by Gary Alexander

June 25, 2024

I’m against war and would do anything I could to bring peace to Ukraine, the Middle East and other hot spots, but the sad truth is that we now face threats of escalation into World War III on at least two fronts.

Ukraine’s President Volodymyr Zelenskyy has warned that failure to fend off Russia’s aggression could spiral into a confrontation with NATO nations, saying: “That certainly means the Third World War.”

Russian cruise missile violated NATO airspace right after Putin warned that any direct confrontation between Russia and the Western alliance would be “one step away from a full-scale World War III,” and in response, England and America have provided missiles that reach deep into Russia, so it is clear that the West is fighting a proxy war against a nuclear-rich (yet otherwise poor) paranoid power.

The same kind of missile aid from the West has also escalated within the Middle East in recent months.

For investors, history indicates that (1) as long as we can avoid nuclear war, and (2) the west wins and/or becomes stronger in the postwar world, markets tend to strengthen during and after major wars. To back up this claim, let me tie in today’s date (within a day: June 24-26) to five or six wars in American history.

#1: The Civil War, keyed to the first day of the Seven Days’ Battle, June 26, 1862, in Mechanicsville, VA.

From 1979 to 1982, I lived in Mechanicsville, Virginia, as a free-lance writer for financial newsletters, but that left me plenty of time to tour major Civil War battlefields under the inspiring leadership of Ed Bearss (1923-2020), a wounded World War II Marine veteran and Park Ranger with an encyclopedic knowledge of Civil War engagements. For the Seven Days Battle (June 26 to July 3, 1862), Ed loaded a bus of us up to tour all seven sites in a day, starting on Beaver Dam Creek, near our home. In each site, he would close his eyes and “see” the battle, describing which unit came over which hill, encountering what level of fire. It was like being there. At the end, a Union bugler sounded Taps, the new lament for the dead, on July 4th.

What did the market do from that point forward? There was no Dow index until 1896, but according to The Stock Trader’s Almanac, using Cowles and other indexes, markets rose 55.4% in 1862, 38% in 1863 and +6.4% in 1864, more than doubling (+128%, compounded) in the three core years of the Civil War.

#2: World War I: On June 26, 1917, the first U.S. expeditionary force of 14,000 arrived in France.

America was late to the Great War, “the war to end all wars.” Stock markets in Europe initially closed for much of World War I. German and Russian markets remained closed until 1917, while other European markets opened sporadically. The U.S. market closed for most of the second half of 1914 and only re-opened in stages in the first half of 1915. When the market shut down on July 30, 1914, the Dow Jones Industrial index stood at 53.23. It more than doubled to 110.15 by November 1916, during the time America stayed out of the war, and President Wilson was re-elected, in part, by promising to keep America out of Europe’s conflict.

Despite Wilson’s promises, America entered the war in April 1917 and the market declined on that news, with the Dow falling 21.7% in 1917. When the tide of war began to turn in favor of the West in 1918, the market reversed and rose: +10.5% in 1918 and +30.5% in 1919. In all, from December 19, 1917, to November 3, 1919, the Dow rose from 66 to 120 (+82%) as U.S. forces prevailed and then came home.

#3: World War II: On June 25, 1942: FDR and Churchill named U.S. General Dwight D. Eisenhower Supreme Allied Commander in Europe over the less flexible British General, Bernard Montgomery.

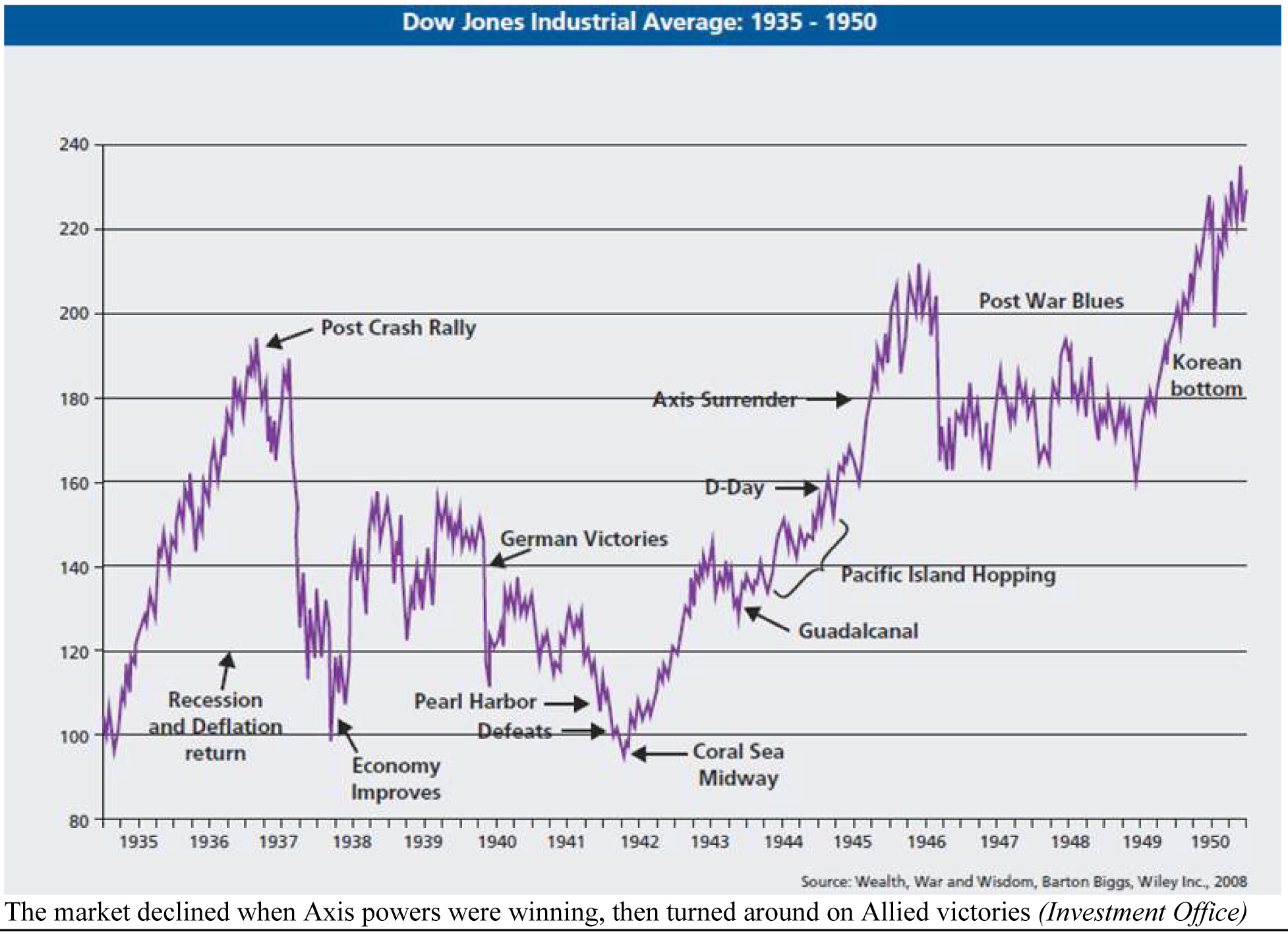

June 1942 was the turnaround month in World War II with the Battle of Midway in the North Pacific, and the naming of General Eisenhower to coordinate the Allied forces in Europe. The actual bottom in the Dow Jones index came on April 28, 1942, shortly after General Jimmy Doolittle’s air raid over Tokyo on April 18. From that point, the Dow more than doubled from 92.92 to 212.50 (+129%) on May 29, 1946.

Dow Gains by Calendar Year

1942 +7.6%

1943 +13.8%

1944 +12.1%

1945 +26.6%

Source: Stock Trader’s Almanac

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

#4: Korean War: On Sunday, June 25, 1950, 200,000 North Korean troops stormed into South Korea.

Just six years after the West’s D-Day on Normandy’s beaches, North Korea, with likely help from the new Maoist regime in China, staged their own surprise D-Day invasion of South Korea, launching the Korean War, giving little or no rest to American soldiers just five years at home after World War II.

The market didn’t suddenly rise after North Korea’s “D-Day” invasion of the south. The next day, the Dow fell by a staggering 4.7% (-10.44 points), to 213.91, the largest one-day drop since 1937, and the worst single-day decline we would see again until 1962. For the week of June 26-30, 1950, the Dow fell 15.24 points (-6.8%), to 209.11, the worst weekly drop since the 1930s. But the market soon took off.

Dow Gains by Calendar Year

1949 +12.9%

1950 +17.6%

1951 +14.4%

1952 +8.4%

Source: Stock Trader’s Almanac

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

The Longest (and Coldest) War Started in 1948

#5: The Cold War: On June 24, 1948, the blockade of Berlin began, leading to the Berlin Airlift.

After the Soviet Union began its blockade of their section of Berlin, buried within their section of East Germany, within a year, 277,000 Allied flights delivered over 2.3 million tons of supplies to Berlin. On the same day in 1948, President Harry Truman also signed the Selective Service Act, calling for all males, age 18-22, to register, for the draft, perhaps anticipating the next hot war in a new, longer-term cold war.

One angle of the Berlin Airlift is that the Soviet blockade may have been caused by currency reforms:

“Currency reform, planned under the name Operation Bird Dog, involved the replacement of [the old German] Reichsmarks with new Deutsche mark (DM), printed in Washington at an exchange ratio of 1000 Reichsmarks = 65 DM. The new currency would be legal tender in the Western zones and its supply would be outside Soviet control. The Soviet Union viewed this as a part of an overall American plan to set up a separate West German government that would be ideologically opposed to the Soviets. On the day the new currency was to go into circulation in Berlin’s Western zones, the Soviet military blockaded the city” (causing the airlift?)

–From “International Financial Markets,” by J. Orlin Grabbe, page 10.

One sadder set of wars had no impact on markets, but it may have caused an election year panic in 1876:

#6: Indian Wars: On June 26, 1876, Custer’s Last Stand at Little Big Horn ended his Presidential dreams.

Civil War boy general, the golden-haired George Armstrong Custer, intended to ride President Grant’s coattails into the Presidency, but he had a bad hair day. The young general got scalped at Little Big Horn, Montana, thinking he was in the midst of a glorious Presidential juggernaut run. What happened instead was an extremely contentious election that ended up sabotaging Reconstruction and dividing the nation.

That’s not a wild excursion into historical revisionism. Republican Civil War generals dominated the White House for 35 years after the Civil War ended: In order, we had General Ulysses S. Grant (in office 1868-76), Major General Rutheford B. Hayes (1876 to 1880), Major General James A. Garfield (elected 1880), General Chester A. Arthur (President, 1881-85), Brigadier General Benjamin Harrison (President, 1888-92) and Brevet Major William McKinley (President, 1897-1901). From Lincoln to Taft, there were eight Republican Presidents, including six Civil War officers, and only one Democrat, Ben Harrison.

The bottom line is that a serious war is terrible news, and I would hope a cease fire and/or truce would end today’s conflicts but, barring that, man’s eternal foolishness is unlikely to keep market from rising.

All content above represents the opinion of Gary Alexander of Navellier & Associates, Inc.

Also In This Issue

A Look Ahead by Louis Navellier

Bond Traders (Not the Fed) Control Interest Rates

Income Mail by Bryan Perry

The Torrid AI Rally Takes a “Pause That Refreshes”

Growth Mail by Gary Alexander

Keep Investing – Even During World War III

Global Mail by Ivan Martchev

More European Political Fireworks Are Coming

Sector Spotlight by Jason Bodner

Try Not to Track Stock Prices Daily

View Full Archive

Read Past Issues Here

About The Author

Gary Alexander

SENIOR EDITOR

Gary Alexander has been Senior Writer at Navellier since 2009. He edits Navellier’s weekly Marketmail and writes a weekly Growth Mail column, in which he uses market history to support the case for growth stocks. For the previous 20 years before joining Navellier, he was Senior Executive Editor at InvestorPlace Media (formerly Phillips Publishing), where he worked with several leading investment analysts, including Louis Navellier (since 1997), helping launch Louis Navellier’s Blue Chip Growth and Global Growth newsletters.

Prior to that, Gary edited Wealth Magazine and Gold Newsletter and wrote various investment research reports for Jefferson Financial in New Orleans in the 1980s. He began his financial newsletter career with KCI Communications in 1980, where he served as consulting editor for Personal Finance newsletter while serving as general manager of KCI’s Alexandria House book division. Before that, he covered the economics beat for news magazines. All content of “Growth Mail” represents the opinion of Gary Alexander

Important Disclosures:

Although information in these reports has been obtained from and is based upon sources that Navellier believes to be reliable, Navellier does not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute Navellier’s judgment as of the date the report was created and are subject to change without notice. These reports are for informational purposes only and are not a solicitation for the purchase or sale of a security. Any decision to purchase securities mentioned in these reports must take into account existing public information on such securities or any registered prospectus.To the extent permitted by law, neither Navellier & Associates, Inc., nor any of its affiliates, agents, or service providers assumes any liability or responsibility nor owes any duty of care for any consequences of any person acting or refraining to act in reliance on the information contained in this communication or for any decision based on it.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any securities recommendations made by Navellier. in the future will be profitable or equal the performance of securities made in this report. Dividend payments are not guaranteed. The amount of a dividend payment, if any, can vary over time and issuers may reduce dividends paid on securities in the event of a recession or adverse event affecting a specific industry or issuer.

None of the stock information, data, and company information presented herein constitutes a recommendation by Navellier or a solicitation to buy or sell any securities. Any specific securities identified and described do not represent all of the securities purchased, sold, or recommended for advisory clients. The holdings identified do not represent all of the securities purchased, sold, or recommended for advisory clients and the reader should not assume that investments in the securities identified and discussed were or will be profitable.

Information presented is general information that does not take into account your individual circumstances, financial situation, or needs, nor does it present a personalized recommendation to you. Individual stocks presented may not be suitable for every investor. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. Investment in fixed income securities has the potential for the investment return and principal value of an investment to fluctuate so that an investor’s holdings, when redeemed, may be worth less than their original cost.

One cannot invest directly in an index. Index is unmanaged and index performance does not reflect deduction of fees, expenses, or taxes. Presentation of Index data does not reflect a belief by Navellier that any stock index constitutes an investment alternative to any Navellier equity strategy or is necessarily comparable to such strategies. Among the most important differences between the Indices and Navellier strategies are that the Navellier equity strategies may (1) incur material management fees, (2) concentrate its investments in relatively few stocks, industries, or sectors, (3) have significantly greater trading activity and related costs, and (4) be significantly more or less volatile than the Indices.

ETF Risk: We may invest in exchange traded funds (“ETFs”) and some of our investment strategies are generally fully invested in ETFs. Like traditional mutual funds, ETFs charge asset-based fees, but they generally do not charge initial sales charges or redemption fees and investors typically pay only customary brokerage fees to buy and sell ETF shares. The fees and costs charged by ETFs held in client accounts will not be deducted from the compensation the client pays Navellier. ETF prices can fluctuate up or down, and a client account could lose money investing in an ETF if the prices of the securities owned by the ETF go down. ETFs are subject to additional risks:

- ETF shares may trade above or below their net asset value;

- An active trading market for an ETF’s shares may not develop or be maintained;

- The value of an ETF may be more volatile than the underlying portfolio of securities the ETF is designed to track;

- The cost of owning shares of the ETF may exceed those a client would incur by directly investing in the underlying securities; and

- Trading of an ETF’s shares may be halted if the listing exchange’s officials deem it appropriate, the shares are delisted from the exchange, or the activation of market-wide “circuit breakers” (which are tied to large decreases in stock prices) halts stock trading generally.

Grader Disclosures: Investment in equity strategies involves substantial risk and has the potential for partial or complete loss of funds invested. The sample portfolio and any accompanying charts are for informational purposes only and are not to be construed as a solicitation to buy or sell any financial instrument and should not be relied upon as the sole factor in an investment making decision. As a matter of normal and important disclosures to you, as a potential investor, please consider the following: The performance presented is not based on any actual securities trading, portfolio, or accounts, and the reported performance of the A, B, C, D, and F portfolios (collectively the “model portfolios”) should be considered mere “paper” or pro forma performance results based on Navellier’s research.

Investors evaluating any of Navellier & Associates, Inc.’s, (or its affiliates’) Investment Products must not use any information presented here, including the performance figures of the model portfolios, in their evaluation of any Navellier Investment Products. Navellier Investment Products include the firm’s mutual funds and managed accounts. The model portfolios, charts, and other information presented do not represent actual funded trades and are not actual funded portfolios. There are material differences between Navellier Investment Products’ portfolios and the model portfolios, research, and performance figures presented here. The model portfolios and the research results (1) may contain stocks or ETFs that are illiquid and difficult to trade; (2) may contain stock or ETF holdings materially different from actual funded Navellier Investment Product portfolios; (3) include the reinvestment of all dividends and other earnings, estimated trading costs, commissions, or management fees; and, (4) may not reflect prices obtained in an actual funded Navellier Investment Product portfolio. For these and other reasons, the reported performances of model portfolios do not reflect the performance results of Navellier’s actually funded and traded Investment Products. In most cases, Navellier’s Investment Products have materially lower performance results than the performances of the model portfolios presented.

This report contains statements that are, or may be considered to be, forward-looking statements. All statements that are not historical facts, including statements about our beliefs or expectations, are “forward-looking statements” within the meaning of The U.S. Private Securities Litigation Reform Act of 1995. These statements may be identified by such forward-looking terminology as “expect,” “estimate,” “plan,” “intend,” “believe,” “anticipate,” “may,” “will,” “should,” “could,” “continue,” “project,” or similar statements or variations of such terms. Our forward-looking statements are based on a series of expectations, assumptions, and projections, are not guarantees of future results or performance, and involve substantial risks and uncertainty as described in Form ADV Part 2A of our filing with the Securities and Exchange Commission (SEC), which is available at www.adviserinfo.sec.gov or by requesting a copy by emailing info@navellier.com. All of our forward-looking statements are as of the date of this report only. We can give no assurance that such expectations or forward-looking statements will prove to be correct. Actual results may differ materially. You are urged to carefully consider all such factors.

FEDERAL TAX ADVICE DISCLAIMER: As required by U.S. Treasury Regulations, you are informed that, to the extent this presentation includes any federal tax advice, the presentation is not written by Navellier to be used, and cannot be used, for the purpose of avoiding federal tax penalties. Navellier does not advise on any income tax requirements or issues. Use of any information presented by Navellier is for general information only and does not represent tax advice either express or implied. You are encouraged to seek professional tax advice for income tax questions and assistance.

IMPORTANT NEWSLETTER DISCLOSURE:The hypothetical performance results for investment newsletters that are authored or edited by Louis Navellier, including Louis Navellier’s Growth Investor, Louis Navellier’s Breakthrough Stocks, Louis Navellier’s Accelerated Profits, and Louis Navellier’s Platinum Club, are not based on any actual securities trading, portfolio, or accounts, and the newsletters’ reported hypothetical performances should be considered mere “paper” or proforma hypothetical performance results and are not actual performance of real world trades. Navellier & Associates, Inc. does not have any relation to or affiliation with the owner of these newsletters. There are material differences between Navellier Investment Products’ portfolios and the InvestorPlace Media, LLC newsletter portfolios authored by Louis Navellier. The InvestorPlace Media, LLC newsletters contain hypothetical performance that do not include transaction costs, advisory fees, or other fees a client might incur if actual investments and trades were being made by an investor. As a result, newsletter performance should not be used to evaluate Navellier Investment services which are separate and different from the newsletters. The owner of the newsletters is InvestorPlace Media, LLC and any questions concerning the newsletters, including any newsletter advertising or hypothetical Newsletter performance claims, (which are calculated solely by Investor Place Media and not Navellier) should be referred to InvestorPlace Media, LLC at (800) 718-8289.

Please note that Navellier & Associates and the Navellier Private Client Group are managed completely independent of the newsletters owned and published by InvestorPlace Media, LLC and written and edited by Louis Navellier, and investment performance of the newsletters should in no way be considered indicative of potential future investment performance for any Navellier & Associates separately managed account portfolio. Potential investors should consult with their financial advisor before investing in any Navellier Investment Product.

Navellier claims compliance with Global Investment Performance Standards (GIPS). To receive a complete list and descriptions of Navellier’s composites and/or a presentation that adheres to the GIPS standards, please contact Navellier or click here. It should not be assumed that any securities recommendations made by Navellier & Associates, Inc. in the future will be profitable or equal the performance of securities made in this report.

FactSet Disclosure: Navellier does not independently calculate the statistical information included in the attached report. The calculation and the information are provided by FactSet, a company not related to Navellier. Although information contained in the report has been obtained from FactSet and is based on sources Navellier believes to be reliable, Navellier does not guarantee its accuracy, and it may be incomplete or condensed. The report and the related FactSet sourced information are provided on an “as is” basis. The user assumes the entire risk of any use made of this information. Investors should consider the report as only a single factor in making their investment decision. The report is for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of a security. FactSet sourced information is the exclusive property of FactSet. Without prior written permission of FactSet, this information may not be reproduced, disseminated or used to create any financial products. All indices are unmanaged and performance of the indices include reinvestment of dividends and interest income, unless otherwise noted, are not illustrative of any particular investment and an investment cannot be made in any index. Past performance is no guarantee of future results.