by Bryan Perry

February 19, 2025

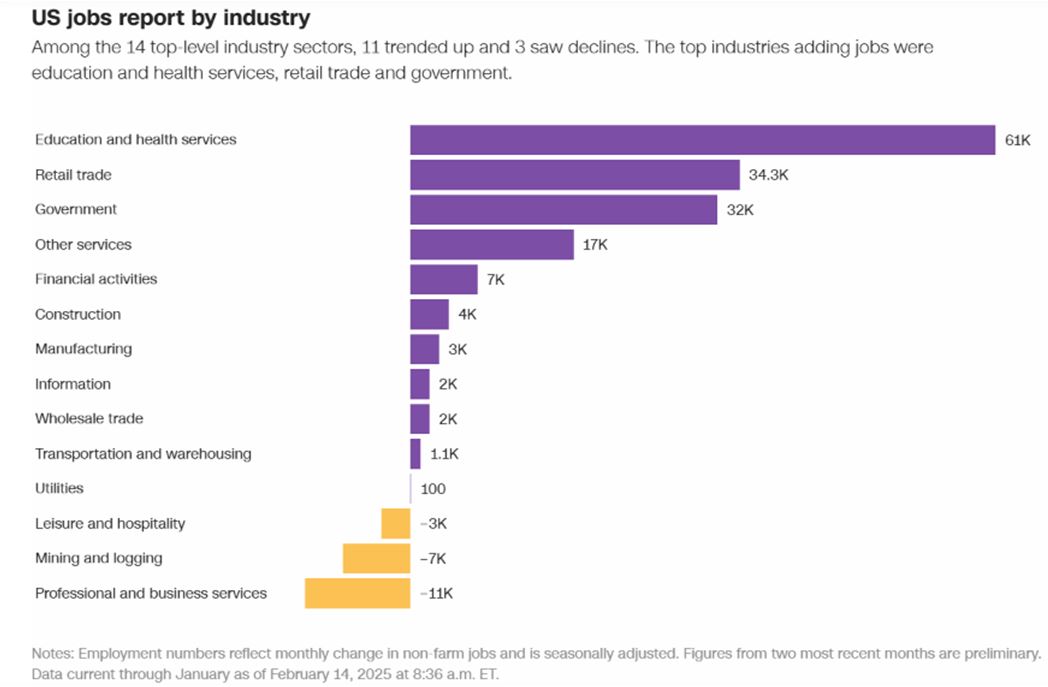

On February 7, it was reported that the U.S. economy kicked off 2025 by adding 143,000 jobs in January, fewer than expected (155,000), but the unemployment rate dipped to 4.0%, according to the Bureau of Labor Statistics (BLS). The three-month average for new non-farm payrolls increased to 237,000 from 204,000, as December payrolls were revised to 307,000 from 256,000 and November payrolls were revised to 261,000 from 212,000 coupled by a solid 0.5% monthly increase in average hourly earnings.

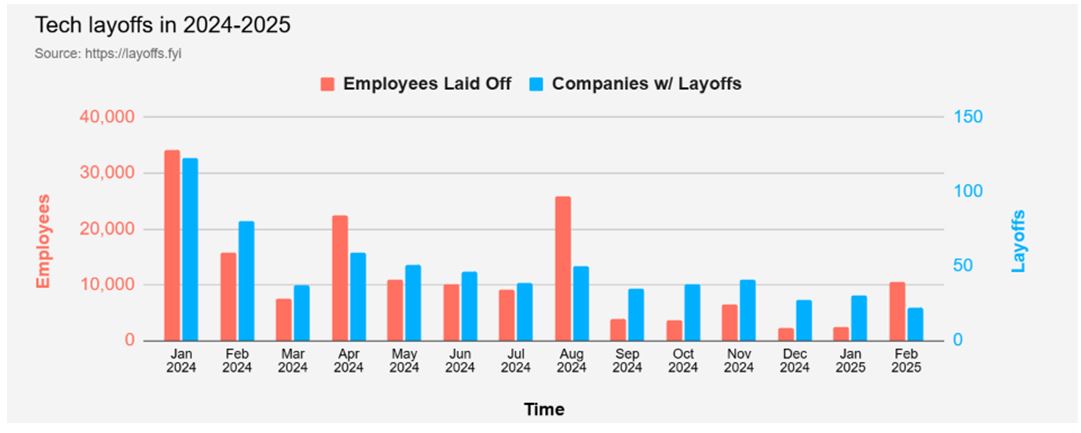

The takeaway from this report was that the labor market is quite healthy, but that’s only according to the government’s official BLS statistics, which have been found to be misleading in several large downward revisions in both 2024 and 2023. Skeptical investors who are suspicious of the veracity of these job numbers put out by the BLS seem to have some ground to stand on, as corroborated by a wave of very large and high-profile layoffs announced recently by many of America’s leading corporations.

The range of layoffs runs across industries. Last week, Chevron announced they will lay-off 20% of their global workforce, or roughly 8,000 employees. BP announced layoffs of 7,700. Microsoft announced an undisclosed number of layoffs. Meta announced another round of layoffs, 5%, that comes to around 3,600 employees. Workday laid-off about 1,750 employees, or 8.5% of staff, and Google is offering voluntary buyouts to workers in its platforms and devices units while Salesforce laid-off 1,000 this month. And Estee Lauder announced this month they are slashing their workforce by 10% or 7,000 employees.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

The January employment report featured some significant data adjustments indicating that job growth last year was weaker than previously estimated. The latest revision showed that there were 589,000 fewer jobs added to the economy in 2024 than first stated. “That leaves us in a situation where things can essentially flip quite quickly, because you’ve already got companies hiring as if they’re in a recession — even if they’re not laying people off,” said Oliver Allen, senior U.S. economist at Pantheon Macroeconomics.

The latest wave of white-collar layoffs and restructuring reflects a significant shift towards leaner, more performance-driven organizations. Rather than casting a wide net that attracts the technology industry’s most talented workers, companies are sharpening their focus for AI jobs. As technology industry’s job cuts sweep through the workforce, roles in machine learning and engineering remain in high demand, signaling an aggressive approach towards precision-driven talent acquisition to build out AI systems and platforms.

The World Economic Forum’s January 2025 Insight Report, titled, “Future Jobs Report,” says that over 40% of companies worldwide are expecting to reduce their work-forces over the next five years, as part of the rising impact of artificial-intelligence. But the wave of rising layoffs doesn’t stop with the technology sector. According to Intellizence, a Toronto-based AI consulting firm, over 5,700 companies announced mass layoffs in 2024, followed by 190+ more in early 2025. From large to small, no sector is being spared.

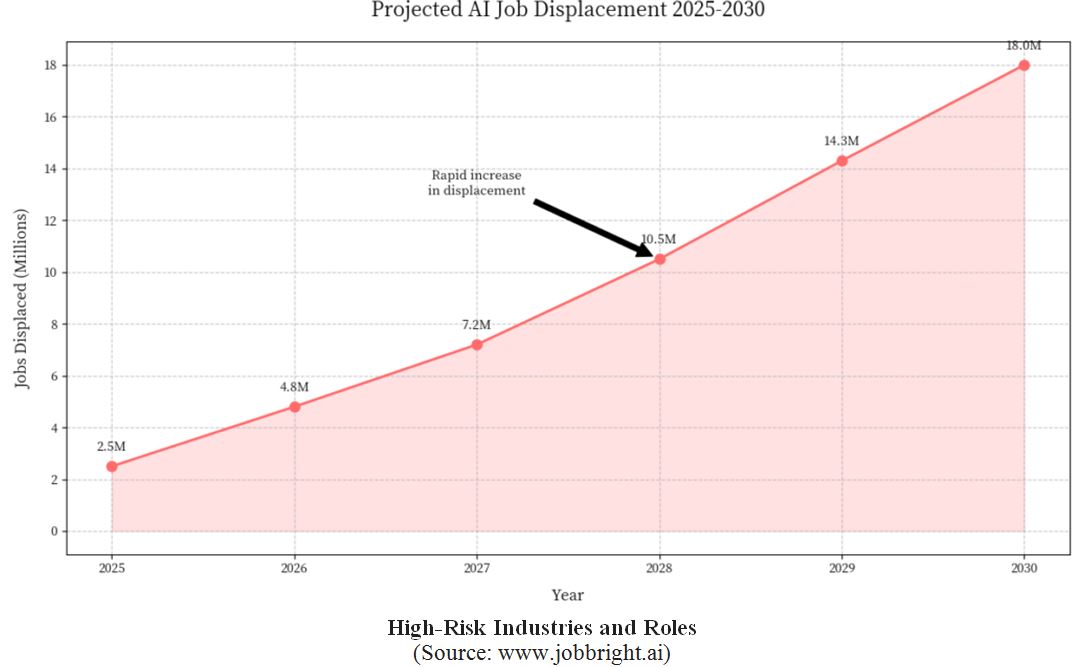

As industries pivot to producing more products and services with fewer employees, workers and businesses alike must adapt to survive. Governments and educational institutions will play a critical role in bridging the skills gap, while companies must balance innovation with ethical responsibility for re-training and transitioning existing employees to align with future work realities.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

- Transportation and Logistics: Since autonomous vehicles are becoming a trend in transportation, AI could replace 2.5-million driving jobs in upcoming years. This includes taxis, metros, and buses. Warehouse automation might displace 1.8-million workers.

- Retail: Some supermarkets or grocery stores are adopting self-checkout, which could eliminate 3.5 million positions. AI-powered inventory management might replace an additional 1.2-million jobs.

- Professional Services: The most affected jobs under professional services are legal research and accounting roles, led by automated accounting systems, with 900,000 jobs potentially affected and legal research automation, with 140,000 positions at risk (source: www.jobbright.ai).

In this light, what was most revealing in the BLS January jobs report was the breakdown of where the job growth was highest. Education, health services, government and retail trade accounted for 127,300 (89%) of the 143,000 additions, while the higher-paid professional and business sector witnessed the largest decline (11,000). It is safe to say that, given the backdrop of AI’s future impact on retail and the efforts of DOGE to shrink government and federal education jobs, those heady January totals are a thing of the past.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

The World Economic Forum estimates that 85 million worldwide jobs may be displaced by AI in 2025 alone. McKinsey Global Institute projects that 375 million jobs (14% of the global workforce) will require “re-skilling” by 2030. The AI boom is here and now, and this means that the job market is going to go through some real upheaval in 2025 and beyond. If the recent pace of layoffs from the S&P 500 and Global 1000 companies picks up speed, the notion of the Fed keeping rates higher for longer will quickly give way to a rapid change in monetary policy if – more likely when – the unemployment rate hits 5%.

Navellier & Associates; a few accounts own Microsoft (MSFT), and Meta Platforms Inc. Class-A (META), per client request. We do not own Chevron (CVX). Bryan Perry does not own Microsoft (MSFT) or Chevron (CVX) personally, he does personally own Meta Platforms Inc. Class-A (META).

All content above represents the opinion of Bryan Perry of Navellier & Associates, Inc.

Also In This Issue

A Look Ahead by Louis Navellier

Europe Fears a Revolution – In German Elections and Trump’s Tariffs

Income Mail by Bryan Perry

AI is Causing a Rising Wave of White-Collar Layoffs

Growth Mail by Gary Alexander

A President’s Day Formula for Soaring Tax Revenues!

Global Mail by Ivan Martchev

Trump’s Strategy of “Reconnaissance Through Battle”

Sector Spotlight by Jason Bodner

The Market is Embracing Change … So Far

View Full Archive

Read Past Issues Here

Bryan Perry

SENIOR DIRECTOR

Bryan Perry is a Senior Director with Navellier Private Client Group, advising and facilitating high net worth investors in the pursuit of their financial goals.

Bryan’s financial services career spanning the past three decades includes over 20-years of wealth management experience with Wall Street firms that include Bear Stearns, Lehman Brothers and Paine Webber, working with both retail and institutional clients. Bryan earned a B.A. in Political Science from Virginia Polytechnic Institute & State University and currently holds a Series 65 license. All content of “Income Mail” represents the opinion of Bryan Perry

Important Disclosures:

Although information in these reports has been obtained from and is based upon sources that Navellier believes to be reliable, Navellier does not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute Navellier’s judgment as of the date the report was created and are subject to change without notice. These reports are for informational purposes only and are not a solicitation for the purchase or sale of a security. Any decision to purchase securities mentioned in these reports must take into account existing public information on such securities or any registered prospectus.To the extent permitted by law, neither Navellier & Associates, Inc., nor any of its affiliates, agents, or service providers assumes any liability or responsibility nor owes any duty of care for any consequences of any person acting or refraining to act in reliance on the information contained in this communication or for any decision based on it.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any securities recommendations made by Navellier. in the future will be profitable or equal the performance of securities made in this report. Dividend payments are not guaranteed. The amount of a dividend payment, if any, can vary over time and issuers may reduce dividends paid on securities in the event of a recession or adverse event affecting a specific industry or issuer.

None of the stock information, data, and company information presented herein constitutes a recommendation by Navellier or a solicitation to buy or sell any securities. Any specific securities identified and described do not represent all of the securities purchased, sold, or recommended for advisory clients. The holdings identified do not represent all of the securities purchased, sold, or recommended for advisory clients and the reader should not assume that investments in the securities identified and discussed were or will be profitable.

Information presented is general information that does not take into account your individual circumstances, financial situation, or needs, nor does it present a personalized recommendation to you. Individual stocks presented may not be suitable for every investor. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. Investment in fixed income securities has the potential for the investment return and principal value of an investment to fluctuate so that an investor’s holdings, when redeemed, may be worth less than their original cost.

One cannot invest directly in an index. Index is unmanaged and index performance does not reflect deduction of fees, expenses, or taxes. Presentation of Index data does not reflect a belief by Navellier that any stock index constitutes an investment alternative to any Navellier equity strategy or is necessarily comparable to such strategies. Among the most important differences between the Indices and Navellier strategies are that the Navellier equity strategies may (1) incur material management fees, (2) concentrate its investments in relatively few stocks, industries, or sectors, (3) have significantly greater trading activity and related costs, and (4) be significantly more or less volatile than the Indices.

ETF Risk: We may invest in exchange traded funds (“ETFs”) and some of our investment strategies are generally fully invested in ETFs. Like traditional mutual funds, ETFs charge asset-based fees, but they generally do not charge initial sales charges or redemption fees and investors typically pay only customary brokerage fees to buy and sell ETF shares. The fees and costs charged by ETFs held in client accounts will not be deducted from the compensation the client pays Navellier. ETF prices can fluctuate up or down, and a client account could lose money investing in an ETF if the prices of the securities owned by the ETF go down. ETFs are subject to additional risks:

- ETF shares may trade above or below their net asset value;

- An active trading market for an ETF’s shares may not develop or be maintained;

- The value of an ETF may be more volatile than the underlying portfolio of securities the ETF is designed to track;

- The cost of owning shares of the ETF may exceed those a client would incur by directly investing in the underlying securities; and

- Trading of an ETF’s shares may be halted if the listing exchange’s officials deem it appropriate, the shares are delisted from the exchange, or the activation of market-wide “circuit breakers” (which are tied to large decreases in stock prices) halts stock trading generally.

Grader Disclosures: Investment in equity strategies involves substantial risk and has the potential for partial or complete loss of funds invested. The sample portfolio and any accompanying charts are for informational purposes only and are not to be construed as a solicitation to buy or sell any financial instrument and should not be relied upon as the sole factor in an investment making decision. As a matter of normal and important disclosures to you, as a potential investor, please consider the following: The performance presented is not based on any actual securities trading, portfolio, or accounts, and the reported performance of the A, B, C, D, and F portfolios (collectively the “model portfolios”) should be considered mere “paper” or pro forma performance results based on Navellier’s research.

Investors evaluating any of Navellier & Associates, Inc.’s, (or its affiliates’) Investment Products must not use any information presented here, including the performance figures of the model portfolios, in their evaluation of any Navellier Investment Products. Navellier Investment Products include the firm’s mutual funds and managed accounts. The model portfolios, charts, and other information presented do not represent actual funded trades and are not actual funded portfolios. There are material differences between Navellier Investment Products’ portfolios and the model portfolios, research, and performance figures presented here. The model portfolios and the research results (1) may contain stocks or ETFs that are illiquid and difficult to trade; (2) may contain stock or ETF holdings materially different from actual funded Navellier Investment Product portfolios; (3) include the reinvestment of all dividends and other earnings, estimated trading costs, commissions, or management fees; and, (4) may not reflect prices obtained in an actual funded Navellier Investment Product portfolio. For these and other reasons, the reported performances of model portfolios do not reflect the performance results of Navellier’s actually funded and traded Investment Products. In most cases, Navellier’s Investment Products have materially lower performance results than the performances of the model portfolios presented.

This report contains statements that are, or may be considered to be, forward-looking statements. All statements that are not historical facts, including statements about our beliefs or expectations, are “forward-looking statements” within the meaning of The U.S. Private Securities Litigation Reform Act of 1995. These statements may be identified by such forward-looking terminology as “expect,” “estimate,” “plan,” “intend,” “believe,” “anticipate,” “may,” “will,” “should,” “could,” “continue,” “project,” or similar statements or variations of such terms. Our forward-looking statements are based on a series of expectations, assumptions, and projections, are not guarantees of future results or performance, and involve substantial risks and uncertainty as described in Form ADV Part 2A of our filing with the Securities and Exchange Commission (SEC), which is available at www.adviserinfo.sec.gov or by requesting a copy by emailing info@navellier.com. All of our forward-looking statements are as of the date of this report only. We can give no assurance that such expectations or forward-looking statements will prove to be correct. Actual results may differ materially. You are urged to carefully consider all such factors.

FEDERAL TAX ADVICE DISCLAIMER: As required by U.S. Treasury Regulations, you are informed that, to the extent this presentation includes any federal tax advice, the presentation is not written by Navellier to be used, and cannot be used, for the purpose of avoiding federal tax penalties. Navellier does not advise on any income tax requirements or issues. Use of any information presented by Navellier is for general information only and does not represent tax advice either express or implied. You are encouraged to seek professional tax advice for income tax questions and assistance.

IMPORTANT NEWSLETTER DISCLOSURE:The hypothetical performance results for investment newsletters that are authored or edited by Louis Navellier, including Louis Navellier’s Growth Investor, Louis Navellier’s Breakthrough Stocks, Louis Navellier’s Accelerated Profits, and Louis Navellier’s Platinum Club, are not based on any actual securities trading, portfolio, or accounts, and the newsletters’ reported hypothetical performances should be considered mere “paper” or proforma hypothetical performance results and are not actual performance of real world trades. Navellier & Associates, Inc. does not have any relation to or affiliation with the owner of these newsletters. There are material differences between Navellier Investment Products’ portfolios and the InvestorPlace Media, LLC newsletter portfolios authored by Louis Navellier. The InvestorPlace Media, LLC newsletters contain hypothetical performance that do not include transaction costs, advisory fees, or other fees a client might incur if actual investments and trades were being made by an investor. As a result, newsletter performance should not be used to evaluate Navellier Investment services which are separate and different from the newsletters. The owner of the newsletters is InvestorPlace Media, LLC and any questions concerning the newsletters, including any newsletter advertising or hypothetical Newsletter performance claims, (which are calculated solely by Investor Place Media and not Navellier) should be referred to InvestorPlace Media, LLC at (800) 718-8289.

Please note that Navellier & Associates and the Navellier Private Client Group are managed completely independent of the newsletters owned and published by InvestorPlace Media, LLC and written and edited by Louis Navellier, and investment performance of the newsletters should in no way be considered indicative of potential future investment performance for any Navellier & Associates separately managed account portfolio. Potential investors should consult with their financial advisor before investing in any Navellier Investment Product.

Navellier claims compliance with Global Investment Performance Standards (GIPS). To receive a complete list and descriptions of Navellier’s composites and/or a presentation that adheres to the GIPS standards, please contact Navellier or click here. It should not be assumed that any securities recommendations made by Navellier & Associates, Inc. in the future will be profitable or equal the performance of securities made in this report.

FactSet Disclosure: Navellier does not independently calculate the statistical information included in the attached report. The calculation and the information are provided by FactSet, a company not related to Navellier. Although information contained in the report has been obtained from FactSet and is based on sources Navellier believes to be reliable, Navellier does not guarantee its accuracy, and it may be incomplete or condensed. The report and the related FactSet sourced information are provided on an “as is” basis. The user assumes the entire risk of any use made of this information. Investors should consider the report as only a single factor in making their investment decision. The report is for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of a security. FactSet sourced information is the exclusive property of FactSet. Without prior written permission of FactSet, this information may not be reproduced, disseminated or used to create any financial products. All indices are unmanaged and performance of the indices include reinvestment of dividends and interest income, unless otherwise noted, are not illustrative of any particular investment and an investment cannot be made in any index. Past performance is no guarantee of future results.