Large Cap Growth Portfolio

Many of the world’s best-known and largest companies are located in the U.S. These are the companies our research attempts to identify for Navellier’s Large Cap Growth Portfolio.

Using Navellier’s time-tested, quantitative investment process, this actively managed portfolio, launched in 1998, seeks inefficiently priced growth stocks with opportunities for long-term price appreciation.

Highlights

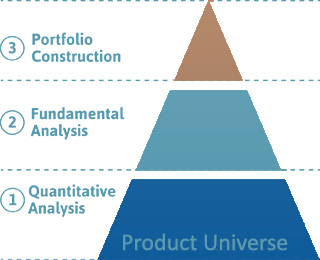

- Disciplined investment process that uses quantitative and fundamental screens

- Dynamic process that adapts to market changes

- Portfolio managed to outperform the index rather than imitate it

Features

- Invests in high quality, inefficiently priced U.S. stocks with growth potential

- Diversification across sectors and industries

- Style pure

Overview

- Identify companies with strong reward (alpha) / risk (standard deviation) ratios

- Screen companies for strong fundamentals that explain their performance and support their future growth potential

- Optimize the portfolio for diversification across sectors and industries

Portfolio Managers

Louis Navellier

CHIEF INVESTMENT OFFICER

Mr. Navellier’s stock selection process focuses on quantitative analysis, fundamental analysis, and optimization of the securities selected for the portfolio.

Michael Garaventa

PORTFOLIO MANAGER

Mr. Garaventa manages the All Cap Core strategy and is a member of many portfolio management teams including, but not limited to the Large Cap Growth, Power Dividend, and Small-to-Mid Cap Growth management teams.

Performance results presented herein do not necessarily indicate future performance; investment in equity strategies involves substantial risk and has the potential for partial or complete loss of funds invested. Results presented include reinvestment of dividends and other earnings. None of the stock information, data and company information presented herein constitutes a recommendation by Navellier or a solicitation of any offer to buy or sell any securities.