by Gary Alexander

May 23, 2023

Come mothers and fathers throughout the land

And don’t criticize what you can’t understand

Your sons and your daughters are beyond your command

Your old road is rapidly aging …For the times they are a-changing

–Bob Dylan, 1963

Bob Dylan turns 82 tomorrow, and I guess he’s a little old fashioned now, too, since he recorded an album of Sinatra standards in 2015 (“Shadows in the Night”) and a Christmas carols album in 2009.

The times are changing in the employment market, too. Work has almost become a four-letter word…

Suzy Welch, 62, a Baby Boomer professor of management practice at NYU’s Stern School of Business and co-author with her late husband Jack of several best-selling business books, wrote a fascinating Op-Ed column in The Wall Street Journal last week (“For Gen Z, Unemployment Can Be a Blast, May 18, 2023). She introduced her latest batch of “bright and shiny young MBA students” who spoke of their lazy, hazy plans after graduation: “I’ll work when I work. Until then, I’ll just do some funemployment.”

Ms. Welch said she “literally screamed in class” the first time she heard that word, shouting, “What, what, what? Are you literally saying ‘funemployment’ – like unemployment can be fun?” The class then “burst into laughter.” Yes, of course that’s what they meant, but they were trying to keep that word secret from the older generation of up-tight Baby Boom professors, since those draft-dodging, dope-smoking hippies of the Vietnam era had now become like their parents – and their students didn’t trust anyone over 30!

For those young ones who still want to work, the older employers must also watch their step, since the old hierarchical order at work is mostly dead, if not buried. In his new book, “Generation Why” (released this month), Dr. Karl Moore of Montreal’s McGill University speaks of the new workplace rules, which sound like no rules – a dangerous minefield for managers. In his introduction, Moore makes three points.

There are three basic changes from our (Boomer) management era: (1) Transparency over secrecy: Young workers can discover all your faults, errors, and past mistakes by surfing the Internet, so transparency is king; (2) Credentials no longer matter as much; an MBA is the old BA, but experience trumps degrees, so all that massive college debt may be wasted; and (3) Introverts and quieter thinkers can now lead, not just those bombastic extroverts. By Moore’s measures, 30% to 35% of C-suite leaders are now introverts. *

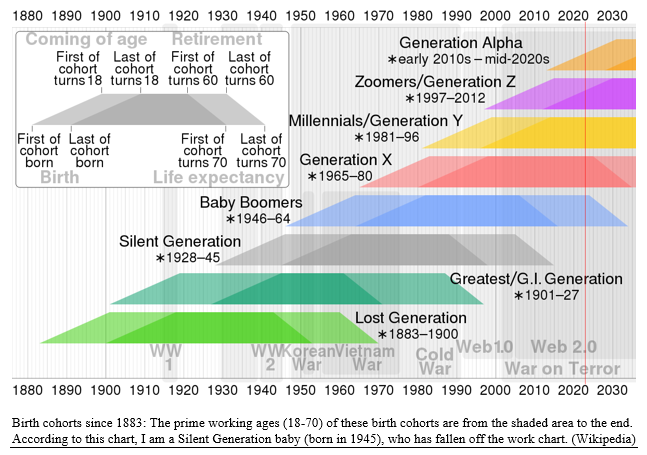

*To clarify terms, “C-suite” refers to anyone with “Chief” in the title, like Chief Executive Officer, Chief Operating/Chief Financial, or Chief Managing Officer. Also, here are the generally accepted birth cohorts:

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Moore has a CEO Insights course at McGill for MBAs. He also takes 30 students each year to some of the fastest growing global economies to see how they do it. He calls it the “Hot Cities of the World Tour.” They just returned from Ghana and Ivory Coast this March. In these 12-day tours, he also has a chance to dine and talk with these 30 students (Millennials and now Gen Z kids) to probe their views. As cohorts in two colleges in Southern California in the 1970s, Moore and I emailed over this, and he told me these tours are promoted as “Taking the Future to the Future,” meaning future business leaders go to where the world is growing fastest. Some of his previous trips were to Israel, the UAE, India, and South Africa.

In his study of young workers for this book, Moore conducted over 800 interviews with under-35 workers (and shirkers) in Canada, the U.S., Japan, and all over Europe, as well as over 750 C-suite executives. Previous to his academic career, Moore also spent 11 years working in high tech firms, so he has the advantage of being a capitalist believer and doer, not just a business critic, as is so common in academia.

In the U.S., Moore writes, over one third of workers are Millennials (age 27-42), recently surpassing Gen X as the largest component of our workforce. Globally, there are 1.8 billion Millennials, about a quarter of the world, and 86% of Millennials come from developing economies, which may determine who rules the Century. Put bluntly, will the hardest workers of the world surpass our new funemployment cohort?

How Can We Have a Recession with So Many Job Openings?

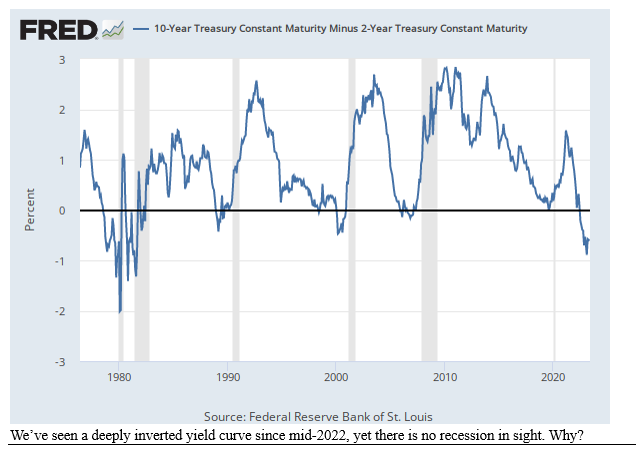

A classic warning sign of a recession ahead is an inverted yield curve, which we have endured for nearly a year now without a recession. The yield curve inverted before the last four real recessions, in 1982, 1990, 2000, and 2008. Even with the artificial 2020 recession, caused by a forced COVID-19 lockdown, the yield curve was neutral before that recession. Today, we have the most inverted yield curve since the double-dip recessions of 1979-82, yet we still stubbornly grow our GDP each quarter since mid-2022.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

It’s hard (some say impossible) to have a recession with the unemployment rate at a record low, jobs continuing to expand at a solid pace, nearly 10 million jobs going begging and wages usually outpacing prices, resulting in real wage gains. Everywhere you look, you’re likely to see “HELP NEEDED” signs.

Jobs are opening even faster: The percentage of all U.S. business owners reporting job openings that they cannot fill rose by 2 points to 45% in April — maybe because “funemployment” is still widely preferable?

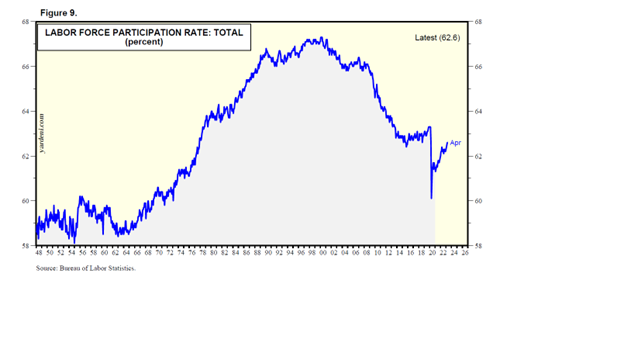

The labor force participation rate remained at 62.6% in April, below the pre-pandemic reading of 63.3% in February 2020, but that rate itself was historically low. It was over 64% from 1984 to 2012, peaking in 2001, when I argue (in recent columns) that we moved from a Growth economy to a Debt economy.

Funemployment Comes Home to Roost

To close on a personal note, I’ve worked every month since April 1962, age 16, first on a paper route by car, then as a night janitor to work my way through college. I commuted to work at a desk job for nearly 40 years before moving to my late parents’ home in the San Juan Islands of Washington State to work online as an editor. I tried to match the work ethic of my parents, who worked in the Great Depression.

Today marks the date when two of our five grown grandchildren arrive to live with us for the next few months, and maybe longer, as part of their funemployment option. It’s a grandparents’ dream come true, having these wonderful young ones around us – and a great help in our old age, a win-win situation. One says, “I don’t want to sit in an office from 9 to 5 each day.” I responded, “Neither did I, nor probably 90% of those who did it, but we felt we had to.” These kids already have online and “gig” jobs, not office jobs.

I know I’m old-fashioned about work, but (with Karl Moore) I’m learning from the youth, and I know that both of these two fine youngsters will find fulfilling jobs and careers after living with us, with the caveat that retail jobs, construction, and even janitor work aren’t careers, but training ground for showing up on time, respecting rules, learning manners, and serving customer needs. They’ll find their best work.

It’s a brave new world for old fogies. But it’s comforting to know these kids will soon be old fogies, too.

All content above represents the opinion of Gary Alexander of Navellier & Associates, Inc.

Also In This Issue

A Look Ahead by Louis Navellier

Global Leaders Fail to Lead (or Even Compromise)

Income Mail by Bryan Perry

Regional Banks Are Setting Up for a Summer of Tough Love

Growth Mail by Gary Alexander

In This “Age of Funemployment,” Is a Recession Possible?

Global Mail by Ivan Martchev

Narrow Market Breadth Continues to Concern Investors

Sector Spotlight by Jason Bodner

The Market’s “Doldrums” Are Well into Overtime

View Full Archive

Read Past Issues Here

About The Author

Gary Alexander

SENIOR EDITOR

Gary Alexander has been Senior Writer at Navellier since 2009. He edits Navellier’s weekly Marketmail and writes a weekly Growth Mail column, in which he uses market history to support the case for growth stocks. For the previous 20 years before joining Navellier, he was Senior Executive Editor at InvestorPlace Media (formerly Phillips Publishing), where he worked with several leading investment analysts, including Louis Navellier (since 1997), helping launch Louis Navellier’s Blue Chip Growth and Global Growth newsletters.

Prior to that, Gary edited Wealth Magazine and Gold Newsletter and wrote various investment research reports for Jefferson Financial in New Orleans in the 1980s. He began his financial newsletter career with KCI Communications in 1980, where he served as consulting editor for Personal Finance newsletter while serving as general manager of KCI’s Alexandria House book division. Before that, he covered the economics beat for news magazines. All content of “Growth Mail” represents the opinion of Gary Alexander

Important Disclosures:

Although information in these reports has been obtained from and is based upon sources that Navellier believes to be reliable, Navellier does not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute Navellier’s judgment as of the date the report was created and are subject to change without notice. These reports are for informational purposes only and are not a solicitation for the purchase or sale of a security. Any decision to purchase securities mentioned in these reports must take into account existing public information on such securities or any registered prospectus.To the extent permitted by law, neither Navellier & Associates, Inc., nor any of its affiliates, agents, or service providers assumes any liability or responsibility nor owes any duty of care for any consequences of any person acting or refraining to act in reliance on the information contained in this communication or for any decision based on it.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any securities recommendations made by Navellier. in the future will be profitable or equal the performance of securities made in this report. Dividend payments are not guaranteed. The amount of a dividend payment, if any, can vary over time and issuers may reduce dividends paid on securities in the event of a recession or adverse event affecting a specific industry or issuer.

None of the stock information, data, and company information presented herein constitutes a recommendation by Navellier or a solicitation to buy or sell any securities. Any specific securities identified and described do not represent all of the securities purchased, sold, or recommended for advisory clients. The holdings identified do not represent all of the securities purchased, sold, or recommended for advisory clients and the reader should not assume that investments in the securities identified and discussed were or will be profitable.

Information presented is general information that does not take into account your individual circumstances, financial situation, or needs, nor does it present a personalized recommendation to you. Individual stocks presented may not be suitable for every investor. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. Investment in fixed income securities has the potential for the investment return and principal value of an investment to fluctuate so that an investor’s holdings, when redeemed, may be worth less than their original cost.

One cannot invest directly in an index. Index is unmanaged and index performance does not reflect deduction of fees, expenses, or taxes. Presentation of Index data does not reflect a belief by Navellier that any stock index constitutes an investment alternative to any Navellier equity strategy or is necessarily comparable to such strategies. Among the most important differences between the Indices and Navellier strategies are that the Navellier equity strategies may (1) incur material management fees, (2) concentrate its investments in relatively few stocks, industries, or sectors, (3) have significantly greater trading activity and related costs, and (4) be significantly more or less volatile than the Indices.

ETF Risk: We may invest in exchange traded funds (“ETFs”) and some of our investment strategies are generally fully invested in ETFs. Like traditional mutual funds, ETFs charge asset-based fees, but they generally do not charge initial sales charges or redemption fees and investors typically pay only customary brokerage fees to buy and sell ETF shares. The fees and costs charged by ETFs held in client accounts will not be deducted from the compensation the client pays Navellier. ETF prices can fluctuate up or down, and a client account could lose money investing in an ETF if the prices of the securities owned by the ETF go down. ETFs are subject to additional risks:

- ETF shares may trade above or below their net asset value;

- An active trading market for an ETF’s shares may not develop or be maintained;

- The value of an ETF may be more volatile than the underlying portfolio of securities the ETF is designed to track;

- The cost of owning shares of the ETF may exceed those a client would incur by directly investing in the underlying securities; and

- Trading of an ETF’s shares may be halted if the listing exchange’s officials deem it appropriate, the shares are delisted from the exchange, or the activation of market-wide “circuit breakers” (which are tied to large decreases in stock prices) halts stock trading generally.

Grader Disclosures: Investment in equity strategies involves substantial risk and has the potential for partial or complete loss of funds invested. The sample portfolio and any accompanying charts are for informational purposes only and are not to be construed as a solicitation to buy or sell any financial instrument and should not be relied upon as the sole factor in an investment making decision. As a matter of normal and important disclosures to you, as a potential investor, please consider the following: The performance presented is not based on any actual securities trading, portfolio, or accounts, and the reported performance of the A, B, C, D, and F portfolios (collectively the “model portfolios”) should be considered mere “paper” or pro forma performance results based on Navellier’s research.

Investors evaluating any of Navellier & Associates, Inc.’s, (or its affiliates’) Investment Products must not use any information presented here, including the performance figures of the model portfolios, in their evaluation of any Navellier Investment Products. Navellier Investment Products include the firm’s mutual funds and managed accounts. The model portfolios, charts, and other information presented do not represent actual funded trades and are not actual funded portfolios. There are material differences between Navellier Investment Products’ portfolios and the model portfolios, research, and performance figures presented here. The model portfolios and the research results (1) may contain stocks or ETFs that are illiquid and difficult to trade; (2) may contain stock or ETF holdings materially different from actual funded Navellier Investment Product portfolios; (3) include the reinvestment of all dividends and other earnings, estimated trading costs, commissions, or management fees; and, (4) may not reflect prices obtained in an actual funded Navellier Investment Product portfolio. For these and other reasons, the reported performances of model portfolios do not reflect the performance results of Navellier’s actually funded and traded Investment Products. In most cases, Navellier’s Investment Products have materially lower performance results than the performances of the model portfolios presented.

This report contains statements that are, or may be considered to be, forward-looking statements. All statements that are not historical facts, including statements about our beliefs or expectations, are “forward-looking statements” within the meaning of The U.S. Private Securities Litigation Reform Act of 1995. These statements may be identified by such forward-looking terminology as “expect,” “estimate,” “plan,” “intend,” “believe,” “anticipate,” “may,” “will,” “should,” “could,” “continue,” “project,” or similar statements or variations of such terms. Our forward-looking statements are based on a series of expectations, assumptions, and projections, are not guarantees of future results or performance, and involve substantial risks and uncertainty as described in Form ADV Part 2A of our filing with the Securities and Exchange Commission (SEC), which is available at www.adviserinfo.sec.gov or by requesting a copy by emailing info@navellier.com. All of our forward-looking statements are as of the date of this report only. We can give no assurance that such expectations or forward-looking statements will prove to be correct. Actual results may differ materially. You are urged to carefully consider all such factors.

FEDERAL TAX ADVICE DISCLAIMER: As required by U.S. Treasury Regulations, you are informed that, to the extent this presentation includes any federal tax advice, the presentation is not written by Navellier to be used, and cannot be used, for the purpose of avoiding federal tax penalties. Navellier does not advise on any income tax requirements or issues. Use of any information presented by Navellier is for general information only and does not represent tax advice either express or implied. You are encouraged to seek professional tax advice for income tax questions and assistance.

IMPORTANT NEWSLETTER DISCLOSURE:The hypothetical performance results for investment newsletters that are authored or edited by Louis Navellier, including Louis Navellier’s Growth Investor, Louis Navellier’s Breakthrough Stocks, Louis Navellier’s Accelerated Profits, and Louis Navellier’s Platinum Club, are not based on any actual securities trading, portfolio, or accounts, and the newsletters’ reported hypothetical performances should be considered mere “paper” or proforma hypothetical performance results and are not actual performance of real world trades. Navellier & Associates, Inc. does not have any relation to or affiliation with the owner of these newsletters. There are material differences between Navellier Investment Products’ portfolios and the InvestorPlace Media, LLC newsletter portfolios authored by Louis Navellier. The InvestorPlace Media, LLC newsletters contain hypothetical performance that do not include transaction costs, advisory fees, or other fees a client might incur if actual investments and trades were being made by an investor. As a result, newsletter performance should not be used to evaluate Navellier Investment services which are separate and different from the newsletters. The owner of the newsletters is InvestorPlace Media, LLC and any questions concerning the newsletters, including any newsletter advertising or hypothetical Newsletter performance claims, (which are calculated solely by Investor Place Media and not Navellier) should be referred to InvestorPlace Media, LLC at (800) 718-8289.

Please note that Navellier & Associates and the Navellier Private Client Group are managed completely independent of the newsletters owned and published by InvestorPlace Media, LLC and written and edited by Louis Navellier, and investment performance of the newsletters should in no way be considered indicative of potential future investment performance for any Navellier & Associates separately managed account portfolio. Potential investors should consult with their financial advisor before investing in any Navellier Investment Product.

Navellier claims compliance with Global Investment Performance Standards (GIPS). To receive a complete list and descriptions of Navellier’s composites and/or a presentation that adheres to the GIPS standards, please contact Navellier or click here. It should not be assumed that any securities recommendations made by Navellier & Associates, Inc. in the future will be profitable or equal the performance of securities made in this report.

FactSet Disclosure: Navellier does not independently calculate the statistical information included in the attached report. The calculation and the information are provided by FactSet, a company not related to Navellier. Although information contained in the report has been obtained from FactSet and is based on sources Navellier believes to be reliable, Navellier does not guarantee its accuracy, and it may be incomplete or condensed. The report and the related FactSet sourced information are provided on an “as is” basis. The user assumes the entire risk of any use made of this information. Investors should consider the report as only a single factor in making their investment decision. The report is for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of a security. FactSet sourced information is the exclusive property of FactSet. Without prior written permission of FactSet, this information may not be reproduced, disseminated or used to create any financial products. All indices are unmanaged and performance of the indices include reinvestment of dividends and interest income, unless otherwise noted, are not illustrative of any particular investment and an investment cannot be made in any index. Past performance is no guarantee of future results.