by Gary Alexander

December 9, 2025

“Potent Storm Is Expected to Drench the Pacific Northwest – A ‘very impressive’ source of moisture from an atmospheric river… is forecast on more than a dozen rivers in Washington and Oregon.”

– New York Times, December 6, 2025

In the Pacific Northwest, where I live, we were warned of high winds and rains and possible flooding this weekend. In most regions, it didn’t happen. Skies were generally clear. False alarms happen quite often. I can’t know this in advance, but I’ll bet the actual outcome in most areas will be far lower than these fears. I’m sure we will see televised examples of storm damage and flooding, but that is not the norm. Most families and homes in our region will be untouched by any storm damage. No great drama there.

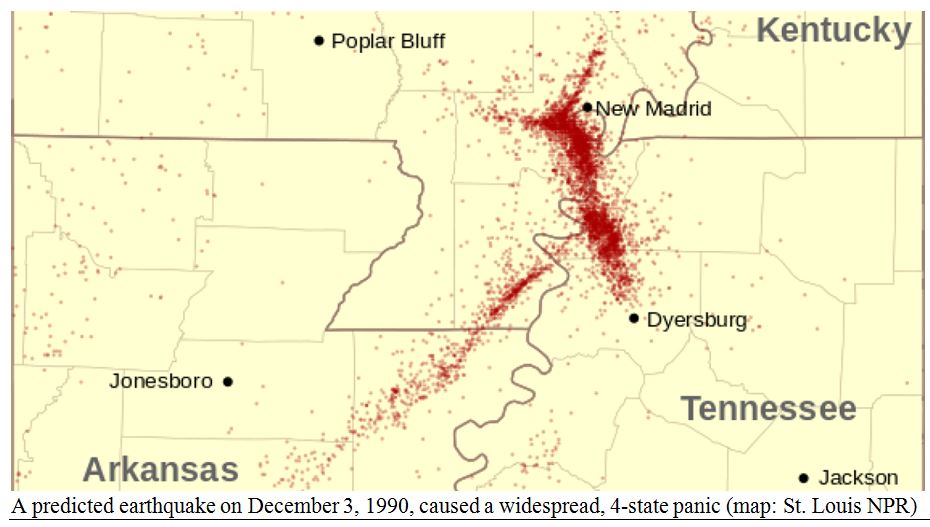

We’ve seen such warnings before. Back in 1990, Dr. Iben Browning predicted that a massive Southeast Missouri earthquake would hit on December 3, 1990 – 35-years ago. I was part of spreading this panic, as Dr. Browning spoke at our New Orleans conferences, which I helped to host. His warnings convinced many to stockpile food or even flee the region that week. As December neared, the National Guard held earthquake drills, and state Offices of Emergency Services circulated earthquake preparation guides.

Dr. Iben Browning died on July 8, 1991, sadly disgraced for his failure, and that’s when I grew tired of making or circulating doomsday predictions that failed to happen. That non-quake event was the straw that broke this bear’s back, so I founded a whimsical organization, Apocaholics Anonymous, for those of us addicted to Doomsday fears that failed to occur. I also became a perma-bull and began to grow in net worth. From that earthquake false alarm, I learned that the fear of catastrophes can cause more problems than the catastrophe itself. Still, to this day, warnings of storms or natural disasters are popular postings.

Three Current Examples of False Fears – Each One Limiting Our Profit Potential

Here are three-cases of failed fears from recent news, each impacting economic growth: #1-The 2025 Hurricane Hiatus, #2-Failed Climate Fears, and #3-The “Broken Window Fallacy” at Home Depot.

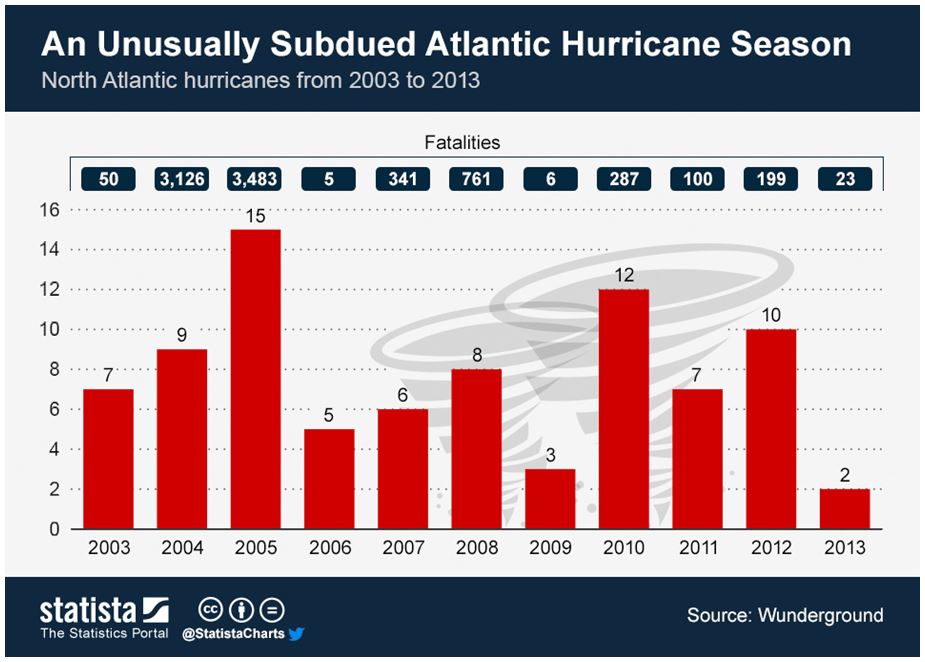

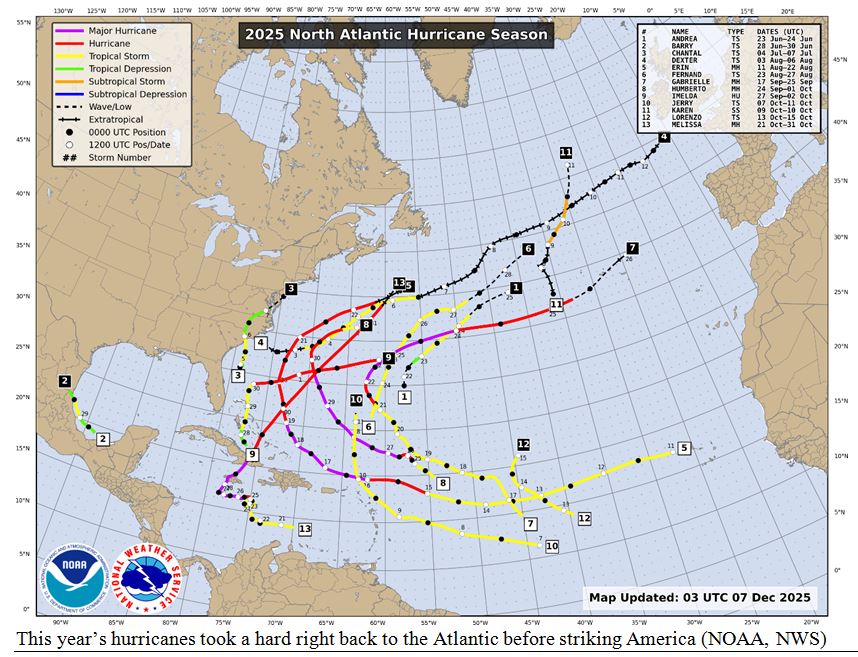

#1: The 2025 Hurricane Hiatus: Last week’s news revealed that 2025 has been the quietest hurricane season since 2015, with no major high winds reaching the U.S. mainland. This continues a two-decade span of sub-par hurricane hits after the Gulf Coast suffered three killer hurricanes in 2005 (Katrina, Rita and Wilma) and 2005 generated more scare rhetoric, as climate Cassandras predicted Katrina’s deadly attack marked the start of the worst hurricane era ever, “the beginning of sorrows,” in Biblical terms.

But it didn’t happen that way. Over the last two decades we’ve seen far fewer deaths and lower levels of damage, adjusted for inflation, population and greater home density in Florida and other target zones.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Bjorn Lomborg commented in The Wall Street Journal following this report, saying that perhaps climate changes have made hurricanes less likely to hit the U.S. (see “Climate Change Might Have Spared America From Hurricanes,” WSJ, December 3, 2025), but that doesn’t fit the Doomsday scenario.

The 2025 Atlantic hurricane season officially ended November 30. Of the first 12-named storms that approached North America this fall, all avoided slamming the U.S. East Coast. The well-publicized 13th Hurricane Melissa hit Jamaica hard, causing 100-deaths, so that satisfied the chronic catastrophe crowd.

#2: Failed Climate Fears: A longer-term trend is the fear of global warming or its more neutrally-named cousin, Climate Change. This has investment implications – especially in this column, called “Growth Mail” – since one of the most often quoted climate warnings last year, in Nature Magazine, was that we would see a massive (60% or more) slowdown in global economic output by 2100 due to climate change.

Last week, The New York Times reported that Nature had withdrawn this article as being “fatally flawed” in its methodology. The 2024 article, titled “The Economic Commitment of Climate Change” (in Nature) contained errors “too substantial” for a mere correction, according to its authors. That retraction comes long after this popular (even viral) study predicted that economic output would fall by multiple trillions of dollars (62% by the end of the century) if drastic anti-fossil fuel actions weren’t taken now, or soon.

The article was so influential that its widespread citation led the World Bank, International Monetary Fund (IMF), Congressional Budget Office (CBO) and even the Vatican and our Federal Reserve to call for sweeping actions to voluntarily cripple current economic growth, in order to prevent a later disaster.

The authors never fully explained why slight warming would kill growth or food output – warming will likely expand food growing regions. It turned out these scientists wandered out of their lane in trying to forecast economics. We who follow the economics profession can’t fathom how any expert can predict the impact of slow-moving trends 75-years later. Would scientists in 1900 predict the annual increase of horse manure in city streets into infinity by 1975? If so, they would have been equally short-sighted.

While this popular paper reflected “settled science” in 2024, we can now see that most of the “evidence” they cited came from economic data in one country – an economic pygmy, the moribund economy of Uzbekistan – during a long-ago study of data from 1995 to 1999. If the authors merely ignored that land-locked land, the 2100 damage fell to -23% rather than -62%. So much for “settled” science!

#3: Home Depot’s “Broken Window Fallacy.” We also heard recently that hurricane damage is somehow “bad news” for some home-repair businesses. Specifically, Home Depot cut its full-year profit forecast and missed Wall Street’s earnings expectations for the third straight quarter because it saw weaker home improvement demand stemming from “lower-than-usual storm activity.” HD’s CEO Ted Decker said on the company’s earnings call that the primary driver of their recent earnings deceleration was the lack of storm activity, which traditionally results in rising sales volume for home repair purchases at the Depot.

Economists would immediately recognize HD’s excuse as an instance of the “Broken Window Fallacy,” in which short-sighted economists claim broken windows fuel the employment of glaziers for their repairs, hence boosting GDP. This is the same circular reasoning which says, “Wars are good for the economy.” Smarter economists deal in trade-offs, since spending on repairs will replace unseen, unused spending of these same resources on new building, research, or other positive growth choices, not repairs.

Some Refreshing Positives About Winter – 12-Days Before Winter Even Begins

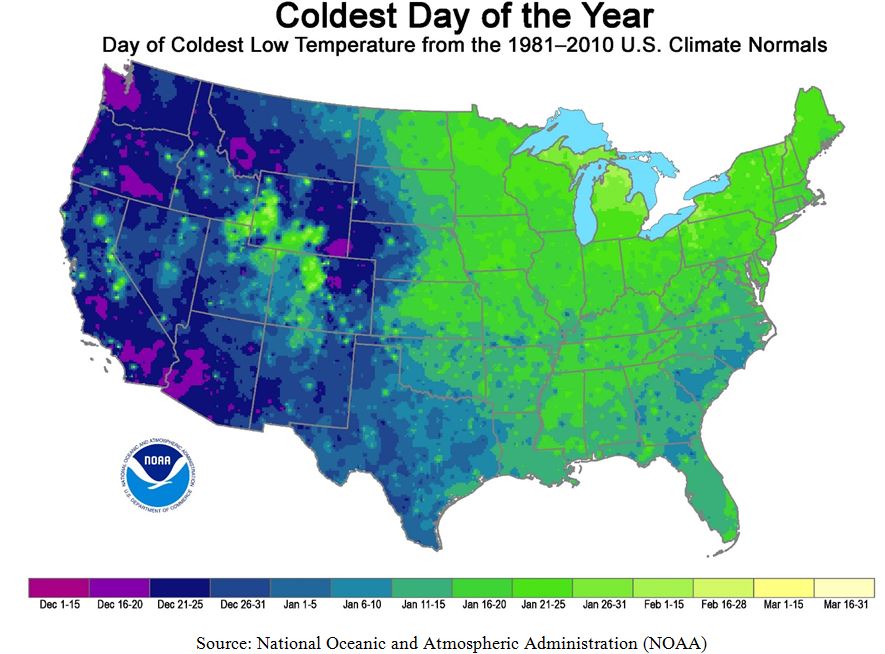

Here in Western Washington State; winter comes early. In the Eastern half of the nation, the coldest month is January and the coldest 15-days in the northern tier are January 16-31 – right around NFL playoff games and Inauguration Day – but due to some regional differences, December is the coldest and windiest month in our area (see the purple areas, below). Our winter is basically over by Groundhog Day.

Let me shatter some other weather myths: Seattle’s rainfall is about average for the nation, and we only get half Seattle’s rain in our islands up north. Here’s another myth: ‘It’s darkest right before dawn.’ Nope, I get up well before dawn and I see gray threads of light long before dawn, versus. the inky black of midnight.

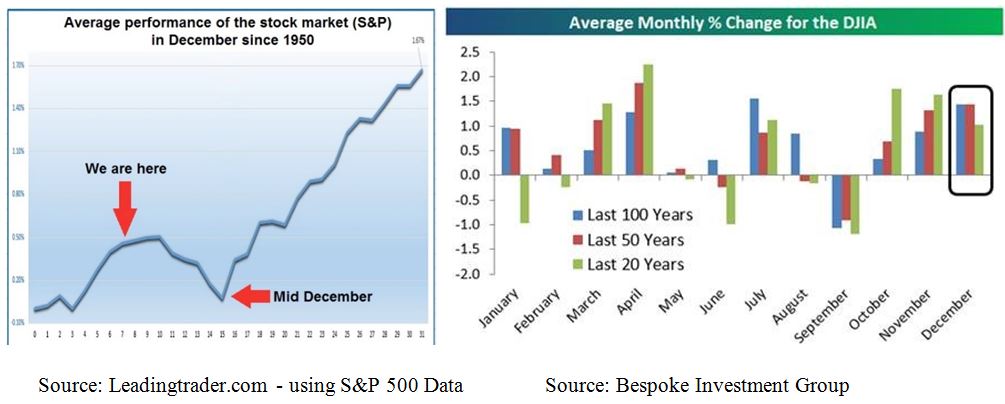

Another piece of good news is that December in the market is great, but it often delivers two-opposing halves. The first-half is often flat or down, while the second-half features a strong Santa Claus rally:

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Dark days turn bright, as sure as daylight hours will soon expand – and the stock market anticipates that.

Navellier & Associates; do not own Home Depot (HD), in managed accounts. Gary Alexander owns Home Depot (HD), personally.

All content above represents the opinion of Gary Alexander of Navellier & Associates, Inc.

Also In This Issue

A Look Ahead by Louis Navellier

2026 Is Shaping Up to be a Spectacular Year

Income Mail by Bryan Perry

“Affordability” Takes Center Stage For 2026

Growth Mail by Gary Alexander

Storms Make the News, but Clear Skies are the Norm

View Full Archive

Read Past Issues Here

Global Mail by Ivan Martchev

New All-Time Highs Are Likely This Week

Sector Spotlight by Jason Bodner

Into Each Month Some Rain Must Fall

Guest Column by Jamie Dlugosch

Opening Bell Arbitrage – The True “Value Cycle”

About The Author

Gary Alexander

SENIOR EDITOR

Gary Alexander has been Senior Writer at Navellier since 2009. He edits Navellier’s weekly Marketmail and writes a weekly Growth Mail column, in which he uses market history to support the case for growth stocks. For the previous 20-years before joining Navellier, he was Senior Executive Editor at InvestorPlace Media (formerly Phillips Publishing), where he worked with several leading investment analysts, including Louis Navellier (since 1997), helping launch Louis Navellier’s Blue Chip Growth and Global Growth newsletters.

Prior to that, Gary edited Wealth Magazine and Gold Newsletter and wrote various investment research reports for Jefferson Financial in New Orleans in the 1980s. He began his financial newsletter career with KCI Communications in 1980, where he served as consulting editor for Personal Finance newsletter while serving as general manager of KCI’s Alexandria House book division. Before that, he covered the economics beat for news magazines. All content of “Growth Mail” represents the opinion of Gary Alexander

Important Disclosures:

Although information in these reports has been obtained from and is based upon sources that Navellier believes to be reliable, Navellier does not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute Navellier’s judgment as of the date the report was created and are subject to change without notice. These reports are for informational purposes only and are not a solicitation for the purchase or sale of a security. Any decision to purchase securities mentioned in these reports must take into account existing public information on such securities or any registered prospectus.To the extent permitted by law, neither Navellier & Associates, Inc., nor any of its affiliates, agents, or service providers assumes any liability or responsibility nor owes any duty of care for any consequences of any person acting or refraining to act in reliance on the information contained in this communication or for any decision based on it.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any securities recommendations made by Navellier. in the future will be profitable or equal the performance of securities made in this report. Dividend payments are not guaranteed. The amount of a dividend payment, if any, can vary over time and issuers may reduce dividends paid on securities in the event of a recession or adverse event affecting a specific industry or issuer.

None of the stock information, data, and company information presented herein constitutes a recommendation by Navellier or a solicitation to buy or sell any securities. Any specific securities identified and described do not represent all of the securities purchased, sold, or recommended for advisory clients. The holdings identified do not represent all of the securities purchased, sold, or recommended for advisory clients and the reader should not assume that investments in the securities identified and discussed were or will be profitable.

Information presented is general information that does not take into account your individual circumstances, financial situation, or needs, nor does it present a personalized recommendation to you. Individual stocks presented may not be suitable for every investor. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. Investment in fixed income securities has the potential for the investment return and principal value of an investment to fluctuate so that an investor’s holdings, when redeemed, may be worth less than their original cost.

One cannot invest directly in an index. Index is unmanaged and index performance does not reflect deduction of fees, expenses, or taxes. Presentation of Index data does not reflect a belief by Navellier that any stock index constitutes an investment alternative to any Navellier equity strategy or is necessarily comparable to such strategies. Among the most important differences between the Indices and Navellier strategies are that the Navellier equity strategies may (1) incur material management fees, (2) concentrate its investments in relatively few stocks, industries, or sectors, (3) have significantly greater trading activity and related costs, and (4) be significantly more or less volatile than the Indices.

ETF Risk: We may invest in exchange traded funds (“ETFs”) and some of our investment strategies are generally fully invested in ETFs. Like traditional mutual funds, ETFs charge asset-based fees, but they generally do not charge initial sales charges or redemption fees and investors typically pay only customary brokerage fees to buy and sell ETF shares. The fees and costs charged by ETFs held in client accounts will not be deducted from the compensation the client pays Navellier. ETF prices can fluctuate up or down, and a client account could lose money investing in an ETF if the prices of the securities owned by the ETF go down. ETFs are subject to additional risks:

- ETF shares may trade above or below their net asset value;

- An active trading market for an ETF’s shares may not develop or be maintained;

- The value of an ETF may be more volatile than the underlying portfolio of securities the ETF is designed to track;

- The cost of owning shares of the ETF may exceed those a client would incur by directly investing in the underlying securities; and

- Trading of an ETF’s shares may be halted if the listing exchange’s officials deem it appropriate, the shares are delisted from the exchange, or the activation of market-wide “circuit breakers” (which are tied to large decreases in stock prices) halts stock trading generally.

Grader Disclosures: Investment in equity strategies involves substantial risk and has the potential for partial or complete loss of funds invested. The sample portfolio and any accompanying charts are for informational purposes only and are not to be construed as a solicitation to buy or sell any financial instrument and should not be relied upon as the sole factor in an investment making decision. As a matter of normal and important disclosures to you, as a potential investor, please consider the following: The performance presented is not based on any actual securities trading, portfolio, or accounts, and the reported performance of the A, B, C, D, and F portfolios (collectively the “model portfolios”) should be considered mere “paper” or pro forma performance results based on Navellier’s research.

Investors evaluating any of Navellier & Associates, Inc.’s, (or its affiliates’) Investment Products must not use any information presented here, including the performance figures of the model portfolios, in their evaluation of any Navellier Investment Products. Navellier Investment Products include the firm’s mutual funds and managed accounts. The model portfolios, charts, and other information presented do not represent actual funded trades and are not actual funded portfolios. There are material differences between Navellier Investment Products’ portfolios and the model portfolios, research, and performance figures presented here. The model portfolios and the research results (1) may contain stocks or ETFs that are illiquid and difficult to trade; (2) may contain stock or ETF holdings materially different from actual funded Navellier Investment Product portfolios; (3) include the reinvestment of all dividends and other earnings, estimated trading costs, commissions, or management fees; and, (4) may not reflect prices obtained in an actual funded Navellier Investment Product portfolio. For these and other reasons, the reported performances of model portfolios do not reflect the performance results of Navellier’s actually funded and traded Investment Products. In most cases, Navellier’s Investment Products have materially lower performance results than the performances of the model portfolios presented.

This report contains statements that are, or may be considered to be, forward-looking statements. All statements that are not historical facts, including statements about our beliefs or expectations, are “forward-looking statements” within the meaning of The U.S. Private Securities Litigation Reform Act of 1995. These statements may be identified by such forward-looking terminology as “expect,” “estimate,” “plan,” “intend,” “believe,” “anticipate,” “may,” “will,” “should,” “could,” “continue,” “project,” or similar statements or variations of such terms. Our forward-looking statements are based on a series of expectations, assumptions, and projections, are not guarantees of future results or performance, and involve substantial risks and uncertainty as described in Form ADV Part 2A of our filing with the Securities and Exchange Commission (SEC), which is available at www.adviserinfo.sec.gov or by requesting a copy by emailing info@navellier.com. All of our forward-looking statements are as of the date of this report only. We can give no assurance that such expectations or forward-looking statements will prove to be correct. Actual results may differ materially. You are urged to carefully consider all such factors.

FEDERAL TAX ADVICE DISCLAIMER: As required by U.S. Treasury Regulations, you are informed that, to the extent this presentation includes any federal tax advice, the presentation is not written by Navellier to be used, and cannot be used, for the purpose of avoiding federal tax penalties. Navellier does not advise on any income tax requirements or issues. Use of any information presented by Navellier is for general information only and does not represent tax advice either express or implied. You are encouraged to seek professional tax advice for income tax questions and assistance.

IMPORTANT NEWSLETTER DISCLOSURE:The hypothetical performance results for investment newsletters that are authored or edited by Louis Navellier, including Louis Navellier’s Growth Investor, Louis Navellier’s Breakthrough Stocks, Louis Navellier’s Accelerated Profits, and Louis Navellier’s Platinum Club, are not based on any actual securities trading, portfolio, or accounts, and the newsletters’ reported hypothetical performances should be considered mere “paper” or proforma hypothetical performance results and are not actual performance of real world trades. Navellier & Associates, Inc. does not have any relation to or affiliation with the owner of these newsletters. There are material differences between Navellier Investment Products’ portfolios and the InvestorPlace Media, LLC newsletter portfolios authored by Louis Navellier. The InvestorPlace Media, LLC newsletters contain hypothetical performance that do not include transaction costs, advisory fees, or other fees a client might incur if actual investments and trades were being made by an investor. As a result, newsletter performance should not be used to evaluate Navellier Investment services which are separate and different from the newsletters. The owner of the newsletters is InvestorPlace Media, LLC and any questions concerning the newsletters, including any newsletter advertising or hypothetical Newsletter performance claims, (which are calculated solely by Investor Place Media and not Navellier) should be referred to InvestorPlace Media, LLC at (800) 718-8289.

Please note that Navellier & Associates and the Navellier Private Client Group are managed completely independent of the newsletters owned and published by InvestorPlace Media, LLC and written and edited by Louis Navellier, and investment performance of the newsletters should in no way be considered indicative of potential future investment performance for any Navellier & Associates separately managed account portfolio. Potential investors should consult with their financial advisor before investing in any Navellier Investment Product.

Navellier claims compliance with Global Investment Performance Standards (GIPS). To receive a complete list and descriptions of Navellier’s composites and/or a presentation that adheres to the GIPS standards, please contact Navellier or click here. It should not be assumed that any securities recommendations made by Navellier & Associates, Inc. in the future will be profitable or equal the performance of securities made in this report.

FactSet Disclosure: Navellier does not independently calculate the statistical information included in the attached report. The calculation and the information are provided by FactSet, a company not related to Navellier. Although information contained in the report has been obtained from FactSet and is based on sources Navellier believes to be reliable, Navellier does not guarantee its accuracy, and it may be incomplete or condensed. The report and the related FactSet sourced information are provided on an “as is” basis. The user assumes the entire risk of any use made of this information. Investors should consider the report as only a single factor in making their investment decision. The report is for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of a security. FactSet sourced information is the exclusive property of FactSet. Without prior written permission of FactSet, this information may not be reproduced, disseminated or used to create any financial products. All indices are unmanaged and performance of the indices include reinvestment of dividends and interest income, unless otherwise noted, are not illustrative of any particular investment and an investment cannot be made in any index. Past performance is no guarantee of future results.