by Gary Alexander

December 27, 2023

On the winter solstice, the shortest day of the year, the Dow Jones Industrial Average closed at a record high (37,404), the S&P 500 neared an all-time high, and the Russell 2000 soared nearly 25% in under two months, so it’s natural to see spreading euphoria in such a grossly overbought market. Wall Street’s favorite trophy wife, Rosy Scenario, is once again showing her smiling face when it comes to predictions for the coming year. Alas, we always seem to mirror the recent past when projecting the year to come.

This is reflected in sentiment surveys. The Bears were roaring in October, but they are now hibernating. The Investors Intelligence Bull/Bear Ratio (BBR) is now over 3-to-1, while the AAII ratio is 2.66-to-1. Discounting the neutrals, bears accounted for only 18.1% in the Bull/Bear poll and 19.3% on the AAII ballot. That’s not extreme by historical standards, but it does show a plurality of Pollyanna’s out there.

Our favorite economist, Ed Yardeni, is clearly in the “Roaring 20s,” camp, as am I, but I’m also on record as saying that a lot depends on the 2024 election. After all, Calvin Coolidge won the 1924 election, and the Roaring 20s really began in 2025. There would have been no “Roar” without Cal and his pro-business administration, including Secretary of the Treasury Andrew Mellon. That is not the case with the current Administration. We need a change. I have said that my main fear is that 2024 will turn out to be so good that we’ll forget to “vote for a change” next November, so that the same policies limiting growth will remain in effect for the next four years, restricting the long-term bull market and any Roar in these ‘20s.

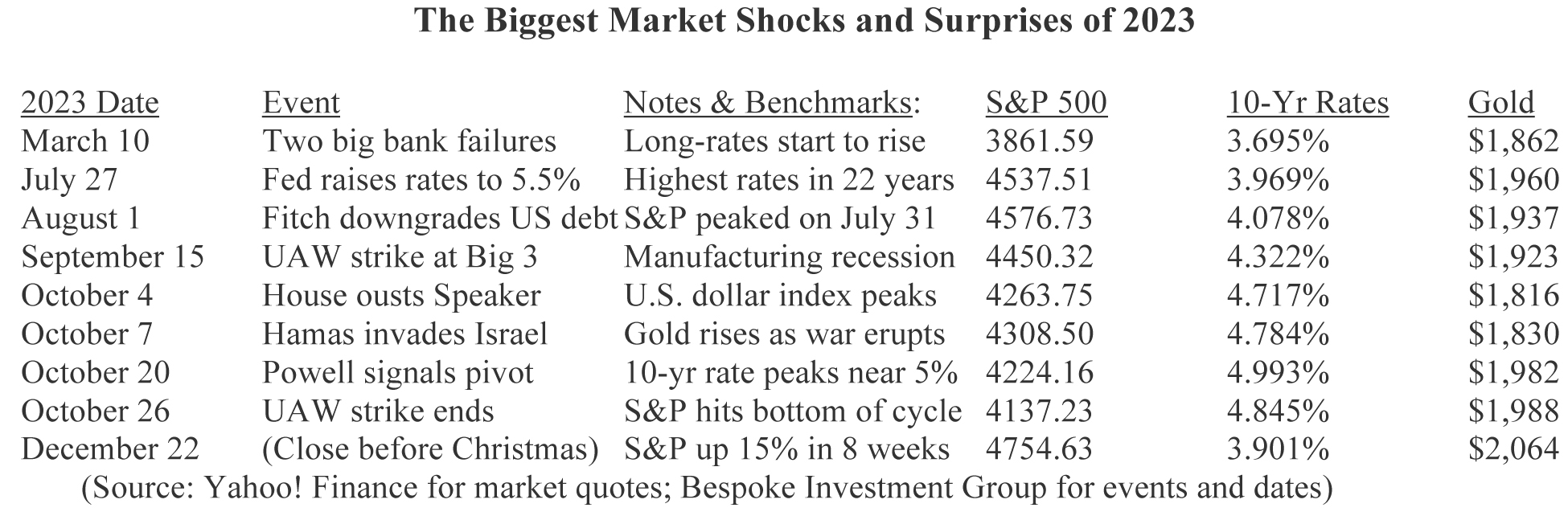

Also, we can look at all the positives in line for 2024 and forget that the Trickster will unveil several surprises. After all, we had several shocks in 2023 that interrupted an otherwise positive year – starting with the banking crisis in March, then the credit downgrade in July and the invasion of Israel in October.

With the firm knowledge that we don’t know the future, let’s rehearse Ed Yardeni’s dozen bullish points:

Ed Yardeni’s Dozen (or More) Good Reasons for Expecting a Great 2024

- Interest rates are back to normal.

- Consumers have purchasing power

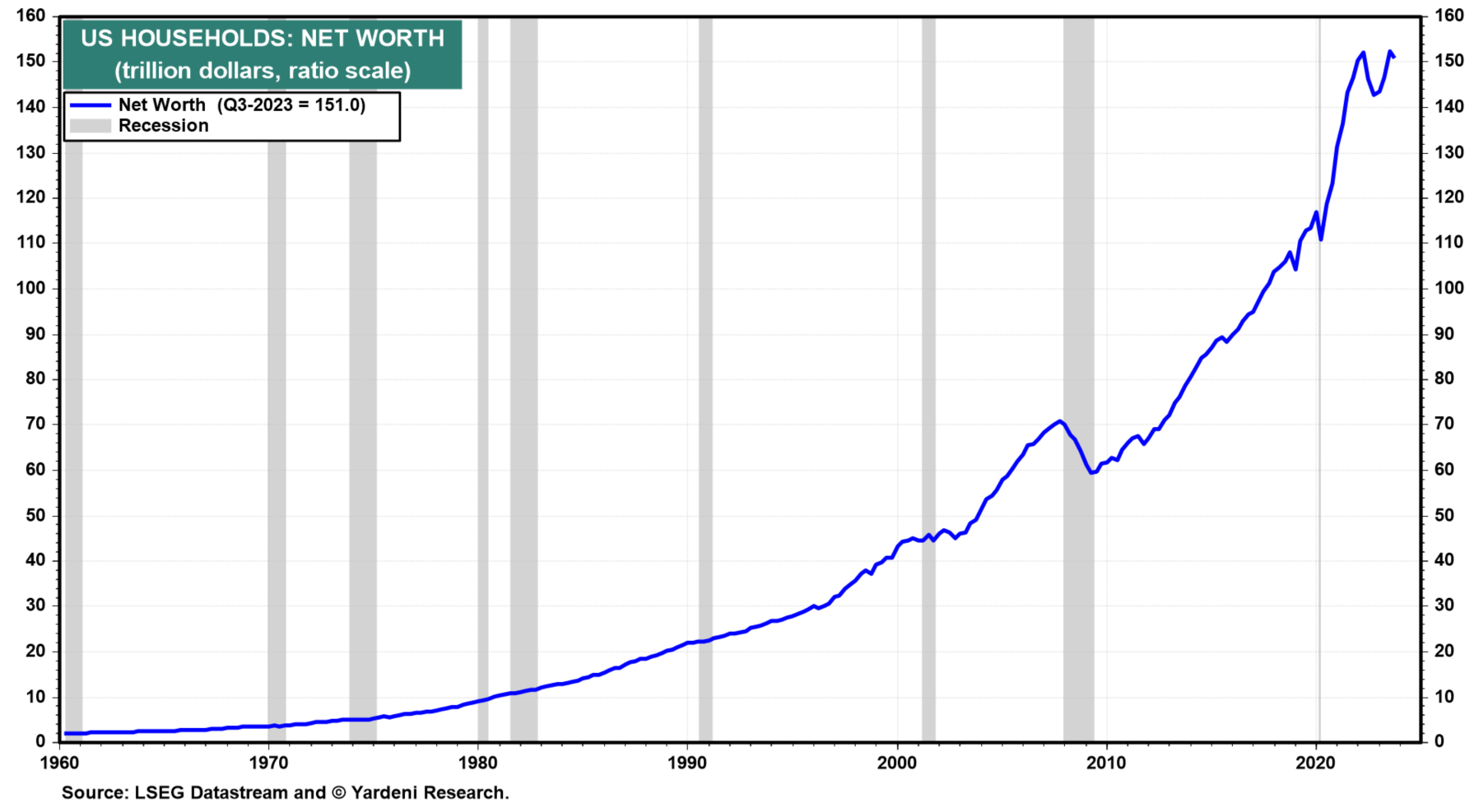

- Households are wealthy and liquid.

Yardeni says, “The net worth of American households totaled a staggering record-high $151 trillion at the end of Q3-2023. A record $5.9 trillion is in money market mutual funds (MMMF) with a record $2.3 trillion in retail MMMFs. Commercial bank deposits in M2 totaled $17.3 trillion during the December 12 week. There are 86 million households who own their own homes, and 40% of them have no mortgages.”

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

That’s a ton of dry fuel to fund new market purchases in the coming year. The next six look solid, too:

(4) Demand for labor is strong. There are still 8.6 million job openings begging for willing workers.

(5) The onshoring boom is boosting capital spending and promising to end the manufacturing recession.

(6) Housing is set for a recovery due to the “plunge in mortgage interest rates since early November.”

(7) Corporate cash flow is at a record high – a record $3.4 trillion during the third quarter of 2023.

(8) Inflation is turning out to be transitory. The inflation of goods was back down to 0% in November.

(9) The High-Tech Revolution is boosting productivity in a trend Yardeni identified as starting in 2015.

The final reasons to be bullish are more defensive in nature, primarily arguing against the perma-bears:

(10) The Leading indicators are mostly misleading. The 10 leading economic indicators (LEI) have forecast a recession for a long time – a recession that has refused to arrive. One dominant example among the LEI is the “inverted yield curve,” which still prevails, due to the Fed fighting market rates – with their high short-term rates versus falling long-term rates. Yardeni argues that, “The LEI has misfired its recession signals because its composition is biased toward predicting the goods sector more than the services sector of the economy. There has been a rolling recession in the goods sector, but it has been more than offset by strength in services, nonresidential private and public construction, and high-tech capital spending.”

(11) The rest of the world’s challenges should remain contained. We already have two active wars, and we may see more, perhaps in Venezuela or China, but Yardeni argues that these threats are contained. He also offer some investment advantages: “The wars between Russia and Ukraine and between Israel and Gaza should remain contained regionally. China’s economic woes reduce the chances that China will invade Taiwan. Nevertheless, these geopolitical hot spots will boost defense spending among the NATO members. The bursting of China’s property bubble should continue to weigh on global economic growth and commodity prices. China will remain a major source of global deflationary pressures. Europe is in a shallow recession and should recover next year as the European Central Bank lowers interest rates.”

(12) The Roaring 2020s will broaden the bull market (dodging a recession). The “soft landing” scenario is gaining traction as 2023’s AI-based rally broadens into several (virtually all) S&P sectors. Yardeni says, “We believe that reflects investors’ realization that the beneficiaries of the Roaring 2020s theme aren’t just the companies that make technology but also those that use it to boost their productivity.”

(13) How About All That Government Debt? This is my main concern. With the lowering of long-term interest rates, I’m afraid that gives Congress, the President, most consumers and businesses a green light to keep running up more debt. Net interest paid on the federal debt reached a record high $716.7 billion in the 12 months ending November 30. Yardeni argues that more federal spending will “stimulate onshore construction of manufacturing facilities,” but I’ve always been skeptical of these “shovel-ready” federal boondoggles. Yardeni admits that too much federal debt could cause “an oversupply of Treasury bonds relative to demand, which could set off a debt crisis. And that certainly could trip up the Roaring 2020s scenario.” That remains my greatest concern – that all this anticipated good news will encourage more deficit spending and more voter apathy come next November, causing unsustainable future debt growth.

Enjoy a great growth year in 2024, but let’s not forget our responsibility to sustain that growth into 2025.

All content above represents the opinion of Gary Alexander of Navellier & Associates, Inc.

Also In This Issue

A Look Ahead by Louis Navellier

The Fed’s Favorite Inflation Indicator Says “Mission Accomplished”

Income Mail by Bryan Perry

What The Tea Leaves Are Telling Us For 2024

Growth Mail by Gary Alexander

Twelve (Or More) Reasons to Expect a Prosperous 2024

Global Mail by Ivan Martchev

Awaiting the Santa Claus Rally

Sector Spotlight by Jason Bodner

When Opinions Go to War, Rely on the Data

View Full Archive

Read Past Issues Here

About The Author

Gary Alexander

SENIOR EDITOR

Gary Alexander has been Senior Writer at Navellier since 2009. He edits Navellier’s weekly Marketmail and writes a weekly Growth Mail column, in which he uses market history to support the case for growth stocks. For the previous 20 years before joining Navellier, he was Senior Executive Editor at InvestorPlace Media (formerly Phillips Publishing), where he worked with several leading investment analysts, including Louis Navellier (since 1997), helping launch Louis Navellier’s Blue Chip Growth and Global Growth newsletters.

Prior to that, Gary edited Wealth Magazine and Gold Newsletter and wrote various investment research reports for Jefferson Financial in New Orleans in the 1980s. He began his financial newsletter career with KCI Communications in 1980, where he served as consulting editor for Personal Finance newsletter while serving as general manager of KCI’s Alexandria House book division. Before that, he covered the economics beat for news magazines. All content of “Growth Mail” represents the opinion of Gary Alexander

Important Disclosures:

Although information in these reports has been obtained from and is based upon sources that Navellier believes to be reliable, Navellier does not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute Navellier’s judgment as of the date the report was created and are subject to change without notice. These reports are for informational purposes only and are not a solicitation for the purchase or sale of a security. Any decision to purchase securities mentioned in these reports must take into account existing public information on such securities or any registered prospectus.To the extent permitted by law, neither Navellier & Associates, Inc., nor any of its affiliates, agents, or service providers assumes any liability or responsibility nor owes any duty of care for any consequences of any person acting or refraining to act in reliance on the information contained in this communication or for any decision based on it.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any securities recommendations made by Navellier. in the future will be profitable or equal the performance of securities made in this report. Dividend payments are not guaranteed. The amount of a dividend payment, if any, can vary over time and issuers may reduce dividends paid on securities in the event of a recession or adverse event affecting a specific industry or issuer.

None of the stock information, data, and company information presented herein constitutes a recommendation by Navellier or a solicitation to buy or sell any securities. Any specific securities identified and described do not represent all of the securities purchased, sold, or recommended for advisory clients. The holdings identified do not represent all of the securities purchased, sold, or recommended for advisory clients and the reader should not assume that investments in the securities identified and discussed were or will be profitable.

Information presented is general information that does not take into account your individual circumstances, financial situation, or needs, nor does it present a personalized recommendation to you. Individual stocks presented may not be suitable for every investor. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. Investment in fixed income securities has the potential for the investment return and principal value of an investment to fluctuate so that an investor’s holdings, when redeemed, may be worth less than their original cost.

One cannot invest directly in an index. Index is unmanaged and index performance does not reflect deduction of fees, expenses, or taxes. Presentation of Index data does not reflect a belief by Navellier that any stock index constitutes an investment alternative to any Navellier equity strategy or is necessarily comparable to such strategies. Among the most important differences between the Indices and Navellier strategies are that the Navellier equity strategies may (1) incur material management fees, (2) concentrate its investments in relatively few stocks, industries, or sectors, (3) have significantly greater trading activity and related costs, and (4) be significantly more or less volatile than the Indices.

ETF Risk: We may invest in exchange traded funds (“ETFs”) and some of our investment strategies are generally fully invested in ETFs. Like traditional mutual funds, ETFs charge asset-based fees, but they generally do not charge initial sales charges or redemption fees and investors typically pay only customary brokerage fees to buy and sell ETF shares. The fees and costs charged by ETFs held in client accounts will not be deducted from the compensation the client pays Navellier. ETF prices can fluctuate up or down, and a client account could lose money investing in an ETF if the prices of the securities owned by the ETF go down. ETFs are subject to additional risks:

- ETF shares may trade above or below their net asset value;

- An active trading market for an ETF’s shares may not develop or be maintained;

- The value of an ETF may be more volatile than the underlying portfolio of securities the ETF is designed to track;

- The cost of owning shares of the ETF may exceed those a client would incur by directly investing in the underlying securities; and

- Trading of an ETF’s shares may be halted if the listing exchange’s officials deem it appropriate, the shares are delisted from the exchange, or the activation of market-wide “circuit breakers” (which are tied to large decreases in stock prices) halts stock trading generally.

Grader Disclosures: Investment in equity strategies involves substantial risk and has the potential for partial or complete loss of funds invested. The sample portfolio and any accompanying charts are for informational purposes only and are not to be construed as a solicitation to buy or sell any financial instrument and should not be relied upon as the sole factor in an investment making decision. As a matter of normal and important disclosures to you, as a potential investor, please consider the following: The performance presented is not based on any actual securities trading, portfolio, or accounts, and the reported performance of the A, B, C, D, and F portfolios (collectively the “model portfolios”) should be considered mere “paper” or pro forma performance results based on Navellier’s research.

Investors evaluating any of Navellier & Associates, Inc.’s, (or its affiliates’) Investment Products must not use any information presented here, including the performance figures of the model portfolios, in their evaluation of any Navellier Investment Products. Navellier Investment Products include the firm’s mutual funds and managed accounts. The model portfolios, charts, and other information presented do not represent actual funded trades and are not actual funded portfolios. There are material differences between Navellier Investment Products’ portfolios and the model portfolios, research, and performance figures presented here. The model portfolios and the research results (1) may contain stocks or ETFs that are illiquid and difficult to trade; (2) may contain stock or ETF holdings materially different from actual funded Navellier Investment Product portfolios; (3) include the reinvestment of all dividends and other earnings, estimated trading costs, commissions, or management fees; and, (4) may not reflect prices obtained in an actual funded Navellier Investment Product portfolio. For these and other reasons, the reported performances of model portfolios do not reflect the performance results of Navellier’s actually funded and traded Investment Products. In most cases, Navellier’s Investment Products have materially lower performance results than the performances of the model portfolios presented.

This report contains statements that are, or may be considered to be, forward-looking statements. All statements that are not historical facts, including statements about our beliefs or expectations, are “forward-looking statements” within the meaning of The U.S. Private Securities Litigation Reform Act of 1995. These statements may be identified by such forward-looking terminology as “expect,” “estimate,” “plan,” “intend,” “believe,” “anticipate,” “may,” “will,” “should,” “could,” “continue,” “project,” or similar statements or variations of such terms. Our forward-looking statements are based on a series of expectations, assumptions, and projections, are not guarantees of future results or performance, and involve substantial risks and uncertainty as described in Form ADV Part 2A of our filing with the Securities and Exchange Commission (SEC), which is available at www.adviserinfo.sec.gov or by requesting a copy by emailing info@navellier.com. All of our forward-looking statements are as of the date of this report only. We can give no assurance that such expectations or forward-looking statements will prove to be correct. Actual results may differ materially. You are urged to carefully consider all such factors.

FEDERAL TAX ADVICE DISCLAIMER: As required by U.S. Treasury Regulations, you are informed that, to the extent this presentation includes any federal tax advice, the presentation is not written by Navellier to be used, and cannot be used, for the purpose of avoiding federal tax penalties. Navellier does not advise on any income tax requirements or issues. Use of any information presented by Navellier is for general information only and does not represent tax advice either express or implied. You are encouraged to seek professional tax advice for income tax questions and assistance.

IMPORTANT NEWSLETTER DISCLOSURE:The hypothetical performance results for investment newsletters that are authored or edited by Louis Navellier, including Louis Navellier’s Growth Investor, Louis Navellier’s Breakthrough Stocks, Louis Navellier’s Accelerated Profits, and Louis Navellier’s Platinum Club, are not based on any actual securities trading, portfolio, or accounts, and the newsletters’ reported hypothetical performances should be considered mere “paper” or proforma hypothetical performance results and are not actual performance of real world trades. Navellier & Associates, Inc. does not have any relation to or affiliation with the owner of these newsletters. There are material differences between Navellier Investment Products’ portfolios and the InvestorPlace Media, LLC newsletter portfolios authored by Louis Navellier. The InvestorPlace Media, LLC newsletters contain hypothetical performance that do not include transaction costs, advisory fees, or other fees a client might incur if actual investments and trades were being made by an investor. As a result, newsletter performance should not be used to evaluate Navellier Investment services which are separate and different from the newsletters. The owner of the newsletters is InvestorPlace Media, LLC and any questions concerning the newsletters, including any newsletter advertising or hypothetical Newsletter performance claims, (which are calculated solely by Investor Place Media and not Navellier) should be referred to InvestorPlace Media, LLC at (800) 718-8289.

Please note that Navellier & Associates and the Navellier Private Client Group are managed completely independent of the newsletters owned and published by InvestorPlace Media, LLC and written and edited by Louis Navellier, and investment performance of the newsletters should in no way be considered indicative of potential future investment performance for any Navellier & Associates separately managed account portfolio. Potential investors should consult with their financial advisor before investing in any Navellier Investment Product.

Navellier claims compliance with Global Investment Performance Standards (GIPS). To receive a complete list and descriptions of Navellier’s composites and/or a presentation that adheres to the GIPS standards, please contact Navellier or click here. It should not be assumed that any securities recommendations made by Navellier & Associates, Inc. in the future will be profitable or equal the performance of securities made in this report.

FactSet Disclosure: Navellier does not independently calculate the statistical information included in the attached report. The calculation and the information are provided by FactSet, a company not related to Navellier. Although information contained in the report has been obtained from FactSet and is based on sources Navellier believes to be reliable, Navellier does not guarantee its accuracy, and it may be incomplete or condensed. The report and the related FactSet sourced information are provided on an “as is” basis. The user assumes the entire risk of any use made of this information. Investors should consider the report as only a single factor in making their investment decision. The report is for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of a security. FactSet sourced information is the exclusive property of FactSet. Without prior written permission of FactSet, this information may not be reproduced, disseminated or used to create any financial products. All indices are unmanaged and performance of the indices include reinvestment of dividends and interest income, unless otherwise noted, are not illustrative of any particular investment and an investment cannot be made in any index. Past performance is no guarantee of future results.