by Gary Alexander

June 13, 2023

It’s time to take a mid-June break to honor the 300th birthday of Adam Smith, who is likely the man most responsible for global growth over the last 250 years. His baptism was listed as June 5, 1723, but that was according to the old-style Julian calendar. According to today’s updated calendar, he was born on June 17.

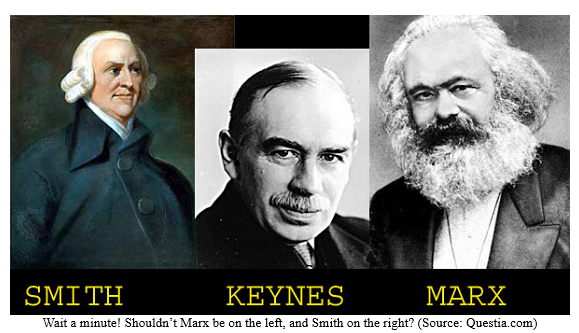

The three most influential economists were born in late spring. All three wrote in Great Britain, but their ideas spread sequentially around the world. Adam Smith was born 300 years ago this weekend in Scotland. Karl Marx was born 205 years ago (May 5, 1818) in Trier, Germany. This year marks (Marx?) the 175th anniversary of his Communist Manifesto (1848), but his most influential work, Das Kapital, was penned in penury, in London. John Maynard Keynes was born 140 years ago (on June 5, 1883) in Cambridge, England. These three are considered the godfathers of the right (Smith), left (Marx), and the golden mean of a democratically elected but centrally controlled economy (Keynesian) “mixed (up) economy.”

It’s ironic that China suffered under Marx (via Mao) for 30 years (1949-78), then flourished with a mixed brand of capitalist vigor for 40 years and now seems to be retreating back to Marxism under Xi, while Europe and America crawl along under Keynesianism. At the 2018 Freedom Fest, to “celebrate” Marx’s bi-centennial, I interviewed economist Dierdre McCloskey about her latest book, “Bourgeois Equality: How Ideas, Not Capital or Institutions, Enriched the World” (2016). It was the third of her “Bourgeois” trilogy of books (by bourgeois, she meant to steal Marx’s denunciation of capitalism by defining the bourgeois as “the hiring or owning or professional or educated class,” basically the entrepreneurs).

Among many fascinating insights, she said, “The Big Economic Story of our times is that the Chinese in 1978 and then the Indians in 1991 adopted liberal [i.e., Adam Smith] ideas in the economy and came to attribute a dignity and liberty to the bourgeoisie formerly denied. And then China and India exploded in economic growth.” India and China certainly had no help from the British, who subjugated India for 90 years and also hooked China on opium. Instead of exporting Adam Smith’s ideas, Britain exported Fabian socialism to the future leaders of India. Jawaharlal Nehru, the first leader of independent India, learned socialism in England. He told Indian businessmen, “Don’t talk to me about profit. Profit is a dirty word.”

India’s spiritual leader, Mahatma Gandhi, agreed, declaring that “there is nothing more disgraceful to man than the principle ‘buy in the cheapest market and sell in the dearest.’” As a result, Indians referred to a 1% rate of growth in the first 40 years of Indian independence as the “Hindu rate of growth.” Since 1991, however, after economic liberalization took root, India has been growing at about 7% per year. The latest edition of The Economist now lists India as the most rapidly growing economy during 2023 (at +6.1%).

These changes are also reflected in India’s culture. Economist Nimish Adhia has shown that India’s leading “Bollywood” films have changed their heroes from government bureaucrats to business leaders and changed their villains from factory owners to corrupt policemen. The same shift is evident in the editorial pages of the Times of India –they now cover businesses more fairly, not as automatic villains.

Sample Adam Smith Quotes in the Context of Today’s Economy

Adam Smith only wrote two books, first “The Theory of Moral Sentiments” (1759), written while he taught at the University of Glasgow, and then his masterpiece, “An Inquiry into The Wealth of Nations,” published March 9, 1776, made possible by a lifetime pension for tutoring students. The key insight Smith made is refuting mercantilism, with its emphasis on protectionism, promoting “favorable” (exports over imports) balance of trade vs. Smith’s unfettered free trade, based on traders’ comparative advantages.

A sample Smith quote on free trade:

“What is prudence in the conduct of every private family can scarce be folly in that of a great kingdom. If a foreign country can supply us with a commodity cheaper than we ourselves can make it, better to buy it of them with some part of the produce of our own industry.” – Wealth of Nations.

Smith’s underlying message, however, is that central planning is misguided and often counter-productive:

“Every man, as long as he does not violate the laws of justice, is free to pursue his own interest his own way, and to bring both his industry and capital into competition with those of any other man, or order of men. The sovereign is completely discharged from a duty…of which no human wisdom or knowledge could ever be sufficient: the duty of superintending the industry of private people, and of directing it towards the employment most suitable to the interest of the society….

“The statesman, who should attempt to direct private people in what manner they ought to employ their capitals, would not only load himself with a most unnecessary attention, but assume an authority which can safely be trusted not only to no single person, but to no council or senate whatever, and which would nowhere be so dangerous as in the hands of a man who had folly and presumption enough to fancy himself fit to exercise it.” – Adam Smith, in The Wealth of Nations.

Smith’s earlier book laid the moral case for these bold statements by defining the “man of the system” (a government overseer with detailed plans) vs. the entrepreneur. See if this “rings a bell” with today’s news.

“The man of the system, on the contrary, is apt to be very wise in his own conceit and is often so enamored with the supposed beauty of his own ideal plan of government that he cannot suffer the smallest deviation from any part of it. He goes on to establish it completely and in all its parts, without any regard either to the great interest or to the strong prejudices which may oppose it.

“He seems to imagine that he can arrange the different members of a great society with as much ease as the hand arranges the different pieces upon a chessboard. He does not consider that the pieces upon the chessboard have no other principle of motion besides that which the hand impresses upon them; but that, in the great chessboard of human society, every single piece has a principle of motion of its own, altogether different from that which the legislature might choose to impress upon it.”

– From Adam Smith’s “The Theory of Moral Sentiments” (1759)

Broadway Brings Adam Smith to Life

The 1960s were a time of peak expansion of Marxism in Russia, China, and the Third World, as well as on campuses, as Keynesian took over Washington DC and Europe, but as the Berlin Wall and the Cuban missile crisis hit the headlines, Broadway reflected the spirit of freedom as well as anything in America.

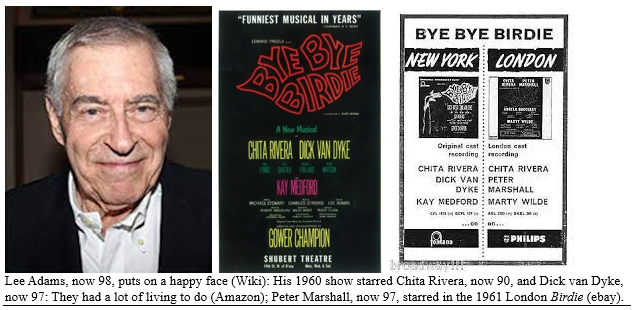

Two Broadway lyricists turn 99 this year and may celebrate their centennials in 2024. The first wrote about “a lot of living to do,” not realizing that he and most of his cast would still be living at age 95+.

Lee Adams (born August 24, 1924) wrote songs for “Bye Bye Birdie” (April 1960), including two great songs about capitalism – one about, steaks, Cadillacs, and living long – another about a long life ahead:

Sizzlin’ steaks all ready for tastin’

And Cadillacs, all shiny and new!

Gotta move, cause time is a-wastin’

There’s such a lot of livin’ to do!

And here’s Lee Adams’ answer to the perma-bears – turning “tragedy” into “glad ya decided to smile.”

Gray skies are gonna clear up: Put on a happy face

Wipe off the clouds and cheer up: Put on a happy face.

Take off that gloomy mask of tragedy; It’s not your style.

You’ll look so good that you’ll be glad you decided to smile.

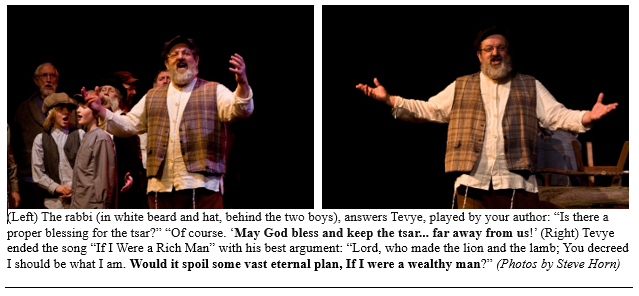

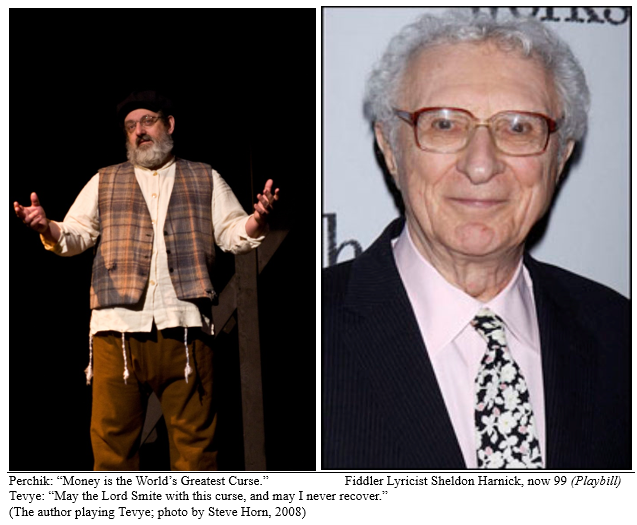

More to the point of capitalism vs. socialism, In Fiddler on the Roof (1964), Tevye the Milkman debated Perchik, the young socialist, with song lyrics by Sheldon Harnick (born April 30, 1924), reflecting Adam Smith in the opening “Tradition,” when Tevye asked the rabbi if there is a blessing suitable for the Tsar.

Later on, the young radical, Perchik, confronted Tevye with his own Marxist manifesto: “Money is the world’s curse.” But Tevye quickly answered, “May the Lord smite me with it. And may I never recover.”

In 2008, this capitalist economist writer had the honor of playing Tevye, addressing a sincere young socialist, playing Perchik, on stage eight times in one week. What a delight! I like to think Adam Smith would enjoy these memorable lyrics about living long, selling milk and cheese, and dreaming of riches.

In 2008, this capitalist economist writer had the honor of playing Tevye, addressing a sincere young socialist, playing Perchik, on stage eight times in one week. What a delight! I like to think Adam Smith would enjoy these memorable lyrics about living long, selling milk and cheese, and dreaming of riches.

All content above represents the opinion of Gary Alexander of Navellier & Associates, Inc.

Also In This Issue

A Look Ahead by Louis Navellier

Small Caps and Energy Stocks Still Look Good

Income Mail by Bryan Perry

Investors Taking a Year-End View Should Be Well Rewarded

Growth Mail by Gary Alexander

As Adam Smith Turns 300 (With Marx at 205 & Keynes 140), Who’s Winning?

Global Mail by Ivan Martchev

Watch Jobless Claims – and Beware Bitcoin

Sector Spotlight by Jason Bodner

Are You Still Waiting for the “Next Shoe to Drop?”

View Full Archive

Read Past Issues Here

About The Author

Gary Alexander

SENIOR EDITOR

Gary Alexander has been Senior Writer at Navellier since 2009. He edits Navellier’s weekly Marketmail and writes a weekly Growth Mail column, in which he uses market history to support the case for growth stocks. For the previous 20 years before joining Navellier, he was Senior Executive Editor at InvestorPlace Media (formerly Phillips Publishing), where he worked with several leading investment analysts, including Louis Navellier (since 1997), helping launch Louis Navellier’s Blue Chip Growth and Global Growth newsletters.

Prior to that, Gary edited Wealth Magazine and Gold Newsletter and wrote various investment research reports for Jefferson Financial in New Orleans in the 1980s. He began his financial newsletter career with KCI Communications in 1980, where he served as consulting editor for Personal Finance newsletter while serving as general manager of KCI’s Alexandria House book division. Before that, he covered the economics beat for news magazines. All content of “Growth Mail” represents the opinion of Gary Alexander

Important Disclosures:

Although information in these reports has been obtained from and is based upon sources that Navellier believes to be reliable, Navellier does not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute Navellier’s judgment as of the date the report was created and are subject to change without notice. These reports are for informational purposes only and are not a solicitation for the purchase or sale of a security. Any decision to purchase securities mentioned in these reports must take into account existing public information on such securities or any registered prospectus.To the extent permitted by law, neither Navellier & Associates, Inc., nor any of its affiliates, agents, or service providers assumes any liability or responsibility nor owes any duty of care for any consequences of any person acting or refraining to act in reliance on the information contained in this communication or for any decision based on it.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any securities recommendations made by Navellier. in the future will be profitable or equal the performance of securities made in this report. Dividend payments are not guaranteed. The amount of a dividend payment, if any, can vary over time and issuers may reduce dividends paid on securities in the event of a recession or adverse event affecting a specific industry or issuer.

None of the stock information, data, and company information presented herein constitutes a recommendation by Navellier or a solicitation to buy or sell any securities. Any specific securities identified and described do not represent all of the securities purchased, sold, or recommended for advisory clients. The holdings identified do not represent all of the securities purchased, sold, or recommended for advisory clients and the reader should not assume that investments in the securities identified and discussed were or will be profitable.

Information presented is general information that does not take into account your individual circumstances, financial situation, or needs, nor does it present a personalized recommendation to you. Individual stocks presented may not be suitable for every investor. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. Investment in fixed income securities has the potential for the investment return and principal value of an investment to fluctuate so that an investor’s holdings, when redeemed, may be worth less than their original cost.

One cannot invest directly in an index. Index is unmanaged and index performance does not reflect deduction of fees, expenses, or taxes. Presentation of Index data does not reflect a belief by Navellier that any stock index constitutes an investment alternative to any Navellier equity strategy or is necessarily comparable to such strategies. Among the most important differences between the Indices and Navellier strategies are that the Navellier equity strategies may (1) incur material management fees, (2) concentrate its investments in relatively few stocks, industries, or sectors, (3) have significantly greater trading activity and related costs, and (4) be significantly more or less volatile than the Indices.

ETF Risk: We may invest in exchange traded funds (“ETFs”) and some of our investment strategies are generally fully invested in ETFs. Like traditional mutual funds, ETFs charge asset-based fees, but they generally do not charge initial sales charges or redemption fees and investors typically pay only customary brokerage fees to buy and sell ETF shares. The fees and costs charged by ETFs held in client accounts will not be deducted from the compensation the client pays Navellier. ETF prices can fluctuate up or down, and a client account could lose money investing in an ETF if the prices of the securities owned by the ETF go down. ETFs are subject to additional risks:

- ETF shares may trade above or below their net asset value;

- An active trading market for an ETF’s shares may not develop or be maintained;

- The value of an ETF may be more volatile than the underlying portfolio of securities the ETF is designed to track;

- The cost of owning shares of the ETF may exceed those a client would incur by directly investing in the underlying securities; and

- Trading of an ETF’s shares may be halted if the listing exchange’s officials deem it appropriate, the shares are delisted from the exchange, or the activation of market-wide “circuit breakers” (which are tied to large decreases in stock prices) halts stock trading generally.

Grader Disclosures: Investment in equity strategies involves substantial risk and has the potential for partial or complete loss of funds invested. The sample portfolio and any accompanying charts are for informational purposes only and are not to be construed as a solicitation to buy or sell any financial instrument and should not be relied upon as the sole factor in an investment making decision. As a matter of normal and important disclosures to you, as a potential investor, please consider the following: The performance presented is not based on any actual securities trading, portfolio, or accounts, and the reported performance of the A, B, C, D, and F portfolios (collectively the “model portfolios”) should be considered mere “paper” or pro forma performance results based on Navellier’s research.

Investors evaluating any of Navellier & Associates, Inc.’s, (or its affiliates’) Investment Products must not use any information presented here, including the performance figures of the model portfolios, in their evaluation of any Navellier Investment Products. Navellier Investment Products include the firm’s mutual funds and managed accounts. The model portfolios, charts, and other information presented do not represent actual funded trades and are not actual funded portfolios. There are material differences between Navellier Investment Products’ portfolios and the model portfolios, research, and performance figures presented here. The model portfolios and the research results (1) may contain stocks or ETFs that are illiquid and difficult to trade; (2) may contain stock or ETF holdings materially different from actual funded Navellier Investment Product portfolios; (3) include the reinvestment of all dividends and other earnings, estimated trading costs, commissions, or management fees; and, (4) may not reflect prices obtained in an actual funded Navellier Investment Product portfolio. For these and other reasons, the reported performances of model portfolios do not reflect the performance results of Navellier’s actually funded and traded Investment Products. In most cases, Navellier’s Investment Products have materially lower performance results than the performances of the model portfolios presented.

This report contains statements that are, or may be considered to be, forward-looking statements. All statements that are not historical facts, including statements about our beliefs or expectations, are “forward-looking statements” within the meaning of The U.S. Private Securities Litigation Reform Act of 1995. These statements may be identified by such forward-looking terminology as “expect,” “estimate,” “plan,” “intend,” “believe,” “anticipate,” “may,” “will,” “should,” “could,” “continue,” “project,” or similar statements or variations of such terms. Our forward-looking statements are based on a series of expectations, assumptions, and projections, are not guarantees of future results or performance, and involve substantial risks and uncertainty as described in Form ADV Part 2A of our filing with the Securities and Exchange Commission (SEC), which is available at www.adviserinfo.sec.gov or by requesting a copy by emailing info@navellier.com. All of our forward-looking statements are as of the date of this report only. We can give no assurance that such expectations or forward-looking statements will prove to be correct. Actual results may differ materially. You are urged to carefully consider all such factors.

FEDERAL TAX ADVICE DISCLAIMER: As required by U.S. Treasury Regulations, you are informed that, to the extent this presentation includes any federal tax advice, the presentation is not written by Navellier to be used, and cannot be used, for the purpose of avoiding federal tax penalties. Navellier does not advise on any income tax requirements or issues. Use of any information presented by Navellier is for general information only and does not represent tax advice either express or implied. You are encouraged to seek professional tax advice for income tax questions and assistance.

IMPORTANT NEWSLETTER DISCLOSURE:The hypothetical performance results for investment newsletters that are authored or edited by Louis Navellier, including Louis Navellier’s Growth Investor, Louis Navellier’s Breakthrough Stocks, Louis Navellier’s Accelerated Profits, and Louis Navellier’s Platinum Club, are not based on any actual securities trading, portfolio, or accounts, and the newsletters’ reported hypothetical performances should be considered mere “paper” or proforma hypothetical performance results and are not actual performance of real world trades. Navellier & Associates, Inc. does not have any relation to or affiliation with the owner of these newsletters. There are material differences between Navellier Investment Products’ portfolios and the InvestorPlace Media, LLC newsletter portfolios authored by Louis Navellier. The InvestorPlace Media, LLC newsletters contain hypothetical performance that do not include transaction costs, advisory fees, or other fees a client might incur if actual investments and trades were being made by an investor. As a result, newsletter performance should not be used to evaluate Navellier Investment services which are separate and different from the newsletters. The owner of the newsletters is InvestorPlace Media, LLC and any questions concerning the newsletters, including any newsletter advertising or hypothetical Newsletter performance claims, (which are calculated solely by Investor Place Media and not Navellier) should be referred to InvestorPlace Media, LLC at (800) 718-8289.

Please note that Navellier & Associates and the Navellier Private Client Group are managed completely independent of the newsletters owned and published by InvestorPlace Media, LLC and written and edited by Louis Navellier, and investment performance of the newsletters should in no way be considered indicative of potential future investment performance for any Navellier & Associates separately managed account portfolio. Potential investors should consult with their financial advisor before investing in any Navellier Investment Product.

Navellier claims compliance with Global Investment Performance Standards (GIPS). To receive a complete list and descriptions of Navellier’s composites and/or a presentation that adheres to the GIPS standards, please contact Navellier or click here. It should not be assumed that any securities recommendations made by Navellier & Associates, Inc. in the future will be profitable or equal the performance of securities made in this report.

FactSet Disclosure: Navellier does not independently calculate the statistical information included in the attached report. The calculation and the information are provided by FactSet, a company not related to Navellier. Although information contained in the report has been obtained from FactSet and is based on sources Navellier believes to be reliable, Navellier does not guarantee its accuracy, and it may be incomplete or condensed. The report and the related FactSet sourced information are provided on an “as is” basis. The user assumes the entire risk of any use made of this information. Investors should consider the report as only a single factor in making their investment decision. The report is for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of a security. FactSet sourced information is the exclusive property of FactSet. Without prior written permission of FactSet, this information may not be reproduced, disseminated or used to create any financial products. All indices are unmanaged and performance of the indices include reinvestment of dividends and interest income, unless otherwise noted, are not illustrative of any particular investment and an investment cannot be made in any index. Past performance is no guarantee of future results.