by Gary Alexander

October 24, 2023

“October is one of the peculiarly dangerous months to speculate in stocks. The others are July, January, September, April, November, May, March, June, December, August & February.”

— Mark Twain, in “The Tragedy of Pudd’n’head Wilson” (1894)

When we say that the fourth quarter is historically strong, we don’t mean to say that this traditional year-end bonanza starts on the opening day of October. Quite often, in history, the market has reached its cyclical low during the last week of October – which we enter this week, and into next Tuesday.

Here are some major 20th Century bull markets which began in late October – and what happened next.

Market Bottom Date:And what the Dow did next

- October 27, 1923:The Dow then went up 345% by September 1929.

- October 22, 1957:The Dow then went up 63% by January 1960.

- October 25, 1960:The Dow then went up 30% within one year.

- October 23, 1962:The Dow then went up 78% by February 1966.

- October 20, 1987:The Dow then went up 73% by July 1990.

- October 29, 1990:The Dow then went up 382% by early 2000.

- October 28, 1997:The Dow then went up 64% in just over two years.

Data Source: Stock Trader’s Almanac, 2010: Page 131

Also, two great market-panics happened on this date early last century – in 1907 and 1929. They were each deemed Black Thursday: one was rescued by J.P. Morgan, Sr., one was ruined by J.P. Morgan, Jr.

Black Thursday, October 24: One Rescued (One Ruined) by The House of Morgan

The Panic of 1907 began on Tuesday, October 22, 1907, when Charles T. Barney, President of the Knickerbocker Trust Company, bravely opened the doors of his troubled bank, the third largest trust company in the city. That was not a wise move. Within a few hours, depositors withdrew $8 million.

By mid-afternoon, the Trust announced its insolvency and closed its doors. The next morning, the streets of lower Manhattan were choked with anxious bank depositors lined up in front of even the soundest of banks. The U.S. Treasury (before the Fed was born) was not authorized to bail out banks, so J.P. Morgan (Sr.) deposited $35 million in troubled banks and told those banks to lend that money out, “or else.”

Then came Black Thursday. Quoting from “The House of Morgan,” by Ron Chernow (page 198):

“On Thursday, October 24, with stock trading virtually halted, New York Stock Exchange president Ransom H. Thomas crossed Broad Street and told Morgan that unless $25 million were raised immediately, at least fifty brokerage firms might fail. Thomas wanted to shut the Exchange [but] Pierpoint wagged an admonitory finger, ‘It must not close one minute before [normal].”

“At two o’clock, Morgan summoned the bank presidents and warned that dozens of brokerage houses might fail unless they mustered $25 million within 10 or 12 minutes. By 2:16, the money was pledged. Morgan then dispatched a team to the Stock Exchange floor to announce that call money would be available. Pierpont heard a mighty roar across the street. Looking up, he asked the cause; he was being given an ovation by the jubilant floor traders” (House of Morgan, p. 198).

That night, Morgan called every important banker in the city to his private library on East 36th Street. After hours of haggling, they came up with a plan to use clearinghouse certificates instead of cash to settle all transactions, in effect increasing the money supply by a then-huge $84 million.

Just like that, the Panic of 1907 was over – in a week. This was Morgan’s shining moment, like a great general commanding troops in the heat of battle. Even President Teddy Roosevelt, who had railed against “the malefactors of great wealth” in early 1907, now said, “Those substantial businessmen acted with wisdom and public spirit.” The Dow didn’t bottom out until November 15, 1907, but then it gained 90% in two years, while J.P. Morgan, at age 70, was worn out, so he promoted the creation of a central bank.

There was another “Black Thursday” on today’s date, October 24, 1929, the first big down-day of the Crash of 1929. Sell orders piled up the night before and the morning brought panic selling at any price. Terrified investors sold a record 13 million shares. The panic was stemmed at 1:30, when Dick Whitney, the Exchange President, stepped to the center of the floor and said loudly, “I will buy 10,000 shares of U.S. Steel at $205.” Buyers were also inspired by J.P. Morgan, Jr., who said this was merely a passing phenomenon, but he did not buy much. The ticker tape did not stop spitting out prices until 7:08 p.m.

Friday, October 25 was an almost exact replay, with record losses, on record volume (13 million shares), but by the end of trading, this was the only “up” day between Black Thursday and Black Tuesday, next week. The big difference between 1929 and 1907 was that Morgan, Jr. had no follow-through on Black Tuesday, when he basically said, “Let these speculators go broke. This is a normal cleansing process.”

The Associated Press report on October 29 said, “powerful financial interests stepped aside today and let the stock market drop.” Morgan, Jr., didn’t muster the leadership and prestige of his illustrious father.

(*Main source for this section: “The House of Morgan,” by Ron Chernow.)

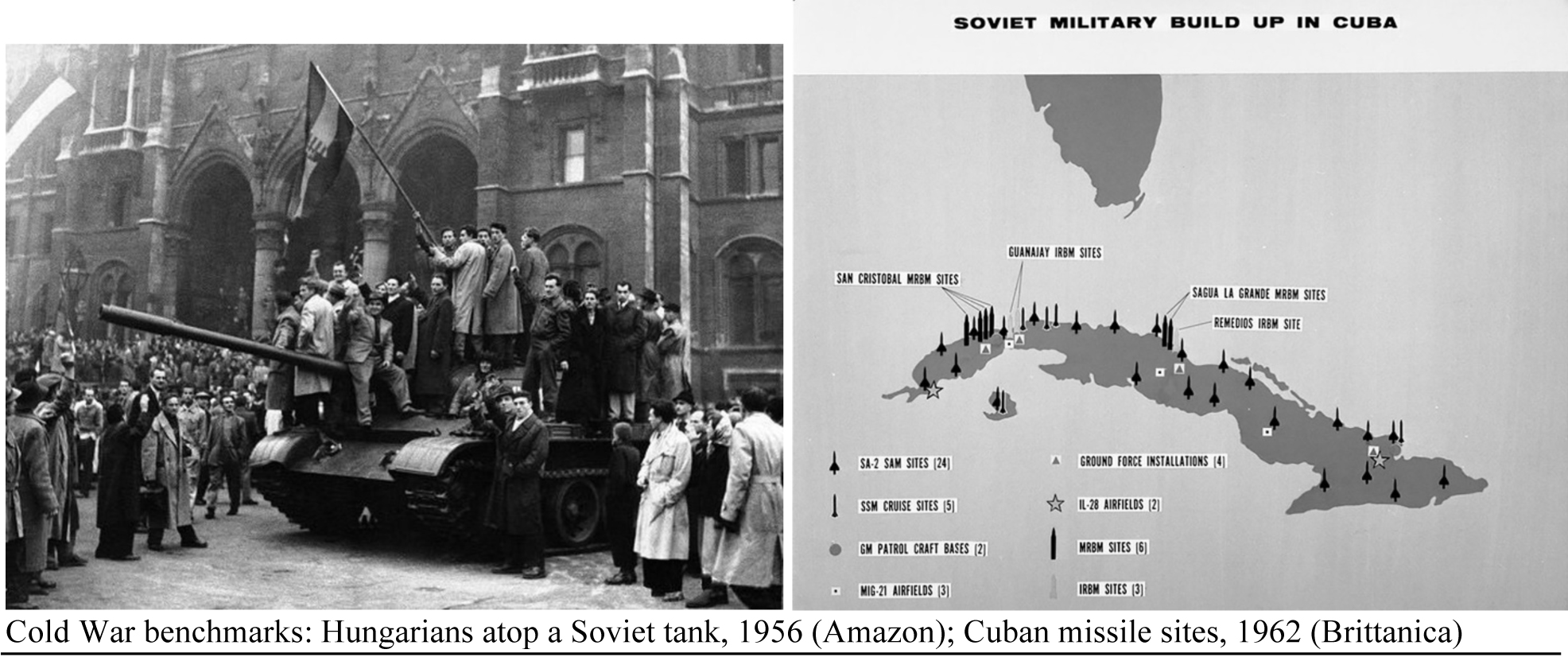

Cold War Milestones During This Week in the Postwar Era

The term “Cold War” entered our vocabulary 75 years ago today, when Presidential advisor Bernard Baruch was speaking to the Senate War Investigating Committee on October 24, 1948, and he stumbled on the term, “Although the war is over, we are in the midst of a cold war, which is getting warm.”

Here are some examples of what Baruch was talking about, and some of the market repercussions:

- On October 23, 1956, Hungary launched its David vs. Goliath resistance against Soviet occupation, which soon escalated into a full-scale national revolt. The Hungarian government first supported the rebels, under Premier Imre Nagy, but then Janos Kadar formed a counter-revolt, and asked the Soviets to intervene, which they did, with tanks, in early November. The Dow rallied from 481 to 499 by year’s end.

- P.S. Hungary became a free nation on this date in 1989, leading directly to the fall of the Berlin Wall.

- October 22, 1957 formed a major Dow bottom at 419.79, reflecting national gloom after the launching of the Soviet satellite, Sputnik, earlier that month. But then, the Dow rose 63% by the end of 1959, starting with the biggest daily gain of the 1950s the next day, October 23, 1957, rising 17 Dow points (+4.1%). Why such a rise? President Eisenhower launched a speaking tour to lift America’s gloomy spirits, and to generate support for his economic policies, plus a vigorous new launch of America’s own space program.

- On October 22, 1962, the day after he was supposed to appear at the close of the Seattle World’s Fair, President Kennedy addressed the nation on TV concerning Russian missile bases in Cuba. He announced a naval blockade, beginning the Cuban missile crisis. On this date, October 24, the tensest moments of the crisis began, as Soviet ships mostly reversed their course as they approached the U.S. blockade, with the exception of one tanker, Bucharest. At the direction of the Joint Chiefs of Staff, all U.S. military forces went to DEFCON 2, the highest military alert ever reached in the postwar era, poised for full-scale war.

Ironically, October 24 marked the day the Dow rose the most (+3.3%). The U.S. and the USSR were each in a state of nuclear readiness. That day, Adlai Stevenson, the U.S. Ambassador to the U.N., demanded of USSR Ambassador Zorin to admit that their Cuban missile bases existed. The once mild-mannered, twice-losing President candidate declared, “I am prepared to wait for my answer until hell freezes over.”

And the market rose! War and tough words energized the markets. The Dow rose over 10% in November, and +78% from October 23, 1962, to February 9, 1966, in the height of Bernard Baruch’s Cold War

- On October 26, 1973, Israeli forces reached the Suez, trapping the Egyptian army, thus ending the Yom Kippur war after just 20 days. That war had resulted in an Arab oil embargo, tripling the price of crude oil within a few months, but the Dow actually rose 7.8% during September and October 1973, so war once again seemed to be good for the stock market, despite the OPEC oil embargo imposed on October 20.

- On October 23, 1983, Lebanese suicide commandos drove trucks packed with explosives into two Beirut bases where U.S. and French troops were stationed. The attacks killed 241 U.S. Marines and Navy personnel and 58 French soldiers. There were very few survivors found in the rubble.

This attack was far worse, from an American perspective, than the recent Hamas attacks on Israel, where perhaps a dozen Americans were killed and a handful maybe taken hostage, but President Reagan did not respond directly to the terrorists in Lebanon in 1983. Instead, two days later, on October 25, U.S. Marines invaded Grenada, where Cuban advisors were building a 12,000-foot airstrip to accommodate Soviet long-range bombers, similar to the airfields that precipitated the 1962 Cuban crisis 20 years previously.

Ironically, there was also a big (-7%) market crash on Friday the 13th of October 1989, but it had more to do with an airline financing problem, not a cold war crisis. Less than a month later, the Berlin Wall fell on November 9-10, and the Cold War was suddenly over. October market crises from then on had more to do with global financial situations – most notably an Asian Currency Crisis (October 22-26, 1997) and the Great Financial Crisis of September and October 2008. Other than that, October has receded from our “pain index” in recent decades, but we still continue to look forward to the dawn of November, much like the morning after any Halloween haunts, even if the current global news seems dark and dismal yet again.

All content above represents the opinion of Gary Alexander of Navellier & Associates, Inc.

Also In This Issue

A Look Ahead by Louis Navellier

War News Dominates Global Concern, and More Deficit Spending

Income Mail by Bryan Perry

A “Hot Mess” In the Middle East and Strong Growth at Home Has the Market Tied in Knots

Growth Mail by Gary Alexander

Wall Street Often Seems Darkest Before the Dawn…of November!

Global Mail by Ivan Martchev

The 10-year Treasury Rate is at the Brink of 5%

Sector Spotlight by Jason Bodner

When Will This October Market Start to Deliver for Us?

View Full Archive

Read Past Issues Here

About The Author

Gary Alexander

SENIOR EDITOR

Gary Alexander has been Senior Writer at Navellier since 2009. He edits Navellier’s weekly Marketmail and writes a weekly Growth Mail column, in which he uses market history to support the case for growth stocks. For the previous 20 years before joining Navellier, he was Senior Executive Editor at InvestorPlace Media (formerly Phillips Publishing), where he worked with several leading investment analysts, including Louis Navellier (since 1997), helping launch Louis Navellier’s Blue Chip Growth and Global Growth newsletters.

Prior to that, Gary edited Wealth Magazine and Gold Newsletter and wrote various investment research reports for Jefferson Financial in New Orleans in the 1980s. He began his financial newsletter career with KCI Communications in 1980, where he served as consulting editor for Personal Finance newsletter while serving as general manager of KCI’s Alexandria House book division. Before that, he covered the economics beat for news magazines. All content of “Growth Mail” represents the opinion of Gary Alexander

Important Disclosures:

Although information in these reports has been obtained from and is based upon sources that Navellier believes to be reliable, Navellier does not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute Navellier’s judgment as of the date the report was created and are subject to change without notice. These reports are for informational purposes only and are not a solicitation for the purchase or sale of a security. Any decision to purchase securities mentioned in these reports must take into account existing public information on such securities or any registered prospectus.To the extent permitted by law, neither Navellier & Associates, Inc., nor any of its affiliates, agents, or service providers assumes any liability or responsibility nor owes any duty of care for any consequences of any person acting or refraining to act in reliance on the information contained in this communication or for any decision based on it.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any securities recommendations made by Navellier. in the future will be profitable or equal the performance of securities made in this report. Dividend payments are not guaranteed. The amount of a dividend payment, if any, can vary over time and issuers may reduce dividends paid on securities in the event of a recession or adverse event affecting a specific industry or issuer.

None of the stock information, data, and company information presented herein constitutes a recommendation by Navellier or a solicitation to buy or sell any securities. Any specific securities identified and described do not represent all of the securities purchased, sold, or recommended for advisory clients. The holdings identified do not represent all of the securities purchased, sold, or recommended for advisory clients and the reader should not assume that investments in the securities identified and discussed were or will be profitable.

Information presented is general information that does not take into account your individual circumstances, financial situation, or needs, nor does it present a personalized recommendation to you. Individual stocks presented may not be suitable for every investor. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. Investment in fixed income securities has the potential for the investment return and principal value of an investment to fluctuate so that an investor’s holdings, when redeemed, may be worth less than their original cost.

One cannot invest directly in an index. Index is unmanaged and index performance does not reflect deduction of fees, expenses, or taxes. Presentation of Index data does not reflect a belief by Navellier that any stock index constitutes an investment alternative to any Navellier equity strategy or is necessarily comparable to such strategies. Among the most important differences between the Indices and Navellier strategies are that the Navellier equity strategies may (1) incur material management fees, (2) concentrate its investments in relatively few stocks, industries, or sectors, (3) have significantly greater trading activity and related costs, and (4) be significantly more or less volatile than the Indices.

ETF Risk: We may invest in exchange traded funds (“ETFs”) and some of our investment strategies are generally fully invested in ETFs. Like traditional mutual funds, ETFs charge asset-based fees, but they generally do not charge initial sales charges or redemption fees and investors typically pay only customary brokerage fees to buy and sell ETF shares. The fees and costs charged by ETFs held in client accounts will not be deducted from the compensation the client pays Navellier. ETF prices can fluctuate up or down, and a client account could lose money investing in an ETF if the prices of the securities owned by the ETF go down. ETFs are subject to additional risks:

- ETF shares may trade above or below their net asset value;

- An active trading market for an ETF’s shares may not develop or be maintained;

- The value of an ETF may be more volatile than the underlying portfolio of securities the ETF is designed to track;

- The cost of owning shares of the ETF may exceed those a client would incur by directly investing in the underlying securities; and

- Trading of an ETF’s shares may be halted if the listing exchange’s officials deem it appropriate, the shares are delisted from the exchange, or the activation of market-wide “circuit breakers” (which are tied to large decreases in stock prices) halts stock trading generally.

Grader Disclosures: Investment in equity strategies involves substantial risk and has the potential for partial or complete loss of funds invested. The sample portfolio and any accompanying charts are for informational purposes only and are not to be construed as a solicitation to buy or sell any financial instrument and should not be relied upon as the sole factor in an investment making decision. As a matter of normal and important disclosures to you, as a potential investor, please consider the following: The performance presented is not based on any actual securities trading, portfolio, or accounts, and the reported performance of the A, B, C, D, and F portfolios (collectively the “model portfolios”) should be considered mere “paper” or pro forma performance results based on Navellier’s research.

Investors evaluating any of Navellier & Associates, Inc.’s, (or its affiliates’) Investment Products must not use any information presented here, including the performance figures of the model portfolios, in their evaluation of any Navellier Investment Products. Navellier Investment Products include the firm’s mutual funds and managed accounts. The model portfolios, charts, and other information presented do not represent actual funded trades and are not actual funded portfolios. There are material differences between Navellier Investment Products’ portfolios and the model portfolios, research, and performance figures presented here. The model portfolios and the research results (1) may contain stocks or ETFs that are illiquid and difficult to trade; (2) may contain stock or ETF holdings materially different from actual funded Navellier Investment Product portfolios; (3) include the reinvestment of all dividends and other earnings, estimated trading costs, commissions, or management fees; and, (4) may not reflect prices obtained in an actual funded Navellier Investment Product portfolio. For these and other reasons, the reported performances of model portfolios do not reflect the performance results of Navellier’s actually funded and traded Investment Products. In most cases, Navellier’s Investment Products have materially lower performance results than the performances of the model portfolios presented.

This report contains statements that are, or may be considered to be, forward-looking statements. All statements that are not historical facts, including statements about our beliefs or expectations, are “forward-looking statements” within the meaning of The U.S. Private Securities Litigation Reform Act of 1995. These statements may be identified by such forward-looking terminology as “expect,” “estimate,” “plan,” “intend,” “believe,” “anticipate,” “may,” “will,” “should,” “could,” “continue,” “project,” or similar statements or variations of such terms. Our forward-looking statements are based on a series of expectations, assumptions, and projections, are not guarantees of future results or performance, and involve substantial risks and uncertainty as described in Form ADV Part 2A of our filing with the Securities and Exchange Commission (SEC), which is available at www.adviserinfo.sec.gov or by requesting a copy by emailing info@navellier.com. All of our forward-looking statements are as of the date of this report only. We can give no assurance that such expectations or forward-looking statements will prove to be correct. Actual results may differ materially. You are urged to carefully consider all such factors.

FEDERAL TAX ADVICE DISCLAIMER: As required by U.S. Treasury Regulations, you are informed that, to the extent this presentation includes any federal tax advice, the presentation is not written by Navellier to be used, and cannot be used, for the purpose of avoiding federal tax penalties. Navellier does not advise on any income tax requirements or issues. Use of any information presented by Navellier is for general information only and does not represent tax advice either express or implied. You are encouraged to seek professional tax advice for income tax questions and assistance.

IMPORTANT NEWSLETTER DISCLOSURE:The hypothetical performance results for investment newsletters that are authored or edited by Louis Navellier, including Louis Navellier’s Growth Investor, Louis Navellier’s Breakthrough Stocks, Louis Navellier’s Accelerated Profits, and Louis Navellier’s Platinum Club, are not based on any actual securities trading, portfolio, or accounts, and the newsletters’ reported hypothetical performances should be considered mere “paper” or proforma hypothetical performance results and are not actual performance of real world trades. Navellier & Associates, Inc. does not have any relation to or affiliation with the owner of these newsletters. There are material differences between Navellier Investment Products’ portfolios and the InvestorPlace Media, LLC newsletter portfolios authored by Louis Navellier. The InvestorPlace Media, LLC newsletters contain hypothetical performance that do not include transaction costs, advisory fees, or other fees a client might incur if actual investments and trades were being made by an investor. As a result, newsletter performance should not be used to evaluate Navellier Investment services which are separate and different from the newsletters. The owner of the newsletters is InvestorPlace Media, LLC and any questions concerning the newsletters, including any newsletter advertising or hypothetical Newsletter performance claims, (which are calculated solely by Investor Place Media and not Navellier) should be referred to InvestorPlace Media, LLC at (800) 718-8289.

Please note that Navellier & Associates and the Navellier Private Client Group are managed completely independent of the newsletters owned and published by InvestorPlace Media, LLC and written and edited by Louis Navellier, and investment performance of the newsletters should in no way be considered indicative of potential future investment performance for any Navellier & Associates separately managed account portfolio. Potential investors should consult with their financial advisor before investing in any Navellier Investment Product.

Navellier claims compliance with Global Investment Performance Standards (GIPS). To receive a complete list and descriptions of Navellier’s composites and/or a presentation that adheres to the GIPS standards, please contact Navellier or click here. It should not be assumed that any securities recommendations made by Navellier & Associates, Inc. in the future will be profitable or equal the performance of securities made in this report.

FactSet Disclosure: Navellier does not independently calculate the statistical information included in the attached report. The calculation and the information are provided by FactSet, a company not related to Navellier. Although information contained in the report has been obtained from FactSet and is based on sources Navellier believes to be reliable, Navellier does not guarantee its accuracy, and it may be incomplete or condensed. The report and the related FactSet sourced information are provided on an “as is” basis. The user assumes the entire risk of any use made of this information. Investors should consider the report as only a single factor in making their investment decision. The report is for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of a security. FactSet sourced information is the exclusive property of FactSet. Without prior written permission of FactSet, this information may not be reproduced, disseminated or used to create any financial products. All indices are unmanaged and performance of the indices include reinvestment of dividends and interest income, unless otherwise noted, are not illustrative of any particular investment and an investment cannot be made in any index. Past performance is no guarantee of future results.