by Louis Navellier

April 18, 2023

The financial media has been warning that first-quarter earnings forecasts may be decelerating from their original estimates at the start of the quarter, but I do not see that from the analyst community covering our stocks. That’s why it’s important to own the right stocks in the right sectors. Analysts have been issuing positive statements about our stocks and I look forward to earnings reports for the stocks we hold.

There also seems to be a big disconnect from the top-down strategists in the big Wall Street firms versus the actual analyst community that covers individual stocks. Although major bank earnings were released last week, and most reported big surprises, we do not own the major banks, so we should not worry about the inverted yield curve and other banking woes. The Fed has opened its discount window for a year to help any troubled banks and it appears that many banks have taken advantage of the discount window.

The FOMC minutes were released last Wednesday, revealing a significant minority of FOMC members who did not want to raise key interest rates at the last FOMC meeting, mostly due to the banking turmoil. These FOMC minutes also revealed that Fed staffers predicted a “mild recession” later this year. Overall, these FOMC minutes revealed that a minority of FOMC members are dovish, so in light of the latest CPI and PPI data, plus lower Treasury yields, I expect that the Fed will not hike key interest rates any further.

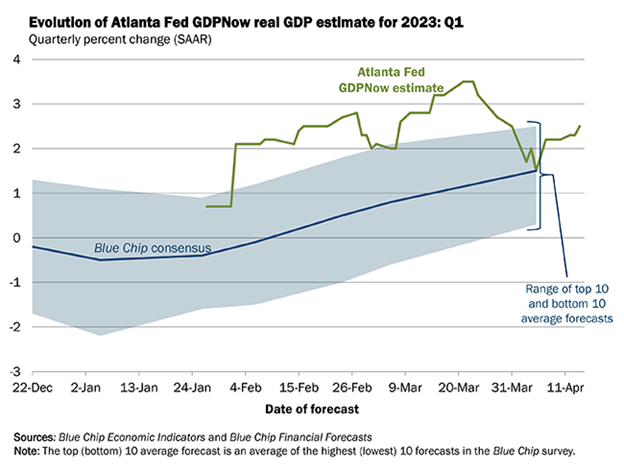

Despite terrible retail sales in the first quarter, the Atlanta Fed actually raised its first-quarter GDP estimate to a 2.5% annual pace, up from its previous estimate of 2.2%. However, I expect that many economists will be revising their first-quarter GDP estimates lower than 2% in the upcoming weeks.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Bloomberg published a great article last week about the money supply contracting in Britain, and in the European Union and the U.S. This article was critical, showing that central banks may have gone too far and “need to restore positive money growth.” Although “monetarism” is not currently influencing central bank policies, when the money supply is reduced, economic activity naturally contracts. This Bloomberg article implies that central banks have to cut their interest rates to restore money supplies, so it will be interesting to see how fast central banks move as inflation continues to cool in the upcoming months.

We Continue to Favor the Energy Sector

We continue to make a big bet on energy stocks, despite (and also because of) the Biden Administration’s “Green New Deal.” The latest ruling came last Wednesday when the head of the Environment Protection Administration (EPA), Michael S. Regan, announced new emission limits that would require as much as 67% of new vehicles sold by 2032 to be fully electric. This would effectively be a death blow to internal combustion engines and even more restrictive than the current regulations covering EPA emissions.

The strict new EPA emissions on light and medium duty trucks would take effect in 2027 and become increasingly strict each year through 2032. Specifically, the EPA is proposing that emissions decline 18% in 2027, then 13% in 2028, 15% in 2029, 8% in 2030, 9% in 2031, and 11% more in 2032. Essentially, these EPA regulations are designed to force consumers to switch to electric vehicles (EVs). It will be interesting to see the reaction from Detroit and other automotive manufacturers to these strict new rules.

The New York Times published an article on Tuesday that questioned whether or not automakers can possibly comply with these new EPA rules that will force nearly all vehicles to be electric within a decade. The article said the new EPA rules are expected to force EVs to make up 54% to 60% of new vehicles sold in the U.S. by 2030, and 64% to 67% by 2032. The article further cited the fact that the world now only makes 10% of the lithium that the EPA will require under these new emission rules.

Sociedad Quimica y Minera de Chile S.A. (SQM) is the second largest lithium mining company in the world and should benefit from these new EPA rules. However, shortages of lithium, nickel, and cobalt have made EVs more expensive than vehicles with internal combustion engines and are therefore preventing new EV manufacturers, like Lucid and Rivian, from reaching profitability.

Currently, there seems to be a glut of overpriced electric vehicles in inventory after China and Germany recently ended their tax incentives to build electric vehicles (EV). Tesla’s inventories at its Berlin plant are apparently growing, so the company announced more price cuts last week.

In Tesla’s defense, the prices of lithium, nickel, and cobalt have all moderated as electric vehicle demand in China has softened. However, long-term, the demand for battery components is expected to soar due to more EV models in the pipeline as well as the anticipated higher electricity storage demand.

Tesla announced that it is building a new factory in Shanghai, China, to build its large-scale batteries for electricity storage, called the Megapack. Australia has been shutting down all its coal plants and has been expanding its electricity storage. California is another big market for Tesla’s Megapacks, which are made with cheaper iron phosphate (LFP) batteries sourced from CATL. It will be interesting to see how fast these storage facilities expand across the U.S., since rising demand usually causes electricity rates to rise.

The Aftermath of Macron’s Flirtation with China

The strikes in France have also disrupted energy markets around the world. Specifically, work stoppages and blockades at key import terminals, distribution hubs, and oil refineries have resulted in fuel shortages all over France. Africa and the East Coast of the U.S. receive refined products from France, like gasoline, so prices at the pump are expected to rise. The French government has relied on its emergency stockpiles during recent strikes, but must replenish its inventories, which should put upward pressure on oil prices.

French President Emmanuel Macron is getting diplomatic heat after saying that Europe should distance itself from the brewing tensions between China and the U.S. over Taiwan. In the wake of massive Chinese military maneuvers last week, Macron’s comments were considered ill-timed by many. In a Politico interview when Macron was asked if the confrontation between China and the U.S. made it see Europe as “a chess piece between two blocs,” Macron responded by saying, “Is it in our interest to accelerate on the subject of Taiwan? No. The worst thing would be to think that we Europeans must become followers on this topic and adapt to the American rhythm and Chinese overreaction.”

Furthermore, Macron also warned of a “trap for Europe” if it got “caught up in a crisis that is not ours.” It is obvious that this rift between the Biden Administration and French President Macron would spill over to Ukraine, since France has been making overtures to its business interests in Russia.

China’s recent military exercises were designed to intimidate Taiwan and the U.S. However, the easiest way for China to take over Taiwan is to merely influence the upcoming Taiwan Presidential election and install a pro-China president. This is how China began to take over Hong Kong, via a pro-China mayor.

China is very patient and pragmatic. China is very good at fighting economic wars and taking over industries. Since Taiwan dominates semiconductor manufacturing, China would like to dominate that industry as well, so it will be interesting to see if the U.S. can diversify semiconductor manufacturing in the upcoming years, since currently the U.S. and the rest of the world are heavily dependent on Taiwan.

I should add that one of China’s largest trading partners, namely Brazil, doubled down on breaking away from the U.S. dollar. Specifically, the new Brazilian President, Luiz Inacio Lulu de Silva. called for developing countries to work toward replacing the U.S. dollar with their own currencies, essentially aiding and abetting China’s efforts to undermine the U.S. dollar. On his first state visit to China, Lulu called for the BRICS nations – Brazil, Russia, India, China, and South Africa – to come up with their own alternative currency for use in trade. In an impassioned speech at the New Development Bank in Shanghai (known as “the BRICs bank”), Lulu said, “Every night I ask myself why all countries have to base their trade on the dollar.” Lulu added, “Why can’t we trade based on our own currencies?” and, “Who was it that decided that the dollar was the currency after the disappearance of the gold standard?”

Yikes! Clearly, the U.S.’s neglect of Latin America for decades is now having profound consequences.

Navellier & Associates owns Sociedad Quimica Y Minera De Chile S.A. (SQM), a few accounts own Tesla (TSLA), per client request in managed accounts. We do not own Rivian Automotive (RIVN) or Lucid Group (LCID). Louis Navellier and his family own Sociedad Quimica Y Minera De Chile S.A. (SQM), via a Navellier managed account. He does not own Tesla (TSLA), Rivian Automotive (RIVN), or Lucid Group (LCID) personally.

All content above represents the opinion of Louis Navellier of Navellier & Associates, Inc.

Also In This Issue

A Look Ahead by Louis Navellier

The First-Quarter Earnings Outlook Remains “Mixed,” At Best

Income Mail by Bryan Perry

Massive Paper Losses Turn Banks into a “Zombie” Sector

Growth Mail by Gary Alexander

Investors Follow the Money While Politicians Fail at Basic Math

Global Mail by Ivan Martchev

What’s Behind the New 2023 VIX Closing Low?

Sector Spotlight by Jason Bodner

Finding Answers in Quiet Data Mining – Not Manic News Noise

View Full Archive

Read Past Issues Here

Louis Navellier

CHIEF INVESTMENT OFFICER

Louis Navellier is Founder, Chairman of the Board, Chief Investment Officer and Chief Compliance Officer of Navellier & Associates, Inc., located in Reno, Nevada. With decades of experience translating what had been purely academic techniques into real market applications, he believes that disciplined, quantitative analysis can select stocks that will significantly outperform the overall market. All content in this “A Look Ahead” section of Market Mail represents the opinion of Louis Navellier of Navellier & Associates, Inc.

Important Disclosures:

Although information in these reports has been obtained from and is based upon sources that Navellier believes to be reliable, Navellier does not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute Navellier’s judgment as of the date the report was created and are subject to change without notice. These reports are for informational purposes only and are not a solicitation for the purchase or sale of a security. Any decision to purchase securities mentioned in these reports must take into account existing public information on such securities or any registered prospectus.To the extent permitted by law, neither Navellier & Associates, Inc., nor any of its affiliates, agents, or service providers assumes any liability or responsibility nor owes any duty of care for any consequences of any person acting or refraining to act in reliance on the information contained in this communication or for any decision based on it.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any securities recommendations made by Navellier. in the future will be profitable or equal the performance of securities made in this report. Dividend payments are not guaranteed. The amount of a dividend payment, if any, can vary over time and issuers may reduce dividends paid on securities in the event of a recession or adverse event affecting a specific industry or issuer.

None of the stock information, data, and company information presented herein constitutes a recommendation by Navellier or a solicitation to buy or sell any securities. Any specific securities identified and described do not represent all of the securities purchased, sold, or recommended for advisory clients. The holdings identified do not represent all of the securities purchased, sold, or recommended for advisory clients and the reader should not assume that investments in the securities identified and discussed were or will be profitable.

Information presented is general information that does not take into account your individual circumstances, financial situation, or needs, nor does it present a personalized recommendation to you. Individual stocks presented may not be suitable for every investor. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. Investment in fixed income securities has the potential for the investment return and principal value of an investment to fluctuate so that an investor’s holdings, when redeemed, may be worth less than their original cost.

One cannot invest directly in an index. Index is unmanaged and index performance does not reflect deduction of fees, expenses, or taxes. Presentation of Index data does not reflect a belief by Navellier that any stock index constitutes an investment alternative to any Navellier equity strategy or is necessarily comparable to such strategies. Among the most important differences between the Indices and Navellier strategies are that the Navellier equity strategies may (1) incur material management fees, (2) concentrate its investments in relatively few stocks, industries, or sectors, (3) have significantly greater trading activity and related costs, and (4) be significantly more or less volatile than the Indices.

ETF Risk: We may invest in exchange traded funds (“ETFs”) and some of our investment strategies are generally fully invested in ETFs. Like traditional mutual funds, ETFs charge asset-based fees, but they generally do not charge initial sales charges or redemption fees and investors typically pay only customary brokerage fees to buy and sell ETF shares. The fees and costs charged by ETFs held in client accounts will not be deducted from the compensation the client pays Navellier. ETF prices can fluctuate up or down, and a client account could lose money investing in an ETF if the prices of the securities owned by the ETF go down. ETFs are subject to additional risks:

- ETF shares may trade above or below their net asset value;

- An active trading market for an ETF’s shares may not develop or be maintained;

- The value of an ETF may be more volatile than the underlying portfolio of securities the ETF is designed to track;

- The cost of owning shares of the ETF may exceed those a client would incur by directly investing in the underlying securities; and

- Trading of an ETF’s shares may be halted if the listing exchange’s officials deem it appropriate, the shares are delisted from the exchange, or the activation of market-wide “circuit breakers” (which are tied to large decreases in stock prices) halts stock trading generally.

Grader Disclosures: Investment in equity strategies involves substantial risk and has the potential for partial or complete loss of funds invested. The sample portfolio and any accompanying charts are for informational purposes only and are not to be construed as a solicitation to buy or sell any financial instrument and should not be relied upon as the sole factor in an investment making decision. As a matter of normal and important disclosures to you, as a potential investor, please consider the following: The performance presented is not based on any actual securities trading, portfolio, or accounts, and the reported performance of the A, B, C, D, and F portfolios (collectively the “model portfolios”) should be considered mere “paper” or pro forma performance results based on Navellier’s research.

Investors evaluating any of Navellier & Associates, Inc.’s, (or its affiliates’) Investment Products must not use any information presented here, including the performance figures of the model portfolios, in their evaluation of any Navellier Investment Products. Navellier Investment Products include the firm’s mutual funds and managed accounts. The model portfolios, charts, and other information presented do not represent actual funded trades and are not actual funded portfolios. There are material differences between Navellier Investment Products’ portfolios and the model portfolios, research, and performance figures presented here. The model portfolios and the research results (1) may contain stocks or ETFs that are illiquid and difficult to trade; (2) may contain stock or ETF holdings materially different from actual funded Navellier Investment Product portfolios; (3) include the reinvestment of all dividends and other earnings, estimated trading costs, commissions, or management fees; and, (4) may not reflect prices obtained in an actual funded Navellier Investment Product portfolio. For these and other reasons, the reported performances of model portfolios do not reflect the performance results of Navellier’s actually funded and traded Investment Products. In most cases, Navellier’s Investment Products have materially lower performance results than the performances of the model portfolios presented.

This report contains statements that are, or may be considered to be, forward-looking statements. All statements that are not historical facts, including statements about our beliefs or expectations, are “forward-looking statements” within the meaning of The U.S. Private Securities Litigation Reform Act of 1995. These statements may be identified by such forward-looking terminology as “expect,” “estimate,” “plan,” “intend,” “believe,” “anticipate,” “may,” “will,” “should,” “could,” “continue,” “project,” or similar statements or variations of such terms. Our forward-looking statements are based on a series of expectations, assumptions, and projections, are not guarantees of future results or performance, and involve substantial risks and uncertainty as described in Form ADV Part 2A of our filing with the Securities and Exchange Commission (SEC), which is available at www.adviserinfo.sec.gov or by requesting a copy by emailing info@navellier.com. All of our forward-looking statements are as of the date of this report only. We can give no assurance that such expectations or forward-looking statements will prove to be correct. Actual results may differ materially. You are urged to carefully consider all such factors.

FEDERAL TAX ADVICE DISCLAIMER: As required by U.S. Treasury Regulations, you are informed that, to the extent this presentation includes any federal tax advice, the presentation is not written by Navellier to be used, and cannot be used, for the purpose of avoiding federal tax penalties. Navellier does not advise on any income tax requirements or issues. Use of any information presented by Navellier is for general information only and does not represent tax advice either express or implied. You are encouraged to seek professional tax advice for income tax questions and assistance.

IMPORTANT NEWSLETTER DISCLOSURE:The hypothetical performance results for investment newsletters that are authored or edited by Louis Navellier, including Louis Navellier’s Growth Investor, Louis Navellier’s Breakthrough Stocks, Louis Navellier’s Accelerated Profits, and Louis Navellier’s Platinum Club, are not based on any actual securities trading, portfolio, or accounts, and the newsletters’ reported hypothetical performances should be considered mere “paper” or proforma hypothetical performance results and are not actual performance of real world trades. Navellier & Associates, Inc. does not have any relation to or affiliation with the owner of these newsletters. There are material differences between Navellier Investment Products’ portfolios and the InvestorPlace Media, LLC newsletter portfolios authored by Louis Navellier. The InvestorPlace Media, LLC newsletters contain hypothetical performance that do not include transaction costs, advisory fees, or other fees a client might incur if actual investments and trades were being made by an investor. As a result, newsletter performance should not be used to evaluate Navellier Investment services which are separate and different from the newsletters. The owner of the newsletters is InvestorPlace Media, LLC and any questions concerning the newsletters, including any newsletter advertising or hypothetical Newsletter performance claims, (which are calculated solely by Investor Place Media and not Navellier) should be referred to InvestorPlace Media, LLC at (800) 718-8289.

Please note that Navellier & Associates and the Navellier Private Client Group are managed completely independent of the newsletters owned and published by InvestorPlace Media, LLC and written and edited by Louis Navellier, and investment performance of the newsletters should in no way be considered indicative of potential future investment performance for any Navellier & Associates separately managed account portfolio. Potential investors should consult with their financial advisor before investing in any Navellier Investment Product.

Navellier claims compliance with Global Investment Performance Standards (GIPS). To receive a complete list and descriptions of Navellier’s composites and/or a presentation that adheres to the GIPS standards, please contact Navellier or click here. It should not be assumed that any securities recommendations made by Navellier & Associates, Inc. in the future will be profitable or equal the performance of securities made in this report.

FactSet Disclosure: Navellier does not independently calculate the statistical information included in the attached report. The calculation and the information are provided by FactSet, a company not related to Navellier. Although information contained in the report has been obtained from FactSet and is based on sources Navellier believes to be reliable, Navellier does not guarantee its accuracy, and it may be incomplete or condensed. The report and the related FactSet sourced information are provided on an “as is” basis. The user assumes the entire risk of any use made of this information. Investors should consider the report as only a single factor in making their investment decision. The report is for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of a security. FactSet sourced information is the exclusive property of FactSet. Without prior written permission of FactSet, this information may not be reproduced, disseminated or used to create any financial products. All indices are unmanaged and performance of the indices include reinvestment of dividends and interest income, unless otherwise noted, are not illustrative of any particular investment and an investment cannot be made in any index. Past performance is no guarantee of future results.