by Gary Alexander

July 11, 2023

Thanksgiving came early this year – on the Fourth of July, as we celebrated a four-day weekend after the market soared by double-digits (+16% in the S&P 500 and twice that in the NASDAQ) and we avoided that dreaded recession that experts said was 99% certain. What’s more, we really could have celebrated July 4th three weeks ago, since June 21 was America’s 235th birthday as the oldest surviving constituted democracy in the world. June 21, 1788 was the day when nine of the 13 original colonies ratified the Constitution to officially create the framework of our nation, enabling our first elections later that year.

Freedom Fest convenes in Memphis this week (July 12-15). My heart is with them, but my aging body no longer enjoys airports and the glories of mass travel, so I’ll let technology bring their main sessions to me.

This week, I want to chronicle two market surprises of the first half: No Recession + An AI/Tech Boom.

Surprise #1: Like I Said in May…No Recession in Sight

I wish Las Vegas offered lines on outcomes like “a 99% certainty of recession this year.” I’d make a lot more money than betting on sports teams that constantly break my heart (and bankroll, when in Vegas).

On May 31, I urged you to take that 99-to-1 long-shot bet against a recession this year. The Conference Board, which sports a 100% accurate track record of calling such things, assured us we would be mired in recession this year, but a downturn is nowhere in sight and is now receding farther into the distance.

Here’s the link to that piece: 5-31-23: A Recession is 99% Certain This Year? Don’t Bet on It – Navellier

In June, the mainstream press began to agree with me. First, on June 5, after the May jobs report came out, CNN’s Matt Egan observed that “the case for a 2023 U.S. recession is crumbling for a simple reason: America’s jobs market is way too strong.” (see: “The case for a 2023 US recession is crumbling”)

Later last month, on June 23, James Mackintosh opened his article in The Wall Street Journal (“Where’s the Recession We Were Promised?), by saying, “The 2023 recession is missing in action,” admitting (as I had written), “The yield curve… inversion doesn’t guarantee recession, but it is foolish to dismiss it.”

On the same date in Barron’s (“There Won’t Be a Recession This Year. You Can Take That to the Bank,” June 23), Andy Serwer ridiculed recession fears as “the most widely predicted economic event in modern history—which seems pretty certain not to happen.” Serwer argued that the $2 trillion of recently added spending from Washington DC in three large new bills will likely continue to jump-start GDP growth.

The following week, Jonathan Levin wrote (in “Is it Time to Cancel the Recession Altogether?” in Bloomberg, June 27), the “US economy keeps surprising the doomsayers.” He listed three better-than-expected economic indicators released on June 27 and quoted our favorite economist, Ed Yardeni: “The permabears will have to postpone their imminent recession yet again, based on today’s batch of U.S. economic indicators, which suggest that our ‘rolling recession’ is turning into a ‘rolling expansion.’”

Levin added: “For the past 15 months or so, economists and strategists have been obsessed with Federal Reserve … and the yield curve.” That blinded them to the strength of household and business balance sheets as well as the strong job market….” Another Bloomberg author (Jahn Authors, in “Waiting for the Godot Recession,” June 28), wrote the next day, “The last two years have been a chronicle of a recession foretold. But global investors who had positioned their portfolios for the slowdown have been left twiddling their thumbs (and losing out) as the economy shows one sign of strength after another.”

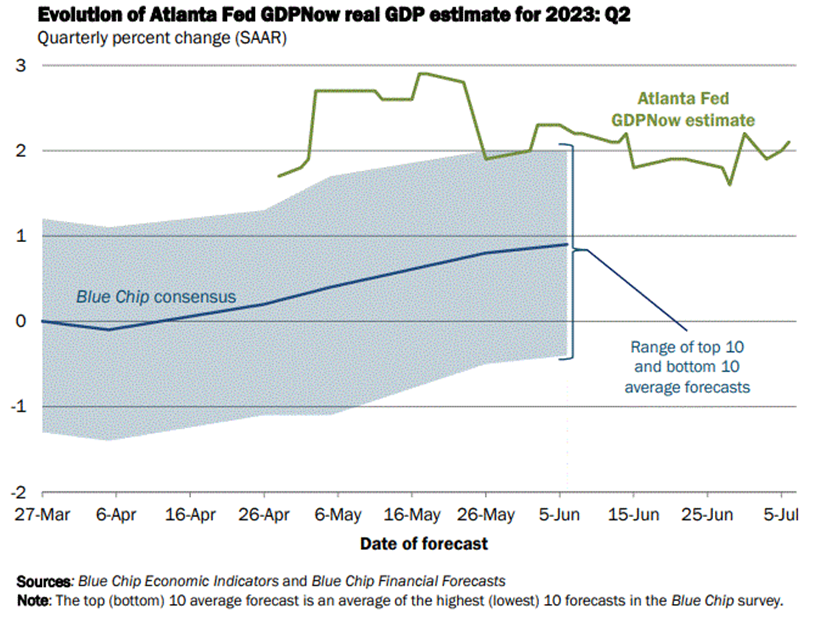

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

The Atlanta Fed’s GDPNow Model for the 2nd Quarter of 2023 is +2.1% (annual rate) as of July 6, 2023.

It’s nice to see my column validated so strongly and unanimously within a month, but I will admit that I’m concerned about such certainty by Barron’s and Bloomberg in phrases like “Take it to the Bank” and “Cancel the Recession Altogether. That is way too dogmatic for this card-carrying contrarian to enjoy.

Surprise #2: “AI” Has Resurrected the Tech Boom (But Beware”GIGO”)

The second big surprise of the first half is the AI fad – oops, boom – rescuing the tech stock sector.

I call AI “Two Vowels that Saved Wall Street.” On Thursday, July 6, The Wall Street Journal summarized this new trend in a Page 1 Headline: “Boom in Artificial Intelligence Helps Lift Tech-Sector Blues.”

“Excitement over artificial intelligence is proving a powerful counter-force for a tech economy that had been slowing, lifting share prices and growth outlooks at many giants and igniting a wave of new startups. …. In the winter, the industry looked like it might be headed for an extended and painful slump. Tech titans were emphasizing efficiency and laying off tens of thousands of people. The NASDAQ Composite Index had lost more than 30% in 2022. But enthusiasm over AI has exploded among investors, executives and technology since the startup OpenAI late last year unveiled ChatGPT, a bot that can converse in human-like language.”

–Tom Dotan, Wall Street Journal, July 6, 2023, Page 1, “Boom in AI Helps Lift Tech Sector Blues”

Maybe I’m missing something in all the champagne celebration here, but I’ve seen several technological revolutions in my lifetime, dating back to the first office computers threatening to do away with all office jobs and paperwork in the 1960s. That didn’t happen. Everyone said, “Feed the data into the computer and the computer will have all the answers in an instant,” but my boss said, “Garbage in, garbage out” (GIGO). Translation: If you feed the computer bad data, you get bad data (multiplied and faster) out the other end.

It will be the same with AI, in my view, at first anyway. This year, from March 20 to April 5, Forbes Data surveyed 600 business owners on how they planned to use AI in their businesses, and I was shocked to see that nearly all (97%) identified at least one aspect of AI they planned to implement, and a huge 74% said they anticipated to use ChatGPT in generating responses to customers through chatbots. About two-thirds (64%) said that AI will improve their customer relationships and 60% expect AI to drive sales growth.

Whew! I thought we were already overloaded with computerized phone bots and clueless Web chatters. Haven’t you (like me) found it nearly impossible to generate real answers by phone or Web sites to your customer needs? Will AI be yet one more tinny voice to misunderstand your very specific questions? Will AI understand irony, inflection, satire, or disgust when you tire of its series of transfers to new portals?

When human intelligence is in such short supply, artificial intelligence is no permanent solution. What goes into the robot’s programmed answer must come from an intelligent, caring, creative human being. When our education system is broken, we can’t create enough robotic answers to replicate smart humans.

I will close with a positive angle from some short techie films I reviewed for Freedom Fest this week.

Technology is Still the Answer – But Created by Humans, Not Machines

I just reviewed 32 films for the Anthem Film Festival (held at Freedom Fest, July 12-15 in Memphis). Three of my favorite short documentaries involve technology and human inventions. The first two show why America is still the leader in technology and invention, but the conclusion to film #2 and the third film show why we still face high hurdles from big business and big government. Here is a summary of each.

Bitcoin Cowboys: Will Wyoming Become the Next Crypto Capital? (Directed by Tim Hedberg) showed a new mainstream way for banking with bitcoin in one of the more independent freedom-loving states, Wyoming, where women first won the vote (in 1870) and where Limited Liability Corporations (LLCs) were first chartered (1977). Some inventive and courageous bankers, like David Kintsky, CEO of Kraken Bank, and Caitlan Long, CEO of Custodia Bank, bypassed the Fed and the FDIC to develop a Special Purpose Depository Institution (SPDI) to back bitcoin accounts with 100% bitcoin backing. They are willing to take reasonable risks and use creative means to provide a real service in a freedom-oriented state. The film makes the case this couldn’t have happened in Europe or even in New York or California.

The Great Equalizer (by Pritchett Cotton) is about the U.S. patent system, profiling two energetic and creative Americans, jump-rope athlete Molly Metz and electrical lineman Rayshaan Conaway, with their inventions of a “better rope” and a “better helmet” and the roadblocks they ran into with corporate thieves and a rigged system against the small inventor. The film should be called “The Great Un-Equalizer” for that reason. Small business owners can go bankrupt seeking ownership of that which they invented.

May I also remind you of a film I reviewed here last week, “Trust Us” (by Chase Kinney), which touches on the potential dangers of AI by tracing the rise of American technocracy: Governance by bureaucratic experts. Beginning in the early 20th century, this documentary reveals how our leaders funneled power to un-elected experts who were convinced they could engineer solutions to all of our nation’s problems, but under FDR it first turned into bureaucratic arrogance, then morphed into a massive administrative state.

All three films are available via YouTube, but please rent or buy copies to support the brave filmmakers.

All content above represents the opinion of Gary Alexander of Navellier & Associates, Inc.

Also In This Issue

A Look Ahead by Louis Navellier

The Fed Governors Are Waging a War of Words… Again

Income Mail by Bryan Perry

The Yield Curve Suddenly Tightens – a Bullish Development

Growth Mail by Gary Alexander

July 4th Is a New Thanksgiving Day – With Two Bullish Surprises

Global Mail by Ivan Martchev

The Short Covering Rally is About to Stall

Sector Spotlight by Jason Bodner

The War Between Market “Noise” and Vital Data

View Full Archive

Read Past Issues Here

About The Author

Gary Alexander

SENIOR EDITOR

Gary Alexander has been Senior Writer at Navellier since 2009. He edits Navellier’s weekly Marketmail and writes a weekly Growth Mail column, in which he uses market history to support the case for growth stocks. For the previous 20 years before joining Navellier, he was Senior Executive Editor at InvestorPlace Media (formerly Phillips Publishing), where he worked with several leading investment analysts, including Louis Navellier (since 1997), helping launch Louis Navellier’s Blue Chip Growth and Global Growth newsletters.

Prior to that, Gary edited Wealth Magazine and Gold Newsletter and wrote various investment research reports for Jefferson Financial in New Orleans in the 1980s. He began his financial newsletter career with KCI Communications in 1980, where he served as consulting editor for Personal Finance newsletter while serving as general manager of KCI’s Alexandria House book division. Before that, he covered the economics beat for news magazines. All content of “Growth Mail” represents the opinion of Gary Alexander

Important Disclosures:

Although information in these reports has been obtained from and is based upon sources that Navellier believes to be reliable, Navellier does not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute Navellier’s judgment as of the date the report was created and are subject to change without notice. These reports are for informational purposes only and are not a solicitation for the purchase or sale of a security. Any decision to purchase securities mentioned in these reports must take into account existing public information on such securities or any registered prospectus.To the extent permitted by law, neither Navellier & Associates, Inc., nor any of its affiliates, agents, or service providers assumes any liability or responsibility nor owes any duty of care for any consequences of any person acting or refraining to act in reliance on the information contained in this communication or for any decision based on it.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any securities recommendations made by Navellier. in the future will be profitable or equal the performance of securities made in this report. Dividend payments are not guaranteed. The amount of a dividend payment, if any, can vary over time and issuers may reduce dividends paid on securities in the event of a recession or adverse event affecting a specific industry or issuer.

None of the stock information, data, and company information presented herein constitutes a recommendation by Navellier or a solicitation to buy or sell any securities. Any specific securities identified and described do not represent all of the securities purchased, sold, or recommended for advisory clients. The holdings identified do not represent all of the securities purchased, sold, or recommended for advisory clients and the reader should not assume that investments in the securities identified and discussed were or will be profitable.

Information presented is general information that does not take into account your individual circumstances, financial situation, or needs, nor does it present a personalized recommendation to you. Individual stocks presented may not be suitable for every investor. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. Investment in fixed income securities has the potential for the investment return and principal value of an investment to fluctuate so that an investor’s holdings, when redeemed, may be worth less than their original cost.

One cannot invest directly in an index. Index is unmanaged and index performance does not reflect deduction of fees, expenses, or taxes. Presentation of Index data does not reflect a belief by Navellier that any stock index constitutes an investment alternative to any Navellier equity strategy or is necessarily comparable to such strategies. Among the most important differences between the Indices and Navellier strategies are that the Navellier equity strategies may (1) incur material management fees, (2) concentrate its investments in relatively few stocks, industries, or sectors, (3) have significantly greater trading activity and related costs, and (4) be significantly more or less volatile than the Indices.

ETF Risk: We may invest in exchange traded funds (“ETFs”) and some of our investment strategies are generally fully invested in ETFs. Like traditional mutual funds, ETFs charge asset-based fees, but they generally do not charge initial sales charges or redemption fees and investors typically pay only customary brokerage fees to buy and sell ETF shares. The fees and costs charged by ETFs held in client accounts will not be deducted from the compensation the client pays Navellier. ETF prices can fluctuate up or down, and a client account could lose money investing in an ETF if the prices of the securities owned by the ETF go down. ETFs are subject to additional risks:

- ETF shares may trade above or below their net asset value;

- An active trading market for an ETF’s shares may not develop or be maintained;

- The value of an ETF may be more volatile than the underlying portfolio of securities the ETF is designed to track;

- The cost of owning shares of the ETF may exceed those a client would incur by directly investing in the underlying securities; and

- Trading of an ETF’s shares may be halted if the listing exchange’s officials deem it appropriate, the shares are delisted from the exchange, or the activation of market-wide “circuit breakers” (which are tied to large decreases in stock prices) halts stock trading generally.

Grader Disclosures: Investment in equity strategies involves substantial risk and has the potential for partial or complete loss of funds invested. The sample portfolio and any accompanying charts are for informational purposes only and are not to be construed as a solicitation to buy or sell any financial instrument and should not be relied upon as the sole factor in an investment making decision. As a matter of normal and important disclosures to you, as a potential investor, please consider the following: The performance presented is not based on any actual securities trading, portfolio, or accounts, and the reported performance of the A, B, C, D, and F portfolios (collectively the “model portfolios”) should be considered mere “paper” or pro forma performance results based on Navellier’s research.

Investors evaluating any of Navellier & Associates, Inc.’s, (or its affiliates’) Investment Products must not use any information presented here, including the performance figures of the model portfolios, in their evaluation of any Navellier Investment Products. Navellier Investment Products include the firm’s mutual funds and managed accounts. The model portfolios, charts, and other information presented do not represent actual funded trades and are not actual funded portfolios. There are material differences between Navellier Investment Products’ portfolios and the model portfolios, research, and performance figures presented here. The model portfolios and the research results (1) may contain stocks or ETFs that are illiquid and difficult to trade; (2) may contain stock or ETF holdings materially different from actual funded Navellier Investment Product portfolios; (3) include the reinvestment of all dividends and other earnings, estimated trading costs, commissions, or management fees; and, (4) may not reflect prices obtained in an actual funded Navellier Investment Product portfolio. For these and other reasons, the reported performances of model portfolios do not reflect the performance results of Navellier’s actually funded and traded Investment Products. In most cases, Navellier’s Investment Products have materially lower performance results than the performances of the model portfolios presented.

This report contains statements that are, or may be considered to be, forward-looking statements. All statements that are not historical facts, including statements about our beliefs or expectations, are “forward-looking statements” within the meaning of The U.S. Private Securities Litigation Reform Act of 1995. These statements may be identified by such forward-looking terminology as “expect,” “estimate,” “plan,” “intend,” “believe,” “anticipate,” “may,” “will,” “should,” “could,” “continue,” “project,” or similar statements or variations of such terms. Our forward-looking statements are based on a series of expectations, assumptions, and projections, are not guarantees of future results or performance, and involve substantial risks and uncertainty as described in Form ADV Part 2A of our filing with the Securities and Exchange Commission (SEC), which is available at www.adviserinfo.sec.gov or by requesting a copy by emailing info@navellier.com. All of our forward-looking statements are as of the date of this report only. We can give no assurance that such expectations or forward-looking statements will prove to be correct. Actual results may differ materially. You are urged to carefully consider all such factors.

FEDERAL TAX ADVICE DISCLAIMER: As required by U.S. Treasury Regulations, you are informed that, to the extent this presentation includes any federal tax advice, the presentation is not written by Navellier to be used, and cannot be used, for the purpose of avoiding federal tax penalties. Navellier does not advise on any income tax requirements or issues. Use of any information presented by Navellier is for general information only and does not represent tax advice either express or implied. You are encouraged to seek professional tax advice for income tax questions and assistance.

IMPORTANT NEWSLETTER DISCLOSURE:The hypothetical performance results for investment newsletters that are authored or edited by Louis Navellier, including Louis Navellier’s Growth Investor, Louis Navellier’s Breakthrough Stocks, Louis Navellier’s Accelerated Profits, and Louis Navellier’s Platinum Club, are not based on any actual securities trading, portfolio, or accounts, and the newsletters’ reported hypothetical performances should be considered mere “paper” or proforma hypothetical performance results and are not actual performance of real world trades. Navellier & Associates, Inc. does not have any relation to or affiliation with the owner of these newsletters. There are material differences between Navellier Investment Products’ portfolios and the InvestorPlace Media, LLC newsletter portfolios authored by Louis Navellier. The InvestorPlace Media, LLC newsletters contain hypothetical performance that do not include transaction costs, advisory fees, or other fees a client might incur if actual investments and trades were being made by an investor. As a result, newsletter performance should not be used to evaluate Navellier Investment services which are separate and different from the newsletters. The owner of the newsletters is InvestorPlace Media, LLC and any questions concerning the newsletters, including any newsletter advertising or hypothetical Newsletter performance claims, (which are calculated solely by Investor Place Media and not Navellier) should be referred to InvestorPlace Media, LLC at (800) 718-8289.

Please note that Navellier & Associates and the Navellier Private Client Group are managed completely independent of the newsletters owned and published by InvestorPlace Media, LLC and written and edited by Louis Navellier, and investment performance of the newsletters should in no way be considered indicative of potential future investment performance for any Navellier & Associates separately managed account portfolio. Potential investors should consult with their financial advisor before investing in any Navellier Investment Product.

Navellier claims compliance with Global Investment Performance Standards (GIPS). To receive a complete list and descriptions of Navellier’s composites and/or a presentation that adheres to the GIPS standards, please contact Navellier or click here. It should not be assumed that any securities recommendations made by Navellier & Associates, Inc. in the future will be profitable or equal the performance of securities made in this report.

FactSet Disclosure: Navellier does not independently calculate the statistical information included in the attached report. The calculation and the information are provided by FactSet, a company not related to Navellier. Although information contained in the report has been obtained from FactSet and is based on sources Navellier believes to be reliable, Navellier does not guarantee its accuracy, and it may be incomplete or condensed. The report and the related FactSet sourced information are provided on an “as is” basis. The user assumes the entire risk of any use made of this information. Investors should consider the report as only a single factor in making their investment decision. The report is for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of a security. FactSet sourced information is the exclusive property of FactSet. Without prior written permission of FactSet, this information may not be reproduced, disseminated or used to create any financial products. All indices are unmanaged and performance of the indices include reinvestment of dividends and interest income, unless otherwise noted, are not illustrative of any particular investment and an investment cannot be made in any index. Past performance is no guarantee of future results.

Important Disclosures:

Although information in these reports has been obtained from and is based upon sources that Navellier believes to be reliable, Navellier does not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute Navellier’s judgment as of the date the report was created and are subject to change without notice. These reports are for informational purposes only and are not a solicitation for the purchase or sale of a security. Any decision to purchase securities mentioned in these reports must take into account existing public information on such securities or any registered prospectus.To the extent permitted by law, neither Navellier & Associates, Inc., nor any of its affiliates, agents, or service providers assumes any liability or responsibility nor owes any duty of care for any consequences of any person acting or refraining to act in reliance on the information contained in this communication or for any decision based on it.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any securities recommendations made by Navellier. in the future will be profitable or equal the performance of securities made in this report. Dividend payments are not guaranteed. The amount of a dividend payment, if any, can vary over time and issuers may reduce dividends paid on securities in the event of a recession or adverse event affecting a specific industry or issuer.

None of the stock information, data, and company information presented herein constitutes a recommendation by Navellier or a solicitation to buy or sell any securities. Any specific securities identified and described do not represent all of the securities purchased, sold, or recommended for advisory clients. The holdings identified do not represent all of the securities purchased, sold, or recommended for advisory clients and the reader should not assume that investments in the securities identified and discussed were or will be profitable.

Information presented is general information that does not take into account your individual circumstances, financial situation, or needs, nor does it present a personalized recommendation to you. Individual stocks presented may not be suitable for every investor. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. Investment in fixed income securities has the potential for the investment return and principal value of an investment to fluctuate so that an investor’s holdings, when redeemed, may be worth less than their original cost.

One cannot invest directly in an index. Index is unmanaged and index performance does not reflect deduction of fees, expenses, or taxes. Presentation of Index data does not reflect a belief by Navellier that any stock index constitutes an investment alternative to any Navellier equity strategy or is necessarily comparable to such strategies. Among the most important differences between the Indices and Navellier strategies are that the Navellier equity strategies may (1) incur material management fees, (2) concentrate its investments in relatively few stocks, industries, or sectors, (3) have significantly greater trading activity and related costs, and (4) be significantly more or less volatile than the Indices.

ETF Risk: We may invest in exchange traded funds (“ETFs”) and some of our investment strategies are generally fully invested in ETFs. Like traditional mutual funds, ETFs charge asset-based fees, but they generally do not charge initial sales charges or redemption fees and investors typically pay only customary brokerage fees to buy and sell ETF shares. The fees and costs charged by ETFs held in client accounts will not be deducted from the compensation the client pays Navellier. ETF prices can fluctuate up or down, and a client account could lose money investing in an ETF if the prices of the securities owned by the ETF go down. ETFs are subject to additional risks:

- ETF shares may trade above or below their net asset value;

- An active trading market for an ETF’s shares may not develop or be maintained;

- The value of an ETF may be more volatile than the underlying portfolio of securities the ETF is designed to track;

- The cost of owning shares of the ETF may exceed those a client would incur by directly investing in the underlying securities; and

- Trading of an ETF’s shares may be halted if the listing exchange’s officials deem it appropriate, the shares are delisted from the exchange, or the activation of market-wide “circuit breakers” (which are tied to large decreases in stock prices) halts stock trading generally.

Grader Disclosures: Investment in equity strategies involves substantial risk and has the potential for partial or complete loss of funds invested. The sample portfolio and any accompanying charts are for informational purposes only and are not to be construed as a solicitation to buy or sell any financial instrument and should not be relied upon as the sole factor in an investment making decision. As a matter of normal and important disclosures to you, as a potential investor, please consider the following: The performance presented is not based on any actual securities trading, portfolio, or accounts, and the reported performance of the A, B, C, D, and F portfolios (collectively the “model portfolios”) should be considered mere “paper” or pro forma performance results based on Navellier’s research.

Investors evaluating any of Navellier & Associates, Inc.’s, (or its affiliates’) Investment Products must not use any information presented here, including the performance figures of the model portfolios, in their evaluation of any Navellier Investment Products. Navellier Investment Products include the firm’s mutual funds and managed accounts. The model portfolios, charts, and other information presented do not represent actual funded trades and are not actual funded portfolios. There are material differences between Navellier Investment Products’ portfolios and the model portfolios, research, and performance figures presented here. The model portfolios and the research results (1) may contain stocks or ETFs that are illiquid and difficult to trade; (2) may contain stock or ETF holdings materially different from actual funded Navellier Investment Product portfolios; (3) include the reinvestment of all dividends and other earnings, estimated trading costs, commissions, or management fees; and, (4) may not reflect prices obtained in an actual funded Navellier Investment Product portfolio. For these and other reasons, the reported performances of model portfolios do not reflect the performance results of Navellier’s actually funded and traded Investment Products. In most cases, Navellier’s Investment Products have materially lower performance results than the performances of the model portfolios presented.

This report contains statements that are, or may be considered to be, forward-looking statements. All statements that are not historical facts, including statements about our beliefs or expectations, are “forward-looking statements” within the meaning of The U.S. Private Securities Litigation Reform Act of 1995. These statements may be identified by such forward-looking terminology as “expect,” “estimate,” “plan,” “intend,” “believe,” “anticipate,” “may,” “will,” “should,” “could,” “continue,” “project,” or similar statements or variations of such terms. Our forward-looking statements are based on a series of expectations, assumptions, and projections, are not guarantees of future results or performance, and involve substantial risks and uncertainty as described in Form ADV Part 2A of our filing with the Securities and Exchange Commission (SEC), which is available at www.adviserinfo.sec.gov or by requesting a copy by emailing info@navellier.com. All of our forward-looking statements are as of the date of this report only. We can give no assurance that such expectations or forward-looking statements will prove to be correct. Actual results may differ materially. You are urged to carefully consider all such factors.

FEDERAL TAX ADVICE DISCLAIMER: As required by U.S. Treasury Regulations, you are informed that, to the extent this presentation includes any federal tax advice, the presentation is not written by Navellier to be used, and cannot be used, for the purpose of avoiding federal tax penalties. Navellier does not advise on any income tax requirements or issues. Use of any information presented by Navellier is for general information only and does not represent tax advice either express or implied. You are encouraged to seek professional tax advice for income tax questions and assistance.

IMPORTANT NEWSLETTER DISCLOSURE:The hypothetical performance results for investment newsletters that are authored or edited by Louis Navellier, including Louis Navellier’s Growth Investor, Louis Navellier’s Breakthrough Stocks, Louis Navellier’s Accelerated Profits, and Louis Navellier’s Platinum Club, are not based on any actual securities trading, portfolio, or accounts, and the newsletters’ reported hypothetical performances should be considered mere “paper” or proforma hypothetical performance results and are not actual performance of real world trades. Navellier & Associates, Inc. does not have any relation to or affiliation with the owner of these newsletters. There are material differences between Navellier Investment Products’ portfolios and the InvestorPlace Media, LLC newsletter portfolios authored by Louis Navellier. The InvestorPlace Media, LLC newsletters contain hypothetical performance that do not include transaction costs, advisory fees, or other fees a client might incur if actual investments and trades were being made by an investor. As a result, newsletter performance should not be used to evaluate Navellier Investment services which are separate and different from the newsletters. The owner of the newsletters is InvestorPlace Media, LLC and any questions concerning the newsletters, including any newsletter advertising or hypothetical Newsletter performance claims, (which are calculated solely by Investor Place Media and not Navellier) should be referred to InvestorPlace Media, LLC at (800) 718-8289.

Please note that Navellier & Associates and the Navellier Private Client Group are managed completely independent of the newsletters owned and published by InvestorPlace Media, LLC and written and edited by Louis Navellier, and investment performance of the newsletters should in no way be considered indicative of potential future investment performance for any Navellier & Associates separately managed account portfolio. Potential investors should consult with their financial advisor before investing in any Navellier Investment Product.

Navellier claims compliance with Global Investment Performance Standards (GIPS). To receive a complete list and descriptions of Navellier’s composites and/or a presentation that adheres to the GIPS standards, please contact Navellier or click here. It should not be assumed that any securities recommendations made by Navellier & Associates, Inc. in the future will be profitable or equal the performance of securities made in this report.

FactSet Disclosure: Navellier does not independently calculate the statistical information included in the attached report. The calculation and the information are provided by FactSet, a company not related to Navellier. Although information contained in the report has been obtained from FactSet and is based on sources Navellier believes to be reliable, Navellier does not guarantee its accuracy, and it may be incomplete or condensed. The report and the related FactSet sourced information are provided on an “as is” basis. The user assumes the entire risk of any use made of this information. Investors should consider the report as only a single factor in making their investment decision. The report is for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of a security. FactSet sourced information is the exclusive property of FactSet. Without prior written permission of FactSet, this information may not be reproduced, disseminated or used to create any financial products. All indices are unmanaged and performance of the indices include reinvestment of dividends and interest income, unless otherwise noted, are not illustrative of any particular investment and an investment cannot be made in any index. Past performance is no guarantee of future results.