by Gary Alexander

March 5, 2024

On March 4, 1789, 235 years ago yesterday, George Washington was sworn in as America’s first President and the first session of the U.S. Congress was held in New York City, near Wall Street. It was an inauspicious session, as only nine of 22 Senators and 13 of 59 representatives showed up. Over in France, a revolution was brewing, breaking out on July 14, 1789, and when Washington left office, he warned of any “entangling alliances” with Europe. Today, we’re still struggling how to handle those alliances.

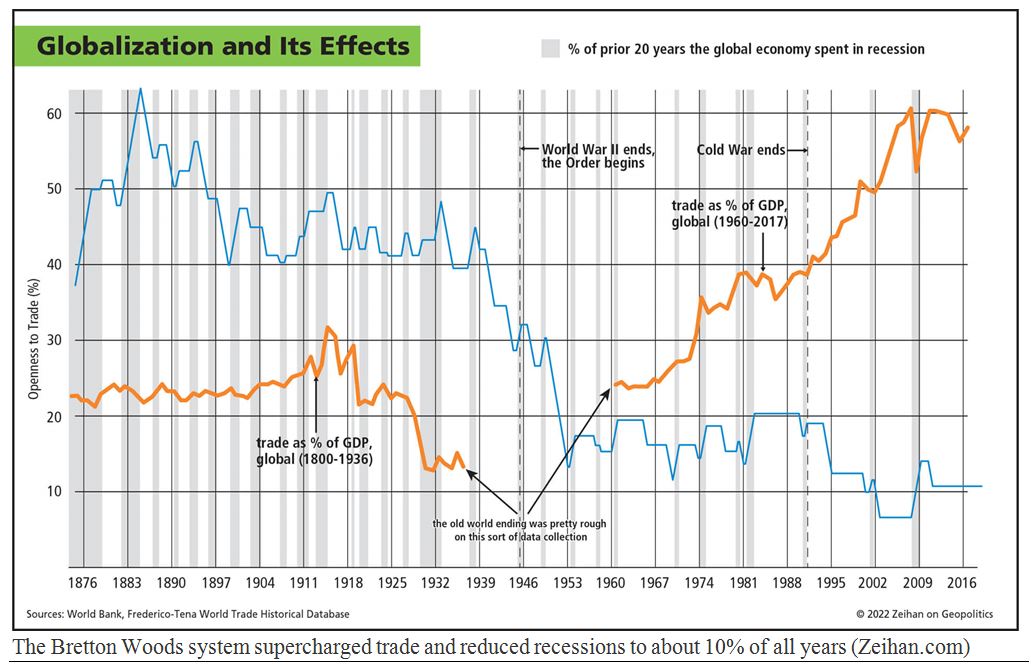

Case in point: Eighty years ago this summer, representatives from all 44 Allied nations met and sealed a deal at a ski lodge in Bretton Woods, New Hampshire. According to geopolitical analyst Peter Zeihan, the deal basically said that we Americans would protect you, if you would trade with us. We would incur two big debts – a trade deficit (via our strong dollar) and a budget deficit (to build our defense shield) if you would buy our products, build your economies and be our Allies against any threat, like the Soviet Union.

Today, to paraphrase Lincoln, “Four score years ago, our 44-fathers made a deal. Now we are engaged in a great civil war at home, testing whether that deal, so conceived and so dedicated, can long endure.”

By any measure, it was a great deal for everyone involved, leading to greater wealth and relative peace:

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

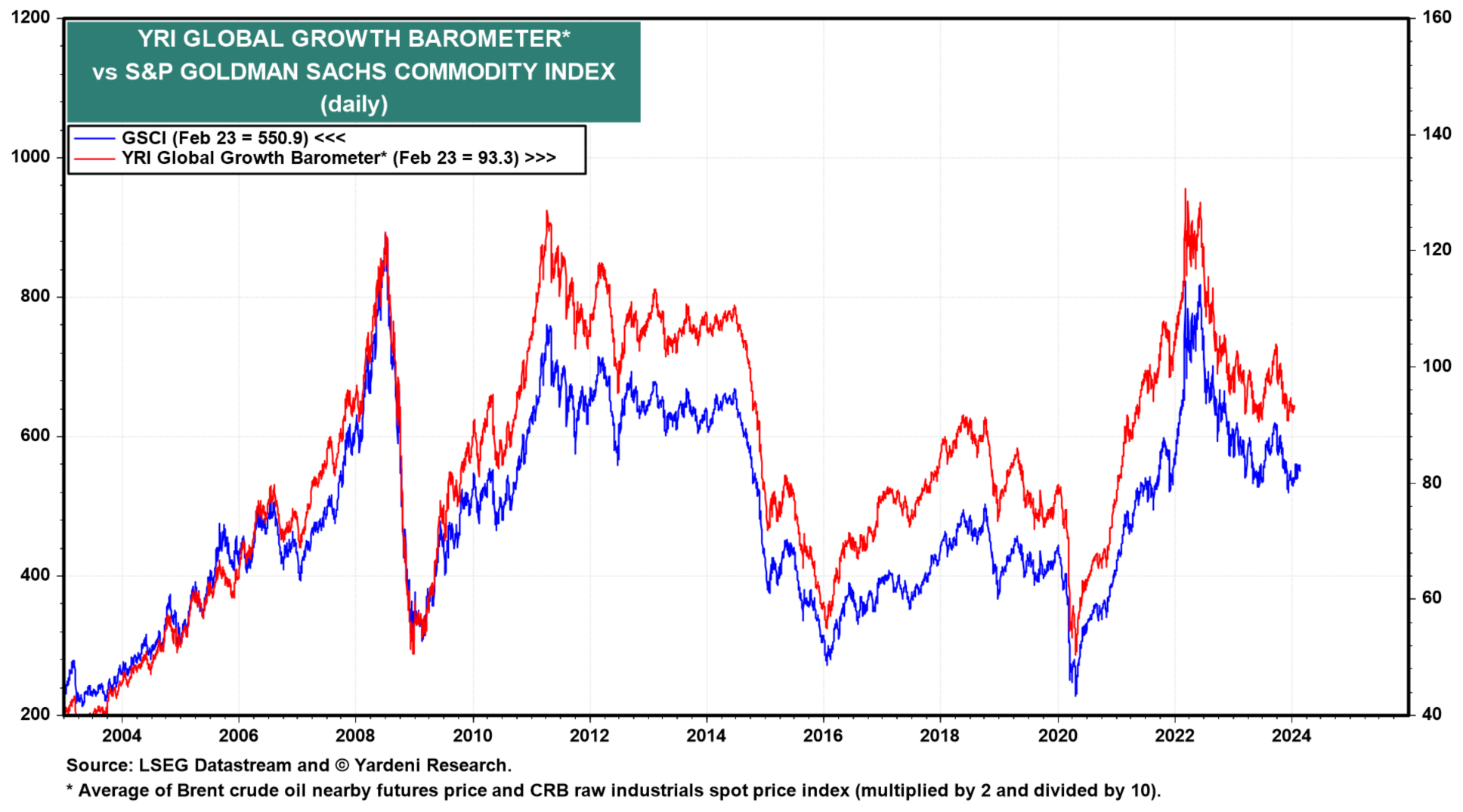

America is still growing, but the rest of the world is not. The next four biggest economic powers are either in or entering a recession – #2-China, #3-Japan, #4-Germany and #5-UK. Last Tuesday, economist Ed Yardeni wrote: “Both the United Kingdom (UK) and Japan entered technical recessions during the last three months of 2023. Germany is on the edge of falling into a recession. In our opinion, China is in a recession, though the government’s official statistics don’t reflect it.” (From “Is the Global Economy in a Recession?”) He adds, “The global economy is in a funk” (citing his YRI Global Growth Barometer).

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Yardeni argues that China’s recession is “attributable to the huge negative wealth effect resulting from the bursting of China’s real estate bubble and the resulting plunge in the stock market. In addition, China’s demographic profile is aging rapidly. The UK, Germany, and Japan also have structural problems related to the aging of their populations,” with the U.S. alone adding people (albeit slowly, and by immigration).

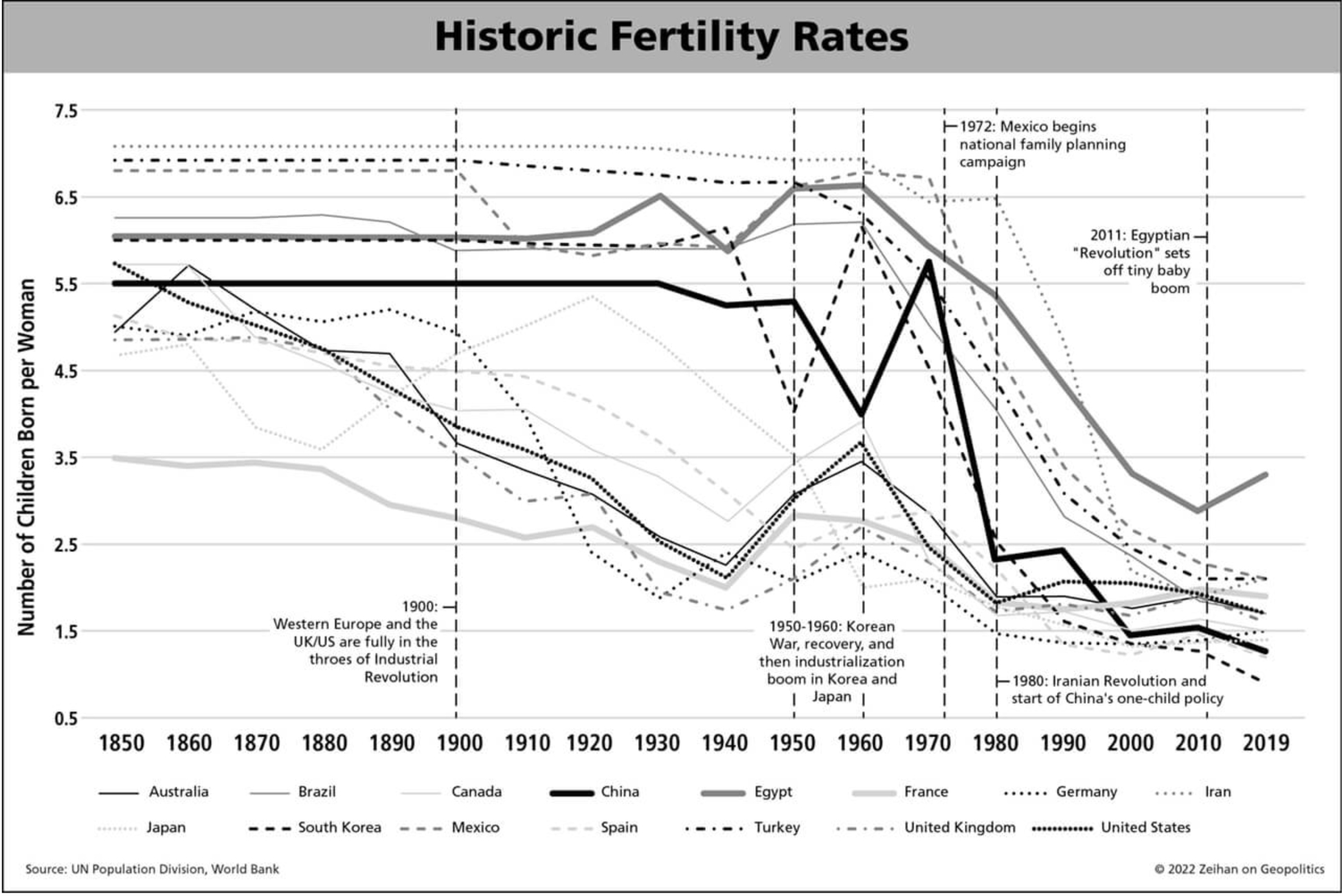

A “birth dearth” is taking place all over Europe and Asia. The fertility rate of 2.1 births per woman (over a lifetime) is necessary for replacement of the existing population, but the ratio is below 1.25 in several of the smaller, richer Asian nations, like Taiwan (1.09), South Korea (1.11), Singapore (1.17) and Hong Kong (1.23). In Europe, the fertility rate is at or below 1.4; in Spain (1.29), Italy (1.30), Portugal (1.37), Greece (1.38) and Finland (1.40). In North America, Canada is at 1.47 and America is at 1.66. No rich, developed economy on earth seems to be close to replacing its population by natural means alone.

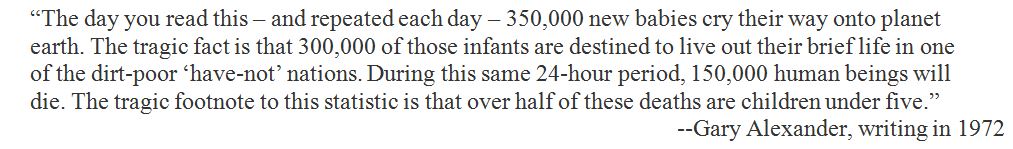

Over 50 years ago (I shamefully admit), I believed Paul Ehrlich’s “Population Bomb” (1968) book and a companion screed called “Famine 1975” by William and Paul Paddock (1967). In my best purple prose of the day, I wrote a booklet predicting “Famine in the 1970s,” proclaiming the rising death rates to come:

Here’s a chart of how wrong young Gary turned out to be:

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

I was blessedly wrong, as infant mortality has largely been conquered, and life expectancy has increased by three decades or more since 1950 for more than half the world’s population. I’m thankful I was wrong!

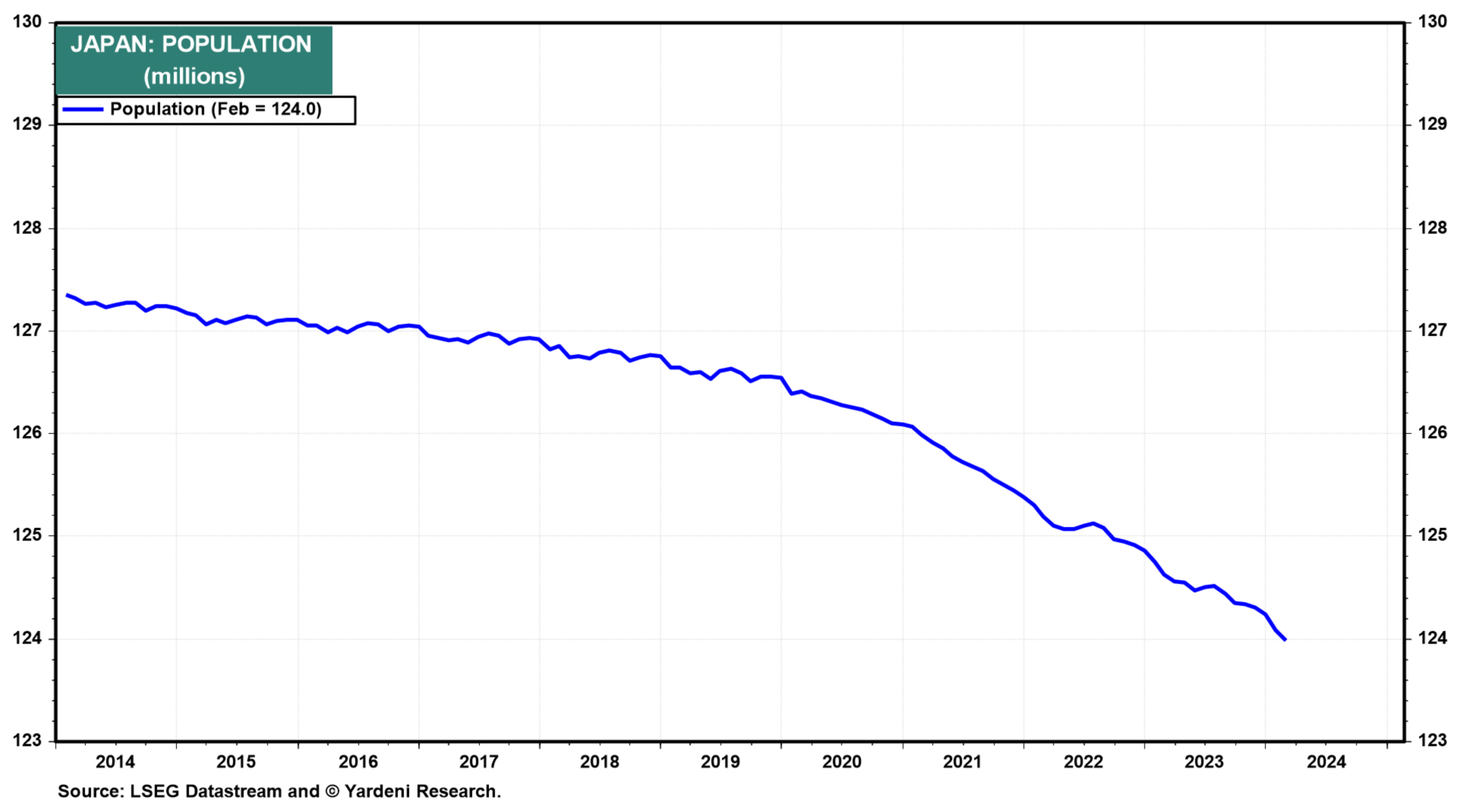

Ehrlich’s Population Bomb implied overpopulation, but today’s population bomb is a “neutron bomb” of slow demographic extinction on the installment plan. In the decade since January 2014, Japan’s head count is down by 3.4 million to 124 million. There are now 51.2 Japanese over 64 for each 100 Japanese age 15 to 64, so fewer than two working age Japanese can support the needs of each retired person.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

The Rivers of Germany and America Fuel Efficient Commerce

Perhaps Germany is the most shocking of the European laggards, since it has been the clear powerhouse of Europe for so long, but Germany’s real GDP declined 1.1% (annual rate) in the fourth quarter after a flat third quarter, with its manufacturing sector down 3.9% for all of 2023. The agricultural sector was also hit hard by Europe’s “all in” Green New Deal at a time when Europe banned Russian energy imports.

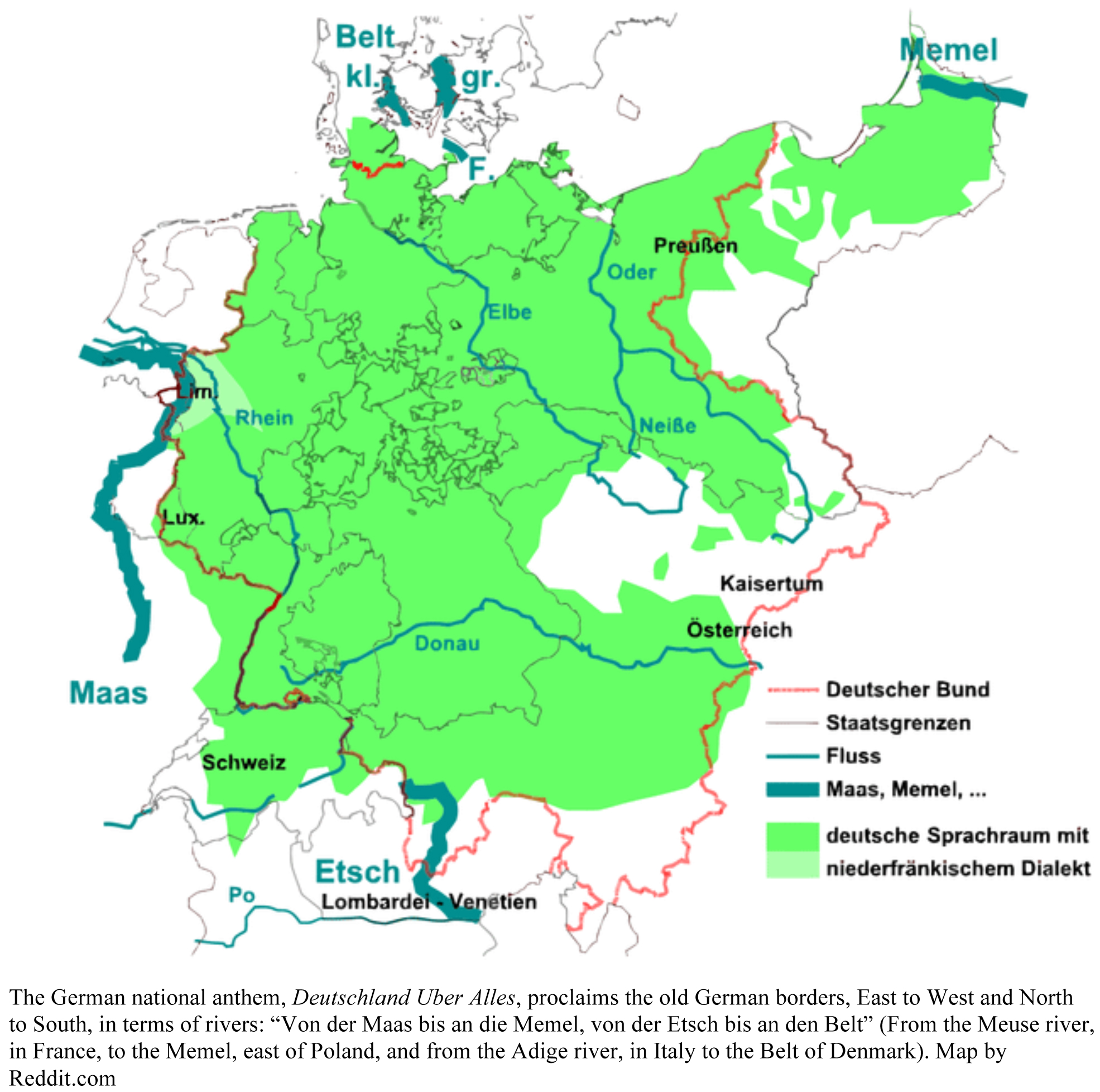

Peter Zeihan believes Germany’s advantage stems more from its navigable rivers than its reputed work ethic. I would add that its rivers even made it into the German national anthem, “Deutschland Uber Alles.” In the first stanza, the line, “From the Meuse to the Memel” names two rivers, which stretched German borders (to Hitler’s delight) from France to the Baltic States, but even today’s shrunken German nation has more navigable rivers than the rest of northern Europe combined. Another line in the anthem stretches Germany’s border from deep into Swiss and Italian land up to Denmark. Even without those lines (since excised from the anthem), the Rhine (bordering France) and Elbe give access to the North Sea, the Oder (near Berlin) empties to the Baltic, and the Danube (down south) flows to the Black Sea.

As Zeihan points out, today’s Germany boasts about 2,000 miles of navigable rivers vs. 1,000 miles for France, but America takes the gold medal for river running by half-a-globe’s width, with 14,650 miles of navigable rivers, plus the Inter-coastal Waterway, running from the Chesapeake to the Texas border with Mexico. The Mississippi River is the longest navigable river in the world, 2,100 miles up to the Twin Cities, with six major tributaries serving most major industrial states, plus Canada’s St. Lawrence Seaway.

Zeihan also points out that moving cargo by water is the cheapest form of transport: “Modern container ships can transport goods for about net 17 cents per container-mile, compared to semi-trailer trucks that do it for net $2.40,” and road traffic “has an annual maintenance cost of $160 billion” vs. $2.7 billion for U.S. waterways and zero for ocean maintenance, so the “practical ratio of road to water transport inflates to anywhere from 40:1 in populated flatlands to in excess of 70:1 in sparsely populated highlands.”

That’s why Zeihan calls America “The Accidental Superpower.” America has a whole cornucopia of geographical advantages that the world wished they had – and fought wars for centuries to gain.

According to Zeihan (and many others), the Bretton Woods Order is now breaking down, whether Trump or Biden or anyone else is elected this year. Nations (and voters) are tired of the deal and are retreating back to their historic borders to try to go it alone in what used to be called “isolationism,” calling it self-sufficiency. It probably won’t work out well, so nations will likely return to the old trading system.

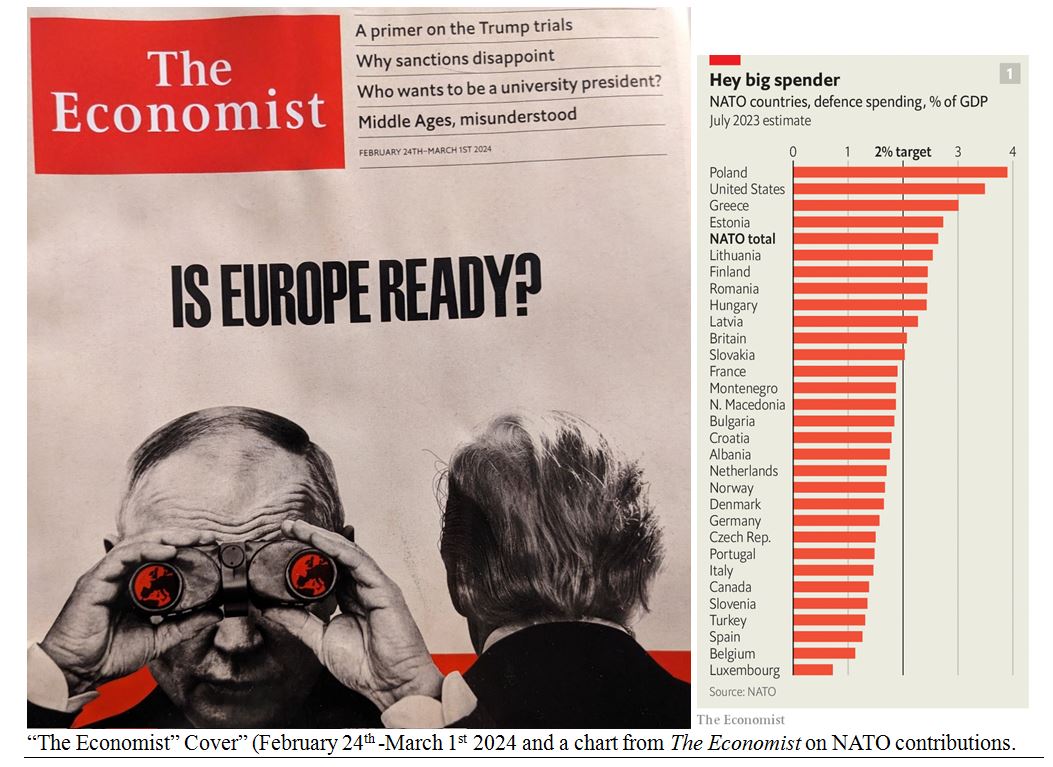

The Economist echoes this conundrum on its latest cover: “Is Europe Ready?” (Answer: Probably not)

The Economist begins: “Russia is becoming more dangerous; America is less reliable, and Europe remains unprepared.” Basically, Europe relied in Russian energy and American military security while spending their tax dollars on social programs, then replacing their negative natural population growth with immigrants, a volatile formula all around. So, they are in a geographical and demographic trap, caught between two old superpowers. It’s time for Europe to make like a Boy Scout and Be Prepared.

All content above represents the opinion of Gary Alexander of Navellier & Associates, Inc.

Also In This Issue

A Look Ahead by Louis Navellier

What Could Go Wrong After This Super Start to 2024?

Income Mail by Bryan Perry

The Coming Tidal Wave of AI-Driven Layoffs

Growth Mail by Gary Alexander

The U.S. Growth Machine Will Likely Rescue the World (Again)

Global Mail by Ivan Martchev

Small Caps are Due to Move Violently to the Upside

Sector Spotlight by Jason Bodner

When Reality and Perfect Planning Clash, Trust Reality

View Full Archive

Read Past Issues Here

About The Author

Gary Alexander

SENIOR EDITOR

Gary Alexander has been Senior Writer at Navellier since 2009. He edits Navellier’s weekly Marketmail and writes a weekly Growth Mail column, in which he uses market history to support the case for growth stocks. For the previous 20 years before joining Navellier, he was Senior Executive Editor at InvestorPlace Media (formerly Phillips Publishing), where he worked with several leading investment analysts, including Louis Navellier (since 1997), helping launch Louis Navellier’s Blue Chip Growth and Global Growth newsletters.

Prior to that, Gary edited Wealth Magazine and Gold Newsletter and wrote various investment research reports for Jefferson Financial in New Orleans in the 1980s. He began his financial newsletter career with KCI Communications in 1980, where he served as consulting editor for Personal Finance newsletter while serving as general manager of KCI’s Alexandria House book division. Before that, he covered the economics beat for news magazines. All content of “Growth Mail” represents the opinion of Gary Alexander

Important Disclosures:

Although information in these reports has been obtained from and is based upon sources that Navellier believes to be reliable, Navellier does not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute Navellier’s judgment as of the date the report was created and are subject to change without notice. These reports are for informational purposes only and are not a solicitation for the purchase or sale of a security. Any decision to purchase securities mentioned in these reports must take into account existing public information on such securities or any registered prospectus.To the extent permitted by law, neither Navellier & Associates, Inc., nor any of its affiliates, agents, or service providers assumes any liability or responsibility nor owes any duty of care for any consequences of any person acting or refraining to act in reliance on the information contained in this communication or for any decision based on it.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any securities recommendations made by Navellier. in the future will be profitable or equal the performance of securities made in this report. Dividend payments are not guaranteed. The amount of a dividend payment, if any, can vary over time and issuers may reduce dividends paid on securities in the event of a recession or adverse event affecting a specific industry or issuer.

None of the stock information, data, and company information presented herein constitutes a recommendation by Navellier or a solicitation to buy or sell any securities. Any specific securities identified and described do not represent all of the securities purchased, sold, or recommended for advisory clients. The holdings identified do not represent all of the securities purchased, sold, or recommended for advisory clients and the reader should not assume that investments in the securities identified and discussed were or will be profitable.

Information presented is general information that does not take into account your individual circumstances, financial situation, or needs, nor does it present a personalized recommendation to you. Individual stocks presented may not be suitable for every investor. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. Investment in fixed income securities has the potential for the investment return and principal value of an investment to fluctuate so that an investor’s holdings, when redeemed, may be worth less than their original cost.

One cannot invest directly in an index. Index is unmanaged and index performance does not reflect deduction of fees, expenses, or taxes. Presentation of Index data does not reflect a belief by Navellier that any stock index constitutes an investment alternative to any Navellier equity strategy or is necessarily comparable to such strategies. Among the most important differences between the Indices and Navellier strategies are that the Navellier equity strategies may (1) incur material management fees, (2) concentrate its investments in relatively few stocks, industries, or sectors, (3) have significantly greater trading activity and related costs, and (4) be significantly more or less volatile than the Indices.

ETF Risk: We may invest in exchange traded funds (“ETFs”) and some of our investment strategies are generally fully invested in ETFs. Like traditional mutual funds, ETFs charge asset-based fees, but they generally do not charge initial sales charges or redemption fees and investors typically pay only customary brokerage fees to buy and sell ETF shares. The fees and costs charged by ETFs held in client accounts will not be deducted from the compensation the client pays Navellier. ETF prices can fluctuate up or down, and a client account could lose money investing in an ETF if the prices of the securities owned by the ETF go down. ETFs are subject to additional risks:

- ETF shares may trade above or below their net asset value;

- An active trading market for an ETF’s shares may not develop or be maintained;

- The value of an ETF may be more volatile than the underlying portfolio of securities the ETF is designed to track;

- The cost of owning shares of the ETF may exceed those a client would incur by directly investing in the underlying securities; and

- Trading of an ETF’s shares may be halted if the listing exchange’s officials deem it appropriate, the shares are delisted from the exchange, or the activation of market-wide “circuit breakers” (which are tied to large decreases in stock prices) halts stock trading generally.

Grader Disclosures: Investment in equity strategies involves substantial risk and has the potential for partial or complete loss of funds invested. The sample portfolio and any accompanying charts are for informational purposes only and are not to be construed as a solicitation to buy or sell any financial instrument and should not be relied upon as the sole factor in an investment making decision. As a matter of normal and important disclosures to you, as a potential investor, please consider the following: The performance presented is not based on any actual securities trading, portfolio, or accounts, and the reported performance of the A, B, C, D, and F portfolios (collectively the “model portfolios”) should be considered mere “paper” or pro forma performance results based on Navellier’s research.

Investors evaluating any of Navellier & Associates, Inc.’s, (or its affiliates’) Investment Products must not use any information presented here, including the performance figures of the model portfolios, in their evaluation of any Navellier Investment Products. Navellier Investment Products include the firm’s mutual funds and managed accounts. The model portfolios, charts, and other information presented do not represent actual funded trades and are not actual funded portfolios. There are material differences between Navellier Investment Products’ portfolios and the model portfolios, research, and performance figures presented here. The model portfolios and the research results (1) may contain stocks or ETFs that are illiquid and difficult to trade; (2) may contain stock or ETF holdings materially different from actual funded Navellier Investment Product portfolios; (3) include the reinvestment of all dividends and other earnings, estimated trading costs, commissions, or management fees; and, (4) may not reflect prices obtained in an actual funded Navellier Investment Product portfolio. For these and other reasons, the reported performances of model portfolios do not reflect the performance results of Navellier’s actually funded and traded Investment Products. In most cases, Navellier’s Investment Products have materially lower performance results than the performances of the model portfolios presented.

This report contains statements that are, or may be considered to be, forward-looking statements. All statements that are not historical facts, including statements about our beliefs or expectations, are “forward-looking statements” within the meaning of The U.S. Private Securities Litigation Reform Act of 1995. These statements may be identified by such forward-looking terminology as “expect,” “estimate,” “plan,” “intend,” “believe,” “anticipate,” “may,” “will,” “should,” “could,” “continue,” “project,” or similar statements or variations of such terms. Our forward-looking statements are based on a series of expectations, assumptions, and projections, are not guarantees of future results or performance, and involve substantial risks and uncertainty as described in Form ADV Part 2A of our filing with the Securities and Exchange Commission (SEC), which is available at www.adviserinfo.sec.gov or by requesting a copy by emailing info@navellier.com. All of our forward-looking statements are as of the date of this report only. We can give no assurance that such expectations or forward-looking statements will prove to be correct. Actual results may differ materially. You are urged to carefully consider all such factors.

FEDERAL TAX ADVICE DISCLAIMER: As required by U.S. Treasury Regulations, you are informed that, to the extent this presentation includes any federal tax advice, the presentation is not written by Navellier to be used, and cannot be used, for the purpose of avoiding federal tax penalties. Navellier does not advise on any income tax requirements or issues. Use of any information presented by Navellier is for general information only and does not represent tax advice either express or implied. You are encouraged to seek professional tax advice for income tax questions and assistance.

IMPORTANT NEWSLETTER DISCLOSURE:The hypothetical performance results for investment newsletters that are authored or edited by Louis Navellier, including Louis Navellier’s Growth Investor, Louis Navellier’s Breakthrough Stocks, Louis Navellier’s Accelerated Profits, and Louis Navellier’s Platinum Club, are not based on any actual securities trading, portfolio, or accounts, and the newsletters’ reported hypothetical performances should be considered mere “paper” or proforma hypothetical performance results and are not actual performance of real world trades. Navellier & Associates, Inc. does not have any relation to or affiliation with the owner of these newsletters. There are material differences between Navellier Investment Products’ portfolios and the InvestorPlace Media, LLC newsletter portfolios authored by Louis Navellier. The InvestorPlace Media, LLC newsletters contain hypothetical performance that do not include transaction costs, advisory fees, or other fees a client might incur if actual investments and trades were being made by an investor. As a result, newsletter performance should not be used to evaluate Navellier Investment services which are separate and different from the newsletters. The owner of the newsletters is InvestorPlace Media, LLC and any questions concerning the newsletters, including any newsletter advertising or hypothetical Newsletter performance claims, (which are calculated solely by Investor Place Media and not Navellier) should be referred to InvestorPlace Media, LLC at (800) 718-8289.

Please note that Navellier & Associates and the Navellier Private Client Group are managed completely independent of the newsletters owned and published by InvestorPlace Media, LLC and written and edited by Louis Navellier, and investment performance of the newsletters should in no way be considered indicative of potential future investment performance for any Navellier & Associates separately managed account portfolio. Potential investors should consult with their financial advisor before investing in any Navellier Investment Product.

Navellier claims compliance with Global Investment Performance Standards (GIPS). To receive a complete list and descriptions of Navellier’s composites and/or a presentation that adheres to the GIPS standards, please contact Navellier or click here. It should not be assumed that any securities recommendations made by Navellier & Associates, Inc. in the future will be profitable or equal the performance of securities made in this report.

FactSet Disclosure: Navellier does not independently calculate the statistical information included in the attached report. The calculation and the information are provided by FactSet, a company not related to Navellier. Although information contained in the report has been obtained from FactSet and is based on sources Navellier believes to be reliable, Navellier does not guarantee its accuracy, and it may be incomplete or condensed. The report and the related FactSet sourced information are provided on an “as is” basis. The user assumes the entire risk of any use made of this information. Investors should consider the report as only a single factor in making their investment decision. The report is for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of a security. FactSet sourced information is the exclusive property of FactSet. Without prior written permission of FactSet, this information may not be reproduced, disseminated or used to create any financial products. All indices are unmanaged and performance of the indices include reinvestment of dividends and interest income, unless otherwise noted, are not illustrative of any particular investment and an investment cannot be made in any index. Past performance is no guarantee of future results.