by Gary Alexander

February 11, 2025

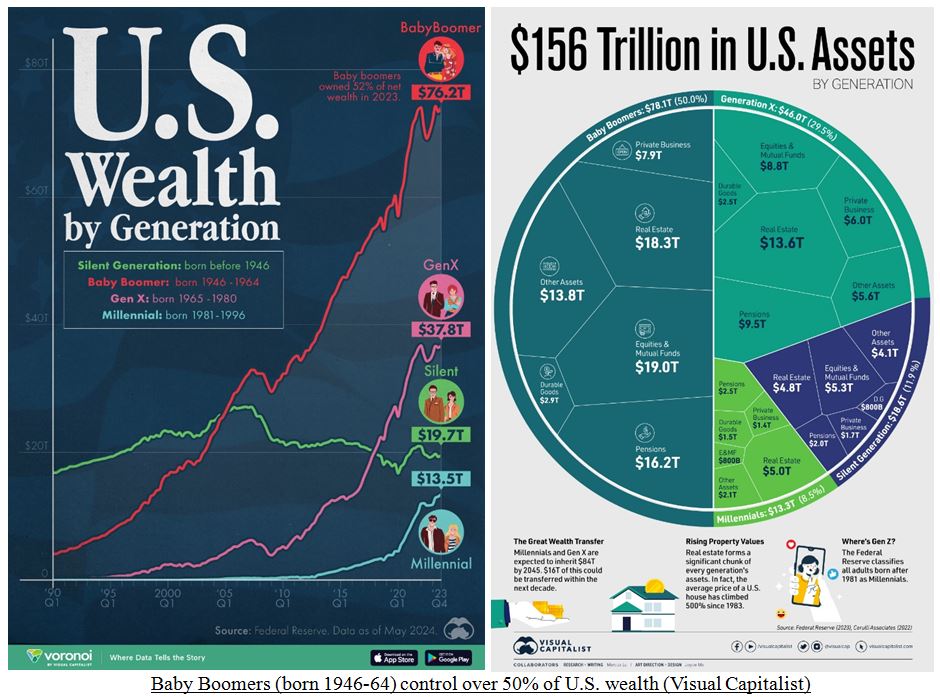

On January 28th, 2025, the day I began sailing on the latest Jazz Cruise, stock for Royal Caribbean Cruises (RCL), the parent company for the cruise line on which we sailed, soared over 12%, as the company reported stellar earnings. In three post-COVID years. RCL has delivered a 47% compound annual growth rate (CAGR) and quadrupled its stock price. This is partly due to the boom in Baby Boomer finances. Unfortunately for me, I’m not a Boomer, that frisky consort of jet-setting youngsters. My wife and I were born late in the “Silent Generation” (WW2 years), and these cruise trips, long flights and airports will have to get along without us in future years, but cruise lines should continue to thrive.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Royal Caribbean was $62.72 two years ago, on January 30, 2023. It doubled to $125.77 on January 30, 2024, and now it has more than doubled again in the last year to $274.79 on January 30, 2025. I wish I could say I owned some shares (I don’t), but I’ve certainly contributed to their earnings, on jazz cruises.

Today I abandon ship and fly home after an eventful fortnight, to say the least, but let’s turn to the high finance of cruising long ago. Last week, I began this column writing about a couple of state-run shipping monopolies that got busted by our Founding Fathers, first the British East India tea monopoly, ending with the Boston Tea Party, and then the Fulton-Livingston New York-Hudson River state-run steamboat monopoly, broken up by Cornelius Vanderbilt and partners in a landmark 1824 Supreme Court decision.

This week I’ll show you how the Commodore (as Vanderbilt was known) broke up a series of trans-oceanic shipping scams, where British and U.S. postal monopolies underwrote some posh cruising.

In 1838, the British began regular Trans-Atlantic steamboat service, and the usual hustlers rushed to set up sweetheart deals with the crown. Samuel Cunard won. He convinced the British government to give him $275,000 a year to run the mails. Cunard then profited by charging $200 per passenger per crossing.

On the American side of the pond, Edward K. Collins wangled an even better deal with the U.S. Congress, which agreed to give him $3 million down and $385,000 a year for building five ships to “outrace the Cunarders” and “drive them from sea,” while underwriting trans-Atlantic mail delivery.

Congress gave Collins (and two Pacific Coast outfits) buckets of money, but these hucksters took years to build their ships because “Collins had champagne taste with taxpayer money,” according to Burton Folsom, Jr., author of “The Myth of the Robber Barons.” Collins build four (not five) luxurious ships, so he went to Congress for more money, a raise to $858,000 a year ($33,000 per voyage), which works out to $1.3 million in today’s dollars for each of 26 trips. (To account for inflation, multiply all figures by 40).

This sweetheart deal was a combination of the “mail monopoly” and “shipping monopoly,” both state-run, so Cornelius Vanderbilt stepped in to save free enterprise yet again! After watching this nonsense for a decade, he offered to deliver the mail across the Atlantic for less than half of what Collins was charging.

Collins was terrified of the competition, so he tried to get Vanderbilt to join him in his monopoly racket, to no avail. Vanderbilt offered to run the Atlantic mail route for $15,000 per trip. As often happens, though, Congress was in Collin’s pocket, so they refused Vanderbilt’s offer to save 55% on mail delivery, which means Congress kept paying Collins $33,000 per trip, rather taking up Vanderbilt’s $15,000 offer.

So, Vanderbilt went private, charging 15-cents per letter, while offering lower passengers fares, too, including third-class steerage for $75 per voyage, not as luxurious but in better-built ships. Collins’ ships had luxurious fittings, but they leaked and vibrated, requiring days of repairs after each crossing. Two of Collins’ four ships eventually sank, killing almost 500 passengers, so he used federal money to build another ship – so poorly that it only lasted only two trips before being sold at a $900,000+ loss.

For the decade between 1848 and 1858, the U.S. government paid Edward Collins and two California-based shipping monopolies $11 million ($400+ million in today’s money) to build ships and carry mail. Vanderbilt took on all three competitors at no charge and beat them all. Folsom concluded, “Vanderbilt’s victory marked the end of political entrepreneurship in the American steamship business.” That’s when railroads began taking over America’s domestic commerce, and Vanderbilt soon dominated that business.

Vanderbilt took his steamship profits and built the New York Central Railroad, soon running to Chicago and beyond, but that’s a story for another day. For now, I’ll conclude with part of my first run at big ships.

My First Published Economics Article (57 Years Ago) Was Also About Big Ships

Just out of college in the fall of 1967, I soon became immersed in economic statistics at our college News Bureau. I actually began my college career in that News Bureau, but on the janitor crew, where I dusted the desks and buffed the floors, while being more interested in the ticker tapes from AP, UPI and Reuters.

After graduation, I got a job there providing data for charts, writing booklets and scripts for our radio/TV speakers, and then I began writing articles for our magazines. On the afternoon of Friday, November 17, 1967, as I was digging through The Journal of Commerce for Japanese shipping tonnages for a series of articles I co-authored with our Dean of Students, who had just returned from a fact-finding trip to Tokyo, I came across tonnage figures for Japanese ships, and became convinced that Japan was building these monster ships in order to become a major exporter, so I co-authored an article appearing in the January 1968 edition of The Plain Truth magazine, titled, “Japan: Industrial Super-giant.” Japan was not yet a super-giant, but we foresaw its rise long before others did. Here’s how I spun those shipbuilding statistics:

“In December 1966, the latest behemoth was launched, Idemitsu-Maru, a 210,000 dead-weight ton (DWT) tanker, measuring 1,122 feet in length (longer than the Eiffel Tower is high), and generating 100,000-horsepower. How much cargo can it hold? It staggers the imagination! The Idemitsu-Maru could hold enough gasoline to drive 750-cars to the moon and back, AND enough kerosene to cook a big breakfast for every person on the face of the earth (and have enough left over to cook dinner for everybody, too). AND enough diesel fuel to drive 900-heavy trucks around the world at the equator, AND still have enough fuel left in its hull to generate electricity to light all the light bulbs in Japan for two weeks!”

— By Gary Alexander, “Japan: Industrial Supergiant,” Plain Truth magazine, January 1968

What makes that November date so memorable is that I was so immersed in this shipping data that when I came down the office stairs that fall Friday in 1967, my future wife was talking with a friend, bemoaning her near engagement to another fellow, and I foolishly blurted out (with my mind still on Japanese ships), “Have you ever considered me?” She immediately said, “Yes I have, but you never give me the time of day!” Oops! I suddenly saw this very good friend as a wonderful woman; we dated daily, were engaged two weeks later and married six weeks later, in January 1968 – when my Japan article was published.

Born in the war years, we old timers have seen Japan fall, recover, then fall and recover again, twice in our lifetimes, first from military overreach, and then economic overreach – but we’re still together 57 years after my bumbling proposal. As you read this on February 11th, jazz fans disembark from my final Florida Jazz Cruise, a great ride, highly recommended, but next time for some younger bodies than ours.

Navellier & Associates owns Royal Caribbean Group (RCL), in managed accounts. Gary Alexander does not own Royal Caribbean Group (RCL), personally.

All content above represents the opinion of Gary Alexander of Navellier & Associates, Inc.

Also In This Issue

A Look Ahead by Louis Navellier

Will the Worst Trade War Since the 1930s Cause Inflation, Depression…or Prosperity?

Income Mail by Bryan Perry

Market Leadership Moves Beyond the Magnificent Seven

Growth Mail by Gary Alexander

Comparing Cruising Stocks from Long Ago to Now

Global Mail by Ivan Martchev

Will We See Another “Groundhog” Week?

Sector Spotlight by Jason Bodner

Don’t Fall Victim to “Recency Bias” (Take a History Pill)

View Full Archive

Read Past Issues Here

About The Author

Gary Alexander

SENIOR EDITOR

Gary Alexander has been Senior Writer at Navellier since 2009. He edits Navellier’s weekly Marketmail and writes a weekly Growth Mail column, in which he uses market history to support the case for growth stocks. For the previous 20-years before joining Navellier, he was Senior Executive Editor at InvestorPlace Media (formerly Phillips Publishing), where he worked with several leading investment analysts, including Louis Navellier (since 1997), helping launch Louis Navellier’s Blue Chip Growth and Global Growth newsletters.

Prior to that, Gary edited Wealth Magazine and Gold Newsletter and wrote various investment research reports for Jefferson Financial in New Orleans in the 1980s. He began his financial newsletter career with KCI Communications in 1980, where he served as consulting editor for Personal Finance newsletter while serving as general manager of KCI’s Alexandria House book division. Before that, he covered the economics beat for news magazines. All content of “Growth Mail” represents the opinion of Gary Alexander

Important Disclosures:

Although information in these reports has been obtained from and is based upon sources that Navellier believes to be reliable, Navellier does not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute Navellier’s judgment as of the date the report was created and are subject to change without notice. These reports are for informational purposes only and are not a solicitation for the purchase or sale of a security. Any decision to purchase securities mentioned in these reports must take into account existing public information on such securities or any registered prospectus.To the extent permitted by law, neither Navellier & Associates, Inc., nor any of its affiliates, agents, or service providers assumes any liability or responsibility nor owes any duty of care for any consequences of any person acting or refraining to act in reliance on the information contained in this communication or for any decision based on it.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any securities recommendations made by Navellier. in the future will be profitable or equal the performance of securities made in this report. Dividend payments are not guaranteed. The amount of a dividend payment, if any, can vary over time and issuers may reduce dividends paid on securities in the event of a recession or adverse event affecting a specific industry or issuer.

None of the stock information, data, and company information presented herein constitutes a recommendation by Navellier or a solicitation to buy or sell any securities. Any specific securities identified and described do not represent all of the securities purchased, sold, or recommended for advisory clients. The holdings identified do not represent all of the securities purchased, sold, or recommended for advisory clients and the reader should not assume that investments in the securities identified and discussed were or will be profitable.

Information presented is general information that does not take into account your individual circumstances, financial situation, or needs, nor does it present a personalized recommendation to you. Individual stocks presented may not be suitable for every investor. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. Investment in fixed income securities has the potential for the investment return and principal value of an investment to fluctuate so that an investor’s holdings, when redeemed, may be worth less than their original cost.

One cannot invest directly in an index. Index is unmanaged and index performance does not reflect deduction of fees, expenses, or taxes. Presentation of Index data does not reflect a belief by Navellier that any stock index constitutes an investment alternative to any Navellier equity strategy or is necessarily comparable to such strategies. Among the most important differences between the Indices and Navellier strategies are that the Navellier equity strategies may (1) incur material management fees, (2) concentrate its investments in relatively few stocks, industries, or sectors, (3) have significantly greater trading activity and related costs, and (4) be significantly more or less volatile than the Indices.

ETF Risk: We may invest in exchange traded funds (“ETFs”) and some of our investment strategies are generally fully invested in ETFs. Like traditional mutual funds, ETFs charge asset-based fees, but they generally do not charge initial sales charges or redemption fees and investors typically pay only customary brokerage fees to buy and sell ETF shares. The fees and costs charged by ETFs held in client accounts will not be deducted from the compensation the client pays Navellier. ETF prices can fluctuate up or down, and a client account could lose money investing in an ETF if the prices of the securities owned by the ETF go down. ETFs are subject to additional risks:

- ETF shares may trade above or below their net asset value;

- An active trading market for an ETF’s shares may not develop or be maintained;

- The value of an ETF may be more volatile than the underlying portfolio of securities the ETF is designed to track;

- The cost of owning shares of the ETF may exceed those a client would incur by directly investing in the underlying securities; and

- Trading of an ETF’s shares may be halted if the listing exchange’s officials deem it appropriate, the shares are delisted from the exchange, or the activation of market-wide “circuit breakers” (which are tied to large decreases in stock prices) halts stock trading generally.

Grader Disclosures: Investment in equity strategies involves substantial risk and has the potential for partial or complete loss of funds invested. The sample portfolio and any accompanying charts are for informational purposes only and are not to be construed as a solicitation to buy or sell any financial instrument and should not be relied upon as the sole factor in an investment making decision. As a matter of normal and important disclosures to you, as a potential investor, please consider the following: The performance presented is not based on any actual securities trading, portfolio, or accounts, and the reported performance of the A, B, C, D, and F portfolios (collectively the “model portfolios”) should be considered mere “paper” or pro forma performance results based on Navellier’s research.

Investors evaluating any of Navellier & Associates, Inc.’s, (or its affiliates’) Investment Products must not use any information presented here, including the performance figures of the model portfolios, in their evaluation of any Navellier Investment Products. Navellier Investment Products include the firm’s mutual funds and managed accounts. The model portfolios, charts, and other information presented do not represent actual funded trades and are not actual funded portfolios. There are material differences between Navellier Investment Products’ portfolios and the model portfolios, research, and performance figures presented here. The model portfolios and the research results (1) may contain stocks or ETFs that are illiquid and difficult to trade; (2) may contain stock or ETF holdings materially different from actual funded Navellier Investment Product portfolios; (3) include the reinvestment of all dividends and other earnings, estimated trading costs, commissions, or management fees; and, (4) may not reflect prices obtained in an actual funded Navellier Investment Product portfolio. For these and other reasons, the reported performances of model portfolios do not reflect the performance results of Navellier’s actually funded and traded Investment Products. In most cases, Navellier’s Investment Products have materially lower performance results than the performances of the model portfolios presented.

This report contains statements that are, or may be considered to be, forward-looking statements. All statements that are not historical facts, including statements about our beliefs or expectations, are “forward-looking statements” within the meaning of The U.S. Private Securities Litigation Reform Act of 1995. These statements may be identified by such forward-looking terminology as “expect,” “estimate,” “plan,” “intend,” “believe,” “anticipate,” “may,” “will,” “should,” “could,” “continue,” “project,” or similar statements or variations of such terms. Our forward-looking statements are based on a series of expectations, assumptions, and projections, are not guarantees of future results or performance, and involve substantial risks and uncertainty as described in Form ADV Part 2A of our filing with the Securities and Exchange Commission (SEC), which is available at www.adviserinfo.sec.gov or by requesting a copy by emailing info@navellier.com. All of our forward-looking statements are as of the date of this report only. We can give no assurance that such expectations or forward-looking statements will prove to be correct. Actual results may differ materially. You are urged to carefully consider all such factors.

FEDERAL TAX ADVICE DISCLAIMER: As required by U.S. Treasury Regulations, you are informed that, to the extent this presentation includes any federal tax advice, the presentation is not written by Navellier to be used, and cannot be used, for the purpose of avoiding federal tax penalties. Navellier does not advise on any income tax requirements or issues. Use of any information presented by Navellier is for general information only and does not represent tax advice either express or implied. You are encouraged to seek professional tax advice for income tax questions and assistance.

IMPORTANT NEWSLETTER DISCLOSURE:The hypothetical performance results for investment newsletters that are authored or edited by Louis Navellier, including Louis Navellier’s Growth Investor, Louis Navellier’s Breakthrough Stocks, Louis Navellier’s Accelerated Profits, and Louis Navellier’s Platinum Club, are not based on any actual securities trading, portfolio, or accounts, and the newsletters’ reported hypothetical performances should be considered mere “paper” or proforma hypothetical performance results and are not actual performance of real world trades. Navellier & Associates, Inc. does not have any relation to or affiliation with the owner of these newsletters. There are material differences between Navellier Investment Products’ portfolios and the InvestorPlace Media, LLC newsletter portfolios authored by Louis Navellier. The InvestorPlace Media, LLC newsletters contain hypothetical performance that do not include transaction costs, advisory fees, or other fees a client might incur if actual investments and trades were being made by an investor. As a result, newsletter performance should not be used to evaluate Navellier Investment services which are separate and different from the newsletters. The owner of the newsletters is InvestorPlace Media, LLC and any questions concerning the newsletters, including any newsletter advertising or hypothetical Newsletter performance claims, (which are calculated solely by Investor Place Media and not Navellier) should be referred to InvestorPlace Media, LLC at (800) 718-8289.

Please note that Navellier & Associates and the Navellier Private Client Group are managed completely independent of the newsletters owned and published by InvestorPlace Media, LLC and written and edited by Louis Navellier, and investment performance of the newsletters should in no way be considered indicative of potential future investment performance for any Navellier & Associates separately managed account portfolio. Potential investors should consult with their financial advisor before investing in any Navellier Investment Product.

Navellier claims compliance with Global Investment Performance Standards (GIPS). To receive a complete list and descriptions of Navellier’s composites and/or a presentation that adheres to the GIPS standards, please contact Navellier or click here. It should not be assumed that any securities recommendations made by Navellier & Associates, Inc. in the future will be profitable or equal the performance of securities made in this report.

FactSet Disclosure: Navellier does not independently calculate the statistical information included in the attached report. The calculation and the information are provided by FactSet, a company not related to Navellier. Although information contained in the report has been obtained from FactSet and is based on sources Navellier believes to be reliable, Navellier does not guarantee its accuracy, and it may be incomplete or condensed. The report and the related FactSet sourced information are provided on an “as is” basis. The user assumes the entire risk of any use made of this information. Investors should consider the report as only a single factor in making their investment decision. The report is for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of a security. FactSet sourced information is the exclusive property of FactSet. Without prior written permission of FactSet, this information may not be reproduced, disseminated or used to create any financial products. All indices are unmanaged and performance of the indices include reinvestment of dividends and interest income, unless otherwise noted, are not illustrative of any particular investment and an investment cannot be made in any index. Past performance is no guarantee of future results.