by Gary Alexander

August 27, 2024

Back in January, I wrote a column here, titled, “The Monthly Jobs Data is Bogus and Premature… Yet it Still Moves Markets: Why?” Apparently, traders are still snookered into overreacting to the jobs report.

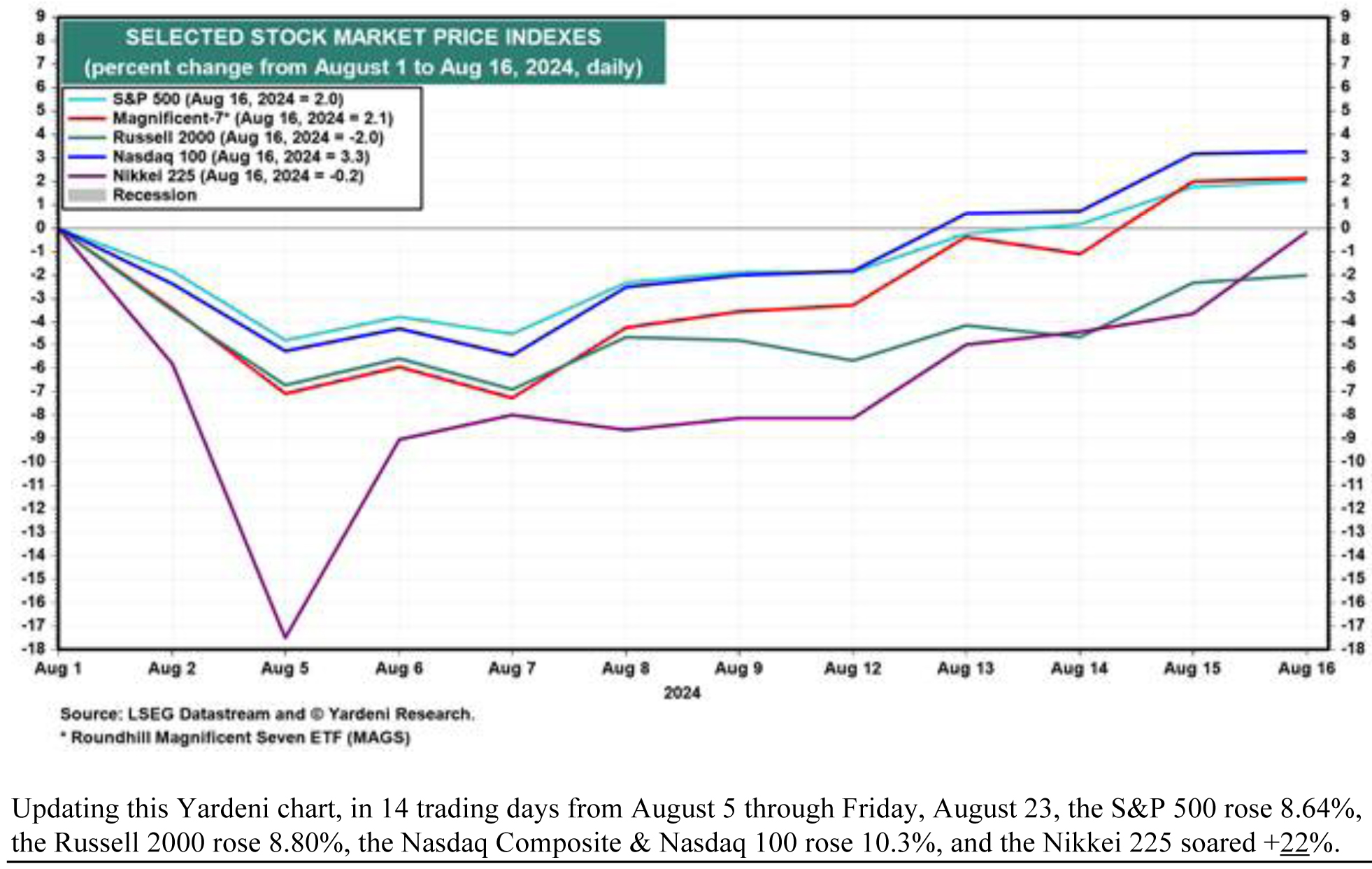

It happened again, on Friday, August 2nd, when the Labor Department came out with a downbeat report of only 114,000 new jobs in July. Also, the jobless rate leaped up to 4.3%, from 4.1% in June and 3.4% last year. In knee-jerk fashion, the market tanked. In two trading days (Friday and Monday), the S&P 500 lost 4.8%, the previously hot Russell 2000 fell 6.7% and the “Magnificent 7” fell 7.1%. In Tokyo, the Nikkei 225 fell 17.5% in the same two trading days, but by August 16, the Mag-7, S&P 500 and NASDAQ 100 were back in positive ground and the Nikkei 225 had regained all its losses, in just 11 days. False alarm.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

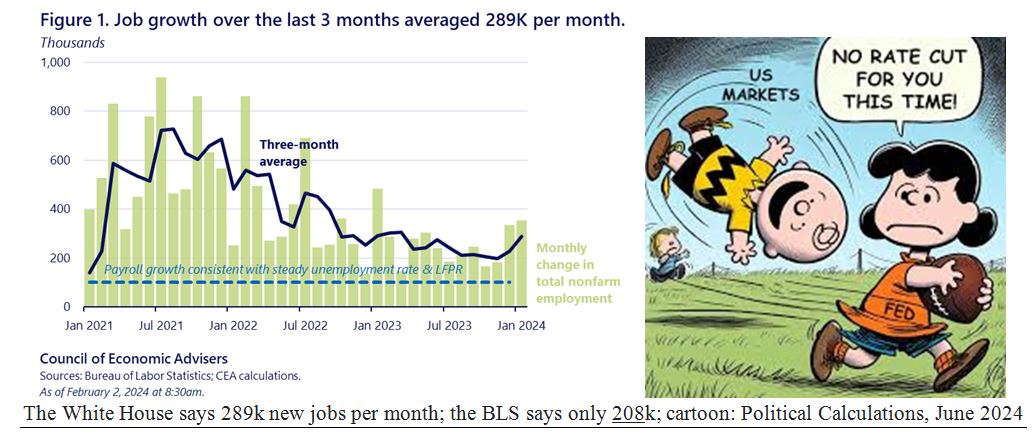

Last week, we learned that the jobs situation was even worse than the Friday BLS report told us. In fact, the BLS itself told us what I had already explained last January: Most Bureau of Labor Statistics jobs data is “bogus and/or premature.” The BLS admitted last week that its preliminary revision for the 12 months ending March 31 showed 818,000 fewer payroll jobs than first reported. We gained 2.08 million jobs, not 2.9 million, an average of 68,000 fewer jobs per month than first reported, 173,500 vs. 241,600 a month.

This revision emerged by comparing tax data with payroll data, since some workers were not on the tax rolls, likely undocumented immigrants, so they may work some real jobs without all taxes being withheld.

Last January, I warned about this trend, saying, “The number of jobs created each month was revised downward in 10 out of the last 11 months, and these cumulative revisions were ratcheted down by a total of 443,000 jobs, the largest downward revisions outside of a recession year since 2002” yet, “Like Charlie Brown kicking at Lucy’s ever disappearing football, it makes you wonder when Chuck will wise up.”

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

The footnotes to the BLS monthly report admit the wide range of error possible in each month’s jobs report:

“The confidence interval for the monthly change in total non-farm employment from the establishment survey is on the order of plus or minus 130,000.”

That explains the wide variance in future revisions. You simply can’t count the total number of new jobs on the first or second day – or the first week – after the end of the month, especially if based on calls or queries to real human beings with their own agenda in answering questions from government agents.

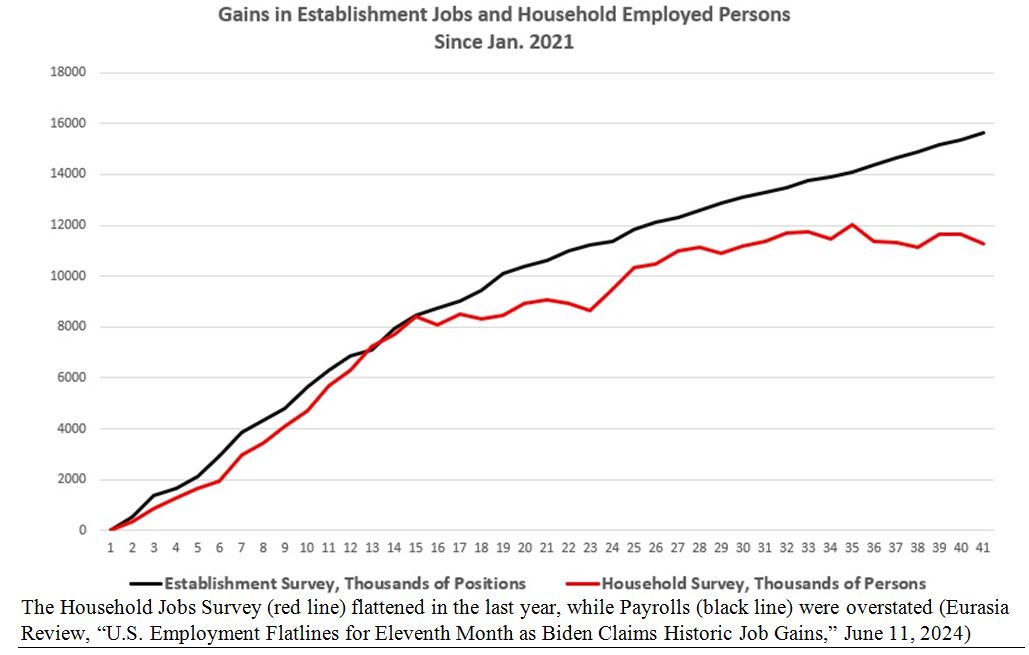

As it turns out, the BLS takes two surveys each month – one being the household survey, to determine how many people at home are working or are looking for work, and the establishment survey, to ask businesses how many people work there. (The establishment survey is the one that was recently revised).

Source: www.mises.org

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

In the household survey, where they call homes and ask if you are working or looking for work, there was near zero job growth in the last year, from 161,209,000 jobs in July 2023 to 161,266,000 in July 2024 (+57,000, or +0.04%), so one job survey was flat, and the other was reduced from 2.90 to 2.08 million.

More Job Market Realities to Ponder Over Labor Day Weekend

Labor Day is traditionally the start of the real Presidential campaign season in election years, even crazy ones like 2024. Big convention rallies are mercifully over, and the stump speeches and debates can begin.

I prefer to look at history…and music…for clues. In my Labor Day radio program this weekend, I will play tunes with “work” in the title. It’s interesting to note that work songs congregate in two time slots: 1937-38, in the Great Depression, when Unions were strong, and then around 1960, about the drudgery of coal mining. From the first list, we get “Nice Work if You Can Get it” by the Gershwins, and “Hi Ho, Hi Ho, It’s Off to Work We Go” from Disney’s “Snow White.” They’re upbeat – just to have a job was heavenly, but in 1960, coal mining was dirty, dingy and low paying – “16 tons and what do you get? Another day older and deeper in debt.” There were lots of coal mining songs and a hit for a “Coal Miner’s Daughter.”

It’s no wonder that one of Dobie Gillis’s TV hippie friends cringed whenever he heard the word “Work.”

In 1950, there were over 537,700 coal miners in America, and over 100 of them usually died each year in coal mine collapses, with many others dying prematurely from lung diseases. According to CDC, in a little over a century (1900 to 2006), 513 underground mine disasters (mostly explosions and fires) killed 11,606 coal miners, or about 110 deaths per year. Thankfully, those jobs are now much rarer and safer.

Before the pandemic, I wrote a review here (on August 7, 2018) of Nicholas Eberstadt’s book, “Men Without Work.” He updated that book in September 2022 as “Men Without Work: Post-Pandemic Edition” (reviewed in the September 3-4, 2022, Wall Street Journal), including these segments:

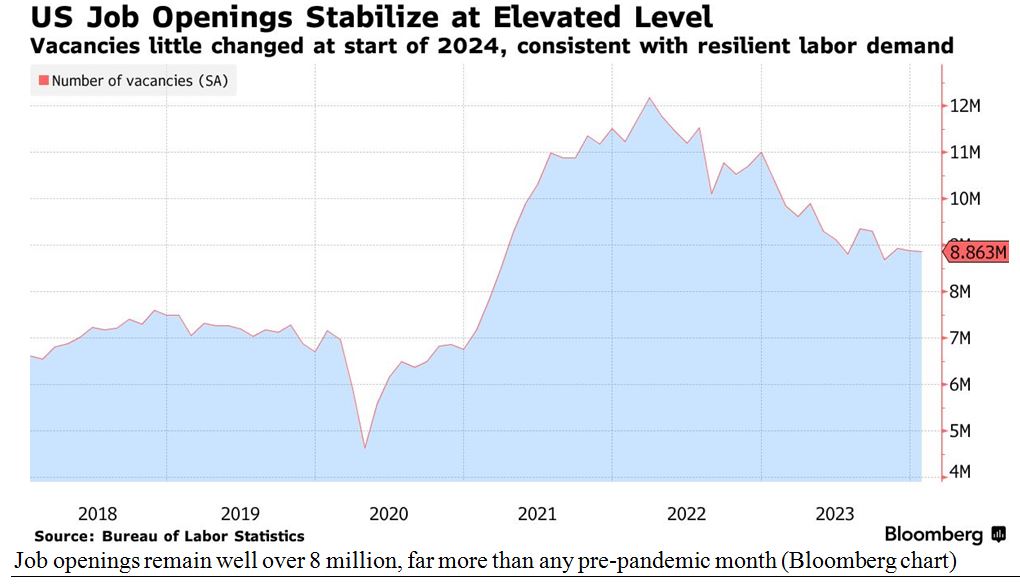

“We now face an unprecedented peacetime labor shortage, with employers practically begging for workers, while vast numbers of grown men and women sit on the sidelines of the economy – even though job applicants have more bargaining power in the ‘Great Resignation’ than at any time in recent memory. Never has work been so readily available in modern America; never have so many been uninterested in taking it. Since Labor Day 2021, unfilled nonfarm positions have averaged over 11 million a month. For every unemployed person in the U.S. today, there are nearly two open jobs, and the labor shortage affects every region of the country.

“Major sectors are now wide open to applicants without any great skills, apart from the ability to show up to work, regularly, and on time, drug-free,” but “Padded by transfer payments, disposable income in America spiked in 2020 and 2021, reaching previously unattained heights…. In 2020 and 2021, a windfall of more than $2.5 trillion in extra savings was bestowed by Washington on private households through borrowed public funds” so that “men appear to have gone into a sort of premature retirement.” — from “Men Without Work: Post-Pandemic Edition” (2022).

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

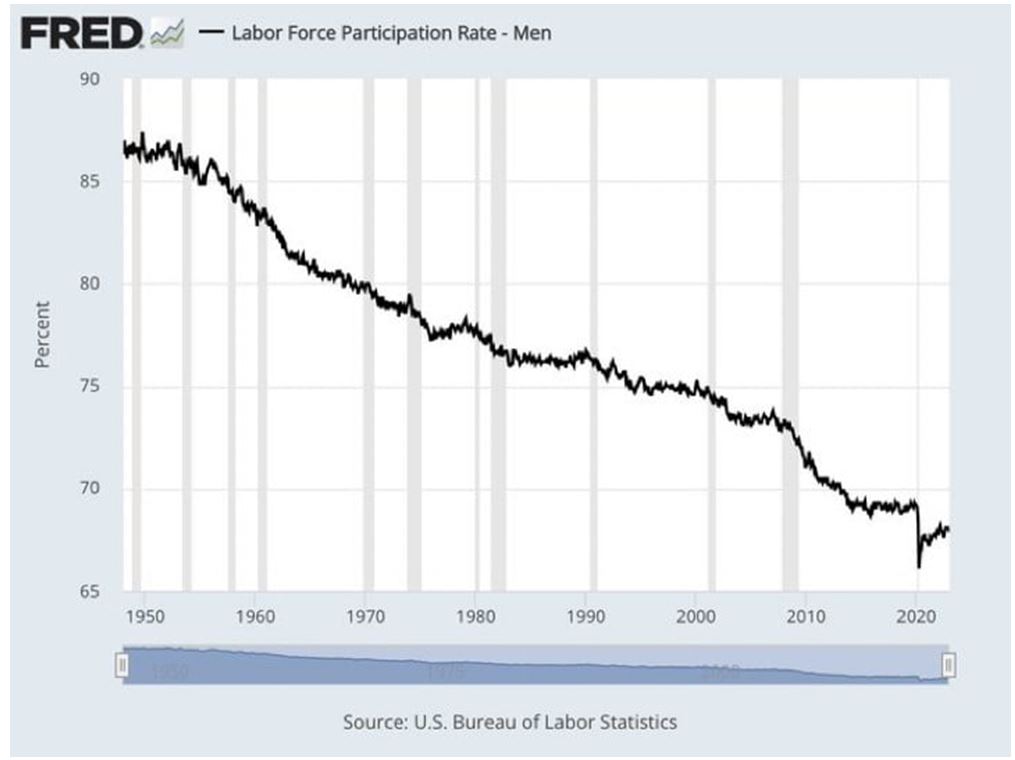

One out of three working age men are not in the Labor Force – the lowest rate ever. Before the pandemic, the major reasons were: (1) skyrocketing disability claims and drug addiction; (2) lower incentives for work and higher rewards for not working; and (3) better off-the-grid options. In a 2017 paper (“Where Have All the Workers Gone? An inquiry Into the Decline of the U.S. Labor Force Participation Rate”), Alan Krueger, a Princeton University economist, cited findings that nearly half of all prime working age males not in the labor force (PWAM-NILFs) “take pain medication on a daily basis, and in nearly two-thirds of these cases they take prescription pain medication,” contributing to the opioid epidemic.

With far safer workplaces than the coal-mining era of 65 years (and 16 tons) ago, far more workers have discovered the magic of bad backs or designer diseases that keep them out of work (while quadriplegic Charles Krauthammer was able to finish medical school and work at the top level of several careers without use of 90% of his body. I guess some people are wired to work more passionately than others).

In the 1950s, men felt they had to support a family, so 87% of working age men were at work or looking for work. That number is now well below 70% and still chugging away below pre-pandemic levels:

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

We’ve come a long way from hauling 16 tons of coal and owing our soul to the company store. There’s no need to enter a coal mine, but millions of healthy men need to put their big-boy pants on and get a job.

All content above represents the opinion of Gary Alexander of Navellier & Associates, Inc.

Also In This Issue

A Look Ahead by Louis Navellier

The Fed Finally Joins the “Rate Cut” Party

Income Mail by Bryan Perry

What the Massive Job Revisions Reveal

Growth Mail by Gary Alexander

Deciphering Our Deceptive Jobs Data over Labor Day Weekend

Global Mail by Ivan Martchev

The “Nvidia Danger” is They Sell the Good News

Sector Spotlight by Jason Bodner

Is It Market Blast-off Time Yet?

View Full Archive

Read Past Issues Here

About The Author

Gary Alexander

SENIOR EDITOR

Gary Alexander has been Senior Writer at Navellier since 2009. He edits Navellier’s weekly Marketmail and writes a weekly Growth Mail column, in which he uses market history to support the case for growth stocks. For the previous 20-years before joining Navellier, he was Senior Executive Editor at InvestorPlace Media (formerly Phillips Publishing), where he worked with several leading investment analysts, including Louis Navellier (since 1997), helping launch Louis Navellier’s Blue Chip Growth and Global Growth newsletters.

Prior to that, Gary edited Wealth Magazine and Gold Newsletter and wrote various investment research reports for Jefferson Financial in New Orleans in the 1980s. He began his financial newsletter career with KCI Communications in 1980, where he served as consulting editor for Personal Finance newsletter while serving as general manager of KCI’s Alexandria House book division. Before that, he covered the economics beat for news magazines. All content of “Growth Mail” represents the opinion of Gary Alexander

Important Disclosures:

Although information in these reports has been obtained from and is based upon sources that Navellier believes to be reliable, Navellier does not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute Navellier’s judgment as of the date the report was created and are subject to change without notice. These reports are for informational purposes only and are not a solicitation for the purchase or sale of a security. Any decision to purchase securities mentioned in these reports must take into account existing public information on such securities or any registered prospectus.To the extent permitted by law, neither Navellier & Associates, Inc., nor any of its affiliates, agents, or service providers assumes any liability or responsibility nor owes any duty of care for any consequences of any person acting or refraining to act in reliance on the information contained in this communication or for any decision based on it.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any securities recommendations made by Navellier. in the future will be profitable or equal the performance of securities made in this report. Dividend payments are not guaranteed. The amount of a dividend payment, if any, can vary over time and issuers may reduce dividends paid on securities in the event of a recession or adverse event affecting a specific industry or issuer.

None of the stock information, data, and company information presented herein constitutes a recommendation by Navellier or a solicitation to buy or sell any securities. Any specific securities identified and described do not represent all of the securities purchased, sold, or recommended for advisory clients. The holdings identified do not represent all of the securities purchased, sold, or recommended for advisory clients and the reader should not assume that investments in the securities identified and discussed were or will be profitable.

Information presented is general information that does not take into account your individual circumstances, financial situation, or needs, nor does it present a personalized recommendation to you. Individual stocks presented may not be suitable for every investor. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. Investment in fixed income securities has the potential for the investment return and principal value of an investment to fluctuate so that an investor’s holdings, when redeemed, may be worth less than their original cost.

One cannot invest directly in an index. Index is unmanaged and index performance does not reflect deduction of fees, expenses, or taxes. Presentation of Index data does not reflect a belief by Navellier that any stock index constitutes an investment alternative to any Navellier equity strategy or is necessarily comparable to such strategies. Among the most important differences between the Indices and Navellier strategies are that the Navellier equity strategies may (1) incur material management fees, (2) concentrate its investments in relatively few stocks, industries, or sectors, (3) have significantly greater trading activity and related costs, and (4) be significantly more or less volatile than the Indices.

ETF Risk: We may invest in exchange traded funds (“ETFs”) and some of our investment strategies are generally fully invested in ETFs. Like traditional mutual funds, ETFs charge asset-based fees, but they generally do not charge initial sales charges or redemption fees and investors typically pay only customary brokerage fees to buy and sell ETF shares. The fees and costs charged by ETFs held in client accounts will not be deducted from the compensation the client pays Navellier. ETF prices can fluctuate up or down, and a client account could lose money investing in an ETF if the prices of the securities owned by the ETF go down. ETFs are subject to additional risks:

- ETF shares may trade above or below their net asset value;

- An active trading market for an ETF’s shares may not develop or be maintained;

- The value of an ETF may be more volatile than the underlying portfolio of securities the ETF is designed to track;

- The cost of owning shares of the ETF may exceed those a client would incur by directly investing in the underlying securities; and

- Trading of an ETF’s shares may be halted if the listing exchange’s officials deem it appropriate, the shares are delisted from the exchange, or the activation of market-wide “circuit breakers” (which are tied to large decreases in stock prices) halts stock trading generally.

Grader Disclosures: Investment in equity strategies involves substantial risk and has the potential for partial or complete loss of funds invested. The sample portfolio and any accompanying charts are for informational purposes only and are not to be construed as a solicitation to buy or sell any financial instrument and should not be relied upon as the sole factor in an investment making decision. As a matter of normal and important disclosures to you, as a potential investor, please consider the following: The performance presented is not based on any actual securities trading, portfolio, or accounts, and the reported performance of the A, B, C, D, and F portfolios (collectively the “model portfolios”) should be considered mere “paper” or pro forma performance results based on Navellier’s research.

Investors evaluating any of Navellier & Associates, Inc.’s, (or its affiliates’) Investment Products must not use any information presented here, including the performance figures of the model portfolios, in their evaluation of any Navellier Investment Products. Navellier Investment Products include the firm’s mutual funds and managed accounts. The model portfolios, charts, and other information presented do not represent actual funded trades and are not actual funded portfolios. There are material differences between Navellier Investment Products’ portfolios and the model portfolios, research, and performance figures presented here. The model portfolios and the research results (1) may contain stocks or ETFs that are illiquid and difficult to trade; (2) may contain stock or ETF holdings materially different from actual funded Navellier Investment Product portfolios; (3) include the reinvestment of all dividends and other earnings, estimated trading costs, commissions, or management fees; and, (4) may not reflect prices obtained in an actual funded Navellier Investment Product portfolio. For these and other reasons, the reported performances of model portfolios do not reflect the performance results of Navellier’s actually funded and traded Investment Products. In most cases, Navellier’s Investment Products have materially lower performance results than the performances of the model portfolios presented.

This report contains statements that are, or may be considered to be, forward-looking statements. All statements that are not historical facts, including statements about our beliefs or expectations, are “forward-looking statements” within the meaning of The U.S. Private Securities Litigation Reform Act of 1995. These statements may be identified by such forward-looking terminology as “expect,” “estimate,” “plan,” “intend,” “believe,” “anticipate,” “may,” “will,” “should,” “could,” “continue,” “project,” or similar statements or variations of such terms. Our forward-looking statements are based on a series of expectations, assumptions, and projections, are not guarantees of future results or performance, and involve substantial risks and uncertainty as described in Form ADV Part 2A of our filing with the Securities and Exchange Commission (SEC), which is available at www.adviserinfo.sec.gov or by requesting a copy by emailing info@navellier.com. All of our forward-looking statements are as of the date of this report only. We can give no assurance that such expectations or forward-looking statements will prove to be correct. Actual results may differ materially. You are urged to carefully consider all such factors.

FEDERAL TAX ADVICE DISCLAIMER: As required by U.S. Treasury Regulations, you are informed that, to the extent this presentation includes any federal tax advice, the presentation is not written by Navellier to be used, and cannot be used, for the purpose of avoiding federal tax penalties. Navellier does not advise on any income tax requirements or issues. Use of any information presented by Navellier is for general information only and does not represent tax advice either express or implied. You are encouraged to seek professional tax advice for income tax questions and assistance.

IMPORTANT NEWSLETTER DISCLOSURE:The hypothetical performance results for investment newsletters that are authored or edited by Louis Navellier, including Louis Navellier’s Growth Investor, Louis Navellier’s Breakthrough Stocks, Louis Navellier’s Accelerated Profits, and Louis Navellier’s Platinum Club, are not based on any actual securities trading, portfolio, or accounts, and the newsletters’ reported hypothetical performances should be considered mere “paper” or proforma hypothetical performance results and are not actual performance of real world trades. Navellier & Associates, Inc. does not have any relation to or affiliation with the owner of these newsletters. There are material differences between Navellier Investment Products’ portfolios and the InvestorPlace Media, LLC newsletter portfolios authored by Louis Navellier. The InvestorPlace Media, LLC newsletters contain hypothetical performance that do not include transaction costs, advisory fees, or other fees a client might incur if actual investments and trades were being made by an investor. As a result, newsletter performance should not be used to evaluate Navellier Investment services which are separate and different from the newsletters. The owner of the newsletters is InvestorPlace Media, LLC and any questions concerning the newsletters, including any newsletter advertising or hypothetical Newsletter performance claims, (which are calculated solely by Investor Place Media and not Navellier) should be referred to InvestorPlace Media, LLC at (800) 718-8289.

Please note that Navellier & Associates and the Navellier Private Client Group are managed completely independent of the newsletters owned and published by InvestorPlace Media, LLC and written and edited by Louis Navellier, and investment performance of the newsletters should in no way be considered indicative of potential future investment performance for any Navellier & Associates separately managed account portfolio. Potential investors should consult with their financial advisor before investing in any Navellier Investment Product.

Navellier claims compliance with Global Investment Performance Standards (GIPS). To receive a complete list and descriptions of Navellier’s composites and/or a presentation that adheres to the GIPS standards, please contact Navellier or click here. It should not be assumed that any securities recommendations made by Navellier & Associates, Inc. in the future will be profitable or equal the performance of securities made in this report.

FactSet Disclosure: Navellier does not independently calculate the statistical information included in the attached report. The calculation and the information are provided by FactSet, a company not related to Navellier. Although information contained in the report has been obtained from FactSet and is based on sources Navellier believes to be reliable, Navellier does not guarantee its accuracy, and it may be incomplete or condensed. The report and the related FactSet sourced information are provided on an “as is” basis. The user assumes the entire risk of any use made of this information. Investors should consider the report as only a single factor in making their investment decision. The report is for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of a security. FactSet sourced information is the exclusive property of FactSet. Without prior written permission of FactSet, this information may not be reproduced, disseminated or used to create any financial products. All indices are unmanaged and performance of the indices include reinvestment of dividends and interest income, unless otherwise noted, are not illustrative of any particular investment and an investment cannot be made in any index. Past performance is no guarantee of future results.