by Louis Navellier

August 6, 2024

When it comes to the payroll reports at the start of each month, ADP reported last Wednesday that only 122,000 private payroll jobs were created in July, which was well below economists’ estimate of 150,000.

Then, the Labor Department reported on Thursday that initial jobless claims rose to 249,000 in the latest week, the highest total in nearly a year – since August 2023. Continuing unemployment claims also rose to 1.877 million, the highest rate since November 2021. Also, due to a weakening job market, wages are rising at their slowest pace since 2021 according to the Stanford Digital Economy Lab. So, as the labor market continues to deteriorate, the pressure on the Fed to cut key interest rates will continue to mount.

Then came the most widely watched jobs report. In Friday’s Labor Department report, we learned that only 114,000 payroll jobs were created in July, substantially below economists’ consensus estimate of 175,000 and remarkably close to the ADP total. The unemployment rate rose to 4.3%, from 4.1% in June.

Average hourly earnings rose only 0.2% in July and 3.6% in the past 12 months. Also, the May and June payroll reports were revised down by a combined 29,000 jobs, so this was a disastrous payroll report.

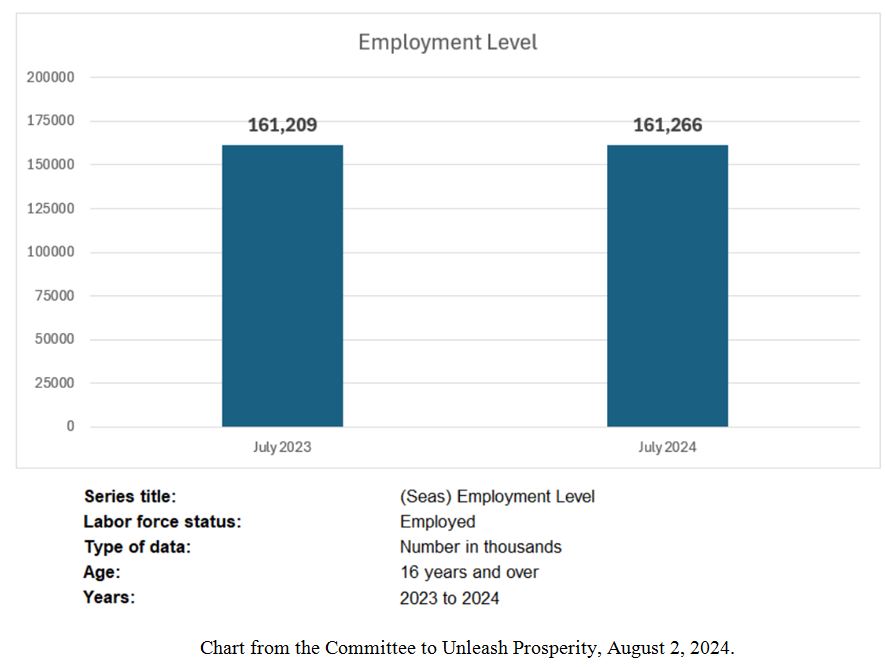

Below the surface, the jobs situation may be even worse, with near-zero growth in the household survey:

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

The payroll survey – which the press keeps quoting – reflects a total of 2.5 million new jobs in the last 12 months – an average of over 200,000 per month – but that mainly covers large businesses reporting their payroll data to the Labor Department, but the Household Survey, which covers small businesses, shows almost no growth over the last year – just 57,000 jobs, rising from 161,209,000 jobs to 161,266,00 jobs.

Also, the Institute of Supply Management (ISM) announced on Thursday that its manufacturing index declined sharply to 46.8 in July, down from 48.5 in June. The Biden Administration’s on-shoring efforts have clearly failed. Since any reading under 50 signals a contraction, the ISM Manufacturing survey represented the 20th contraction in the past 21 months. In fact, 11 of the 16 industries contracted in July, but that report came out too late for the Fed to act on the news. Clearly, the Fed should have started cutting rates last week, but they chose to delay, once again, even though other central banks are acting.

Last Thursday, the Bank of England cut its key interest rate 0.25% for the first time since 2020, joining other central banks – like Canada, and the European Central Bank (ECB) and China that have already cut their key interest rates and are signaling more cuts ahead. The Bank of England vote was 5 to 4, so clearly there was no big consensus to cut. Naturally, the British pound slipped a bit after the rate cut.

The Bank of Japan maintained its key interest rate below zero (-0.1%) for nearly eight years, since 2016, but the BOJ raised its benchmark rate to a range of zero to 0.1% early this year and then raised it again to 0.25% last Wednesday, July 31, while curtailing its quantitative easing by 50%. By finally allowing positive interest rates to re-emerge, the Bank of Japan is trying to attract buying pressure on its government bonds, since Japan is a case study of what happens to a currency when its debt becomes unmanageable – at 257% of GDP – about twice the level of Europe and America. The population of Japan is also declining, which does not help its debt service either, so Japan is a special case, warning Europe and America of what can happen after decades of deflation, high debt and negative population growth.

Last week, I told you that former New York Fed President Bill Dudley came out with a powerful Bloomberg Opinion article entitled, “I Changed My Mind. The Fed Needs to Cut Rates Now.” Later in the week, another former Fed official, Alan Blinder, had an opinion piece published in The Wall Street Journal entitled, “The Fed Should Cut Interest Rates This Week.” Blinder was the Vice-Chairman of the Fed in 1994 through 1996 and is currently a Professor of Economics and Public Policy at Princeton.

Blinder said that “Money is tight right now. With inflation in the 2.5% to 3% range, depending on how you measure it, the current federal-funds rate of 5.25% to 5.50% leaves the real interest rate—the interest rate adjusted for inflation—around 2.5% to 3%.” Interestingly, Blinder added, “the 12-month PCE inflation rate has been flat or falling every month since last September. Looks like a trend to me.” Amen!

The Battle for Votes – and for Silicon Valley Support

As the Presidential campaign heats up, more promises are emerging. The Biden Administration is still trying to provide student loan relief, despite the fact that federal courts have squashed student loan relief multiple times. Interestingly, at a rally on Wednesday, Donald Trump promised no federal taxes on Social Security benefits in a move expected to be very popular with senior citizens. I should add that Trump also promised service workers no taxes on tips. Kamala Harris is making similar campaign pitches offering more social benefits. This is why consumer confidence tends to rise heading into a Presidential election.

At the Bitcoin 2024 conference in Nashville, candidate Trump said that he would fire SEC Chairman Gary Gensler (his term expires in 2026) and pick more crypto-friendly regulators. Specifically, Trump said, “This afternoon, I’m laying out my plan to ensure that the United States will be the crypto capital of the planet and the Bitcoin superpower of the world, and we’ll get it done.” Trump added that, “The rules will be written by people who love your industry, not hate your industry.” He also said he would appoint a crypto industry presidential advisory council, create a stable coin framework, and he called for a scaled-back enforcement. There is no doubt that this is all part of candidate Trump’s outreach to Silicon Valley.

Trump’s case is bolstered by Silicon Valley’s seemingly endless litigation with the Biden Administration DOJ and FTC. In fact, FTC Chair Lina Khan is backing open AI models and said, “Open-weight models can liberate startups from the arbitrary whims of closed developers and cloud gate-keepers.”

However, with an open model, cloud crashes would be more common. A Microsoft spokesperson pointed out a 2009 ruling by the European Commission that prevented the company from enhancing its Windows 365 operating security more rigorously. Essentially, Microsoft is blaming these restrictions by the European Union (EU) for preventing Microsoft from fixing the CrowdStrike software upgrade glitch that crashed cloud servers worldwide recently. The EU’s agreement specifies that Microsoft must share its application programing interface (API) for Windows Client and Server operating systems with third-party security software developers, but the CrowdStrike incident highlighted the risks of such openness.

Apple has been restricting developers from access to its operating system API since 2020. Google is also not bound by similar API regulations. So essentially, Microsoft is forced to have an open API, while Apple, Google and other competitors have closed APIs. I think it is safe to conclude that regulators, like the EU and FTC, should not modify software to aid cyber-hackers that can crash cloud computing centers.

One other reason that Silicon Valley is warming to Donald Trump is that Peter Thiel, who was J.D. Vance’s former mentor and employer, pushed for J.D. Vance to be chosen as Vice President. Many in Silicon Valley, like Peter Thiel, are euphoric about J.D. Vance being on the GOP ticket and advising Donald Trump. Based on the Bitcoin 2024 conference, I think it is safe to say that J.D. Vance’s influence is obvious. The Biden Administration and previous administrations have allowed the “Magnificent-7” stocks to operate legal monopolies. Much of the anxiety recently surrounding the Magnificent-7 pertains to whether or not they can maintain their legal monopolies. The truth of the matter is that these legal monopolies will persist, but whenever there are cracks in their foundations, like Google’s disappointing YouTube results, or Tesla’s lackluster guidance, these Magnificent-7 stocks can get hit with profit-taking.

Speaking of disappointing results, McDonald’s announced its first quarterly sales decline since 2020. In the second quarter, McDonald’s same-store sales declined by 1%. This did not come as a huge surprise, since French-fry supplier, Lamb-Weston, also reported disappointing sales to restaurants and consumers. There is also evidence that some of this sales decline may be attributable to resistance to price inflation. The CEO of McDonald’s said that their $5 meal deal is a big hit and will be extended to boost sales.

Burger King and KFC have also introduced $5 meal options. Furthermore, Target, Walmart, and the German chain Aldi have lowered prices on food and some household staples, while Amazon, Walgreens, and Best Buy have announced price cuts on selected items. These price cuts reflect increasing signs of consumer distress, especially for the bottom 20% of consumers that are struggling with inflation and trying to make ends meet. If the Fed ever needed a sign of consumer distress, McDonald’s first sales decline in 13-quarters was a clear signal, so hopefully this will help coax the Fed to cut key interest rates sooner than later.

Even liquor sales were hit. Diageo warned that consumers are facing an “extraordinary environment” and announced its first decline in sales since 2020. Specifically, this manufacturer of Smirnoff Vodka, Tanqueray Gin, Casamigos Tequila and Johnnie Walker Whisky (plus dozens of other name brands) said its annual sales declined by 1.4% and its unit sales dropped 5% as consumers cut back on consumption.

Finally, if you are wondering how the U.S. economy can grow when other indicators are flat, the answer can be traced to productivity. The Labor Department on Thursday reported that U.S. productivity rose at a 2.3% annual pace in the second quarter, compared to a revised 0.4% in the first quarter. This was much better than the economists’ consensus estimate of a 1.8% increase. Unit labor costs only rose at a 0.5% annual pace in the second quarter, down from a 0.9% annual pace in the first quarter. In the past 12 months, unit labor costs have risen 1.2%. In theory, some productivity increases are attributable to AI as well as better inventory management. As long as profits rise faster than labor costs, productivity will rise.

Other Election (and World) News

While we concentrate on America’s Presidential contest, a more violent election took place in Venezuela, in the wake of President Nicolas Maduro’s claim that he won last week’s election. Specifically, the government-controlled National Election Council said that after 73% of ballots were tabulated that Maduro received a narrow victory, with 51.2% of the vote. Opposition candidate Edmundo Gonzalez told reporters, “We’ve won in places where the democratic forces had never won in the last 25 years.” Specifically, Gonzalez’s team said they won 6.3 million votes, while the National Election Council only counted 4.4 million votes for Gonzalez. Furthermore, a 40% sample of votes by independent observers show a 6.2 million votes for Gonzalez (69%) compared to only 2.8 million (31%) for Maduro.

As a result, protests erupted, and a statue of Maduro was knocked down in protest. Opposition leader María Corina Machado, who had been banned from running in the election but rallied mass support behind Gonzalez, said that their network of volunteer election monitors had created a database by scanning and digitizing physical tally sheets that they obtained. Voters will be permitted to use their IDs to see if their votes were truly cast in the way they actually voted. In response, Maduro’s opposition now claims an even wider victory – with 73% of the vote tally, saying its victory is irreversible! In response, the military has been breaking up at least 115 protests across Venezuela, leaving nine protesters dead.

The Ukraine war now enters its 30th month, and Russian crude oil shipments have dropped to their lowest level since late August 2023, based on a four-week moving average. Officially, Russia says that these cuts are related to reducing crude oil production according to OPEC+ guidelines. Despite these cuts, Europe remains addicted to Russian LNG exports. Recent heatwaves in Europe have increased the demand for natural gas to generate electricity for air conditioning, so I’d say the sanctions on Russia are ineffective.

In the other major world war, in the wake of Israel’s attack on the Hamas leader at his home in Tehran, as well as the attack on a Hezbollah commander in Beirut, crude oil prices have surged on the news that Iran plans to retaliate. Ironically, the last time Iran sent missiles into Israel a few months ago, virtually all were intercepted by Israel, but shrapnel from missile fragments are dangerous to people on the ground.

The Hezbollah missile that killed 12 school children in the Golan Heights was one of the rare times a missile successfully penetrated Israeli air space. Clearly, the Middle East remains a tinder box and crude oil prices will remain high as long as Iran and its proxies continue to threaten Israel. Iran’s Ayatollah Ali Khamenei said he had a “duty to seek vengeance” and that Israel should prepare for “severe punishment.” Ironically, since Iran was humiliated by Israel’s defense of its last missile attack, Iran may be planning a new way of attacking, so crude oil prices are expected to remain elevated amidst all this uncertainty.

Navellier & Associates owns CrowdStrike Holdings, Inc. Class A (CRWD), Apple Computer (AAPL), Microsoft (MSFT), Alphabet Inc. Class A (GOOGL), Diageo plc Sponsored ADR (DEO), and Amazon (AMZN), in managed accounts. A few accounts own McDonald’s Corporation (MCD), Target Corporation (TGT), Walmart Inc. (WMT), and Tesla (TSLA), per client request only. We do not own Lamb Weston Holdings, Inc. (LW), Walgreens (WBA), and Best Buy Co (BBY). Louis Navellier and his family own CrowdStrike Holdings, Inc. Class A (CRWD), and Microsoft (MSFT), via a Navellier managed account, and Apple Computer (AAPL) and Amazon (AMZN) in a personal account. He does not own Alphabet Inc. Class A (GOOGL), Diageo plc Sponsored ADR (DEO), McDonald’s Corporation (MCD), Target Corporation (TGT), Walmart Inc. (WMT), Tesla (TSLA), Lamb Weston Holdings, Inc. (LW), Walgreens (WBA), or Best Buy Co (BBY), personally.

All content above represents the opinion of Louis Navellier of Navellier & Associates, Inc.

Also In This Issue

A Look Ahead by Louis Navellier

The Jobs Data is Weaker Than Expected

Income Mail by Bryan Perry

The Market Fears the Fed is Behind the Curve Again

Growth Mail by Gary Alexander

The Current Medal Count Between the Big 3 Economies

Global Mail by Ivan Martchev

The Bond Market is Already Cutting Rates for the Fed

Sector Spotlight by Jason Bodner

What Kind of Volatility to Expect, Especially in Election Years

View Full Archive

Read Past Issues Here

Louis Navellier

CHIEF INVESTMENT OFFICER

Louis Navellier is Founder, Chairman of the Board, Chief Investment Officer and Chief Compliance Officer of Navellier & Associates, Inc., located in Reno, Nevada. With decades of experience translating what had been purely academic techniques into real market applications, he believes that disciplined, quantitative analysis can select stocks that will significantly outperform the overall market. All content in this “A Look Ahead” section of Market Mail represents the opinion of Louis Navellier of Navellier & Associates, Inc.

Important Disclosures:

Although information in these reports has been obtained from and is based upon sources that Navellier believes to be reliable, Navellier does not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute Navellier’s judgment as of the date the report was created and are subject to change without notice. These reports are for informational purposes only and are not a solicitation for the purchase or sale of a security. Any decision to purchase securities mentioned in these reports must take into account existing public information on such securities or any registered prospectus.To the extent permitted by law, neither Navellier & Associates, Inc., nor any of its affiliates, agents, or service providers assumes any liability or responsibility nor owes any duty of care for any consequences of any person acting or refraining to act in reliance on the information contained in this communication or for any decision based on it.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any securities recommendations made by Navellier. in the future will be profitable or equal the performance of securities made in this report. Dividend payments are not guaranteed. The amount of a dividend payment, if any, can vary over time and issuers may reduce dividends paid on securities in the event of a recession or adverse event affecting a specific industry or issuer.

None of the stock information, data, and company information presented herein constitutes a recommendation by Navellier or a solicitation to buy or sell any securities. Any specific securities identified and described do not represent all of the securities purchased, sold, or recommended for advisory clients. The holdings identified do not represent all of the securities purchased, sold, or recommended for advisory clients and the reader should not assume that investments in the securities identified and discussed were or will be profitable.

Information presented is general information that does not take into account your individual circumstances, financial situation, or needs, nor does it present a personalized recommendation to you. Individual stocks presented may not be suitable for every investor. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. Investment in fixed income securities has the potential for the investment return and principal value of an investment to fluctuate so that an investor’s holdings, when redeemed, may be worth less than their original cost.

One cannot invest directly in an index. Index is unmanaged and index performance does not reflect deduction of fees, expenses, or taxes. Presentation of Index data does not reflect a belief by Navellier that any stock index constitutes an investment alternative to any Navellier equity strategy or is necessarily comparable to such strategies. Among the most important differences between the Indices and Navellier strategies are that the Navellier equity strategies may (1) incur material management fees, (2) concentrate its investments in relatively few stocks, industries, or sectors, (3) have significantly greater trading activity and related costs, and (4) be significantly more or less volatile than the Indices.

ETF Risk: We may invest in exchange traded funds (“ETFs”) and some of our investment strategies are generally fully invested in ETFs. Like traditional mutual funds, ETFs charge asset-based fees, but they generally do not charge initial sales charges or redemption fees and investors typically pay only customary brokerage fees to buy and sell ETF shares. The fees and costs charged by ETFs held in client accounts will not be deducted from the compensation the client pays Navellier. ETF prices can fluctuate up or down, and a client account could lose money investing in an ETF if the prices of the securities owned by the ETF go down. ETFs are subject to additional risks:

- ETF shares may trade above or below their net asset value;

- An active trading market for an ETF’s shares may not develop or be maintained;

- The value of an ETF may be more volatile than the underlying portfolio of securities the ETF is designed to track;

- The cost of owning shares of the ETF may exceed those a client would incur by directly investing in the underlying securities; and

- Trading of an ETF’s shares may be halted if the listing exchange’s officials deem it appropriate, the shares are delisted from the exchange, or the activation of market-wide “circuit breakers” (which are tied to large decreases in stock prices) halts stock trading generally.

Grader Disclosures: Investment in equity strategies involves substantial risk and has the potential for partial or complete loss of funds invested. The sample portfolio and any accompanying charts are for informational purposes only and are not to be construed as a solicitation to buy or sell any financial instrument and should not be relied upon as the sole factor in an investment making decision. As a matter of normal and important disclosures to you, as a potential investor, please consider the following: The performance presented is not based on any actual securities trading, portfolio, or accounts, and the reported performance of the A, B, C, D, and F portfolios (collectively the “model portfolios”) should be considered mere “paper” or pro forma performance results based on Navellier’s research.

Investors evaluating any of Navellier & Associates, Inc.’s, (or its affiliates’) Investment Products must not use any information presented here, including the performance figures of the model portfolios, in their evaluation of any Navellier Investment Products. Navellier Investment Products include the firm’s mutual funds and managed accounts. The model portfolios, charts, and other information presented do not represent actual funded trades and are not actual funded portfolios. There are material differences between Navellier Investment Products’ portfolios and the model portfolios, research, and performance figures presented here. The model portfolios and the research results (1) may contain stocks or ETFs that are illiquid and difficult to trade; (2) may contain stock or ETF holdings materially different from actual funded Navellier Investment Product portfolios; (3) include the reinvestment of all dividends and other earnings, estimated trading costs, commissions, or management fees; and, (4) may not reflect prices obtained in an actual funded Navellier Investment Product portfolio. For these and other reasons, the reported performances of model portfolios do not reflect the performance results of Navellier’s actually funded and traded Investment Products. In most cases, Navellier’s Investment Products have materially lower performance results than the performances of the model portfolios presented.

This report contains statements that are, or may be considered to be, forward-looking statements. All statements that are not historical facts, including statements about our beliefs or expectations, are “forward-looking statements” within the meaning of The U.S. Private Securities Litigation Reform Act of 1995. These statements may be identified by such forward-looking terminology as “expect,” “estimate,” “plan,” “intend,” “believe,” “anticipate,” “may,” “will,” “should,” “could,” “continue,” “project,” or similar statements or variations of such terms. Our forward-looking statements are based on a series of expectations, assumptions, and projections, are not guarantees of future results or performance, and involve substantial risks and uncertainty as described in Form ADV Part 2A of our filing with the Securities and Exchange Commission (SEC), which is available at www.adviserinfo.sec.gov or by requesting a copy by emailing info@navellier.com. All of our forward-looking statements are as of the date of this report only. We can give no assurance that such expectations or forward-looking statements will prove to be correct. Actual results may differ materially. You are urged to carefully consider all such factors.

FEDERAL TAX ADVICE DISCLAIMER: As required by U.S. Treasury Regulations, you are informed that, to the extent this presentation includes any federal tax advice, the presentation is not written by Navellier to be used, and cannot be used, for the purpose of avoiding federal tax penalties. Navellier does not advise on any income tax requirements or issues. Use of any information presented by Navellier is for general information only and does not represent tax advice either express or implied. You are encouraged to seek professional tax advice for income tax questions and assistance.

IMPORTANT NEWSLETTER DISCLOSURE:The hypothetical performance results for investment newsletters that are authored or edited by Louis Navellier, including Louis Navellier’s Growth Investor, Louis Navellier’s Breakthrough Stocks, Louis Navellier’s Accelerated Profits, and Louis Navellier’s Platinum Club, are not based on any actual securities trading, portfolio, or accounts, and the newsletters’ reported hypothetical performances should be considered mere “paper” or proforma hypothetical performance results and are not actual performance of real world trades. Navellier & Associates, Inc. does not have any relation to or affiliation with the owner of these newsletters. There are material differences between Navellier Investment Products’ portfolios and the InvestorPlace Media, LLC newsletter portfolios authored by Louis Navellier. The InvestorPlace Media, LLC newsletters contain hypothetical performance that do not include transaction costs, advisory fees, or other fees a client might incur if actual investments and trades were being made by an investor. As a result, newsletter performance should not be used to evaluate Navellier Investment services which are separate and different from the newsletters. The owner of the newsletters is InvestorPlace Media, LLC and any questions concerning the newsletters, including any newsletter advertising or hypothetical Newsletter performance claims, (which are calculated solely by Investor Place Media and not Navellier) should be referred to InvestorPlace Media, LLC at (800) 718-8289.

Please note that Navellier & Associates and the Navellier Private Client Group are managed completely independent of the newsletters owned and published by InvestorPlace Media, LLC and written and edited by Louis Navellier, and investment performance of the newsletters should in no way be considered indicative of potential future investment performance for any Navellier & Associates separately managed account portfolio. Potential investors should consult with their financial advisor before investing in any Navellier Investment Product.

Navellier claims compliance with Global Investment Performance Standards (GIPS). To receive a complete list and descriptions of Navellier’s composites and/or a presentation that adheres to the GIPS standards, please contact Navellier or click here. It should not be assumed that any securities recommendations made by Navellier & Associates, Inc. in the future will be profitable or equal the performance of securities made in this report.

FactSet Disclosure: Navellier does not independently calculate the statistical information included in the attached report. The calculation and the information are provided by FactSet, a company not related to Navellier. Although information contained in the report has been obtained from FactSet and is based on sources Navellier believes to be reliable, Navellier does not guarantee its accuracy, and it may be incomplete or condensed. The report and the related FactSet sourced information are provided on an “as is” basis. The user assumes the entire risk of any use made of this information. Investors should consider the report as only a single factor in making their investment decision. The report is for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of a security. FactSet sourced information is the exclusive property of FactSet. Without prior written permission of FactSet, this information may not be reproduced, disseminated or used to create any financial products. All indices are unmanaged and performance of the indices include reinvestment of dividends and interest income, unless otherwise noted, are not illustrative of any particular investment and an investment cannot be made in any index. Past performance is no guarantee of future results.