by Bryan Perry

January 27, 2026

The SpaceX IPO is being forecasted to be “the mother of all IPOs,” with a target valuation making it immediately one of the most valuable companies in the world. SpaceX is reportedly targeting an IPO valuation of $1.5-trillion. This is nearly double its private secondary market valuation of $800-billion as of late 2025. Analysts have cited this $1.5-trillion as roughly the current valuation of Tesla, suggesting Musk is positioning SpaceX to become the new flagship of its public universe of assets.

This offering is expected to be record-breaking in terms of the actual capital raised: SpaceX is looking to raise significantly more than $30-billion in new capital, and four-big banks are selected to lead the deal.

While some speculate an IPO date coming as early as June 2026, the company has officially entered a quiet period as of December 2025, which typically precedes a listing by six-to-12-months.

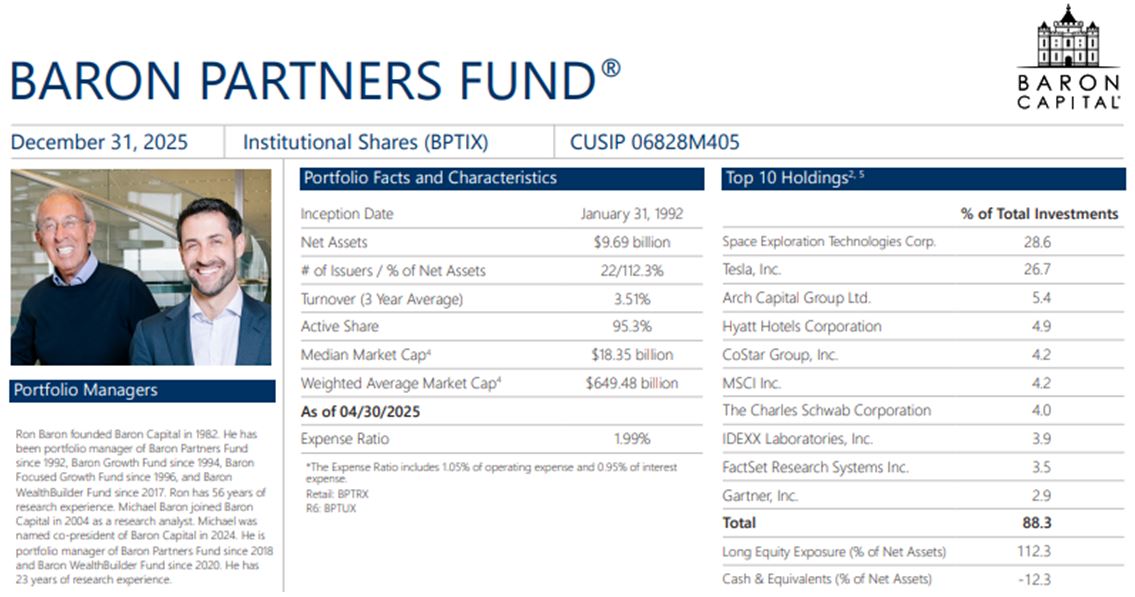

Aside from private sales by SpaceX employees over recent years, retail investors who want a position without paying a premium over current valuations can do via shares in Baron Partners Fund (BPTRX).

Co-portfolio managers Ron Baron and Michael Baron manage this unique non-diversified, all-cap growth fund. As founder of Baron Capital, Ron Baron’s New York City-based firm managing the Baron Funds has $45-billion in assets under management. (Baron has an estimated net worth of $6.5-billion).

Within its $9.7-billion in assets, BPTRX has amassed a large position in SpaceX representing the fund’s largest holding (28.6%), with Tesla Inc. (TSLA) as its second largest holding. (26.7%, see table, below).

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Following the December 2025 revaluation, when SpaceX was marked up to an $800-billion valuation, the dollar amount held by BPTRX surged. Because Ron Baron has been buying and holding SpaceX since its early stages, the fund owns millions of shares across several series (including the Series H, I, and N).

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Much of the BPTRX position in SpaceX was purchased at a split-adjusted price of roughly $15 to $30-per share. As of January 2026, the fund is valuing those same shares at approximately $135-per share.

A major part of the anticipated $1.5-trillion future valuation of a post-IPO SpaceX is based on Space-Based Data Centers, and SpaceX is pitching itself as the ultimate infrastructure provider for the AI boom, using Starlink satellites to host “orbital compute” for companies like xAI and OpenAI.

There were long-standing rumors Musk would spin off Starlink (the satellite internet business) as a separate IPO. However, the 2026 forecast indicates he will likely take the entire company public as one unit. Keeping Starlink and the launch division (Starship) together allows massive cash flow from Starlink to fund the “Capex burn” of the Mars and Starship programs.

In late 2025 and early 2026, Ron Baron has become much more vocal about the geopolitical risks China poses to his Tesla and SpaceX, his primary investments. His convictions about China making a move on Taiwan is a relatively new and sharp pivot. He has moved from being neutral-to-optimistic about China’s market to concerned over an invasion of Taiwan becoming a major Black Swan Event for global markets.

He also said Xi is racing to make China sanction-proof by achieving breakthroughs in domestic AI and chips, both of which Xi bragged about in the 2026 speech.

In response to this specific threat, SpaceX is currently ramping up Starshield (the military version of Starlink). The U.S. Space Force recently fast-tracked a contract with SpaceX for a 480-satellite MILNET constellation, designed for resilient communication in a contested environment (i.e., the Pacific).

There have been some recent headlines about Congress pressuring Elon Musk to ensure Starshield will be fully active over Taiwan, as it is seen as the only invasion-proof communication network for U.S. troops in the region. Baron believes Xi sees a strategic window due to U.S. politics and China’s tech milestones. In his 2026 New Year’s speech, President Xi used specific language Ron Baron (and many other analysts) interpreted as a transition from long-term aspiration to an active operational objective.

Xi explicitly declared the reunification of Taiwan as a trend of the times, now “unstoppable.” While Xi has used the term “unstoppable” in the past, he framed it as a goal for this year, not as a distant goal for 2049 but a “next step” in China’s national rejuvenation. Baron has said when a leader with absolute power uses such definitive, time-sensitive language, to me, it signals the internal political clock is ticking faster.

Xi’s speech heavily promoted the newly institutionalized Taiwan Recovery Day (first established in 2025). By celebrating the 1945 return of Taiwan from Japan to China, Xi is reframing a potential invasion not as a new war, but as the completion of World War II. Baron has suggested this is psychological conditioning for the Chinese public and a legalistic justification intended to blunt international criticism.

Xi delivered the speech just one day after the People’s Liberation Army (PLA) concluded “Justice Mission 2025,” a massive, 48-hour live exercise simulating a complete blockade of Taiwan. In the speech, Xi praised the military’s heightened readiness and innovative combat capabilities.

With this more aggressive tone from Xi, I believe it would make sense for the SpaceX IPO to go public soon. The capital raised could be gigantic, providing funds to fast-forward systems deployment in controlling space.

Navellier & Associates; a few accounts own Tesla (TSLA), per client request only. Bryan Perry owns Tesla (TSLA) personally.

All content above represents the opinion of Bryan Perry of Navellier & Associates, Inc.

Also In This Issue

A Look Ahead by Louis Navellier

President Trump Takes on Davos…and the World

Income Mail by Bryan Perry

An Opportunity to Own SpaceX Pre-IPO

Growth Mail by Gary Alexander

Black Swans May Shock Us, But the Market Ignores Them

Global Mail by Ivan Martchev

Unintended Consequences (and Fed Chair Announcement) Alert

Sector Spotlight by Jason Bodner

How to See Clearly While Flying Through Dense Market Fog

View Full Archive

Read Past Issues Here

Bryan Perry

SENIOR DIRECTOR

Bryan Perry is a Senior Director with Navellier Private Client Group, advising and facilitating high net worth investors in the pursuit of their financial goals.

Bryan’s financial services career spanning the past three decades includes over 20-years of wealth management experience with Wall Street firms that include Bear Stearns, Lehman Brothers and Paine Webber, working with both retail and institutional clients. Bryan earned a B.A. in Political Science from Virginia Polytechnic Institute & State University and currently holds a Series 65 license. All content of “Income Mail” represents the opinion of Bryan Perry

Important Disclosures:

Although information in these reports has been obtained from and is based upon sources that Navellier believes to be reliable, Navellier does not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute Navellier’s judgment as of the date the report was created and are subject to change without notice. These reports are for informational purposes only and are not a solicitation for the purchase or sale of a security. Any decision to purchase securities mentioned in these reports must take into account existing public information on such securities or any registered prospectus.To the extent permitted by law, neither Navellier & Associates, Inc., nor any of its affiliates, agents, or service providers assumes any liability or responsibility nor owes any duty of care for any consequences of any person acting or refraining to act in reliance on the information contained in this communication or for any decision based on it.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any securities recommendations made by Navellier. in the future will be profitable or equal the performance of securities made in this report. Dividend payments are not guaranteed. The amount of a dividend payment, if any, can vary over time and issuers may reduce dividends paid on securities in the event of a recession or adverse event affecting a specific industry or issuer.

None of the stock information, data, and company information presented herein constitutes a recommendation by Navellier or a solicitation to buy or sell any securities. Any specific securities identified and described do not represent all of the securities purchased, sold, or recommended for advisory clients. The holdings identified do not represent all of the securities purchased, sold, or recommended for advisory clients and the reader should not assume that investments in the securities identified and discussed were or will be profitable.

Information presented is general information that does not take into account your individual circumstances, financial situation, or needs, nor does it present a personalized recommendation to you. Individual stocks presented may not be suitable for every investor. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. Investment in fixed income securities has the potential for the investment return and principal value of an investment to fluctuate so that an investor’s holdings, when redeemed, may be worth less than their original cost.

One cannot invest directly in an index. Index is unmanaged and index performance does not reflect deduction of fees, expenses, or taxes. Presentation of Index data does not reflect a belief by Navellier that any stock index constitutes an investment alternative to any Navellier equity strategy or is necessarily comparable to such strategies. Among the most important differences between the Indices and Navellier strategies are that the Navellier equity strategies may (1) incur material management fees, (2) concentrate its investments in relatively few stocks, industries, or sectors, (3) have significantly greater trading activity and related costs, and (4) be significantly more or less volatile than the Indices.

ETF Risk: We may invest in exchange traded funds (“ETFs”) and some of our investment strategies are generally fully invested in ETFs. Like traditional mutual funds, ETFs charge asset-based fees, but they generally do not charge initial sales charges or redemption fees and investors typically pay only customary brokerage fees to buy and sell ETF shares. The fees and costs charged by ETFs held in client accounts will not be deducted from the compensation the client pays Navellier. ETF prices can fluctuate up or down, and a client account could lose money investing in an ETF if the prices of the securities owned by the ETF go down. ETFs are subject to additional risks:

- ETF shares may trade above or below their net asset value;

- An active trading market for an ETF’s shares may not develop or be maintained;

- The value of an ETF may be more volatile than the underlying portfolio of securities the ETF is designed to track;

- The cost of owning shares of the ETF may exceed those a client would incur by directly investing in the underlying securities; and

- Trading of an ETF’s shares may be halted if the listing exchange’s officials deem it appropriate, the shares are delisted from the exchange, or the activation of market-wide “circuit breakers” (which are tied to large decreases in stock prices) halts stock trading generally.

Grader Disclosures: Investment in equity strategies involves substantial risk and has the potential for partial or complete loss of funds invested. The sample portfolio and any accompanying charts are for informational purposes only and are not to be construed as a solicitation to buy or sell any financial instrument and should not be relied upon as the sole factor in an investment making decision. As a matter of normal and important disclosures to you, as a potential investor, please consider the following: The performance presented is not based on any actual securities trading, portfolio, or accounts, and the reported performance of the A, B, C, D, and F portfolios (collectively the “model portfolios”) should be considered mere “paper” or pro forma performance results based on Navellier’s research.

Investors evaluating any of Navellier & Associates, Inc.’s, (or its affiliates’) Investment Products must not use any information presented here, including the performance figures of the model portfolios, in their evaluation of any Navellier Investment Products. Navellier Investment Products include the firm’s mutual funds and managed accounts. The model portfolios, charts, and other information presented do not represent actual funded trades and are not actual funded portfolios. There are material differences between Navellier Investment Products’ portfolios and the model portfolios, research, and performance figures presented here. The model portfolios and the research results (1) may contain stocks or ETFs that are illiquid and difficult to trade; (2) may contain stock or ETF holdings materially different from actual funded Navellier Investment Product portfolios; (3) include the reinvestment of all dividends and other earnings, estimated trading costs, commissions, or management fees; and, (4) may not reflect prices obtained in an actual funded Navellier Investment Product portfolio. For these and other reasons, the reported performances of model portfolios do not reflect the performance results of Navellier’s actually funded and traded Investment Products. In most cases, Navellier’s Investment Products have materially lower performance results than the performances of the model portfolios presented.

This report contains statements that are, or may be considered to be, forward-looking statements. All statements that are not historical facts, including statements about our beliefs or expectations, are “forward-looking statements” within the meaning of The U.S. Private Securities Litigation Reform Act of 1995. These statements may be identified by such forward-looking terminology as “expect,” “estimate,” “plan,” “intend,” “believe,” “anticipate,” “may,” “will,” “should,” “could,” “continue,” “project,” or similar statements or variations of such terms. Our forward-looking statements are based on a series of expectations, assumptions, and projections, are not guarantees of future results or performance, and involve substantial risks and uncertainty as described in Form ADV Part 2A of our filing with the Securities and Exchange Commission (SEC), which is available at www.adviserinfo.sec.gov or by requesting a copy by emailing info@navellier.com. All of our forward-looking statements are as of the date of this report only. We can give no assurance that such expectations or forward-looking statements will prove to be correct. Actual results may differ materially. You are urged to carefully consider all such factors.

FEDERAL TAX ADVICE DISCLAIMER: As required by U.S. Treasury Regulations, you are informed that, to the extent this presentation includes any federal tax advice, the presentation is not written by Navellier to be used, and cannot be used, for the purpose of avoiding federal tax penalties. Navellier does not advise on any income tax requirements or issues. Use of any information presented by Navellier is for general information only and does not represent tax advice either express or implied. You are encouraged to seek professional tax advice for income tax questions and assistance.

IMPORTANT NEWSLETTER DISCLOSURE:The hypothetical performance results for investment newsletters that are authored or edited by Louis Navellier, including Louis Navellier’s Growth Investor, Louis Navellier’s Breakthrough Stocks, Louis Navellier’s Accelerated Profits, and Louis Navellier’s Platinum Club, are not based on any actual securities trading, portfolio, or accounts, and the newsletters’ reported hypothetical performances should be considered mere “paper” or proforma hypothetical performance results and are not actual performance of real world trades. Navellier & Associates, Inc. does not have any relation to or affiliation with the owner of these newsletters. There are material differences between Navellier Investment Products’ portfolios and the InvestorPlace Media, LLC newsletter portfolios authored by Louis Navellier. The InvestorPlace Media, LLC newsletters contain hypothetical performance that do not include transaction costs, advisory fees, or other fees a client might incur if actual investments and trades were being made by an investor. As a result, newsletter performance should not be used to evaluate Navellier Investment services which are separate and different from the newsletters. The owner of the newsletters is InvestorPlace Media, LLC and any questions concerning the newsletters, including any newsletter advertising or hypothetical Newsletter performance claims, (which are calculated solely by Investor Place Media and not Navellier) should be referred to InvestorPlace Media, LLC at (800) 718-8289.

Please note that Navellier & Associates and the Navellier Private Client Group are managed completely independent of the newsletters owned and published by InvestorPlace Media, LLC and written and edited by Louis Navellier, and investment performance of the newsletters should in no way be considered indicative of potential future investment performance for any Navellier & Associates separately managed account portfolio. Potential investors should consult with their financial advisor before investing in any Navellier Investment Product.

Navellier claims compliance with Global Investment Performance Standards (GIPS). To receive a complete list and descriptions of Navellier’s composites and/or a presentation that adheres to the GIPS standards, please contact Navellier or click here. It should not be assumed that any securities recommendations made by Navellier & Associates, Inc. in the future will be profitable or equal the performance of securities made in this report.

FactSet Disclosure: Navellier does not independently calculate the statistical information included in the attached report. The calculation and the information are provided by FactSet, a company not related to Navellier. Although information contained in the report has been obtained from FactSet and is based on sources Navellier believes to be reliable, Navellier does not guarantee its accuracy, and it may be incomplete or condensed. The report and the related FactSet sourced information are provided on an “as is” basis. The user assumes the entire risk of any use made of this information. Investors should consider the report as only a single factor in making their investment decision. The report is for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of a security. FactSet sourced information is the exclusive property of FactSet. Without prior written permission of FactSet, this information may not be reproduced, disseminated or used to create any financial products. All indices are unmanaged and performance of the indices include reinvestment of dividends and interest income, unless otherwise noted, are not illustrative of any particular investment and an investment cannot be made in any index. Past performance is no guarantee of future results.