by Gary Alexander

July 15, 2025

This morning, I turn 80 – that seems amazing, it happened so fast – so let me claim an old geezer’s prerogative to share 10-investment (and life) lessons from my first 80-circumnavigations of Old Sol:

Lesson #1 (1945): Doomsday Never Arrived – So: Invest as If Mankind Will Keep Growing in Prosperity

I was born early on July 15, 1945, the day before J. Robert Oppenheimer and his friends set off the first nuclear blast in Alamagordo, New Mexico. That atomic power was soon unleashed upon Japan, ending World War II, but atomic weapons have not been used in war since then, despite the constant warnings of books, novels and Nuclear Scientists, who have kept their doomsday clock at a few minutes before midnight for almost 80-years. In fact, their Doomsday Clock is now just 89-seconds (down from 90-seconds last year), the closest it has ever been to midnight, representing their ongoing fears of a terrible global catastrophe.

On July 16, 1945, President Harry S. Truman was in Potsdam, Germany, when the bomb exploded. To code that event, the President’s coders told him, “Baby Boy Born. Eyes Bright. Can hear him (from 50-miles) and see him (200-miles away).” So, President Truman was informed of the blast – and my birth!

On the day the bomb exploded, Oppenheimer was a bear, and the New York Times reporter was a bull:

“I am become death, the shatterer of worlds.” — J. Robert Oppenheimer, the bomb’s chief architect.

“I feel privileged to…be present at the moment of the Creation when the Lord said: Let there be Light.”

— William L. Laurence of the New York Times, on seeing that blinding explosion.

So, lesson #1 is that the predicted doomsday never happened and overly fearful bears lost out due to fears, even as America began to expand on a 20-year postwar boom, when businesses and markets flourished.

Here’s a case in point: On July 25, 1945, industrialists Henry J. Kaiser and Joseph Frazer announced their plans to form a corporation to manufacture cars. They had to be insane. By 1945, there were only four major carmakers left standing, but Kaiser was a major industrialist who had helped arm America in World War II, so if anyone could break the Detroit cartel, Kaiser could. By 1945, he sat atop an empire of shipbuilding, cement, steel, and other basic building businesses, from which he had earned a fortune.

With Kaiser’s capital and Frazer’s car knowledge and contacts, they were optimistic about their new firm’s chances. But, even with all that money and expertise, skeptics said they only had “one white chip” in Detroit’s poker game. But by 1947, they produced 100,000-cars and netted $19-million in profits. Success was within their grasp, and the next year they made $10-million in profits, but Kaiser-Frazer couldn’t afford to come up with new models every year – and consumers demanded novelty. In 1949, Kaiser-Frazer lost $30-million. Frazer left the team. But Kaiser kept going until 1953, when he sold out to Willys-Overland.

This extended history is a tribute to the memory of our first two family cars – a “Henry J” and a “Kaiser.” Dad was an engineer and he loved well-engineered products, so he bought a “Henry J” and then a Kaiser.

Lesson #2 (1950s): Keep Reading Widely, Especially History (and Finance)

Several events happened in July 1955, besides turning 10. On July 9, Bill Haley and the Comets soared to #1 on the hit parade (for seven weeks) with “Rock Around the Clock,” the rock era’s H-bomb event – but I preferred big band jazz and Sinatra. A week later, Anaheim’s Disneyland opened for the first time. “The Happiest Place on Earth” greeted four-million that first year, in Fantasyland, Frontierland, Fantasyland and Tomorrowland. Opening day featured Walt Disney, Art Linkletter and…Ronald Reagan.

That summer, my parents bought a complete set of the World Book encyclopedias, and I don’t think I emerged from reading or scanning every article within a year or two, reproducing the economic charts as school projects and virtually memorizing all the key production statistics for crops and natural resources.

I quickly graduated to devouring TIME Magazine, cover-to-cover each week, and dad’s college physics textbooks, anything with print. Since then – each year since at least the 1960s – I have read at least 100-books a year, focusing on history and economics as proof of how we overcome crises and keep growing.

Lesson #3 (1960s): Start Investing in Your Salad Days – By Cutting Costs to the Bone

In July 1965, the erosion of our currency began, launching six decades of inflation. With a powerful 68% majority in both Houses of Congress in the 1964 election, LBJ could do whatever he wanted – and did. One early act was the Coinage Act of 1965, signed into law on July 23, 1965, by LBJ. After all, it was his idea – to remove most of the silver from our coins in order to fund “Guns, Butter, Rockets, and More!” Of course, silver dimes and quarters disappeared into personal hoards, while the cheap substitutes circulated.

In the mid-1960s, I worked my way through college, as did my wife-to-be, and we paid off our college debts within a year of graduation. It can still be done. We have helped explain the process to our children and grand-kids, and our two eldest grandsons have already graduated debt-free, in 2018 and 2019. One key is to stay at home the first two years, attending classes at extension campuses or junior college, then do so well you earn scholarships for the last two years in a major college, working and cutting costs to the bone.

Marrying young in 1968, with three kids coming by 1972, we had to be especially cost-cutting in all our needs, finding a $75-rental first, then buying a home in Pasadena for under $20,000, with a $129-monthly mortgage nut. Our big treat was splitting a quart of 29-cent beer each Friday night. We made a game of it.

Lesson #4 (1970s): Don’t “Sell to Soon,” Unless the Numbers Work Out

The 1970s were a rough time to invest and support a family on one salary. The nation was in a blue funk over Vietnam, Watergate, high inflation and more. We even bailed out on moon-shots. On July 24, 1975, Apollo 18 returned to Earth, six-years to the day after Apollo 11 returned. That was the end of all moon shots, which seemed repetitive and politically expendable, so we’re now 50-years into no moon walks!

At our wedding, Aunt Margie gave us 10 shares of a glamour “Nifty Fifty” stock, and we held it until I finally had to bail out in 1974, near the bottom of a bear market. The stock (after mergers) kept rising, but it went bankrupt in 2023, so I lost a nice ride there, but not nearly as much as when we sold our Pasadena home and cashed in my TIAA-CREF account at USC, worth over $8,000, minus penalties, to assume a low-cost mortgage in Virginia to begin my investment newsletter career with some great publishers there.

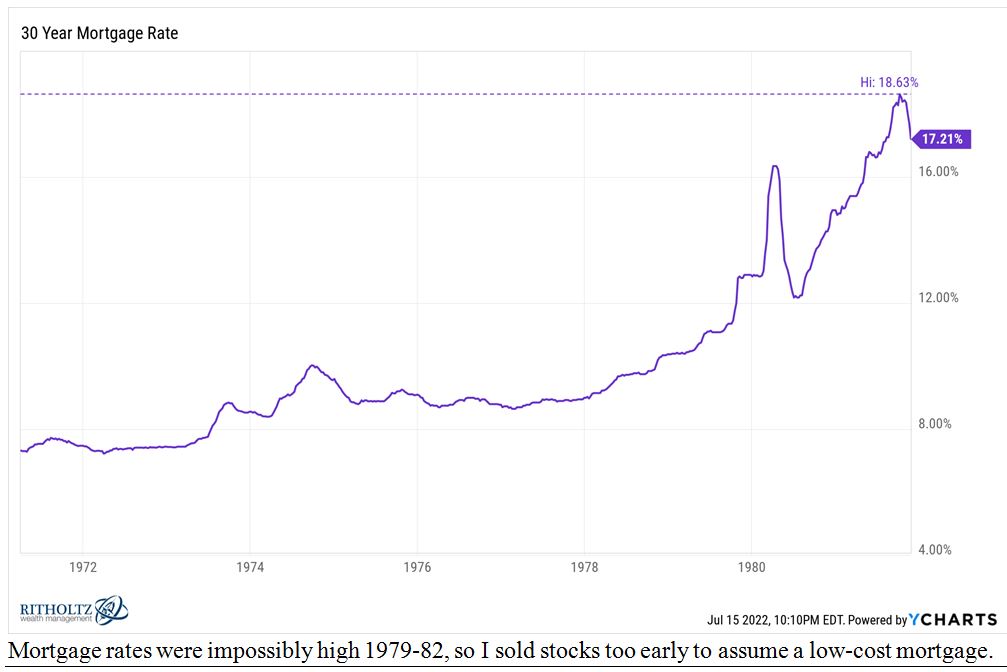

At the time, mortgage rates were soaring, rising from 16% when we shopped around, to peak at 18.6%. To buy a home in that market seemed like financial suicide to this penny-pinching economist, so I cashed in my TIAA retirement account and home profits to pay a huge amount (20%+ down, or about $35,000) to assume a mortgage at much lower rates (under 8%), bringing our monthly payments down to $389.

It seemed smart at the time, but if I had been patient, leaving that $8,000 in TIAA-CREF untouched, it would likely approach the 60-fold S&P gains since then, so that $8,000 retirement account, all alone and untouched, could very likely be worth nearly $500,000 today, so it seems I made a mistake cashing out.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Lesson #5 (1980s): The Bears May Roar, but the Bulls Make More Money

In 1980, I began my 45-year career in the investment newsletter business, first by serving as Consulting Editor to Personal Finance in Alexander, Virginia. This gave me a chance to edit the advice of dozens of top professionals in the financial newsletter business. The other two Consulting Editors and I held some informative weekly debates over articles. One, the author of the #1 financial best-seller that year, “Crisis Investing,” argued for a “Greater Depression” ahead, while the other boldly predicted, “Reaganomics Will Work,” turning the market around. For two or more years, the bear seemed right, then the Reagan tax cuts and deregulation turned the bull into the winner. This taught me patience, to weigh the arguments on both sides, but mostly to let the market decide – and it did so, decisively, for the next 15 years and more.

My first investment seminar duties came offshore with four seminars across the Caribbean and Canada in 1981, and I have since moderated panels and served as MC for over 100-seminars, mostly in New Orleans (42), but also in Atlanta (15), Switzerland (14), at Money Shows (15+) around the nation, and on cruises.

The New Orleans speakers were primarily bearish on stocks and bullish on gold, which didn’t work well in the 1980s, and I didn’t make much money then, but I had the good sense to listen to bullish exhibitors (and speakers) in New Orleans – most notably, Louis Navellier and John Dessauer – who helped turn my mind around to think more positively about stocks, while maintaining a small balancing position in gold.

I didn’t wise up fast enough – I missed out on most 1980s gains, but the relentless teachings (and success) of these few bulls turned me around before the end of the decade, and I have been a perma-bull in stocks since 1989. Even though I was late to the game – turning 34 in 1989 – that change made a big difference.

The S&P 500 stood at 318 in mid-1989, when I went to work with a team of bulls (editing Richard Band, Mark Skousen, and later John Dessauer and Louis Navellier), so I missed the big gains in the 1980s, but the S&P is still up nearly 20-fold since 1989 – and some great partnerships helped magnify those gains.

In six of my eight decades on the planet, the S&P more than doubled – and the two slow patches (in the 1970s and 2000s) also delivered net gains, for a total 80-year gain of 423-fold, not counting dividends or inflation, which tend to cancel each other out, over time. Those are the benefits of a bullish outlook.

Oops! I can see this story is already too long, so let me bring you my five post-1990 lessons next week.

(To Be Continued)

All content above represents the opinion of Gary Alexander of Navellier & Associates, Inc.

Also In This Issue

A Look Ahead by Louis Navellier

Trump’s Game of “Tariff Chicken” Enters the Final Stage

Income Mail by Bryan Perry

Trump’s Tariff Bluffs Could Cause an August Slump

Growth Mail by Gary Alexander

10 Investment Lessons from 60-Years in the Game

Global Mail by Ivan Martchev

We’re Waiting on More Tariff Escalation to Come

Sector Spotlight by Jason Bodner

Is The World Speeding Up or Slowing Down? (That Depends…)

View Full Archive

Read Past Issues Here

About The Author

Gary Alexander

SENIOR EDITOR

Gary Alexander has been Senior Writer at Navellier since 2009. He edits Navellier’s weekly Marketmail and writes a weekly Growth Mail column, in which he uses market history to support the case for growth stocks. For the previous 20-years before joining Navellier, he was Senior Executive Editor at InvestorPlace Media (formerly Phillips Publishing), where he worked with several leading investment analysts, including Louis Navellier (since 1997), helping launch Louis Navellier’s Blue Chip Growth and Global Growth newsletters.

Prior to that, Gary edited Wealth Magazine and Gold Newsletter and wrote various investment research reports for Jefferson Financial in New Orleans in the 1980s. He began his financial newsletter career with KCI Communications in 1980, where he served as consulting editor for Personal Finance newsletter while serving as general manager of KCI’s Alexandria House book division. Before that, he covered the economics beat for news magazines. All content of “Growth Mail” represents the opinion of Gary Alexander

Important Disclosures:

Although information in these reports has been obtained from and is based upon sources that Navellier believes to be reliable, Navellier does not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute Navellier’s judgment as of the date the report was created and are subject to change without notice. These reports are for informational purposes only and are not a solicitation for the purchase or sale of a security. Any decision to purchase securities mentioned in these reports must take into account existing public information on such securities or any registered prospectus.To the extent permitted by law, neither Navellier & Associates, Inc., nor any of its affiliates, agents, or service providers assumes any liability or responsibility nor owes any duty of care for any consequences of any person acting or refraining to act in reliance on the information contained in this communication or for any decision based on it.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any securities recommendations made by Navellier. in the future will be profitable or equal the performance of securities made in this report. Dividend payments are not guaranteed. The amount of a dividend payment, if any, can vary over time and issuers may reduce dividends paid on securities in the event of a recession or adverse event affecting a specific industry or issuer.

None of the stock information, data, and company information presented herein constitutes a recommendation by Navellier or a solicitation to buy or sell any securities. Any specific securities identified and described do not represent all of the securities purchased, sold, or recommended for advisory clients. The holdings identified do not represent all of the securities purchased, sold, or recommended for advisory clients and the reader should not assume that investments in the securities identified and discussed were or will be profitable.

Information presented is general information that does not take into account your individual circumstances, financial situation, or needs, nor does it present a personalized recommendation to you. Individual stocks presented may not be suitable for every investor. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. Investment in fixed income securities has the potential for the investment return and principal value of an investment to fluctuate so that an investor’s holdings, when redeemed, may be worth less than their original cost.

One cannot invest directly in an index. Index is unmanaged and index performance does not reflect deduction of fees, expenses, or taxes. Presentation of Index data does not reflect a belief by Navellier that any stock index constitutes an investment alternative to any Navellier equity strategy or is necessarily comparable to such strategies. Among the most important differences between the Indices and Navellier strategies are that the Navellier equity strategies may (1) incur material management fees, (2) concentrate its investments in relatively few stocks, industries, or sectors, (3) have significantly greater trading activity and related costs, and (4) be significantly more or less volatile than the Indices.

ETF Risk: We may invest in exchange traded funds (“ETFs”) and some of our investment strategies are generally fully invested in ETFs. Like traditional mutual funds, ETFs charge asset-based fees, but they generally do not charge initial sales charges or redemption fees and investors typically pay only customary brokerage fees to buy and sell ETF shares. The fees and costs charged by ETFs held in client accounts will not be deducted from the compensation the client pays Navellier. ETF prices can fluctuate up or down, and a client account could lose money investing in an ETF if the prices of the securities owned by the ETF go down. ETFs are subject to additional risks:

- ETF shares may trade above or below their net asset value;

- An active trading market for an ETF’s shares may not develop or be maintained;

- The value of an ETF may be more volatile than the underlying portfolio of securities the ETF is designed to track;

- The cost of owning shares of the ETF may exceed those a client would incur by directly investing in the underlying securities; and

- Trading of an ETF’s shares may be halted if the listing exchange’s officials deem it appropriate, the shares are delisted from the exchange, or the activation of market-wide “circuit breakers” (which are tied to large decreases in stock prices) halts stock trading generally.

Grader Disclosures: Investment in equity strategies involves substantial risk and has the potential for partial or complete loss of funds invested. The sample portfolio and any accompanying charts are for informational purposes only and are not to be construed as a solicitation to buy or sell any financial instrument and should not be relied upon as the sole factor in an investment making decision. As a matter of normal and important disclosures to you, as a potential investor, please consider the following: The performance presented is not based on any actual securities trading, portfolio, or accounts, and the reported performance of the A, B, C, D, and F portfolios (collectively the “model portfolios”) should be considered mere “paper” or pro forma performance results based on Navellier’s research.

Investors evaluating any of Navellier & Associates, Inc.’s, (or its affiliates’) Investment Products must not use any information presented here, including the performance figures of the model portfolios, in their evaluation of any Navellier Investment Products. Navellier Investment Products include the firm’s mutual funds and managed accounts. The model portfolios, charts, and other information presented do not represent actual funded trades and are not actual funded portfolios. There are material differences between Navellier Investment Products’ portfolios and the model portfolios, research, and performance figures presented here. The model portfolios and the research results (1) may contain stocks or ETFs that are illiquid and difficult to trade; (2) may contain stock or ETF holdings materially different from actual funded Navellier Investment Product portfolios; (3) include the reinvestment of all dividends and other earnings, estimated trading costs, commissions, or management fees; and, (4) may not reflect prices obtained in an actual funded Navellier Investment Product portfolio. For these and other reasons, the reported performances of model portfolios do not reflect the performance results of Navellier’s actually funded and traded Investment Products. In most cases, Navellier’s Investment Products have materially lower performance results than the performances of the model portfolios presented.

This report contains statements that are, or may be considered to be, forward-looking statements. All statements that are not historical facts, including statements about our beliefs or expectations, are “forward-looking statements” within the meaning of The U.S. Private Securities Litigation Reform Act of 1995. These statements may be identified by such forward-looking terminology as “expect,” “estimate,” “plan,” “intend,” “believe,” “anticipate,” “may,” “will,” “should,” “could,” “continue,” “project,” or similar statements or variations of such terms. Our forward-looking statements are based on a series of expectations, assumptions, and projections, are not guarantees of future results or performance, and involve substantial risks and uncertainty as described in Form ADV Part 2A of our filing with the Securities and Exchange Commission (SEC), which is available at www.adviserinfo.sec.gov or by requesting a copy by emailing info@navellier.com. All of our forward-looking statements are as of the date of this report only. We can give no assurance that such expectations or forward-looking statements will prove to be correct. Actual results may differ materially. You are urged to carefully consider all such factors.

FEDERAL TAX ADVICE DISCLAIMER: As required by U.S. Treasury Regulations, you are informed that, to the extent this presentation includes any federal tax advice, the presentation is not written by Navellier to be used, and cannot be used, for the purpose of avoiding federal tax penalties. Navellier does not advise on any income tax requirements or issues. Use of any information presented by Navellier is for general information only and does not represent tax advice either express or implied. You are encouraged to seek professional tax advice for income tax questions and assistance.

IMPORTANT NEWSLETTER DISCLOSURE:The hypothetical performance results for investment newsletters that are authored or edited by Louis Navellier, including Louis Navellier’s Growth Investor, Louis Navellier’s Breakthrough Stocks, Louis Navellier’s Accelerated Profits, and Louis Navellier’s Platinum Club, are not based on any actual securities trading, portfolio, or accounts, and the newsletters’ reported hypothetical performances should be considered mere “paper” or proforma hypothetical performance results and are not actual performance of real world trades. Navellier & Associates, Inc. does not have any relation to or affiliation with the owner of these newsletters. There are material differences between Navellier Investment Products’ portfolios and the InvestorPlace Media, LLC newsletter portfolios authored by Louis Navellier. The InvestorPlace Media, LLC newsletters contain hypothetical performance that do not include transaction costs, advisory fees, or other fees a client might incur if actual investments and trades were being made by an investor. As a result, newsletter performance should not be used to evaluate Navellier Investment services which are separate and different from the newsletters. The owner of the newsletters is InvestorPlace Media, LLC and any questions concerning the newsletters, including any newsletter advertising or hypothetical Newsletter performance claims, (which are calculated solely by Investor Place Media and not Navellier) should be referred to InvestorPlace Media, LLC at (800) 718-8289.

Please note that Navellier & Associates and the Navellier Private Client Group are managed completely independent of the newsletters owned and published by InvestorPlace Media, LLC and written and edited by Louis Navellier, and investment performance of the newsletters should in no way be considered indicative of potential future investment performance for any Navellier & Associates separately managed account portfolio. Potential investors should consult with their financial advisor before investing in any Navellier Investment Product.

Navellier claims compliance with Global Investment Performance Standards (GIPS). To receive a complete list and descriptions of Navellier’s composites and/or a presentation that adheres to the GIPS standards, please contact Navellier or click here. It should not be assumed that any securities recommendations made by Navellier & Associates, Inc. in the future will be profitable or equal the performance of securities made in this report.

FactSet Disclosure: Navellier does not independently calculate the statistical information included in the attached report. The calculation and the information are provided by FactSet, a company not related to Navellier. Although information contained in the report has been obtained from FactSet and is based on sources Navellier believes to be reliable, Navellier does not guarantee its accuracy, and it may be incomplete or condensed. The report and the related FactSet sourced information are provided on an “as is” basis. The user assumes the entire risk of any use made of this information. Investors should consider the report as only a single factor in making their investment decision. The report is for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of a security. FactSet sourced information is the exclusive property of FactSet. Without prior written permission of FactSet, this information may not be reproduced, disseminated or used to create any financial products. All indices are unmanaged and performance of the indices include reinvestment of dividends and interest income, unless otherwise noted, are not illustrative of any particular investment and an investment cannot be made in any index. Past performance is no guarantee of future results.