by Gary Alexander

November 28, 2023

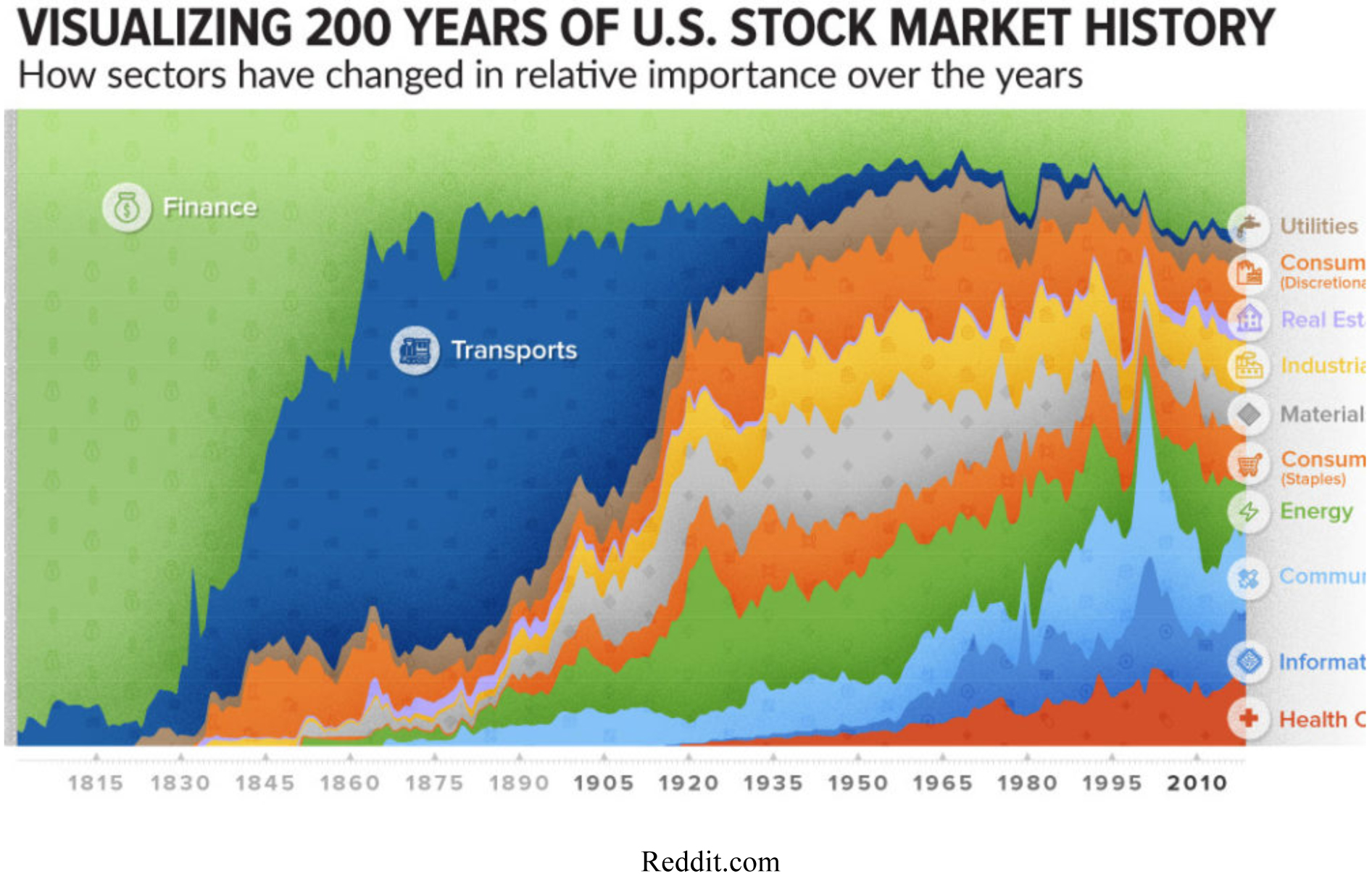

At the end of October, according to several speakers at the New Orleans Investment Conference (held November 1-4), and backed up by S&P data, the technology sector accounted for 28.1% of S&P 500 capitalization, more than the next two sectors (Healthcare and Financial) combined, and more than 10 times each of the three smallest sectors – Utilities, Materials and Real Estate – at about 2.4% each.

Tavi Costa, Macro Strategist at Crescat Capital, told the assembled investors in the Big Easy that Apple and Microsoft alone (comprising 14% of S&P capitalization) dwarfed those three smallest sectors PLUS Energy (at 4.6%), and they were 70 times larger than the entire metals and mining stock sector (at 0.2%)!

Furthermore, the S&P 500 Communications Services sector (at 8.2% of the S&P 500) contains two of the Magnificent 7 tech stocks, so the Tech Mega-Colossus really accounts for over 36% of the S&P 500.

This has happened several times in market history – and not just in the “dot-com bubble” of 1999-2000.

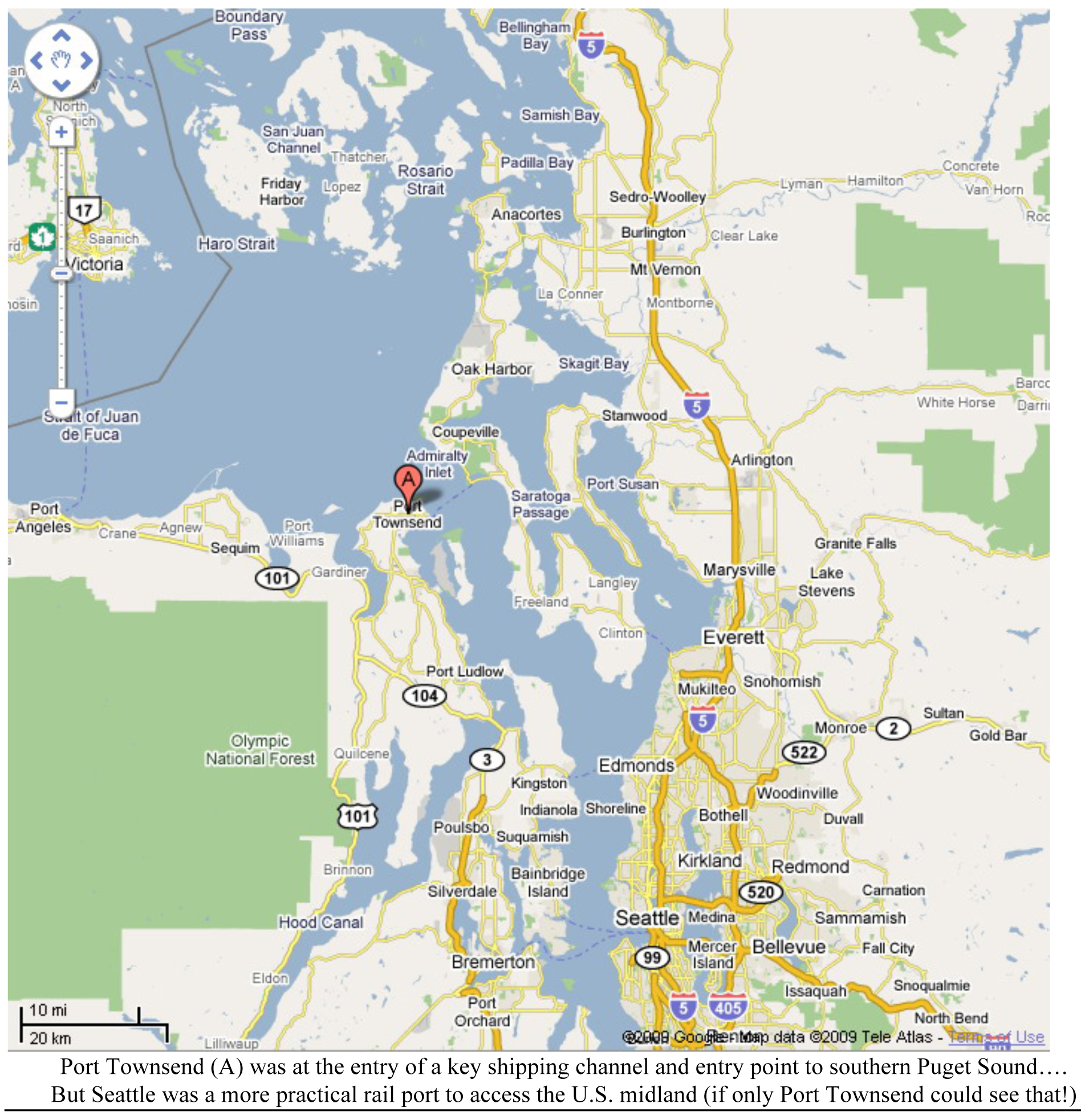

I’m currently acting in a local play that is centered around the railroad boom of the 1890s, resulting in the Panic of 1893. It’s a lot more personal and heart-warming than all that, of course; it’s centered around one family in nearby Port Townsend, Washington, but the fate of that town was wrapped around the high-tech fantasy of that day – building a railroad terminal for Pacific trade from Puget Sound to the inland U.S.

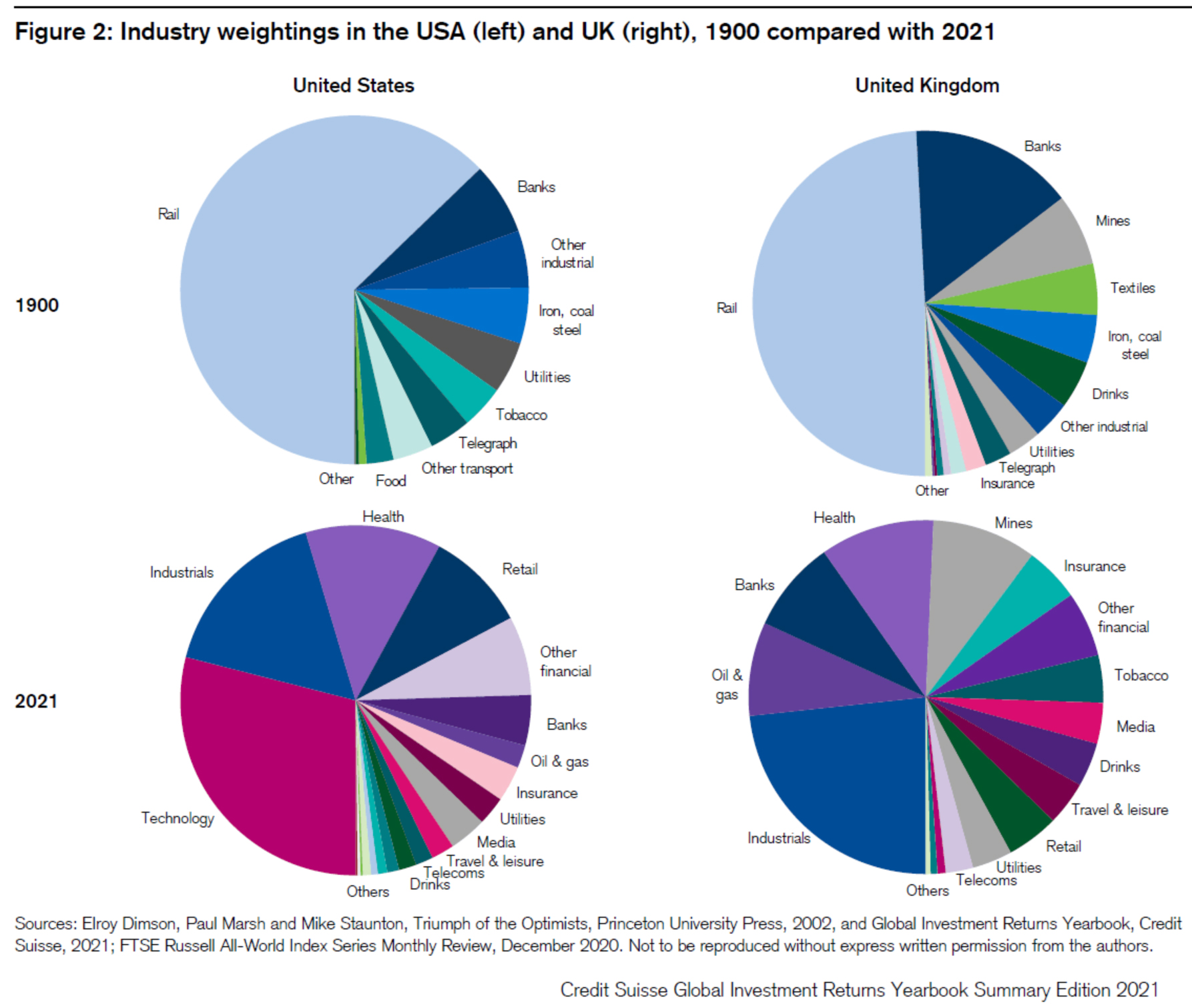

From 1850 to 1910, ‘transports’ (dominated by railroad stocks) comprised the bulk of the New York Stock Exchange. Railroads peaked as a controlling industry during our Industrial Revolution in the 1870s and 1880s, and they still controlled 2/3rds of the market around 1890, and nearly 63% at the end of the 1890s.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

New York Stock Exchange 1900 (end-1899) 1950 2000

Railroad stock capitalization (NYSE) 62.8% 4.2% 0.2%

(Source: Triumph of the Optimists: 101 Years of Global Investment Returns, Princeton University Press, p. 24)

In addition, “there were also many railroad-related stocks, such as street railways, rail freight companies, and railroad car and wagon manufacturers, and if these are included, the U.S. weighting for railroads rises to 70 percent. 101 years later, railroads have declined in importance, almost to the point of stock market extinction, representing just 0.2 percent of the U.S. equity at the end of 2000” (Triumph of the Optimists).

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

In hindsight, it’s easy to see that all that money flowing into railroads caused them to become overbuilt. The first bubble to pop came in February 1893, just 12 days before the Inauguration of the new (and former) President, Grover Cleveland – the only Democrat elected in the 50 years between the Civil War and Woodrow Wilson in 1912 – with the bankruptcy of the Philadelphia and Reading Railroad. Then came some big bank failures and bigger railroad bankruptcies – at Northern Pacific, Union Pacific and the future movie song – The Atchison, Topeka and Santa Fe. In all, 500 banks and 15,000 companies failed.

Out west, Port Townsend was devastated – in history and in our play. To this day, that little port town is best known for its Victorian architecture, since so many buildings were erected in the 1880s and 1890s – the Victorian era – to welcome the coming railroads. By the time Washington became a state in 1889, Port Townsend was the fourth largest city in the State, and its boosters hoped it would become the “New York of the West.” After all, it offered an ideal deep port with a vibrant waterfront, the first town to welcome ships plying the Pacific to the U.S. Northwest – for trade to and from America and the emerging Orient.

Late in 1889 (after Washington gained statehood), Union Pacific offered to make Port Townsend the northern terminus of its trans-continental line, if U.P. could acquire the Port Townsend & Southern’s franchise and rights of way, and if the city would pony up $100,000 (about $5 million in today’s money) in their venture. A sucker’s bet, it turned out – and the citizenry bought into those unrealistic promises, at the urging of boosters and its cheer-leading newspaper, the Leader, which opined: “Port Townsend will now get its share of the wealth and commerce of Europe that … has heretofore passed us by.”

Railroad fever consumed the little peninsula. About 2,000 local and imported workers began chopping trees and laying rails. Business boomed, property values soared and before 1890 was out, the city boasted six banks, six dry-goods stores, six hardware stores, 10 hotels, 28 real estate offices, three streetcar lines and a new electric company. In our little play, however, I portray an aging sea captain who passed through San Francisco on his way north and heard from “lads who know” that “they won’t be layin’ the track out here. It’s a dead end. There’s nowhere for a train to go…. The ships will sail right past Port Townsend.”

And that’s what happened. Property values plummeted. Port Townsend’s population fell by 30% in the 1900 Census, and Port Townsend would never again be among the 10 largest cities in Washington state.

The lessons are clear to us in hindsight. Fad investments come and go. The money pouring into them gets spent on bubble projects that can’t be sustained by long-term demand. Common-sense products and services are ignored, and so become affordable again, like those unpopular sectors, headed recently by energy – which, by the way, still runs the world. As Rick Rule said in New Orleans, fossil fuels once provided 82% of our energy needs at their peak in the 1980s. Now, after 40 years and $5 trillion invested in alternative energy sources, our percentage of energy coming from fossil fuels has fallen to…81%!

This is the basic principle of Contrarian Investing, also expressed in poetic terms as, “The Road Less Traveled,” or in sports argot as, “Hit ‘em where they ain’t.” It’s simply a way to improve your odds.

Two Examples of Contrary Investing in Today’s Market

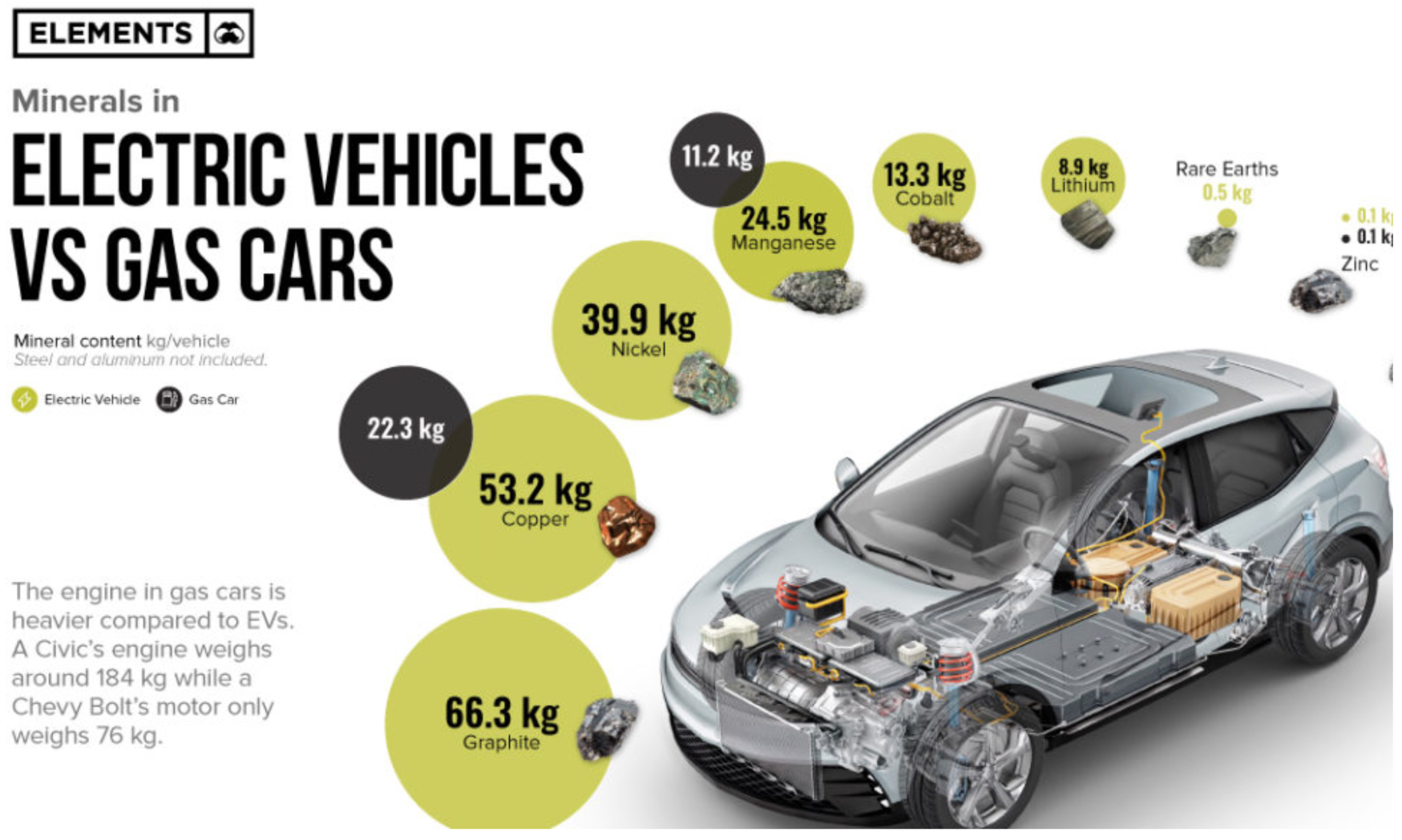

If we truly believe that electric vehicles (EVs) are the answer – as millions seem to believe, including the Biden Administration – then true believers in EVs must realize that mining stocks are the wave of the future. EVs rely on minerals far more than conventional cars do – by a factor of about 6-to-1. An EV requires 206 kilograms (453 pounds) of specific minerals, beyond basic steel, vs. 33.5 kg (74 pounds) for a standard gas-run vehicle. EVs require far more copper and manganese, plus elements not tapped by our basic gas guzzler, like nickel, graphite, cobalt and lithium, yet mining and mineral stocks make up just 0.2% of market capitalization. If investors believed in EVs, they would own a lot more mining stocks.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

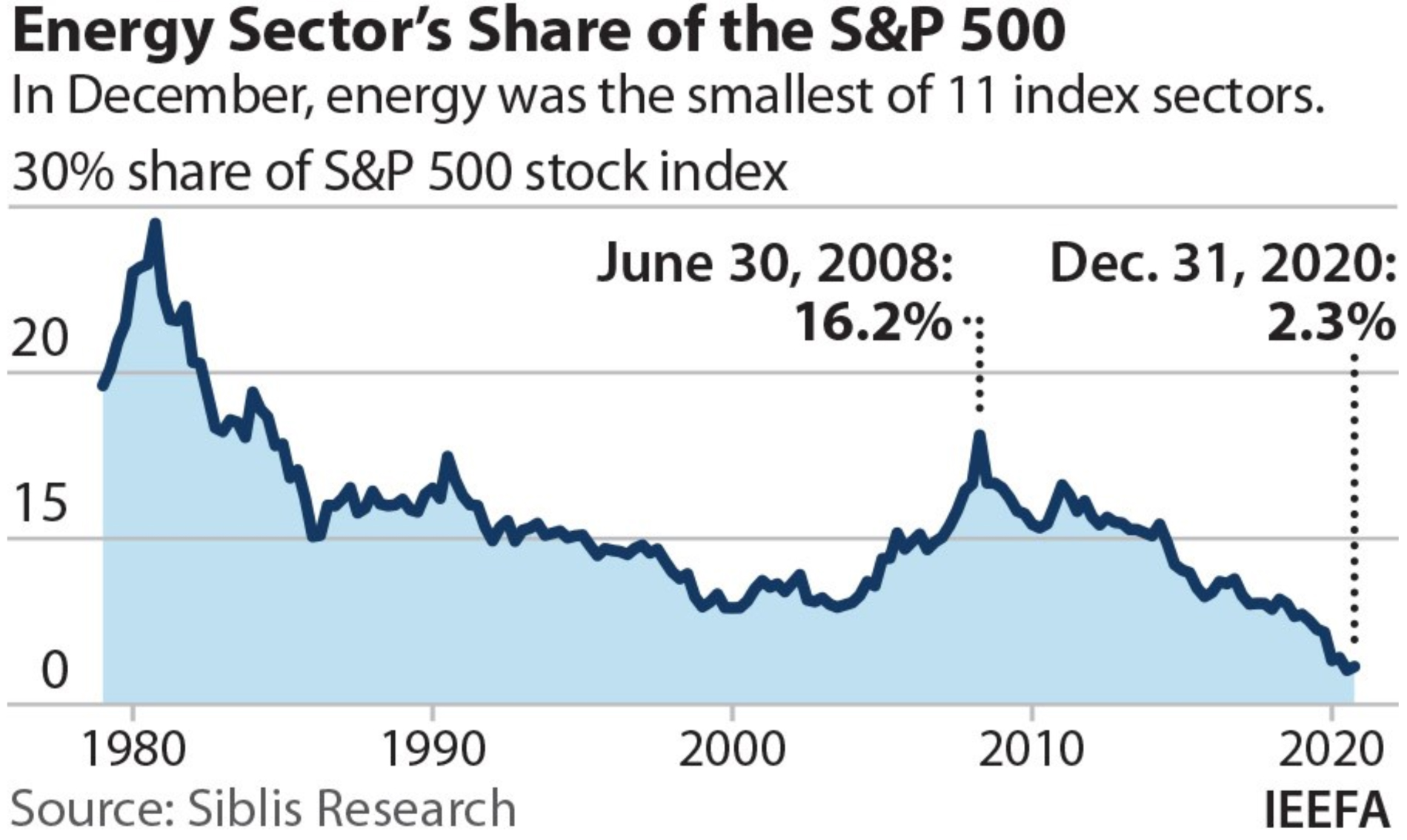

A second example is the traditional energy sector. Energy was way over-represented in the S&P 500 in mid-2008, when crude oil reached its all-time high of $153, and the energy sector reached a recent peak of 16.2% of S&P 500 capitalization. By 2020, energy dipped to barely 2% of S&P market capitalization.

In 2021, Louis Navellier invested in energy, and energy was the only S&P sector that increased in 2022. In 2021, Louis said energy would double and double again to 8% of market cap and perhaps top tech by 2025 at 30% of S&P market cap. The energy sector has been up and down in 2023, but it’s still only 4.6% of S&P market cap, and he believes, has plenty of room for growth, as the world still needs heat and energy.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

For further study, here are two books that bring you the basic principles of Contrary Investing:

Navellier & Associates owns Apple Computer (AAPL), and Microsoft Corporation (MSFT) in some managed accounts. Gary Alexander does not own Apple Computer (AAPL), or Microsoft Corporation (MSFT) personally.

All content above represents the opinion of Gary Alexander of Navellier & Associates, Inc.

Also In This Issue

A Look Ahead by Louis Navellier

While America Gave Thanks, the World Was in Revolt

Income Mail by Bryan Perry

The Bullish Case for U.S. High Yield Bonds

Growth Mail by Gary Alexander

Beware Hot, Trendy Sectors (I Favor Unloved Essential Sectors)

Global Mail by Ivan Martchev

New Volatility Lows for 2023 Indicate a Coming Overdue Small Correction

Sector Spotlight by Jason Bodner

The Market Roller Coaster Starts Rising Again

View Full Archive

Read Past Issues Here

About The Author

Gary Alexander

SENIOR EDITOR

Gary Alexander has been Senior Writer at Navellier since 2009. He edits Navellier’s weekly Marketmail and writes a weekly Growth Mail column, in which he uses market history to support the case for growth stocks. For the previous 20 years before joining Navellier, he was Senior Executive Editor at InvestorPlace Media (formerly Phillips Publishing), where he worked with several leading investment analysts, including Louis Navellier (since 1997), helping launch Louis Navellier’s Blue Chip Growth and Global Growth newsletters.

Prior to that, Gary edited Wealth Magazine and Gold Newsletter and wrote various investment research reports for Jefferson Financial in New Orleans in the 1980s. He began his financial newsletter career with KCI Communications in 1980, where he served as consulting editor for Personal Finance newsletter while serving as general manager of KCI’s Alexandria House book division. Before that, he covered the economics beat for news magazines. All content of “Growth Mail” represents the opinion of Gary Alexander

Important Disclosures:

Although information in these reports has been obtained from and is based upon sources that Navellier believes to be reliable, Navellier does not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute Navellier’s judgment as of the date the report was created and are subject to change without notice. These reports are for informational purposes only and are not a solicitation for the purchase or sale of a security. Any decision to purchase securities mentioned in these reports must take into account existing public information on such securities or any registered prospectus.To the extent permitted by law, neither Navellier & Associates, Inc., nor any of its affiliates, agents, or service providers assumes any liability or responsibility nor owes any duty of care for any consequences of any person acting or refraining to act in reliance on the information contained in this communication or for any decision based on it.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any securities recommendations made by Navellier. in the future will be profitable or equal the performance of securities made in this report. Dividend payments are not guaranteed. The amount of a dividend payment, if any, can vary over time and issuers may reduce dividends paid on securities in the event of a recession or adverse event affecting a specific industry or issuer.

None of the stock information, data, and company information presented herein constitutes a recommendation by Navellier or a solicitation to buy or sell any securities. Any specific securities identified and described do not represent all of the securities purchased, sold, or recommended for advisory clients. The holdings identified do not represent all of the securities purchased, sold, or recommended for advisory clients and the reader should not assume that investments in the securities identified and discussed were or will be profitable.

Information presented is general information that does not take into account your individual circumstances, financial situation, or needs, nor does it present a personalized recommendation to you. Individual stocks presented may not be suitable for every investor. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. Investment in fixed income securities has the potential for the investment return and principal value of an investment to fluctuate so that an investor’s holdings, when redeemed, may be worth less than their original cost.

One cannot invest directly in an index. Index is unmanaged and index performance does not reflect deduction of fees, expenses, or taxes. Presentation of Index data does not reflect a belief by Navellier that any stock index constitutes an investment alternative to any Navellier equity strategy or is necessarily comparable to such strategies. Among the most important differences between the Indices and Navellier strategies are that the Navellier equity strategies may (1) incur material management fees, (2) concentrate its investments in relatively few stocks, industries, or sectors, (3) have significantly greater trading activity and related costs, and (4) be significantly more or less volatile than the Indices.

ETF Risk: We may invest in exchange traded funds (“ETFs”) and some of our investment strategies are generally fully invested in ETFs. Like traditional mutual funds, ETFs charge asset-based fees, but they generally do not charge initial sales charges or redemption fees and investors typically pay only customary brokerage fees to buy and sell ETF shares. The fees and costs charged by ETFs held in client accounts will not be deducted from the compensation the client pays Navellier. ETF prices can fluctuate up or down, and a client account could lose money investing in an ETF if the prices of the securities owned by the ETF go down. ETFs are subject to additional risks:

- ETF shares may trade above or below their net asset value;

- An active trading market for an ETF’s shares may not develop or be maintained;

- The value of an ETF may be more volatile than the underlying portfolio of securities the ETF is designed to track;

- The cost of owning shares of the ETF may exceed those a client would incur by directly investing in the underlying securities; and

- Trading of an ETF’s shares may be halted if the listing exchange’s officials deem it appropriate, the shares are delisted from the exchange, or the activation of market-wide “circuit breakers” (which are tied to large decreases in stock prices) halts stock trading generally.

Grader Disclosures: Investment in equity strategies involves substantial risk and has the potential for partial or complete loss of funds invested. The sample portfolio and any accompanying charts are for informational purposes only and are not to be construed as a solicitation to buy or sell any financial instrument and should not be relied upon as the sole factor in an investment making decision. As a matter of normal and important disclosures to you, as a potential investor, please consider the following: The performance presented is not based on any actual securities trading, portfolio, or accounts, and the reported performance of the A, B, C, D, and F portfolios (collectively the “model portfolios”) should be considered mere “paper” or pro forma performance results based on Navellier’s research.

Investors evaluating any of Navellier & Associates, Inc.’s, (or its affiliates’) Investment Products must not use any information presented here, including the performance figures of the model portfolios, in their evaluation of any Navellier Investment Products. Navellier Investment Products include the firm’s mutual funds and managed accounts. The model portfolios, charts, and other information presented do not represent actual funded trades and are not actual funded portfolios. There are material differences between Navellier Investment Products’ portfolios and the model portfolios, research, and performance figures presented here. The model portfolios and the research results (1) may contain stocks or ETFs that are illiquid and difficult to trade; (2) may contain stock or ETF holdings materially different from actual funded Navellier Investment Product portfolios; (3) include the reinvestment of all dividends and other earnings, estimated trading costs, commissions, or management fees; and, (4) may not reflect prices obtained in an actual funded Navellier Investment Product portfolio. For these and other reasons, the reported performances of model portfolios do not reflect the performance results of Navellier’s actually funded and traded Investment Products. In most cases, Navellier’s Investment Products have materially lower performance results than the performances of the model portfolios presented.

This report contains statements that are, or may be considered to be, forward-looking statements. All statements that are not historical facts, including statements about our beliefs or expectations, are “forward-looking statements” within the meaning of The U.S. Private Securities Litigation Reform Act of 1995. These statements may be identified by such forward-looking terminology as “expect,” “estimate,” “plan,” “intend,” “believe,” “anticipate,” “may,” “will,” “should,” “could,” “continue,” “project,” or similar statements or variations of such terms. Our forward-looking statements are based on a series of expectations, assumptions, and projections, are not guarantees of future results or performance, and involve substantial risks and uncertainty as described in Form ADV Part 2A of our filing with the Securities and Exchange Commission (SEC), which is available at www.adviserinfo.sec.gov or by requesting a copy by emailing info@navellier.com. All of our forward-looking statements are as of the date of this report only. We can give no assurance that such expectations or forward-looking statements will prove to be correct. Actual results may differ materially. You are urged to carefully consider all such factors.

FEDERAL TAX ADVICE DISCLAIMER: As required by U.S. Treasury Regulations, you are informed that, to the extent this presentation includes any federal tax advice, the presentation is not written by Navellier to be used, and cannot be used, for the purpose of avoiding federal tax penalties. Navellier does not advise on any income tax requirements or issues. Use of any information presented by Navellier is for general information only and does not represent tax advice either express or implied. You are encouraged to seek professional tax advice for income tax questions and assistance.

IMPORTANT NEWSLETTER DISCLOSURE:The hypothetical performance results for investment newsletters that are authored or edited by Louis Navellier, including Louis Navellier’s Growth Investor, Louis Navellier’s Breakthrough Stocks, Louis Navellier’s Accelerated Profits, and Louis Navellier’s Platinum Club, are not based on any actual securities trading, portfolio, or accounts, and the newsletters’ reported hypothetical performances should be considered mere “paper” or proforma hypothetical performance results and are not actual performance of real world trades. Navellier & Associates, Inc. does not have any relation to or affiliation with the owner of these newsletters. There are material differences between Navellier Investment Products’ portfolios and the InvestorPlace Media, LLC newsletter portfolios authored by Louis Navellier. The InvestorPlace Media, LLC newsletters contain hypothetical performance that do not include transaction costs, advisory fees, or other fees a client might incur if actual investments and trades were being made by an investor. As a result, newsletter performance should not be used to evaluate Navellier Investment services which are separate and different from the newsletters. The owner of the newsletters is InvestorPlace Media, LLC and any questions concerning the newsletters, including any newsletter advertising or hypothetical Newsletter performance claims, (which are calculated solely by Investor Place Media and not Navellier) should be referred to InvestorPlace Media, LLC at (800) 718-8289.

Please note that Navellier & Associates and the Navellier Private Client Group are managed completely independent of the newsletters owned and published by InvestorPlace Media, LLC and written and edited by Louis Navellier, and investment performance of the newsletters should in no way be considered indicative of potential future investment performance for any Navellier & Associates separately managed account portfolio. Potential investors should consult with their financial advisor before investing in any Navellier Investment Product.

Navellier claims compliance with Global Investment Performance Standards (GIPS). To receive a complete list and descriptions of Navellier’s composites and/or a presentation that adheres to the GIPS standards, please contact Navellier or click here. It should not be assumed that any securities recommendations made by Navellier & Associates, Inc. in the future will be profitable or equal the performance of securities made in this report.

FactSet Disclosure: Navellier does not independently calculate the statistical information included in the attached report. The calculation and the information are provided by FactSet, a company not related to Navellier. Although information contained in the report has been obtained from FactSet and is based on sources Navellier believes to be reliable, Navellier does not guarantee its accuracy, and it may be incomplete or condensed. The report and the related FactSet sourced information are provided on an “as is” basis. The user assumes the entire risk of any use made of this information. Investors should consider the report as only a single factor in making their investment decision. The report is for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of a security. FactSet sourced information is the exclusive property of FactSet. Without prior written permission of FactSet, this information may not be reproduced, disseminated or used to create any financial products. All indices are unmanaged and performance of the indices include reinvestment of dividends and interest income, unless otherwise noted, are not illustrative of any particular investment and an investment cannot be made in any index. Past performance is no guarantee of future results.