by Gary Alexander

September 4, 2024

Seventy-five years ago next week, on September 14, 1949, Yale University Press published Ludwig von Mises’ magnum opus, “Human Action: A Treatise on Economics.” That first edition ran a daunting 900 pages, but it entered a second printing within two weeks, with plans for a third printing, and it is now recognized as one of the major works of economic thought, in parallel with Adam Smith’s “Wealth of Nations” (1776), Karl Marx’ “Das Kapital” (1867) and John Maynard Keynes’ “General Theory” (1936).

I first read it around 1980, when I was introduced to the Austrian School of Economics by several of its modern champions, including Robert D. Kephart, Mark Skousen, Doug Casey, Leonard Liggio, Walter Grinder and scholars at the Institute for Humane Studies at George Mason University. “Human Action” gave me what I now call the “decoding key” for predicting the outcome (puncturing) the promises of political panaceas, both right and left. Briefly, Human Action says humans act based on subjective choice, not as programmed robots. If the government raises taxes or benefits, we predictably change our behavior.

Human beings are not animals, or machines. We have consciousness. We alter our behavior based on our personal preferences, due to shifting realities. These choices can be in defiance of what our rulers expect.

None of this has any connection with the mathematical models of central planners – such as “raising tax rates will raise more money,” or “drafting new benefits will not raise price levels or increase indolence.”

Back in 1949, this was academic heresy. Economic orthodoxy was represented by Paul Samuelson’s new economics textbook, first published in 1948, representing the clearest distillation of Keynesianism – the virtues of top-down economic planning. There were few Mises fans, led by Newsweek columnist Henry Hazlitt, author of “Economics in One Lesson,” who reviewed “Human Action” in these glowing words:

“[This] book is destined to become a landmark in the progress of economics… Human Action is, in short, the most uncompromising and the most rigorously reasoned statement of the case for capitalism that has yet appeared…. It should become the leading text of everyone who believes in freedom, in individualism, and the ability of a free-market economy not only to outdistance any government-planned system in the production of goods and services for the masses, but to promote and safeguard, as no collectivist tyranny can ever do, those intellectual, cultural, and moral values upon which all civilization ultimately rests.”

– Henry Hazlitt in Newsweek, 1949

Von Mises was stunned by this reaction, since his German language first edition of the book, which took six years to write, mostly in exile in Switzerland during the lead-up to the Nazi Anschluss of Austria, was almost totally ignored. Then, it took almost four years to negotiate and publish this American version.

After reading Human Action in 1980, I enlisted Henry Hazlitt to write the opening editorial in the first edition of our new magazine, Wealth, published by fellow von Mises fan, James U. Blanchard III. In that maiden effort, Hazlitt showed our readers why “wealth” is not a dirty word. I also enlisted Mises-friendly writers Skousen, Casey, Art Laffer, Larry Reed and others to decode various economic myths of the day.

But that’s now ancient history. The national debt was then crossing $1 trillion. Now, it’s near $35 trillion.

“Human Action” Decodes the Current Election Season Nonsense

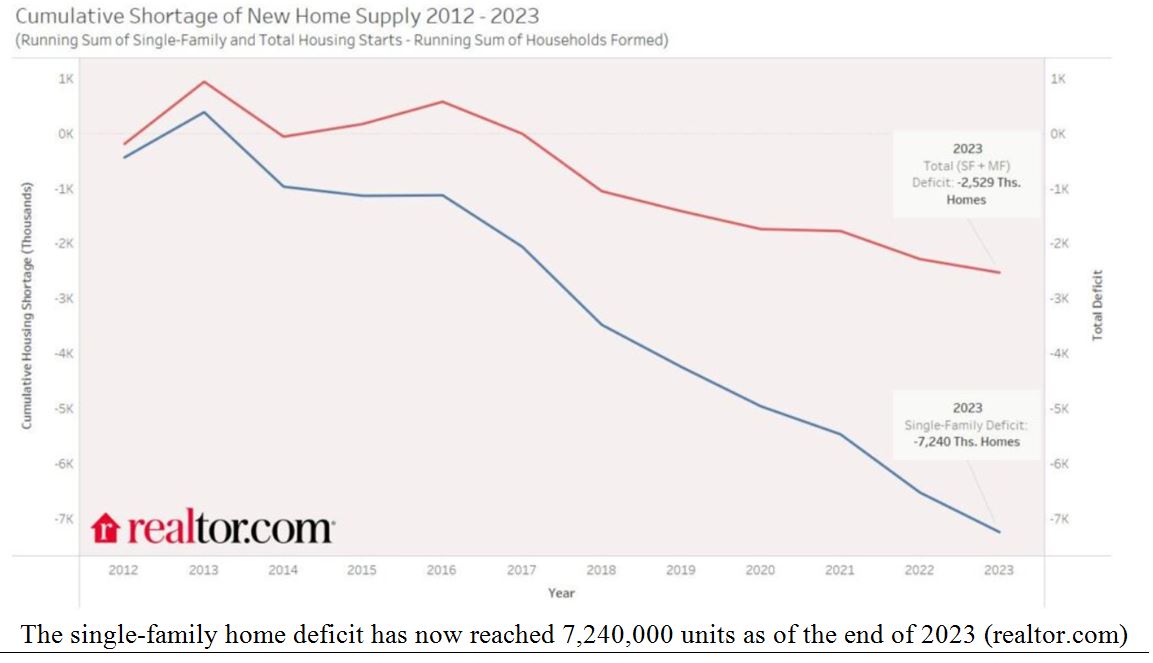

Where to start – the pickings are so lush. First, let’s take the housing shortage and the fact that buying a home is virtually impossible for most young couples. The political solution, of course, is to give first-time buyers $25,000. Brilliant! The “human action” response is that the sellers of homes will then raise the price $25,000 to meet rising demand and we’ve loosened the inflation (and debt) monsters once again.

The real problem is that the U.S. needs over seven million more homes built, yesterday, and no candidate is offering any fresh ideas on how to get homebuilders off their duff. That’s because of a wide range of crippling and time-consuming regulations, zoning, high interest rates and fresh memories of the housing collapse of 2005-08. The answer is to cut regulations deeply, lower interest rates, cut back zoning, allow some smaller homes, micro-units, triplexes, some creative thinking, and less roadblocks for homebuilders.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Here’s a new doozy: Kamala Harris has said that she wants to cancel medical debts, a winning populist plan, similar to Joe Biden’s forgiveness of college debts. Both of those high-debt situations came about from what von Mises would call “transference of risk” to a disinterested third party. Nobody watches over their own money like the owner of that money. When the government offered loan guarantees to college students, universities (all of a sudden!) recognized a golden opportunity to raise tuition (and other fees) to the sky, with no corresponding need to deliver better services. College costs grew two or three times the rate of inflation and students ended up with $50,000 to $100,000 in debt and non-marketable degrees.

The same thing happened when insurance companies took over our entire range of health costs, from a stubbed toe to cancer hospitalization. There was no cost control. We were no longer able to make trade-offs for office visits, tests or services, so costs skyrocketed and now we treat the effect – “cancelling the debt.” In both cases – college debt or health debt – this involves violation of contract and insulting those who paid for their own services, at great sacrifice, without asking for a bailout, a clear double standard.

Two weeks ago, I went into detail about the silly plan to micro-manage grocery store prices, in what our economics-challenged Vice-President called “price-gauging,” so I won’t go into that any further here. No decent economist of either Party likes this idea or thinks it will work, so it will likely evaporate soon.

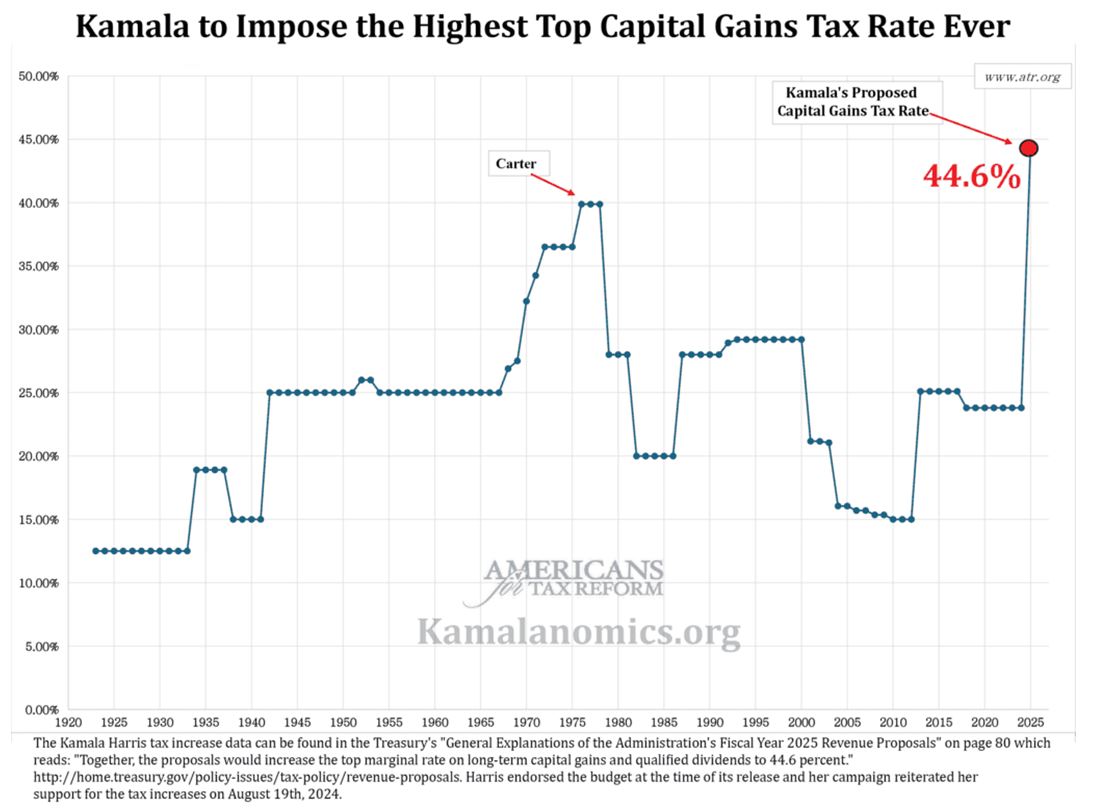

Harris has also proposed $5 trillion in tax increases over the next 10 years, which will take us back to the pre-Trump Obama world of many corporations sequestering their profits overseas instead of declaring them for taxation in the United States. When Trump lowered the business tax rate from 35% to 21%, part of the benefit was when corporations brought overseas profits back to American and paid taxes on them.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Harris is also proposing the highest capital gains tax rate since the inception of that tax in 1922: 44.6 percent. The previous high was Jimmy Carter’s 40% rate. (China’s top capital gains tax rate is 20%). Under her proposal, the combined federal-state capital gains tax rate would exceed 50% in many states, such as California, 57.9%, New Jersey 55.3%, Oregon 54.5%, Minnesota 54.4%, and New York 53.4%.

Capital gains are not indexed to inflation, so in many cases these gains are not gains at all, but inflation — especially in the Biden era. And she has also proposed a capital gains tax on “unrealized” (unsold) gains for the richest Americans, which history tells us will eventually be expanded to hit many or most of us.

This would be a life-killing, economy-killing tax, since it would force the sale of a big part of those assets at “fire sale” prices, thereby reducing the value of those assets and fueling an overall market crash and likely a recession. Any reader of Ludwig von Mises or other Austrian-based economist could tell you that. (A $5 Kindle version of the 1998 scholar’s edition of Human Action will get you your own decoder key).

All content above represents the opinion of Gary Alexander of Navellier & Associates, Inc.

Also In This Issue

A Look Ahead by Louis Navellier

Nvidia Delivers Spectacular Earnings Report

Income Mail by Bryan Perry

Turning Volatility Into AI-Related Covered Call Trading Strategy

Growth Mail by Gary Alexander

A 1949 Book Provides a Key to Puncturing Political Panaceas

Global Mail by Ivan Martchev

Will This be a September to Remember?

Sector Spotlight by Jason Bodner

August is Mercifully Over – Will the Market Return to Reality?

View Full Archive

Read Past Issues Here

About The Author

Gary Alexander

SENIOR EDITOR

Gary Alexander has been Senior Writer at Navellier since 2009. He edits Navellier’s weekly Marketmail and writes a weekly Growth Mail column, in which he uses market history to support the case for growth stocks. For the previous 20-years before joining Navellier, he was Senior Executive Editor at InvestorPlace Media (formerly Phillips Publishing), where he worked with several leading investment analysts, including Louis Navellier (since 1997), helping launch Louis Navellier’s Blue Chip Growth and Global Growth newsletters.

Prior to that, Gary edited Wealth Magazine and Gold Newsletter and wrote various investment research reports for Jefferson Financial in New Orleans in the 1980s. He began his financial newsletter career with KCI Communications in 1980, where he served as consulting editor for Personal Finance newsletter while serving as general manager of KCI’s Alexandria House book division. Before that, he covered the economics beat for news magazines. All content of “Growth Mail” represents the opinion of Gary Alexander

Important Disclosures:

Although information in these reports has been obtained from and is based upon sources that Navellier believes to be reliable, Navellier does not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute Navellier’s judgment as of the date the report was created and are subject to change without notice. These reports are for informational purposes only and are not a solicitation for the purchase or sale of a security. Any decision to purchase securities mentioned in these reports must take into account existing public information on such securities or any registered prospectus.To the extent permitted by law, neither Navellier & Associates, Inc., nor any of its affiliates, agents, or service providers assumes any liability or responsibility nor owes any duty of care for any consequences of any person acting or refraining to act in reliance on the information contained in this communication or for any decision based on it.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any securities recommendations made by Navellier. in the future will be profitable or equal the performance of securities made in this report. Dividend payments are not guaranteed. The amount of a dividend payment, if any, can vary over time and issuers may reduce dividends paid on securities in the event of a recession or adverse event affecting a specific industry or issuer.

None of the stock information, data, and company information presented herein constitutes a recommendation by Navellier or a solicitation to buy or sell any securities. Any specific securities identified and described do not represent all of the securities purchased, sold, or recommended for advisory clients. The holdings identified do not represent all of the securities purchased, sold, or recommended for advisory clients and the reader should not assume that investments in the securities identified and discussed were or will be profitable.

Information presented is general information that does not take into account your individual circumstances, financial situation, or needs, nor does it present a personalized recommendation to you. Individual stocks presented may not be suitable for every investor. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. Investment in fixed income securities has the potential for the investment return and principal value of an investment to fluctuate so that an investor’s holdings, when redeemed, may be worth less than their original cost.

One cannot invest directly in an index. Index is unmanaged and index performance does not reflect deduction of fees, expenses, or taxes. Presentation of Index data does not reflect a belief by Navellier that any stock index constitutes an investment alternative to any Navellier equity strategy or is necessarily comparable to such strategies. Among the most important differences between the Indices and Navellier strategies are that the Navellier equity strategies may (1) incur material management fees, (2) concentrate its investments in relatively few stocks, industries, or sectors, (3) have significantly greater trading activity and related costs, and (4) be significantly more or less volatile than the Indices.

ETF Risk: We may invest in exchange traded funds (“ETFs”) and some of our investment strategies are generally fully invested in ETFs. Like traditional mutual funds, ETFs charge asset-based fees, but they generally do not charge initial sales charges or redemption fees and investors typically pay only customary brokerage fees to buy and sell ETF shares. The fees and costs charged by ETFs held in client accounts will not be deducted from the compensation the client pays Navellier. ETF prices can fluctuate up or down, and a client account could lose money investing in an ETF if the prices of the securities owned by the ETF go down. ETFs are subject to additional risks:

- ETF shares may trade above or below their net asset value;

- An active trading market for an ETF’s shares may not develop or be maintained;

- The value of an ETF may be more volatile than the underlying portfolio of securities the ETF is designed to track;

- The cost of owning shares of the ETF may exceed those a client would incur by directly investing in the underlying securities; and

- Trading of an ETF’s shares may be halted if the listing exchange’s officials deem it appropriate, the shares are delisted from the exchange, or the activation of market-wide “circuit breakers” (which are tied to large decreases in stock prices) halts stock trading generally.

Grader Disclosures: Investment in equity strategies involves substantial risk and has the potential for partial or complete loss of funds invested. The sample portfolio and any accompanying charts are for informational purposes only and are not to be construed as a solicitation to buy or sell any financial instrument and should not be relied upon as the sole factor in an investment making decision. As a matter of normal and important disclosures to you, as a potential investor, please consider the following: The performance presented is not based on any actual securities trading, portfolio, or accounts, and the reported performance of the A, B, C, D, and F portfolios (collectively the “model portfolios”) should be considered mere “paper” or pro forma performance results based on Navellier’s research.

Investors evaluating any of Navellier & Associates, Inc.’s, (or its affiliates’) Investment Products must not use any information presented here, including the performance figures of the model portfolios, in their evaluation of any Navellier Investment Products. Navellier Investment Products include the firm’s mutual funds and managed accounts. The model portfolios, charts, and other information presented do not represent actual funded trades and are not actual funded portfolios. There are material differences between Navellier Investment Products’ portfolios and the model portfolios, research, and performance figures presented here. The model portfolios and the research results (1) may contain stocks or ETFs that are illiquid and difficult to trade; (2) may contain stock or ETF holdings materially different from actual funded Navellier Investment Product portfolios; (3) include the reinvestment of all dividends and other earnings, estimated trading costs, commissions, or management fees; and, (4) may not reflect prices obtained in an actual funded Navellier Investment Product portfolio. For these and other reasons, the reported performances of model portfolios do not reflect the performance results of Navellier’s actually funded and traded Investment Products. In most cases, Navellier’s Investment Products have materially lower performance results than the performances of the model portfolios presented.

This report contains statements that are, or may be considered to be, forward-looking statements. All statements that are not historical facts, including statements about our beliefs or expectations, are “forward-looking statements” within the meaning of The U.S. Private Securities Litigation Reform Act of 1995. These statements may be identified by such forward-looking terminology as “expect,” “estimate,” “plan,” “intend,” “believe,” “anticipate,” “may,” “will,” “should,” “could,” “continue,” “project,” or similar statements or variations of such terms. Our forward-looking statements are based on a series of expectations, assumptions, and projections, are not guarantees of future results or performance, and involve substantial risks and uncertainty as described in Form ADV Part 2A of our filing with the Securities and Exchange Commission (SEC), which is available at www.adviserinfo.sec.gov or by requesting a copy by emailing info@navellier.com. All of our forward-looking statements are as of the date of this report only. We can give no assurance that such expectations or forward-looking statements will prove to be correct. Actual results may differ materially. You are urged to carefully consider all such factors.

FEDERAL TAX ADVICE DISCLAIMER: As required by U.S. Treasury Regulations, you are informed that, to the extent this presentation includes any federal tax advice, the presentation is not written by Navellier to be used, and cannot be used, for the purpose of avoiding federal tax penalties. Navellier does not advise on any income tax requirements or issues. Use of any information presented by Navellier is for general information only and does not represent tax advice either express or implied. You are encouraged to seek professional tax advice for income tax questions and assistance.

IMPORTANT NEWSLETTER DISCLOSURE:The hypothetical performance results for investment newsletters that are authored or edited by Louis Navellier, including Louis Navellier’s Growth Investor, Louis Navellier’s Breakthrough Stocks, Louis Navellier’s Accelerated Profits, and Louis Navellier’s Platinum Club, are not based on any actual securities trading, portfolio, or accounts, and the newsletters’ reported hypothetical performances should be considered mere “paper” or proforma hypothetical performance results and are not actual performance of real world trades. Navellier & Associates, Inc. does not have any relation to or affiliation with the owner of these newsletters. There are material differences between Navellier Investment Products’ portfolios and the InvestorPlace Media, LLC newsletter portfolios authored by Louis Navellier. The InvestorPlace Media, LLC newsletters contain hypothetical performance that do not include transaction costs, advisory fees, or other fees a client might incur if actual investments and trades were being made by an investor. As a result, newsletter performance should not be used to evaluate Navellier Investment services which are separate and different from the newsletters. The owner of the newsletters is InvestorPlace Media, LLC and any questions concerning the newsletters, including any newsletter advertising or hypothetical Newsletter performance claims, (which are calculated solely by Investor Place Media and not Navellier) should be referred to InvestorPlace Media, LLC at (800) 718-8289.

Please note that Navellier & Associates and the Navellier Private Client Group are managed completely independent of the newsletters owned and published by InvestorPlace Media, LLC and written and edited by Louis Navellier, and investment performance of the newsletters should in no way be considered indicative of potential future investment performance for any Navellier & Associates separately managed account portfolio. Potential investors should consult with their financial advisor before investing in any Navellier Investment Product.

Navellier claims compliance with Global Investment Performance Standards (GIPS). To receive a complete list and descriptions of Navellier’s composites and/or a presentation that adheres to the GIPS standards, please contact Navellier or click here. It should not be assumed that any securities recommendations made by Navellier & Associates, Inc. in the future will be profitable or equal the performance of securities made in this report.

FactSet Disclosure: Navellier does not independently calculate the statistical information included in the attached report. The calculation and the information are provided by FactSet, a company not related to Navellier. Although information contained in the report has been obtained from FactSet and is based on sources Navellier believes to be reliable, Navellier does not guarantee its accuracy, and it may be incomplete or condensed. The report and the related FactSet sourced information are provided on an “as is” basis. The user assumes the entire risk of any use made of this information. Investors should consider the report as only a single factor in making their investment decision. The report is for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of a security. FactSet sourced information is the exclusive property of FactSet. Without prior written permission of FactSet, this information may not be reproduced, disseminated or used to create any financial products. All indices are unmanaged and performance of the indices include reinvestment of dividends and interest income, unless otherwise noted, are not illustrative of any particular investment and an investment cannot be made in any index. Past performance is no guarantee of future results.