by Gary Alexander

August 29, 2023

Yesterday marked the 60th anniversary of Dr. Martin Luther King’s “I Have a Dream” speech, delivered in Washington, DC. I remember it well. It was a Wednesday. It also marked the first day I set foot on my college campus. Dr. King’s speech was inspiring to me, delivered from the heart, and it marked the start of a major, long overdue reform in civil rights. On a less personal but equally overdue challenge, we need to address the runaway deficit spending that could bankrupt our nation, but nobody seems to be willing to start the dialogue. Politicians aren’t ready to promise less pork to the people. It’s a job for a money man.

Jerome Powell’s term lasts almost three more years, until May of 2026. By then, the 2024 election will be long gone. Powell has already seen enough politics to last a lifetime, so he may be ready to tell the truth by 2025. At Jackson Hole this year, Powell delivered 2,046 words, but if he took some truth serum and spoke from his heart, he might deliver a 2025 valedictory address of only one-third that length, like this:

“My fellow central bankers, investors, and all politicians with an ear to hear, I will not seek, neither will I accept, another term as your Federal Reserve Chairman next year. It has been a very educational eight years, which – like our Presidents – should mark the term limit for Fed Chairs. I have learned from my many mistakes, but it’s time for someone else to learn from their own mistakes. Before I share what’s most on my mind today, let me look in the mirror and admit my own mistakes. Most recently, I and my colleagues helped cause high inflation by printing too much electronic money in late 2020 and 2021; then we mis-labeled that high inflation as ‘transitory’ for nearly all of the remainder of 2021. Then, we waited too long to end Quantitative Easing (QE) while failing to raise rates above their unsustainable zero-level until April of 2022. Then we raised them too far, too fast, at the fastest rate in history, to well above 5%.

“I could spend the rest of my allotted time going over our other past mistakes, but it’s time to look at what the Fed can and cannot do. We have been assigned two mandates – low inflation and low unemployment rates. Some want us to add a third mandate – lower global temperatures, but I made it clear in early 2023 that we will not add a third mandate as ‘climate controller.’ In fact, I would also question our initial two mandates, which are based on the outdated and disproved “Phillips Curve,” concerning the alleged trade-off between inflation and employment. We have no control over the job market, nor can we force those who won’t work to accept jobs when politicians pay them more to remain idle. I would simply revert to our two founding mandates – (1) to keep the U.S. dollar reliable and strong through slow money creation tied to population and economic growth, and (2) to supervise bank stability through our 12 Fed Districts.

“The part of my job I will miss the least is appearing before Congressional committees way too often and there to be lectured by spendthrift blowhards on how we should manage the nation’s money, or to be told that we are not doing enough to create new jobs in their district. How long will these elected officials fail to do their Constitutional duty and then put someone else in the proverbial ‘hot seat’ to take the blame?

“As a central banker, we can raise or lower short-term interest rates, or add to our balance sheet, but we cannot do what our frequent Inquisitors in Congress keep demanding of us in their open hearings – tasks which are really their mandate, not ours. We cannot stop the profligate spending of the President and the majority of Congress. We cannot address fiscal policy – spending – we can only address monetary policy.

“We are nearing the point of no return in our national debt, at $35 trillion and growing by $2 trillion per year in times of relative peace and prosperity, which is unprecedented in our history. We have abandoned all caution in spending for at least 25 years ago, after 9/11. Few politicians of either major party take this threat seriously. At an average 5.7% interest, we are spending $2 trillion a year on debt service alone.

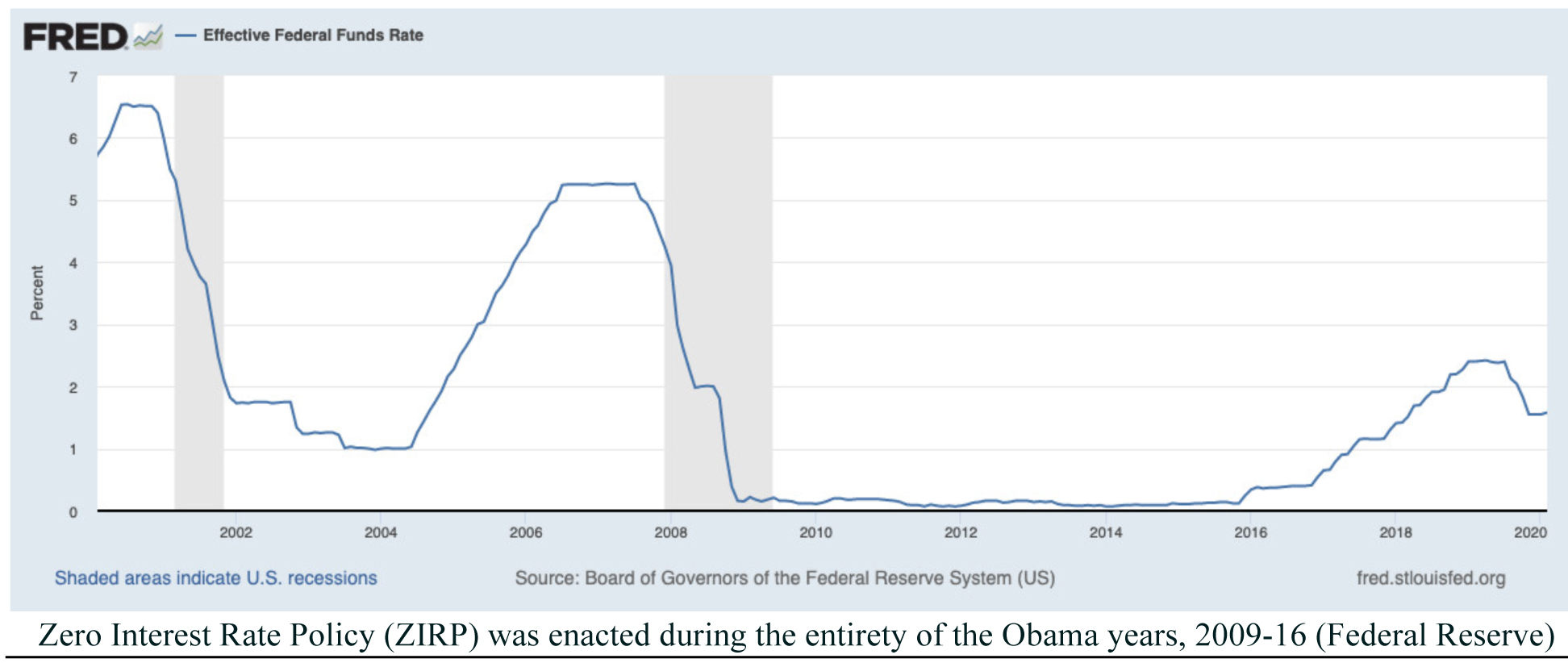

“For a way to put our budget where my mouth is, I volunteer to cut our central bank payroll by 90%, including any future pay, severance package, benefits, or pension I may have earned. We don’t need 400 PhD economists to keep turning out failed forecasts based on our faulty Keynesian template. We don’t need to offer any future President ‘training wheels’ of zero-percent interest rates for eight years, as my predecessors did for President Obama, on the theory that the greatest economy in the history of the world was too fragile to recover from the 2008 financial crisis by returning to normal monetary policies. We don’t need committees and economic models to figure out how much money we need to match population and GDP growth. As Milton Friedman said years ago, we could be replaced by a few good algorithms.

“So, I’ve thrown down the gauntlet for you, Mr. President and Congress. I’m willing to cut 90% of our personnel and serve without pay or benefits. Who will follow me – to return our nation to fiscal sanity?”

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

What Powell Actually Said on August 25, 2023

Please realize that everything above was my imagination of a truth-serum “dream speech,” not reality.

“Here’s how Mr. Powell actually concluded his Jackson Hole talk last Friday – through a glass darkly.

“As is often the case, we are navigating by the stars under cloudy skies. In such circumstances, risk-management considerations are critical. At upcoming meetings, we will assess our progress based on the totality of the data and the evolving outlook and risks. Based on this assessment, we will proceed carefully as we decide whether to tighten further or, instead, to hold the policy rate constant and await further data. Restoring price stability is essential to achieving both sides of our dual mandate. We need price stability to achieve a sustained period of strong labor market conditions that benefit all. We will keep at it until the job is done.”

The debt data is not so cloudy, sir, unless you’re a man speaking in code…Maybe two years from now, you will take that truth serum and deliver a dream speech for the ages. We can always hope for miracles.

All content above represents the opinion of Gary Alexander of Navellier & Associates, Inc.

Also In This Issue

A Look Ahead by Louis Navellier

Wall Street Likes to Add Volatility to the August Doldrums

Income Mail by Bryan Perry

Stocks Are Looking to Make Peace with The Bond Market

Growth Mail by Gary Alexander

Jerome Powell’s “Dream Speech” at Jackson Hole, 2025

Global Mail by Ivan Martchev

The Stock Market Reaches Another Fork in the Road

Sector Spotlight by Jason Bodner

Why Good Stocks Go Down in Price…on Good News

View Full Archive

Read Past Issues Here

About The Author

Gary Alexander

SENIOR EDITOR

Gary Alexander has been Senior Writer at Navellier since 2009. He edits Navellier’s weekly Marketmail and writes a weekly Growth Mail column, in which he uses market history to support the case for growth stocks. For the previous 20 years before joining Navellier, he was Senior Executive Editor at InvestorPlace Media (formerly Phillips Publishing), where he worked with several leading investment analysts, including Louis Navellier (since 1997), helping launch Louis Navellier’s Blue Chip Growth and Global Growth newsletters.

Prior to that, Gary edited Wealth Magazine and Gold Newsletter and wrote various investment research reports for Jefferson Financial in New Orleans in the 1980s. He began his financial newsletter career with KCI Communications in 1980, where he served as consulting editor for Personal Finance newsletter while serving as general manager of KCI’s Alexandria House book division. Before that, he covered the economics beat for news magazines. All content of “Growth Mail” represents the opinion of Gary Alexander

Important Disclosures:

Although information in these reports has been obtained from and is based upon sources that Navellier believes to be reliable, Navellier does not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute Navellier’s judgment as of the date the report was created and are subject to change without notice. These reports are for informational purposes only and are not a solicitation for the purchase or sale of a security. Any decision to purchase securities mentioned in these reports must take into account existing public information on such securities or any registered prospectus.To the extent permitted by law, neither Navellier & Associates, Inc., nor any of its affiliates, agents, or service providers assumes any liability or responsibility nor owes any duty of care for any consequences of any person acting or refraining to act in reliance on the information contained in this communication or for any decision based on it.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any securities recommendations made by Navellier. in the future will be profitable or equal the performance of securities made in this report. Dividend payments are not guaranteed. The amount of a dividend payment, if any, can vary over time and issuers may reduce dividends paid on securities in the event of a recession or adverse event affecting a specific industry or issuer.

None of the stock information, data, and company information presented herein constitutes a recommendation by Navellier or a solicitation to buy or sell any securities. Any specific securities identified and described do not represent all of the securities purchased, sold, or recommended for advisory clients. The holdings identified do not represent all of the securities purchased, sold, or recommended for advisory clients and the reader should not assume that investments in the securities identified and discussed were or will be profitable.

Information presented is general information that does not take into account your individual circumstances, financial situation, or needs, nor does it present a personalized recommendation to you. Individual stocks presented may not be suitable for every investor. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. Investment in fixed income securities has the potential for the investment return and principal value of an investment to fluctuate so that an investor’s holdings, when redeemed, may be worth less than their original cost.

One cannot invest directly in an index. Index is unmanaged and index performance does not reflect deduction of fees, expenses, or taxes. Presentation of Index data does not reflect a belief by Navellier that any stock index constitutes an investment alternative to any Navellier equity strategy or is necessarily comparable to such strategies. Among the most important differences between the Indices and Navellier strategies are that the Navellier equity strategies may (1) incur material management fees, (2) concentrate its investments in relatively few stocks, industries, or sectors, (3) have significantly greater trading activity and related costs, and (4) be significantly more or less volatile than the Indices.

ETF Risk: We may invest in exchange traded funds (“ETFs”) and some of our investment strategies are generally fully invested in ETFs. Like traditional mutual funds, ETFs charge asset-based fees, but they generally do not charge initial sales charges or redemption fees and investors typically pay only customary brokerage fees to buy and sell ETF shares. The fees and costs charged by ETFs held in client accounts will not be deducted from the compensation the client pays Navellier. ETF prices can fluctuate up or down, and a client account could lose money investing in an ETF if the prices of the securities owned by the ETF go down. ETFs are subject to additional risks:

- ETF shares may trade above or below their net asset value;

- An active trading market for an ETF’s shares may not develop or be maintained;

- The value of an ETF may be more volatile than the underlying portfolio of securities the ETF is designed to track;

- The cost of owning shares of the ETF may exceed those a client would incur by directly investing in the underlying securities; and

- Trading of an ETF’s shares may be halted if the listing exchange’s officials deem it appropriate, the shares are delisted from the exchange, or the activation of market-wide “circuit breakers” (which are tied to large decreases in stock prices) halts stock trading generally.

Grader Disclosures: Investment in equity strategies involves substantial risk and has the potential for partial or complete loss of funds invested. The sample portfolio and any accompanying charts are for informational purposes only and are not to be construed as a solicitation to buy or sell any financial instrument and should not be relied upon as the sole factor in an investment making decision. As a matter of normal and important disclosures to you, as a potential investor, please consider the following: The performance presented is not based on any actual securities trading, portfolio, or accounts, and the reported performance of the A, B, C, D, and F portfolios (collectively the “model portfolios”) should be considered mere “paper” or pro forma performance results based on Navellier’s research.

Investors evaluating any of Navellier & Associates, Inc.’s, (or its affiliates’) Investment Products must not use any information presented here, including the performance figures of the model portfolios, in their evaluation of any Navellier Investment Products. Navellier Investment Products include the firm’s mutual funds and managed accounts. The model portfolios, charts, and other information presented do not represent actual funded trades and are not actual funded portfolios. There are material differences between Navellier Investment Products’ portfolios and the model portfolios, research, and performance figures presented here. The model portfolios and the research results (1) may contain stocks or ETFs that are illiquid and difficult to trade; (2) may contain stock or ETF holdings materially different from actual funded Navellier Investment Product portfolios; (3) include the reinvestment of all dividends and other earnings, estimated trading costs, commissions, or management fees; and, (4) may not reflect prices obtained in an actual funded Navellier Investment Product portfolio. For these and other reasons, the reported performances of model portfolios do not reflect the performance results of Navellier’s actually funded and traded Investment Products. In most cases, Navellier’s Investment Products have materially lower performance results than the performances of the model portfolios presented.

This report contains statements that are, or may be considered to be, forward-looking statements. All statements that are not historical facts, including statements about our beliefs or expectations, are “forward-looking statements” within the meaning of The U.S. Private Securities Litigation Reform Act of 1995. These statements may be identified by such forward-looking terminology as “expect,” “estimate,” “plan,” “intend,” “believe,” “anticipate,” “may,” “will,” “should,” “could,” “continue,” “project,” or similar statements or variations of such terms. Our forward-looking statements are based on a series of expectations, assumptions, and projections, are not guarantees of future results or performance, and involve substantial risks and uncertainty as described in Form ADV Part 2A of our filing with the Securities and Exchange Commission (SEC), which is available at www.adviserinfo.sec.gov or by requesting a copy by emailing info@navellier.com. All of our forward-looking statements are as of the date of this report only. We can give no assurance that such expectations or forward-looking statements will prove to be correct. Actual results may differ materially. You are urged to carefully consider all such factors.

FEDERAL TAX ADVICE DISCLAIMER: As required by U.S. Treasury Regulations, you are informed that, to the extent this presentation includes any federal tax advice, the presentation is not written by Navellier to be used, and cannot be used, for the purpose of avoiding federal tax penalties. Navellier does not advise on any income tax requirements or issues. Use of any information presented by Navellier is for general information only and does not represent tax advice either express or implied. You are encouraged to seek professional tax advice for income tax questions and assistance.

IMPORTANT NEWSLETTER DISCLOSURE:The hypothetical performance results for investment newsletters that are authored or edited by Louis Navellier, including Louis Navellier’s Growth Investor, Louis Navellier’s Breakthrough Stocks, Louis Navellier’s Accelerated Profits, and Louis Navellier’s Platinum Club, are not based on any actual securities trading, portfolio, or accounts, and the newsletters’ reported hypothetical performances should be considered mere “paper” or proforma hypothetical performance results and are not actual performance of real world trades. Navellier & Associates, Inc. does not have any relation to or affiliation with the owner of these newsletters. There are material differences between Navellier Investment Products’ portfolios and the InvestorPlace Media, LLC newsletter portfolios authored by Louis Navellier. The InvestorPlace Media, LLC newsletters contain hypothetical performance that do not include transaction costs, advisory fees, or other fees a client might incur if actual investments and trades were being made by an investor. As a result, newsletter performance should not be used to evaluate Navellier Investment services which are separate and different from the newsletters. The owner of the newsletters is InvestorPlace Media, LLC and any questions concerning the newsletters, including any newsletter advertising or hypothetical Newsletter performance claims, (which are calculated solely by Investor Place Media and not Navellier) should be referred to InvestorPlace Media, LLC at (800) 718-8289.

Please note that Navellier & Associates and the Navellier Private Client Group are managed completely independent of the newsletters owned and published by InvestorPlace Media, LLC and written and edited by Louis Navellier, and investment performance of the newsletters should in no way be considered indicative of potential future investment performance for any Navellier & Associates separately managed account portfolio. Potential investors should consult with their financial advisor before investing in any Navellier Investment Product.

Navellier claims compliance with Global Investment Performance Standards (GIPS). To receive a complete list and descriptions of Navellier’s composites and/or a presentation that adheres to the GIPS standards, please contact Navellier or click here. It should not be assumed that any securities recommendations made by Navellier & Associates, Inc. in the future will be profitable or equal the performance of securities made in this report.

FactSet Disclosure: Navellier does not independently calculate the statistical information included in the attached report. The calculation and the information are provided by FactSet, a company not related to Navellier. Although information contained in the report has been obtained from FactSet and is based on sources Navellier believes to be reliable, Navellier does not guarantee its accuracy, and it may be incomplete or condensed. The report and the related FactSet sourced information are provided on an “as is” basis. The user assumes the entire risk of any use made of this information. Investors should consider the report as only a single factor in making their investment decision. The report is for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of a security. FactSet sourced information is the exclusive property of FactSet. Without prior written permission of FactSet, this information may not be reproduced, disseminated or used to create any financial products. All indices are unmanaged and performance of the indices include reinvestment of dividends and interest income, unless otherwise noted, are not illustrative of any particular investment and an investment cannot be made in any index. Past performance is no guarantee of future results.