by Gary Alexander

August 26, 2025

It’s time for my annual Labor Day report on the nature of work – beyond the headlines. While market traders, political pundits and a clueless media keep over-emphasizing the monthly jobs report, it is near-worthless, notoriously inaccurate and subject to wide revisions in future months, usually downward.

The Fed is charged with a dual mandate, one of which is to promote jobs and lower unemployment rates, as if they could change birthrates or engender worker motivation or change the nature of work accepted by a picky labor force. President Trump may fire one job counter in favor of another, but nothing will change long-term demographic trends, which include fewer workers and shifting views of what a job is.

If I may indulge in personal realities once again, at age 80, I don’t expect to see any beautiful longed-for great-grandchildren…ever. Five of our Gen-Z grand-kids (born 1996 to 2004) aren’t much interested in marriage, much less children, and they are not alone. The clear demographic trend is that Americans in child-bearing range (including Millennials, born 1980 to 1995) aren’t much interested in bringing new Americans into this world, so Social Security will suffer from ever-shrinking funding. If more young folk people don’t work to fund Social Security, their parents, grandparents – and they themselves – will suffer.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

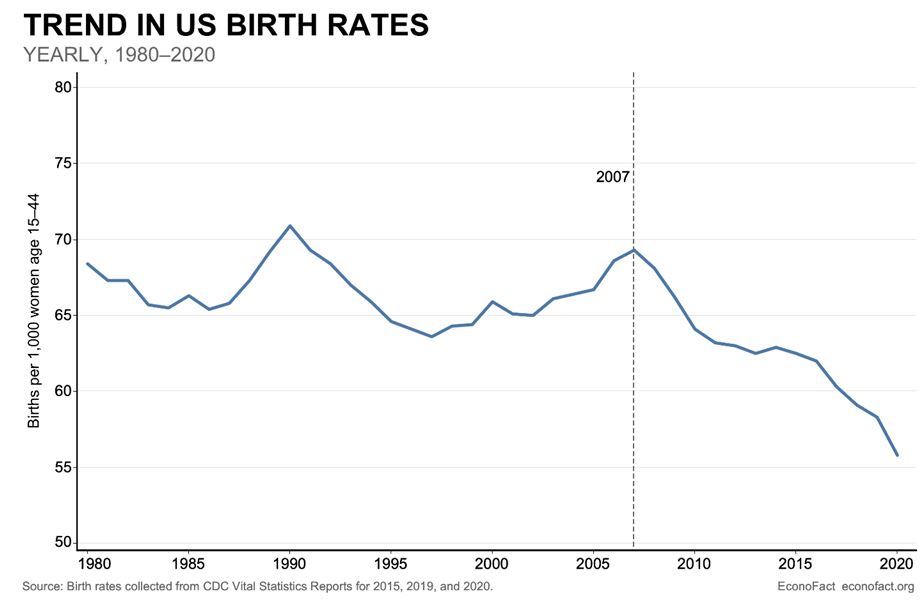

This “birth dearth’ began in earnest after the financial crisis of 2007-08, but most youngsters cite global warming and other “existential threats” as their motivation for not bringing children into this sad world.

Well, we had three children, born 1968-72, when Russia had nuclear weapons aimed at us, the Vietnam War was raging, thousands of domestic terrorists bombed buildings and other terrorists hijacked airplanes on a weekly basis. We suffered Watergate at home, campus and urban riots killing hundreds, China’s Cultural Revolution and Brezhnev’s Soviet empire-building on each continent – not to mention several discredited threats like the Population Bomb, energy shortages, global famine and a Coming Ice Age.

Yes, the world has always been dangerous, but that’s no reason not to bring new lives into the world. We humans provide solutions more than problems, as humans are our Ultimate Resource (Julian Simon).

The Whole World is Retreating from Procreation: What Does That Mean?

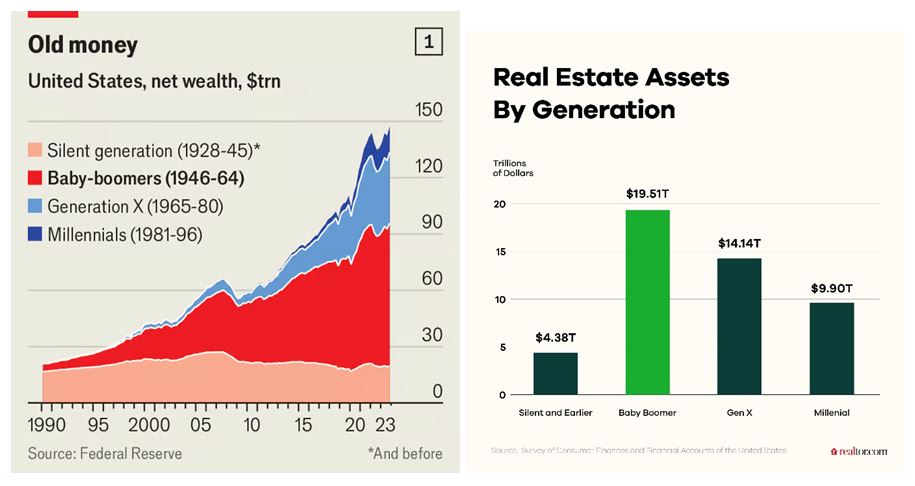

Having too many people to feed is a well-publicized risk, and fear, but having too few people creates a whole new set of problems – and perhaps a larger problem set than over-population. A lower birthrate causes workforce shortages, fewer customers for goods and services, and far fewer taxpayers, specifically those making regular FICA contributions to fund retirement. The young also tend to start businesses more often than older Americans, and they have more energy to fuel future economic growth, as millions retire.

Expressed in terms of births per woman, a level of 2.1 is the minimum level for population growth, after you account for infant mortality and other risks, but in April of this year, the Centers for Disease Control and Prevention (CDC) announced that the total U.S. fertility rate in 2024 was 1.6-children per woman, or when stretched to five digits: 1,626.5-births per 1,000-women, or about 23% below replacement value.

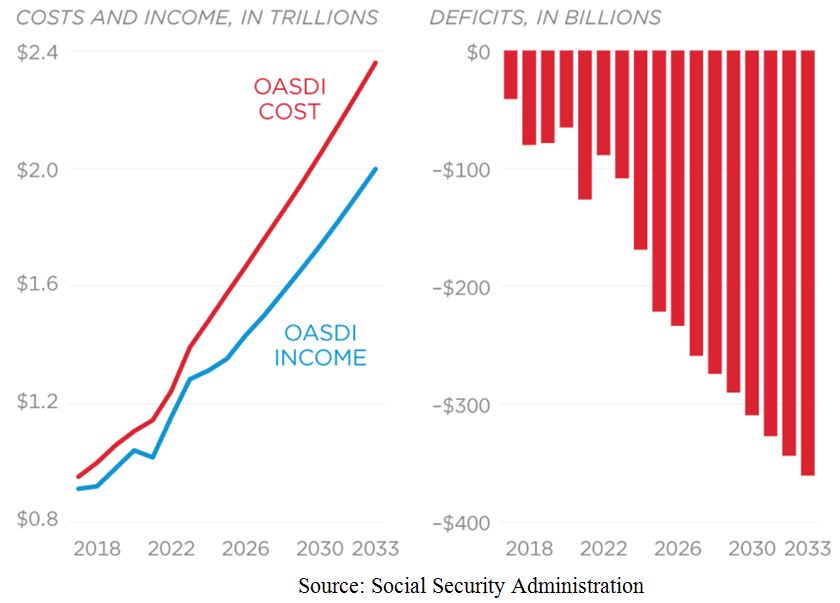

This refusal to procreate is a generational time bomb, set to explode within a decade or two. The Social Security Administration says they will be bankrupt within a decade, but they’re technically bankrupt now.

Many young workers don’t expect to collect Social Security, so they respond, “So What?” but nothing is set in stone. Their refusal to have children will cause the outcome they fear – lower (or no) benefits, and during the bulk of their working life, they will suffer higher “contribution” levels into that dying system.

How long will it take before workers revolt and refuse to pay their FICA deductions or – in a more practical, less dangerous move – choose to work off the books, where FICA won’t take 10% of their pay?

The accountants in DC call Social Security “Old-Age, Survivors and Disability Insurance” (OASDI), and the Social Security administration itself is very concerned about current and future deficit projections:

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Beyond the current birth dearth, there is now an oversupply of unfilled job positions and a rising aversion to work, or – more favorably expressed – the search for “work-life balance” in one’s younger years, a noble ambition, but slightly impractical when you don’t have many life skills that employers will value.

To generalize a bit, Baby Boomers (born 1946 to 1964) entered adulthood by rejecting everyone over 30, but they wised up (and got rich) after age 30. They, like their parents in the Greatest Generation, created a wave of kids in Generation X (born 1965-80) and Generation Y (or Millennials, born 1980-95), while Generation Z (born 1996-2012) is less interested in work, marriage and children than their parents were.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Three Books (and an article) Describing Conflicted Young Male Workers at a Crossroads

As I often do here, let me recommend three books which isolate the challenge, and a new solution:

- “Men Without Work” (2017, updated after COVID) by Nic Eberstadt, describes America’s “invisible crisis” of men shunning work. The work rate for American males aged 25-54 – their “prime working age” was lower in 2015 than in 1940, a time 17% unemployment as in the last year of the Great Depression. Today’s low jobless rate is mainly due to dropouts – those not seeking work. Today, Nic writes, nearly one in six prime working-age men has no paid work at all, and nearly one in eight is out of the labor force entirely, neither working nor looking for work, living in an Internet bubble at home.

- “Of Boys and Men: Why the Modern Male Is Struggling, Why It Matters, and What to Do About It,” by Richard Reeves (2024) is an overview of the rise of women and downfall of men in colleges and the labor force since the 1980s. Today, men represent only 42% of college students (age 18 to 24), down from 47% in 2011. Many have also rejected “dirty jobs,” according to Mike Rowe, so boys and men are subject to more “deaths of despair” (suicide and overdose), greater jobless rates and isolation.

- A solution is in “The Preparation,” released last week, authored by three generations of entrepreneurs: Doug Casey, age 79, along with a father-son team of Matt and Maxim Smith (age 20). The book’s teaser summarizes a better option than college and standard careers: “Skip the debt. Build the man. What if you could trade four stagnant years in lecture halls for four years of adventure—emerging as a debt‑free EMT, pilot, welder, web/app builder, rancher, and entrepreneur all in one? The Preparationis the field manual for young men (and parents who love them) who know the old college formula is broken and want a roadmap that forges competence, confidence, and value.”

As “The Preparation” demonstrates, there is something of a revolt against spending a fortune and four years in colleges, partying too much while hoping to advance your lifetime earnings potential with a voodoo math formula that no longer works (for most majors). Emil Barr wrote a great Op-Ed last week (August 19, 2025, Wall Street Journal), titled “’Work-Life Balance’ Will Keep You Mediocre.” In it, he describes the value of creating companies at a young age and seeking to become independently wealthy at 30, when you have all the options of work-life balance” you treasure for the rest of your life – but don’t fall victim to youthful debt and disillusion through a work-life balance offering little value to employers.

Most of the World Has the Same Problem – Only Worse

America has some pockets of high birth rates, often in the South and Mountain West, and we assimilate immigrants better than other nations, so there is hope, but we’re accepting fewer immigrants in the Trump era, so this may lower our worker base (along with taxes collected, businesses started, and wealth earned).

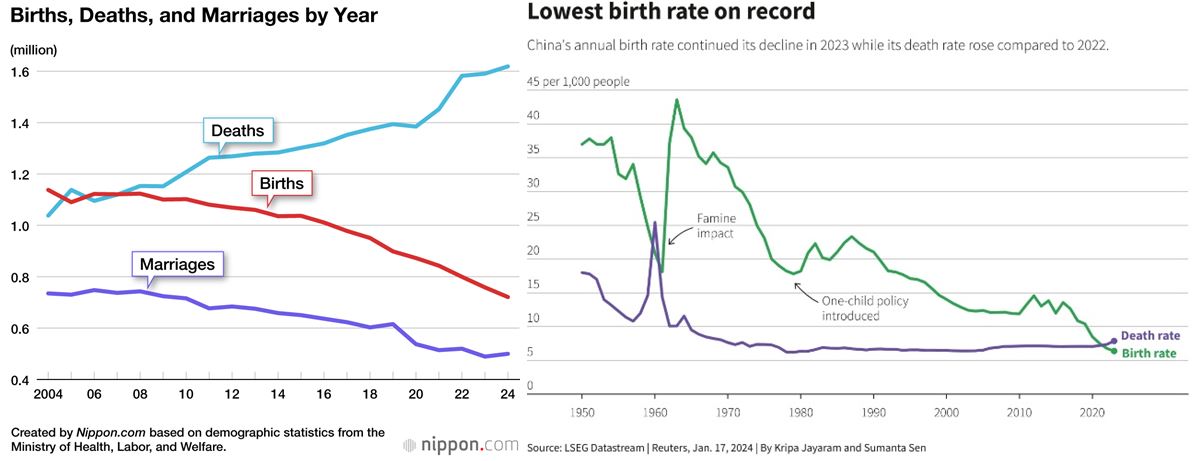

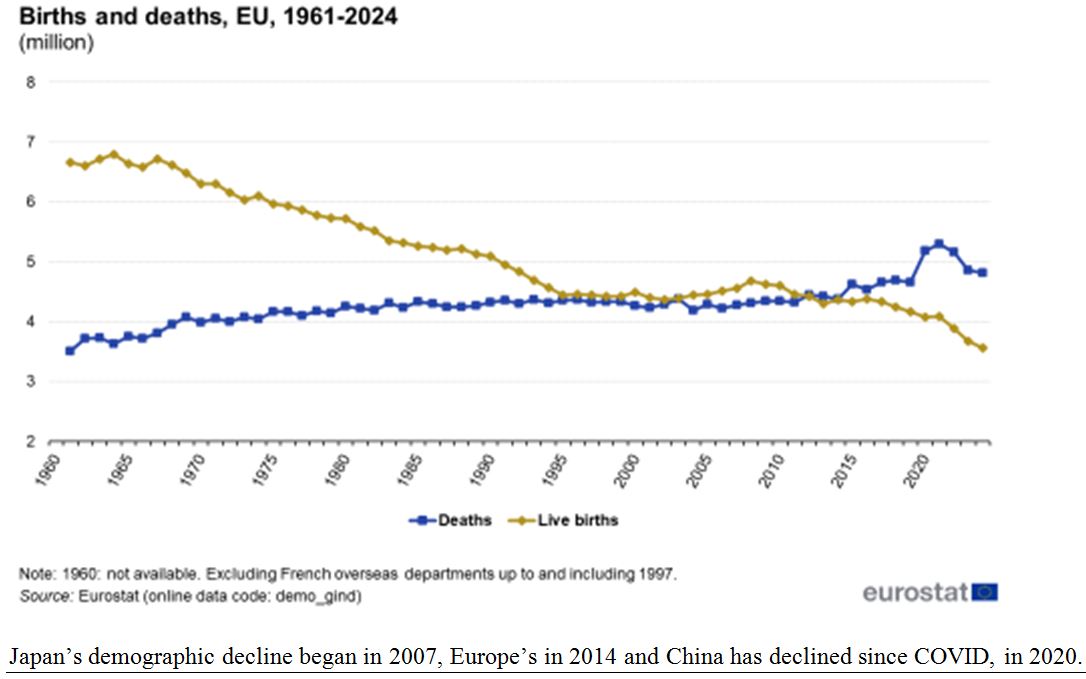

This is not just a problem in the U.S. and Canada, Europe and Asia are even worse off in the trend toward lower birth rates, and they have a larger slice of older citizens, who need health care and regular checks.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

This will have a significant impact on the world’s ability to keep working, while funding old-age benefits:

Maybe Zero Population Growth advocates will fund their own retirement from all the royalties of their doomsday books about an alleged “Population Bomb” coming in our lifetimes…but they’re still wrong.

All content above represents the opinion of Gary Alexander of Navellier & Associates, Inc.

Also In This Issue

A Look Ahead by Louis Navellier

Ukraine Talks Shift from Alaska to the White House

Income Mail by Bryan Perry

Gold is Set for More Gains, Based on “Weak Dollar” Misconceptions

Growth Mail by Gary Alexander

Labor Day Time Bomb: Fewer Births = Fewer Workers (and Lower Benefits)

Global Mail by Ivan Martchev

The S&P 500 Could Tag 6600 this Week

Sector Spotlight by Jason Bodner

The Market Finds Its Voice at Jackson Hole

View Full Archive

Read Past Issues Here

About The Author

Gary Alexander

SENIOR EDITOR

Gary Alexander has been Senior Writer at Navellier since 2009. He edits Navellier’s weekly Marketmail and writes a weekly Growth Mail column, in which he uses market history to support the case for growth stocks. For the previous 20-years before joining Navellier, he was Senior Executive Editor at InvestorPlace Media (formerly Phillips Publishing), where he worked with several leading investment analysts, including Louis Navellier (since 1997), helping launch Louis Navellier’s Blue Chip Growth and Global Growth newsletters.

Prior to that, Gary edited Wealth Magazine and Gold Newsletter and wrote various investment research reports for Jefferson Financial in New Orleans in the 1980s. He began his financial newsletter career with KCI Communications in 1980, where he served as consulting editor for Personal Finance newsletter while serving as general manager of KCI’s Alexandria House book division. Before that, he covered the economics beat for news magazines. All content of “Growth Mail” represents the opinion of Gary Alexander

Important Disclosures:

Although information in these reports has been obtained from and is based upon sources that Navellier believes to be reliable, Navellier does not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute Navellier’s judgment as of the date the report was created and are subject to change without notice. These reports are for informational purposes only and are not a solicitation for the purchase or sale of a security. Any decision to purchase securities mentioned in these reports must take into account existing public information on such securities or any registered prospectus.To the extent permitted by law, neither Navellier & Associates, Inc., nor any of its affiliates, agents, or service providers assumes any liability or responsibility nor owes any duty of care for any consequences of any person acting or refraining to act in reliance on the information contained in this communication or for any decision based on it.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any securities recommendations made by Navellier. in the future will be profitable or equal the performance of securities made in this report. Dividend payments are not guaranteed. The amount of a dividend payment, if any, can vary over time and issuers may reduce dividends paid on securities in the event of a recession or adverse event affecting a specific industry or issuer.

None of the stock information, data, and company information presented herein constitutes a recommendation by Navellier or a solicitation to buy or sell any securities. Any specific securities identified and described do not represent all of the securities purchased, sold, or recommended for advisory clients. The holdings identified do not represent all of the securities purchased, sold, or recommended for advisory clients and the reader should not assume that investments in the securities identified and discussed were or will be profitable.

Information presented is general information that does not take into account your individual circumstances, financial situation, or needs, nor does it present a personalized recommendation to you. Individual stocks presented may not be suitable for every investor. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. Investment in fixed income securities has the potential for the investment return and principal value of an investment to fluctuate so that an investor’s holdings, when redeemed, may be worth less than their original cost.

One cannot invest directly in an index. Index is unmanaged and index performance does not reflect deduction of fees, expenses, or taxes. Presentation of Index data does not reflect a belief by Navellier that any stock index constitutes an investment alternative to any Navellier equity strategy or is necessarily comparable to such strategies. Among the most important differences between the Indices and Navellier strategies are that the Navellier equity strategies may (1) incur material management fees, (2) concentrate its investments in relatively few stocks, industries, or sectors, (3) have significantly greater trading activity and related costs, and (4) be significantly more or less volatile than the Indices.

ETF Risk: We may invest in exchange traded funds (“ETFs”) and some of our investment strategies are generally fully invested in ETFs. Like traditional mutual funds, ETFs charge asset-based fees, but they generally do not charge initial sales charges or redemption fees and investors typically pay only customary brokerage fees to buy and sell ETF shares. The fees and costs charged by ETFs held in client accounts will not be deducted from the compensation the client pays Navellier. ETF prices can fluctuate up or down, and a client account could lose money investing in an ETF if the prices of the securities owned by the ETF go down. ETFs are subject to additional risks:

- ETF shares may trade above or below their net asset value;

- An active trading market for an ETF’s shares may not develop or be maintained;

- The value of an ETF may be more volatile than the underlying portfolio of securities the ETF is designed to track;

- The cost of owning shares of the ETF may exceed those a client would incur by directly investing in the underlying securities; and

- Trading of an ETF’s shares may be halted if the listing exchange’s officials deem it appropriate, the shares are delisted from the exchange, or the activation of market-wide “circuit breakers” (which are tied to large decreases in stock prices) halts stock trading generally.

Grader Disclosures: Investment in equity strategies involves substantial risk and has the potential for partial or complete loss of funds invested. The sample portfolio and any accompanying charts are for informational purposes only and are not to be construed as a solicitation to buy or sell any financial instrument and should not be relied upon as the sole factor in an investment making decision. As a matter of normal and important disclosures to you, as a potential investor, please consider the following: The performance presented is not based on any actual securities trading, portfolio, or accounts, and the reported performance of the A, B, C, D, and F portfolios (collectively the “model portfolios”) should be considered mere “paper” or pro forma performance results based on Navellier’s research.

Investors evaluating any of Navellier & Associates, Inc.’s, (or its affiliates’) Investment Products must not use any information presented here, including the performance figures of the model portfolios, in their evaluation of any Navellier Investment Products. Navellier Investment Products include the firm’s mutual funds and managed accounts. The model portfolios, charts, and other information presented do not represent actual funded trades and are not actual funded portfolios. There are material differences between Navellier Investment Products’ portfolios and the model portfolios, research, and performance figures presented here. The model portfolios and the research results (1) may contain stocks or ETFs that are illiquid and difficult to trade; (2) may contain stock or ETF holdings materially different from actual funded Navellier Investment Product portfolios; (3) include the reinvestment of all dividends and other earnings, estimated trading costs, commissions, or management fees; and, (4) may not reflect prices obtained in an actual funded Navellier Investment Product portfolio. For these and other reasons, the reported performances of model portfolios do not reflect the performance results of Navellier’s actually funded and traded Investment Products. In most cases, Navellier’s Investment Products have materially lower performance results than the performances of the model portfolios presented.

This report contains statements that are, or may be considered to be, forward-looking statements. All statements that are not historical facts, including statements about our beliefs or expectations, are “forward-looking statements” within the meaning of The U.S. Private Securities Litigation Reform Act of 1995. These statements may be identified by such forward-looking terminology as “expect,” “estimate,” “plan,” “intend,” “believe,” “anticipate,” “may,” “will,” “should,” “could,” “continue,” “project,” or similar statements or variations of such terms. Our forward-looking statements are based on a series of expectations, assumptions, and projections, are not guarantees of future results or performance, and involve substantial risks and uncertainty as described in Form ADV Part 2A of our filing with the Securities and Exchange Commission (SEC), which is available at www.adviserinfo.sec.gov or by requesting a copy by emailing info@navellier.com. All of our forward-looking statements are as of the date of this report only. We can give no assurance that such expectations or forward-looking statements will prove to be correct. Actual results may differ materially. You are urged to carefully consider all such factors.

FEDERAL TAX ADVICE DISCLAIMER: As required by U.S. Treasury Regulations, you are informed that, to the extent this presentation includes any federal tax advice, the presentation is not written by Navellier to be used, and cannot be used, for the purpose of avoiding federal tax penalties. Navellier does not advise on any income tax requirements or issues. Use of any information presented by Navellier is for general information only and does not represent tax advice either express or implied. You are encouraged to seek professional tax advice for income tax questions and assistance.

IMPORTANT NEWSLETTER DISCLOSURE:The hypothetical performance results for investment newsletters that are authored or edited by Louis Navellier, including Louis Navellier’s Growth Investor, Louis Navellier’s Breakthrough Stocks, Louis Navellier’s Accelerated Profits, and Louis Navellier’s Platinum Club, are not based on any actual securities trading, portfolio, or accounts, and the newsletters’ reported hypothetical performances should be considered mere “paper” or proforma hypothetical performance results and are not actual performance of real world trades. Navellier & Associates, Inc. does not have any relation to or affiliation with the owner of these newsletters. There are material differences between Navellier Investment Products’ portfolios and the InvestorPlace Media, LLC newsletter portfolios authored by Louis Navellier. The InvestorPlace Media, LLC newsletters contain hypothetical performance that do not include transaction costs, advisory fees, or other fees a client might incur if actual investments and trades were being made by an investor. As a result, newsletter performance should not be used to evaluate Navellier Investment services which are separate and different from the newsletters. The owner of the newsletters is InvestorPlace Media, LLC and any questions concerning the newsletters, including any newsletter advertising or hypothetical Newsletter performance claims, (which are calculated solely by Investor Place Media and not Navellier) should be referred to InvestorPlace Media, LLC at (800) 718-8289.

Please note that Navellier & Associates and the Navellier Private Client Group are managed completely independent of the newsletters owned and published by InvestorPlace Media, LLC and written and edited by Louis Navellier, and investment performance of the newsletters should in no way be considered indicative of potential future investment performance for any Navellier & Associates separately managed account portfolio. Potential investors should consult with their financial advisor before investing in any Navellier Investment Product.

Navellier claims compliance with Global Investment Performance Standards (GIPS). To receive a complete list and descriptions of Navellier’s composites and/or a presentation that adheres to the GIPS standards, please contact Navellier or click here. It should not be assumed that any securities recommendations made by Navellier & Associates, Inc. in the future will be profitable or equal the performance of securities made in this report.

FactSet Disclosure: Navellier does not independently calculate the statistical information included in the attached report. The calculation and the information are provided by FactSet, a company not related to Navellier. Although information contained in the report has been obtained from FactSet and is based on sources Navellier believes to be reliable, Navellier does not guarantee its accuracy, and it may be incomplete or condensed. The report and the related FactSet sourced information are provided on an “as is” basis. The user assumes the entire risk of any use made of this information. Investors should consider the report as only a single factor in making their investment decision. The report is for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of a security. FactSet sourced information is the exclusive property of FactSet. Without prior written permission of FactSet, this information may not be reproduced, disseminated or used to create any financial products. All indices are unmanaged and performance of the indices include reinvestment of dividends and interest income, unless otherwise noted, are not illustrative of any particular investment and an investment cannot be made in any index. Past performance is no guarantee of future results.