by Gary Alexander

March 19, 2024

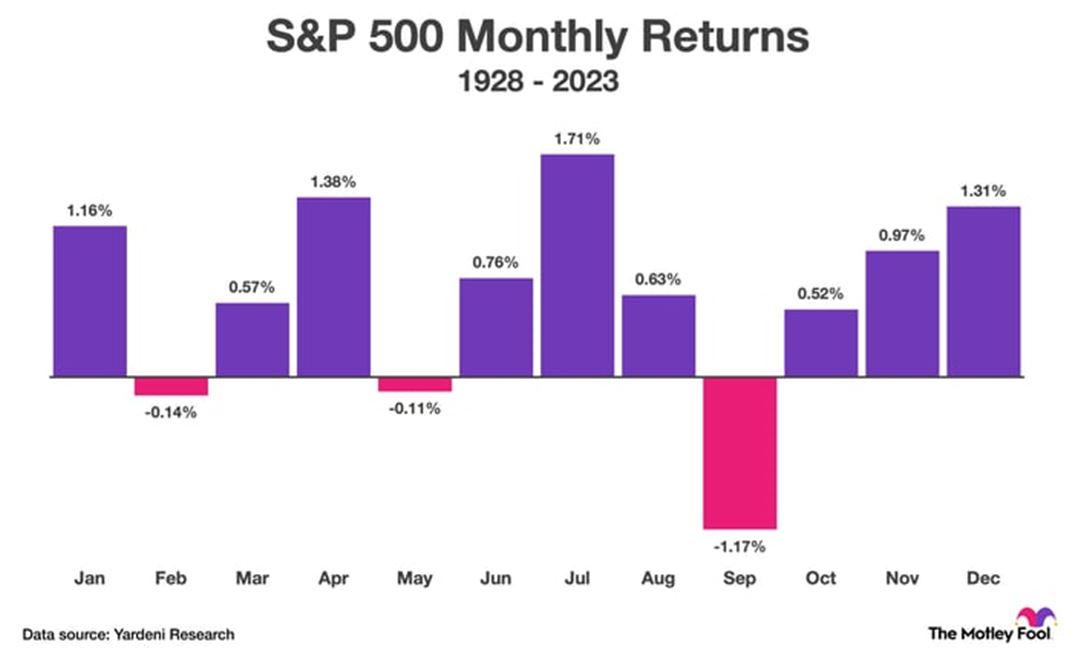

Spring begins on the earliest possible date today, March 19. Living way up north, near Canada, flowers are blooming outside my window today, and I’m happy to report that early Spring is also a good time for stocks to bloom. I just charted the performance of the S&P 500 from March 15 to April 30 since 1995, and it yields average gains of over 3% for that span, with 79% up-years. Taken together, March and April present a strong tandem (about +2%) in the last 95 years, according to research by economist Ed Yardeni:

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

However, that won’t keep the press from trying to spook us, so I always like to recall some round-number anniversaries in these columns. Here are two March Madness melodramas from 15 and 60 years ago:

On Monday, March 9, 2009 – 15 years ago last week – the Dow reached its lowest closing level since January 3, 1997, at 6547, but America’s leading financial newspaper made the case that morning that we would see a further fall to 1995 levels – to Dow 5000. Their article asked: “Just how low can stocks go?”

The Wall Street Journal was merely reflecting our national gloom. According to Charles Rotblut, editor of AAII Journal, bearish sentiment dominated that week’s American Association of Individual Investors poll, as it “reached a record high of 70.3% on March 5, 2009, just as the bear market was reaching a bottom.”

Even seven years later, on March 9, 2016, Bloomberg called it the “Most-Hated Bull Market” in history.

And last week, the Dow reached 39,200 – closing in on 40,000 – without plunging to 5,000 first.

But I have bigger fish to fry this week. In light of President Biden’s spendthrift budget request last week, first signaled by his laundry list in the State of the Union address the previous Thursday, I thought I’d go back to the birth of the “long election year laundry list budget promising process” 60 years ago, the most massive laundry list ever, the Great Society, delivered at a time when the President’s economic advisors thought we really had enough money to fund their most ambitious wish list – with billions to spare.

“We’re the Richest Country in the World. We Can Do It All.”

– President Lyndon B. Johnson, 1964

On March 16, 1964, President Lyndon Baines Johnson sent a modest billion-dollar request to Congress for a down payment on his declaration of “an all-out War on Poverty and unemployment” in America. It was a year in which the first 200 days of Beatlemania & Budget Mania rivalled FDR’s first 100 days.

By August, LBJ had created the Job Corps, Food Stamps, Medicare and Medicaid, a War on Poverty, the Gulf of Tonkin Resolution on August 7, which escalated the Vietnam War, combining “guns and butter” with rockets, since we had to “put a man on the moon and bring him back safely”! JFK had promised it!

The Greatest Generation lapped it all up. In November, President Johnson won 90% of the electoral votes and his coattails created the biggest Blue Wave in history: The House went 295-140 (68%) Democrat and the Senate turned 66-34 True Blue. These quotes summarize LBJ’s state of peak euphoria in late 1964:

“I doubt there have ever been so many people seeing things alike on Decision Day.”

– LBJ on November 5, 1964, the morning after he thrashed Barry Goldwater

“These are the most hopeful times since Christ was born in Bethlehem.”

– LBJ, when lighting the December 1964 White House Christmas Tree

“We have achieved a unity of interest among our people that is unmatched in the history of freedom.”

– LBJ in his State of the Union Speech, January 4, 1965

In a 1965 poll, the plurality of Americans who said they “trust the U.S. government” was an awesome 75%. That number reversed in a decade, after the ignominious end of the Vietnam War, Watergate, urban riots, and the OPEC oil embargo. By the late 1970s, only 25% said they “trusted the U.S. government.”

It took LBJ only three years to lose trust in himself, and to recant on his giddy hopes of national unity:

“I shall not seek-nor will I accept-the nomination of my party for another term as your President.”

– LBJ, March 31, 1968

The hubris of the Imperial Presidency – that’s the title of a 1973 book by Arthur Schlesinger, Jr., mostly referring to the times from Franklin D. Roosevelt through Richard Nixon – was midwifed by those who ran the Council of Economic Advisors, all of them disciples of British economist John Maynard Keynes.

According to former Fed Chairman Alan Greenspan and his co-author (from The Economist), Adrian Woolridge (writing in the 2018 book, “Capitalism in America”), those economists told JFK and LBJ that “the biggest problem facing the country was that the Treasury was raising too much money. A large federal surplus would act as a deflationary brake on economic growth [so] the government needed to find ways of spending money. Predictably, there was no shortage of ideas for doing the spending…’

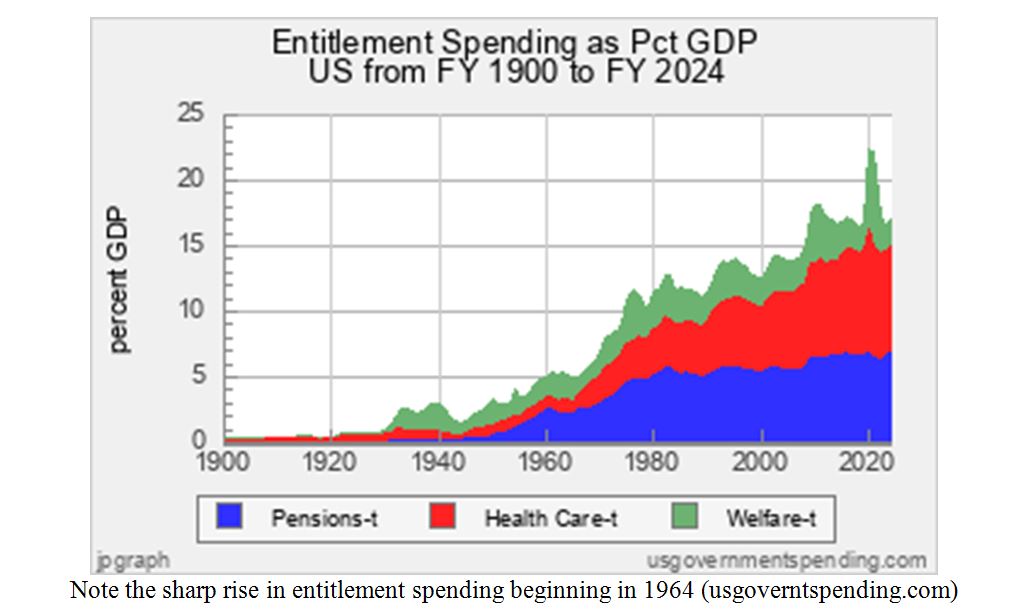

That’s why, after the JFK assassination, LBJ doubled down on spending, adding a huge array of Great Society entitlements – Medicare, Medicaid, additions to Social Security, Aid to Families with Dependent Children (AFDC), a War on Poverty, Public TV (later radio), a moon shot, and escalating Vietnam costs.

“Hell,” LBJ said in his 1964 presidential campaign, “I’m sick of all the people who talk about the things we can’t do. We’re the richest country in the world. We can do it all.” And therein lay the seeds of eternal deficits, LBJ’s Great programs that must be funded each year, in highly inflated dollars, forever and ever.

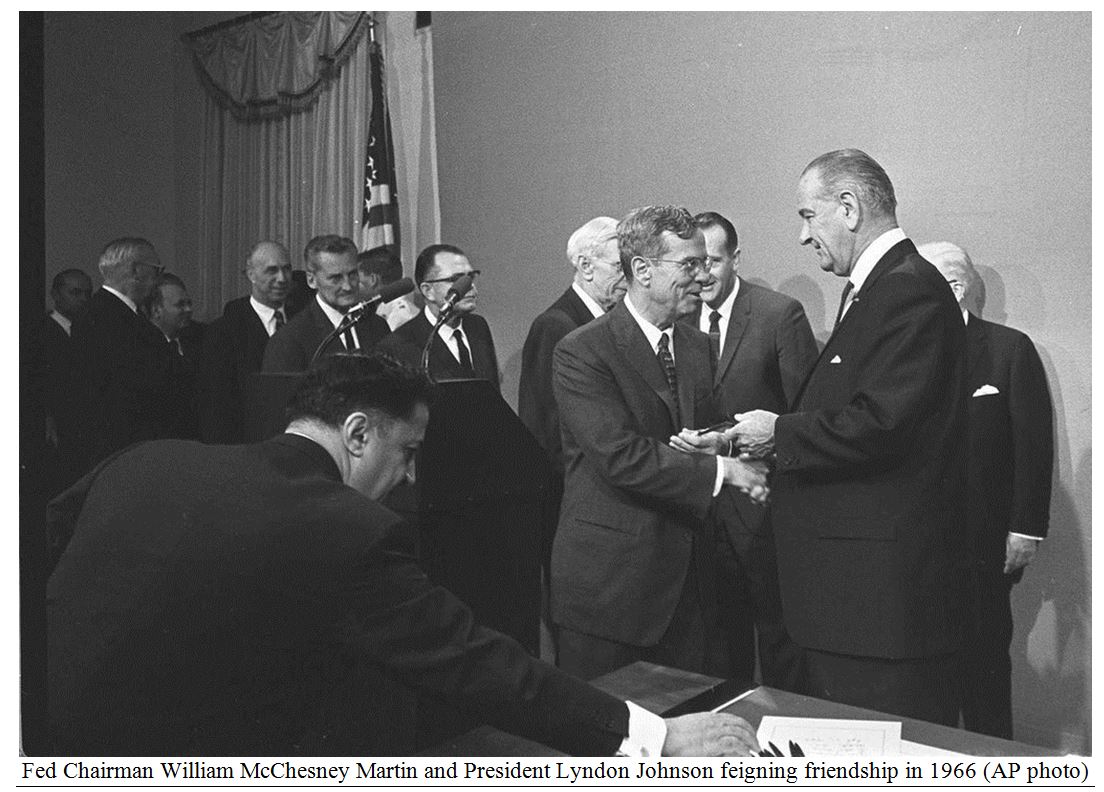

A Fed Chairman Stood in LBJ’s Path – But He Got Bullied into Submission

The Federal Reserve (almost alone) tried to rein in LBJ’s spending plans. On June 1, 1965, Fed Chairman William McChesney Martin – who had been in that office since 1951 – gave a famous warning. He was already famous for saying that his job was to “take away the punch bowl just as the party gets going,” so he tried to do just that, by limiting money supply just as the President was taking silver out of our coins.

In his address to Columbia University’s Alumni Federation on Commencement Day, Mr. Martin said he saw “disquieting similarities between our present prosperity and the fabulous 1920s.” Martin then listed several comparisons to 1929, including the fact that “many government officials, scholars, and businessmen were convinced that a new economic era had opened, an era in which business fluctuations had become a thing of the past.” He said, “Some experts seem resolved to ignore the lessons of the past.”

In the end, Martin sounded like a Biblical prophet, saying there had been “seven fat years of uninterrupted economic progress,” but now, “Prosperity was unequally concentrated…domestic debt was soaring.”

LBJ can overlook a flowery speech, but not tight monetary policy. In their book “Capitalism in America,” Greenspan and Wooldridge said that LBJ invited McChesney Martin to his Texas ranch and gave him the once-over, physically shoving him around the room, and yelling in his face. According to a New York Times report, Johnson told Martin, “You took advantage of me and I’m not going to forget it. Here I am, a sick man. You’ve got me into a position where you can run a rapier into me, and you’ve run it.” LBJ then played the blood card: “Martin, my boys are dying in Vietnam, and you won’t print the money I need.”

Wow! And we thought President Trump’s tweets to Fed Chair Jerome Powell were cheeky? Can you imagine such a war of words and physical confrontation between a President and a Fed Chairman today?

At first, fiat money seemed to work, like a drug. A top Census official said that America’s most pressing problem would be how to consume all the wealth it was producing: “A continuation of recent trends will carry us to unbelievable levels of economic activity in our own lifetimes.” But then came high inflation.

Now, after 60 years, the fruits of 1964’s Great Society are dooming us to deficits as far as the eye can see. The sad truth is that it is near-impossible to balance the budget due to ballooning LBJ-era entitlements.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

This brings us full circle to Biden’s Budget of Fiscal 2025, promising trillion-dollar deficits for as far as the eye can see. They are the sad legacy of LBJ’s “we can do it all” Great Society plans, born in 1964.

All content above represents the opinion of Gary Alexander of Navellier & Associates, Inc.

Also In This Issue

A Look Ahead by Louis Navellier

The Common-Sense Electrical Energy Solution (Everyone Ignores)

Income Mail by Bryan Perry

Here Comes Another Major Catalyst for the AI-Led Rally

Growth Mail by Gary Alexander

March Madness: Dow 5k Fears (2009) & Bloated Budgets Begin (1964)

Global Mail by Ivan Martchev

The Rotation into the Broad Market Accelerates

Sector Spotlight by Jason Bodner

The Easy Road (After Hard Study) to Riches

View Full Archive

Read Past Issues Here

About The Author

Gary Alexander

SENIOR EDITOR

Gary Alexander has been Senior Writer at Navellier since 2009. He edits Navellier’s weekly Marketmail and writes a weekly Growth Mail column, in which he uses market history to support the case for growth stocks. For the previous 20 years before joining Navellier, he was Senior Executive Editor at InvestorPlace Media (formerly Phillips Publishing), where he worked with several leading investment analysts, including Louis Navellier (since 1997), helping launch Louis Navellier’s Blue Chip Growth and Global Growth newsletters.

Prior to that, Gary edited Wealth Magazine and Gold Newsletter and wrote various investment research reports for Jefferson Financial in New Orleans in the 1980s. He began his financial newsletter career with KCI Communications in 1980, where he served as consulting editor for Personal Finance newsletter while serving as general manager of KCI’s Alexandria House book division. Before that, he covered the economics beat for news magazines. All content of “Growth Mail” represents the opinion of Gary Alexander

Important Disclosures:

Although information in these reports has been obtained from and is based upon sources that Navellier believes to be reliable, Navellier does not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute Navellier’s judgment as of the date the report was created and are subject to change without notice. These reports are for informational purposes only and are not a solicitation for the purchase or sale of a security. Any decision to purchase securities mentioned in these reports must take into account existing public information on such securities or any registered prospectus.To the extent permitted by law, neither Navellier & Associates, Inc., nor any of its affiliates, agents, or service providers assumes any liability or responsibility nor owes any duty of care for any consequences of any person acting or refraining to act in reliance on the information contained in this communication or for any decision based on it.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any securities recommendations made by Navellier. in the future will be profitable or equal the performance of securities made in this report. Dividend payments are not guaranteed. The amount of a dividend payment, if any, can vary over time and issuers may reduce dividends paid on securities in the event of a recession or adverse event affecting a specific industry or issuer.

None of the stock information, data, and company information presented herein constitutes a recommendation by Navellier or a solicitation to buy or sell any securities. Any specific securities identified and described do not represent all of the securities purchased, sold, or recommended for advisory clients. The holdings identified do not represent all of the securities purchased, sold, or recommended for advisory clients and the reader should not assume that investments in the securities identified and discussed were or will be profitable.

Information presented is general information that does not take into account your individual circumstances, financial situation, or needs, nor does it present a personalized recommendation to you. Individual stocks presented may not be suitable for every investor. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. Investment in fixed income securities has the potential for the investment return and principal value of an investment to fluctuate so that an investor’s holdings, when redeemed, may be worth less than their original cost.

One cannot invest directly in an index. Index is unmanaged and index performance does not reflect deduction of fees, expenses, or taxes. Presentation of Index data does not reflect a belief by Navellier that any stock index constitutes an investment alternative to any Navellier equity strategy or is necessarily comparable to such strategies. Among the most important differences between the Indices and Navellier strategies are that the Navellier equity strategies may (1) incur material management fees, (2) concentrate its investments in relatively few stocks, industries, or sectors, (3) have significantly greater trading activity and related costs, and (4) be significantly more or less volatile than the Indices.

ETF Risk: We may invest in exchange traded funds (“ETFs”) and some of our investment strategies are generally fully invested in ETFs. Like traditional mutual funds, ETFs charge asset-based fees, but they generally do not charge initial sales charges or redemption fees and investors typically pay only customary brokerage fees to buy and sell ETF shares. The fees and costs charged by ETFs held in client accounts will not be deducted from the compensation the client pays Navellier. ETF prices can fluctuate up or down, and a client account could lose money investing in an ETF if the prices of the securities owned by the ETF go down. ETFs are subject to additional risks:

- ETF shares may trade above or below their net asset value;

- An active trading market for an ETF’s shares may not develop or be maintained;

- The value of an ETF may be more volatile than the underlying portfolio of securities the ETF is designed to track;

- The cost of owning shares of the ETF may exceed those a client would incur by directly investing in the underlying securities; and

- Trading of an ETF’s shares may be halted if the listing exchange’s officials deem it appropriate, the shares are delisted from the exchange, or the activation of market-wide “circuit breakers” (which are tied to large decreases in stock prices) halts stock trading generally.

Grader Disclosures: Investment in equity strategies involves substantial risk and has the potential for partial or complete loss of funds invested. The sample portfolio and any accompanying charts are for informational purposes only and are not to be construed as a solicitation to buy or sell any financial instrument and should not be relied upon as the sole factor in an investment making decision. As a matter of normal and important disclosures to you, as a potential investor, please consider the following: The performance presented is not based on any actual securities trading, portfolio, or accounts, and the reported performance of the A, B, C, D, and F portfolios (collectively the “model portfolios”) should be considered mere “paper” or pro forma performance results based on Navellier’s research.

Investors evaluating any of Navellier & Associates, Inc.’s, (or its affiliates’) Investment Products must not use any information presented here, including the performance figures of the model portfolios, in their evaluation of any Navellier Investment Products. Navellier Investment Products include the firm’s mutual funds and managed accounts. The model portfolios, charts, and other information presented do not represent actual funded trades and are not actual funded portfolios. There are material differences between Navellier Investment Products’ portfolios and the model portfolios, research, and performance figures presented here. The model portfolios and the research results (1) may contain stocks or ETFs that are illiquid and difficult to trade; (2) may contain stock or ETF holdings materially different from actual funded Navellier Investment Product portfolios; (3) include the reinvestment of all dividends and other earnings, estimated trading costs, commissions, or management fees; and, (4) may not reflect prices obtained in an actual funded Navellier Investment Product portfolio. For these and other reasons, the reported performances of model portfolios do not reflect the performance results of Navellier’s actually funded and traded Investment Products. In most cases, Navellier’s Investment Products have materially lower performance results than the performances of the model portfolios presented.

This report contains statements that are, or may be considered to be, forward-looking statements. All statements that are not historical facts, including statements about our beliefs or expectations, are “forward-looking statements” within the meaning of The U.S. Private Securities Litigation Reform Act of 1995. These statements may be identified by such forward-looking terminology as “expect,” “estimate,” “plan,” “intend,” “believe,” “anticipate,” “may,” “will,” “should,” “could,” “continue,” “project,” or similar statements or variations of such terms. Our forward-looking statements are based on a series of expectations, assumptions, and projections, are not guarantees of future results or performance, and involve substantial risks and uncertainty as described in Form ADV Part 2A of our filing with the Securities and Exchange Commission (SEC), which is available at www.adviserinfo.sec.gov or by requesting a copy by emailing info@navellier.com. All of our forward-looking statements are as of the date of this report only. We can give no assurance that such expectations or forward-looking statements will prove to be correct. Actual results may differ materially. You are urged to carefully consider all such factors.

FEDERAL TAX ADVICE DISCLAIMER: As required by U.S. Treasury Regulations, you are informed that, to the extent this presentation includes any federal tax advice, the presentation is not written by Navellier to be used, and cannot be used, for the purpose of avoiding federal tax penalties. Navellier does not advise on any income tax requirements or issues. Use of any information presented by Navellier is for general information only and does not represent tax advice either express or implied. You are encouraged to seek professional tax advice for income tax questions and assistance.

IMPORTANT NEWSLETTER DISCLOSURE:The hypothetical performance results for investment newsletters that are authored or edited by Louis Navellier, including Louis Navellier’s Growth Investor, Louis Navellier’s Breakthrough Stocks, Louis Navellier’s Accelerated Profits, and Louis Navellier’s Platinum Club, are not based on any actual securities trading, portfolio, or accounts, and the newsletters’ reported hypothetical performances should be considered mere “paper” or proforma hypothetical performance results and are not actual performance of real world trades. Navellier & Associates, Inc. does not have any relation to or affiliation with the owner of these newsletters. There are material differences between Navellier Investment Products’ portfolios and the InvestorPlace Media, LLC newsletter portfolios authored by Louis Navellier. The InvestorPlace Media, LLC newsletters contain hypothetical performance that do not include transaction costs, advisory fees, or other fees a client might incur if actual investments and trades were being made by an investor. As a result, newsletter performance should not be used to evaluate Navellier Investment services which are separate and different from the newsletters. The owner of the newsletters is InvestorPlace Media, LLC and any questions concerning the newsletters, including any newsletter advertising or hypothetical Newsletter performance claims, (which are calculated solely by Investor Place Media and not Navellier) should be referred to InvestorPlace Media, LLC at (800) 718-8289.

Please note that Navellier & Associates and the Navellier Private Client Group are managed completely independent of the newsletters owned and published by InvestorPlace Media, LLC and written and edited by Louis Navellier, and investment performance of the newsletters should in no way be considered indicative of potential future investment performance for any Navellier & Associates separately managed account portfolio. Potential investors should consult with their financial advisor before investing in any Navellier Investment Product.

Navellier claims compliance with Global Investment Performance Standards (GIPS). To receive a complete list and descriptions of Navellier’s composites and/or a presentation that adheres to the GIPS standards, please contact Navellier or click here. It should not be assumed that any securities recommendations made by Navellier & Associates, Inc. in the future will be profitable or equal the performance of securities made in this report.

FactSet Disclosure: Navellier does not independently calculate the statistical information included in the attached report. The calculation and the information are provided by FactSet, a company not related to Navellier. Although information contained in the report has been obtained from FactSet and is based on sources Navellier believes to be reliable, Navellier does not guarantee its accuracy, and it may be incomplete or condensed. The report and the related FactSet sourced information are provided on an “as is” basis. The user assumes the entire risk of any use made of this information. Investors should consider the report as only a single factor in making their investment decision. The report is for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of a security. FactSet sourced information is the exclusive property of FactSet. Without prior written permission of FactSet, this information may not be reproduced, disseminated or used to create any financial products. All indices are unmanaged and performance of the indices include reinvestment of dividends and interest income, unless otherwise noted, are not illustrative of any particular investment and an investment cannot be made in any index. Past performance is no guarantee of future results.