by Gary Alexander

July 22, 2025

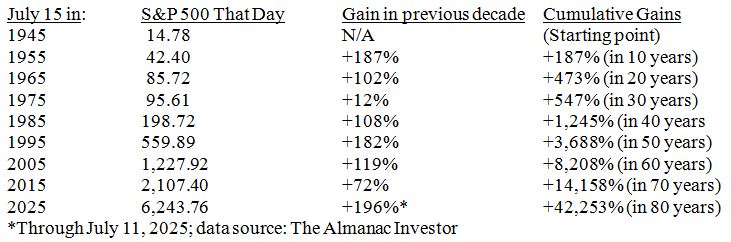

Last week, on my 80th birthday, I offered five investment lessons from the first half of my life, when the S&P rose 1,245%, but the market did much better in my second 40-years, up over 30-fold since I began to invest in stocks in the late 1980s. As this table shows, the S&P is up over 420-fold in my lifetime, not counting dividends or inflation, which tend to even out. Witness the benefits of a bullish outlook:

423-fold gains Since Mid-1945 (and 65-fold Gains Since 1975)

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Today, I’ll conclude with three more lessons from my 80-years – including 58-years of active research and writing about the markets – long before I was able to afford my first long-term investments in stocks.

Lesson #6: When the Bulls Run, There’s “Pamplona Power” on Wall Street

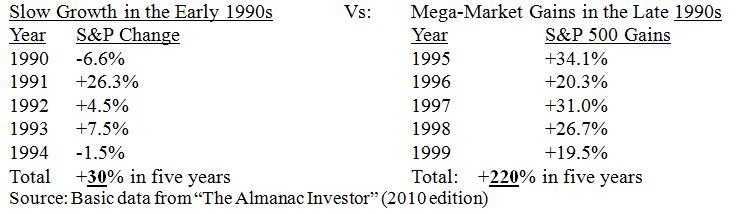

You never know when the market will rise or fall – or bore you to tears for years. From 1991 to 1995, the Dow did not make a move of 100 points on any single day for over four years, from November 15, 1991, through December 18, 1995. In four calendar years, 1992 to 1995, the Dow changed by 2% or more on only five of 1,000 (0.5%) of all trading days. Those markets seemed to be in a permanent siesta, but the market finally awoke to cash in on the “peace dividend” by hoovering up stocks in this Internet thing:

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

As I discussed last week, I never really got into the market until 1989, but I was “all in” in a committed way, then in ups and downs. The early 1990s torpor didn’t concern me. In 1995, my dad let me manage his retirement account – he was mostly in bonds and gold – and I switched to stocks (with help from my affiliation with some great advisors) and found some superb gainers for both my dad and our family.

Clinton’s second term was a bonanza for stocks – as I wrote in my March 11 column. After the 1994 Republican Revolution, stocks soared, as “Pamplona Power” prevailed, and El Toro Grande roared.

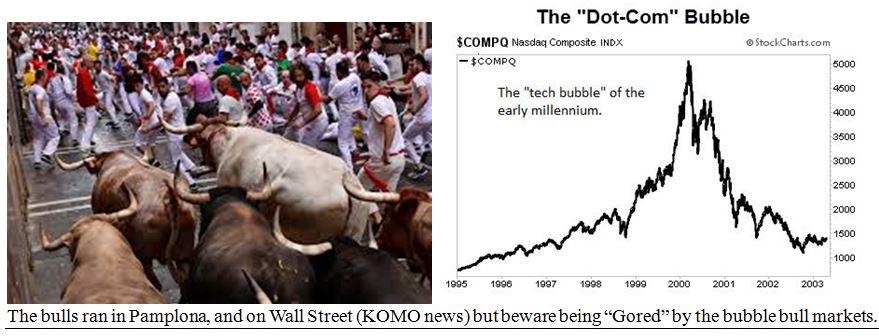

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

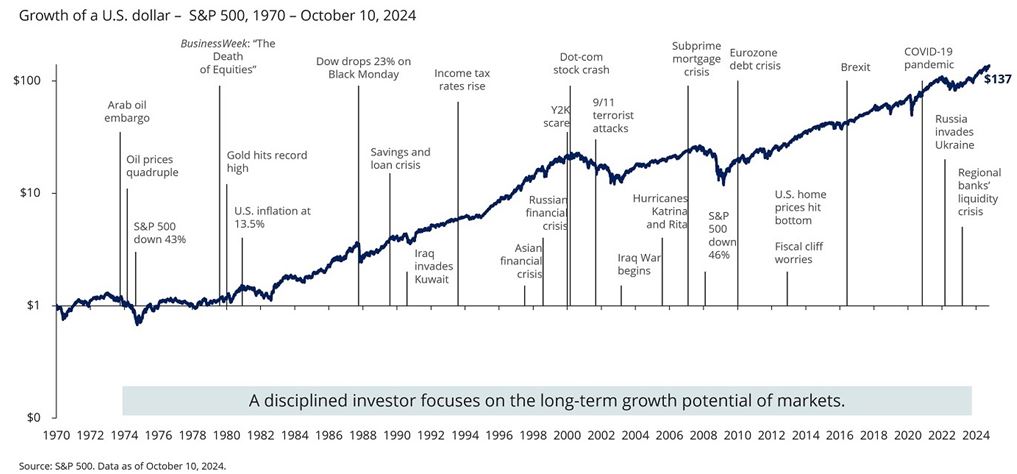

As the above chart shows, NASDAQ became a classic bubble, shooting up too far too fast, then falling to 5-year lows by early 2003. However, the more stable market indexes barely felt the blip of the flat 1970s and early 2000s, but longer-term (next chart), for each dollar invested in 1970, investors would now have about $140, although two long slumps from 1970 to 1982, and again from 2000 to 2009, seemed endless.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Lesson #7: Be Part of the Solution (not a constant complainer) – and Have Fun Doing It!

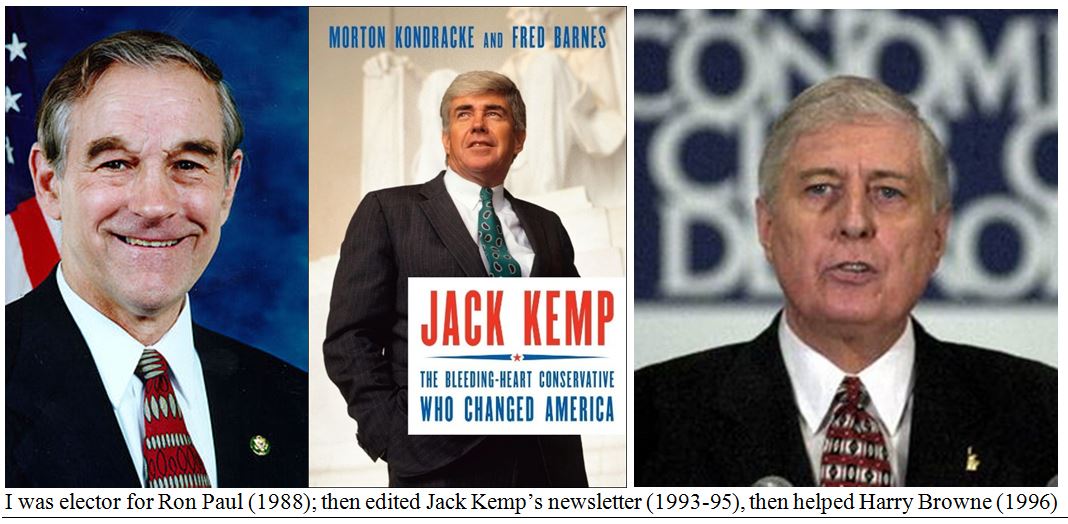

A second big lesson from the 1990s was that capitalism crushed communism, big time – a trend that became clear after the surprise fall of the Berlin Wall in late 1989 (fueled in part by the Chinese protests in Tiananmen Square the previous June). All my adult life, I was an activist for freedom – the freedom of investors to gain access to markets long denied them, and political freedom. Maybe I went too far as a tax protestor and Constitutional advocate in the late 1970s through the early Reagan era, but after the Berlin Wall crumbled, I wanted to be part of the solution, first by editing a newsletter authored by the “bleeding-heart conservative” from Buffalo, Jack Kemp (before he ran for Vice-President in 1996). Then, I served on the finance committee of Libertarian presidential candidate, Harry Browne, one of my favorite authors.

Harry Browne had been living quietly at home, writing while listening to operas and classical music and complaining about big government, until his wife finally said, “Why don’t you quit complaining and run for President? Be part of the solution.” So, Harry studied up his platform and became a very effective speaker for liberty. In his campaign, I was still complaining about the federal debt and big government, so Harry asked me the same question his wife asked him, and I ran for Virginia State Delegate in 1997. I knew (even hoped) I would lose to a 10-time Democratic Party incumbent, but the process was a thrill, a chance to face questions and audiences of all ages and stripes – from high schools to 3-way TV debates.

At the same time, I gained proximity to other politicians and their policies and noticed a wonderful trend of both Parties talking peacefully together to create real solutions. (Yes, that once happened!) To his credit, President Clinton admitted the mistakes of his first term and said, “The era of big government is over” and “we must end welfare as we know it,” and he did…both. He and Speaker Newt Gingrich with a strong Republican bench in Congress crafted tax cuts, spending cuts and pro-business packages which delivered four straight budget surpluses, 1997-2001, something that had not been done for over 80 years.

(I told this story in more detail in my March 11 column, if you want to review that unprecedented era).

The pay-off is that I was able to chair some fascinating political panels over the next quarter century, first at the New Orleans Investment Conference (NOIC). I give thanks to Brien Lundin, conference director there after the passing of conference founder Jim Blanchard at age 55 in early 1999. Our panelists were usually a top Republican (conservative), a top Democrat (liberal) and a Libertarian. I have many great memories from those debates, as we were always animated, respectful and focused on core principles.

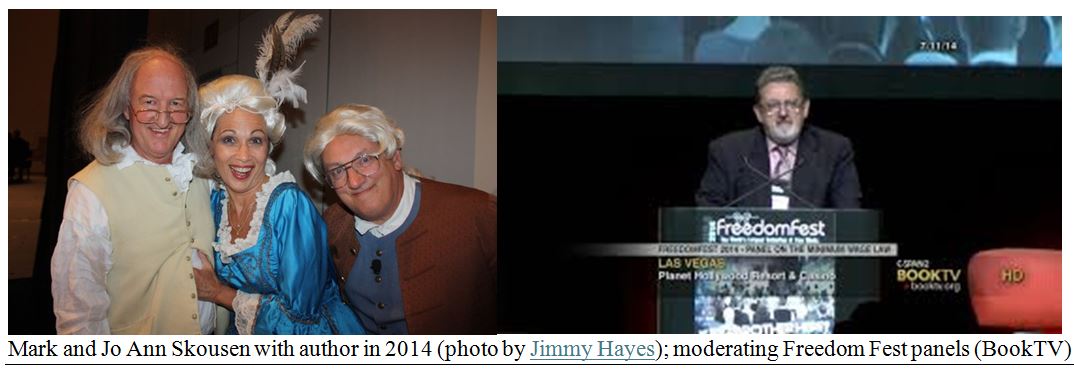

In parallel conferences, Mark and Jo Ann Skousen and I formed the “Freedom Fest Players” to bring American history alive, with stagings of selections from 1776, Camelot and the French Revolution with Franklin in Paris, with Mark as Ben Franklin, wife Jo Ann as Madame de Stael and me as John Adams:

Going beyond these historical events, I have always advocated citizens do their part to make this nation great, by helping those in need or starting a charity, not by relying on politicians of any stripe to do it all for them (“Ask not what your country can do for you, but what you can do for our country.” – JFK).

Lesson 8: “Know When to Hold ‘em, and When to Fold ‘em” – Kenny Rogers

Last year (2024) brought an end to my 45-year investment seminar career, as travel became too much of a hassle for these old bones. The 50th New Orleans conference was my 42nd and last, and the 2024 Freedom Fest was my last, too, but I learned a huge amount from nearly every speaker at both events, especially when I was on stage as moderator, asking tough questions to some of the sharpest minds in the business.

I’ll still go on writing, since that is second nature to me and the “perfect crime,” actually making money by sitting in my gorgeous island forest sharing my life of research with appreciative clients and investors.

As for any portfolio shifts, age 80 is the time to “grow it” while also “shrinking it,” through minimum annual distributions in our retirement accounts and yet still growing the portfolio by investing in growth stocks instead of the way octogenarians are supposed to behave, by clipping “bond coupons” for income.

So, perhaps this final lesson (#8) can morph into a rebuttal to a trio of typical investment shibboleths:

Lesson #8–Don’t mindlessly “invest your age,” especially if you know what you’re doing. Investment textbooks say you should subtract your age from 100 (that’s 20 for me) and only invest that much (20%) in stocks. The rest should be in bonds. Recently, I reluctantly upped my bond percentage to maybe 30%, but I refuse to go out to pasture. We didn’t see Warren Buffett or Charlie Munger slowing down after age 85. They kept investing in good stocks, in businesses they understood, rather than clip bond coupons.

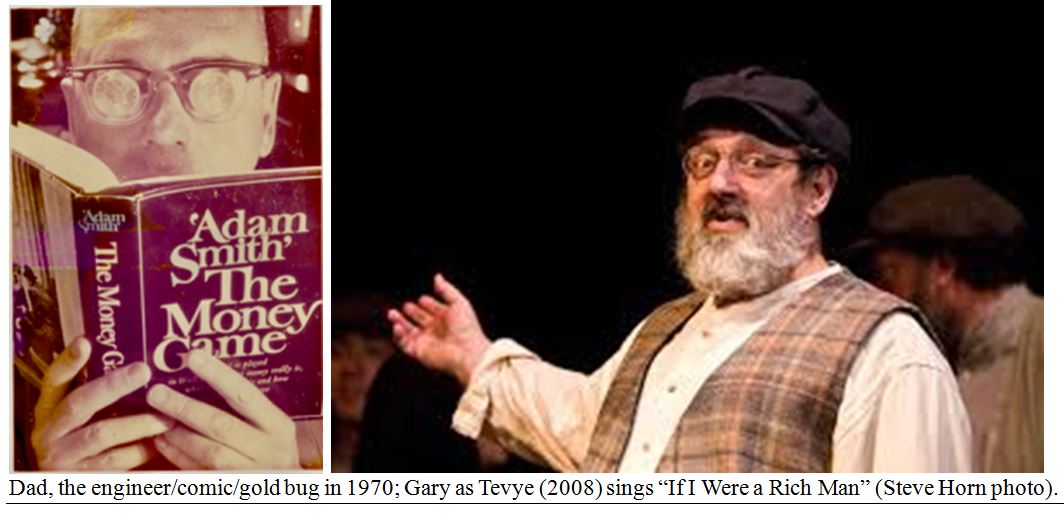

Consider the times more than your age. Would it make sense to be 75% in stocks in 1929, if you were then age 25? No way. Would it make sense for my dad to be 20% in stocks and 80% in bonds at age 80 in a bull market? No way, so I put him in some growth stocks and his portfolio soared in the late 1990s. My Depression-era dad, who nearly starved in the 1930s, died a millionaire with a beatific smile on his face.

Lesson #9–Don’t chase glamour stocks and fads. I won’t name names, but I like to invest in businesses I understand and can champion their cause. I don’t like a lot of speculations in the small-cap arena – nor most of the established mega-cap (multi-trillion-dollar) giant glamour stocks. In general, I invest in mid-cap stocks – the Goldilocks size, for me – not too big or too small, well-established but with room to grow.

Lesson #10–Forget market timing. We’re not that smart. Don’t “Sell in May and go away,” or “Sell in July and wonder why.” Keep riding winners while maybe taking 50% of profits in a stock that soared too far too fast. Keep studying markets and human behavior but don’t try to pinpoint market tops or bottoms. The reversal is too fast and too vicious. You can’t easily exit a bear market at a good price. Neither would I chase a bubble by buying more at nosebleed levels. Let your winners run – until you need the money.

The best advice I can end with is: Keep making money – so you can invest more. If work is fun, why not?

Happy and successful investing – and thank you for enduring clips from my family albums along the way.

As Edward R. Murrow ended his shows, “Good Night and Good Luck.”

All content above represents the opinion of Gary Alexander of Navellier & Associates, Inc.

Also In This Issue

A Look Ahead by Louis Navellier

Inflation Rates Remain Low, But the Fed Fears “Phantom Inflation”

Income Mail by Bryan Perry

An Eventful 10-Days Await Both Bulls and Bears

Growth Mail by Gary Alexander

More Investment Lessons after Nearly 60-Years in the Game (Part 2)

Global Mail by Ivan Martchev

Too Many Irons Remain in the Trade War Fire

Sector Spotlight by Jason Bodner

Making Time “Slow Down” in a Fast-Moving Market

View Full Archive

Read Past Issues Here

About The Author

Gary Alexander

SENIOR EDITOR

Gary Alexander has been Senior Writer at Navellier since 2009. He edits Navellier’s weekly Marketmail and writes a weekly Growth Mail column, in which he uses market history to support the case for growth stocks. For the previous 20-years before joining Navellier, he was Senior Executive Editor at InvestorPlace Media (formerly Phillips Publishing), where he worked with several leading investment analysts, including Louis Navellier (since 1997), helping launch Louis Navellier’s Blue Chip Growth and Global Growth newsletters.

Prior to that, Gary edited Wealth Magazine and Gold Newsletter and wrote various investment research reports for Jefferson Financial in New Orleans in the 1980s. He began his financial newsletter career with KCI Communications in 1980, where he served as consulting editor for Personal Finance newsletter while serving as general manager of KCI’s Alexandria House book division. Before that, he covered the economics beat for news magazines. All content of “Growth Mail” represents the opinion of Gary Alexander

Important Disclosures:

Although information in these reports has been obtained from and is based upon sources that Navellier believes to be reliable, Navellier does not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute Navellier’s judgment as of the date the report was created and are subject to change without notice. These reports are for informational purposes only and are not a solicitation for the purchase or sale of a security. Any decision to purchase securities mentioned in these reports must take into account existing public information on such securities or any registered prospectus.To the extent permitted by law, neither Navellier & Associates, Inc., nor any of its affiliates, agents, or service providers assumes any liability or responsibility nor owes any duty of care for any consequences of any person acting or refraining to act in reliance on the information contained in this communication or for any decision based on it.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any securities recommendations made by Navellier. in the future will be profitable or equal the performance of securities made in this report. Dividend payments are not guaranteed. The amount of a dividend payment, if any, can vary over time and issuers may reduce dividends paid on securities in the event of a recession or adverse event affecting a specific industry or issuer.

None of the stock information, data, and company information presented herein constitutes a recommendation by Navellier or a solicitation to buy or sell any securities. Any specific securities identified and described do not represent all of the securities purchased, sold, or recommended for advisory clients. The holdings identified do not represent all of the securities purchased, sold, or recommended for advisory clients and the reader should not assume that investments in the securities identified and discussed were or will be profitable.

Information presented is general information that does not take into account your individual circumstances, financial situation, or needs, nor does it present a personalized recommendation to you. Individual stocks presented may not be suitable for every investor. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. Investment in fixed income securities has the potential for the investment return and principal value of an investment to fluctuate so that an investor’s holdings, when redeemed, may be worth less than their original cost.

One cannot invest directly in an index. Index is unmanaged and index performance does not reflect deduction of fees, expenses, or taxes. Presentation of Index data does not reflect a belief by Navellier that any stock index constitutes an investment alternative to any Navellier equity strategy or is necessarily comparable to such strategies. Among the most important differences between the Indices and Navellier strategies are that the Navellier equity strategies may (1) incur material management fees, (2) concentrate its investments in relatively few stocks, industries, or sectors, (3) have significantly greater trading activity and related costs, and (4) be significantly more or less volatile than the Indices.

ETF Risk: We may invest in exchange traded funds (“ETFs”) and some of our investment strategies are generally fully invested in ETFs. Like traditional mutual funds, ETFs charge asset-based fees, but they generally do not charge initial sales charges or redemption fees and investors typically pay only customary brokerage fees to buy and sell ETF shares. The fees and costs charged by ETFs held in client accounts will not be deducted from the compensation the client pays Navellier. ETF prices can fluctuate up or down, and a client account could lose money investing in an ETF if the prices of the securities owned by the ETF go down. ETFs are subject to additional risks:

- ETF shares may trade above or below their net asset value;

- An active trading market for an ETF’s shares may not develop or be maintained;

- The value of an ETF may be more volatile than the underlying portfolio of securities the ETF is designed to track;

- The cost of owning shares of the ETF may exceed those a client would incur by directly investing in the underlying securities; and

- Trading of an ETF’s shares may be halted if the listing exchange’s officials deem it appropriate, the shares are delisted from the exchange, or the activation of market-wide “circuit breakers” (which are tied to large decreases in stock prices) halts stock trading generally.

Grader Disclosures: Investment in equity strategies involves substantial risk and has the potential for partial or complete loss of funds invested. The sample portfolio and any accompanying charts are for informational purposes only and are not to be construed as a solicitation to buy or sell any financial instrument and should not be relied upon as the sole factor in an investment making decision. As a matter of normal and important disclosures to you, as a potential investor, please consider the following: The performance presented is not based on any actual securities trading, portfolio, or accounts, and the reported performance of the A, B, C, D, and F portfolios (collectively the “model portfolios”) should be considered mere “paper” or pro forma performance results based on Navellier’s research.

Investors evaluating any of Navellier & Associates, Inc.’s, (or its affiliates’) Investment Products must not use any information presented here, including the performance figures of the model portfolios, in their evaluation of any Navellier Investment Products. Navellier Investment Products include the firm’s mutual funds and managed accounts. The model portfolios, charts, and other information presented do not represent actual funded trades and are not actual funded portfolios. There are material differences between Navellier Investment Products’ portfolios and the model portfolios, research, and performance figures presented here. The model portfolios and the research results (1) may contain stocks or ETFs that are illiquid and difficult to trade; (2) may contain stock or ETF holdings materially different from actual funded Navellier Investment Product portfolios; (3) include the reinvestment of all dividends and other earnings, estimated trading costs, commissions, or management fees; and, (4) may not reflect prices obtained in an actual funded Navellier Investment Product portfolio. For these and other reasons, the reported performances of model portfolios do not reflect the performance results of Navellier’s actually funded and traded Investment Products. In most cases, Navellier’s Investment Products have materially lower performance results than the performances of the model portfolios presented.

This report contains statements that are, or may be considered to be, forward-looking statements. All statements that are not historical facts, including statements about our beliefs or expectations, are “forward-looking statements” within the meaning of The U.S. Private Securities Litigation Reform Act of 1995. These statements may be identified by such forward-looking terminology as “expect,” “estimate,” “plan,” “intend,” “believe,” “anticipate,” “may,” “will,” “should,” “could,” “continue,” “project,” or similar statements or variations of such terms. Our forward-looking statements are based on a series of expectations, assumptions, and projections, are not guarantees of future results or performance, and involve substantial risks and uncertainty as described in Form ADV Part 2A of our filing with the Securities and Exchange Commission (SEC), which is available at www.adviserinfo.sec.gov or by requesting a copy by emailing info@navellier.com. All of our forward-looking statements are as of the date of this report only. We can give no assurance that such expectations or forward-looking statements will prove to be correct. Actual results may differ materially. You are urged to carefully consider all such factors.

FEDERAL TAX ADVICE DISCLAIMER: As required by U.S. Treasury Regulations, you are informed that, to the extent this presentation includes any federal tax advice, the presentation is not written by Navellier to be used, and cannot be used, for the purpose of avoiding federal tax penalties. Navellier does not advise on any income tax requirements or issues. Use of any information presented by Navellier is for general information only and does not represent tax advice either express or implied. You are encouraged to seek professional tax advice for income tax questions and assistance.

IMPORTANT NEWSLETTER DISCLOSURE:The hypothetical performance results for investment newsletters that are authored or edited by Louis Navellier, including Louis Navellier’s Growth Investor, Louis Navellier’s Breakthrough Stocks, Louis Navellier’s Accelerated Profits, and Louis Navellier’s Platinum Club, are not based on any actual securities trading, portfolio, or accounts, and the newsletters’ reported hypothetical performances should be considered mere “paper” or proforma hypothetical performance results and are not actual performance of real world trades. Navellier & Associates, Inc. does not have any relation to or affiliation with the owner of these newsletters. There are material differences between Navellier Investment Products’ portfolios and the InvestorPlace Media, LLC newsletter portfolios authored by Louis Navellier. The InvestorPlace Media, LLC newsletters contain hypothetical performance that do not include transaction costs, advisory fees, or other fees a client might incur if actual investments and trades were being made by an investor. As a result, newsletter performance should not be used to evaluate Navellier Investment services which are separate and different from the newsletters. The owner of the newsletters is InvestorPlace Media, LLC and any questions concerning the newsletters, including any newsletter advertising or hypothetical Newsletter performance claims, (which are calculated solely by Investor Place Media and not Navellier) should be referred to InvestorPlace Media, LLC at (800) 718-8289.

Please note that Navellier & Associates and the Navellier Private Client Group are managed completely independent of the newsletters owned and published by InvestorPlace Media, LLC and written and edited by Louis Navellier, and investment performance of the newsletters should in no way be considered indicative of potential future investment performance for any Navellier & Associates separately managed account portfolio. Potential investors should consult with their financial advisor before investing in any Navellier Investment Product.

Navellier claims compliance with Global Investment Performance Standards (GIPS). To receive a complete list and descriptions of Navellier’s composites and/or a presentation that adheres to the GIPS standards, please contact Navellier or click here. It should not be assumed that any securities recommendations made by Navellier & Associates, Inc. in the future will be profitable or equal the performance of securities made in this report.

FactSet Disclosure: Navellier does not independently calculate the statistical information included in the attached report. The calculation and the information are provided by FactSet, a company not related to Navellier. Although information contained in the report has been obtained from FactSet and is based on sources Navellier believes to be reliable, Navellier does not guarantee its accuracy, and it may be incomplete or condensed. The report and the related FactSet sourced information are provided on an “as is” basis. The user assumes the entire risk of any use made of this information. Investors should consider the report as only a single factor in making their investment decision. The report is for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of a security. FactSet sourced information is the exclusive property of FactSet. Without prior written permission of FactSet, this information may not be reproduced, disseminated or used to create any financial products. All indices are unmanaged and performance of the indices include reinvestment of dividends and interest income, unless otherwise noted, are not illustrative of any particular investment and an investment cannot be made in any index. Past performance is no guarantee of future results.