by Gary Alexander

May 7, 2024

As we approach the 80th anniversary of D-Day in June and the beginning of the end for the Axis powers in World War II, today marks the 79th anniversary of VE-Day, as the formal German surrender was made by German General Alfred Jodl on May 7, 1945. The big celebration came the next day, May 8, our VE-Day.

In the eight decades since World War II, the U.S. has been the world’s #1 economic and military power, although four or five rising powers have tried to dethrone Uncle Sam – depending on whether you count Hitler as our first big knockout victims. I was reminded of Victim #2 last week while rifling through some of my 14 editions of Wealth magazine, published in the mid-1980s. In our summer 1985 issue (title “Capitalism vs. Communism: The Re-emergence of Free Enterprise”), I saw these bullet points …

- The U.S. created more jobs last year than all of Europe created in the last decade (source: FT)

- Penalty in Russia for holding more than $100 in American currency: four years of hard labor. Amount offered by Russians on the street of Moscow for a pair of our faded blue jeans: $100.

- What Russian children, age 8 to 10, say they want (in a poll of 300 Moscow schoolchildren): Lucrative jobs, two-bedroom apartments, cars, country homes, and foreign travel.

These last two points came out of a visit to Russia. At the time, many thought the Soviets were stronger than the U.S. in their military, their missile capacity, and even in their economy. In 1961, according to Paul Samuelson’s famous Economics textbook, the Soviet system was superior to the capitalist West and would surpass us by the mid-1980s, but I visited that Potemkin economy then and could see they poured everything into the military and had nothing left over for their citizens. Still, even as late as 1989, the year the Berlin Wall crumbled, Samuelson’s Economics textbook said, “The Soviet economy is proof that, contrary to what many skeptics…believed, a socialist command economy can function and even thrive.”

Sorry, Paul. Russia never thrived. It was even poorer than its seven captive East European satellites.

At the same time, in the 1980s, Japan was a free-market challenger for being Ichiban (“#1”), but they blew their wad in an inflationary bubble that peaked in 1989, going into a 30-year deflationary funk.

China is the most recent challenger, but they are now in danger of going the way of Japan and Russia.

That’s four failed challengers in the last 80 years, and the U.S. is still #1, with no viable challenger in sight. Maybe India will become the fifth challenger (stifle that laugh!), with the strongest GDP growth this year, but don’t count on it. They have more long-term structural impediments than either China or Japan. In this week’s Economist, their lead editorial cites India as the world’s fastest-growing big country, expanding at an annual rate of 6%-7% with “Private-sector confidence at its highest level since 2010.”

Yet that fine magazine’s back-page scorecard shows this array of scary numbers – 5% inflation, a 7.6% jobless rate, 5.3% debt-to-GDP ratio, 7.2% interest rates and a falling currency. A closer look under the hood shows even scarier numbers: “Out of a working-age population of one billion, only 100 million or so have formal jobs. Most of the rest are stuck in casual work or joblessness.” This is our next rival!?

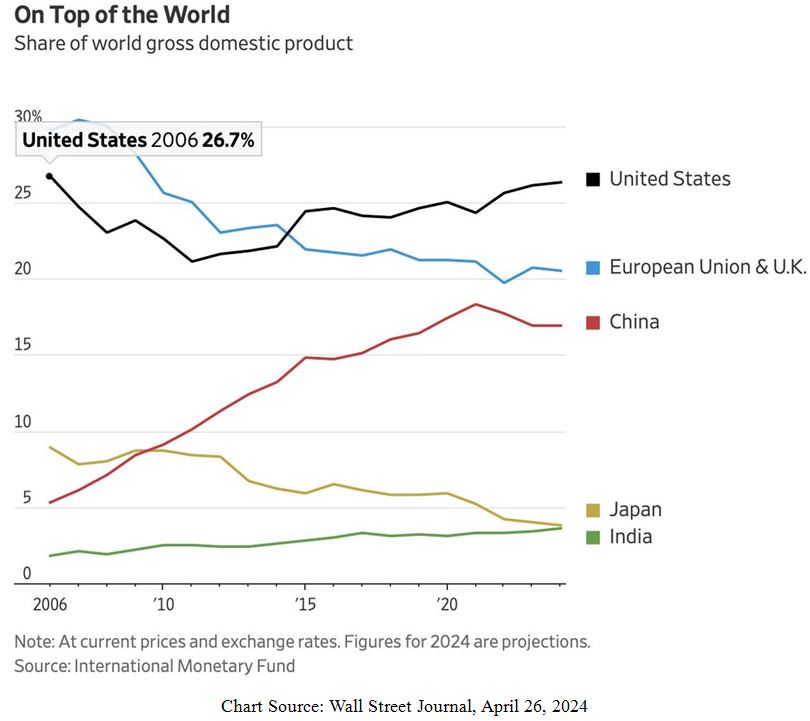

In his April 26, 2024, Wall Street Journal Capital Account (“U.S. Economy Reigns…”), Greg Ip opens:

“This year, the U.S. will account for 26.3% of the global gross domestic product, the highest in almost two decades. That’s based on the latest projections from the International Monetary Fund. According to the IMF, Europe’s share of world GDP has dropped 1.4 percentage points since 2018, and Japan’s by 2.1 points. The U.S. share, by contrast, is up 2.3 points. China’s share is up since 2018, too. But instead of overtaking the U.S. as the world’s largest economy, the Chinese economy has slipped in size to 64% of the U.S.’s, from 67% in 2018.” This chart followed:

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

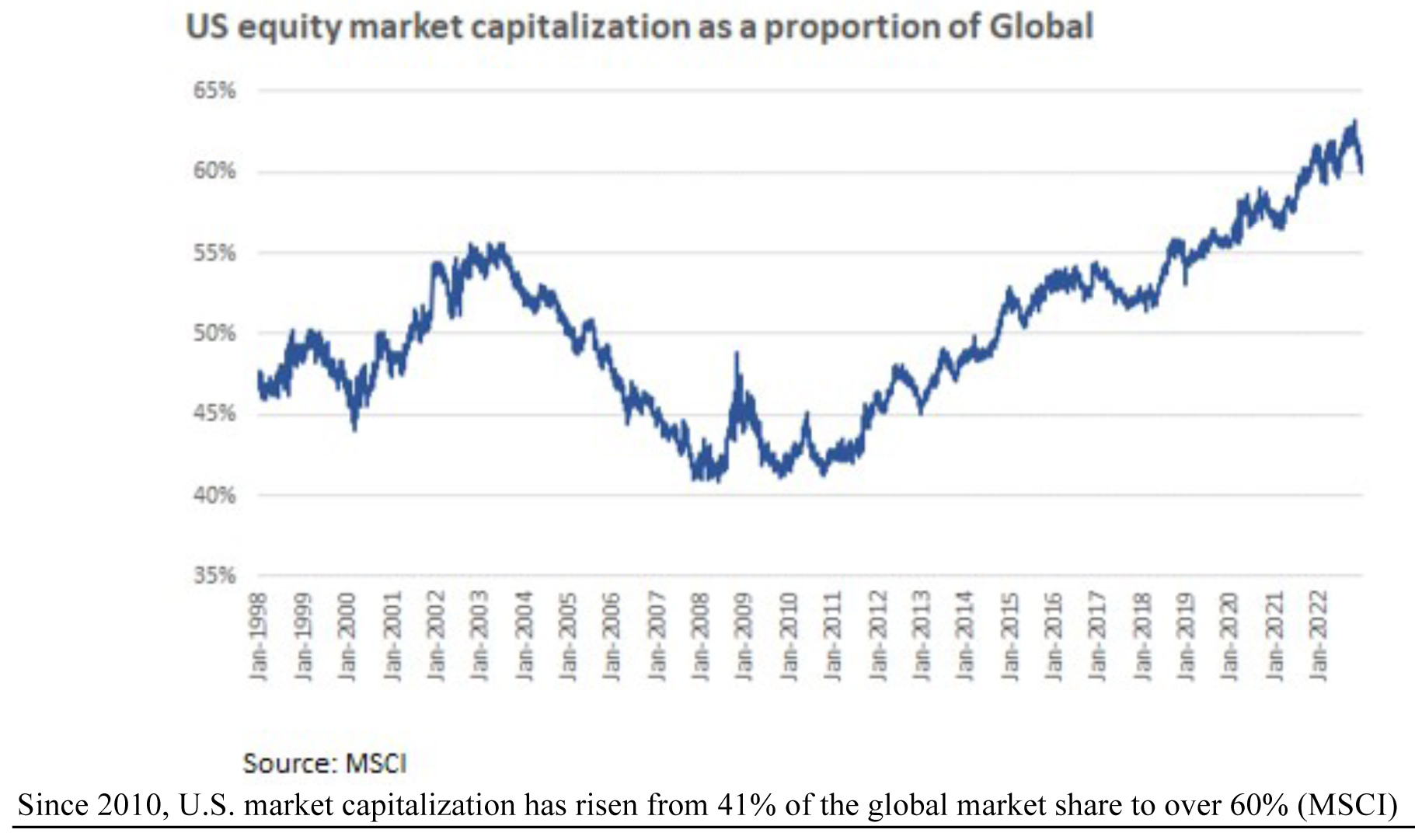

As an investment oasis, the U.S. has also long been the haven of first choice, just like the dollar has been the world’s reserve currency since 1944. For a short while, in the first decade of the century – after the birth of the euro, from about 1998 to the Great Financial Crisis of 2008 – Europe had its day in the sun, but that crisis hit European banks and governments deeper than it hurt American banks and our Treasury, so we saw crises erupt in the European PIGS (Portugal, Italy, Greece and Spain) in the following decade, and the U.S. once again became the investment oasis to the world in terms of market capitalization.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Some Reasons Why the U.S. Will Likely Remain No. 1

The U.S. still has natural population growth from many pro-family regions like the Mountain West (with its Mormon heritage) and the South, plus lots of immigration, but large families aren’t limited to religious groups and immigrants. Canada also has immigration, but immigration shrank a bit last year (immigrants must have figured out it was cold up there). A new study by Catherine Ruth Pakaluk (“Hannah’s Children: The Women Quietly Defying the Birth Dearth”) shows that the percentage of religious families with large families (five children or more) has declined, and more college-educated women have created large families, while the number of women having five or more children has remained around 5% since 1990.

The U.S. also assimilates immigrants better than most other countries, especially those among our major competitors in Europe and Asia. This is fairly evident when you walk the streets of Tokyo or Beijing.

Why do we assimilate others so well? As usual, Ronald Reagan put it best, here in a 1988 speech:

“America represents something universal in the human spirit. I received a letter not long ago from a man who said, ‘You can go to Japan to live, but you cannot become Japanese. You can go to France to live and not become a Frenchman. You can go to live in Germany or Turkey, and you won’t become a German or a Turk.’ But then he added, ‘Anybody from any corner of the world can come to America to live and become an American.’?’ A person becomes an American by adopting America’s principles, especially those … in the Declaration of Independence.”

Also, America represents an ongoing laboratory of growth, with 50 states competing among themselves to attract businesses and population (i.e., taxpayers) luring better ideas by offering more freedom, with those states that punish businesses and people (with high taxes and regulations) generally losing population.

In the same manner, the U.S. is like the most popular State among 50 big Nation States competing for people on a global scale, as the U.S. continues to attract the best and brightest minds to our universities and corporations. That’s why most of the new inventions and innovations come from our shores, not from overseas. Quick, name the top three inventions or innovations coming out of Europe or Asia since 1980.

Sure, other nations can copy or steal U.S. technology, but do these other nations innovate or create the big new ideas? Not likely, due to their central controls over private productivity and output, robbing their creative class of the fruits of their creativity – so the most creative among them often migrate to the U.S.

If I may close on a musical note, so many of America’s greatest composers and songwriters came to America because of persecution in Russia and Europe and made the music we love – music about the greatness of America. I cover their songs in my weekly radio programs. This coming weekend, I celebrate the songs of Dmitri Tiomkin (born May 10, 1894 in Ukraine), Max Steiner (May 10, 1888 in Vienna) and the greatest of all, Irving Berlin (born May 11, 1888 in Russia) as well as the Austrian-American hoofer who sang Berlin’s tunes, Fred Astaire, born Friedrich Austerlitz, August 10, 1899. Berlin put our holidays into song, from White Christmas to God Bless America to Thanksgiving (Count Your Blessings). Steiner wrote songs of the south (Tara’s Theme from Gone with the Wind) and Tiomkin wrote for the Westerns (including “Green Leaves of Summer” for “The Alamo”). Can you imagine any American-born composer emigrating to Japan, Russia, China, Austria or India and writing songs about his great new adopted land?

America is more than a nation. It is an idea, the only nation born out of ideas. May it always be so.

All content above represents the opinion of Gary Alexander of Navellier & Associates, Inc.

Also In This Issue

A Look Ahead by Louis Navellier

Powell’s Performance Boosts the Market Amid Downbeat Economic Reports

Income Mail by Bryan Perry

The Market Holds Up as Economic Cross Currents Collide

Growth Mail by Gary Alexander

Why the U.S. is an Economic and Investment Oasis – And Likely Will Remain So

Global Mail by Ivan Martchev

It Looks Like That Was “It” for the April Correction

Sector Spotlight by Jason Bodner

Powell’s Upbeat Music Lifted the Market

View Full Archive

Read Past Issues Here

About The Author

Gary Alexander

SENIOR EDITOR

Gary Alexander has been Senior Writer at Navellier since 2009. He edits Navellier’s weekly Marketmail and writes a weekly Growth Mail column, in which he uses market history to support the case for growth stocks. For the previous 20 years before joining Navellier, he was Senior Executive Editor at InvestorPlace Media (formerly Phillips Publishing), where he worked with several leading investment analysts, including Louis Navellier (since 1997), helping launch Louis Navellier’s Blue Chip Growth and Global Growth newsletters.

Prior to that, Gary edited Wealth Magazine and Gold Newsletter and wrote various investment research reports for Jefferson Financial in New Orleans in the 1980s. He began his financial newsletter career with KCI Communications in 1980, where he served as consulting editor for Personal Finance newsletter while serving as general manager of KCI’s Alexandria House book division. Before that, he covered the economics beat for news magazines. All content of “Growth Mail” represents the opinion of Gary Alexander

Important Disclosures:

Although information in these reports has been obtained from and is based upon sources that Navellier believes to be reliable, Navellier does not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute Navellier’s judgment as of the date the report was created and are subject to change without notice. These reports are for informational purposes only and are not a solicitation for the purchase or sale of a security. Any decision to purchase securities mentioned in these reports must take into account existing public information on such securities or any registered prospectus.To the extent permitted by law, neither Navellier & Associates, Inc., nor any of its affiliates, agents, or service providers assumes any liability or responsibility nor owes any duty of care for any consequences of any person acting or refraining to act in reliance on the information contained in this communication or for any decision based on it.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any securities recommendations made by Navellier. in the future will be profitable or equal the performance of securities made in this report. Dividend payments are not guaranteed. The amount of a dividend payment, if any, can vary over time and issuers may reduce dividends paid on securities in the event of a recession or adverse event affecting a specific industry or issuer.

None of the stock information, data, and company information presented herein constitutes a recommendation by Navellier or a solicitation to buy or sell any securities. Any specific securities identified and described do not represent all of the securities purchased, sold, or recommended for advisory clients. The holdings identified do not represent all of the securities purchased, sold, or recommended for advisory clients and the reader should not assume that investments in the securities identified and discussed were or will be profitable.

Information presented is general information that does not take into account your individual circumstances, financial situation, or needs, nor does it present a personalized recommendation to you. Individual stocks presented may not be suitable for every investor. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. Investment in fixed income securities has the potential for the investment return and principal value of an investment to fluctuate so that an investor’s holdings, when redeemed, may be worth less than their original cost.

One cannot invest directly in an index. Index is unmanaged and index performance does not reflect deduction of fees, expenses, or taxes. Presentation of Index data does not reflect a belief by Navellier that any stock index constitutes an investment alternative to any Navellier equity strategy or is necessarily comparable to such strategies. Among the most important differences between the Indices and Navellier strategies are that the Navellier equity strategies may (1) incur material management fees, (2) concentrate its investments in relatively few stocks, industries, or sectors, (3) have significantly greater trading activity and related costs, and (4) be significantly more or less volatile than the Indices.

ETF Risk: We may invest in exchange traded funds (“ETFs”) and some of our investment strategies are generally fully invested in ETFs. Like traditional mutual funds, ETFs charge asset-based fees, but they generally do not charge initial sales charges or redemption fees and investors typically pay only customary brokerage fees to buy and sell ETF shares. The fees and costs charged by ETFs held in client accounts will not be deducted from the compensation the client pays Navellier. ETF prices can fluctuate up or down, and a client account could lose money investing in an ETF if the prices of the securities owned by the ETF go down. ETFs are subject to additional risks:

- ETF shares may trade above or below their net asset value;

- An active trading market for an ETF’s shares may not develop or be maintained;

- The value of an ETF may be more volatile than the underlying portfolio of securities the ETF is designed to track;

- The cost of owning shares of the ETF may exceed those a client would incur by directly investing in the underlying securities; and

- Trading of an ETF’s shares may be halted if the listing exchange’s officials deem it appropriate, the shares are delisted from the exchange, or the activation of market-wide “circuit breakers” (which are tied to large decreases in stock prices) halts stock trading generally.

Grader Disclosures: Investment in equity strategies involves substantial risk and has the potential for partial or complete loss of funds invested. The sample portfolio and any accompanying charts are for informational purposes only and are not to be construed as a solicitation to buy or sell any financial instrument and should not be relied upon as the sole factor in an investment making decision. As a matter of normal and important disclosures to you, as a potential investor, please consider the following: The performance presented is not based on any actual securities trading, portfolio, or accounts, and the reported performance of the A, B, C, D, and F portfolios (collectively the “model portfolios”) should be considered mere “paper” or pro forma performance results based on Navellier’s research.

Investors evaluating any of Navellier & Associates, Inc.’s, (or its affiliates’) Investment Products must not use any information presented here, including the performance figures of the model portfolios, in their evaluation of any Navellier Investment Products. Navellier Investment Products include the firm’s mutual funds and managed accounts. The model portfolios, charts, and other information presented do not represent actual funded trades and are not actual funded portfolios. There are material differences between Navellier Investment Products’ portfolios and the model portfolios, research, and performance figures presented here. The model portfolios and the research results (1) may contain stocks or ETFs that are illiquid and difficult to trade; (2) may contain stock or ETF holdings materially different from actual funded Navellier Investment Product portfolios; (3) include the reinvestment of all dividends and other earnings, estimated trading costs, commissions, or management fees; and, (4) may not reflect prices obtained in an actual funded Navellier Investment Product portfolio. For these and other reasons, the reported performances of model portfolios do not reflect the performance results of Navellier’s actually funded and traded Investment Products. In most cases, Navellier’s Investment Products have materially lower performance results than the performances of the model portfolios presented.

This report contains statements that are, or may be considered to be, forward-looking statements. All statements that are not historical facts, including statements about our beliefs or expectations, are “forward-looking statements” within the meaning of The U.S. Private Securities Litigation Reform Act of 1995. These statements may be identified by such forward-looking terminology as “expect,” “estimate,” “plan,” “intend,” “believe,” “anticipate,” “may,” “will,” “should,” “could,” “continue,” “project,” or similar statements or variations of such terms. Our forward-looking statements are based on a series of expectations, assumptions, and projections, are not guarantees of future results or performance, and involve substantial risks and uncertainty as described in Form ADV Part 2A of our filing with the Securities and Exchange Commission (SEC), which is available at www.adviserinfo.sec.gov or by requesting a copy by emailing info@navellier.com. All of our forward-looking statements are as of the date of this report only. We can give no assurance that such expectations or forward-looking statements will prove to be correct. Actual results may differ materially. You are urged to carefully consider all such factors.

FEDERAL TAX ADVICE DISCLAIMER: As required by U.S. Treasury Regulations, you are informed that, to the extent this presentation includes any federal tax advice, the presentation is not written by Navellier to be used, and cannot be used, for the purpose of avoiding federal tax penalties. Navellier does not advise on any income tax requirements or issues. Use of any information presented by Navellier is for general information only and does not represent tax advice either express or implied. You are encouraged to seek professional tax advice for income tax questions and assistance.

IMPORTANT NEWSLETTER DISCLOSURE:The hypothetical performance results for investment newsletters that are authored or edited by Louis Navellier, including Louis Navellier’s Growth Investor, Louis Navellier’s Breakthrough Stocks, Louis Navellier’s Accelerated Profits, and Louis Navellier’s Platinum Club, are not based on any actual securities trading, portfolio, or accounts, and the newsletters’ reported hypothetical performances should be considered mere “paper” or proforma hypothetical performance results and are not actual performance of real world trades. Navellier & Associates, Inc. does not have any relation to or affiliation with the owner of these newsletters. There are material differences between Navellier Investment Products’ portfolios and the InvestorPlace Media, LLC newsletter portfolios authored by Louis Navellier. The InvestorPlace Media, LLC newsletters contain hypothetical performance that do not include transaction costs, advisory fees, or other fees a client might incur if actual investments and trades were being made by an investor. As a result, newsletter performance should not be used to evaluate Navellier Investment services which are separate and different from the newsletters. The owner of the newsletters is InvestorPlace Media, LLC and any questions concerning the newsletters, including any newsletter advertising or hypothetical Newsletter performance claims, (which are calculated solely by Investor Place Media and not Navellier) should be referred to InvestorPlace Media, LLC at (800) 718-8289.

Please note that Navellier & Associates and the Navellier Private Client Group are managed completely independent of the newsletters owned and published by InvestorPlace Media, LLC and written and edited by Louis Navellier, and investment performance of the newsletters should in no way be considered indicative of potential future investment performance for any Navellier & Associates separately managed account portfolio. Potential investors should consult with their financial advisor before investing in any Navellier Investment Product.

Navellier claims compliance with Global Investment Performance Standards (GIPS). To receive a complete list and descriptions of Navellier’s composites and/or a presentation that adheres to the GIPS standards, please contact Navellier or click here. It should not be assumed that any securities recommendations made by Navellier & Associates, Inc. in the future will be profitable or equal the performance of securities made in this report.

FactSet Disclosure: Navellier does not independently calculate the statistical information included in the attached report. The calculation and the information are provided by FactSet, a company not related to Navellier. Although information contained in the report has been obtained from FactSet and is based on sources Navellier believes to be reliable, Navellier does not guarantee its accuracy, and it may be incomplete or condensed. The report and the related FactSet sourced information are provided on an “as is” basis. The user assumes the entire risk of any use made of this information. Investors should consider the report as only a single factor in making their investment decision. The report is for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of a security. FactSet sourced information is the exclusive property of FactSet. Without prior written permission of FactSet, this information may not be reproduced, disseminated or used to create any financial products. All indices are unmanaged and performance of the indices include reinvestment of dividends and interest income, unless otherwise noted, are not illustrative of any particular investment and an investment cannot be made in any index. Past performance is no guarantee of future results.