Michigan Consumer Confidence index came in at 69.5 vs. a consensus forecast of 71.2 – suggesting that consumers are looking at curtailing spending heading into the fall. It makes me wonder who gets surveyed for these consumer confidence readings when nearly 7 out of 10 Americans have no savings to pay bills beyond 30 days, and nearly half don’t have ready cash for a small emergency.

A recent Bank rate report found that in the event of a major emergency, 68% of survey takers said they wouldn’t be able to cover their living expenses for a month if they lost their job today. Fewer than half (45%) of Americans would be able to cover a $1,000 emergency expense without turning to a credit card.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

The July 11 Washington Post reported, “Businesses are starting to cut workers’ hours, forcing hundreds of thousands of people into part-time roles, in what could be an early warning sign for the economy,” adding, “The number of people who worked part time, but want to work full time, rose by 452,000 in June, the biggest jump in more than three years, according to the Bureau of Labor Statistics. In all, 4.2 million people were employed part time for economic reasons beyond their control, a 12 percent increase from the month before.” Economists suspect the latest spike in involuntary part-time work could be a harbinger of coming layoffs, especially when combined with other signs of a slowing job market.

The Washington Post report continues: “Looking at this indicator — along with two straight months of decline in Black employment — gives me a bit of pause,” said Michele Evermore, senior fellow at the Century Foundation and former deputy director at the Labor Department. “I don’t mean to be Chicken Little here, but this does tend to be a leading indicator that things are starting to slow down.”

Joshua Mask, an economics professor at Temple University, says that in every recession since 1980, a marked increase in involuntary part-time work has predicted a downturn in the coming months. U.S. households are sitting on nearly $1 trillion in credit card debt and are turning to buy-now-pay later services for groceries, as they hit credit limits with rates averaging 24% for outstanding credit card debt. (“Americans using ‘buy now, pay later’ apps to contend with high grocery prices” Washington Post, July 12, 2003.)

This week, a tsunami of economic data will roll over the news tape, moving both bond and stock prices. Data on inflation, jobs, housing, retail, wholesale, construction, and manufacturing will highlight a back-end loaded week. Below is a data table for referencing what to expect compared to what will be reported.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

As we head into an extended Labor Day weekend, it will be nice to put August in the rear-view mirror. August is often a tough month for the market – and this August is no exception, as bond yields spiked to multi-year highs – but if the economic calendar is kind to us this week, and bond yields begin to recede, September could bring about some better conditions on Wall Street.

Other than celebrating the contributions and achievements of 155 million working men and women currently in our U.S. Labor Force, let me close with a few other fun facts about Labor Day:

- Oregon was the first state to declare Labor Day as an official holiday in 1887.

- Congress passed the Act in 1894 making the first Monday of September a national Labor Day.

- Besides kicking off the school year, and the college and NFL football seasons, Labor Day marks the opening of the first Waffle House. (I know this because my grandsons love the Waffle House. It’s open 24/7, 365 days per year. Don’t ask me why. I’m old fashioned. I prefer Silver Diner!)

All content above represents the opinion of Bryan Perry of Navellier & Associates, Inc.

Also In This Issue

A Look Ahead by Louis Navellier

Wall Street Likes to Add Volatility to the August Doldrums

Income Mail by Bryan Perry

Stocks Are Looking to Make Peace with The Bond Market

Growth Mail by Gary Alexander

Jerome Powell’s “Dream Speech” at Jackson Hole, 2025

Global Mail by Ivan Martchev

The Stock Market Reaches Another Fork in the Road

Sector Spotlight by Jason Bodner

Why Good Stocks Go Down in Price…on Good News

View Full Archive

Read Past Issues Here

Bryan Perry

SENIOR DIRECTOR

Bryan Perry is a Senior Director with Navellier Private Client Group, advising and facilitating high net worth investors in the pursuit of their financial goals.

Bryan’s financial services career spanning the past three decades includes over 20 years of wealth management experience with Wall Street firms that include Bear Stearns, Lehman Brothers and Paine Webber, working with both retail and institutional clients. Bryan earned a B.A. in Political Science from Virginia Polytechnic Institute & State University and currently holds a Series 65 license. All content of “Income Mail” represents the opinion of Bryan Perry

Important Disclosures:

Although information in these reports has been obtained from and is based upon sources that Navellier believes to be reliable, Navellier does not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute Navellier’s judgment as of the date the report was created and are subject to change without notice. These reports are for informational purposes only and are not a solicitation for the purchase or sale of a security. Any decision to purchase securities mentioned in these reports must take into account existing public information on such securities or any registered prospectus.To the extent permitted by law, neither Navellier & Associates, Inc., nor any of its affiliates, agents, or service providers assumes any liability or responsibility nor owes any duty of care for any consequences of any person acting or refraining to act in reliance on the information contained in this communication or for any decision based on it.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any securities recommendations made by Navellier. in the future will be profitable or equal the performance of securities made in this report. Dividend payments are not guaranteed. The amount of a dividend payment, if any, can vary over time and issuers may reduce dividends paid on securities in the event of a recession or adverse event affecting a specific industry or issuer.

None of the stock information, data, and company information presented herein constitutes a recommendation by Navellier or a solicitation to buy or sell any securities. Any specific securities identified and described do not represent all of the securities purchased, sold, or recommended for advisory clients. The holdings identified do not represent all of the securities purchased, sold, or recommended for advisory clients and the reader should not assume that investments in the securities identified and discussed were or will be profitable.

Information presented is general information that does not take into account your individual circumstances, financial situation, or needs, nor does it present a personalized recommendation to you. Individual stocks presented may not be suitable for every investor. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. Investment in fixed income securities has the potential for the investment return and principal value of an investment to fluctuate so that an investor’s holdings, when redeemed, may be worth less than their original cost.

One cannot invest directly in an index. Index is unmanaged and index performance does not reflect deduction of fees, expenses, or taxes. Presentation of Index data does not reflect a belief by Navellier that any stock index constitutes an investment alternative to any Navellier equity strategy or is necessarily comparable to such strategies. Among the most important differences between the Indices and Navellier strategies are that the Navellier equity strategies may (1) incur material management fees, (2) concentrate its investments in relatively few stocks, industries, or sectors, (3) have significantly greater trading activity and related costs, and (4) be significantly more or less volatile than the Indices.

ETF Risk: We may invest in exchange traded funds (“ETFs”) and some of our investment strategies are generally fully invested in ETFs. Like traditional mutual funds, ETFs charge asset-based fees, but they generally do not charge initial sales charges or redemption fees and investors typically pay only customary brokerage fees to buy and sell ETF shares. The fees and costs charged by ETFs held in client accounts will not be deducted from the compensation the client pays Navellier. ETF prices can fluctuate up or down, and a client account could lose money investing in an ETF if the prices of the securities owned by the ETF go down. ETFs are subject to additional risks:

- ETF shares may trade above or below their net asset value;

- An active trading market for an ETF’s shares may not develop or be maintained;

- The value of an ETF may be more volatile than the underlying portfolio of securities the ETF is designed to track;

- The cost of owning shares of the ETF may exceed those a client would incur by directly investing in the underlying securities; and

- Trading of an ETF’s shares may be halted if the listing exchange’s officials deem it appropriate, the shares are delisted from the exchange, or the activation of market-wide “circuit breakers” (which are tied to large decreases in stock prices) halts stock trading generally.

Grader Disclosures: Investment in equity strategies involves substantial risk and has the potential for partial or complete loss of funds invested. The sample portfolio and any accompanying charts are for informational purposes only and are not to be construed as a solicitation to buy or sell any financial instrument and should not be relied upon as the sole factor in an investment making decision. As a matter of normal and important disclosures to you, as a potential investor, please consider the following: The performance presented is not based on any actual securities trading, portfolio, or accounts, and the reported performance of the A, B, C, D, and F portfolios (collectively the “model portfolios”) should be considered mere “paper” or pro forma performance results based on Navellier’s research.

Investors evaluating any of Navellier & Associates, Inc.’s, (or its affiliates’) Investment Products must not use any information presented here, including the performance figures of the model portfolios, in their evaluation of any Navellier Investment Products. Navellier Investment Products include the firm’s mutual funds and managed accounts. The model portfolios, charts, and other information presented do not represent actual funded trades and are not actual funded portfolios. There are material differences between Navellier Investment Products’ portfolios and the model portfolios, research, and performance figures presented here. The model portfolios and the research results (1) may contain stocks or ETFs that are illiquid and difficult to trade; (2) may contain stock or ETF holdings materially different from actual funded Navellier Investment Product portfolios; (3) include the reinvestment of all dividends and other earnings, estimated trading costs, commissions, or management fees; and, (4) may not reflect prices obtained in an actual funded Navellier Investment Product portfolio. For these and other reasons, the reported performances of model portfolios do not reflect the performance results of Navellier’s actually funded and traded Investment Products. In most cases, Navellier’s Investment Products have materially lower performance results than the performances of the model portfolios presented.

This report contains statements that are, or may be considered to be, forward-looking statements. All statements that are not historical facts, including statements about our beliefs or expectations, are “forward-looking statements” within the meaning of The U.S. Private Securities Litigation Reform Act of 1995. These statements may be identified by such forward-looking terminology as “expect,” “estimate,” “plan,” “intend,” “believe,” “anticipate,” “may,” “will,” “should,” “could,” “continue,” “project,” or similar statements or variations of such terms. Our forward-looking statements are based on a series of expectations, assumptions, and projections, are not guarantees of future results or performance, and involve substantial risks and uncertainty as described in Form ADV Part 2A of our filing with the Securities and Exchange Commission (SEC), which is available at www.adviserinfo.sec.gov or by requesting a copy by emailing info@navellier.com. All of our forward-looking statements are as of the date of this report only. We can give no assurance that such expectations or forward-looking statements will prove to be correct. Actual results may differ materially. You are urged to carefully consider all such factors.

FEDERAL TAX ADVICE DISCLAIMER: As required by U.S. Treasury Regulations, you are informed that, to the extent this presentation includes any federal tax advice, the presentation is not written by Navellier to be used, and cannot be used, for the purpose of avoiding federal tax penalties. Navellier does not advise on any income tax requirements or issues. Use of any information presented by Navellier is for general information only and does not represent tax advice either express or implied. You are encouraged to seek professional tax advice for income tax questions and assistance.

IMPORTANT NEWSLETTER DISCLOSURE:The hypothetical performance results for investment newsletters that are authored or edited by Louis Navellier, including Louis Navellier’s Growth Investor, Louis Navellier’s Breakthrough Stocks, Louis Navellier’s Accelerated Profits, and Louis Navellier’s Platinum Club, are not based on any actual securities trading, portfolio, or accounts, and the newsletters’ reported hypothetical performances should be considered mere “paper” or proforma hypothetical performance results and are not actual performance of real world trades. Navellier & Associates, Inc. does not have any relation to or affiliation with the owner of these newsletters. There are material differences between Navellier Investment Products’ portfolios and the InvestorPlace Media, LLC newsletter portfolios authored by Louis Navellier. The InvestorPlace Media, LLC newsletters contain hypothetical performance that do not include transaction costs, advisory fees, or other fees a client might incur if actual investments and trades were being made by an investor. As a result, newsletter performance should not be used to evaluate Navellier Investment services which are separate and different from the newsletters. The owner of the newsletters is InvestorPlace Media, LLC and any questions concerning the newsletters, including any newsletter advertising or hypothetical Newsletter performance claims, (which are calculated solely by Investor Place Media and not Navellier) should be referred to InvestorPlace Media, LLC at (800) 718-8289.

Please note that Navellier & Associates and the Navellier Private Client Group are managed completely independent of the newsletters owned and published by InvestorPlace Media, LLC and written and edited by Louis Navellier, and investment performance of the newsletters should in no way be considered indicative of potential future investment performance for any Navellier & Associates separately managed account portfolio. Potential investors should consult with their financial advisor before investing in any Navellier Investment Product.

Navellier claims compliance with Global Investment Performance Standards (GIPS). To receive a complete list and descriptions of Navellier’s composites and/or a presentation that adheres to the GIPS standards, please contact Navellier or click here. It should not be assumed that any securities recommendations made by Navellier & Associates, Inc. in the future will be profitable or equal the performance of securities made in this report.

FactSet Disclosure: Navellier does not independently calculate the statistical information included in the attached report. The calculation and the information are provided by FactSet, a company not related to Navellier. Although information contained in the report has been obtained from FactSet and is based on sources Navellier believes to be reliable, Navellier does not guarantee its accuracy, and it may be incomplete or condensed. The report and the related FactSet sourced information are provided on an “as is” basis. The user assumes the entire risk of any use made of this information. Investors should consider the report as only a single factor in making their investment decision. The report is for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of a security. FactSet sourced information is the exclusive property of FactSet. Without prior written permission of FactSet, this information may not be reproduced, disseminated or used to create any financial products. All indices are unmanaged and performance of the indices include reinvestment of dividends and interest income, unless otherwise noted, are not illustrative of any particular investment and an investment cannot be made in any index. Past performance is no guarantee of future results.