by Gary Alexander

April 9, 2024

The annual IRS tax deadline is on us, matching the historic date of the sinking of the Titanic in 1912 and the death of Lincoln, so let’s forget Shakespeare and Julius Caesar and fear the Ides of April, not March.

Back in the 1990s, when I moderated six investment conferences a year, I used the Atlanta Investment Conference (timed to coincide with the Masters Golf Tournament) to thank the audience, something like this: “Since most of you are at, or near, the top income tax bracket, I want to thank you for paying more than your fair share in income taxes. Your nation should thank you. They don’t, so I will. Thank you.”

I must admit that the audience usually gave me a blank stare – a deer in the headlights look – like nobody ever said that to them before. A few smiled, but most looked down like it was an embarrassing secret.

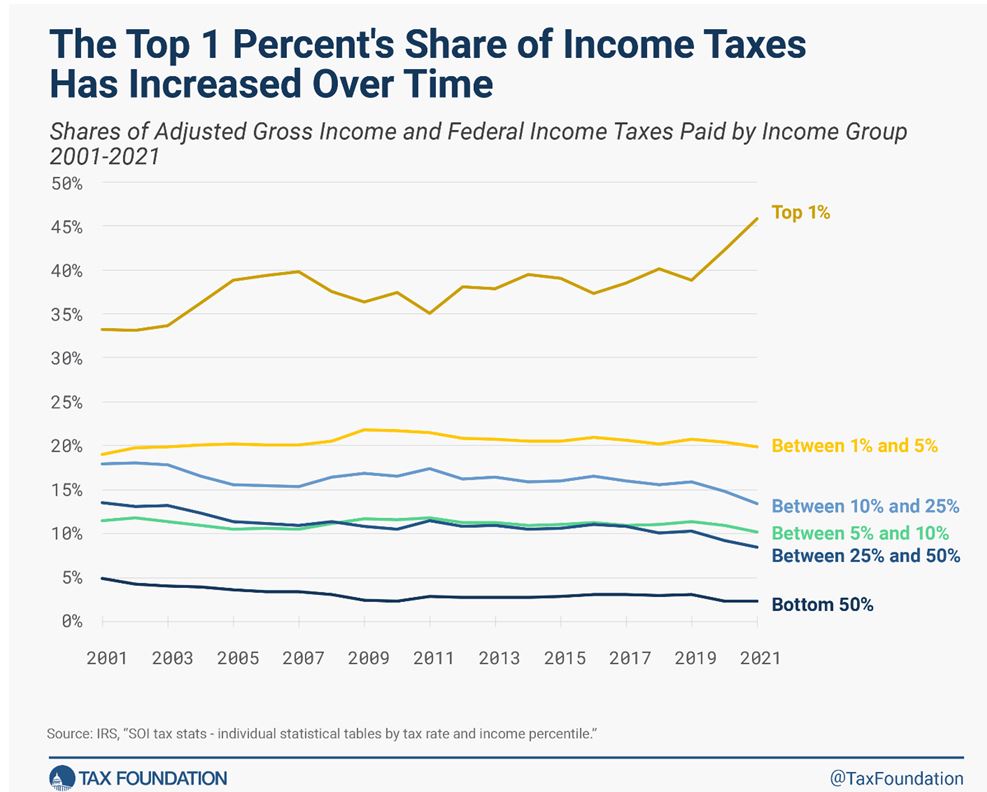

Sure enough, President Biden is proposing tax increases on the rich in his 2025 budget, vowing they will pay their “fair share,” even though the top 1% in 2021 paid 46% of all income taxes, up from 33% in 2001, and 39% in 2018. The Top 10% of earners in 2021 paid 75.8% of all income taxes. How much more than that do they need to reach the “fair” plateau? The bottom 50% paid only 2.3% of all income taxes.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

I could go on quoting such statistics for another 1,000 words or a dozen paragraphs, while listing the booms in the stock market and federal tax revenues following the tax rate cuts in the 1920s, 1960s, 1980s 2000s and 2017, but skeptics ignore that like white noise in the room, or disco music. It’s “cognitive dissonance” to their belief system. So let me try another angle. I was there and saw it happen, first-hand, with the Tax Reform Act of 1986, the act that killed the magazine I was editing, “Wealth Magazine.”

The 1986 Tax Bill That Killed Nearly All Tax Shelters – and My “Wealth Magazine”

In the mid-1980s, I had all the editorial energy in the world, editing two monthly newsletters, “Gold Newsletter” and a compendium of over 100 newsletters which I called “Investor’s Notebook,” plus a daily news summary for our staff called “Alexander’s Morning Economic Newsletter” (AMEN), a few other bulletins, and a quarterly glossy magazine, called “Wealth” (like Money but for the top 1%). It wasn’t something I did by choice, but it was an outgrowth of other endeavors for my publisher, as we tried to reach a wider mainstream audience with our message of alternative investment portfolio choices.

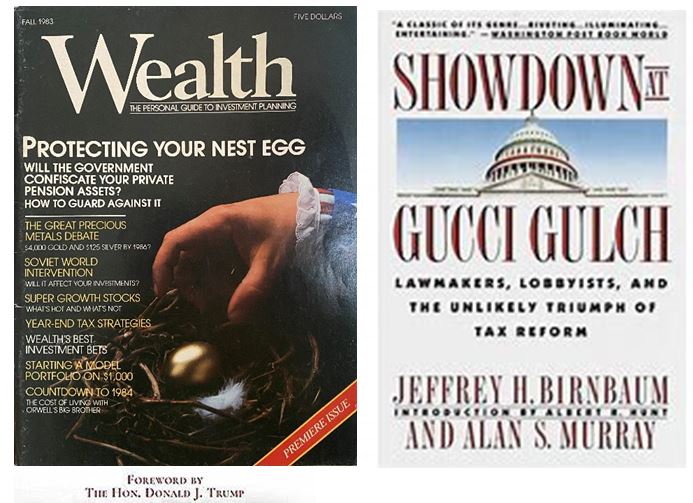

However, there was a dark side of “wealth investing” that I didn’t enjoy, and that was the advertising-driven array of articles necessary to cover tax shelters for the super-wealthy. The first edition in the Fall of 1983 (pictured below) was titled “Protecting Your Nest Egg” against confiscation or high taxes, with articles on “Year-end Tax Strategies.” I’ve been looking at all 14 issues and each has such tax strategies.

As Reagan’s second term began, tax reform was in the air. Our Spring 1985 issue begin with rumors of a big tax cut coming. Our first article was headlined: “Tax Shelters: The Flat Tax and Your Investments:” The article began, “There has been considerable talk about a flat tax or ‘modified flat tax.’ …. Some investors, paralyzed by uncertainty, have reacted by avoiding all tax shelters. This is exactly the wrong strategy.” The article went on to promote limited partnerships. The next two articles in that issue were also about tax shelters: “Low-Profile Offshore Investing” and “Tried and True Real Estate Techniques,” which involved leverage, adjusted cost basis, tax deferral rollovers and other tricks not involving actually living in the darned house! Later in that issue was a major article on “tax-sheltered life insurance.”

I must admit that these articles were no fun editing. I didn’t solicit them. They usually came as part of a package of advertising or speaker deals. Although I insisted they be clear, legal, informative and not geared toward a sales pitch, they either confused me with their convoluted legalese and math or they bored me. I would rather publish articles about clear profit opportunities than how to spend $10,000 to lose $5,000 in order to save $20,000 to $30,000 in taxes because you are in the 50% or higher tax bracket.

To the very rich, it made sense to spend (waste) up to half of their time and money weighing these very obscure tax shelters if they were in the 50% personal federal income tax bracket (plus more in state, local and other add-on taxes) or in the 46% corporate tax bracket, which prevailed from 1983 to 1986.

That’s where the 1986 Tax Act came in, killing all of these shelters, and our magazine. Most tax shelters disappeared at the end of 1986 due to the Tax Act that reduced top rates to 28% and eliminated virtually all abusive tax shelters. It passed the Senate Financial Committee 20-0 on May 7, 1986, a warning shot, and then it passed the full Senate by a commanding majority of 97-3, including the vote of one Joe Biden.

On September 25, it passed the House and it was signed into law by President Reagan on October 22, 1986. Very soon, we went to press with our final (winter 1986-87 edition of Wealth Magazine. We just couldn’t sell enough advertising among tax shelter folks and others benefiting from wealth workarounds.

That law really goosed the stock market, too. In the 10 months from October 21, 1986 (the day before tax reform passed) to August 25, 1987, the Dow Jones Industrial average rose 50%, from 1805 to 2702, so in a sense you could say that the Crash of 1987 was caused by over-reaction to the Tax Reform of 1986.

Wall Street Journal reporters Jeffrey H. Birnbaum and Allen S. Murray wrote up this whole process in a very entertaining style in their book, “Showdown at Gucci Gulch,” so named because well-paid lobbyists for special interests in the tax code often charged $200 to $400 an hour ($500 to $1,000 today) and invariably wore Gucci shoes, but they didn’t expect 97 of 100 Senators to turn against them so suddenly.

Wealth magazine (1983-86) often focused on asset protection and tax shelters – until the 1986 Tax Reform killed that demand; “Gucci Gulch” referred to tax lawyer lobbyists; the 1986 tax reform held Consequences for them, too.

To give you a taste of the drama in the air back then, Washington bureau chief for the Journal at the time, Albert R. Hunt, began the introduction to Gucci Gulch: “The Tax Reform Act was the best political story of its time, full of suspense, and with a vivid cast of characters. It marked the most significant achievement of the second Reagan administration. Indeed, in the history of the Republic, very few pieces of legislation have more profoundly affected so many Americans. The saga was all the more dramatic because it was so unlikely. When the 99th Congress convened, tax reform barely was on the agenda.” The authors go on to show how all the characters who made it happen were previously in the pocket to special interests but transcended that trap and made the miracle happen – two low simple tax rates and virtually no shelters.

The Tax Reform Act suddenly lowered the top federal income tax rate from 50 percent to 28 percent, and rich people, as if with one sighing voice, surrendered, saying, “OK, we can live with that. Back to work.”

Likewise, when taxes are raised, rich folks go back to work on tax shelters. As Art Laffer says at the start of his book, “Taxes Have Consequences,” high-income earners can switch courses four ways, rapidly:

“The extent of their wherewithal gives them options. High earners can readily change the location of where they earn their income, the timing as to when they receive their income, and the form in which they receive their income – not to mention how much income they choose to earn.” (page 23).

Laffer presents compelling evidence (with his Laffer Curve) that the rich pay about 20% of their total income in taxes, whether the top rate is 30%, 50% or 70%. They so arrange their affairs that the income they report is about what they’re willing to pay, even though they must create strained legal structures to reduce, move, delay or shelter the income they don’t want to share with Uncle Sam quite yet.

So, we either admit reality and human nature, or we deny history and science. Which will we choose?

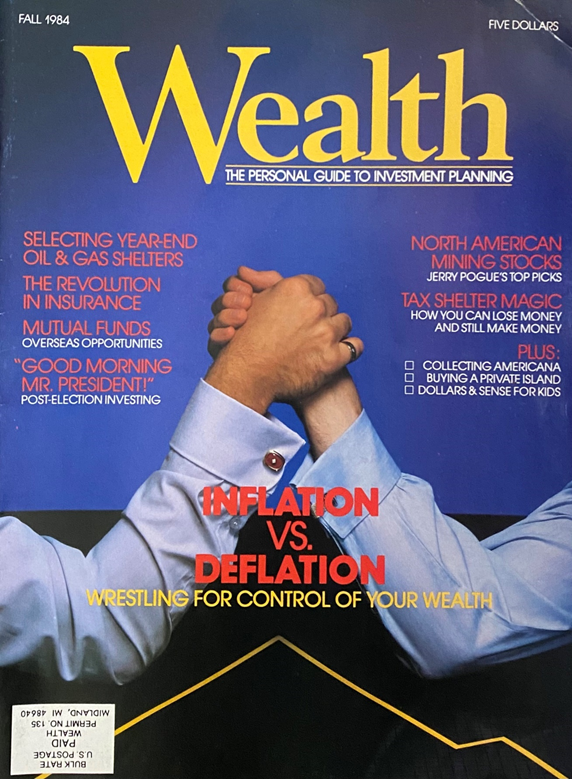

My “Wealth” Magazine (1983-86): May it rest in peace, along with high tax rates. This typical (Fall 1984) issue featured “Year-End Oil & Gas Shelters” (upper left) and “Tax Shelter Magic: How you can lose money and still make money,” the dirty little secret of tax shelters. (I much preferred moderating the “Inflation vs. Deflation debate” between two real experts and great gentlemen, Alexander Paris/inflation and Richard Russell/deflation).

Photo by grand-daughter Marleigh Alexander, since all evidence of Wealth Magazine is ghosted on the Internet.

All content above represents the opinion of Gary Alexander of Navellier & Associates, Inc.

Also In This Issue

A Look Ahead by Louis Navellier

With Rising Inflation and Bond Rates, is a June Fed Rate Cut Still Likely?

Income Mail by Bryan Perry

Fresh Market Volatility Comes from Unexpected Sources

Growth Mail by Gary Alexander

Why Raising Tax Rates Does NOT Raise More Tax Dollars

Global Mail by Ivan Martchev

With 10-Year Treasuries At 4.4%, How High is Too High?

Sector Spotlight by Jason Bodner

No April Showers on the Horizon

View Full Archive

Read Past Issues Here

About The Author

Gary Alexander

SENIOR EDITOR

Gary Alexander has been Senior Writer at Navellier since 2009. He edits Navellier’s weekly Marketmail and writes a weekly Growth Mail column, in which he uses market history to support the case for growth stocks. For the previous 20 years before joining Navellier, he was Senior Executive Editor at InvestorPlace Media (formerly Phillips Publishing), where he worked with several leading investment analysts, including Louis Navellier (since 1997), helping launch Louis Navellier’s Blue Chip Growth and Global Growth newsletters.

Prior to that, Gary edited Wealth Magazine and Gold Newsletter and wrote various investment research reports for Jefferson Financial in New Orleans in the 1980s. He began his financial newsletter career with KCI Communications in 1980, where he served as consulting editor for Personal Finance newsletter while serving as general manager of KCI’s Alexandria House book division. Before that, he covered the economics beat for news magazines. All content of “Growth Mail” represents the opinion of Gary Alexander

Important Disclosures:

Although information in these reports has been obtained from and is based upon sources that Navellier believes to be reliable, Navellier does not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute Navellier’s judgment as of the date the report was created and are subject to change without notice. These reports are for informational purposes only and are not a solicitation for the purchase or sale of a security. Any decision to purchase securities mentioned in these reports must take into account existing public information on such securities or any registered prospectus.To the extent permitted by law, neither Navellier & Associates, Inc., nor any of its affiliates, agents, or service providers assumes any liability or responsibility nor owes any duty of care for any consequences of any person acting or refraining to act in reliance on the information contained in this communication or for any decision based on it.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any securities recommendations made by Navellier. in the future will be profitable or equal the performance of securities made in this report. Dividend payments are not guaranteed. The amount of a dividend payment, if any, can vary over time and issuers may reduce dividends paid on securities in the event of a recession or adverse event affecting a specific industry or issuer.

None of the stock information, data, and company information presented herein constitutes a recommendation by Navellier or a solicitation to buy or sell any securities. Any specific securities identified and described do not represent all of the securities purchased, sold, or recommended for advisory clients. The holdings identified do not represent all of the securities purchased, sold, or recommended for advisory clients and the reader should not assume that investments in the securities identified and discussed were or will be profitable.

Information presented is general information that does not take into account your individual circumstances, financial situation, or needs, nor does it present a personalized recommendation to you. Individual stocks presented may not be suitable for every investor. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. Investment in fixed income securities has the potential for the investment return and principal value of an investment to fluctuate so that an investor’s holdings, when redeemed, may be worth less than their original cost.

One cannot invest directly in an index. Index is unmanaged and index performance does not reflect deduction of fees, expenses, or taxes. Presentation of Index data does not reflect a belief by Navellier that any stock index constitutes an investment alternative to any Navellier equity strategy or is necessarily comparable to such strategies. Among the most important differences between the Indices and Navellier strategies are that the Navellier equity strategies may (1) incur material management fees, (2) concentrate its investments in relatively few stocks, industries, or sectors, (3) have significantly greater trading activity and related costs, and (4) be significantly more or less volatile than the Indices.

ETF Risk: We may invest in exchange traded funds (“ETFs”) and some of our investment strategies are generally fully invested in ETFs. Like traditional mutual funds, ETFs charge asset-based fees, but they generally do not charge initial sales charges or redemption fees and investors typically pay only customary brokerage fees to buy and sell ETF shares. The fees and costs charged by ETFs held in client accounts will not be deducted from the compensation the client pays Navellier. ETF prices can fluctuate up or down, and a client account could lose money investing in an ETF if the prices of the securities owned by the ETF go down. ETFs are subject to additional risks:

- ETF shares may trade above or below their net asset value;

- An active trading market for an ETF’s shares may not develop or be maintained;

- The value of an ETF may be more volatile than the underlying portfolio of securities the ETF is designed to track;

- The cost of owning shares of the ETF may exceed those a client would incur by directly investing in the underlying securities; and

- Trading of an ETF’s shares may be halted if the listing exchange’s officials deem it appropriate, the shares are delisted from the exchange, or the activation of market-wide “circuit breakers” (which are tied to large decreases in stock prices) halts stock trading generally.

Grader Disclosures: Investment in equity strategies involves substantial risk and has the potential for partial or complete loss of funds invested. The sample portfolio and any accompanying charts are for informational purposes only and are not to be construed as a solicitation to buy or sell any financial instrument and should not be relied upon as the sole factor in an investment making decision. As a matter of normal and important disclosures to you, as a potential investor, please consider the following: The performance presented is not based on any actual securities trading, portfolio, or accounts, and the reported performance of the A, B, C, D, and F portfolios (collectively the “model portfolios”) should be considered mere “paper” or pro forma performance results based on Navellier’s research.

Investors evaluating any of Navellier & Associates, Inc.’s, (or its affiliates’) Investment Products must not use any information presented here, including the performance figures of the model portfolios, in their evaluation of any Navellier Investment Products. Navellier Investment Products include the firm’s mutual funds and managed accounts. The model portfolios, charts, and other information presented do not represent actual funded trades and are not actual funded portfolios. There are material differences between Navellier Investment Products’ portfolios and the model portfolios, research, and performance figures presented here. The model portfolios and the research results (1) may contain stocks or ETFs that are illiquid and difficult to trade; (2) may contain stock or ETF holdings materially different from actual funded Navellier Investment Product portfolios; (3) include the reinvestment of all dividends and other earnings, estimated trading costs, commissions, or management fees; and, (4) may not reflect prices obtained in an actual funded Navellier Investment Product portfolio. For these and other reasons, the reported performances of model portfolios do not reflect the performance results of Navellier’s actually funded and traded Investment Products. In most cases, Navellier’s Investment Products have materially lower performance results than the performances of the model portfolios presented.

This report contains statements that are, or may be considered to be, forward-looking statements. All statements that are not historical facts, including statements about our beliefs or expectations, are “forward-looking statements” within the meaning of The U.S. Private Securities Litigation Reform Act of 1995. These statements may be identified by such forward-looking terminology as “expect,” “estimate,” “plan,” “intend,” “believe,” “anticipate,” “may,” “will,” “should,” “could,” “continue,” “project,” or similar statements or variations of such terms. Our forward-looking statements are based on a series of expectations, assumptions, and projections, are not guarantees of future results or performance, and involve substantial risks and uncertainty as described in Form ADV Part 2A of our filing with the Securities and Exchange Commission (SEC), which is available at www.adviserinfo.sec.gov or by requesting a copy by emailing info@navellier.com. All of our forward-looking statements are as of the date of this report only. We can give no assurance that such expectations or forward-looking statements will prove to be correct. Actual results may differ materially. You are urged to carefully consider all such factors.

FEDERAL TAX ADVICE DISCLAIMER: As required by U.S. Treasury Regulations, you are informed that, to the extent this presentation includes any federal tax advice, the presentation is not written by Navellier to be used, and cannot be used, for the purpose of avoiding federal tax penalties. Navellier does not advise on any income tax requirements or issues. Use of any information presented by Navellier is for general information only and does not represent tax advice either express or implied. You are encouraged to seek professional tax advice for income tax questions and assistance.

IMPORTANT NEWSLETTER DISCLOSURE:The hypothetical performance results for investment newsletters that are authored or edited by Louis Navellier, including Louis Navellier’s Growth Investor, Louis Navellier’s Breakthrough Stocks, Louis Navellier’s Accelerated Profits, and Louis Navellier’s Platinum Club, are not based on any actual securities trading, portfolio, or accounts, and the newsletters’ reported hypothetical performances should be considered mere “paper” or proforma hypothetical performance results and are not actual performance of real world trades. Navellier & Associates, Inc. does not have any relation to or affiliation with the owner of these newsletters. There are material differences between Navellier Investment Products’ portfolios and the InvestorPlace Media, LLC newsletter portfolios authored by Louis Navellier. The InvestorPlace Media, LLC newsletters contain hypothetical performance that do not include transaction costs, advisory fees, or other fees a client might incur if actual investments and trades were being made by an investor. As a result, newsletter performance should not be used to evaluate Navellier Investment services which are separate and different from the newsletters. The owner of the newsletters is InvestorPlace Media, LLC and any questions concerning the newsletters, including any newsletter advertising or hypothetical Newsletter performance claims, (which are calculated solely by Investor Place Media and not Navellier) should be referred to InvestorPlace Media, LLC at (800) 718-8289.

Please note that Navellier & Associates and the Navellier Private Client Group are managed completely independent of the newsletters owned and published by InvestorPlace Media, LLC and written and edited by Louis Navellier, and investment performance of the newsletters should in no way be considered indicative of potential future investment performance for any Navellier & Associates separately managed account portfolio. Potential investors should consult with their financial advisor before investing in any Navellier Investment Product.

Navellier claims compliance with Global Investment Performance Standards (GIPS). To receive a complete list and descriptions of Navellier’s composites and/or a presentation that adheres to the GIPS standards, please contact Navellier or click here. It should not be assumed that any securities recommendations made by Navellier & Associates, Inc. in the future will be profitable or equal the performance of securities made in this report.

FactSet Disclosure: Navellier does not independently calculate the statistical information included in the attached report. The calculation and the information are provided by FactSet, a company not related to Navellier. Although information contained in the report has been obtained from FactSet and is based on sources Navellier believes to be reliable, Navellier does not guarantee its accuracy, and it may be incomplete or condensed. The report and the related FactSet sourced information are provided on an “as is” basis. The user assumes the entire risk of any use made of this information. Investors should consider the report as only a single factor in making their investment decision. The report is for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of a security. FactSet sourced information is the exclusive property of FactSet. Without prior written permission of FactSet, this information may not be reproduced, disseminated or used to create any financial products. All indices are unmanaged and performance of the indices include reinvestment of dividends and interest income, unless otherwise noted, are not illustrative of any particular investment and an investment cannot be made in any index. Past performance is no guarantee of future results.