by Louis Navellier

March 12, 2024

From the latest news and earnings reports, it looks like the Magnificent 7 leadership is changing. For starters, Apple and Tesla are beginning to falter, while the AI-related rally in Nvidia (NVDA) and Super Micro Computer (SMCI) continues to lead the overall stock market higher. NVDA rose 3.6% on Monday, while SMCI soared 18.65% due largely to the news that it will be added to the S&P 500 on March 18th – and many investors decided to get a head start on the index funds.

It looks like Super Micro Computer snuck up on many institutional investors, since Goldman Sachs only began its coverage last Monday with a “neutral” rating, while Bank of America and Wells Fargo were also late to the party in SMCI, initiating their coverage back in mid-February.

So far, March has been characterized by wave after wave of positive analyst earnings revisions, since fourth-quarter earnings surprises were so strong. In fact, in the past month, the analyst community has revised their consensus earnings estimate by an extraordinary average of 5.3% for our average growth stock. Typically, such strong earnings revisions precede positive surprises.

In other words, this market’s current “melt up” is likely to persist, since there is plenty of fuel ($8.8 trillion in money market assets on the sidelines) that can be tapped to move back into the stock market over the next several months. Furthermore, Goldman Sachs stated that it expects corporate stock buybacks to rise by 13%, to $925 trillion in 2024 and another 16% in 2025. If the volume of outstanding shares shrinks this rapidly, underlying earnings per share can rise faster.

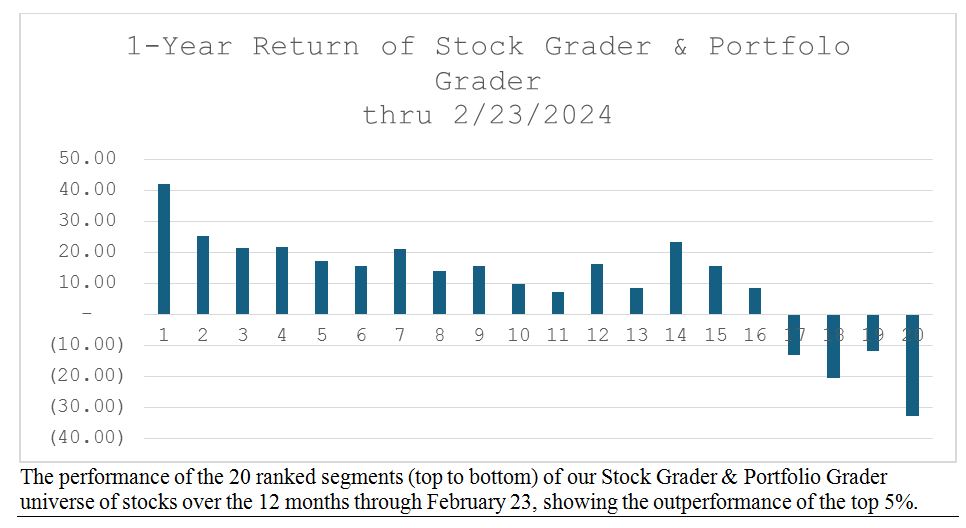

My latest back-testing of “what works now on Wall Street” (via my on-line Stock Grader and Portfolio Grader databases) revealed that the top 35% of stocks with A & B stock rankings are dramatically outperforming the overall stock market. More importantly, the top 5% are beating the top 35% by over 2 to 1, so the stock market leadership remains concentrated in these elite, extraordinary, powerful stocks, like Nvidia, Super Micro Computer, Eli Lilly and Novo-Nordisk.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Inflation and Job Trends Put the Fed in a “Wait and See” Mode

Chaos in the Middle East persists. Last Wednesday, a dry bulk carrier, ‘True Confidence,’ was hit by a missile from Yemen, killing three crewmen. Additionally, Houthi rebels in Yemen have reportedly cut three internet and telecommunication cables in the Red Sea. These cables control about 25% of transmissions passing through the Red Sea. Specifically, these cables control major internet and telecommunications traffic between Europe and Asia.

Despite this chaos in the Middle East, crude oil prices have been stagnant over the last month, so OPEC extended its voluntary production cuts through June, despite the fact that demand for crude oil rises in the spring and summer. Saudi Arabia continues to account for most of the production cuts, but Algeria, Kuwait, Iraq, Kazakhstan, Oman and UAE said that they will comply with these cuts. I expect oil prices will meander higher, but mostly due to rising seasonal demand.

While the Fed focuses on U.S. inflation, deflation in China has spread to pork, which is China’s staple meat. China’s pork herds make up about half of the global total, reaching 434 million in 2023, up substantially (+40%) from 310 million in 2019, when an outbreak of African swine fever dramatically shrank the nation’s pig herds. During 2023, pork prices declined 13.6% and in January, there was an additional 17% plunge in pork prices, which caused total food prices to fall 5.9%. Clearly, there are too many pigs in China, so prices will remain soft until herd sizes shrink.

Despite global deflation, Fed Chairman Jerome Powell keeps focusing on core U.S. inflation data instead of the threat of future global deflation. Last Wednesday, he testified in front of the House Financial Services Committee, where he stuck to the script and said that the Fed is still on track to cut key interest rates this year – as soon as inflation falls within its 2% target range. Specifically, Powell said, “What we want is more evidence that will give us more confidence that inflation is on the path down to 2%, sustainably.” Powell added: “We don’t want a situation where the six months of good inflation data we had last year … didn’t turn out to be an accurate signal.”

Then on Thursday, in front of the Senate Banking Committee, Powell added, “We’re waiting to become more confident that inflation is moving sustainably at 2%,” and added, “When we do get that confidence, and we’re not far from it, it’ll be appropriate to begin to dial back the level of restriction.” Notably, Treasury yields fell in the wake of Powell’s “not far from it” comment.

Turning to the Fed’s other mandate, sustaining employment, ADP reported on Wednesday that 140,000 private payroll jobs were created in February, slightly below the economists’ consensus estimate of 150,000. But on Friday, the Labor Department announced that nearly twice that total (275,000) payroll jobs were created in January. However, December and January payrolls were revised down by 167,000 to 290,000 (from 333,000) and 229,000 (from 353,000), respectively.

As long as the U.S. economy is creating jobs, there is minimal pressure on the Fed to cut key interest rates, but the higher unemployment rate (3.9% vs. 3.7%), as well as slower wage growth, likely got the Fed’s attention and may encourage key interest rate cuts sooner rather than later.

Super Tuesday and Biden’s Long Speech Launched an Odd Election Campaign

Super Tuesday results clarified that there will likely be a rematch between President Biden and Donald Trump. Robert F. Kennedy, Jr. will also run as an independent or maybe as a libertarian.

The current Presidential election cycle is certainly odd, as demonstrated by Thursday’s State of the Union speech, in which President Biden criticized Donald Trump’s economic agenda without naming him, calling him “my predecessor” 13 times. He also referred four times to a “comeback” in the fourth year of his first term. President Biden said, “In thousands of cities and towns the American people are writing the greatest comeback story never told” and, “America’s comeback is building a future of American possibilities.” I am not sure if “comeback” is the best word for a re-election campaign. President Biden went on to criticize the Supreme Court, billionaires and corporations for many of America’s problems. Obviously, the Presidential campaign is underway. Let’s hope there are some debates between Biden and Trump; they should be very entertaining!

President Biden’s energetic 68-minute speech seemed to sew up the nomination, arguing against him being replaced by a younger candidate with more energy, but we still have five months until the August Democratic Convention in Chicago, when we will know if Joe Biden is nominated or if he will be replaced by Gavin Newsom. Typically, the candidate with the most inspirational message prevails, since it lifts both consumer and investor confidence. Obviously, Newsom has more energy, so it will be interesting to see if there is an abrupt substitution by the Super Delegates at the Democratic Convention. Let’s hope that Robert F. Kennedy, Jr. and other candidates bring more energy into the Presidential election race, so Americans can be inspired.

Since candidate Trump wants to “drill, baby, drill” on Day #1, I suspect that crude oil prices may decline if Trump wins, so if Biden is not replaced in August, do not be surprised if I sell my remaining energy stocks by September, just before crude oil demand ebbs in the fall.

Despite any negative politics this year, the improving earnings environment, the expectation of multiple Fed rate cuts, and the hope for some political change help to boost investor confidence.

In summary, my fundamentally superior growth stocks are now acting like the market leaders. Not only do we have favorable year-over-year comparisons to boost sales and earnings, but I believe the Fed will start cutting key interest rates no later than the June FOMC meeting. Government gridlock is allowing the private sector to prosper and since this year is a Presidential election year, change is coming. Americans can sense that investor optimism is rising, so that $8.8 trillion of cash on the sidelines I expect will fuel a rally in growth stocks this year, possibly even better than in 1999!

Navellier & Associates owns Nvidia Corp (NVDA), Super Micro Computer, Inc. (SMCI), Novo-Nordisk A/S Sponsored ADR Class B (NVO), Eli Lilly and Company (LLY), and some accounts own Tesla (TSLA), and Apple Computer (AAPL), in managed accounts. Louis Navellier and his family own Nvidia Corp (NVDA), Super Micro Computer, Inc. (SMCI), Novo-Nordisk A/S Sponsored ADR Class B (NVO), and Eli Lilly and Company (LLY), via a Navellier managed account, and Nvidia Corp (NVDA) and Apple Computer (AAPL) in a personal account. He does not own Tesla (TSLA) personally.

All content above represents the opinion of Louis Navellier of Navellier & Associates, Inc.

Also In This Issue

A Look Ahead by Louis Navellier

New Leaders Emerge as Market Dynamics Change

Income Mail by Bryan Perry

A Bullish Breakout That’s “As Good as Gold”

Growth Mail by Gary Alexander

Growth Stocks Keep Trouncing Value (and Global) Stocks

Global Mail by Ivan Martchev

Measuring the Bull Market by the Numbers

Sector Spotlight by Jason Bodner

Where is the Market Headed Next?

View Full Archive

Read Past Issues Here

Louis Navellier

CHIEF INVESTMENT OFFICER

Louis Navellier is Founder, Chairman of the Board, Chief Investment Officer and Chief Compliance Officer of Navellier & Associates, Inc., located in Reno, Nevada. With decades of experience translating what had been purely academic techniques into real market applications, he believes that disciplined, quantitative analysis can select stocks that will significantly outperform the overall market. All content in this “A Look Ahead” section of Market Mail represents the opinion of Louis Navellier of Navellier & Associates, Inc.

Important Disclosures:

Although information in these reports has been obtained from and is based upon sources that Navellier believes to be reliable, Navellier does not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute Navellier’s judgment as of the date the report was created and are subject to change without notice. These reports are for informational purposes only and are not a solicitation for the purchase or sale of a security. Any decision to purchase securities mentioned in these reports must take into account existing public information on such securities or any registered prospectus.To the extent permitted by law, neither Navellier & Associates, Inc., nor any of its affiliates, agents, or service providers assumes any liability or responsibility nor owes any duty of care for any consequences of any person acting or refraining to act in reliance on the information contained in this communication or for any decision based on it.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any securities recommendations made by Navellier. in the future will be profitable or equal the performance of securities made in this report. Dividend payments are not guaranteed. The amount of a dividend payment, if any, can vary over time and issuers may reduce dividends paid on securities in the event of a recession or adverse event affecting a specific industry or issuer.

None of the stock information, data, and company information presented herein constitutes a recommendation by Navellier or a solicitation to buy or sell any securities. Any specific securities identified and described do not represent all of the securities purchased, sold, or recommended for advisory clients. The holdings identified do not represent all of the securities purchased, sold, or recommended for advisory clients and the reader should not assume that investments in the securities identified and discussed were or will be profitable.

Information presented is general information that does not take into account your individual circumstances, financial situation, or needs, nor does it present a personalized recommendation to you. Individual stocks presented may not be suitable for every investor. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. Investment in fixed income securities has the potential for the investment return and principal value of an investment to fluctuate so that an investor’s holdings, when redeemed, may be worth less than their original cost.

One cannot invest directly in an index. Index is unmanaged and index performance does not reflect deduction of fees, expenses, or taxes. Presentation of Index data does not reflect a belief by Navellier that any stock index constitutes an investment alternative to any Navellier equity strategy or is necessarily comparable to such strategies. Among the most important differences between the Indices and Navellier strategies are that the Navellier equity strategies may (1) incur material management fees, (2) concentrate its investments in relatively few stocks, industries, or sectors, (3) have significantly greater trading activity and related costs, and (4) be significantly more or less volatile than the Indices.

ETF Risk: We may invest in exchange traded funds (“ETFs”) and some of our investment strategies are generally fully invested in ETFs. Like traditional mutual funds, ETFs charge asset-based fees, but they generally do not charge initial sales charges or redemption fees and investors typically pay only customary brokerage fees to buy and sell ETF shares. The fees and costs charged by ETFs held in client accounts will not be deducted from the compensation the client pays Navellier. ETF prices can fluctuate up or down, and a client account could lose money investing in an ETF if the prices of the securities owned by the ETF go down. ETFs are subject to additional risks:

- ETF shares may trade above or below their net asset value;

- An active trading market for an ETF’s shares may not develop or be maintained;

- The value of an ETF may be more volatile than the underlying portfolio of securities the ETF is designed to track;

- The cost of owning shares of the ETF may exceed those a client would incur by directly investing in the underlying securities; and

- Trading of an ETF’s shares may be halted if the listing exchange’s officials deem it appropriate, the shares are delisted from the exchange, or the activation of market-wide “circuit breakers” (which are tied to large decreases in stock prices) halts stock trading generally.

Grader Disclosures: Investment in equity strategies involves substantial risk and has the potential for partial or complete loss of funds invested. The sample portfolio and any accompanying charts are for informational purposes only and are not to be construed as a solicitation to buy or sell any financial instrument and should not be relied upon as the sole factor in an investment making decision. As a matter of normal and important disclosures to you, as a potential investor, please consider the following: The performance presented is not based on any actual securities trading, portfolio, or accounts, and the reported performance of the A, B, C, D, and F portfolios (collectively the “model portfolios”) should be considered mere “paper” or pro forma performance results based on Navellier’s research.

Investors evaluating any of Navellier & Associates, Inc.’s, (or its affiliates’) Investment Products must not use any information presented here, including the performance figures of the model portfolios, in their evaluation of any Navellier Investment Products. Navellier Investment Products include the firm’s mutual funds and managed accounts. The model portfolios, charts, and other information presented do not represent actual funded trades and are not actual funded portfolios. There are material differences between Navellier Investment Products’ portfolios and the model portfolios, research, and performance figures presented here. The model portfolios and the research results (1) may contain stocks or ETFs that are illiquid and difficult to trade; (2) may contain stock or ETF holdings materially different from actual funded Navellier Investment Product portfolios; (3) include the reinvestment of all dividends and other earnings, estimated trading costs, commissions, or management fees; and, (4) may not reflect prices obtained in an actual funded Navellier Investment Product portfolio. For these and other reasons, the reported performances of model portfolios do not reflect the performance results of Navellier’s actually funded and traded Investment Products. In most cases, Navellier’s Investment Products have materially lower performance results than the performances of the model portfolios presented.

This report contains statements that are, or may be considered to be, forward-looking statements. All statements that are not historical facts, including statements about our beliefs or expectations, are “forward-looking statements” within the meaning of The U.S. Private Securities Litigation Reform Act of 1995. These statements may be identified by such forward-looking terminology as “expect,” “estimate,” “plan,” “intend,” “believe,” “anticipate,” “may,” “will,” “should,” “could,” “continue,” “project,” or similar statements or variations of such terms. Our forward-looking statements are based on a series of expectations, assumptions, and projections, are not guarantees of future results or performance, and involve substantial risks and uncertainty as described in Form ADV Part 2A of our filing with the Securities and Exchange Commission (SEC), which is available at www.adviserinfo.sec.gov or by requesting a copy by emailing info@navellier.com. All of our forward-looking statements are as of the date of this report only. We can give no assurance that such expectations or forward-looking statements will prove to be correct. Actual results may differ materially. You are urged to carefully consider all such factors.

FEDERAL TAX ADVICE DISCLAIMER: As required by U.S. Treasury Regulations, you are informed that, to the extent this presentation includes any federal tax advice, the presentation is not written by Navellier to be used, and cannot be used, for the purpose of avoiding federal tax penalties. Navellier does not advise on any income tax requirements or issues. Use of any information presented by Navellier is for general information only and does not represent tax advice either express or implied. You are encouraged to seek professional tax advice for income tax questions and assistance.

IMPORTANT NEWSLETTER DISCLOSURE:The hypothetical performance results for investment newsletters that are authored or edited by Louis Navellier, including Louis Navellier’s Growth Investor, Louis Navellier’s Breakthrough Stocks, Louis Navellier’s Accelerated Profits, and Louis Navellier’s Platinum Club, are not based on any actual securities trading, portfolio, or accounts, and the newsletters’ reported hypothetical performances should be considered mere “paper” or proforma hypothetical performance results and are not actual performance of real world trades. Navellier & Associates, Inc. does not have any relation to or affiliation with the owner of these newsletters. There are material differences between Navellier Investment Products’ portfolios and the InvestorPlace Media, LLC newsletter portfolios authored by Louis Navellier. The InvestorPlace Media, LLC newsletters contain hypothetical performance that do not include transaction costs, advisory fees, or other fees a client might incur if actual investments and trades were being made by an investor. As a result, newsletter performance should not be used to evaluate Navellier Investment services which are separate and different from the newsletters. The owner of the newsletters is InvestorPlace Media, LLC and any questions concerning the newsletters, including any newsletter advertising or hypothetical Newsletter performance claims, (which are calculated solely by Investor Place Media and not Navellier) should be referred to InvestorPlace Media, LLC at (800) 718-8289.

Please note that Navellier & Associates and the Navellier Private Client Group are managed completely independent of the newsletters owned and published by InvestorPlace Media, LLC and written and edited by Louis Navellier, and investment performance of the newsletters should in no way be considered indicative of potential future investment performance for any Navellier & Associates separately managed account portfolio. Potential investors should consult with their financial advisor before investing in any Navellier Investment Product.

Navellier claims compliance with Global Investment Performance Standards (GIPS). To receive a complete list and descriptions of Navellier’s composites and/or a presentation that adheres to the GIPS standards, please contact Navellier or click here. It should not be assumed that any securities recommendations made by Navellier & Associates, Inc. in the future will be profitable or equal the performance of securities made in this report.

FactSet Disclosure: Navellier does not independently calculate the statistical information included in the attached report. The calculation and the information are provided by FactSet, a company not related to Navellier. Although information contained in the report has been obtained from FactSet and is based on sources Navellier believes to be reliable, Navellier does not guarantee its accuracy, and it may be incomplete or condensed. The report and the related FactSet sourced information are provided on an “as is” basis. The user assumes the entire risk of any use made of this information. Investors should consider the report as only a single factor in making their investment decision. The report is for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of a security. FactSet sourced information is the exclusive property of FactSet. Without prior written permission of FactSet, this information may not be reproduced, disseminated or used to create any financial products. All indices are unmanaged and performance of the indices include reinvestment of dividends and interest income, unless otherwise noted, are not illustrative of any particular investment and an investment cannot be made in any index. Past performance is no guarantee of future results.