by Louis Navellier

February 3, 2026

Due to last fall’s government shutdown, some statistics are coming out later than usual. For instance, the November Producer Price Index (PPI) was released on January 14 (about a month later than usual), and the December PPI was released just 16-days later, last Friday. In this report, the U.S. Labor Department calculated the Producer Price Index (PPI) for December rose substantially more than expected, at +0.5% (a 6% annual rate), more than double the economists’ consensus estimate of just a 0.2% increase.

The core PPI surged 0.7%, due mostly to a 1.7% rise in trade services, even though wholesale food prices declined 0.3% and energy prices declined 1.4%, which is good news. Wholesale service costs rose 0.7%, while wholesale goods costs were unchanged. So, it seems trade services distorted the December PPI, but there were encouraging details, like lower food and energy prices and stable wholesale goods prices.

I noticed many overreactions to this single inflation report, including a big drop in gold and silver, on the mistaken assumption high inflation will cause the Fed to delay any further interest rate-cuts. The truth of the matter is gold has soared during times of high interest rates in history, and we’re seeing falling rental and home prices, low crude oil prices, plus waves of deflation imported from China and other economies. All of this adds up to a serious deflation risk, requiring the Fed to slash rates by at least 1% this year.

One example of America importing deflation is the price of television sets falling 6.7% in the past year. If you go to a major box store, you can get a 98-inch TCL television set for under $1,300. China’s TCL built the biggest factory for mini-LED televisions in the world and can now out-price anyone, which may explain why Sony and TCL are now teaming up together, otherwise Sony would not be able to compete.

I have been predicting 5% GDP growth later this year but the fourth-quarter 2025 GDP just took a hit as the trade deficit resurged in November. Specifically, exports declined by 3.6% to $292-billion and imports surged 5% to $349-billion, so the trade deficit rose a whopping 94.6% to $56.8-billion compared with last October’s record low trade deficit – the biggest monthly change in the trade deficit since 1992!

This rising trade deficit caused the Atlanta Fed to revise their fourth-quarter GDP estimate significantly lower to a 4.2% annual pace (down from 5.4% previously estimated) but for the first 11-months of 2025, exports still grew faster than imports, with exports up 6.3%, vs. +5.8% for imports. The November data was skewed by imports of pharmaceuticals, up $6.7-billion, and gold exports declining by $6.8-billion.

There is no doubt the Trump administration’s shifting tariff polices may have impacted the trade deficit, but since most tariffs are largely finalized, except for South Korea, we should be getting more reliable trade data. While these trade figures may cut GDP estimates, some further evidence of GDP growth came from the Commerce Department, which reported durable goods orders surging 5.3% in November – well above economists’ consensus estimate of a 4% increase. Excluding a 143% surge in commercial aircraft orders, durable goods still rose by 0.5% in November, which is positive for fourth-quarter GDP growth.

Interestingly, gold peaked at over $5,500 per-ounce last week, but gold fell sharply on Friday, in an overreaction to the PPI data and Fed nomination. I believe gold will continue its rally soon, as many central banks around the world have lost credibility and lost faith in their own currency by buying more gold. We are teetering on the verge of a deflationary environment, where interest rates around the world may collapse, so gold remains an oasis and a great deflation hedge. (I now recommend 19-gold stocks).

I would not fear any return to inflation, but I do fear a deflationary spiral. What started in China and Japan may spread around the world, due in part to shrinking households from aging demographics and a failure to assimilate immigrants efficiently. Britain and France tried to tax the rich and failed, so more middle-class tax hikes may be in store. This could trigger new elections. Germany and Italy are blaming the European Union (EU) for impeding innovation and hindering growth. In my opinion, the EU may break up after their series of 2027 elections, when many anti-EU parties may gain leadership roles.

President Trump Tells Europe (at Davos) to Create Growth in the American Image

With the fastest economic growth in the world, it is difficult to argue with the U.S. economic agenda which President Trump, Scott Bessent and Howard Lutnick laid out in Davos, despite heckling from Al Gore and Gavin Newsom, plus ECB President Christine Lagarde walking out as Howard Lutnick talked.

In Davos, President Trump said Europe should reject globalism and follow U.S. economic policies if they want to prosper. So essentially, the Trump administration went to Davos to blow up the global elite’s club and assert themselves on Greenland, NATO, energy and other important matters.

AI is also making America more productive, and the 4.9% productivity gain in the third-quarter was the strongest surge I can remember. All these efficiencies promote falling prices as well as GDP growth!

Another boost to GDP will be the output produced by an estimated $20-trillion of on-shoring underway.

Optimism for America’s future can be addictive, so it will be interesting to see how well the Trump administration can sell their economic agenda through cheerleaders like Kevin Warsh, Kevin Hassett, Scott Bessent and Howard Lutnick. Obviously, President Trump is working hard to win the November mid-term elections, so he will not face impeachment and other unpleasant events from his first term.

One last point: Although we are in the midst of an incredible small-cap rally and a strong January effect, I see my large-cap stocks posting their strongest relative out-performance (compared to the S&P 500) in the past 22-months!

On the latest price gold correction, I’ve added more gold stocks, as my fundamentally superior stocks are poised to post record sales, earnings, surprises and raise guidance in the upcoming weeks, so please enjoy the ride! I just want to remind you how special the current economic environment is and why being invested in my fundamentally superior stocks – including my 19 gold stocks – is a key to getting rich!

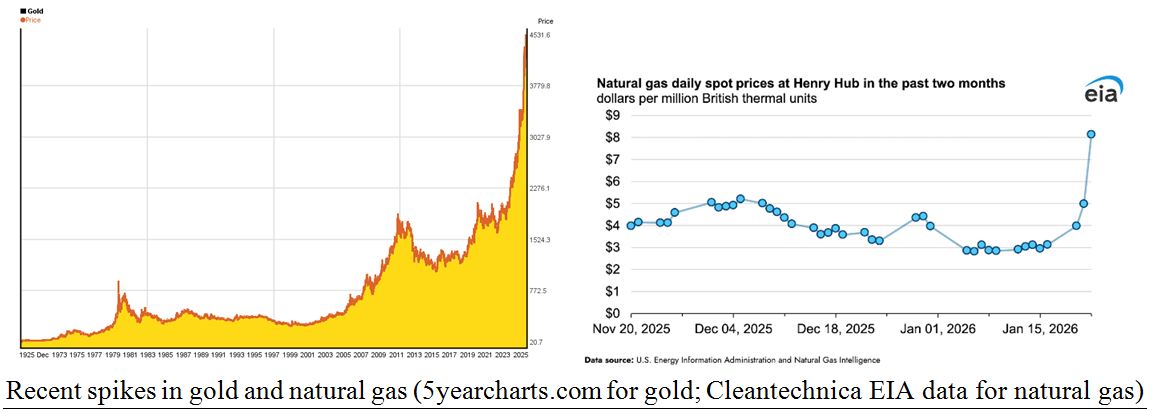

As the following chart shows, natural gas has now joined gold in a sudden price spike early this year:

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

In conclusion, a new world order of peace and prosperity is unfolding. Countries are being told to reject globalism, take care of their citizens, protect their borders and prosper. Even though countries like the Czech Republic, Hungary, Poland and Slovakia are already benefitting from these policies; these policies are now finally spreading to Germany and Italy as they push back on Brussels’ influence. Meanwhile, a new economic experiment is now underway in America, and 5% GDP growth is just the first result. The next scenario could be 6% GDP growth and a stock market doubling, as President Trump predicted in Davos!

All content above represents the opinion of Louis Navellier of Navellier & Associates, Inc.

Also In This Issue

A Look Ahead by Louis Navellier

Is Inflation Returning – or is Deflation a Greater Threat?

Income Mail by Bryan Perry

Kevin Hassett’s Base Case for an Economic Supply Shock

Growth Mail by Gary Alexander

What’s Behind the Surge (then Collapse) in Gold and Silver?

Global Mail by Ivan Martchev

The Stock Market is Worried about Iran

Sector Spotlight by Jason Bodner

What A Stock Market Rotation Looks Like

View Full Archive

Read Past Issues Here

Louis Navellier

CHIEF INVESTMENT OFFICER

Louis Navellier is Founder, Chairman of the Board, Chief Investment Officer and Chief Compliance Officer of Navellier & Associates, Inc., located in Reno, Nevada. With decades of experience translating what had been purely academic techniques into real market applications, he believes that disciplined, quantitative analysis can select stocks that will significantly outperform the overall market. All content in this “A Look Ahead” section of Market Mail represents the opinion of Louis Navellier of Navellier & Associates, Inc.

Important Disclosures:

Although information in these reports has been obtained from and is based upon sources that Navellier believes to be reliable, Navellier does not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute Navellier’s judgment as of the date the report was created and are subject to change without notice. These reports are for informational purposes only and are not a solicitation for the purchase or sale of a security. Any decision to purchase securities mentioned in these reports must take into account existing public information on such securities or any registered prospectus.To the extent permitted by law, neither Navellier & Associates, Inc., nor any of its affiliates, agents, or service providers assumes any liability or responsibility nor owes any duty of care for any consequences of any person acting or refraining to act in reliance on the information contained in this communication or for any decision based on it.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any securities recommendations made by Navellier. in the future will be profitable or equal the performance of securities made in this report. Dividend payments are not guaranteed. The amount of a dividend payment, if any, can vary over time and issuers may reduce dividends paid on securities in the event of a recession or adverse event affecting a specific industry or issuer.

None of the stock information, data, and company information presented herein constitutes a recommendation by Navellier or a solicitation to buy or sell any securities. Any specific securities identified and described do not represent all of the securities purchased, sold, or recommended for advisory clients. The holdings identified do not represent all of the securities purchased, sold, or recommended for advisory clients and the reader should not assume that investments in the securities identified and discussed were or will be profitable.

Information presented is general information that does not take into account your individual circumstances, financial situation, or needs, nor does it present a personalized recommendation to you. Individual stocks presented may not be suitable for every investor. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. Investment in fixed income securities has the potential for the investment return and principal value of an investment to fluctuate so that an investor’s holdings, when redeemed, may be worth less than their original cost.

One cannot invest directly in an index. Index is unmanaged and index performance does not reflect deduction of fees, expenses, or taxes. Presentation of Index data does not reflect a belief by Navellier that any stock index constitutes an investment alternative to any Navellier equity strategy or is necessarily comparable to such strategies. Among the most important differences between the Indices and Navellier strategies are that the Navellier equity strategies may (1) incur material management fees, (2) concentrate its investments in relatively few stocks, industries, or sectors, (3) have significantly greater trading activity and related costs, and (4) be significantly more or less volatile than the Indices.

ETF Risk: We may invest in exchange traded funds (“ETFs”) and some of our investment strategies are generally fully invested in ETFs. Like traditional mutual funds, ETFs charge asset-based fees, but they generally do not charge initial sales charges or redemption fees and investors typically pay only customary brokerage fees to buy and sell ETF shares. The fees and costs charged by ETFs held in client accounts will not be deducted from the compensation the client pays Navellier. ETF prices can fluctuate up or down, and a client account could lose money investing in an ETF if the prices of the securities owned by the ETF go down. ETFs are subject to additional risks:

- ETF shares may trade above or below their net asset value;

- An active trading market for an ETF’s shares may not develop or be maintained;

- The value of an ETF may be more volatile than the underlying portfolio of securities the ETF is designed to track;

- The cost of owning shares of the ETF may exceed those a client would incur by directly investing in the underlying securities; and

- Trading of an ETF’s shares may be halted if the listing exchange’s officials deem it appropriate, the shares are delisted from the exchange, or the activation of market-wide “circuit breakers” (which are tied to large decreases in stock prices) halts stock trading generally.

Grader Disclosures: Investment in equity strategies involves substantial risk and has the potential for partial or complete loss of funds invested. The sample portfolio and any accompanying charts are for informational purposes only and are not to be construed as a solicitation to buy or sell any financial instrument and should not be relied upon as the sole factor in an investment making decision. As a matter of normal and important disclosures to you, as a potential investor, please consider the following: The performance presented is not based on any actual securities trading, portfolio, or accounts, and the reported performance of the A, B, C, D, and F portfolios (collectively the “model portfolios”) should be considered mere “paper” or pro forma performance results based on Navellier’s research.

Investors evaluating any of Navellier & Associates, Inc.’s, (or its affiliates’) Investment Products must not use any information presented here, including the performance figures of the model portfolios, in their evaluation of any Navellier Investment Products. Navellier Investment Products include the firm’s mutual funds and managed accounts. The model portfolios, charts, and other information presented do not represent actual funded trades and are not actual funded portfolios. There are material differences between Navellier Investment Products’ portfolios and the model portfolios, research, and performance figures presented here. The model portfolios and the research results (1) may contain stocks or ETFs that are illiquid and difficult to trade; (2) may contain stock or ETF holdings materially different from actual funded Navellier Investment Product portfolios; (3) include the reinvestment of all dividends and other earnings, estimated trading costs, commissions, or management fees; and, (4) may not reflect prices obtained in an actual funded Navellier Investment Product portfolio. For these and other reasons, the reported performances of model portfolios do not reflect the performance results of Navellier’s actually funded and traded Investment Products. In most cases, Navellier’s Investment Products have materially lower performance results than the performances of the model portfolios presented.

This report contains statements that are, or may be considered to be, forward-looking statements. All statements that are not historical facts, including statements about our beliefs or expectations, are “forward-looking statements” within the meaning of The U.S. Private Securities Litigation Reform Act of 1995. These statements may be identified by such forward-looking terminology as “expect,” “estimate,” “plan,” “intend,” “believe,” “anticipate,” “may,” “will,” “should,” “could,” “continue,” “project,” or similar statements or variations of such terms. Our forward-looking statements are based on a series of expectations, assumptions, and projections, are not guarantees of future results or performance, and involve substantial risks and uncertainty as described in Form ADV Part 2A of our filing with the Securities and Exchange Commission (SEC), which is available at www.adviserinfo.sec.gov or by requesting a copy by emailing info@navellier.com. All of our forward-looking statements are as of the date of this report only. We can give no assurance that such expectations or forward-looking statements will prove to be correct. Actual results may differ materially. You are urged to carefully consider all such factors.

FEDERAL TAX ADVICE DISCLAIMER: As required by U.S. Treasury Regulations, you are informed that, to the extent this presentation includes any federal tax advice, the presentation is not written by Navellier to be used, and cannot be used, for the purpose of avoiding federal tax penalties. Navellier does not advise on any income tax requirements or issues. Use of any information presented by Navellier is for general information only and does not represent tax advice either express or implied. You are encouraged to seek professional tax advice for income tax questions and assistance.

IMPORTANT NEWSLETTER DISCLOSURE:The hypothetical performance results for investment newsletters that are authored or edited by Louis Navellier, including Louis Navellier’s Growth Investor, Louis Navellier’s Breakthrough Stocks, Louis Navellier’s Accelerated Profits, and Louis Navellier’s Platinum Club, are not based on any actual securities trading, portfolio, or accounts, and the newsletters’ reported hypothetical performances should be considered mere “paper” or proforma hypothetical performance results and are not actual performance of real world trades. Navellier & Associates, Inc. does not have any relation to or affiliation with the owner of these newsletters. There are material differences between Navellier Investment Products’ portfolios and the InvestorPlace Media, LLC newsletter portfolios authored by Louis Navellier. The InvestorPlace Media, LLC newsletters contain hypothetical performance that do not include transaction costs, advisory fees, or other fees a client might incur if actual investments and trades were being made by an investor. As a result, newsletter performance should not be used to evaluate Navellier Investment services which are separate and different from the newsletters. The owner of the newsletters is InvestorPlace Media, LLC and any questions concerning the newsletters, including any newsletter advertising or hypothetical Newsletter performance claims, (which are calculated solely by Investor Place Media and not Navellier) should be referred to InvestorPlace Media, LLC at (800) 718-8289.

Please note that Navellier & Associates and the Navellier Private Client Group are managed completely independent of the newsletters owned and published by InvestorPlace Media, LLC and written and edited by Louis Navellier, and investment performance of the newsletters should in no way be considered indicative of potential future investment performance for any Navellier & Associates separately managed account portfolio. Potential investors should consult with their financial advisor before investing in any Navellier Investment Product.

Navellier claims compliance with Global Investment Performance Standards (GIPS). To receive a complete list and descriptions of Navellier’s composites and/or a presentation that adheres to the GIPS standards, please contact Navellier or click here. It should not be assumed that any securities recommendations made by Navellier & Associates, Inc. in the future will be profitable or equal the performance of securities made in this report.

FactSet Disclosure: Navellier does not independently calculate the statistical information included in the attached report. The calculation and the information are provided by FactSet, a company not related to Navellier. Although information contained in the report has been obtained from FactSet and is based on sources Navellier believes to be reliable, Navellier does not guarantee its accuracy, and it may be incomplete or condensed. The report and the related FactSet sourced information are provided on an “as is” basis. The user assumes the entire risk of any use made of this information. Investors should consider the report as only a single factor in making their investment decision. The report is for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of a security. FactSet sourced information is the exclusive property of FactSet. Without prior written permission of FactSet, this information may not be reproduced, disseminated or used to create any financial products. All indices are unmanaged and performance of the indices include reinvestment of dividends and interest income, unless otherwise noted, are not illustrative of any particular investment and an investment cannot be made in any index. Past performance is no guarantee of future results.