by Gary Alexander

October 17, 2023

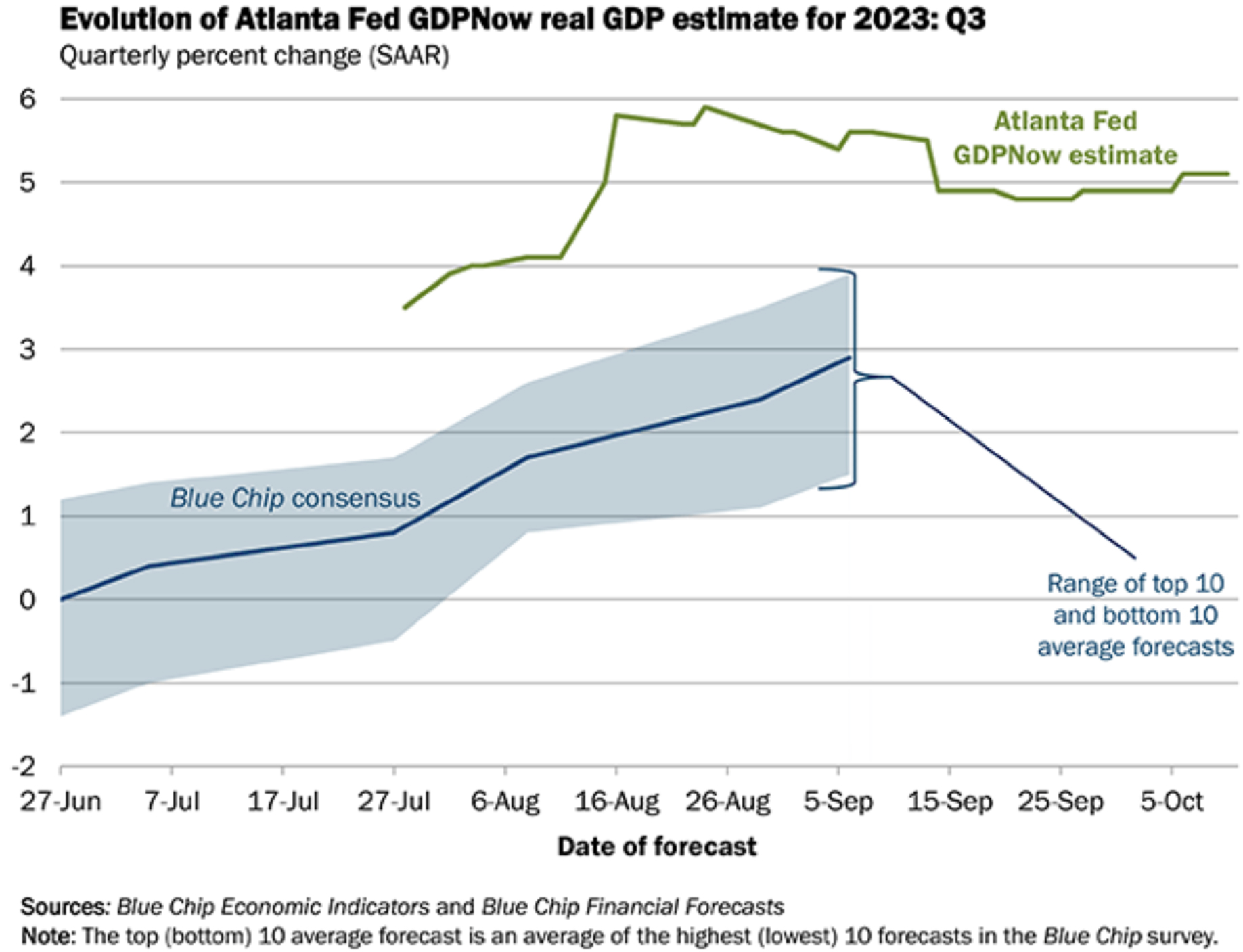

The first (advance) estimate of third-quarter GDP will be released next week, on October 26, at 8:30 am Eastern time. Nearly all of the relevant data points for the quarter are in, which should make calculations close to complete, but the Atlanta Fed’s GDPNow predictive algorithm is amazingly (and very bullishly) divergent from the consensus of blue-chip economists. In the latest GDPNow report, their weight of all the GDP constituent elements puts last quarter’s annualized growth rate above 5%, while their survey of the blue-chip economists’ estimates reflects growth under 3%, with the low estimates near 1.5% and no blue-chip estimate topping 3.9%. So…what does the Atlanta Fed know that no other economist knows?

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

We’ll know who was right after the second (November 29) and final (December 22) GDP releases.

More importantly, we need to ask why GDP growth is so robust when the Fed has raised interest rates at the fastest pace in history: the President has declared war on fossil fuels, our labor force participation rate has remained so low for so long, federal and private debt rates are growing so rapidly, and we have been in a manufacturing recession for nearly a year! On top of that, there is a growing academic consensus that economic growth is a malaise, even a cancer, as reflected in two magazines I got in the mail last Tuesday:

The War on Growth is an old, old story. Over 50 years ago, I remember reading the original “Limits to Growth” best-seller of 1972, co-authored by “The Club of Rome” – eventually selling over 30 million copies in 30 languages. It predicted we would run out of many natural resources by the end of the 1980s. It didn’t happen, but true believers said we either “got lucky” or “we only postponed doomsday,” as life-saving discoveries like the Green Revolution only served to “increase greenhouse-gas emissions” later on.

Translation: All those billions of people saved through technology should have starved, to save the planet.

It has become fashionable in the highest circles that growth is cancerous, that it leads toward doomsday.

At the U.S. 2021 Climate Conference of the Parties 26 (COP26) in Glasgow, Scotland, which began on Halloween evening 2021, the ghosts and goblins came out in force. Speaking on November 1, Britain’s then-Prime Minister Boris Johnson flew north from London with his entourage to tell the assembled jet setters that, “It was here in Glasgow, 250 years ago, that James Watt came up with a machine that was powered by steam, that was produced by burning coal…. We’ve brought you to the very place where the doomsday machine began to tick.” He then added that, “It’s now one minute to midnight on that doomsday clock and we need to act now.” And he was one of the more “moderate” speakers at COP26.

If Johnson (and the other speakers) truly believed their doomsday rhetoric, they would have held their UN Climate Conference (COP26) by ZOOM over the Internet from home, rather than chartering private jets to fly there. According to data compiled by WingX, an aviation consultancy, 118 different business jets flew into Glasgow and Edinburgh airports on the opening day of the summit. Those taking private jets to COP26 included Jeff Bezos, Prince Charles, and Boris Johnson, who flew back to London to attend a dinner during the middle of the conference, then flew back, indifferent to the extra fuel he consumed.

That conference was held during the midst of COVID, when most of us were learning how to work from home. In the years of COVID and its aftermath, there has been an escalation in calls to limit growth, even though global growth has naturally slowed, in part due to COVID precautions, global trade disruptions, new recessions in China and Europe, and a reversion to higher interest rates in most leading economies.

The following three new books are a small sample of the academic movement questioning the value of growth – the basic building block of capitalism as a tool for better outcomes in life: A longer, healthier, more joy-filled existence through technological innovation, more free choice and mobility, freedom of association across borders and barriers – what Mr. Jefferson summarized as “the pursuit of happiness.”

Britain was the birthplace of the Industrial Revolution, and it also gave birth to the Industrial Counter-revolution. Luddites were named after a legendary weaver named Ned Ludd, who sent threatening letters to mill owners and government officials about the threat of new machinery putting craft workers out of their jobs. Some textile workers went so far as to destroy their machines in clandestine raids. The belief continues to this day, a fear that “AI” or some other robotic mind machine will put people out of work.

Elon Musk argues otherwise. In the new biography by Walter Isaacson, Musk went through his battery factory manually doing the job of the robots better and faster, so he wanted to replace his own robots. “Workers were hired to replace the robots and the assembly line moved more quickly” (Musk, p. 274).

The Economist’s Special Report Favors Reviving Global Trade

The Economist’s special report this week (“Redividing the World” by Callum Williams) recognizes the fact that “Governments across the world are rediscovering industrial policy. They are making a big mistake.” The fact that China has dominated global trade and taken advantage of that dominant position to steal intellectual property has given globalization a bad name, but we ought not to throw out all global trade and buy only from local sources, as that would defy Adam Smith’s tenet of comparative advantage.

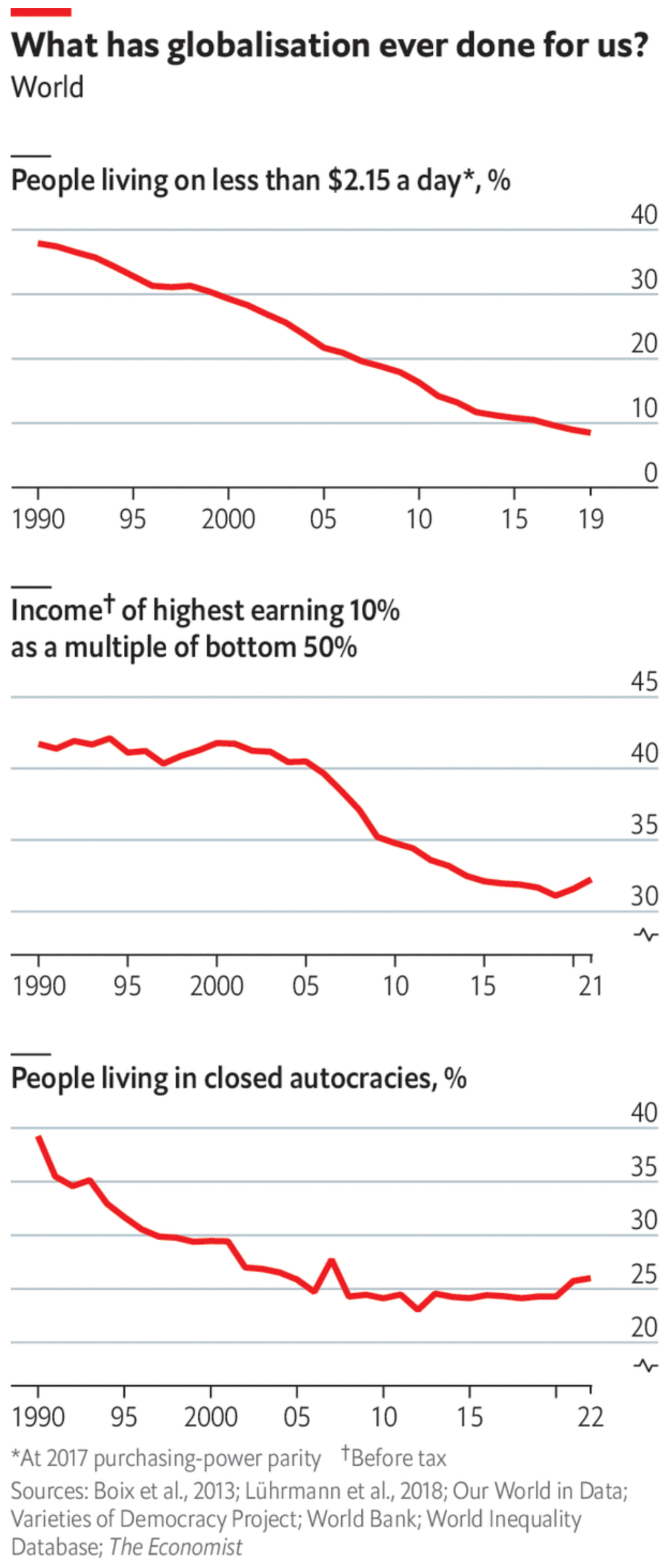

Here are a series of charts from The Economist showing how globalization since 1990 has helped lower global poverty, closed the income gap, and reduced the number of people living under autocratic control:

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

The major fallacy most anti-growth theoreticians make is that they equate growth with waste, pollution, consumerism and “more stuff.” True, that is a risk, but manufacturing isn’t the major “stuff” of growth. It’s miniaturization, efficiency, productivity, creativity, innovation and technology, so that we can create more with less. We can work, meet and shop on the Internet instead of in person. We can put all our data into a small phone instead of a room-sized computer. We travel less, pollute less, and create less “junk.”

Many apocalyptic anti-growth zealots want us to return to a mythical Arcadia of harmony with nature, which never existed. That world was filled with disease and bandits, with a life expectancy under 30.

Our climate zealots now want us to rely mostly on electricity, when we can’t even support today’s grid, much less support a world where all fossil fuel inputs are banned. But that is a story for another day

The Luddites will always lose, since most people want a better life and will fight hard to make it happen.

All content above represents the opinion of Gary Alexander of Navellier & Associates, Inc.

Also In This Issue

A Look Ahead by Louis Navellier

Can Washington Afford to Fund Another Overseas War?

Income Mail by Bryan Perry

Bulls Retreat to the Bunker During Middle East Tensions

Growth Mail by Gary Alexander

In The War Against Growth, The Luddites are the Losers!

Global Mail by Ivan Martchev

The Present Explosive Geopolitical Situation is Impossible to Predict

Sector Spotlight by Jason Bodner

What Would a Market X-Ray Look Like?

View Full Archive

Read Past Issues Here

About The Author

Gary Alexander

SENIOR EDITOR

Gary Alexander has been Senior Writer at Navellier since 2009. He edits Navellier’s weekly Marketmail and writes a weekly Growth Mail column, in which he uses market history to support the case for growth stocks. For the previous 20 years before joining Navellier, he was Senior Executive Editor at InvestorPlace Media (formerly Phillips Publishing), where he worked with several leading investment analysts, including Louis Navellier (since 1997), helping launch Louis Navellier’s Blue Chip Growth and Global Growth newsletters.

Prior to that, Gary edited Wealth Magazine and Gold Newsletter and wrote various investment research reports for Jefferson Financial in New Orleans in the 1980s. He began his financial newsletter career with KCI Communications in 1980, where he served as consulting editor for Personal Finance newsletter while serving as general manager of KCI’s Alexandria House book division. Before that, he covered the economics beat for news magazines. All content of “Growth Mail” represents the opinion of Gary Alexander

Important Disclosures:

Although information in these reports has been obtained from and is based upon sources that Navellier believes to be reliable, Navellier does not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute Navellier’s judgment as of the date the report was created and are subject to change without notice. These reports are for informational purposes only and are not a solicitation for the purchase or sale of a security. Any decision to purchase securities mentioned in these reports must take into account existing public information on such securities or any registered prospectus.To the extent permitted by law, neither Navellier & Associates, Inc., nor any of its affiliates, agents, or service providers assumes any liability or responsibility nor owes any duty of care for any consequences of any person acting or refraining to act in reliance on the information contained in this communication or for any decision based on it.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any securities recommendations made by Navellier. in the future will be profitable or equal the performance of securities made in this report. Dividend payments are not guaranteed. The amount of a dividend payment, if any, can vary over time and issuers may reduce dividends paid on securities in the event of a recession or adverse event affecting a specific industry or issuer.

None of the stock information, data, and company information presented herein constitutes a recommendation by Navellier or a solicitation to buy or sell any securities. Any specific securities identified and described do not represent all of the securities purchased, sold, or recommended for advisory clients. The holdings identified do not represent all of the securities purchased, sold, or recommended for advisory clients and the reader should not assume that investments in the securities identified and discussed were or will be profitable.

Information presented is general information that does not take into account your individual circumstances, financial situation, or needs, nor does it present a personalized recommendation to you. Individual stocks presented may not be suitable for every investor. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. Investment in fixed income securities has the potential for the investment return and principal value of an investment to fluctuate so that an investor’s holdings, when redeemed, may be worth less than their original cost.

One cannot invest directly in an index. Index is unmanaged and index performance does not reflect deduction of fees, expenses, or taxes. Presentation of Index data does not reflect a belief by Navellier that any stock index constitutes an investment alternative to any Navellier equity strategy or is necessarily comparable to such strategies. Among the most important differences between the Indices and Navellier strategies are that the Navellier equity strategies may (1) incur material management fees, (2) concentrate its investments in relatively few stocks, industries, or sectors, (3) have significantly greater trading activity and related costs, and (4) be significantly more or less volatile than the Indices.

ETF Risk: We may invest in exchange traded funds (“ETFs”) and some of our investment strategies are generally fully invested in ETFs. Like traditional mutual funds, ETFs charge asset-based fees, but they generally do not charge initial sales charges or redemption fees and investors typically pay only customary brokerage fees to buy and sell ETF shares. The fees and costs charged by ETFs held in client accounts will not be deducted from the compensation the client pays Navellier. ETF prices can fluctuate up or down, and a client account could lose money investing in an ETF if the prices of the securities owned by the ETF go down. ETFs are subject to additional risks:

- ETF shares may trade above or below their net asset value;

- An active trading market for an ETF’s shares may not develop or be maintained;

- The value of an ETF may be more volatile than the underlying portfolio of securities the ETF is designed to track;

- The cost of owning shares of the ETF may exceed those a client would incur by directly investing in the underlying securities; and

- Trading of an ETF’s shares may be halted if the listing exchange’s officials deem it appropriate, the shares are delisted from the exchange, or the activation of market-wide “circuit breakers” (which are tied to large decreases in stock prices) halts stock trading generally.

Grader Disclosures: Investment in equity strategies involves substantial risk and has the potential for partial or complete loss of funds invested. The sample portfolio and any accompanying charts are for informational purposes only and are not to be construed as a solicitation to buy or sell any financial instrument and should not be relied upon as the sole factor in an investment making decision. As a matter of normal and important disclosures to you, as a potential investor, please consider the following: The performance presented is not based on any actual securities trading, portfolio, or accounts, and the reported performance of the A, B, C, D, and F portfolios (collectively the “model portfolios”) should be considered mere “paper” or pro forma performance results based on Navellier’s research.

Investors evaluating any of Navellier & Associates, Inc.’s, (or its affiliates’) Investment Products must not use any information presented here, including the performance figures of the model portfolios, in their evaluation of any Navellier Investment Products. Navellier Investment Products include the firm’s mutual funds and managed accounts. The model portfolios, charts, and other information presented do not represent actual funded trades and are not actual funded portfolios. There are material differences between Navellier Investment Products’ portfolios and the model portfolios, research, and performance figures presented here. The model portfolios and the research results (1) may contain stocks or ETFs that are illiquid and difficult to trade; (2) may contain stock or ETF holdings materially different from actual funded Navellier Investment Product portfolios; (3) include the reinvestment of all dividends and other earnings, estimated trading costs, commissions, or management fees; and, (4) may not reflect prices obtained in an actual funded Navellier Investment Product portfolio. For these and other reasons, the reported performances of model portfolios do not reflect the performance results of Navellier’s actually funded and traded Investment Products. In most cases, Navellier’s Investment Products have materially lower performance results than the performances of the model portfolios presented.

This report contains statements that are, or may be considered to be, forward-looking statements. All statements that are not historical facts, including statements about our beliefs or expectations, are “forward-looking statements” within the meaning of The U.S. Private Securities Litigation Reform Act of 1995. These statements may be identified by such forward-looking terminology as “expect,” “estimate,” “plan,” “intend,” “believe,” “anticipate,” “may,” “will,” “should,” “could,” “continue,” “project,” or similar statements or variations of such terms. Our forward-looking statements are based on a series of expectations, assumptions, and projections, are not guarantees of future results or performance, and involve substantial risks and uncertainty as described in Form ADV Part 2A of our filing with the Securities and Exchange Commission (SEC), which is available at www.adviserinfo.sec.gov or by requesting a copy by emailing info@navellier.com. All of our forward-looking statements are as of the date of this report only. We can give no assurance that such expectations or forward-looking statements will prove to be correct. Actual results may differ materially. You are urged to carefully consider all such factors.

FEDERAL TAX ADVICE DISCLAIMER: As required by U.S. Treasury Regulations, you are informed that, to the extent this presentation includes any federal tax advice, the presentation is not written by Navellier to be used, and cannot be used, for the purpose of avoiding federal tax penalties. Navellier does not advise on any income tax requirements or issues. Use of any information presented by Navellier is for general information only and does not represent tax advice either express or implied. You are encouraged to seek professional tax advice for income tax questions and assistance.

IMPORTANT NEWSLETTER DISCLOSURE:The hypothetical performance results for investment newsletters that are authored or edited by Louis Navellier, including Louis Navellier’s Growth Investor, Louis Navellier’s Breakthrough Stocks, Louis Navellier’s Accelerated Profits, and Louis Navellier’s Platinum Club, are not based on any actual securities trading, portfolio, or accounts, and the newsletters’ reported hypothetical performances should be considered mere “paper” or proforma hypothetical performance results and are not actual performance of real world trades. Navellier & Associates, Inc. does not have any relation to or affiliation with the owner of these newsletters. There are material differences between Navellier Investment Products’ portfolios and the InvestorPlace Media, LLC newsletter portfolios authored by Louis Navellier. The InvestorPlace Media, LLC newsletters contain hypothetical performance that do not include transaction costs, advisory fees, or other fees a client might incur if actual investments and trades were being made by an investor. As a result, newsletter performance should not be used to evaluate Navellier Investment services which are separate and different from the newsletters. The owner of the newsletters is InvestorPlace Media, LLC and any questions concerning the newsletters, including any newsletter advertising or hypothetical Newsletter performance claims, (which are calculated solely by Investor Place Media and not Navellier) should be referred to InvestorPlace Media, LLC at (800) 718-8289.

Please note that Navellier & Associates and the Navellier Private Client Group are managed completely independent of the newsletters owned and published by InvestorPlace Media, LLC and written and edited by Louis Navellier, and investment performance of the newsletters should in no way be considered indicative of potential future investment performance for any Navellier & Associates separately managed account portfolio. Potential investors should consult with their financial advisor before investing in any Navellier Investment Product.

Navellier claims compliance with Global Investment Performance Standards (GIPS). To receive a complete list and descriptions of Navellier’s composites and/or a presentation that adheres to the GIPS standards, please contact Navellier or click here. It should not be assumed that any securities recommendations made by Navellier & Associates, Inc. in the future will be profitable or equal the performance of securities made in this report.

FactSet Disclosure: Navellier does not independently calculate the statistical information included in the attached report. The calculation and the information are provided by FactSet, a company not related to Navellier. Although information contained in the report has been obtained from FactSet and is based on sources Navellier believes to be reliable, Navellier does not guarantee its accuracy, and it may be incomplete or condensed. The report and the related FactSet sourced information are provided on an “as is” basis. The user assumes the entire risk of any use made of this information. Investors should consider the report as only a single factor in making their investment decision. The report is for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of a security. FactSet sourced information is the exclusive property of FactSet. Without prior written permission of FactSet, this information may not be reproduced, disseminated or used to create any financial products. All indices are unmanaged and performance of the indices include reinvestment of dividends and interest income, unless otherwise noted, are not illustrative of any particular investment and an investment cannot be made in any index. Past performance is no guarantee of future results.