by Bryan Perry

February 4, 2025

On the campaign trail, candidate Donald Trump said that he would levy tariffs on Mexico and China for being the source of the flow of deadly Fentanyl and illegal immigrants into the United States. Up until this past week, investors largely viewed these tariff threats as hot air within the negotiating process for fairer trade terms. Not knowing what was behind the scenes, it seems clear that any such measures or good intentions to slow the smuggling of Fentanyl across the border by China and Mexico in the first 10 days of the Trump administration did not materialize, but now the Trump team is focusing on Fentanyl.

In his first day of office, Trump issued numerous executive orders, one of which designated drug cartels in Mexico as “foreign terrorist organizations” engaged “in a campaign of violence and terror throughout the western hemisphere that has not only destabilized countries with significant importance for our national interests but also flooded the U.S. with deadly drugs, violent criminals, and vicious gangs.”

The U.S. Customs and Protection Agency said that it seized 27,023 pounds of Fentanyl in fiscal 2023, nearly double the 14,700 pounds the agency says it seized in 2022. The CDC said that Fentanyl overdoses caused an estimated 81,083 deaths in the U.S in 2023, down slightly from 84,181 in 2022.

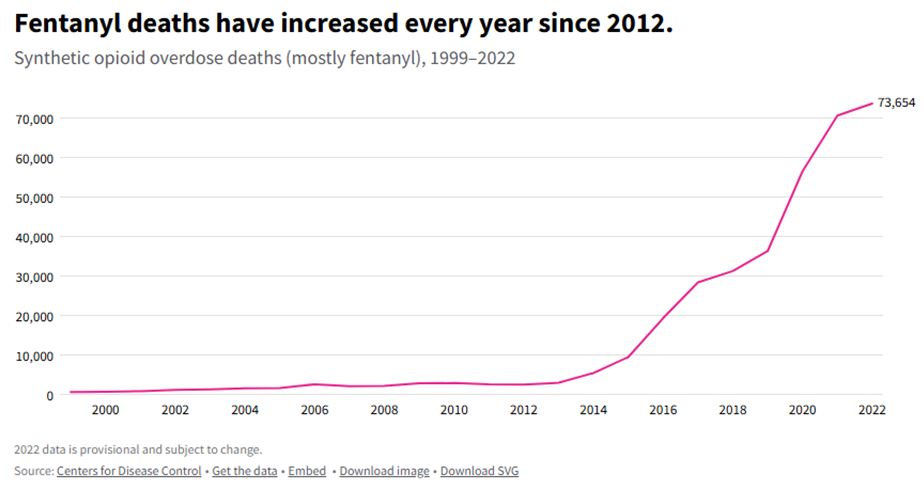

“The tariffs on imports from Canada, Mexico, and China send a powerful message that the United States will no longer stand by as other nations fail to halt the flow of illegal drugs and immigrants into our country,” House Ways and Means Chairman Jason Smith (Rep-Mo), said a statement, as U.S. deaths from Fentanyl exploded from a low flat line under 3,000 (2001-2012), to over 80,000 deaths in recent years:

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

A significant portion of the Fentanyl smuggled into the U.S. through Mexico originates from China. Chinese manufacturers produce the precursor chemicals needed to make Fentanyl, which are then shipped to Mexico. Mexican cartels use these chemicals to produce Fentanyl and smuggle it into the U.S. This complex supply chain has made it challenging for authorities to curb the flow of the deadly opioid.

One could argue this is China’s retribution for the Opium Wars of the 19th century, which significantly weakened the Qing dynasty, resulting in the ceding of Hong Kong to Britain, and increased Western influence in China. The addition to opium in China caused serious social and economic disruption.

Fentanyl is a synthetic opioid that is up to 50 times stronger than heroin and 100 times stronger than morphine. Putting a dollar amount on the Fentanyl drug trade is hard to calculate due to the illegal nature of the trade, but according to the RAND Corporation, the illicit drug trade in the United States is worth $150 billion. Worldwide, it reached as much as $652 billion, according to Global Financial Integrity, so, if this were a national GDP, it would be 22nd in the world, ahead of Sweden, Poland, and Belgium.

While suppliers in China and criminal gangs in Mexico have been long accused of trafficking Fentanyl into the U.S., Trump’s tariff order against Canada included a long preamble saying that drug trafficking from Canada is growing. “The challenges at our southern border are foremost in the public consciousness, but our northern border is not exempt from these issues,” the order reads. “Criminal networks are implicated in human trafficking and smuggling operations, enabling unvetted illegal migration across our northern border. There is also a growing presence of Mexican cartels operating Fentanyl labs in Canada.”

The new tariff orders against Canada, Mexico and China all contain clauses suspending duty-free exemption for low-value shipments below $800 that is widely seen as a loophole that has allowed shipments of Fentanyl and its precursor chemicals into the United States. Such small shipments often are not screened at ports of entry, allowing shipments of drugs and their ingredients to enter undetected.

A Reuters investigation last year revealed how Chinese chemical traders are using this de minimis exception to sneak shipments of Fentanyl precursors into America, from chemical labs in Mexico.

With the war on Fentanyl now becoming a new trade war, this could fuel inflation: “Most immediately, Americans will see food prices rise. Mexico is the source of around half U.S. fruit and vegetables. Gas prices, especially in the Midwest, may also rise,” says Marc Chandler, chief strategist at Bannockburn Global. “This is more of a slap than a gut-punch for China,” says Louis-Vincent Gave, co-founder of Gavekal Research, via email. “For Canada and Mexico, this is far more problematic. They have spent the past few years totally tying their economies to the U.S.” The newly announced tariffs could push Mexico and Canada into recession, and Canada’s Justin Trudeau and Mexico’s president Claudia Sheinbaum just announced their own retaliatory tariffs on U.S.-made goods that makes for some fresh market uncertainty.

The massive cross-border trade between the three major North American nations now exceeds U.S. trade with China by a large margin, totaling $1.8 trillion in 2023. That is far greater than the $643 billion in commerce that the U.S. did with China in that same year. Early estimates on the impact of new tariffs on American consumers, aside from fresh produce, include expected increases for automobiles and auto parts, along with Canadian whiskey and tequila from Mexico, and many consumer electronics.

The big question at this point is how Mexico and Canada will respond to waging war on Fentanyl production and smuggling into the U.S. If there are immediate concerted efforts on the part of both governments, with the assistance of U.S. military assets, the tariffs could be lifted soon and trade as usual restored. The cartels are powerful, financially liquid, weaponized to the teeth and ruthlessly evil.

Destroying or seriously weakening their operations will not be easy, but it is a war America must win.

All content above represents the opinion of Bryan Perry of Navellier & Associates, Inc.

Also In This Issue

A Look Ahead by Louis Navellier

A Deeper Dive into DeepSeek and Nvidia

Income Mail by Bryan Perry

A Major Campaign Promise Kept – Now What?

Growth Mail by Gary Alexander

Is a Monopoly Always Bad? How Can We Tell?

Global Mail by Ivan Martchev

The Cycle of Tariff Recriminations Has Started

Sector Spotlight by Jason Bodner

What Should Investors Do with Nvidia Now?

View Full Archive

Read Past Issues Here

Bryan Perry

SENIOR DIRECTOR

Bryan Perry is a Senior Director with Navellier Private Client Group, advising and facilitating high net worth investors in the pursuit of their financial goals.

Bryan’s financial services career spanning the past three decades includes over 20 years of wealth management experience with Wall Street firms that include Bear Stearns, Lehman Brothers and Paine Webber, working with both retail and institutional clients. Bryan earned a B.A. in Political Science from Virginia Polytechnic Institute & State University and currently holds a Series 65 license. All content of “Income Mail” represents the opinion of Bryan Perry

Important Disclosures:

Although information in these reports has been obtained from and is based upon sources that Navellier believes to be reliable, Navellier does not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute Navellier’s judgment as of the date the report was created and are subject to change without notice. These reports are for informational purposes only and are not a solicitation for the purchase or sale of a security. Any decision to purchase securities mentioned in these reports must take into account existing public information on such securities or any registered prospectus.To the extent permitted by law, neither Navellier & Associates, Inc., nor any of its affiliates, agents, or service providers assumes any liability or responsibility nor owes any duty of care for any consequences of any person acting or refraining to act in reliance on the information contained in this communication or for any decision based on it.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any securities recommendations made by Navellier. in the future will be profitable or equal the performance of securities made in this report. Dividend payments are not guaranteed. The amount of a dividend payment, if any, can vary over time and issuers may reduce dividends paid on securities in the event of a recession or adverse event affecting a specific industry or issuer.

None of the stock information, data, and company information presented herein constitutes a recommendation by Navellier or a solicitation to buy or sell any securities. Any specific securities identified and described do not represent all of the securities purchased, sold, or recommended for advisory clients. The holdings identified do not represent all of the securities purchased, sold, or recommended for advisory clients and the reader should not assume that investments in the securities identified and discussed were or will be profitable.

Information presented is general information that does not take into account your individual circumstances, financial situation, or needs, nor does it present a personalized recommendation to you. Individual stocks presented may not be suitable for every investor. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. Investment in fixed income securities has the potential for the investment return and principal value of an investment to fluctuate so that an investor’s holdings, when redeemed, may be worth less than their original cost.

One cannot invest directly in an index. Index is unmanaged and index performance does not reflect deduction of fees, expenses, or taxes. Presentation of Index data does not reflect a belief by Navellier that any stock index constitutes an investment alternative to any Navellier equity strategy or is necessarily comparable to such strategies. Among the most important differences between the Indices and Navellier strategies are that the Navellier equity strategies may (1) incur material management fees, (2) concentrate its investments in relatively few stocks, industries, or sectors, (3) have significantly greater trading activity and related costs, and (4) be significantly more or less volatile than the Indices.

ETF Risk: We may invest in exchange traded funds (“ETFs”) and some of our investment strategies are generally fully invested in ETFs. Like traditional mutual funds, ETFs charge asset-based fees, but they generally do not charge initial sales charges or redemption fees and investors typically pay only customary brokerage fees to buy and sell ETF shares. The fees and costs charged by ETFs held in client accounts will not be deducted from the compensation the client pays Navellier. ETF prices can fluctuate up or down, and a client account could lose money investing in an ETF if the prices of the securities owned by the ETF go down. ETFs are subject to additional risks:

- ETF shares may trade above or below their net asset value;

- An active trading market for an ETF’s shares may not develop or be maintained;

- The value of an ETF may be more volatile than the underlying portfolio of securities the ETF is designed to track;

- The cost of owning shares of the ETF may exceed those a client would incur by directly investing in the underlying securities; and

- Trading of an ETF’s shares may be halted if the listing exchange’s officials deem it appropriate, the shares are delisted from the exchange, or the activation of market-wide “circuit breakers” (which are tied to large decreases in stock prices) halts stock trading generally.

Grader Disclosures: Investment in equity strategies involves substantial risk and has the potential for partial or complete loss of funds invested. The sample portfolio and any accompanying charts are for informational purposes only and are not to be construed as a solicitation to buy or sell any financial instrument and should not be relied upon as the sole factor in an investment making decision. As a matter of normal and important disclosures to you, as a potential investor, please consider the following: The performance presented is not based on any actual securities trading, portfolio, or accounts, and the reported performance of the A, B, C, D, and F portfolios (collectively the “model portfolios”) should be considered mere “paper” or pro forma performance results based on Navellier’s research.

Investors evaluating any of Navellier & Associates, Inc.’s, (or its affiliates’) Investment Products must not use any information presented here, including the performance figures of the model portfolios, in their evaluation of any Navellier Investment Products. Navellier Investment Products include the firm’s mutual funds and managed accounts. The model portfolios, charts, and other information presented do not represent actual funded trades and are not actual funded portfolios. There are material differences between Navellier Investment Products’ portfolios and the model portfolios, research, and performance figures presented here. The model portfolios and the research results (1) may contain stocks or ETFs that are illiquid and difficult to trade; (2) may contain stock or ETF holdings materially different from actual funded Navellier Investment Product portfolios; (3) include the reinvestment of all dividends and other earnings, estimated trading costs, commissions, or management fees; and, (4) may not reflect prices obtained in an actual funded Navellier Investment Product portfolio. For these and other reasons, the reported performances of model portfolios do not reflect the performance results of Navellier’s actually funded and traded Investment Products. In most cases, Navellier’s Investment Products have materially lower performance results than the performances of the model portfolios presented.

This report contains statements that are, or may be considered to be, forward-looking statements. All statements that are not historical facts, including statements about our beliefs or expectations, are “forward-looking statements” within the meaning of The U.S. Private Securities Litigation Reform Act of 1995. These statements may be identified by such forward-looking terminology as “expect,” “estimate,” “plan,” “intend,” “believe,” “anticipate,” “may,” “will,” “should,” “could,” “continue,” “project,” or similar statements or variations of such terms. Our forward-looking statements are based on a series of expectations, assumptions, and projections, are not guarantees of future results or performance, and involve substantial risks and uncertainty as described in Form ADV Part 2A of our filing with the Securities and Exchange Commission (SEC), which is available at www.adviserinfo.sec.gov or by requesting a copy by emailing info@navellier.com. All of our forward-looking statements are as of the date of this report only. We can give no assurance that such expectations or forward-looking statements will prove to be correct. Actual results may differ materially. You are urged to carefully consider all such factors.

FEDERAL TAX ADVICE DISCLAIMER: As required by U.S. Treasury Regulations, you are informed that, to the extent this presentation includes any federal tax advice, the presentation is not written by Navellier to be used, and cannot be used, for the purpose of avoiding federal tax penalties. Navellier does not advise on any income tax requirements or issues. Use of any information presented by Navellier is for general information only and does not represent tax advice either express or implied. You are encouraged to seek professional tax advice for income tax questions and assistance.

IMPORTANT NEWSLETTER DISCLOSURE:The hypothetical performance results for investment newsletters that are authored or edited by Louis Navellier, including Louis Navellier’s Growth Investor, Louis Navellier’s Breakthrough Stocks, Louis Navellier’s Accelerated Profits, and Louis Navellier’s Platinum Club, are not based on any actual securities trading, portfolio, or accounts, and the newsletters’ reported hypothetical performances should be considered mere “paper” or proforma hypothetical performance results and are not actual performance of real world trades. Navellier & Associates, Inc. does not have any relation to or affiliation with the owner of these newsletters. There are material differences between Navellier Investment Products’ portfolios and the InvestorPlace Media, LLC newsletter portfolios authored by Louis Navellier. The InvestorPlace Media, LLC newsletters contain hypothetical performance that do not include transaction costs, advisory fees, or other fees a client might incur if actual investments and trades were being made by an investor. As a result, newsletter performance should not be used to evaluate Navellier Investment services which are separate and different from the newsletters. The owner of the newsletters is InvestorPlace Media, LLC and any questions concerning the newsletters, including any newsletter advertising or hypothetical Newsletter performance claims, (which are calculated solely by Investor Place Media and not Navellier) should be referred to InvestorPlace Media, LLC at (800) 718-8289.

Please note that Navellier & Associates and the Navellier Private Client Group are managed completely independent of the newsletters owned and published by InvestorPlace Media, LLC and written and edited by Louis Navellier, and investment performance of the newsletters should in no way be considered indicative of potential future investment performance for any Navellier & Associates separately managed account portfolio. Potential investors should consult with their financial advisor before investing in any Navellier Investment Product.

Navellier claims compliance with Global Investment Performance Standards (GIPS). To receive a complete list and descriptions of Navellier’s composites and/or a presentation that adheres to the GIPS standards, please contact Navellier or click here. It should not be assumed that any securities recommendations made by Navellier & Associates, Inc. in the future will be profitable or equal the performance of securities made in this report.

FactSet Disclosure: Navellier does not independently calculate the statistical information included in the attached report. The calculation and the information are provided by FactSet, a company not related to Navellier. Although information contained in the report has been obtained from FactSet and is based on sources Navellier believes to be reliable, Navellier does not guarantee its accuracy, and it may be incomplete or condensed. The report and the related FactSet sourced information are provided on an “as is” basis. The user assumes the entire risk of any use made of this information. Investors should consider the report as only a single factor in making their investment decision. The report is for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of a security. FactSet sourced information is the exclusive property of FactSet. Without prior written permission of FactSet, this information may not be reproduced, disseminated or used to create any financial products. All indices are unmanaged and performance of the indices include reinvestment of dividends and interest income, unless otherwise noted, are not illustrative of any particular investment and an investment cannot be made in any index. Past performance is no guarantee of future results.