by Louis Navellier

June 4, 2024

Thursday’s guilty verdict in the New York criminal case against Donald Trump will not likely change the election outcome, but it crashed his website, as his backers rushed to donate money to his presidential campaign. The Biden Administration and his opponents have been eerily quiet, as they are starting to fear what they may have unleased. While Trump’s opponents may relish calling Donald Trump a felon, they effectively galvanized his supporters and caused the fund raising for his Presidential campaign to soar!

I should add that Trump advisor Peter Navarro is already in federal prison and another former advisor, Steve Bannon, is headed to a federal prison. Navarro refused to comply with a Congressional subpoena after asserting executive privilege and may be out in time to speak at the Republican National Convention (RNC) in July. Bannon also refused to comply with a Congressional subpoena and will likely miss the RNC. Donald Trump’s sentencing is on July 11th, just before the RNC, and I expect that if the judge tries to put Trump in jail, then “all hell” will break out among his supporters, and that could impact the market.

In all that furor, I believe voters should be more worried about deficit spending and where that money is going. The Commerce Department recently announced that a 15.2% increase in new defense orders (largely due to aid to Ukraine) boosted the April durable goods report and caused it to rise 0.7%, when economists were expecting an 0.8% decline, so the good news is that the U.S. aid to Ukraine is boosting the defense industry, but the bad news is that is not helping ordinary American voters this election year.

Speaking of the Ukraine war, Ukraine is running out of men to fight, since their women are increasingly running the factories and farms. Furthermore, Ukraine recently freed almost 350 inmates to join the Army in exchange for the possibility of parole. Prisoners have submitted 4,300 applications to join the Army, while up to 20,000 inmates are expected to apply. Not that long ago, Ukraine mocked Russia’s push to recruit prisoners in exchange for early parole, but now that this sad war has persisted well into its third year, Ukraine is running out of men to resist Russia’s assault on Ukraine’s second largest city, Kharkiv.

Britain and the U.S. have supplied Ukraine with longer-range missiles that can strike deeper into Russia, so the fighting is no longer just a border skirmish, but it has escalated into a major proxy war funded by NATO. Ukraine recently destroyed a Russian radar station designed to track incoming nuclear missiles. Germany refused to provide long-range missiles to Ukraine, since it wanted to avoid nuclear escalation. NATO Secretary General Jens Stoltenberg said that the “time has come to consider whether it will be right to lift some restrictions” on Ukraine. Then, U.S. Secretary of State Anthony Blinken, on Wednesday, signaled that the U.S. is weighing the idea of allowing Ukraine to strike Russia with U.S. weapons.

The nations of Europe, with American aid, may be stumbling into World War III. I for one, would hope that President Biden can find a clear way to present his idea of an endgame in this conflict, on or before the first Presidential debate on June 27th, other than to repeat some vague idea of “total victory.”

I was in Virginia on Wednesday talking to a former Reagan Administration official, and his view was that if Ukraine falls to Russia, the Republican leaders in Congress would be blamed for any defeat, since they delayed aid to Ukraine. However, the collapse of Ukraine cannot reflect well on Democrats either, since Biden said we will “see what Russia takes” in a “minor incursion” before funding this war with Russia.

In the meantime, crude oil markets remain on high alert for more potential disruptions to Russian crude oil output, which has dropped steadily for the past three weeks, reaching its lowest level in 10 weeks.

Some energy companies seem to be expecting a Trump victory and a return to more drilling. Bloomberg reported on Wednesday that Conoco-Philips is acquiring Marathon Oil in a $17.1 billion stock swap. This will boost Conoco-Philips’s presence in Texas shale fields and in the light sweet crude from North Dakota. Conoco-Philips has already expanded dramatically in the Permian Basin in recent years through a $13 billion takeover of Concho Resources as well as a purchase of Shell assets in the region, so it appears that the U.S. domestic crude oil boom is continuing, as Conoco-Philips may be anticipating a Trump victory.

One other potential surprise I have been writing about here in recent weeks is the booming private credit market, which soared from $432.9 billion in 2014 to $1.7 trillion in 2023. This year, private credit is on track to soar above $2 trillion. In my opinion, the 11% yields that the private credit industry is offering investors is not sustainable, so as this industry grows, it is raiding more private credit “rain makers,” so that somewhere along the line these bad loans will be exposed as part of a private credit bubble, a la 2008.

In other news, China keeps slipping in and out of recession territory. China’s National Bureau of Statistics announced that its official purchasing managers index (PMI) declined to 49.5 in May, down from 50.4 in April, so China’s manufacturing sector has resumed contracting after expanding in March and April. The overproduction of batteries, EVs and solar panels that China “dumped” on the world, helped boost its first-quarter GDP growth. However, as I have repeatedly said, building excess inventory is not “real” GDP growth. The National Bureau of Statistics also announced that its service PMI declined slightly to 51.2 in May, so China’s service sector is still expanding. But since manufacturing is bigger than services in the Chinese economy, there is no doubt that China’s economic growth is sputtering.

U.S. growth isn’t soaring, either. The Fed released its Beige Book survey of all 12 Fed districts last Wednesday, and it said that the U.S. economy expanded at a “slight or modest” pace across most regions as consumers pushed back against high prices. Specifically, the Beige Book survey said, “Retail spending was flat-to-up slightly, reflecting lower discretionary spending and heightened price sensitivity among consumers.” Also, the Beige Book reported that job growth in 8 of the 12 Fed districts was “negligible to modest,” so the U.S. economy is not hitting on all cylinders, and the Fed may have to focus more on jobs.

What Our Portfolio Grader is Telling Us Now

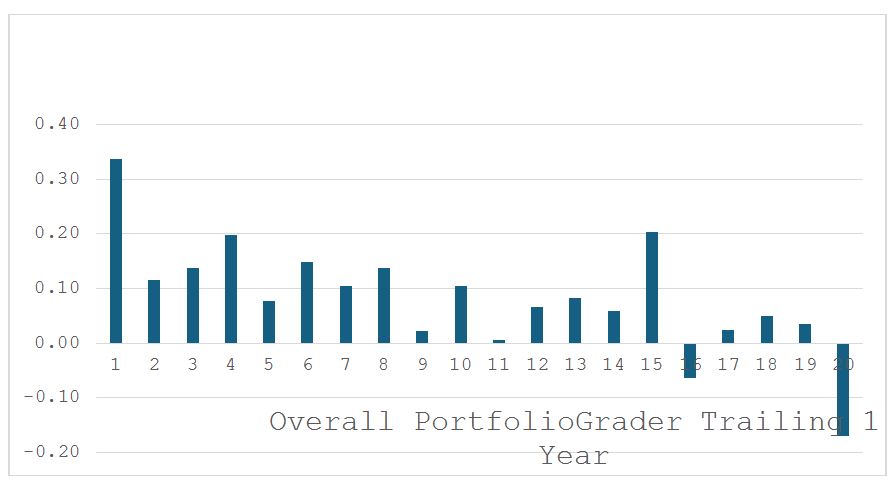

Turning to our investment portfolios, at the end of each quarterly announcement season, we retest how our Portfolio-Grader is performing. The main conclusion from our latest back test of the first-quarter reporting period is that the Top 5% of our 6,000+ stock universe is the place to be, as this chart shows:

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

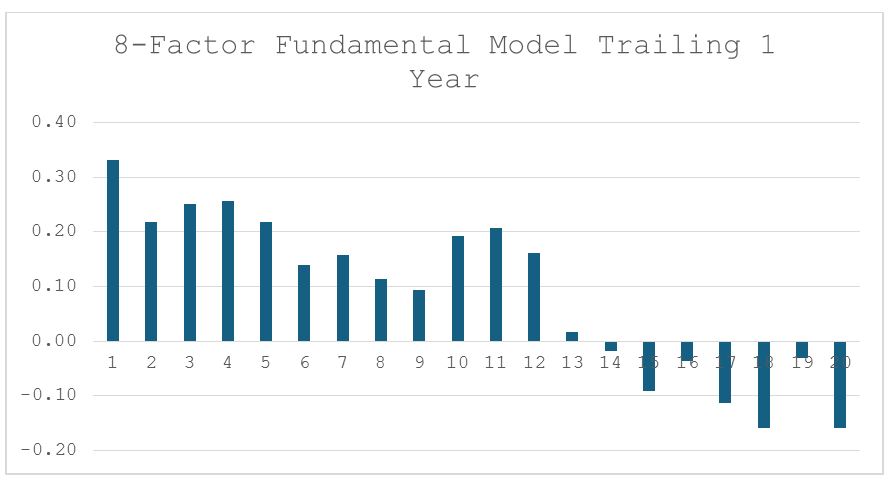

Also important is that the Top 60% of stocks with the highest fundamental scores (A, B & C grades) are performing much better than the overall stock market, as the following chart illustrates:

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

This focus on fundamentals bodes well for our stocks in the upcoming months. When the Fed finally decides to start cutting key interest rates, the breadth and power of the overall stock should improve.

Navellier & Associates owns Marathon Oil Corporation (MRO), Shell Plc Sponsored ADR (SHEL), and Conoco-Phillips (COP), in managed accounts. We do not own Concho Resources (CXO). Louis Navellier and his family own Conoco-Phillips (COP), via a Navellier managed account, He does not personally own Shell Plc Sponsored ADR (SHEL), Marathon Oil Corporation (MRO) or Concho Resources (CXO).

All content above represents the opinion of Louis Navellier of Navellier & Associates, Inc.

Also In This Issue

A Look Ahead by Louis Navellier

Are We Flirting with World War III While Over-Focusing on Politics?

Income Mail by Bryan Perry

The PCE Data Shows the First Signs of Inflation Cooling

Growth Mail by Gary Alexander

America’s New D-Day: The Day Debt Doubled Growth

Global Mail by Ivan Martchev

The Reversal of the Reversal

Sector Spotlight by Jason Bodner

It’s June. Time For Some “Good Vibrations”

View Full Archive

Read Past Issues Here

Louis Navellier

CHIEF INVESTMENT OFFICER

Louis Navellier is Founder, Chairman of the Board, Chief Investment Officer and Chief Compliance Officer of Navellier & Associates, Inc., located in Reno, Nevada. With decades of experience translating what had been purely academic techniques into real market applications, he believes that disciplined, quantitative analysis can select stocks that will significantly outperform the overall market. All content in this “A Look Ahead” section of Market Mail represents the opinion of Louis Navellier of Navellier & Associates, Inc.

Important Disclosures:

Although information in these reports has been obtained from and is based upon sources that Navellier believes to be reliable, Navellier does not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute Navellier’s judgment as of the date the report was created and are subject to change without notice. These reports are for informational purposes only and are not a solicitation for the purchase or sale of a security. Any decision to purchase securities mentioned in these reports must take into account existing public information on such securities or any registered prospectus.To the extent permitted by law, neither Navellier & Associates, Inc., nor any of its affiliates, agents, or service providers assumes any liability or responsibility nor owes any duty of care for any consequences of any person acting or refraining to act in reliance on the information contained in this communication or for any decision based on it.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any securities recommendations made by Navellier. in the future will be profitable or equal the performance of securities made in this report. Dividend payments are not guaranteed. The amount of a dividend payment, if any, can vary over time and issuers may reduce dividends paid on securities in the event of a recession or adverse event affecting a specific industry or issuer.

None of the stock information, data, and company information presented herein constitutes a recommendation by Navellier or a solicitation to buy or sell any securities. Any specific securities identified and described do not represent all of the securities purchased, sold, or recommended for advisory clients. The holdings identified do not represent all of the securities purchased, sold, or recommended for advisory clients and the reader should not assume that investments in the securities identified and discussed were or will be profitable.

Information presented is general information that does not take into account your individual circumstances, financial situation, or needs, nor does it present a personalized recommendation to you. Individual stocks presented may not be suitable for every investor. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. Investment in fixed income securities has the potential for the investment return and principal value of an investment to fluctuate so that an investor’s holdings, when redeemed, may be worth less than their original cost.

One cannot invest directly in an index. Index is unmanaged and index performance does not reflect deduction of fees, expenses, or taxes. Presentation of Index data does not reflect a belief by Navellier that any stock index constitutes an investment alternative to any Navellier equity strategy or is necessarily comparable to such strategies. Among the most important differences between the Indices and Navellier strategies are that the Navellier equity strategies may (1) incur material management fees, (2) concentrate its investments in relatively few stocks, industries, or sectors, (3) have significantly greater trading activity and related costs, and (4) be significantly more or less volatile than the Indices.

ETF Risk: We may invest in exchange traded funds (“ETFs”) and some of our investment strategies are generally fully invested in ETFs. Like traditional mutual funds, ETFs charge asset-based fees, but they generally do not charge initial sales charges or redemption fees and investors typically pay only customary brokerage fees to buy and sell ETF shares. The fees and costs charged by ETFs held in client accounts will not be deducted from the compensation the client pays Navellier. ETF prices can fluctuate up or down, and a client account could lose money investing in an ETF if the prices of the securities owned by the ETF go down. ETFs are subject to additional risks:

- ETF shares may trade above or below their net asset value;

- An active trading market for an ETF’s shares may not develop or be maintained;

- The value of an ETF may be more volatile than the underlying portfolio of securities the ETF is designed to track;

- The cost of owning shares of the ETF may exceed those a client would incur by directly investing in the underlying securities; and

- Trading of an ETF’s shares may be halted if the listing exchange’s officials deem it appropriate, the shares are delisted from the exchange, or the activation of market-wide “circuit breakers” (which are tied to large decreases in stock prices) halts stock trading generally.

Grader Disclosures: Investment in equity strategies involves substantial risk and has the potential for partial or complete loss of funds invested. The sample portfolio and any accompanying charts are for informational purposes only and are not to be construed as a solicitation to buy or sell any financial instrument and should not be relied upon as the sole factor in an investment making decision. As a matter of normal and important disclosures to you, as a potential investor, please consider the following: The performance presented is not based on any actual securities trading, portfolio, or accounts, and the reported performance of the A, B, C, D, and F portfolios (collectively the “model portfolios”) should be considered mere “paper” or pro forma performance results based on Navellier’s research.

Investors evaluating any of Navellier & Associates, Inc.’s, (or its affiliates’) Investment Products must not use any information presented here, including the performance figures of the model portfolios, in their evaluation of any Navellier Investment Products. Navellier Investment Products include the firm’s mutual funds and managed accounts. The model portfolios, charts, and other information presented do not represent actual funded trades and are not actual funded portfolios. There are material differences between Navellier Investment Products’ portfolios and the model portfolios, research, and performance figures presented here. The model portfolios and the research results (1) may contain stocks or ETFs that are illiquid and difficult to trade; (2) may contain stock or ETF holdings materially different from actual funded Navellier Investment Product portfolios; (3) include the reinvestment of all dividends and other earnings, estimated trading costs, commissions, or management fees; and, (4) may not reflect prices obtained in an actual funded Navellier Investment Product portfolio. For these and other reasons, the reported performances of model portfolios do not reflect the performance results of Navellier’s actually funded and traded Investment Products. In most cases, Navellier’s Investment Products have materially lower performance results than the performances of the model portfolios presented.

This report contains statements that are, or may be considered to be, forward-looking statements. All statements that are not historical facts, including statements about our beliefs or expectations, are “forward-looking statements” within the meaning of The U.S. Private Securities Litigation Reform Act of 1995. These statements may be identified by such forward-looking terminology as “expect,” “estimate,” “plan,” “intend,” “believe,” “anticipate,” “may,” “will,” “should,” “could,” “continue,” “project,” or similar statements or variations of such terms. Our forward-looking statements are based on a series of expectations, assumptions, and projections, are not guarantees of future results or performance, and involve substantial risks and uncertainty as described in Form ADV Part 2A of our filing with the Securities and Exchange Commission (SEC), which is available at www.adviserinfo.sec.gov or by requesting a copy by emailing info@navellier.com. All of our forward-looking statements are as of the date of this report only. We can give no assurance that such expectations or forward-looking statements will prove to be correct. Actual results may differ materially. You are urged to carefully consider all such factors.

FEDERAL TAX ADVICE DISCLAIMER: As required by U.S. Treasury Regulations, you are informed that, to the extent this presentation includes any federal tax advice, the presentation is not written by Navellier to be used, and cannot be used, for the purpose of avoiding federal tax penalties. Navellier does not advise on any income tax requirements or issues. Use of any information presented by Navellier is for general information only and does not represent tax advice either express or implied. You are encouraged to seek professional tax advice for income tax questions and assistance.

IMPORTANT NEWSLETTER DISCLOSURE:The hypothetical performance results for investment newsletters that are authored or edited by Louis Navellier, including Louis Navellier’s Growth Investor, Louis Navellier’s Breakthrough Stocks, Louis Navellier’s Accelerated Profits, and Louis Navellier’s Platinum Club, are not based on any actual securities trading, portfolio, or accounts, and the newsletters’ reported hypothetical performances should be considered mere “paper” or proforma hypothetical performance results and are not actual performance of real world trades. Navellier & Associates, Inc. does not have any relation to or affiliation with the owner of these newsletters. There are material differences between Navellier Investment Products’ portfolios and the InvestorPlace Media, LLC newsletter portfolios authored by Louis Navellier. The InvestorPlace Media, LLC newsletters contain hypothetical performance that do not include transaction costs, advisory fees, or other fees a client might incur if actual investments and trades were being made by an investor. As a result, newsletter performance should not be used to evaluate Navellier Investment services which are separate and different from the newsletters. The owner of the newsletters is InvestorPlace Media, LLC and any questions concerning the newsletters, including any newsletter advertising or hypothetical Newsletter performance claims, (which are calculated solely by Investor Place Media and not Navellier) should be referred to InvestorPlace Media, LLC at (800) 718-8289.

Please note that Navellier & Associates and the Navellier Private Client Group are managed completely independent of the newsletters owned and published by InvestorPlace Media, LLC and written and edited by Louis Navellier, and investment performance of the newsletters should in no way be considered indicative of potential future investment performance for any Navellier & Associates separately managed account portfolio. Potential investors should consult with their financial advisor before investing in any Navellier Investment Product.

Navellier claims compliance with Global Investment Performance Standards (GIPS). To receive a complete list and descriptions of Navellier’s composites and/or a presentation that adheres to the GIPS standards, please contact Navellier or click here. It should not be assumed that any securities recommendations made by Navellier & Associates, Inc. in the future will be profitable or equal the performance of securities made in this report.

FactSet Disclosure: Navellier does not independently calculate the statistical information included in the attached report. The calculation and the information are provided by FactSet, a company not related to Navellier. Although information contained in the report has been obtained from FactSet and is based on sources Navellier believes to be reliable, Navellier does not guarantee its accuracy, and it may be incomplete or condensed. The report and the related FactSet sourced information are provided on an “as is” basis. The user assumes the entire risk of any use made of this information. Investors should consider the report as only a single factor in making their investment decision. The report is for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of a security. FactSet sourced information is the exclusive property of FactSet. Without prior written permission of FactSet, this information may not be reproduced, disseminated or used to create any financial products. All indices are unmanaged and performance of the indices include reinvestment of dividends and interest income, unless otherwise noted, are not illustrative of any particular investment and an investment cannot be made in any index. Past performance is no guarantee of future results.