by Gary Alexander

February 25, 2025

February 25th, 2025 has a certain symmetry in the way the numbers fall on the page. My-oh my, how true that is!

How is it possible that a single calendar date marks the birth of seven or more singular events in U.S. history – many of them tied to current debates, helping us view today’s hot news trends in wider context.

Maybe Buddy Holly honored this date best, when on February 25, 1957, he and his Crickets drove 100-miles from Lubbock Texas, to Clovis New Mexico, to record their first (and only #1) hit, “That’ll Be the Day!”

February 25th marks the first Fed, the first cabinet meeting, the first NYSE expansion, our first fiat-currency, first big market-bubble, first billion-dollar firm and first income-tax – all falling on Day number-56 of the year.

#1: February 25, 1791 – The Birth of the First Bank of the United States

The first of our failed Central Banks – the First Bank of the United States – was the brainchild of our first Secretary of the Treasury, Alexander Hamilton. It was chartered by the young U.S. Congress on February 25, 1791. It lasted only 20-years. It followed the “Bank of North America,” our first de facto national bank, but neither was anything like a modern central bank. They were “national” only in that they could open branches in each state and lend money to the U.S. government. All other banks could only do business in a single state. The First Bank building, in Philadelphia, wasn’t completed until 1797.

Hamilton used the charter of the Bank of England (founded in 1694) as his basis for this First U.S. Bank. He argued that this “Bank of America” could issue any new U.S. currency, provide a safe place to keep public funds, facilitate commercial transactions, collect taxes and pay off the nation’s debts. Virginia’s Thomas Jefferson, of course, disagreed, fearing that a national bank would create a financial monopoly favoring urban financiers and merchants, who tended to be creditors, over plantation owners and farmers.

The Bank’s 20-year charter turned out to be its death sentence, as its charter was not renewed in 1811, even though branches quickly sprang up in Baltimore, Boston, Charleston and New York in 1792, followed by Norfolk (1800), Savannah (1802), Washington, DC (1802), and New Orleans (1805). A quick survey reveals that these branches were in port cities, as tariffs were a major source of tax revenue.

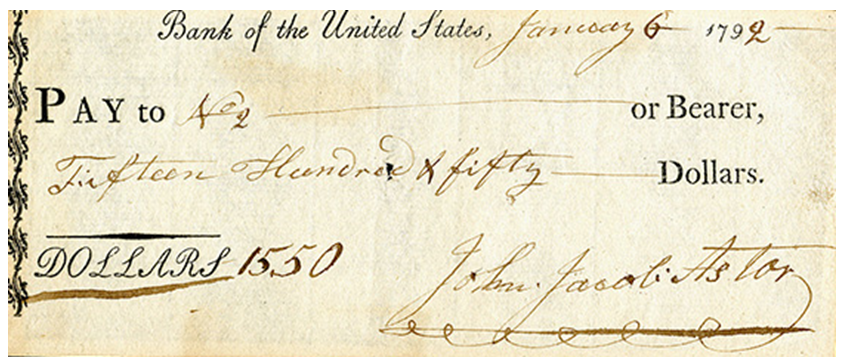

A Bank of the United States check signed by John Jacob Astor in 1792. (Smithsonian via Wikimedia Commons)

In March 1809, outgoing President Jefferson’s Secretary of the Treasury Albert Gallatin recommended renewing the Bank’s charter. Congress let the matter languish until January 1810. At that time, the House gave the renewal request a quick reading but took no action. In January 1811, the House voted against renewal by a single vote. In February 1811, the Senate vote was a tie. Vice president George Clinton (of New York) cast the tie-breaking veto, so the Bank charter renewal was again defeated by a single vote.

#2: February 25, 1793: The First Cabinet Meeting Was Held – at President Washington’s Home

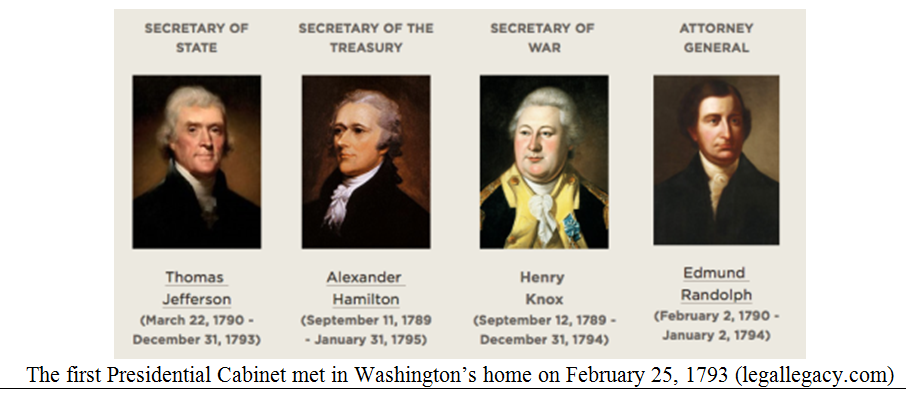

Amazingly enough, 24 of President Trump’s 25 cabinet and close advisory nominations have already been approved 30-days into his “shock and awe” first 100-days, with only his Labor Secretary-designate still being questioned, but it wasn’t until four years into President George Washington’s two terms – about a week before his second inauguration – that he first met with all four of his cabinet team at once, and it was in his home. On February 25, 1793, President Washington held his first cabinet meeting, consisting of Secretary of State Thomas Jefferson, Treasury Secretary Alexander Hamilton, Secretary of War Henry Knox, and Attorney General Edmund Randolph. There were frequent fights between some of them – notably Jefferson and Hamilton – so the peace-making general didn’t often pit them all together.

Jefferson himself said that confronting Hamilton in any intimate cabinet setting was “like two fighting cocks.” From their major political differences arose the foundation for the eventual creation of our two warring political factions (Adams vs. Jefferson) in 1796 – and partisanship ever since. Washington hated conflicts, often writing letters to his two “fighting cocks,” saying this to Hamilton: “My earnest wish is that balsam may be poured into all the wounds which have been given, to prevent them from gangrening.”

#3: February 25, 1817: The New York Stock Exchange (NYSE) Board Was First Organized

In early February 1817, when the Erie Canal needed capitalization, several leading Wall Street brokers sent William Lamb to Philadelphia to find out how the Philadelphia Stock Exchange worked so well. On his return, the brokers met in the office of Samuel Beebe to draw up a constitution on February 25th that was nearly identical to that of the Philadelphia Stock Exchange. It was signed by 28 brokers from seven firms, who became the original Board of Brokers of the New York Stock & Exchange Board.

A previous form of the New York stock exchange was founded almost exactly 25-years earlier, under a Buttonwood tree on Wall Street, hence called the Buttonwood Agreement, but that was more or less a cabal to limit trading to those elite. In March 1792, 24 of New York’s leading merchants met secretly at Corre’s Hotel to discuss ways to bring order to the securities business by limiting trade to their cartel. In 1817, New York stockbrokers instituted reforms to broaden their outreach to several locations instead of limiting all their trades to their “Old Boys’ Club” at the Tontine Coffee House, as the boom times began.

#4: Fiat Money Creation (1) On February 25, 1862, The U.S. formed the Bureau of Engraving & Printing, and (2) on February 25, 1863, Congress created the National Currency Bureau.

Here are two acts of Congress falling on this date during the Civil War, each facilitating military spending with President Lincoln’s un-backed Greenbacks. Here’s some of the legalese from the National Archives:

“A Congressional act of February 25, 1862 (12 Stat. 346) required engraved signatures and an imprinted Treasury seal on all notes, with such engraving to be done at the Treasury Department, using government personnel and equipment. Under the latter authority, an experimental engraving and printing operation was established in the Treasury Department, from which the personnel and equipment were drawn to organize the First Division of the National Currency Bureau, established by the National Banking Act (12 Stat. 665), February 25, 1863. The First Division, responsible for engraving and printing federally backed bank notes, and known informally as the Bureau of Engraving and Printing as early as 1866, was formally separated from the National Currency Bureau by administrative order in 1869.”

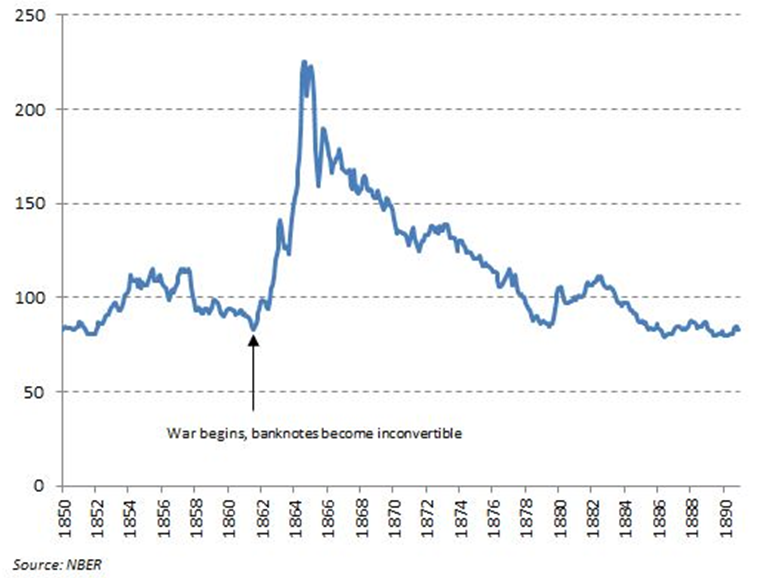

What this means is that prices began soaring when all gold backing was “temporarily” abandoned. Prices in Union States rose about 120% from 1862 to 1866. (Gold and silver backing was resumed in 1879).

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Inflation was far worse in the confederate states. Their version of a Consumer Price Index reached hyperinflation with price increases exceeding 9,000%, due to excessive printing of fiat money.

#5: On February 25, 1893, the Philadelphia & Reading Railroad bankruptcy launched a Panic

The Panic of 1893 was a long time coming, but it began on this specific date, when the first of the big railroads collapsed. The Philadelphia & Reading railroad listed debts exceeding $125-million on this date, a huge sum for that time. This admission launched the Panic of 1893, which basically lasted four years – the entirety of poor Grover Cleveland’s second term. He’s the only other President (besides Trump) to win two non-consecutive elections. He was also the only Democrat elected after Lincoln (1865) until Woodrow Wilson in 1912. Basically, retired Republican Union Army officers born in Ohio (Grant, Hayes, Garfield, Harrison, McKinley, then Taft) dominated the presidency nine of 11 terms, from 1868 to 1912.

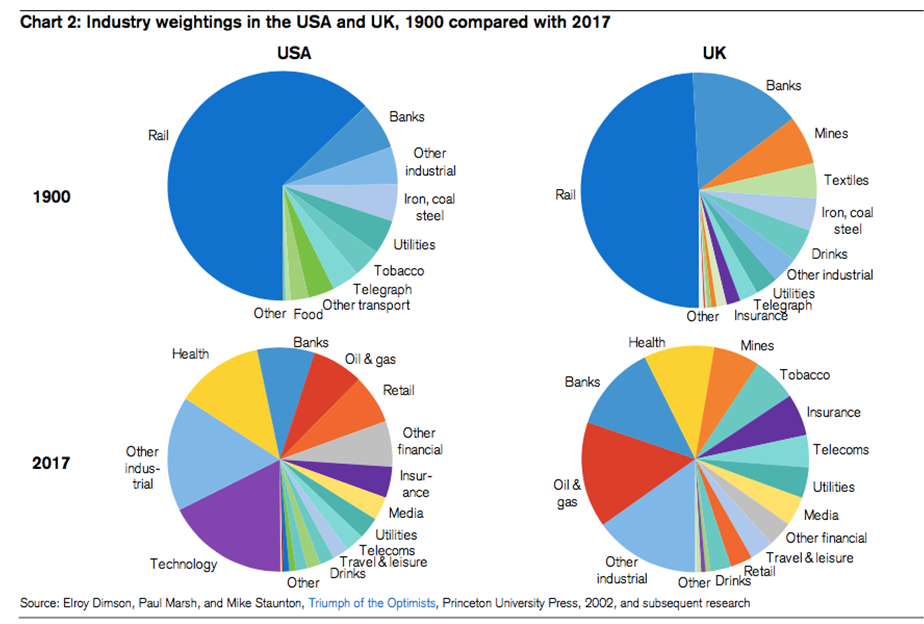

Railroads peaked as a controlling industry in the 1880s, but they still controlled 2/3 of the stock market in the 1890s, controlling far more capital than technology stocks, or any other industry, in recent market decades:

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Investors in the 1880s dove into railroad stocks like day traders in 1999 poured cash into dot-com dreams. The bubble burst about a week before Grover Cleveland’s second inauguration, just after the appointment of receivers for the Philadelphia & Reading RR. After P&R failed, a series of banks failed, followed by the Northern Pacific, the Union Pacific and that noted song train, “The Atchison, Topeka and Santa Fe.”

According to estimates back then, about 18% of the workforce was unemployed in the following year.

#6: February 25, 1901: J.P. Morgan Created the First Billion-Dollar Company, U.S. Steel

The Industrial Revolution was soaring again at the turn of the century. In 1900 the demand for steel was at peak levels, and J.P. Morgan wanted to dominate this market by creating a centralized combine, or trust, in steel. He heard that Andrew Carnegie wanted to retire, and President William McKinley was warm to business consolidations, so in December 1900, Morgan attended a now-famous dinner at New York’s University Club, where Carnegie Steel’s CEO, Charles Schwab, gave a speech that triggered Morgan’s plan to merge Carnegie and Morgan steel, along with several smaller steel, mining, and shipping firms.

On February 25, 1901, United States Steel Corporation was incorporated with a capitalization of $1.4-billion, the first billion-dollar corporation in history. The 10 companies that were merged to form U.S. Steel were American Bridge Company, American Sheet Steel Company, American Steel Hoop Company, American Steel & Wire Company, American Tin Plate Company, Carnegie Steel Company, Federal Steel Company, Lake Superior Consolidated Iron Mines, National Steel Company and National Tube Company. J.P. Morgan named Schwab the CEO, but the real power was Morgan’s hand-picked deputy, Elbert Gary.

#7: February 25, 1913: The 16th Amendment Authorized the First Federal Income Tax

Finally, we come to the hated income-tax. In our nation’s first 125-years, including the Age of Invention and our massive and powerful Industrial Revolution, the nation’s main federal fuel came from tariffs.

A federal income-tax was beaten down twice by the Supreme Court in the late 1800s, but the 1-2 punch of the Panic of 1893 and Panic of 1907 convinced J.P. Morgan and other financiers that they could no longer stem Panics (what we later called Depressions) by gathering together major bankers to restore investor confidence by throwing money (or gold) back into the market the next morning. They needed: (1) a central bank as our “lender of last resort” and (2) a national income-tax system to bring in more tax revenues.

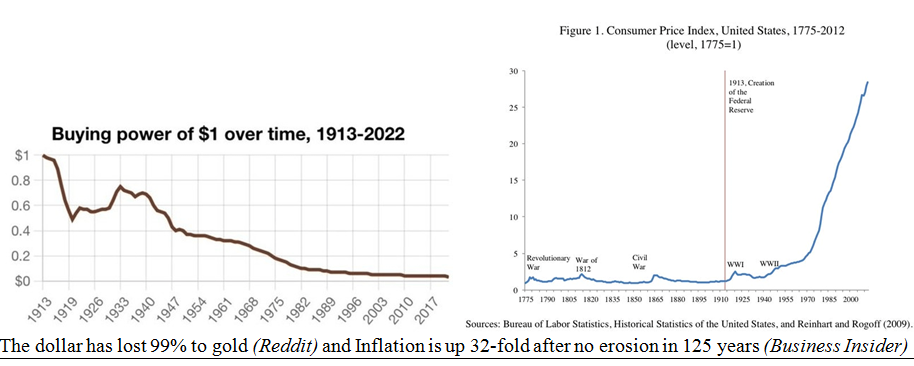

Both came about in 1913, a year that created our modern centralized financial system in the United States, but since then the dollar has lost over 99% to gold and 97% of its purchasing power (32-fold inflation).

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

This brings us back to the current Trump Revolution, whereby he promises to do away with income-tax – or at least remove a great amount of our income from taxation – by funding more federal spending from tariffs. This seems to be an outlandish promise. I give it a 1% chance of materializing, but this 7-part historical survey of our U.S. financial history on a single date, February 25th, can at least give us some hope that we might learn some lessons about 2025 if we dare read some history books from time to time.

All content above represents the opinion of Gary Alexander of Navellier & Associates, Inc.

Also In This Issue

A Look Ahead by Louis Navellier

As U.S. Relations Thaw with Putin, a Chill Falls Over Europe

Income Mail by Bryan Perry

Taking Stock of Trump’s Tough Tariff Talk

Growth Mail by Gary Alexander

All Hail February 25th – a Red-Letter Day in U.S. Financial History

Global Mail by Ivan Martchev

The Friday Curse of the S&P 500

Sector Spotlight by Jason Bodner

A Mid-Quarter S&P Sector Review

View Full Archive

Read Past Issues Here

About The Author

Gary Alexander

SENIOR EDITOR

Gary Alexander has been Senior Writer at Navellier since 2009. He edits Navellier’s weekly Marketmail and writes a weekly Growth Mail column, in which he uses market history to support the case for growth stocks. For the previous 20-years before joining Navellier, he was Senior Executive Editor at InvestorPlace Media (formerly Phillips Publishing), where he worked with several leading investment analysts, including Louis Navellier (since 1997), helping launch Louis Navellier’s Blue Chip Growth and Global Growth newsletters.

Prior to that, Gary edited Wealth Magazine and Gold Newsletter and wrote various investment research reports for Jefferson Financial in New Orleans in the 1980s. He began his financial newsletter career with KCI Communications in 1980, where he served as consulting editor for Personal Finance newsletter while serving as general manager of KCI’s Alexandria House book division. Before that, he covered the economics beat for news magazines. All content of “Growth Mail” represents the opinion of Gary Alexander

Important Disclosures:

Although information in these reports has been obtained from and is based upon sources that Navellier believes to be reliable, Navellier does not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute Navellier’s judgment as of the date the report was created and are subject to change without notice. These reports are for informational purposes only and are not a solicitation for the purchase or sale of a security. Any decision to purchase securities mentioned in these reports must take into account existing public information on such securities or any registered prospectus.To the extent permitted by law, neither Navellier & Associates, Inc., nor any of its affiliates, agents, or service providers assumes any liability or responsibility nor owes any duty of care for any consequences of any person acting or refraining to act in reliance on the information contained in this communication or for any decision based on it.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any securities recommendations made by Navellier. in the future will be profitable or equal the performance of securities made in this report. Dividend payments are not guaranteed. The amount of a dividend payment, if any, can vary over time and issuers may reduce dividends paid on securities in the event of a recession or adverse event affecting a specific industry or issuer.

None of the stock information, data, and company information presented herein constitutes a recommendation by Navellier or a solicitation to buy or sell any securities. Any specific securities identified and described do not represent all of the securities purchased, sold, or recommended for advisory clients. The holdings identified do not represent all of the securities purchased, sold, or recommended for advisory clients and the reader should not assume that investments in the securities identified and discussed were or will be profitable.

Information presented is general information that does not take into account your individual circumstances, financial situation, or needs, nor does it present a personalized recommendation to you. Individual stocks presented may not be suitable for every investor. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. Investment in fixed income securities has the potential for the investment return and principal value of an investment to fluctuate so that an investor’s holdings, when redeemed, may be worth less than their original cost.

One cannot invest directly in an index. Index is unmanaged and index performance does not reflect deduction of fees, expenses, or taxes. Presentation of Index data does not reflect a belief by Navellier that any stock index constitutes an investment alternative to any Navellier equity strategy or is necessarily comparable to such strategies. Among the most important differences between the Indices and Navellier strategies are that the Navellier equity strategies may (1) incur material management fees, (2) concentrate its investments in relatively few stocks, industries, or sectors, (3) have significantly greater trading activity and related costs, and (4) be significantly more or less volatile than the Indices.

ETF Risk: We may invest in exchange traded funds (“ETFs”) and some of our investment strategies are generally fully invested in ETFs. Like traditional mutual funds, ETFs charge asset-based fees, but they generally do not charge initial sales charges or redemption fees and investors typically pay only customary brokerage fees to buy and sell ETF shares. The fees and costs charged by ETFs held in client accounts will not be deducted from the compensation the client pays Navellier. ETF prices can fluctuate up or down, and a client account could lose money investing in an ETF if the prices of the securities owned by the ETF go down. ETFs are subject to additional risks:

- ETF shares may trade above or below their net asset value;

- An active trading market for an ETF’s shares may not develop or be maintained;

- The value of an ETF may be more volatile than the underlying portfolio of securities the ETF is designed to track;

- The cost of owning shares of the ETF may exceed those a client would incur by directly investing in the underlying securities; and

- Trading of an ETF’s shares may be halted if the listing exchange’s officials deem it appropriate, the shares are delisted from the exchange, or the activation of market-wide “circuit breakers” (which are tied to large decreases in stock prices) halts stock trading generally.

Grader Disclosures: Investment in equity strategies involves substantial risk and has the potential for partial or complete loss of funds invested. The sample portfolio and any accompanying charts are for informational purposes only and are not to be construed as a solicitation to buy or sell any financial instrument and should not be relied upon as the sole factor in an investment making decision. As a matter of normal and important disclosures to you, as a potential investor, please consider the following: The performance presented is not based on any actual securities trading, portfolio, or accounts, and the reported performance of the A, B, C, D, and F portfolios (collectively the “model portfolios”) should be considered mere “paper” or pro forma performance results based on Navellier’s research.

Investors evaluating any of Navellier & Associates, Inc.’s, (or its affiliates’) Investment Products must not use any information presented here, including the performance figures of the model portfolios, in their evaluation of any Navellier Investment Products. Navellier Investment Products include the firm’s mutual funds and managed accounts. The model portfolios, charts, and other information presented do not represent actual funded trades and are not actual funded portfolios. There are material differences between Navellier Investment Products’ portfolios and the model portfolios, research, and performance figures presented here. The model portfolios and the research results (1) may contain stocks or ETFs that are illiquid and difficult to trade; (2) may contain stock or ETF holdings materially different from actual funded Navellier Investment Product portfolios; (3) include the reinvestment of all dividends and other earnings, estimated trading costs, commissions, or management fees; and, (4) may not reflect prices obtained in an actual funded Navellier Investment Product portfolio. For these and other reasons, the reported performances of model portfolios do not reflect the performance results of Navellier’s actually funded and traded Investment Products. In most cases, Navellier’s Investment Products have materially lower performance results than the performances of the model portfolios presented.

This report contains statements that are, or may be considered to be, forward-looking statements. All statements that are not historical facts, including statements about our beliefs or expectations, are “forward-looking statements” within the meaning of The U.S. Private Securities Litigation Reform Act of 1995. These statements may be identified by such forward-looking terminology as “expect,” “estimate,” “plan,” “intend,” “believe,” “anticipate,” “may,” “will,” “should,” “could,” “continue,” “project,” or similar statements or variations of such terms. Our forward-looking statements are based on a series of expectations, assumptions, and projections, are not guarantees of future results or performance, and involve substantial risks and uncertainty as described in Form ADV Part 2A of our filing with the Securities and Exchange Commission (SEC), which is available at www.adviserinfo.sec.gov or by requesting a copy by emailing info@navellier.com. All of our forward-looking statements are as of the date of this report only. We can give no assurance that such expectations or forward-looking statements will prove to be correct. Actual results may differ materially. You are urged to carefully consider all such factors.

FEDERAL TAX ADVICE DISCLAIMER: As required by U.S. Treasury Regulations, you are informed that, to the extent this presentation includes any federal tax advice, the presentation is not written by Navellier to be used, and cannot be used, for the purpose of avoiding federal tax penalties. Navellier does not advise on any income tax requirements or issues. Use of any information presented by Navellier is for general information only and does not represent tax advice either express or implied. You are encouraged to seek professional tax advice for income tax questions and assistance.

IMPORTANT NEWSLETTER DISCLOSURE:The hypothetical performance results for investment newsletters that are authored or edited by Louis Navellier, including Louis Navellier’s Growth Investor, Louis Navellier’s Breakthrough Stocks, Louis Navellier’s Accelerated Profits, and Louis Navellier’s Platinum Club, are not based on any actual securities trading, portfolio, or accounts, and the newsletters’ reported hypothetical performances should be considered mere “paper” or proforma hypothetical performance results and are not actual performance of real world trades. Navellier & Associates, Inc. does not have any relation to or affiliation with the owner of these newsletters. There are material differences between Navellier Investment Products’ portfolios and the InvestorPlace Media, LLC newsletter portfolios authored by Louis Navellier. The InvestorPlace Media, LLC newsletters contain hypothetical performance that do not include transaction costs, advisory fees, or other fees a client might incur if actual investments and trades were being made by an investor. As a result, newsletter performance should not be used to evaluate Navellier Investment services which are separate and different from the newsletters. The owner of the newsletters is InvestorPlace Media, LLC and any questions concerning the newsletters, including any newsletter advertising or hypothetical Newsletter performance claims, (which are calculated solely by Investor Place Media and not Navellier) should be referred to InvestorPlace Media, LLC at (800) 718-8289.

Please note that Navellier & Associates and the Navellier Private Client Group are managed completely independent of the newsletters owned and published by InvestorPlace Media, LLC and written and edited by Louis Navellier, and investment performance of the newsletters should in no way be considered indicative of potential future investment performance for any Navellier & Associates separately managed account portfolio. Potential investors should consult with their financial advisor before investing in any Navellier Investment Product.

Navellier claims compliance with Global Investment Performance Standards (GIPS). To receive a complete list and descriptions of Navellier’s composites and/or a presentation that adheres to the GIPS standards, please contact Navellier or click here. It should not be assumed that any securities recommendations made by Navellier & Associates, Inc. in the future will be profitable or equal the performance of securities made in this report.

FactSet Disclosure: Navellier does not independently calculate the statistical information included in the attached report. The calculation and the information are provided by FactSet, a company not related to Navellier. Although information contained in the report has been obtained from FactSet and is based on sources Navellier believes to be reliable, Navellier does not guarantee its accuracy, and it may be incomplete or condensed. The report and the related FactSet sourced information are provided on an “as is” basis. The user assumes the entire risk of any use made of this information. Investors should consider the report as only a single factor in making their investment decision. The report is for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of a security. FactSet sourced information is the exclusive property of FactSet. Without prior written permission of FactSet, this information may not be reproduced, disseminated or used to create any financial products. All indices are unmanaged and performance of the indices include reinvestment of dividends and interest income, unless otherwise noted, are not illustrative of any particular investment and an investment cannot be made in any index. Past performance is no guarantee of future results.