by Gary Alexander

July 16, 2024

“History does not repeat itself, but it does often rhyme.” – Mark Twain

With everyone’s eyes glued to cable TV news, as usual, I want to bring you some history – as usual – in my belief that history might be a bit more helpful than speculation by a passing parade of talking heads.

The theme of last week’s Freedom Fest, as I reported here last week, was “The Brave New World,” based on a dystopian novel by Aldous Huxley in 1932, in the depths of the Depression. During the middle of 1932, however, we saw the dawn of the most spectacular two-month (or five-year) rise in the Dow Jones Industrial Average in the 128-year history of that index. During the week of July 11-15, 1932, the Dow rose 10.3%, from its low of 41.22 – and that was just the opening round, as the Dow rose over 80% from July 11 to August 26, 1932, and nearly five-fold by early 1937, from its Depression low on July 8.

The proximate cause of that euphoria was the nomination of Franklin Delano Roosevelt for President at the Democratic National convention the previous week, giving hope to the nation for the defeat of the incumbent Herbert Hoover, who was widely blamed for the deep Depression and the eruption of homeless “Hoovervilles” across the nation. Ironically, on July 15, 1932, President Hoover cut his salary by 15%, in a vain effort to appear to be a man of the people, and to share their suffering. Hoover was a sincere man, trying to set the right example, but he only deepened the Great Depression by freezing industrial salaries at an unrealistically high level, at a time of massive deflation. He should have allowed everyone else’s salaries to fall. That would have kept unemployment rates lower, but he took a pointless pay cut himself.

Now, let’s move a dozen years ahead to the advent of FDR’s unprecedented fourth term, following his unprecedented third term. Although relatively young, at 62 in 1944, FDR and his doctors knew he was on death’s door. FDR also knew that his incumbent Vice President Henry Wallace was a friend of the Soviet Union and so would not be an appropriate successor after his death, so FDR quietly engineered the firing of his VP and the installation of a more moderate, more likable Harry Truman as his successor in 1945.

President Biden ought to take a lesson from FDR in 1944 and pick his replacement (or next VP) wisely.

Next, we turn to assassination plots. On July 20, 1944, the very day that President Franklin Roosevelt was nominated for his unprecedented fourth term at the Democratic National convention, the top news story of the day came out of Germany, where Klaus von Stauffenberg left a briefcase concealing a time bomb at Adolf Hitler’s feet during a meeting, and then excused himself. The bomb killed four people, but a broad, thick table leg shielded Hitler, who was only slightly wounded. Thinking Hitler dead, the conspirators met in Berlin to make a peace offer with the Allies, but by midnight, most conspirators, including Klaus, were dead. On that day, British premier Winston Churchill flew to France to meet Generals Eisenhower and Montgomery. It would have been a perfect day to end World War II, if that bomb had done its job.

This leads me to the Curse of the Kennedys, which I encountered last week in Las Vegas at Freedom Fest.

The Curse of the Kennedys – Revived at Freedom Fest

Ironically, it was 25 years ago today, on Friday, July 16, 1999, after the Dow had peaked at 11,209.84, shortly after the market closed, that John F. Kennedy, Jr., his wife and her sister flew a private jet to Cape Cod. They crashed, and so did the market. The Dow fell 5% in the second half of July 1999 and the Dow was down over 10% by October before reviving its bubble run up to a new peak on January 14, 2000.

Also on July 16, in 1969, the first moon-landing mission took off from Florida. The touchdown date on the moon was set for Sunday, July 20, but while mankind was making one giant leap onto moon sand, the youngest Kennedy brother, Ted, was making a small step toward oblivion, under a full moon: On Friday night, July 18, 1969, Ted drove over Chappaquiddick Bridge and allowed Mary Jo Kopechne to die in the shallow water there. The 1960s were summarized by a moon landing and a moonlit night under a bridge.

A family of important Kennedys were born in late July: First, JFK’s mother, Rose Fitzgerald Kennedy (on July 22, 1890), then first-born son, Joseph P. Kennedy Jr. on July 25, 1915 (he died in 1944, when his bomber exploded); and then JFK’s wife Jacqueline Bouvier Kennedy Onassis, born July 28, 1929. Also, their daughter’s husband, Edwin Schlossberg, husband of Carolyn Kennedy, was born on July 19, 1945.

At Freedom Fest last week, Robert F. Kennedy, Jr. spoke for 30 minutes on Friday, July 12th, and he had to bring his own security detail, at his own expense, as he has been denied Secret Service protection by the Homeland Security office of the Biden Administration, after at least five formal requests – despite what happened to his father and uncle, and despite polling 15% in some Presidential polls, which is the traditional threshold for being invited to debates and earning federal protection against gun violence.

The next afternoon, Saturday, while I was attending a two-hour session revisiting the JFK assassination by a pair of authors who had examined irregularities in the slicing and dicing of the Zapruder film before its release, and the faked autopsy of JFK’s brain and body after the attack, we heard news of the shooting of President Trump in Pennsylvania. Talk about a chilling coincidence and timing for hearing that news!

The heart of the conference was the talks and Film Festival. There were many profitable speeches I could cite. One came from conference founder Mark Skousen in evaluating Professor Joseph Stiglitz’s new book, “The Road to Freedom: Economics and the Good Society,” a take-off on the free-market classic, “The Road to Serfdom,” by Friedrich Hayek. Stiglitz writes (on page 235) that, “Globally, government has played an important role in the countries with the highest growth rates,” while “unfettered markets have created many of the central problems we face, including inequalities, the climate crisis and America’s opioid crisis” (page 279). In the past, I have countered these myths about income inequality (in Senator Phil Gramm’s book), as well as the climate pollution and opioid exports by China and others.

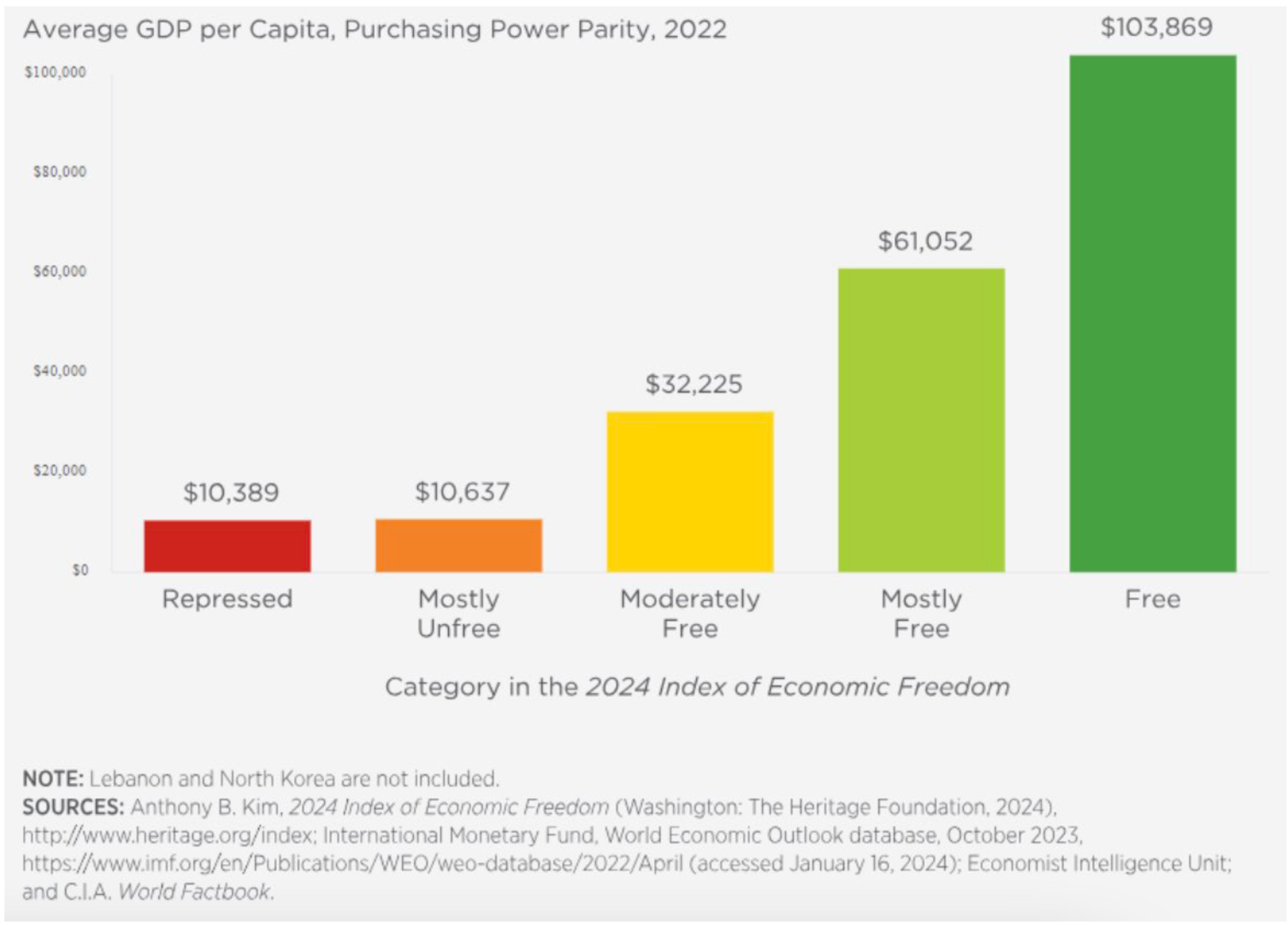

But here is a single chart to dispel Stiglitz’s assertions. The Fraser Institute and Heritage Foundation conduct studies showing that the countries with the highest levels of economic freedom enjoy a better environment, less poverty and a more fulfilling lifestyle – top to bottom – plus better market returns:

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

All content above represents the opinion of Gary Alexander of Navellier & Associates, Inc.

Also In This Issue

A Look Ahead by Louis Navellier

The Fed Dithers While Inflation Withers

Income Mail by Bryan Perry

Bond Yields Appear to Be Normalizing in the 4% Range

Growth Mail by Gary Alexander

“The Week That Was” vs. “Rhyming History”

Global Mail by Ivan Martchev

An Assassination Attempt + The Curse of the Mega-Caps

Sector Spotlight by Jason Bodner

This is a Big Year – For a Lot of Reasons

View Full Archive

Read Past Issues Here

About The Author

Gary Alexander

SENIOR EDITOR

Gary Alexander has been Senior Writer at Navellier since 2009. He edits Navellier’s weekly Marketmail and writes a weekly Growth Mail column, in which he uses market history to support the case for growth stocks. For the previous 20 years before joining Navellier, he was Senior Executive Editor at InvestorPlace Media (formerly Phillips Publishing), where he worked with several leading investment analysts, including Louis Navellier (since 1997), helping launch Louis Navellier’s Blue Chip Growth and Global Growth newsletters.

Prior to that, Gary edited Wealth Magazine and Gold Newsletter and wrote various investment research reports for Jefferson Financial in New Orleans in the 1980s. He began his financial newsletter career with KCI Communications in 1980, where he served as consulting editor for Personal Finance newsletter while serving as general manager of KCI’s Alexandria House book division. Before that, he covered the economics beat for news magazines. All content of “Growth Mail” represents the opinion of Gary Alexander

Important Disclosures:

Although information in these reports has been obtained from and is based upon sources that Navellier believes to be reliable, Navellier does not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute Navellier’s judgment as of the date the report was created and are subject to change without notice. These reports are for informational purposes only and are not a solicitation for the purchase or sale of a security. Any decision to purchase securities mentioned in these reports must take into account existing public information on such securities or any registered prospectus.To the extent permitted by law, neither Navellier & Associates, Inc., nor any of its affiliates, agents, or service providers assumes any liability or responsibility nor owes any duty of care for any consequences of any person acting or refraining to act in reliance on the information contained in this communication or for any decision based on it.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any securities recommendations made by Navellier. in the future will be profitable or equal the performance of securities made in this report. Dividend payments are not guaranteed. The amount of a dividend payment, if any, can vary over time and issuers may reduce dividends paid on securities in the event of a recession or adverse event affecting a specific industry or issuer.

None of the stock information, data, and company information presented herein constitutes a recommendation by Navellier or a solicitation to buy or sell any securities. Any specific securities identified and described do not represent all of the securities purchased, sold, or recommended for advisory clients. The holdings identified do not represent all of the securities purchased, sold, or recommended for advisory clients and the reader should not assume that investments in the securities identified and discussed were or will be profitable.

Information presented is general information that does not take into account your individual circumstances, financial situation, or needs, nor does it present a personalized recommendation to you. Individual stocks presented may not be suitable for every investor. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. Investment in fixed income securities has the potential for the investment return and principal value of an investment to fluctuate so that an investor’s holdings, when redeemed, may be worth less than their original cost.

One cannot invest directly in an index. Index is unmanaged and index performance does not reflect deduction of fees, expenses, or taxes. Presentation of Index data does not reflect a belief by Navellier that any stock index constitutes an investment alternative to any Navellier equity strategy or is necessarily comparable to such strategies. Among the most important differences between the Indices and Navellier strategies are that the Navellier equity strategies may (1) incur material management fees, (2) concentrate its investments in relatively few stocks, industries, or sectors, (3) have significantly greater trading activity and related costs, and (4) be significantly more or less volatile than the Indices.

ETF Risk: We may invest in exchange traded funds (“ETFs”) and some of our investment strategies are generally fully invested in ETFs. Like traditional mutual funds, ETFs charge asset-based fees, but they generally do not charge initial sales charges or redemption fees and investors typically pay only customary brokerage fees to buy and sell ETF shares. The fees and costs charged by ETFs held in client accounts will not be deducted from the compensation the client pays Navellier. ETF prices can fluctuate up or down, and a client account could lose money investing in an ETF if the prices of the securities owned by the ETF go down. ETFs are subject to additional risks:

- ETF shares may trade above or below their net asset value;

- An active trading market for an ETF’s shares may not develop or be maintained;

- The value of an ETF may be more volatile than the underlying portfolio of securities the ETF is designed to track;

- The cost of owning shares of the ETF may exceed those a client would incur by directly investing in the underlying securities; and

- Trading of an ETF’s shares may be halted if the listing exchange’s officials deem it appropriate, the shares are delisted from the exchange, or the activation of market-wide “circuit breakers” (which are tied to large decreases in stock prices) halts stock trading generally.

Grader Disclosures: Investment in equity strategies involves substantial risk and has the potential for partial or complete loss of funds invested. The sample portfolio and any accompanying charts are for informational purposes only and are not to be construed as a solicitation to buy or sell any financial instrument and should not be relied upon as the sole factor in an investment making decision. As a matter of normal and important disclosures to you, as a potential investor, please consider the following: The performance presented is not based on any actual securities trading, portfolio, or accounts, and the reported performance of the A, B, C, D, and F portfolios (collectively the “model portfolios”) should be considered mere “paper” or pro forma performance results based on Navellier’s research.

Investors evaluating any of Navellier & Associates, Inc.’s, (or its affiliates’) Investment Products must not use any information presented here, including the performance figures of the model portfolios, in their evaluation of any Navellier Investment Products. Navellier Investment Products include the firm’s mutual funds and managed accounts. The model portfolios, charts, and other information presented do not represent actual funded trades and are not actual funded portfolios. There are material differences between Navellier Investment Products’ portfolios and the model portfolios, research, and performance figures presented here. The model portfolios and the research results (1) may contain stocks or ETFs that are illiquid and difficult to trade; (2) may contain stock or ETF holdings materially different from actual funded Navellier Investment Product portfolios; (3) include the reinvestment of all dividends and other earnings, estimated trading costs, commissions, or management fees; and, (4) may not reflect prices obtained in an actual funded Navellier Investment Product portfolio. For these and other reasons, the reported performances of model portfolios do not reflect the performance results of Navellier’s actually funded and traded Investment Products. In most cases, Navellier’s Investment Products have materially lower performance results than the performances of the model portfolios presented.

This report contains statements that are, or may be considered to be, forward-looking statements. All statements that are not historical facts, including statements about our beliefs or expectations, are “forward-looking statements” within the meaning of The U.S. Private Securities Litigation Reform Act of 1995. These statements may be identified by such forward-looking terminology as “expect,” “estimate,” “plan,” “intend,” “believe,” “anticipate,” “may,” “will,” “should,” “could,” “continue,” “project,” or similar statements or variations of such terms. Our forward-looking statements are based on a series of expectations, assumptions, and projections, are not guarantees of future results or performance, and involve substantial risks and uncertainty as described in Form ADV Part 2A of our filing with the Securities and Exchange Commission (SEC), which is available at www.adviserinfo.sec.gov or by requesting a copy by emailing info@navellier.com. All of our forward-looking statements are as of the date of this report only. We can give no assurance that such expectations or forward-looking statements will prove to be correct. Actual results may differ materially. You are urged to carefully consider all such factors.

FEDERAL TAX ADVICE DISCLAIMER: As required by U.S. Treasury Regulations, you are informed that, to the extent this presentation includes any federal tax advice, the presentation is not written by Navellier to be used, and cannot be used, for the purpose of avoiding federal tax penalties. Navellier does not advise on any income tax requirements or issues. Use of any information presented by Navellier is for general information only and does not represent tax advice either express or implied. You are encouraged to seek professional tax advice for income tax questions and assistance.

IMPORTANT NEWSLETTER DISCLOSURE:The hypothetical performance results for investment newsletters that are authored or edited by Louis Navellier, including Louis Navellier’s Growth Investor, Louis Navellier’s Breakthrough Stocks, Louis Navellier’s Accelerated Profits, and Louis Navellier’s Platinum Club, are not based on any actual securities trading, portfolio, or accounts, and the newsletters’ reported hypothetical performances should be considered mere “paper” or proforma hypothetical performance results and are not actual performance of real world trades. Navellier & Associates, Inc. does not have any relation to or affiliation with the owner of these newsletters. There are material differences between Navellier Investment Products’ portfolios and the InvestorPlace Media, LLC newsletter portfolios authored by Louis Navellier. The InvestorPlace Media, LLC newsletters contain hypothetical performance that do not include transaction costs, advisory fees, or other fees a client might incur if actual investments and trades were being made by an investor. As a result, newsletter performance should not be used to evaluate Navellier Investment services which are separate and different from the newsletters. The owner of the newsletters is InvestorPlace Media, LLC and any questions concerning the newsletters, including any newsletter advertising or hypothetical Newsletter performance claims, (which are calculated solely by Investor Place Media and not Navellier) should be referred to InvestorPlace Media, LLC at (800) 718-8289.

Please note that Navellier & Associates and the Navellier Private Client Group are managed completely independent of the newsletters owned and published by InvestorPlace Media, LLC and written and edited by Louis Navellier, and investment performance of the newsletters should in no way be considered indicative of potential future investment performance for any Navellier & Associates separately managed account portfolio. Potential investors should consult with their financial advisor before investing in any Navellier Investment Product.

Navellier claims compliance with Global Investment Performance Standards (GIPS). To receive a complete list and descriptions of Navellier’s composites and/or a presentation that adheres to the GIPS standards, please contact Navellier or click here. It should not be assumed that any securities recommendations made by Navellier & Associates, Inc. in the future will be profitable or equal the performance of securities made in this report.

FactSet Disclosure: Navellier does not independently calculate the statistical information included in the attached report. The calculation and the information are provided by FactSet, a company not related to Navellier. Although information contained in the report has been obtained from FactSet and is based on sources Navellier believes to be reliable, Navellier does not guarantee its accuracy, and it may be incomplete or condensed. The report and the related FactSet sourced information are provided on an “as is” basis. The user assumes the entire risk of any use made of this information. Investors should consider the report as only a single factor in making their investment decision. The report is for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of a security. FactSet sourced information is the exclusive property of FactSet. Without prior written permission of FactSet, this information may not be reproduced, disseminated or used to create any financial products. All indices are unmanaged and performance of the indices include reinvestment of dividends and interest income, unless otherwise noted, are not illustrative of any particular investment and an investment cannot be made in any index. Past performance is no guarantee of future results.