by Gary Alexander

February 4, 2025

As we continue to celebrate the 250th anniversary of America’s birth, I want to fulfill a promise I made in my year-end book reviews. My final book was “The Nvidia Way,” but it was just published (on December 10th), so I was not through reading it, promising at the end of the article “to write a column on the virtues of a benign monopoly in January.” Well, it is early February now, but let’s start with two big shipping monopolies that helped define and create America’s independence and freedom 250 and 200 years ago.

First, a British monopoly helped launch the American Revolution 250+ years ago: The British East India Company was granted a monopoly by the Crown for all tea sold in the American colonies from 1698 until the Boston Tea Party in late 1773. The company was granted this monopoly by the British government to help the company grow out of debt and eliminate foreign competition. Only action by rebellious colonists in the chilly Boston harbor on December 16, 1773, brought an end to that 75-year state-run monopoly.

Then, 200 years ago, a state-run shipping monopoly ended in an “emancipation proclamation for American commerce.” This story emerges from a book, “The Myth of the Robber Barons” by Burton W. Folson, Jr. First published in 1987 as “Entrepreneurs vs. the State,” Folsom starts with a 21-year-old Cornelius Vanderbilt in 1815 – long before the Robber Baron era. (I prefer the older book title, since the book focuses on little Davids fighting state-run Goliaths: Hungry entrepreneurs vs. state-funded oligarchs.

In the opening chapter, young Vanderbilt began shipping passengers at low cost, but he had to fight the New York state-run shipping monopoly. At the time, Vanderbilt worked for Thomas Gibbons, under whose flag Vanderbilt’s Bellona ferried passengers from New Jersey to Manhattan in violation of the monopoly’s charter. Vanderbilt’s fare was just $1 – below cost and well below the monopoly price of $4, but he made up those losses by selling food and drink in the steamboat’s bar. Vanderbilt evaded capture by police for 60 straight days but was caught and thereafter had to sue for the right to engage in free trade.

On one side of the courtroom was Aaron Ogden, a New Jersey steamboat operator who had purchased a license from the Fulton monopoly. He brought suit against Thomas Gibbons for violating his monopoly (Daniel Webster was an attorney for Gibbons and Vanderbilt). In the landmark Gibbons vs. Ogden Supreme Court decision of March 1824, the Fulton-Livingston monopoly was declared illegal as it violated the U.S. Constitution’s commerce clause – that only the U.S. government could regulate interstate commerce. The collapse of the state-run monopoly resulted in: 1) an immediate drop in prices for both freight and passengers; 2) new competitors in the business; and 3) new technology – such as better boilers and the use of anthracite coal (from nearby Pennsylvania) rather than wood for fuel.

A century after Gibbons v. Ogden, legal historian Charles Warren called that decision “the emancipation proclamation of American commerce.” But shysters did not stop seeking government-added monopolies.

The next chapter in Folson’s book covers Canadian-born railroad tycoon James J. Hill, who built the Great Northern Railroad without a dime of federal aid. In the late 1860s, the federal government tried to lay a quick, fast and dirty Transcontinental Railroad by funding a subsidized race between the Union Pacific and Central Pacific lines with dollars paid per mile of rail laid. You always get more of what you subsidize, so the railroads chose easy routes, sometimes laying them in useless circles with cheap, light rail to maximize income, under orders to “substitute wooden culvert for masonry wherever you can.”

One estimate was that these lines spent “three times what should have.” They also ran right through major Cheyenne and Sioux lands, inviting Indian attacks that killed hundreds, while creating new enemies, and despite being given 44 million acres of free land and $61 million in cash loans, Union Pacific went bankrupt.

By contrast, James J. Hill, operating privately out of St. Paul, Minnesota, slowly built a far superior transcontinental railroad from St. Paul to Seattle with no federal aid, funded by short-term routes hauling crops. It became the best built, least corrupt, most popular line and the only transcontinental line never to go bankrupt. He found the lowest mountain passes with gradual grades. It took longer to complete, but he found the shortest route with the least curvature to attract settlement and trade by cutting costs for passengers and freight. He also skirted Native Indian land along the route, or paid them for access rights.

A Third Example – the Postal Monopoly

If I may add a third example – not in Folson’s book – this provides the clearest example of the contrast between a federal monopoly and private entrepreneurs. Shortly thereafter America won its freedom from Britain, the new American government gave birth to its own business monopoly in the form of a cabinet post called The Postmaster General. Why delivering letters became a protected monopoly along the line of Defense, Treasury and State, our Founders never explained well, but the postal monopoly endured.

So far, we’ve seen that ships and railroads could compete to carry people and cargo, but carrying pieces of paper with a stamp became a state monopoly. When trusts were busted in the early 1900s, nobody noticed a teen-aged bicyclist in Seattle 1907 busting the federal postal trust, but Jim Casey, 19, borrowed $100 to fund a bank of telephones and rent an office below a saloon in Pioneer Square (near Skid Road). Due to its location, Casey soon discovered that people wanted more beer and food delivered than messages, so Casey first called his service “Rushing the Growler.” They also delivered messages, food and liquor.

At first, they called themselves the American Messenger Service, later United Parcel Service, or UPS. In an early corporate decision, due to all the dirt on Skid Road, UPS painted all their trucks brown, to avoid collecting dirt, since they didn’t want to wash the trucks or uniforms often. That’s why UPS is still brown.

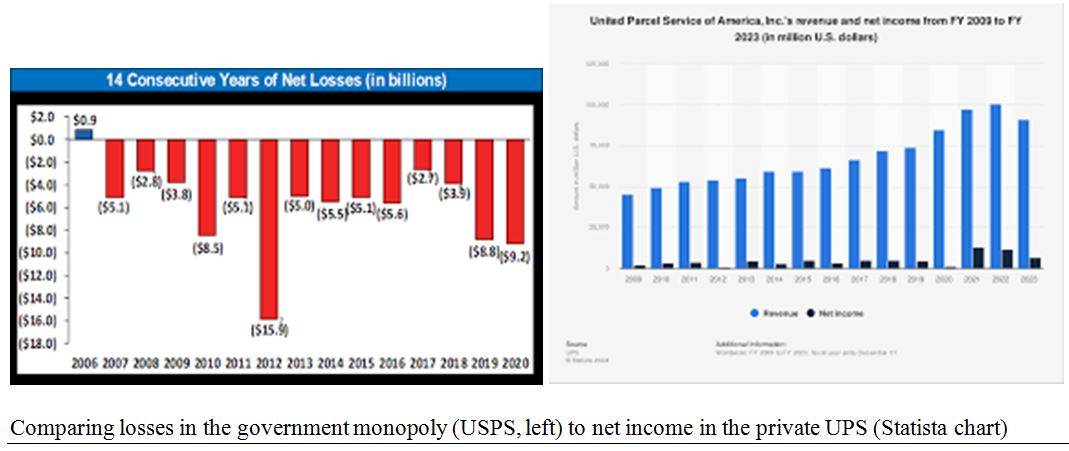

Now we see the difference between the federal monopoly – the U.S. Postal Service, always losing money and often late – and UPS delivering parcels since 1907. Then came overnight delivery out of Memphis, invented by Fred Smith of “Federal Express” fame, competing directly with USPS’s First-Class Mail. Then came faxes, Internet, email, texting, and all the other ways to put the federal behemoth in the back seat.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

The ground-breaking book on anti-trust is Robert Bork’s “The Antitrust Paradox: A Policy at War with Itself” (1978), which changed how justices looked at companies since the 1980s. It was cited in several court rulings, including the Supreme Court. Since it first appeared, courts have taken into account customer benefits over the impact of big corporate giants on smaller, less efficient, less competitive firms.

This Brave New Borkian World has given gave birth to several mega-corporations, or more accurately, new types of mega-corporations, more knowledge-oriented than industrial, based on Bork’s historical understanding that not all small businesses must survive by right of existence, since capitalism implies “creative destruction” (à la Joseph Schumpeter) and “survival of the fittest” (Darwin’s maxim expanded).

In this accounting, even the richest “Robber Baron,” John D. Rockefeller, “saved the whales” and lit millions of homes far more cheaply with kerosene, while eventually proving that trust-busting didn’t work when the sum of Standard Oil’s offshoot parts became worth more than his behemoth mother ship.

To bring this story to the present book and today’s headlines, “The Nvidia Way” (2024) is a retelling of the same old story. As a young immigrant, Jensen Huang worked long hours in grueling jobs, including as a busboy at a famous dining chain, where he launched Nvidia with two partners in the mid-1990s.

Even now, 31 years after co-founding Nvidia, CEO Jensen Huang refuses to work in a private office. He stakes out a spot in a couple of bullpens to be close to his smartest team members. One of those rooms is called the Mind Meld, based on Star Trek lore, when Vulcans telepathically combine their thoughts.

Humble beginnings make a difference, if CEOs merely stay hungry by recalling how they came up. According to author Tae Kim, the company treats people well, “as human beings rather than fungible engineers,” in contrast to some other companies we could name. Many Nvidians, the book reports, stay for decades, and not just for the money. They are already rich. People don’t generally work 80 or more hours a week just for money. You have to be motivated by a mission to work those kinds of hours.

Last week, Nvidia was put to the test, once again. It has been put to many such tests since its founding, but the latest attack by DeepSeek only proves that Nvidia is not a protected monopoly. Other companies have tried to penetrate its secret sauce without success, and now comes a cheaper, perhaps inferior, and likely state-sponsored threat, and… we’ll see who wins. But this is not a monopoly that restrains trade.

The principle of legal private monopolies was expressed by super-investor Warren Buffett as “creating a moat” about your product or service, doing something important for consumers far better than anyone else can do it – for a long foreseeable time into the future. In his 1995 corporate report, Buffett summarized this process: “We’re trying to find a business with a wide and long-lasting moat around it.” This moat “protects a terrific economic castle with an honest lord in charge of the castle.” And that’s what separates an honest, honorable, creative hard-working monopoly of skills from a state-sponsored protection racket.

Navellier & Associates owns Nvidia Corp (NVDA), in managed accounts. We do not own FedEx Corp (FDX), or United Parcel Services (UPS). Gary Alexander owns Nvidia Corp (NVDA), in a personal account. He does not own FedEx Corp (FDX), or United Parcel Services (UPS).

All content above represents the opinion of Gary Alexander of Navellier & Associates, Inc.

Also In This Issue

A Look Ahead by Louis Navellier

A Deeper Dive into DeepSeek and Nvidia

Income Mail by Bryan Perry

A Major Campaign Promise Kept – Now What?

Growth Mail by Gary Alexander

Is a Monopoly Always Bad? How Can We Tell?

Global Mail by Ivan Martchev

The Cycle of Tariff Recriminations Has Started

Sector Spotlight by Jason Bodner

What Should Investors Do with Nvidia Now?

View Full Archive

Read Past Issues Here

About The Author

Gary Alexander

SENIOR EDITOR

Gary Alexander has been Senior Writer at Navellier since 2009. He edits Navellier’s weekly Marketmail and writes a weekly Growth Mail column, in which he uses market history to support the case for growth stocks. For the previous 20 years before joining Navellier, he was Senior Executive Editor at InvestorPlace Media (formerly Phillips Publishing), where he worked with several leading investment analysts, including Louis Navellier (since 1997), helping launch Louis Navellier’s Blue Chip Growth and Global Growth newsletters.

Prior to that, Gary edited Wealth Magazine and Gold Newsletter and wrote various investment research reports for Jefferson Financial in New Orleans in the 1980s. He began his financial newsletter career with KCI Communications in 1980, where he served as consulting editor for Personal Finance newsletter while serving as general manager of KCI’s Alexandria House book division. Before that, he covered the economics beat for news magazines. All content of “Growth Mail” represents the opinion of Gary Alexander

Important Disclosures:

Although information in these reports has been obtained from and is based upon sources that Navellier believes to be reliable, Navellier does not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute Navellier’s judgment as of the date the report was created and are subject to change without notice. These reports are for informational purposes only and are not a solicitation for the purchase or sale of a security. Any decision to purchase securities mentioned in these reports must take into account existing public information on such securities or any registered prospectus.To the extent permitted by law, neither Navellier & Associates, Inc., nor any of its affiliates, agents, or service providers assumes any liability or responsibility nor owes any duty of care for any consequences of any person acting or refraining to act in reliance on the information contained in this communication or for any decision based on it.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any securities recommendations made by Navellier. in the future will be profitable or equal the performance of securities made in this report. Dividend payments are not guaranteed. The amount of a dividend payment, if any, can vary over time and issuers may reduce dividends paid on securities in the event of a recession or adverse event affecting a specific industry or issuer.

None of the stock information, data, and company information presented herein constitutes a recommendation by Navellier or a solicitation to buy or sell any securities. Any specific securities identified and described do not represent all of the securities purchased, sold, or recommended for advisory clients. The holdings identified do not represent all of the securities purchased, sold, or recommended for advisory clients and the reader should not assume that investments in the securities identified and discussed were or will be profitable.

Information presented is general information that does not take into account your individual circumstances, financial situation, or needs, nor does it present a personalized recommendation to you. Individual stocks presented may not be suitable for every investor. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. Investment in fixed income securities has the potential for the investment return and principal value of an investment to fluctuate so that an investor’s holdings, when redeemed, may be worth less than their original cost.

One cannot invest directly in an index. Index is unmanaged and index performance does not reflect deduction of fees, expenses, or taxes. Presentation of Index data does not reflect a belief by Navellier that any stock index constitutes an investment alternative to any Navellier equity strategy or is necessarily comparable to such strategies. Among the most important differences between the Indices and Navellier strategies are that the Navellier equity strategies may (1) incur material management fees, (2) concentrate its investments in relatively few stocks, industries, or sectors, (3) have significantly greater trading activity and related costs, and (4) be significantly more or less volatile than the Indices.

ETF Risk: We may invest in exchange traded funds (“ETFs”) and some of our investment strategies are generally fully invested in ETFs. Like traditional mutual funds, ETFs charge asset-based fees, but they generally do not charge initial sales charges or redemption fees and investors typically pay only customary brokerage fees to buy and sell ETF shares. The fees and costs charged by ETFs held in client accounts will not be deducted from the compensation the client pays Navellier. ETF prices can fluctuate up or down, and a client account could lose money investing in an ETF if the prices of the securities owned by the ETF go down. ETFs are subject to additional risks:

- ETF shares may trade above or below their net asset value;

- An active trading market for an ETF’s shares may not develop or be maintained;

- The value of an ETF may be more volatile than the underlying portfolio of securities the ETF is designed to track;

- The cost of owning shares of the ETF may exceed those a client would incur by directly investing in the underlying securities; and

- Trading of an ETF’s shares may be halted if the listing exchange’s officials deem it appropriate, the shares are delisted from the exchange, or the activation of market-wide “circuit breakers” (which are tied to large decreases in stock prices) halts stock trading generally.

Grader Disclosures: Investment in equity strategies involves substantial risk and has the potential for partial or complete loss of funds invested. The sample portfolio and any accompanying charts are for informational purposes only and are not to be construed as a solicitation to buy or sell any financial instrument and should not be relied upon as the sole factor in an investment making decision. As a matter of normal and important disclosures to you, as a potential investor, please consider the following: The performance presented is not based on any actual securities trading, portfolio, or accounts, and the reported performance of the A, B, C, D, and F portfolios (collectively the “model portfolios”) should be considered mere “paper” or pro forma performance results based on Navellier’s research.

Investors evaluating any of Navellier & Associates, Inc.’s, (or its affiliates’) Investment Products must not use any information presented here, including the performance figures of the model portfolios, in their evaluation of any Navellier Investment Products. Navellier Investment Products include the firm’s mutual funds and managed accounts. The model portfolios, charts, and other information presented do not represent actual funded trades and are not actual funded portfolios. There are material differences between Navellier Investment Products’ portfolios and the model portfolios, research, and performance figures presented here. The model portfolios and the research results (1) may contain stocks or ETFs that are illiquid and difficult to trade; (2) may contain stock or ETF holdings materially different from actual funded Navellier Investment Product portfolios; (3) include the reinvestment of all dividends and other earnings, estimated trading costs, commissions, or management fees; and, (4) may not reflect prices obtained in an actual funded Navellier Investment Product portfolio. For these and other reasons, the reported performances of model portfolios do not reflect the performance results of Navellier’s actually funded and traded Investment Products. In most cases, Navellier’s Investment Products have materially lower performance results than the performances of the model portfolios presented.

This report contains statements that are, or may be considered to be, forward-looking statements. All statements that are not historical facts, including statements about our beliefs or expectations, are “forward-looking statements” within the meaning of The U.S. Private Securities Litigation Reform Act of 1995. These statements may be identified by such forward-looking terminology as “expect,” “estimate,” “plan,” “intend,” “believe,” “anticipate,” “may,” “will,” “should,” “could,” “continue,” “project,” or similar statements or variations of such terms. Our forward-looking statements are based on a series of expectations, assumptions, and projections, are not guarantees of future results or performance, and involve substantial risks and uncertainty as described in Form ADV Part 2A of our filing with the Securities and Exchange Commission (SEC), which is available at www.adviserinfo.sec.gov or by requesting a copy by emailing info@navellier.com. All of our forward-looking statements are as of the date of this report only. We can give no assurance that such expectations or forward-looking statements will prove to be correct. Actual results may differ materially. You are urged to carefully consider all such factors.

FEDERAL TAX ADVICE DISCLAIMER: As required by U.S. Treasury Regulations, you are informed that, to the extent this presentation includes any federal tax advice, the presentation is not written by Navellier to be used, and cannot be used, for the purpose of avoiding federal tax penalties. Navellier does not advise on any income tax requirements or issues. Use of any information presented by Navellier is for general information only and does not represent tax advice either express or implied. You are encouraged to seek professional tax advice for income tax questions and assistance.

IMPORTANT NEWSLETTER DISCLOSURE:The hypothetical performance results for investment newsletters that are authored or edited by Louis Navellier, including Louis Navellier’s Growth Investor, Louis Navellier’s Breakthrough Stocks, Louis Navellier’s Accelerated Profits, and Louis Navellier’s Platinum Club, are not based on any actual securities trading, portfolio, or accounts, and the newsletters’ reported hypothetical performances should be considered mere “paper” or proforma hypothetical performance results and are not actual performance of real world trades. Navellier & Associates, Inc. does not have any relation to or affiliation with the owner of these newsletters. There are material differences between Navellier Investment Products’ portfolios and the InvestorPlace Media, LLC newsletter portfolios authored by Louis Navellier. The InvestorPlace Media, LLC newsletters contain hypothetical performance that do not include transaction costs, advisory fees, or other fees a client might incur if actual investments and trades were being made by an investor. As a result, newsletter performance should not be used to evaluate Navellier Investment services which are separate and different from the newsletters. The owner of the newsletters is InvestorPlace Media, LLC and any questions concerning the newsletters, including any newsletter advertising or hypothetical Newsletter performance claims, (which are calculated solely by Investor Place Media and not Navellier) should be referred to InvestorPlace Media, LLC at (800) 718-8289.

Please note that Navellier & Associates and the Navellier Private Client Group are managed completely independent of the newsletters owned and published by InvestorPlace Media, LLC and written and edited by Louis Navellier, and investment performance of the newsletters should in no way be considered indicative of potential future investment performance for any Navellier & Associates separately managed account portfolio. Potential investors should consult with their financial advisor before investing in any Navellier Investment Product.

Navellier claims compliance with Global Investment Performance Standards (GIPS). To receive a complete list and descriptions of Navellier’s composites and/or a presentation that adheres to the GIPS standards, please contact Navellier or click here. It should not be assumed that any securities recommendations made by Navellier & Associates, Inc. in the future will be profitable or equal the performance of securities made in this report.

FactSet Disclosure: Navellier does not independently calculate the statistical information included in the attached report. The calculation and the information are provided by FactSet, a company not related to Navellier. Although information contained in the report has been obtained from FactSet and is based on sources Navellier believes to be reliable, Navellier does not guarantee its accuracy, and it may be incomplete or condensed. The report and the related FactSet sourced information are provided on an “as is” basis. The user assumes the entire risk of any use made of this information. Investors should consider the report as only a single factor in making their investment decision. The report is for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of a security. FactSet sourced information is the exclusive property of FactSet. Without prior written permission of FactSet, this information may not be reproduced, disseminated or used to create any financial products. All indices are unmanaged and performance of the indices include reinvestment of dividends and interest income, unless otherwise noted, are not illustrative of any particular investment and an investment cannot be made in any index. Past performance is no guarantee of future results.