by Louis Navellier

December 9, 2025

Financial markets are fully anticipating a Fed interest rate cut tomorrow, after Mary Daly, Stephen Miran, Christopher Waller and John Williams all spoke in favor of a December Fed rate cut, due mostly to labor market weakness. Adding to the evidence the labor market is under duress is ADP reported last week that private companies have lost an average of 13,500-jobs per week in the past few weeks.

In making their decision this week, the Fed’s Beige Book offers voting FOMC members further reasons for a coming cut, as recent economic activity in the 12-Federal districts showed little change over the past few weeks. Much of the Beige Book survey was conducted during the government shutdown and so may be misleading. But multiple Fed districts, including New York, Atlanta and Minneapolis, reported spending among upper-income consumers was resilient, while spending was flagging for low and middle-income households. This “K-shaped” spending divergence, where older (Boomer) spending is healthy, is a persistent characteristic this year. As the Minneapolis Fed report said, “Higher-income customers were unconstrained, but customers in the middle to lower end of the financial spectrum are tightening the belt.”

One other reason for the Fed to cut rates on Wednesday, December 10th, is real estate, since home and rental prices across the nation remain soft. In my opinion, there is more risk of deflation than inflation at the present time. Not only are real estate prices falling, but the U.S. is importing deflation from China and other global nations. The U.S. dollar is strengthening a bit, as many other counties sputter economically, cutting interest rates amid speculation of potential currency devaluations, as central banks attempt to step in to bail out some of these troubled countries with lower interest rates and/or quantitative easing.

In a possible sign that Kevin Hassett will be President Trump’s nominee as the next Fed Chair, Bloomberg reported that Treasury Secretary Scott Bessent may lead the Council of Economic Advisors (CEA), which is Hassett’s current post, giving Bessent two top roles in the Trump administration. President Trump will likely wait until January to announce a new Fed Chair, since it is a big deal and requires Congressional approval. The holidays are not the best time to make such an announcement but naming Kevin Hassett as Fed Chair should boost employment and economic growth, without posing any new inflation risks.

Wars (in Ukraine) May End Soon, While Rumors of War (in Venezuela) May Escalate

The Trump administration is still pursuing a Ukrainian/Russia peace agreement in 2025, as U.S. special envoys Steve Witkoff and Jared Kushner met with Russian President Vladmir Putin at the Kremlin on Tuesday for almost five hours of hammering out the details of a peace plan without input from European allies. In the event that Vladmir Putin agrees to a peace deal that should boost the stock market and cause energy prices to further soften on the prospect of more Russian natural gas and crude oil being available.

So far, the financial markets are largely ignoring potential war in Venezuela, as the U.S. Navy is poised off the coast of that nation and continues to sink boats that are allegedly transporting cocaine and other illegal drugs. The U.S. has closed Venezuelan airspace, and ground attacks on drug facilities may follow.

Venezuelan President Nicolas Maduro has reportedly talked with President Trump, which raises some speculation that he may seek asylum. Meanwhile, any escalation of U.S. actions in Venezuela is expected to be a boom for Venezuela’s domestic oil industry, which has fallen into disrepair, but it could boom again with closer help from U.S. energy companies. Longer-term, a resurging Venezuelan energy sector would likely cause crude oil prices to remain soft, due to all the new supply that could hit the world market.

Critics of President Trump’s actions, like Colombian President Gustavo Petro, have pointed out that the U.S. action against drug boats is about exploiting Venezuela’s vast crude oil reserves. Since the U.S. has also been attacking boats from Colombia, President Petro has been humiliated and is in danger of losing his Presidency. The bottom line is due to aggressive U.S. military actions; crude oil prices may decline if Venezuela’s domestic oil industry can be revived with the help of U.S. energy companies.

Interestingly, The Wall Street Journal reported Venezuela is sending massive amounts of cocaine to West Africa, where it is then largely sold in Europe by jihadist groups. Specifically, the WSJ said “Unprecedented levels of cocaine production in Colombia in recent years have overwhelmed traditional smuggling routes, leading traffickers to exploit Venezuela’s strategic location, ineffectual security institutions and long coastline, the law-enforcement officials have said. That has led cocaine consumption to rise worldwide in regions that hadn’t been major consumers, from Australia to Eastern Europe.”

U.S. Economic Statistics May Seem Tepid, For Now, But the U.S. Remains the Global Economic Oasis

The latest ADP jobs report last Wednesday showed that 32,000-private payroll jobs were lost last month, in November, well below the economists’ consensus estimate of a 10,000 gain. However, ADP revised its October payrolls to a net 42,000 gain after first reporting a decline of 5,000-jobs, so October represented the first monthly private payroll increase since July. However, ADP also reported that small businesses, with 50 or fewer employees, shed 120,000-jobs, while businesses with more than 50-employees created 90,000-jobs. From this data, the Fed must cut key interest rates this week – due to their jobs mandate.

The next day, the Labor Department reported on Thursday that weekly jobless claims dropped to 191,000, down from 218,000 in the previous week. This dramatic drop in jobless claims was blamed on a “sloppy seasonal” adjustment from Thanksgiving week, according to Pantheon’s Chief Economist, Samuel Tombs. What that tells us is, essentially, this positive weekly jobless claims data should be ignored.

Despite anticipated Fed rate cuts tomorrow, home and rental prices remain soft, which should result in lower shelter costs via “owner’s equivalent rent,” which has been the main inflationary headache most months in the Consumer Price Index (CPI). Although the Labor Department will not be reporting an October CPI, due to the federal government shutdown, the November CPI is expected to be soft.

The news media has been reporting higher electricity prices due to data center demand, but I want to assure you that since the U.S. is the largest natural gas producer in the world, there will be plenty of natural gas to generate electricity for most of the U.S. Natural gas prices are very sensitive to cold weather, since demand soars during cold snaps, so I am selling some of my natural gas-related stocks.

More deflationary pressure is coming from poor demographics in Asia and Northern Europe, including trends toward shrinking households and lackluster economic growth. Some countries that recently slipped into a recession include New Zealand, Thailand and Japan, and the Bank of Mexico just slashed its annual GDP forecast to 0.3%, down from its previous estimate of 0.6%. Germany is now in its third year of a recession and hopes for a recovery have been hindered after the Green Party forced Chancellor Merz to cut new natural gas plant expansion in half, which would perpetuate high electricity prices in Germany.

Britain is also expected to slip into a recession after new middle class tax increases were imposed to fill a larger-than-expected budget deficit after many wealthy citizens fled Britain to avoid these new tax hikes.

In Italy, Prime Minister Giorgia Meloni has been furious that when she tried to deport some immigrants an EU court blocked her deportation orders. The latest attempt by Brussels to annoy Meloni is the EU is asking her to reconsider her plan that the Bank of Italy’s gold reserves belong to the Italian people. Italy has the third largest gold reserves, after the U.S. and Germany, and many Italian families hold gold as a safe haven because of the inflation long associated with the lira, before the euro was born.

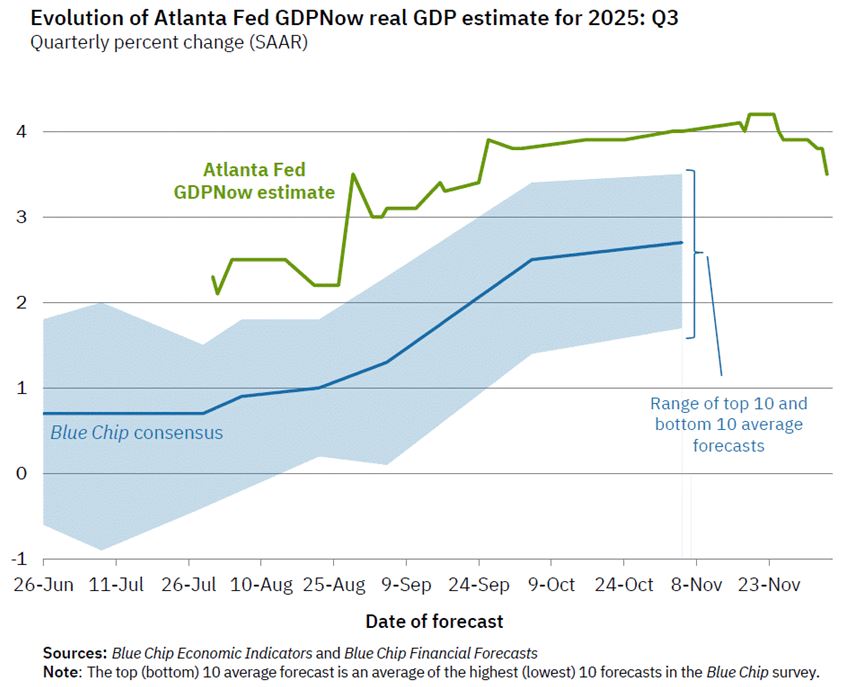

So, as you look around the world, the U.S. seems to be the only major economy that is actually growing by more than 1% or so. The Atlanta Fed is currently estimating 3.5% annual GDP growth, and that is expected to reach a 5% annual pace some time in 2026 as more onshoring boosts economic growth.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Although Harvard economist Jason Furman has pointed out that 92% of recent U.S. GDP growth is related to the data center boom, growth will now be boosted by another Fed key interest rate cut, recent tax-cuts and rising order backlogs for data centers. That means economic growth could soar in 2026, with this new economic growth unlikely to be inflationary due to a glut of goods coming from weak global economies.

In other economic news released last week, the Institute of Supply Management (ISM) announced its manufacturing index declined to 48.2 in November, down from 48.7 in October. Any reading below 50-signals a contraction and this was the ninth-straight month that the ISM manufacturing index declined, but one “green shoot” in that report is that the production component rose to 51.4 in November, up from 48.2 in October. Eleven of 15-manufacturing industries surveyed reported a contraction in November, so this deterioration in the manufacturing sector is another reason the Fed has to cut key interest rates this week.

On the positive side, ISM announced on Wednesday its non-manufacturing (service) index rose to 52.6 in November, up from 52.4 in October. Economists were expecting this service index to come in at 52, so this was a nice surprise. The supplier delivery component rose to 54.1 in November, up from 50.8 in October. Also encouraging is that the inventories component rose to 53.4 in November, up from 49.5 in October, and a majority (12 of 17) services industries ISM surveyed expanded in November.

In summary, the U.S. is in the midst of an exciting economic boom, which will expand in 2026. Clearly, all the onshoring of data centers, semiconductors, pharmaceutical and automotive industries is creating an incredible economic growth outlook. The U.S. is energy-independent and has many advantages over competing countries around the world, since overseas manufacturers can circumvent tariffs by onshoring.

Therefore, due to (1) lower crude oil prices, (2) the fact that the U.S. is importing deflation from China, and (3) weak economies around the world, robust U.S. GDP growth will follow and not be inflationary. In my opinion, 2026 could go down in history as “economic nirvana,” with 5% growth and low inflation.

All content above represents the opinion of Louis Navellier of Navellier & Associates, Inc.

Also In This Issue

A Look Ahead by Louis Navellier

2026 Is Shaping Up to be a Spectacular Year

Income Mail by Bryan Perry

“Affordability” Takes Center Stage For 2026

Growth Mail by Gary Alexander

Storms Make the News, but Clear Skies are the Norm

View Full Archive

Read Past Issues Here

Global Mail by Ivan Martchev

New All-Time Highs Are Likely This Week

Sector Spotlight by Jason Bodner

Into Each Month Some Rain Must Fall

Guest Column by Jamie Dlugosch

Opening Bell Arbitrage – The True “Value Cycle”

Louis Navellier

CHIEF INVESTMENT OFFICER

Louis Navellier is Founder, Chairman of the Board, Chief Investment Officer and Chief Compliance Officer of Navellier & Associates, Inc., located in Reno, Nevada. With decades of experience translating what had been purely academic techniques into real market applications, he believes that disciplined, quantitative analysis can select stocks that will significantly outperform the overall market. All content in this “A Look Ahead” section of Market Mail represents the opinion of Louis Navellier of Navellier & Associates, Inc.

Important Disclosures:

Although information in these reports has been obtained from and is based upon sources that Navellier believes to be reliable, Navellier does not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute Navellier’s judgment as of the date the report was created and are subject to change without notice. These reports are for informational purposes only and are not a solicitation for the purchase or sale of a security. Any decision to purchase securities mentioned in these reports must take into account existing public information on such securities or any registered prospectus.To the extent permitted by law, neither Navellier & Associates, Inc., nor any of its affiliates, agents, or service providers assumes any liability or responsibility nor owes any duty of care for any consequences of any person acting or refraining to act in reliance on the information contained in this communication or for any decision based on it.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any securities recommendations made by Navellier. in the future will be profitable or equal the performance of securities made in this report. Dividend payments are not guaranteed. The amount of a dividend payment, if any, can vary over time and issuers may reduce dividends paid on securities in the event of a recession or adverse event affecting a specific industry or issuer.

None of the stock information, data, and company information presented herein constitutes a recommendation by Navellier or a solicitation to buy or sell any securities. Any specific securities identified and described do not represent all of the securities purchased, sold, or recommended for advisory clients. The holdings identified do not represent all of the securities purchased, sold, or recommended for advisory clients and the reader should not assume that investments in the securities identified and discussed were or will be profitable.

Information presented is general information that does not take into account your individual circumstances, financial situation, or needs, nor does it present a personalized recommendation to you. Individual stocks presented may not be suitable for every investor. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. Investment in fixed income securities has the potential for the investment return and principal value of an investment to fluctuate so that an investor’s holdings, when redeemed, may be worth less than their original cost.

One cannot invest directly in an index. Index is unmanaged and index performance does not reflect deduction of fees, expenses, or taxes. Presentation of Index data does not reflect a belief by Navellier that any stock index constitutes an investment alternative to any Navellier equity strategy or is necessarily comparable to such strategies. Among the most important differences between the Indices and Navellier strategies are that the Navellier equity strategies may (1) incur material management fees, (2) concentrate its investments in relatively few stocks, industries, or sectors, (3) have significantly greater trading activity and related costs, and (4) be significantly more or less volatile than the Indices.

ETF Risk: We may invest in exchange traded funds (“ETFs”) and some of our investment strategies are generally fully invested in ETFs. Like traditional mutual funds, ETFs charge asset-based fees, but they generally do not charge initial sales charges or redemption fees and investors typically pay only customary brokerage fees to buy and sell ETF shares. The fees and costs charged by ETFs held in client accounts will not be deducted from the compensation the client pays Navellier. ETF prices can fluctuate up or down, and a client account could lose money investing in an ETF if the prices of the securities owned by the ETF go down. ETFs are subject to additional risks:

- ETF shares may trade above or below their net asset value;

- An active trading market for an ETF’s shares may not develop or be maintained;

- The value of an ETF may be more volatile than the underlying portfolio of securities the ETF is designed to track;

- The cost of owning shares of the ETF may exceed those a client would incur by directly investing in the underlying securities; and

- Trading of an ETF’s shares may be halted if the listing exchange’s officials deem it appropriate, the shares are delisted from the exchange, or the activation of market-wide “circuit breakers” (which are tied to large decreases in stock prices) halts stock trading generally.

Grader Disclosures: Investment in equity strategies involves substantial risk and has the potential for partial or complete loss of funds invested. The sample portfolio and any accompanying charts are for informational purposes only and are not to be construed as a solicitation to buy or sell any financial instrument and should not be relied upon as the sole factor in an investment making decision. As a matter of normal and important disclosures to you, as a potential investor, please consider the following: The performance presented is not based on any actual securities trading, portfolio, or accounts, and the reported performance of the A, B, C, D, and F portfolios (collectively the “model portfolios”) should be considered mere “paper” or pro forma performance results based on Navellier’s research.

Investors evaluating any of Navellier & Associates, Inc.’s, (or its affiliates’) Investment Products must not use any information presented here, including the performance figures of the model portfolios, in their evaluation of any Navellier Investment Products. Navellier Investment Products include the firm’s mutual funds and managed accounts. The model portfolios, charts, and other information presented do not represent actual funded trades and are not actual funded portfolios. There are material differences between Navellier Investment Products’ portfolios and the model portfolios, research, and performance figures presented here. The model portfolios and the research results (1) may contain stocks or ETFs that are illiquid and difficult to trade; (2) may contain stock or ETF holdings materially different from actual funded Navellier Investment Product portfolios; (3) include the reinvestment of all dividends and other earnings, estimated trading costs, commissions, or management fees; and, (4) may not reflect prices obtained in an actual funded Navellier Investment Product portfolio. For these and other reasons, the reported performances of model portfolios do not reflect the performance results of Navellier’s actually funded and traded Investment Products. In most cases, Navellier’s Investment Products have materially lower performance results than the performances of the model portfolios presented.

This report contains statements that are, or may be considered to be, forward-looking statements. All statements that are not historical facts, including statements about our beliefs or expectations, are “forward-looking statements” within the meaning of The U.S. Private Securities Litigation Reform Act of 1995. These statements may be identified by such forward-looking terminology as “expect,” “estimate,” “plan,” “intend,” “believe,” “anticipate,” “may,” “will,” “should,” “could,” “continue,” “project,” or similar statements or variations of such terms. Our forward-looking statements are based on a series of expectations, assumptions, and projections, are not guarantees of future results or performance, and involve substantial risks and uncertainty as described in Form ADV Part 2A of our filing with the Securities and Exchange Commission (SEC), which is available at www.adviserinfo.sec.gov or by requesting a copy by emailing info@navellier.com. All of our forward-looking statements are as of the date of this report only. We can give no assurance that such expectations or forward-looking statements will prove to be correct. Actual results may differ materially. You are urged to carefully consider all such factors.

FEDERAL TAX ADVICE DISCLAIMER: As required by U.S. Treasury Regulations, you are informed that, to the extent this presentation includes any federal tax advice, the presentation is not written by Navellier to be used, and cannot be used, for the purpose of avoiding federal tax penalties. Navellier does not advise on any income tax requirements or issues. Use of any information presented by Navellier is for general information only and does not represent tax advice either express or implied. You are encouraged to seek professional tax advice for income tax questions and assistance.

IMPORTANT NEWSLETTER DISCLOSURE:The hypothetical performance results for investment newsletters that are authored or edited by Louis Navellier, including Louis Navellier’s Growth Investor, Louis Navellier’s Breakthrough Stocks, Louis Navellier’s Accelerated Profits, and Louis Navellier’s Platinum Club, are not based on any actual securities trading, portfolio, or accounts, and the newsletters’ reported hypothetical performances should be considered mere “paper” or proforma hypothetical performance results and are not actual performance of real world trades. Navellier & Associates, Inc. does not have any relation to or affiliation with the owner of these newsletters. There are material differences between Navellier Investment Products’ portfolios and the InvestorPlace Media, LLC newsletter portfolios authored by Louis Navellier. The InvestorPlace Media, LLC newsletters contain hypothetical performance that do not include transaction costs, advisory fees, or other fees a client might incur if actual investments and trades were being made by an investor. As a result, newsletter performance should not be used to evaluate Navellier Investment services which are separate and different from the newsletters. The owner of the newsletters is InvestorPlace Media, LLC and any questions concerning the newsletters, including any newsletter advertising or hypothetical Newsletter performance claims, (which are calculated solely by Investor Place Media and not Navellier) should be referred to InvestorPlace Media, LLC at (800) 718-8289.

Please note that Navellier & Associates and the Navellier Private Client Group are managed completely independent of the newsletters owned and published by InvestorPlace Media, LLC and written and edited by Louis Navellier, and investment performance of the newsletters should in no way be considered indicative of potential future investment performance for any Navellier & Associates separately managed account portfolio. Potential investors should consult with their financial advisor before investing in any Navellier Investment Product.

Navellier claims compliance with Global Investment Performance Standards (GIPS). To receive a complete list and descriptions of Navellier’s composites and/or a presentation that adheres to the GIPS standards, please contact Navellier or click here. It should not be assumed that any securities recommendations made by Navellier & Associates, Inc. in the future will be profitable or equal the performance of securities made in this report.

FactSet Disclosure: Navellier does not independently calculate the statistical information included in the attached report. The calculation and the information are provided by FactSet, a company not related to Navellier. Although information contained in the report has been obtained from FactSet and is based on sources Navellier believes to be reliable, Navellier does not guarantee its accuracy, and it may be incomplete or condensed. The report and the related FactSet sourced information are provided on an “as is” basis. The user assumes the entire risk of any use made of this information. Investors should consider the report as only a single factor in making their investment decision. The report is for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of a security. FactSet sourced information is the exclusive property of FactSet. Without prior written permission of FactSet, this information may not be reproduced, disseminated or used to create any financial products. All indices are unmanaged and performance of the indices include reinvestment of dividends and interest income, unless otherwise noted, are not illustrative of any particular investment and an investment cannot be made in any index. Past performance is no guarantee of future results.