by Gary Alexander

March 4, 2025

March 4th marks Mardi-Gras day in New Orleans, Rio de Janeiro and a few other serious party towns.

March 4th was also our national Inauguration Day from 1789 to 1933 before the 20th Amendment moved the swearing-in ceremony to January 20th, so imagine all these Trump tornado events not happening yet…

Also, March Madness begins this week, with baseball’s Opening Day and golf’s Masters following soon.

March 4th is also the birthday of composer Antonin Vivaldi in 1678, and that is only relevant here because he composed Four Seasons, a four-movement piece (for the four seasons), divided into 12 segments (for the 12 months), beginning in spring, not winter, since the year traditionally began with the birth of life in spring, not in the icy winter, so… try to listen to Vivaldi’s spring or Mardi-Gras music while reading this!

The ancient year used to begin in March, before Julius Caesar sabotaged that great idea in 45 BC, before he got stabbed to death for a series of such bad ideas the next year. The Roman calendar began in March as the season of planting and growth, a time of optimism and hope, for the rebirth of life. Alas, his Julian calendar (named for himself, of course) brought the god Janus to the fore, starting the year with January, pushing Mars (March), the god of war, into to the third position. After that, only the Jewish calendar kept the first month (Nisan) in the spring, beginning in March, so as to calculate Passover on the 14th of Nisan.

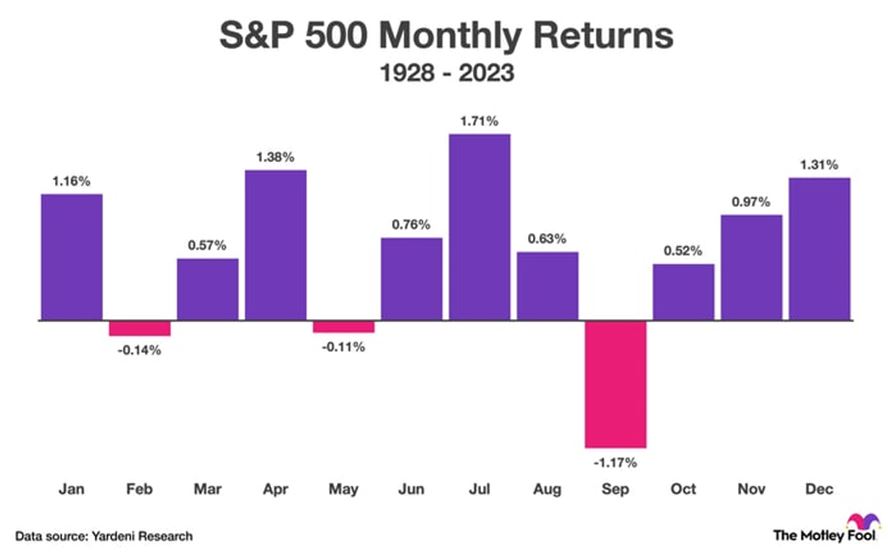

Turning to investments, wise investors know that March and April mark the best 1-2 punch in the first half of the year, behind only the June-July surge, then November-December closing each year strongly.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

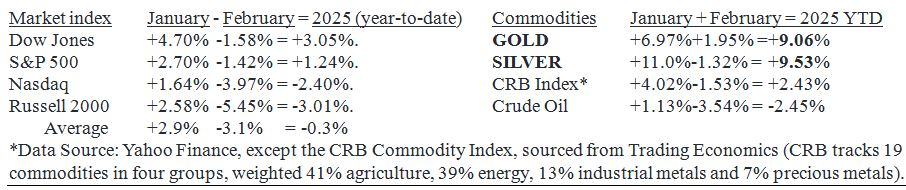

In 2025, January was robust and February was weak, according to form, so there is no reason to suspect that March and April won’t deliver some welcome gains. Here are the recent Jan (+) and Feb (-) totals:

March often welcomes warmer weather, and it closes with “window-dressing” in the quarter-ending portfolio cleansing process – not unlike the spring cleaning in many households, or the cleaning out of leavened products in orthodox Jewish households before Passover. There are typically several analyst earnings revisions causing switches from yesterday’s winners to tomorrow’s hopefuls. Revenue surprises were unusually high (at 75%) during the first quarter of 2023, so we may see a bump in sales this month.

March the Fourth be With You

On March 4, 1789, Congress met for the first time, and on this date in 1793, Washington gave the shortest Inauguration speech ever (133 words), which basically said, “I’m here, let’s get this nonsense over with.”

As we move deeper into the month of March – whether into More Madness or Market Momentum – we can take some pep talks from former Presidents, recalling our nation’s “mystic chords of memory” (ala Lincoln, 1861). Many have spoken well on this date in history, in times much more divisive than today.

Let’s hear short samples from Jefferson, Lincoln, Coolidge and FDR, an alternative Rushmore quartet.

1801: After Washington retired came the partisanship which has haunted us ever since, first between federalists (Adams) and Republicans (Jefferson), but on March 4, 1801, in the first inauguration held in Washington, DC, Jefferson said, “Every difference of opinion is not a difference of principle. We have called by different names brethren of the same principle. We are all Republicans. We are all Federalists.”

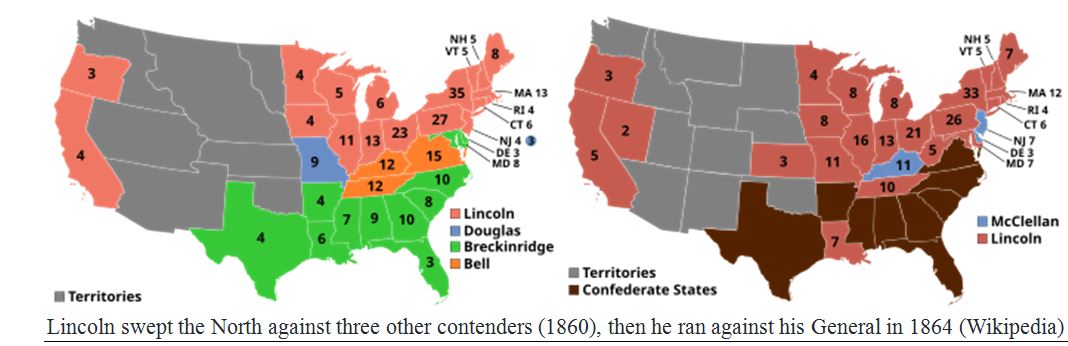

1861-65: Some of our best Inaugural speeches have been written by the Presidents themselves, with no ghost writers. Perhaps our greatest poet in the top post was Honest Abe, who also presided over our most divided era, winning less than 40% of the popular vote against three other candidates in 1860, then facing down his own General in 1864, but he uttered his most stirring words to beg for unity in both Inaugurals:

“We are not enemies, but friends. We must not be enemies. Though passion may have strained it must not break our bonds of affection. The mystic chords of memory, stretching from every battlefield and patriot grave to every living heart and hearthstone all over this broad land, will yet swell the chorus of the Union, when again touched, as surely they will be, by the better angels of our nature.” Lincoln, March 4, 1861.

“With malice toward none, with charity for all, with firmness in the right as God gives us to see the right, let us strive on to finish the work we are in, to bind up the nation’s wounds, to care for him who shall have borne the battle and for his widow and his orphan, to do all which may achieve and cherish a just and lasting peace among ourselves and all nations.” – Lincoln, March 4, 1865, six weeks before his death.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

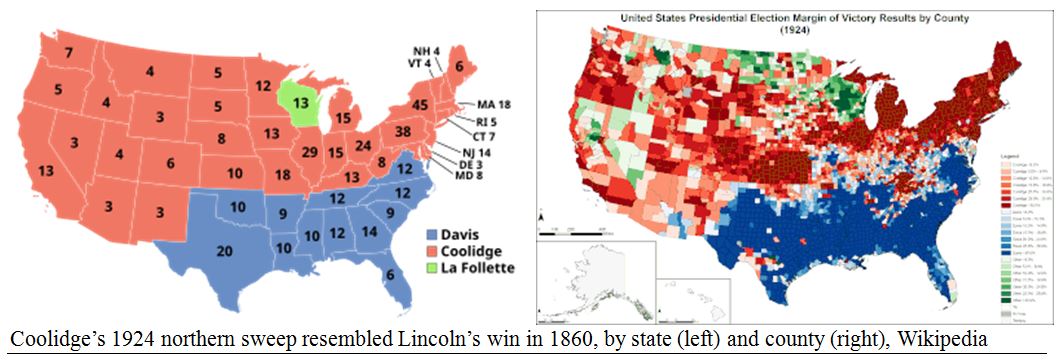

1925: A century ago today, the electoral map looked almost identical to when the Civil War ended, but in his only Inaugural speech, a century ago today, Calvin Coolidge focused on the morality of tax reforms:

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

“The resources of this country are almost beyond computation. No mind can comprehend them. But the cost of our combined governments is likewise almost beyond definition. Not only those who are now making their tax returns, but those who meet the enhanced cost of existence in their monthly bills, know by hard experience what this great burden is and what it does…. They know that extravagance lengthens the hours and diminishes the rewards of their labor. I favor the policy of economy, not because I wish to save money, but because I wish to save-people. The men and women of this country who toil are the ones who bear the cost of the Government. Every dollar that we carelessly waste means that their life will be the more meager. Every dollar that we prudently save means that their life will be the more abundant.

“The collection of any taxes which are not absolutely required, which do not beyond reasonable doubt contribute to the public welfare, is only a species of legalized larceny. Under this republic the rewards of industry belong to those who earn them. The only constitutional tax is the tax which ministers to public necessity. The property of the country belongs to the people of the country. Their title is absolute.

“I am opposed to extremely high rates, because they produce little or no revenue, because they are bad for the country, and, finally, because they are wrong. We cannot finance the country, we cannot improve social conditions, through any system of injustice, even if we attempt to inflict it upon the rich. Those who suffer the most harm will be the poor. This country believes in prosperity. It is absurd to suppose that it is envious of those who are already prosperous. The wise and correct course to follow in taxation and all other economic legislation is not to destroy those who have already secured success, but to create conditions under which everyone will have a better chance to be successful.” – Coolidge, March 4, 1925.

1933: In the final March 4 Inaugural talk, Franklin D. Roosevelt uttered his unforgettable reassurance that “We have nothing to fear but fear itself,” but he also announced a Bank Holiday closing banks to customer access, so we had something new to fear – a lack of access to our meager cash during a Depression.

“…Let me assert my firm belief that the only thing we have to fear is fear itself – nameless, unreasoning, unjustified terror which paralyzes needed efforts to convert retreat into advance.” – FDR, March 4, 1933.

And so, our 32nd President gave the 32nd and final Presidential Inauguration speech delivered on March 4th (when that date fell on a Sunday, the speech was delivered on Monday, March 5th). From 1789 to 1933, the nation was often in a sorrier state of division than we see today, but with fewer telecommunications devices to bring us a constant flow of scary news and partisan rhetoric. So…March Forth in confidence.

All content above represents the opinion of Gary Alexander of Navellier & Associates, Inc.

Also In This Issue

A Look Ahead by Louis Navellier

The Blow-up in Washington – and its Likely Repercussions

Income Mail by Bryan Perry

The Fed May Cut Rates Sooner Than Expected–to Deal with a Tighter Job Market

Growth Mail by Gary Alexander

March in Market History – and Some Great March 4th Inauguration Messages

Global Mail by Ivan Martchev

The Bond Market Is Beginning to Worry (a Little) About the Economy

Sector Spotlight by Jason Bodner

March – A New Month That is Almost Like a New Year!

View Full Archive

Read Past Issues Here

About The Author

Gary Alexander

SENIOR EDITOR

Gary Alexander has been Senior Writer at Navellier since 2009. He edits Navellier’s weekly Marketmail and writes a weekly Growth Mail column, in which he uses market history to support the case for growth stocks. For the previous 20-years before joining Navellier, he was Senior Executive Editor at InvestorPlace Media (formerly Phillips Publishing), where he worked with several leading investment analysts, including Louis Navellier (since 1997), helping launch Louis Navellier’s Blue Chip Growth and Global Growth newsletters.

Prior to that, Gary edited Wealth Magazine and Gold Newsletter and wrote various investment research reports for Jefferson Financial in New Orleans in the 1980s. He began his financial newsletter career with KCI Communications in 1980, where he served as consulting editor for Personal Finance newsletter while serving as general manager of KCI’s Alexandria House book division. Before that, he covered the economics beat for news magazines. All content of “Growth Mail” represents the opinion of Gary Alexander

Important Disclosures:

Although information in these reports has been obtained from and is based upon sources that Navellier believes to be reliable, Navellier does not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute Navellier’s judgment as of the date the report was created and are subject to change without notice. These reports are for informational purposes only and are not a solicitation for the purchase or sale of a security. Any decision to purchase securities mentioned in these reports must take into account existing public information on such securities or any registered prospectus.To the extent permitted by law, neither Navellier & Associates, Inc., nor any of its affiliates, agents, or service providers assumes any liability or responsibility nor owes any duty of care for any consequences of any person acting or refraining to act in reliance on the information contained in this communication or for any decision based on it.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any securities recommendations made by Navellier. in the future will be profitable or equal the performance of securities made in this report. Dividend payments are not guaranteed. The amount of a dividend payment, if any, can vary over time and issuers may reduce dividends paid on securities in the event of a recession or adverse event affecting a specific industry or issuer.

None of the stock information, data, and company information presented herein constitutes a recommendation by Navellier or a solicitation to buy or sell any securities. Any specific securities identified and described do not represent all of the securities purchased, sold, or recommended for advisory clients. The holdings identified do not represent all of the securities purchased, sold, or recommended for advisory clients and the reader should not assume that investments in the securities identified and discussed were or will be profitable.

Information presented is general information that does not take into account your individual circumstances, financial situation, or needs, nor does it present a personalized recommendation to you. Individual stocks presented may not be suitable for every investor. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. Investment in fixed income securities has the potential for the investment return and principal value of an investment to fluctuate so that an investor’s holdings, when redeemed, may be worth less than their original cost.

One cannot invest directly in an index. Index is unmanaged and index performance does not reflect deduction of fees, expenses, or taxes. Presentation of Index data does not reflect a belief by Navellier that any stock index constitutes an investment alternative to any Navellier equity strategy or is necessarily comparable to such strategies. Among the most important differences between the Indices and Navellier strategies are that the Navellier equity strategies may (1) incur material management fees, (2) concentrate its investments in relatively few stocks, industries, or sectors, (3) have significantly greater trading activity and related costs, and (4) be significantly more or less volatile than the Indices.

ETF Risk: We may invest in exchange traded funds (“ETFs”) and some of our investment strategies are generally fully invested in ETFs. Like traditional mutual funds, ETFs charge asset-based fees, but they generally do not charge initial sales charges or redemption fees and investors typically pay only customary brokerage fees to buy and sell ETF shares. The fees and costs charged by ETFs held in client accounts will not be deducted from the compensation the client pays Navellier. ETF prices can fluctuate up or down, and a client account could lose money investing in an ETF if the prices of the securities owned by the ETF go down. ETFs are subject to additional risks:

- ETF shares may trade above or below their net asset value;

- An active trading market for an ETF’s shares may not develop or be maintained;

- The value of an ETF may be more volatile than the underlying portfolio of securities the ETF is designed to track;

- The cost of owning shares of the ETF may exceed those a client would incur by directly investing in the underlying securities; and

- Trading of an ETF’s shares may be halted if the listing exchange’s officials deem it appropriate, the shares are delisted from the exchange, or the activation of market-wide “circuit breakers” (which are tied to large decreases in stock prices) halts stock trading generally.

Grader Disclosures: Investment in equity strategies involves substantial risk and has the potential for partial or complete loss of funds invested. The sample portfolio and any accompanying charts are for informational purposes only and are not to be construed as a solicitation to buy or sell any financial instrument and should not be relied upon as the sole factor in an investment making decision. As a matter of normal and important disclosures to you, as a potential investor, please consider the following: The performance presented is not based on any actual securities trading, portfolio, or accounts, and the reported performance of the A, B, C, D, and F portfolios (collectively the “model portfolios”) should be considered mere “paper” or pro forma performance results based on Navellier’s research.

Investors evaluating any of Navellier & Associates, Inc.’s, (or its affiliates’) Investment Products must not use any information presented here, including the performance figures of the model portfolios, in their evaluation of any Navellier Investment Products. Navellier Investment Products include the firm’s mutual funds and managed accounts. The model portfolios, charts, and other information presented do not represent actual funded trades and are not actual funded portfolios. There are material differences between Navellier Investment Products’ portfolios and the model portfolios, research, and performance figures presented here. The model portfolios and the research results (1) may contain stocks or ETFs that are illiquid and difficult to trade; (2) may contain stock or ETF holdings materially different from actual funded Navellier Investment Product portfolios; (3) include the reinvestment of all dividends and other earnings, estimated trading costs, commissions, or management fees; and, (4) may not reflect prices obtained in an actual funded Navellier Investment Product portfolio. For these and other reasons, the reported performances of model portfolios do not reflect the performance results of Navellier’s actually funded and traded Investment Products. In most cases, Navellier’s Investment Products have materially lower performance results than the performances of the model portfolios presented.

This report contains statements that are, or may be considered to be, forward-looking statements. All statements that are not historical facts, including statements about our beliefs or expectations, are “forward-looking statements” within the meaning of The U.S. Private Securities Litigation Reform Act of 1995. These statements may be identified by such forward-looking terminology as “expect,” “estimate,” “plan,” “intend,” “believe,” “anticipate,” “may,” “will,” “should,” “could,” “continue,” “project,” or similar statements or variations of such terms. Our forward-looking statements are based on a series of expectations, assumptions, and projections, are not guarantees of future results or performance, and involve substantial risks and uncertainty as described in Form ADV Part 2A of our filing with the Securities and Exchange Commission (SEC), which is available at www.adviserinfo.sec.gov or by requesting a copy by emailing info@navellier.com. All of our forward-looking statements are as of the date of this report only. We can give no assurance that such expectations or forward-looking statements will prove to be correct. Actual results may differ materially. You are urged to carefully consider all such factors.

FEDERAL TAX ADVICE DISCLAIMER: As required by U.S. Treasury Regulations, you are informed that, to the extent this presentation includes any federal tax advice, the presentation is not written by Navellier to be used, and cannot be used, for the purpose of avoiding federal tax penalties. Navellier does not advise on any income tax requirements or issues. Use of any information presented by Navellier is for general information only and does not represent tax advice either express or implied. You are encouraged to seek professional tax advice for income tax questions and assistance.

IMPORTANT NEWSLETTER DISCLOSURE:The hypothetical performance results for investment newsletters that are authored or edited by Louis Navellier, including Louis Navellier’s Growth Investor, Louis Navellier’s Breakthrough Stocks, Louis Navellier’s Accelerated Profits, and Louis Navellier’s Platinum Club, are not based on any actual securities trading, portfolio, or accounts, and the newsletters’ reported hypothetical performances should be considered mere “paper” or proforma hypothetical performance results and are not actual performance of real world trades. Navellier & Associates, Inc. does not have any relation to or affiliation with the owner of these newsletters. There are material differences between Navellier Investment Products’ portfolios and the InvestorPlace Media, LLC newsletter portfolios authored by Louis Navellier. The InvestorPlace Media, LLC newsletters contain hypothetical performance that do not include transaction costs, advisory fees, or other fees a client might incur if actual investments and trades were being made by an investor. As a result, newsletter performance should not be used to evaluate Navellier Investment services which are separate and different from the newsletters. The owner of the newsletters is InvestorPlace Media, LLC and any questions concerning the newsletters, including any newsletter advertising or hypothetical Newsletter performance claims, (which are calculated solely by Investor Place Media and not Navellier) should be referred to InvestorPlace Media, LLC at (800) 718-8289.

Please note that Navellier & Associates and the Navellier Private Client Group are managed completely independent of the newsletters owned and published by InvestorPlace Media, LLC and written and edited by Louis Navellier, and investment performance of the newsletters should in no way be considered indicative of potential future investment performance for any Navellier & Associates separately managed account portfolio. Potential investors should consult with their financial advisor before investing in any Navellier Investment Product.

Navellier claims compliance with Global Investment Performance Standards (GIPS). To receive a complete list and descriptions of Navellier’s composites and/or a presentation that adheres to the GIPS standards, please contact Navellier or click here. It should not be assumed that any securities recommendations made by Navellier & Associates, Inc. in the future will be profitable or equal the performance of securities made in this report.

FactSet Disclosure: Navellier does not independently calculate the statistical information included in the attached report. The calculation and the information are provided by FactSet, a company not related to Navellier. Although information contained in the report has been obtained from FactSet and is based on sources Navellier believes to be reliable, Navellier does not guarantee its accuracy, and it may be incomplete or condensed. The report and the related FactSet sourced information are provided on an “as is” basis. The user assumes the entire risk of any use made of this information. Investors should consider the report as only a single factor in making their investment decision. The report is for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of a security. FactSet sourced information is the exclusive property of FactSet. Without prior written permission of FactSet, this information may not be reproduced, disseminated or used to create any financial products. All indices are unmanaged and performance of the indices include reinvestment of dividends and interest income, unless otherwise noted, are not illustrative of any particular investment and an investment cannot be made in any index. Past performance is no guarantee of future results.