by Gary Alexander

May 21, 2024

A decade ago (May 6, 2014), I wrote a column here, “Happy Birthday, Karl Marx…Now, Get Lost,” based on the dual birthdays of the original brainiac of communism, Karl Marx (born May 5, 1818) and his newest disciple, a young French economist, Thomas Piketty (born May 7, 1971). A decade ago, Piketty’s door-stop-size book, “Capital in the 21st Century” was the #1 best-seller in America, bearing a title (and size, and message) reminiscent of Marx’s “Das Kapital.” He recommended super-high taxes on the rich.

May begins with May Day (“International Worker’s Day”), communism’s call to action day, so what did we see this year but a new film touting huge growth in government through monetary over-printing.

On Friday night, May 3, the nation was treated to a worshipful new film about Modern Monetary Theory (MMT) by its creator, Dr. Stephanie Kelton, who was appointed Chief Economist of the Senate Budget Committee for Senator Bernie Sanders (from Vermont), when he was its ranking Democrat in 2014.

“Finding the Money,” a new 95-minute “documentary” argues that any government capable of minting its own currency can always print more money (a statement so obvious that it earned my subtitle, “Printing for Dummies,” as that is one of many claims uttered so slowly and clearly it seems aimed at 10-year-olds:

“We don’t find the money, we create it. That’s the simplest part of the equation.”

– Stephanie Kelton, Professor of Economics, Stony Brook University

““The government spends by creating money, and when it taxes, it destroys money. We don’t need to tax rich people for their money. We need to tax them because they’re too rich.”

— Professor L. Randall Wray, Professor Economics, Bard College

Perhaps you can sense the seduction in such statements – there’s no need for any taxes; we can just print the money we need and do whatever we want. It’s no wonder this film already won the Audience Award for Best Feature at the Green Film Festival of San Francisco. Professor Jason Hickel (who is “opposed to capitalism…as well as economic growth,” according to Wikipedia) calls it “A Masterpiece! By far the most inspiring economics film I have ever seen… a gift to humanity. Everyone should watch it!”

The film is very well made, and MMT is not all bad – since it accurately shows that most of our debt has an equal and opposite credit offset, as a bond holding, or as savings – but when it comes to the blind spots of MMT, its proponents all seem smitten with Marxist priorities, usually masqueraded as altruism, as they favor better collective use of our national resources, like turning casinos into hospitals, making financiers into cancer researchers, or addressing the “ultimate threat” of climate change in a Green New Deal, or providing Medicare for all, or ending poverty; each of these dreams require almost unlimited new dollars.

Their bias emerges again when they rewrite history, saying markets didn’t exist before governments were born. Markets needed governments and laws to exist first, they say; markets could only develop after we had money, they say. Barter didn’t exist, they shockingly say. For instance, Pavlina Tcherneva, associate economics professor at Bard College, said, “Markets don’t spring up on their own.” And Professor Wray asserted, “There has never been a market economy with no government.” Really? These MMT advocates seem to think that two or three people couldn’t ever agree on a trade without a licensed agent butting in.

A climate catastrophe looms over the entire film. While Kelton thinks the Debt Clock is a silly tool of false alarm, she is truly alarmed by the six-year countdown to oblivion called the Climate Clock. One other MMT advocate, Fadhel Kaboub, Economics Professor at Denison University, addresses his class:

“The planet is on fire. Hundreds of millions of climate refugees will be moving across the planet. Yet we are told there is nothing we can do since we don’t have the money. To solve climate change, we need to move around 10% of our GDP to decarbonize transportation, energy, agriculture, housing…” and more.

The closing line of the film says, “The Climate Clock stood at 5 years 295 days at the date of this film’s premiere.” The implication is that an unlimited printing of new dollars could forestall Doomsday, but that’s a bit wacko. It also reflects another fatal flaw of MMT: Everyone has different spending priorities! If money supply is unlimited, $10 trillion may go to climate concerns and $10 trillion to the poor, but a third $10 trillion may go to military aid for Ukraine, Gaza and ‘Palookistan’ or $10 trillion to pork at home.

Professor Denton shows us the National Debt Clock turning its last six digits over at a tornado’s pace, but she assures us, “You could take the National Debt Clock that scares everyone and just rename it ‘the U.S. Dollar Savings Clock’ and I think everyone would have a very different kind of reaction.” OK, so, here’s a compromise: I’ll quit carping about our Debt Clock if you abandon that silly old Climate Clock!

We begin to smell a rat (or is it a wrat?) when Dr. Wray says, toward the end of the film, that taxes aren’t important for the money they raise, but for social levelling: “What is too rich? You remove that and leave the rest. You don’t stop when you get enough money, since we’re going to burn that money anyway.” So, I’d give this film high marks for the MMT gang giving us full disclosure for their underlying motivations.

Two Key Tests Show Why MMT Will Likely Fail

Films like this are seductive and can easily convince young minds to follow Pied Pipers of easy money into a very dangerous future. Many economists have written fine, detailed refutations of MMT in theory, so I will only add that its good parts are simple and obvious, while its bad parts are dangerous and easily disproven. Rather than spout economic theory, let me examine two road tests of money printing in action:

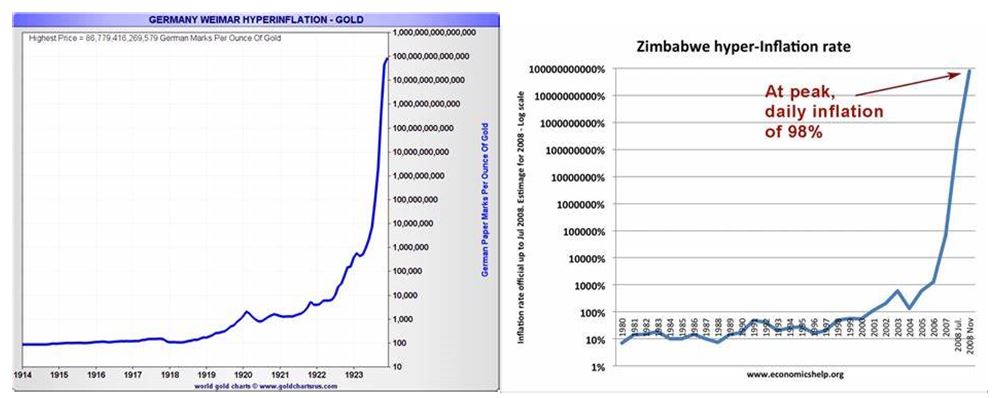

#1: MMT has no successful test cases, and many failures: We just passed the centennial of Germany’s hyper-inflation of late 1923, which not only destroyed an entire nation’s life savings, but launched Hitler’s Nazi Party and World War II. Where is the success story of a nation printing unlimited money?

If this is a theory, cite the evidence. Dozens of Banana Republics have suffered hyper-inflation in the last century, but if you want to practice this theory in the most powerful nation that ever existed, you’d better cite just one credible precedent of more money (especially with no taxation) creating magical prosperity. Why not experiment in a small nation – Uganda, Serbia, Panama – to see if it can create prosperity there.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

#2: States and cities can’t print money. State and local governments must balance their budgets or float a new bond offering – which voters have lately tended to reject. The Wall Street Journal profiled the case of Chicago (“Chicago Will Need a Miracle to Escape Its Debt Burden,” May 11-12, 2024), with its debt load now at $40 billion, or $43,000 per Chicago resident, with taxes so sky-high – a 12% state and local burden, on top of federal taxes, plus a property tax of over 4% a year on office buildings – that residents are fleeing the city. Both Chicago and the high-tax state of Illinois now have fewer people than they did 15 years ago. As a result, Chicago will likely default on its pension and health plan obligations, which total $26 billion. Mayor Brandon Johnson projects a $538 million deficit this year and $1 billion in 2025.

Mixing these two points, our 50 states are 50 laboratories of tax and spending policies, and the outcome is reflected in business and personal migration statistics – and that is true of other nations around the world, too. When various nations of Europe over-tax their citizens (think Britain and Scandinavia in the 1970s), their leading athletes and movie stars set up residence in Monaco or other tax havens. Super-high 95% tax rates motivated the Beatles’ George Harrison to write “Taxman” (“1 for you, 19 for me”). Later, Maggie Thatcher added, “The problem with socialism is that you eventually run out of other people’s money.”

I expect many young people to love this film, but I don’t expect many to recall the 1923 German hyper-inflation or view the political motivation of MMT advocates with the skepticism I brought to the viewing.

All content above represents the opinion of Gary Alexander of Navellier & Associates, Inc.

Also In This Issue

A Look Ahead by Louis Navellier

Thanks to Sky-High Tariffs, China is No Longer Exporting Deflation

Income Mail by Bryan Perry

The Current Bull Market Rally is Built on Three Bullish Pillars

Growth Mail by Gary Alexander

It’s May – The Month for Marketing Marxism

Global Mail by Ivan Martchev

The Big NVIDIA News Arrives Tomorrow

Sector Spotlight by Jason Bodner

Why “Being the Best” Matters

View Full Archive

Read Past Issues Here

About The Author

Gary Alexander

SENIOR EDITOR

Gary Alexander has been Senior Writer at Navellier since 2009. He edits Navellier’s weekly Marketmail and writes a weekly Growth Mail column, in which he uses market history to support the case for growth stocks. For the previous 20 years before joining Navellier, he was Senior Executive Editor at InvestorPlace Media (formerly Phillips Publishing), where he worked with several leading investment analysts, including Louis Navellier (since 1997), helping launch Louis Navellier’s Blue Chip Growth and Global Growth newsletters.

Prior to that, Gary edited Wealth Magazine and Gold Newsletter and wrote various investment research reports for Jefferson Financial in New Orleans in the 1980s. He began his financial newsletter career with KCI Communications in 1980, where he served as consulting editor for Personal Finance newsletter while serving as general manager of KCI’s Alexandria House book division. Before that, he covered the economics beat for news magazines. All content of “Growth Mail” represents the opinion of Gary Alexander

Important Disclosures:

Although information in these reports has been obtained from and is based upon sources that Navellier believes to be reliable, Navellier does not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute Navellier’s judgment as of the date the report was created and are subject to change without notice. These reports are for informational purposes only and are not a solicitation for the purchase or sale of a security. Any decision to purchase securities mentioned in these reports must take into account existing public information on such securities or any registered prospectus.To the extent permitted by law, neither Navellier & Associates, Inc., nor any of its affiliates, agents, or service providers assumes any liability or responsibility nor owes any duty of care for any consequences of any person acting or refraining to act in reliance on the information contained in this communication or for any decision based on it.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any securities recommendations made by Navellier. in the future will be profitable or equal the performance of securities made in this report. Dividend payments are not guaranteed. The amount of a dividend payment, if any, can vary over time and issuers may reduce dividends paid on securities in the event of a recession or adverse event affecting a specific industry or issuer.

None of the stock information, data, and company information presented herein constitutes a recommendation by Navellier or a solicitation to buy or sell any securities. Any specific securities identified and described do not represent all of the securities purchased, sold, or recommended for advisory clients. The holdings identified do not represent all of the securities purchased, sold, or recommended for advisory clients and the reader should not assume that investments in the securities identified and discussed were or will be profitable.

Information presented is general information that does not take into account your individual circumstances, financial situation, or needs, nor does it present a personalized recommendation to you. Individual stocks presented may not be suitable for every investor. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. Investment in fixed income securities has the potential for the investment return and principal value of an investment to fluctuate so that an investor’s holdings, when redeemed, may be worth less than their original cost.

One cannot invest directly in an index. Index is unmanaged and index performance does not reflect deduction of fees, expenses, or taxes. Presentation of Index data does not reflect a belief by Navellier that any stock index constitutes an investment alternative to any Navellier equity strategy or is necessarily comparable to such strategies. Among the most important differences between the Indices and Navellier strategies are that the Navellier equity strategies may (1) incur material management fees, (2) concentrate its investments in relatively few stocks, industries, or sectors, (3) have significantly greater trading activity and related costs, and (4) be significantly more or less volatile than the Indices.

ETF Risk: We may invest in exchange traded funds (“ETFs”) and some of our investment strategies are generally fully invested in ETFs. Like traditional mutual funds, ETFs charge asset-based fees, but they generally do not charge initial sales charges or redemption fees and investors typically pay only customary brokerage fees to buy and sell ETF shares. The fees and costs charged by ETFs held in client accounts will not be deducted from the compensation the client pays Navellier. ETF prices can fluctuate up or down, and a client account could lose money investing in an ETF if the prices of the securities owned by the ETF go down. ETFs are subject to additional risks:

- ETF shares may trade above or below their net asset value;

- An active trading market for an ETF’s shares may not develop or be maintained;

- The value of an ETF may be more volatile than the underlying portfolio of securities the ETF is designed to track;

- The cost of owning shares of the ETF may exceed those a client would incur by directly investing in the underlying securities; and

- Trading of an ETF’s shares may be halted if the listing exchange’s officials deem it appropriate, the shares are delisted from the exchange, or the activation of market-wide “circuit breakers” (which are tied to large decreases in stock prices) halts stock trading generally.

Grader Disclosures: Investment in equity strategies involves substantial risk and has the potential for partial or complete loss of funds invested. The sample portfolio and any accompanying charts are for informational purposes only and are not to be construed as a solicitation to buy or sell any financial instrument and should not be relied upon as the sole factor in an investment making decision. As a matter of normal and important disclosures to you, as a potential investor, please consider the following: The performance presented is not based on any actual securities trading, portfolio, or accounts, and the reported performance of the A, B, C, D, and F portfolios (collectively the “model portfolios”) should be considered mere “paper” or pro forma performance results based on Navellier’s research.

Investors evaluating any of Navellier & Associates, Inc.’s, (or its affiliates’) Investment Products must not use any information presented here, including the performance figures of the model portfolios, in their evaluation of any Navellier Investment Products. Navellier Investment Products include the firm’s mutual funds and managed accounts. The model portfolios, charts, and other information presented do not represent actual funded trades and are not actual funded portfolios. There are material differences between Navellier Investment Products’ portfolios and the model portfolios, research, and performance figures presented here. The model portfolios and the research results (1) may contain stocks or ETFs that are illiquid and difficult to trade; (2) may contain stock or ETF holdings materially different from actual funded Navellier Investment Product portfolios; (3) include the reinvestment of all dividends and other earnings, estimated trading costs, commissions, or management fees; and, (4) may not reflect prices obtained in an actual funded Navellier Investment Product portfolio. For these and other reasons, the reported performances of model portfolios do not reflect the performance results of Navellier’s actually funded and traded Investment Products. In most cases, Navellier’s Investment Products have materially lower performance results than the performances of the model portfolios presented.

This report contains statements that are, or may be considered to be, forward-looking statements. All statements that are not historical facts, including statements about our beliefs or expectations, are “forward-looking statements” within the meaning of The U.S. Private Securities Litigation Reform Act of 1995. These statements may be identified by such forward-looking terminology as “expect,” “estimate,” “plan,” “intend,” “believe,” “anticipate,” “may,” “will,” “should,” “could,” “continue,” “project,” or similar statements or variations of such terms. Our forward-looking statements are based on a series of expectations, assumptions, and projections, are not guarantees of future results or performance, and involve substantial risks and uncertainty as described in Form ADV Part 2A of our filing with the Securities and Exchange Commission (SEC), which is available at www.adviserinfo.sec.gov or by requesting a copy by emailing info@navellier.com. All of our forward-looking statements are as of the date of this report only. We can give no assurance that such expectations or forward-looking statements will prove to be correct. Actual results may differ materially. You are urged to carefully consider all such factors.

FEDERAL TAX ADVICE DISCLAIMER: As required by U.S. Treasury Regulations, you are informed that, to the extent this presentation includes any federal tax advice, the presentation is not written by Navellier to be used, and cannot be used, for the purpose of avoiding federal tax penalties. Navellier does not advise on any income tax requirements or issues. Use of any information presented by Navellier is for general information only and does not represent tax advice either express or implied. You are encouraged to seek professional tax advice for income tax questions and assistance.

IMPORTANT NEWSLETTER DISCLOSURE:The hypothetical performance results for investment newsletters that are authored or edited by Louis Navellier, including Louis Navellier’s Growth Investor, Louis Navellier’s Breakthrough Stocks, Louis Navellier’s Accelerated Profits, and Louis Navellier’s Platinum Club, are not based on any actual securities trading, portfolio, or accounts, and the newsletters’ reported hypothetical performances should be considered mere “paper” or proforma hypothetical performance results and are not actual performance of real world trades. Navellier & Associates, Inc. does not have any relation to or affiliation with the owner of these newsletters. There are material differences between Navellier Investment Products’ portfolios and the InvestorPlace Media, LLC newsletter portfolios authored by Louis Navellier. The InvestorPlace Media, LLC newsletters contain hypothetical performance that do not include transaction costs, advisory fees, or other fees a client might incur if actual investments and trades were being made by an investor. As a result, newsletter performance should not be used to evaluate Navellier Investment services which are separate and different from the newsletters. The owner of the newsletters is InvestorPlace Media, LLC and any questions concerning the newsletters, including any newsletter advertising or hypothetical Newsletter performance claims, (which are calculated solely by Investor Place Media and not Navellier) should be referred to InvestorPlace Media, LLC at (800) 718-8289.

Please note that Navellier & Associates and the Navellier Private Client Group are managed completely independent of the newsletters owned and published by InvestorPlace Media, LLC and written and edited by Louis Navellier, and investment performance of the newsletters should in no way be considered indicative of potential future investment performance for any Navellier & Associates separately managed account portfolio. Potential investors should consult with their financial advisor before investing in any Navellier Investment Product.

Navellier claims compliance with Global Investment Performance Standards (GIPS). To receive a complete list and descriptions of Navellier’s composites and/or a presentation that adheres to the GIPS standards, please contact Navellier or click here. It should not be assumed that any securities recommendations made by Navellier & Associates, Inc. in the future will be profitable or equal the performance of securities made in this report.

FactSet Disclosure: Navellier does not independently calculate the statistical information included in the attached report. The calculation and the information are provided by FactSet, a company not related to Navellier. Although information contained in the report has been obtained from FactSet and is based on sources Navellier believes to be reliable, Navellier does not guarantee its accuracy, and it may be incomplete or condensed. The report and the related FactSet sourced information are provided on an “as is” basis. The user assumes the entire risk of any use made of this information. Investors should consider the report as only a single factor in making their investment decision. The report is for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of a security. FactSet sourced information is the exclusive property of FactSet. Without prior written permission of FactSet, this information may not be reproduced, disseminated or used to create any financial products. All indices are unmanaged and performance of the indices include reinvestment of dividends and interest income, unless otherwise noted, are not illustrative of any particular investment and an investment cannot be made in any index. Past performance is no guarantee of future results.