by Bryan Perry

September 17, 2024

Investors and traders alike are in a state of awe at last week’s torrid rally for equities that had mega-cap AI-centric stocks once again leading the charge higher. Earlier this month, it was thought that there was a “new paradigm shift” in the AI narrative, as if this generational technological transformation somehow had peaked in terms of the stocks pricing in all future capital investment, revenues, and potential profits.

This skepticism was quickly debunked, and funds flowed back into the AI trade again as CEOs of the leading AI companies reinforced the secular spending cycle and widespread applications that are still in their nascent state of development. As a case in point, it was reported that Elon Musk’s xAI – a company he launched in 2023 – had brought a massive new training cluster of chips online, claiming that it represented “the most powerful AI training system in the world.” Dubbed Colossus, the system was built in Memphis, using 100,000 chips from Nvidia, specifically its H100 GPUs. Musk said the cluster was built in 122 days and would “double in size” in a few months as more GPUs are added.

Also, Oracle reported its Q2 results last week, and its Chairman Larry Ellison claimed there was the potential to build 2,000 data centers globally from the 168 it currently operates. These data centers can span three football fields, while others are built to suit smaller sizes. Headlines such as these are now reinvigorating the AI FOMO trade, as reflected in the recovery in Vanguard’s Mega Cap Growth ETF:

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

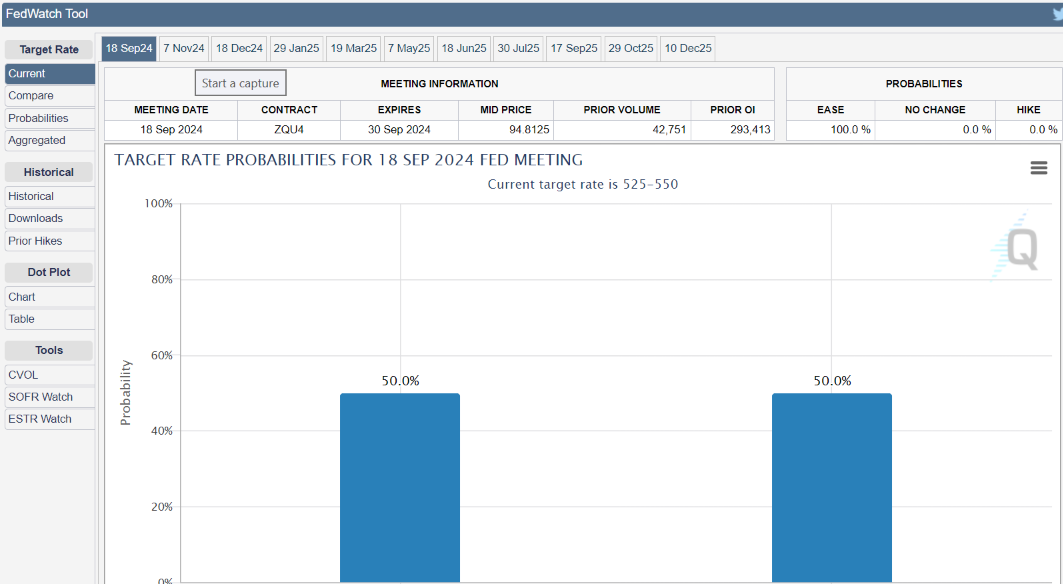

Beyond this revived love affair with the AI theme, another catalyst for the rally was the notion of the Fed possibly front-loading rate cuts by taking the current 5.25%-5.50% Fed Funds down by a half-point to 4.75%-5.00%. As of last Friday, the bond futures market was showing a 50% probability of a 50-basis point cut at this week’s FOMC meeting. This is up from 30% a week ago, and 25% a month ago.

This shift marks a rapid about-face for traders who earlier last week had almost completely discounted the possibility of a large rate cut in the wake of hotter-than-forecast consumer-price data and signs the labor market remains robust. The trigger for the revision was a Wall Street Journal report on Thursday that Fed policy makers were considering whether to reduce rates by a quarter point or opt for half-point cut.

The chief U.S economist at JPMorgan Chase & Co. Friday reiterated its call for a half-point cut, leading to a volume surge in Fed funds futures that would benefit from that outcome, but JPMorgan is the lone large Wall Street bank forecasting a half-point rather than a quarter-point cut.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

This might be a September rally to remember on Wall Street, as history is not on the side of September delivering many market rallies. And even though the pace of inflation has declined to around 2.5% per year, that doesn’t reverse the damage done to the majority of American families. The Consumer Price Index (CPI) has increased significantly over the past three years. From 2021 to 2024, the cumulative price increases in the CPI total more than 21%, which represents a big drag on most families’ budgets.

There is also a string of staggering jobs revisions, bringing attention to whether the Labor Department data can be trusted. There is also more empirical evidence of delinquencies on consumer debt on the rise. Ally Financial Corp.’s stock was crushed after the consumer lender said delinquencies in its retail car-loan business were up more than expected as people continue to struggle with higher costs.

“Over the course of the quarter, our credit challenges have intensified,” said Ally Chief Financial Officer Russ Hutchinson at the Barclays Global Financial Services Conference in New York on Monday. “Our borrower is struggling with high inflation and cost of living, and now, more recently, a weakening employment picture.” Combine this revelation with the prospect of slimmer Net Interest Margin (NIM) for banks, and it might explain why Warren Buffet is dumping his Bank of America position.

The low-income wage earner is on the ropes, as lending practices have been looser these past three years than most would admit, Covid payouts have been largely exhausted and consumer credit card debt is at an all-time high with millions of consumers maxed out, so maybe the Fed is finally getting some internal religion and doesn’t want to see the 65% of Americans living paycheck to paycheck, and the 47% of Americans that don’t pay any income tax experience a collective tsunami-sized financial meltdown.

That wave seems to be forming out on the horizon, so why wait until it hits the coastline? There seems to be little disagreement that the upper middle-class, more affluent consumers and workers are doing pretty well, enjoying superior asset appreciation from home ownership and stock market gains, but the other much larger swatch of the population is showing evidence of increasing financial strain.

The Fed needs to provide some relief right away and the bond market seems to sense newfound urgency. Most folks are hardworking and are not looking for a handout, but in these times where inflation has pushed prices of everything higher from three years ago, they sure could use a break in interest rates.

Navellier & Associates owns Nvidia Corp (NVDA), and a few accounts own Oracle (ORCL), in managed accounts. We do not own Bank of America (BAC), or Ally Financial. Bryan Perry does not own Nvidia Corp (NVDA), Oracle (ORCL), Bank of America (BAC), or Ally Financial personally.

All content above represents the opinion of Bryan Perry of Navellier & Associates, Inc.

Also In This Issue

A Look Ahead by Louis Navellier

We Barely Dodged World War III (Again) Last Week

Income Mail by Bryan Perry

The Rally That Nobody Saw Coming

Growth Mail by Gary Alexander

Debaters Dodge Deficits (and Growth, and Lots More)

Global Mail by Ivan Martchev

A Fresh All-Time High in the S&P 500 Likely This Week

Sector Spotlight by Jason Bodner

September 18th Creates a Turning Point for Stocks

View Full Archive

Read Past Issues Here

Bryan Perry

SENIOR DIRECTOR

Bryan Perry is a Senior Director with Navellier Private Client Group, advising and facilitating high net worth investors in the pursuit of their financial goals.

Bryan’s financial services career spanning the past three decades includes over 20-years of wealth management experience with Wall Street firms that include Bear Stearns, Lehman Brothers and Paine Webber, working with both retail and institutional clients. Bryan earned a B.A. in Political Science from Virginia Polytechnic Institute & State University and currently holds a Series 65 license. All content of “Income Mail” represents the opinion of Bryan Perry

Important Disclosures:

Although information in these reports has been obtained from and is based upon sources that Navellier believes to be reliable, Navellier does not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute Navellier’s judgment as of the date the report was created and are subject to change without notice. These reports are for informational purposes only and are not a solicitation for the purchase or sale of a security. Any decision to purchase securities mentioned in these reports must take into account existing public information on such securities or any registered prospectus.To the extent permitted by law, neither Navellier & Associates, Inc., nor any of its affiliates, agents, or service providers assumes any liability or responsibility nor owes any duty of care for any consequences of any person acting or refraining to act in reliance on the information contained in this communication or for any decision based on it.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any securities recommendations made by Navellier. in the future will be profitable or equal the performance of securities made in this report. Dividend payments are not guaranteed. The amount of a dividend payment, if any, can vary over time and issuers may reduce dividends paid on securities in the event of a recession or adverse event affecting a specific industry or issuer.

None of the stock information, data, and company information presented herein constitutes a recommendation by Navellier or a solicitation to buy or sell any securities. Any specific securities identified and described do not represent all of the securities purchased, sold, or recommended for advisory clients. The holdings identified do not represent all of the securities purchased, sold, or recommended for advisory clients and the reader should not assume that investments in the securities identified and discussed were or will be profitable.

Information presented is general information that does not take into account your individual circumstances, financial situation, or needs, nor does it present a personalized recommendation to you. Individual stocks presented may not be suitable for every investor. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. Investment in fixed income securities has the potential for the investment return and principal value of an investment to fluctuate so that an investor’s holdings, when redeemed, may be worth less than their original cost.

One cannot invest directly in an index. Index is unmanaged and index performance does not reflect deduction of fees, expenses, or taxes. Presentation of Index data does not reflect a belief by Navellier that any stock index constitutes an investment alternative to any Navellier equity strategy or is necessarily comparable to such strategies. Among the most important differences between the Indices and Navellier strategies are that the Navellier equity strategies may (1) incur material management fees, (2) concentrate its investments in relatively few stocks, industries, or sectors, (3) have significantly greater trading activity and related costs, and (4) be significantly more or less volatile than the Indices.

ETF Risk: We may invest in exchange traded funds (“ETFs”) and some of our investment strategies are generally fully invested in ETFs. Like traditional mutual funds, ETFs charge asset-based fees, but they generally do not charge initial sales charges or redemption fees and investors typically pay only customary brokerage fees to buy and sell ETF shares. The fees and costs charged by ETFs held in client accounts will not be deducted from the compensation the client pays Navellier. ETF prices can fluctuate up or down, and a client account could lose money investing in an ETF if the prices of the securities owned by the ETF go down. ETFs are subject to additional risks:

- ETF shares may trade above or below their net asset value;

- An active trading market for an ETF’s shares may not develop or be maintained;

- The value of an ETF may be more volatile than the underlying portfolio of securities the ETF is designed to track;

- The cost of owning shares of the ETF may exceed those a client would incur by directly investing in the underlying securities; and

- Trading of an ETF’s shares may be halted if the listing exchange’s officials deem it appropriate, the shares are delisted from the exchange, or the activation of market-wide “circuit breakers” (which are tied to large decreases in stock prices) halts stock trading generally.

Grader Disclosures: Investment in equity strategies involves substantial risk and has the potential for partial or complete loss of funds invested. The sample portfolio and any accompanying charts are for informational purposes only and are not to be construed as a solicitation to buy or sell any financial instrument and should not be relied upon as the sole factor in an investment making decision. As a matter of normal and important disclosures to you, as a potential investor, please consider the following: The performance presented is not based on any actual securities trading, portfolio, or accounts, and the reported performance of the A, B, C, D, and F portfolios (collectively the “model portfolios”) should be considered mere “paper” or pro forma performance results based on Navellier’s research.

Investors evaluating any of Navellier & Associates, Inc.’s, (or its affiliates’) Investment Products must not use any information presented here, including the performance figures of the model portfolios, in their evaluation of any Navellier Investment Products. Navellier Investment Products include the firm’s mutual funds and managed accounts. The model portfolios, charts, and other information presented do not represent actual funded trades and are not actual funded portfolios. There are material differences between Navellier Investment Products’ portfolios and the model portfolios, research, and performance figures presented here. The model portfolios and the research results (1) may contain stocks or ETFs that are illiquid and difficult to trade; (2) may contain stock or ETF holdings materially different from actual funded Navellier Investment Product portfolios; (3) include the reinvestment of all dividends and other earnings, estimated trading costs, commissions, or management fees; and, (4) may not reflect prices obtained in an actual funded Navellier Investment Product portfolio. For these and other reasons, the reported performances of model portfolios do not reflect the performance results of Navellier’s actually funded and traded Investment Products. In most cases, Navellier’s Investment Products have materially lower performance results than the performances of the model portfolios presented.

This report contains statements that are, or may be considered to be, forward-looking statements. All statements that are not historical facts, including statements about our beliefs or expectations, are “forward-looking statements” within the meaning of The U.S. Private Securities Litigation Reform Act of 1995. These statements may be identified by such forward-looking terminology as “expect,” “estimate,” “plan,” “intend,” “believe,” “anticipate,” “may,” “will,” “should,” “could,” “continue,” “project,” or similar statements or variations of such terms. Our forward-looking statements are based on a series of expectations, assumptions, and projections, are not guarantees of future results or performance, and involve substantial risks and uncertainty as described in Form ADV Part 2A of our filing with the Securities and Exchange Commission (SEC), which is available at www.adviserinfo.sec.gov or by requesting a copy by emailing info@navellier.com. All of our forward-looking statements are as of the date of this report only. We can give no assurance that such expectations or forward-looking statements will prove to be correct. Actual results may differ materially. You are urged to carefully consider all such factors.

FEDERAL TAX ADVICE DISCLAIMER: As required by U.S. Treasury Regulations, you are informed that, to the extent this presentation includes any federal tax advice, the presentation is not written by Navellier to be used, and cannot be used, for the purpose of avoiding federal tax penalties. Navellier does not advise on any income tax requirements or issues. Use of any information presented by Navellier is for general information only and does not represent tax advice either express or implied. You are encouraged to seek professional tax advice for income tax questions and assistance.

IMPORTANT NEWSLETTER DISCLOSURE:The hypothetical performance results for investment newsletters that are authored or edited by Louis Navellier, including Louis Navellier’s Growth Investor, Louis Navellier’s Breakthrough Stocks, Louis Navellier’s Accelerated Profits, and Louis Navellier’s Platinum Club, are not based on any actual securities trading, portfolio, or accounts, and the newsletters’ reported hypothetical performances should be considered mere “paper” or proforma hypothetical performance results and are not actual performance of real world trades. Navellier & Associates, Inc. does not have any relation to or affiliation with the owner of these newsletters. There are material differences between Navellier Investment Products’ portfolios and the InvestorPlace Media, LLC newsletter portfolios authored by Louis Navellier. The InvestorPlace Media, LLC newsletters contain hypothetical performance that do not include transaction costs, advisory fees, or other fees a client might incur if actual investments and trades were being made by an investor. As a result, newsletter performance should not be used to evaluate Navellier Investment services which are separate and different from the newsletters. The owner of the newsletters is InvestorPlace Media, LLC and any questions concerning the newsletters, including any newsletter advertising or hypothetical Newsletter performance claims, (which are calculated solely by Investor Place Media and not Navellier) should be referred to InvestorPlace Media, LLC at (800) 718-8289.

Please note that Navellier & Associates and the Navellier Private Client Group are managed completely independent of the newsletters owned and published by InvestorPlace Media, LLC and written and edited by Louis Navellier, and investment performance of the newsletters should in no way be considered indicative of potential future investment performance for any Navellier & Associates separately managed account portfolio. Potential investors should consult with their financial advisor before investing in any Navellier Investment Product.

Navellier claims compliance with Global Investment Performance Standards (GIPS). To receive a complete list and descriptions of Navellier’s composites and/or a presentation that adheres to the GIPS standards, please contact Navellier or click here. It should not be assumed that any securities recommendations made by Navellier & Associates, Inc. in the future will be profitable or equal the performance of securities made in this report.

FactSet Disclosure: Navellier does not independently calculate the statistical information included in the attached report. The calculation and the information are provided by FactSet, a company not related to Navellier. Although information contained in the report has been obtained from FactSet and is based on sources Navellier believes to be reliable, Navellier does not guarantee its accuracy, and it may be incomplete or condensed. The report and the related FactSet sourced information are provided on an “as is” basis. The user assumes the entire risk of any use made of this information. Investors should consider the report as only a single factor in making their investment decision. The report is for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of a security. FactSet sourced information is the exclusive property of FactSet. Without prior written permission of FactSet, this information may not be reproduced, disseminated or used to create any financial products. All indices are unmanaged and performance of the indices include reinvestment of dividends and interest income, unless otherwise noted, are not illustrative of any particular investment and an investment cannot be made in any index. Past performance is no guarantee of future results.