by Gary Alexander

July 8, 2025

On July 6, 1785 – 240-years ago this week – the Continental Congress authorized the issuance of the first U.S. dollar, to replace the Spanish “pieces of 8” then in circulation. Why call it a dollar? That word comes from the German, a sort of slang version of the High German term Thaler, which effectively means “a valley person” (a “Thal” is a valley). The Joachimsthaler was a large silver coin first minted in the town of Joachimsthal, Bohemia, in 1519. These “dollars” were traded by many Germanic immigrants.

The U.S. dollar was not intended to be printed, but to be minted, as the silver dollar was officially defined as 371-1/4-grains of pure silver, based on the average weight of the old and worn Spanish ‘dollars’ (pieces of eight). America had learned its lesson with inflated paper, so the Constitution decreed that nothing but gold or silver should be used as a tender of exchange by States or the nation as a whole.

This system was instituted in detail in the 1792 Coinage Act, crafted by Alexander Hamilton, our first Treasury Secretary. The Act also called for the first Mint in Philadelphia, the U.S. Capitol in the 1790s.

Gold dollar coins were first denominated as Eagles—an Eagle being $10, containing 247-1/2-grains of pure gold, or 270-grains of standard 22-carat gold (0.9167 purity). Half-Eagles cut those numbers in half and were worth $5. Quarter-Eagles—worth $2.50 – cut the $10-gold content by 75%. Double Eagles ($20-coins) were launched in 1849, in response to the rapid inflow of gold bullion during the 1849 Gold Rush.

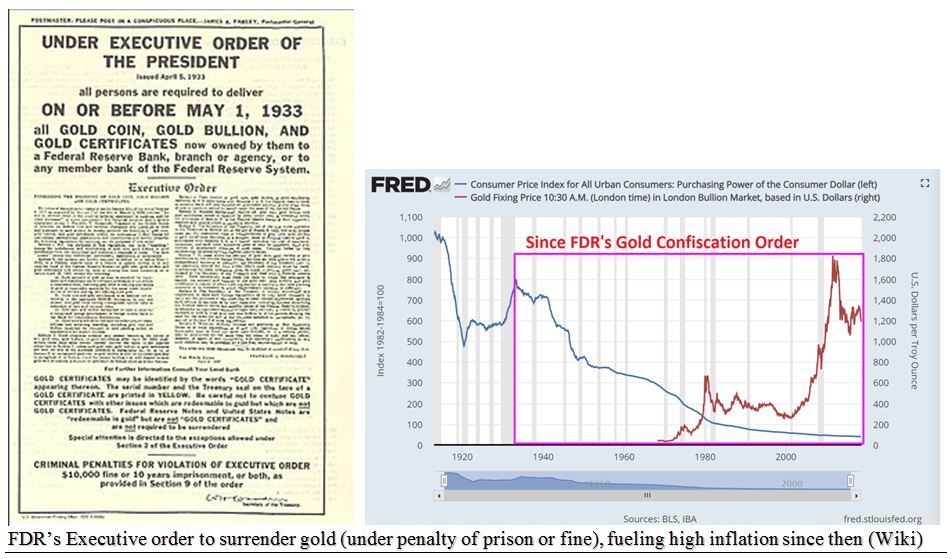

There was little peacetime inflation during the 120-years from the 1792 Coinage Act to the birth of the Federal Reserve in 1913, and no net inflation for another 20-years to 1933, when new President Franklin D. Roosevelt first launched a bank holiday and then an Executive Order to surrender all gold by May 1, at the price fixed in 1785 and 1792, equivalent to $20.67 per-ounce. He then revalued gold to $35 per-ounce.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

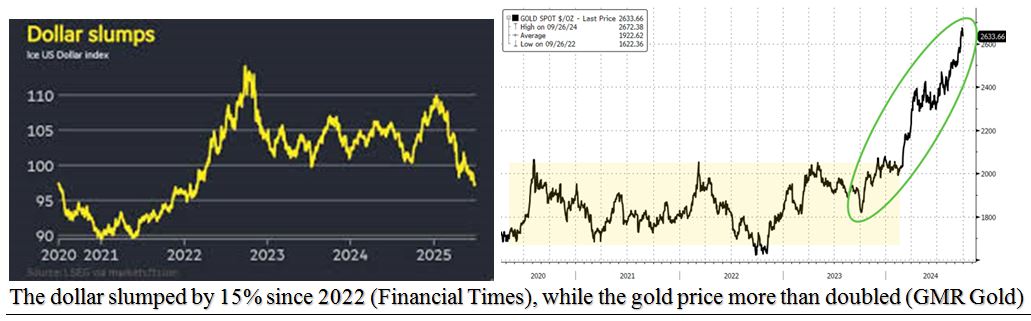

Moving up to modern times, most investors and pundits compare the Dollar to other currencies, not gold. In that “race to the bottom,” the Dollar celebrated its 240th birthday by losing 12% in the last six-months.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

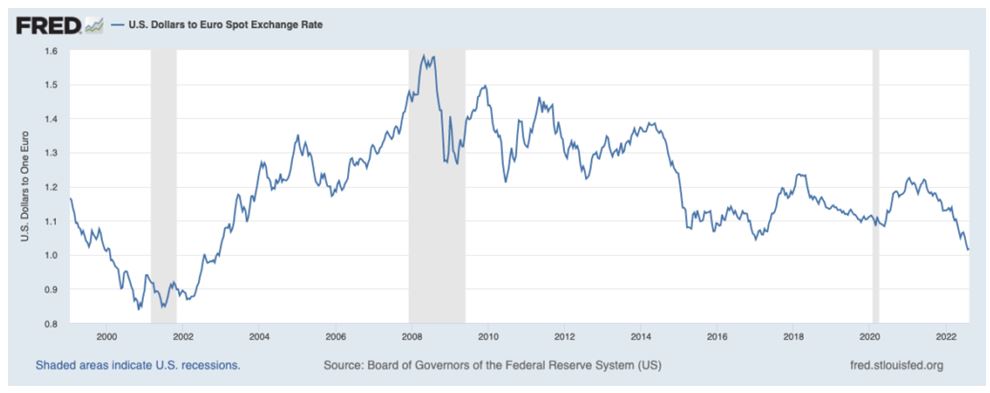

The U.S. Dollar Index (DXY) fell from a peak of 110 on January 13, 2025, to under 97 last week. The U.S. Dollar is heavily weighted (57%) in the euro, so let’s see how the dollar has fared in euro terms.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

The euro was born on January 1, 1999, at a set price (like an IPO, or initial public offering) of $1.18. The investment world did not take kindly to this IPO, as the euro sank to $0.85 (-28%) by year-end 2000. However, the euro then soared to $1.60 during the 2008 Financial Crisis, a gain of 88%. After 2009, it soon became clear that Europe was hit harder by that 2008 financial crisis than the U.S. – with continuing funding crises in their Mediterranean PIGS (Portugal, Italy, Greece and Spain), so the euro began sinking.

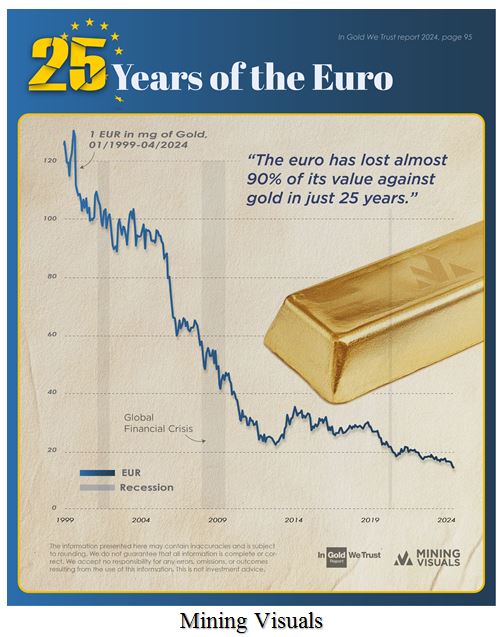

During those same years in which the euro and the dollar were fighting to a virtual tie, the price of gold increased about 14-fold, from barely $250 per-ounce in 1999 through 2001, to nearly $3,500 now. The same has happened in euro terms, since paper follows paper, and gold crushes all paper in time.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

In the last six-months, a fear of tariffs and other major policy shifts has pushed the euro back up to its IPO rate of $1.18. (The euro has risen from $1.02 on January 13, 2025, to its current $1.18, up nearly 16%). Going back further, the euro traded below the dollar ($0.96 in late 2022), so it is up 23% in 33-months.

Does it matter? That is the $64-trillion question. In comparing paper to paper, it doesn’t matter much. The euro and dollar will continue this waltz around zero net change, but gold tells us that failing paper of all colors is concerning. That’s why the 1787 Constitution and 1792 Coinage Act mandated gold and silver.

Want More History? Conflicting Edicts (An Olive Branch and a Call to Arms)

Were Issued on Successive Days 250-years ago This Week

A quarter millennium ago*, after the 13-Colonies started fighting their British overlords, the ever-waffling Continental Congress got cold feet one day (July 5, 1775), sending an Olive Branch across the pond to King George III, then (in a 180-degree turn) they drafted a resolution titled “the Declaration of the Causes and Necessity of Taking Up Arms” on the very next day. That treatise was sort of a “rough draft” of the 1776 Declaration, which consisted mostly of a list of reasons why we should have “No King” here.

*A centennial is 100-years, a sesquicentennial is 150-years, and our nation’s 200th birthday was a glorious bicentennial in 1976. So, what do you call a 250% birthday? According to the savants who draft “AI” responses, the proper word is semi-quincentennial, or “half of 500” (quin=5) years. That’s not going to gain traction, my fellow Americans. It fails to trip off the tongue. How ‘bout a “Quarter-Millennial” gala?

This 1775 Declaration, like the one to come, was written primarily by Thomas Jefferson. Meanwhile, the Olive Branch was ignored by the Crown, so the colonies continued to take up arms in battle during 1775.

The July call to arms was the sort of red meat the street protestors ate up, so why did Congress also send King George an Olive Branch Petition, which restated our loyalty to Britain and wished King George III a long reign and healthy life? It sounds more like a desperate “Hail Mary pass” to avoid losing a costly war.

The musical version of “Hamilton” explains some of the understandable fear of losing to mighty Britain:

How does a ragtag volunteer army in need of a shower

Somehow defeat a global superpower?

How do we emerge victorious from the quagmire?

Leave the battlefield, waving Betsy Ross’ flag higher?

–Lin-Manuel Miranda, in “Hamilton”

Long after “Hamilton” celebrated the Betsy Ross flag (below), that flag became controversial. In 2019, a major shoe company canceled the release of a sneaker featuring the Betsy Ross flag after former NFL player Colin Kaepernick raised concerns about its 13-stars representing a time of slavery. But such critics may need to crack a book. Betsy Ross was a Quaker who opposed slavery, so let’s celebrate her flag!

All content above represents the opinion of Gary Alexander of Navellier & Associates, Inc.

Also In This Issue

A Look Ahead by Louis Navellier

Which is Right? The Downbeat ADP Jobs Report or Friday’s Bullish Report?

Income Mail by Bryan Perry

Bond Equivalents Should Shine in the Second Half Of 2025

Growth Mail by Gary Alexander

Where is the U.S. Dollar Headed? – And Does it Matter?

Global Mail by Ivan Martchev

The S&P Is Flying High, Like Icarus

Sector Spotlight by Jason Bodner

How Overbought is this Market? (And Does it Matter?)

View Full Archive

Read Past Issues Here

About The Author

Gary Alexander

SENIOR EDITOR

Gary Alexander has been Senior Writer at Navellier since 2009. He edits Navellier’s weekly Marketmail and writes a weekly Growth Mail column, in which he uses market history to support the case for growth stocks. For the previous 20-years before joining Navellier, he was Senior Executive Editor at InvestorPlace Media (formerly Phillips Publishing), where he worked with several leading investment analysts, including Louis Navellier (since 1997), helping launch Louis Navellier’s Blue Chip Growth and Global Growth newsletters.

Prior to that, Gary edited Wealth Magazine and Gold Newsletter and wrote various investment research reports for Jefferson Financial in New Orleans in the 1980s. He began his financial newsletter career with KCI Communications in 1980, where he served as consulting editor for Personal Finance newsletter while serving as general manager of KCI’s Alexandria House book division. Before that, he covered the economics beat for news magazines. All content of “Growth Mail” represents the opinion of Gary Alexander

Important Disclosures:

Although information in these reports has been obtained from and is based upon sources that Navellier believes to be reliable, Navellier does not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute Navellier’s judgment as of the date the report was created and are subject to change without notice. These reports are for informational purposes only and are not a solicitation for the purchase or sale of a security. Any decision to purchase securities mentioned in these reports must take into account existing public information on such securities or any registered prospectus.To the extent permitted by law, neither Navellier & Associates, Inc., nor any of its affiliates, agents, or service providers assumes any liability or responsibility nor owes any duty of care for any consequences of any person acting or refraining to act in reliance on the information contained in this communication or for any decision based on it.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any securities recommendations made by Navellier. in the future will be profitable or equal the performance of securities made in this report. Dividend payments are not guaranteed. The amount of a dividend payment, if any, can vary over time and issuers may reduce dividends paid on securities in the event of a recession or adverse event affecting a specific industry or issuer.

None of the stock information, data, and company information presented herein constitutes a recommendation by Navellier or a solicitation to buy or sell any securities. Any specific securities identified and described do not represent all of the securities purchased, sold, or recommended for advisory clients. The holdings identified do not represent all of the securities purchased, sold, or recommended for advisory clients and the reader should not assume that investments in the securities identified and discussed were or will be profitable.

Information presented is general information that does not take into account your individual circumstances, financial situation, or needs, nor does it present a personalized recommendation to you. Individual stocks presented may not be suitable for every investor. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. Investment in fixed income securities has the potential for the investment return and principal value of an investment to fluctuate so that an investor’s holdings, when redeemed, may be worth less than their original cost.

One cannot invest directly in an index. Index is unmanaged and index performance does not reflect deduction of fees, expenses, or taxes. Presentation of Index data does not reflect a belief by Navellier that any stock index constitutes an investment alternative to any Navellier equity strategy or is necessarily comparable to such strategies. Among the most important differences between the Indices and Navellier strategies are that the Navellier equity strategies may (1) incur material management fees, (2) concentrate its investments in relatively few stocks, industries, or sectors, (3) have significantly greater trading activity and related costs, and (4) be significantly more or less volatile than the Indices.

ETF Risk: We may invest in exchange traded funds (“ETFs”) and some of our investment strategies are generally fully invested in ETFs. Like traditional mutual funds, ETFs charge asset-based fees, but they generally do not charge initial sales charges or redemption fees and investors typically pay only customary brokerage fees to buy and sell ETF shares. The fees and costs charged by ETFs held in client accounts will not be deducted from the compensation the client pays Navellier. ETF prices can fluctuate up or down, and a client account could lose money investing in an ETF if the prices of the securities owned by the ETF go down. ETFs are subject to additional risks:

- ETF shares may trade above or below their net asset value;

- An active trading market for an ETF’s shares may not develop or be maintained;

- The value of an ETF may be more volatile than the underlying portfolio of securities the ETF is designed to track;

- The cost of owning shares of the ETF may exceed those a client would incur by directly investing in the underlying securities; and

- Trading of an ETF’s shares may be halted if the listing exchange’s officials deem it appropriate, the shares are delisted from the exchange, or the activation of market-wide “circuit breakers” (which are tied to large decreases in stock prices) halts stock trading generally.

Grader Disclosures: Investment in equity strategies involves substantial risk and has the potential for partial or complete loss of funds invested. The sample portfolio and any accompanying charts are for informational purposes only and are not to be construed as a solicitation to buy or sell any financial instrument and should not be relied upon as the sole factor in an investment making decision. As a matter of normal and important disclosures to you, as a potential investor, please consider the following: The performance presented is not based on any actual securities trading, portfolio, or accounts, and the reported performance of the A, B, C, D, and F portfolios (collectively the “model portfolios”) should be considered mere “paper” or pro forma performance results based on Navellier’s research.

Investors evaluating any of Navellier & Associates, Inc.’s, (or its affiliates’) Investment Products must not use any information presented here, including the performance figures of the model portfolios, in their evaluation of any Navellier Investment Products. Navellier Investment Products include the firm’s mutual funds and managed accounts. The model portfolios, charts, and other information presented do not represent actual funded trades and are not actual funded portfolios. There are material differences between Navellier Investment Products’ portfolios and the model portfolios, research, and performance figures presented here. The model portfolios and the research results (1) may contain stocks or ETFs that are illiquid and difficult to trade; (2) may contain stock or ETF holdings materially different from actual funded Navellier Investment Product portfolios; (3) include the reinvestment of all dividends and other earnings, estimated trading costs, commissions, or management fees; and, (4) may not reflect prices obtained in an actual funded Navellier Investment Product portfolio. For these and other reasons, the reported performances of model portfolios do not reflect the performance results of Navellier’s actually funded and traded Investment Products. In most cases, Navellier’s Investment Products have materially lower performance results than the performances of the model portfolios presented.

This report contains statements that are, or may be considered to be, forward-looking statements. All statements that are not historical facts, including statements about our beliefs or expectations, are “forward-looking statements” within the meaning of The U.S. Private Securities Litigation Reform Act of 1995. These statements may be identified by such forward-looking terminology as “expect,” “estimate,” “plan,” “intend,” “believe,” “anticipate,” “may,” “will,” “should,” “could,” “continue,” “project,” or similar statements or variations of such terms. Our forward-looking statements are based on a series of expectations, assumptions, and projections, are not guarantees of future results or performance, and involve substantial risks and uncertainty as described in Form ADV Part 2A of our filing with the Securities and Exchange Commission (SEC), which is available at www.adviserinfo.sec.gov or by requesting a copy by emailing info@navellier.com. All of our forward-looking statements are as of the date of this report only. We can give no assurance that such expectations or forward-looking statements will prove to be correct. Actual results may differ materially. You are urged to carefully consider all such factors.

FEDERAL TAX ADVICE DISCLAIMER: As required by U.S. Treasury Regulations, you are informed that, to the extent this presentation includes any federal tax advice, the presentation is not written by Navellier to be used, and cannot be used, for the purpose of avoiding federal tax penalties. Navellier does not advise on any income tax requirements or issues. Use of any information presented by Navellier is for general information only and does not represent tax advice either express or implied. You are encouraged to seek professional tax advice for income tax questions and assistance.

IMPORTANT NEWSLETTER DISCLOSURE:The hypothetical performance results for investment newsletters that are authored or edited by Louis Navellier, including Louis Navellier’s Growth Investor, Louis Navellier’s Breakthrough Stocks, Louis Navellier’s Accelerated Profits, and Louis Navellier’s Platinum Club, are not based on any actual securities trading, portfolio, or accounts, and the newsletters’ reported hypothetical performances should be considered mere “paper” or proforma hypothetical performance results and are not actual performance of real world trades. Navellier & Associates, Inc. does not have any relation to or affiliation with the owner of these newsletters. There are material differences between Navellier Investment Products’ portfolios and the InvestorPlace Media, LLC newsletter portfolios authored by Louis Navellier. The InvestorPlace Media, LLC newsletters contain hypothetical performance that do not include transaction costs, advisory fees, or other fees a client might incur if actual investments and trades were being made by an investor. As a result, newsletter performance should not be used to evaluate Navellier Investment services which are separate and different from the newsletters. The owner of the newsletters is InvestorPlace Media, LLC and any questions concerning the newsletters, including any newsletter advertising or hypothetical Newsletter performance claims, (which are calculated solely by Investor Place Media and not Navellier) should be referred to InvestorPlace Media, LLC at (800) 718-8289.

Please note that Navellier & Associates and the Navellier Private Client Group are managed completely independent of the newsletters owned and published by InvestorPlace Media, LLC and written and edited by Louis Navellier, and investment performance of the newsletters should in no way be considered indicative of potential future investment performance for any Navellier & Associates separately managed account portfolio. Potential investors should consult with their financial advisor before investing in any Navellier Investment Product.

Navellier claims compliance with Global Investment Performance Standards (GIPS). To receive a complete list and descriptions of Navellier’s composites and/or a presentation that adheres to the GIPS standards, please contact Navellier or click here. It should not be assumed that any securities recommendations made by Navellier & Associates, Inc. in the future will be profitable or equal the performance of securities made in this report.

FactSet Disclosure: Navellier does not independently calculate the statistical information included in the attached report. The calculation and the information are provided by FactSet, a company not related to Navellier. Although information contained in the report has been obtained from FactSet and is based on sources Navellier believes to be reliable, Navellier does not guarantee its accuracy, and it may be incomplete or condensed. The report and the related FactSet sourced information are provided on an “as is” basis. The user assumes the entire risk of any use made of this information. Investors should consider the report as only a single factor in making their investment decision. The report is for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of a security. FactSet sourced information is the exclusive property of FactSet. Without prior written permission of FactSet, this information may not be reproduced, disseminated or used to create any financial products. All indices are unmanaged and performance of the indices include reinvestment of dividends and interest income, unless otherwise noted, are not illustrative of any particular investment and an investment cannot be made in any index. Past performance is no guarantee of future results.