by Gary Alexander

December 3, 2024

At the 50th Annual New Orleans Investment Conference (November 20-23), I couldn’t help remembering the events of 1974, when the conference was born. I wasn’t there, but I helped conference founder James U. Blanchard III write his memoirs, “Confessions of a Gold Bug,” in 1989 by multiple interviews and a deep dive into his archives. I was also a financial journalist for a major national magazine from 1967 to 1975, covering the dollar devaluation, rise of Japan, globalization and deficits that began back then.

In this week’s column, I’d like to take you back to three times of trouble in December 1974, 1994, and 2019 – 50, 30 and five years ago this week – to show how times of trouble often deliver the highest profits, or, as Baron Rothschild put it in 1815, “The time to buy is when there’s blood in the streets.”

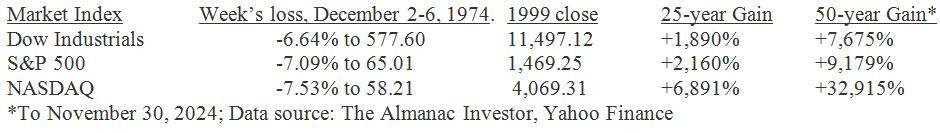

100-Fold Market Gains in the Last 50 Years

50 years ago: The week of December 2-6, 1974, marked the stock market’s absolute bottom in the 1970s. On Monday evening, December 2, 1974, President Gerald Ford addressed the nation in a televised speech in which he sounded the alarm for three major economic crises happening at once – inflation, recession, and a major oil shortage. President Ford thought his WIN buttons (Whip Inflation Now) were the solution rather than reducing spending or monetary expansion. The following week, on Friday, December 13, the former Beatle George Harrison visited the White House and exchanged buttons: Ford gave Harrison a ‘WIN’ button, while Harrison gave Ford an equally useless (to Ford) ‘OM’ (meditation mantra) button.

As the market struggled to recover, it was politics as usual, as powerful Congressman Wilbur Mills (D-Ark.), chairman of the Ways and Means Committee, chose to retire in the wake of the first major public sex scandal in postwar America. He had been caught in the DC Tidal Basin at 2:00 am on October 7th with a stripper, Fanne Fox. Despite that, he was re-elected to Congress on November 5th, but calls for Mills to resign mounted, so he left office on December 13th. The stock market rose 14 points (+2.5%) that Tuesday, from Dow 579 to 594, the first strong daily gain after from the absolute low of 577.6 on the previous Friday. (The stock market also rose when President Clinton admitted his in-office affair).

As usual, the seeds of recovery had nothing to do with headlines about politics, inflation or sex scandals. The PC revolution was quietly launched on December 19, the same day Nelson Rockefeller was sworn in as Ford’s Vice President. On that day, the Altair 8800, a do-it-yourself computer kit, went on sale for $397. It used switches for input and flashing lights as a display. The Altair 8800 was featured on the cover of the January 1975 Popular Electronics, where it caught the attention of a Harvard student, Bill Gates.

Gates and his buddy Paul Allen wrote programs for large business computers during high school, and they realized that the Altair would need a programming language, so they quickly created a version of BASIC (Beginners’ All-Purpose Symbolic Instruction Code) to run on Altair. Gates and Allen soon dropped out of Harvard and went to Albuquerque to sell Ed Roberts, founder of Altair’s maker, Micro Instrumentation and Telemetry Systems (MITS), their operating system. Their demonstration of BASIC for Altair worked out well, even though the two kids had never seen an Altair before. Gates and Allen established Micro-Soft (later Microsoft), in Albuquerque. They later moved to Seattle, where they had gone to high school.

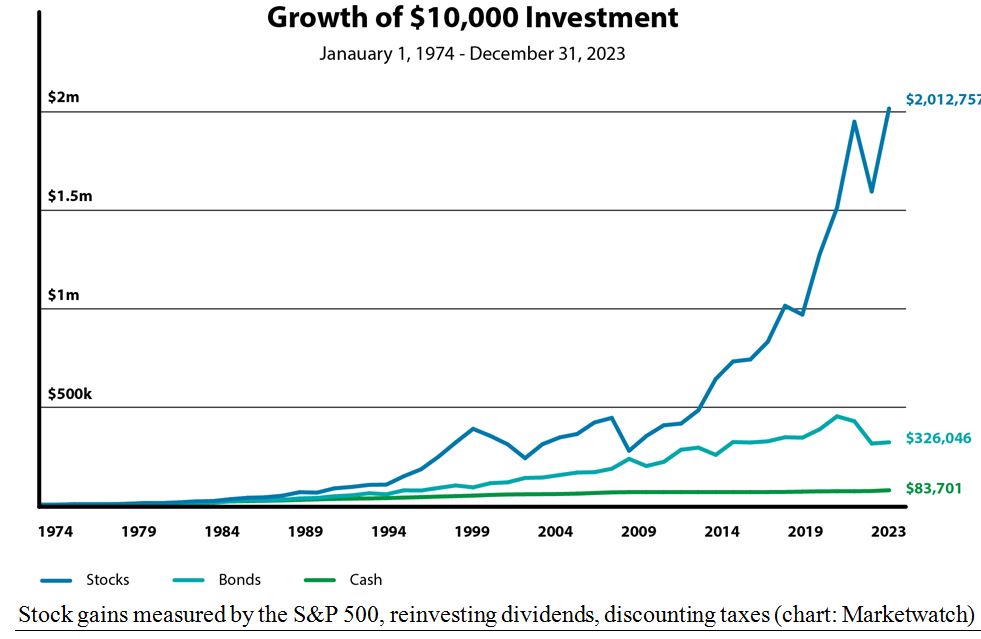

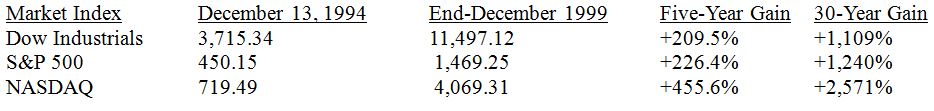

Partly due to the tech boom, stocks gained 20-fold over the next 25 years, and 77- to 330-fold in 50 years:

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Oh, by the way, on the final day of December 1974, gold was finally legal for Americans to own, after more than 41 years of prohibition, thanks to FDR. This legalization came about due to lobbying by the organizers of the New Orleans conference, the National Committee to Legalize Gold. Today, gold is up 130-fold from its price of $20.67, which Americans were paid in 1933, when it was confiscated, but Americans were not allowed to participate in the first big gains – to $190 per ounce by year-end 1974.

10-to-25-Fold Gains from the Crises (and Opportunity) of December 1994

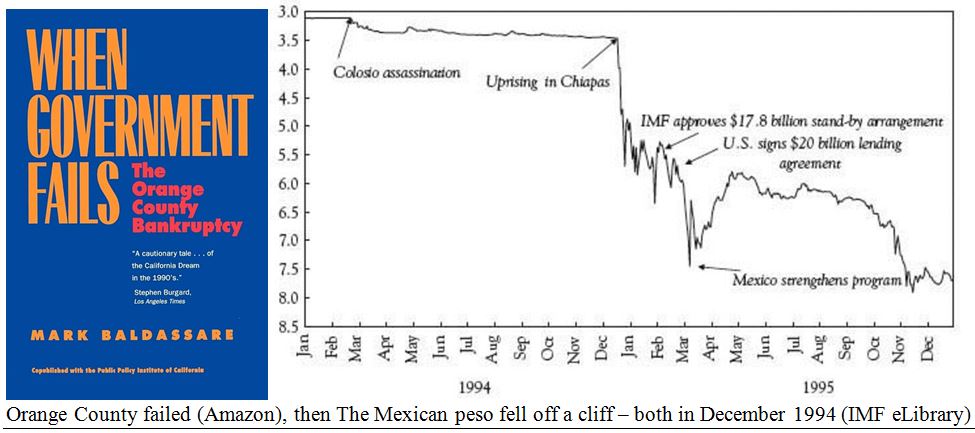

Those who lived through the markets of December 1994 won’t remember the birth of the Internet. They will remember the headlines of the Tequila crisis – the peso crisis – and the bankruptcy of Orange County.

On December 6, 1994, Orange County (California) declared Chapter 9 bankruptcy in the single biggest bankruptcy filing by a municipality in American history. The county’s losses from derivative investments reached $2 billion before officials decided to surrender all hope. The Dow fell 60 points (-1.7%) in the next two days to 3,685. These losses were exacerbated by the Fed’s six interest rate increases since February of 1994 in Fed Chair Alan Greenspan’s war against phantom inflation, causing an economic slowdown (but not a recession), which may have fueled the Republican Revolution in November 1994.

Later in December, the Mexican central bank suddenly devalued the peso on December 20, 1994, and investors added an even higher risk premium to all peso-based investments. To discourage any further capital flight, the Bank of Mexico raised interest rates, but that cost them dearly, hurting economic growth and resulting in threats of a default, as few investors were interested in buying any new Mexican bonds.

Mexican inflation rose to 52% and mutual funds began liquidating Mexican assets and other emerging market assets throughout the rest of Latin America and Asia, forcing an IMF bailout in January 1995.

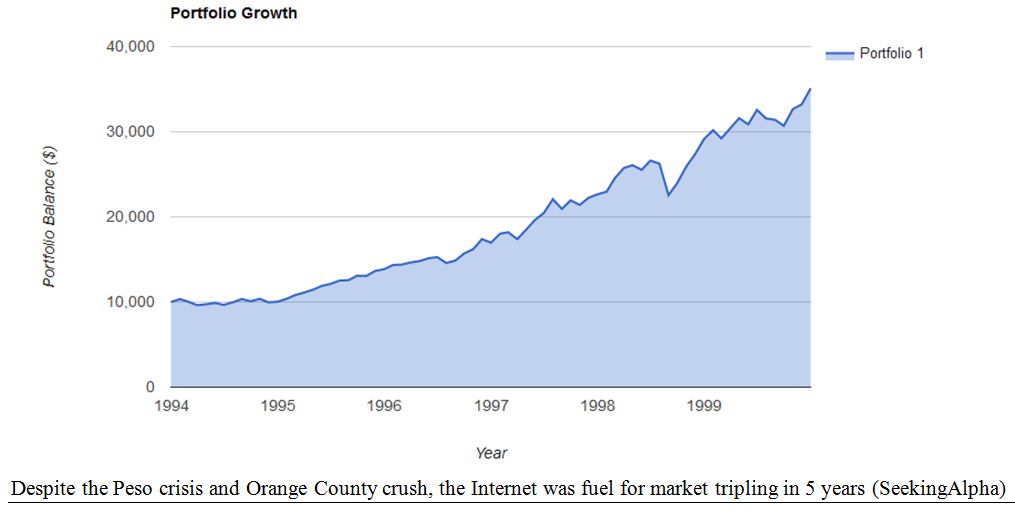

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Precisely in the middle of these two scary debt-driven events, on Tuesday, December 13, 1994, the first meeting of the World Wide Web Consortium took place at the Massachusetts Institute of Technology. This ad-hoc international association was formed to promote the common protocols of the World Wide Web.

The Web’s creator, Tim Berners-Lee, became the first director. Berners-Lee had helped to develop the Web while he was a fellow at CERN, the European particle physics lab, in Geneva, in the early 1990s.

On the day the Internet was born, the Dow index stood at 3,715. In the next two weeks, the Dow gained 146 points (+4%). More importantly, it tripled in the following five years, partly on the euphoria of this new Web creation, hatched in Geneva and nurtured in America, without government input or control.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Finally, five years ago, a new bug emerged from Wuhan, China. It was called COVID-19 because it was born in 2019, not 2020. Symptoms of the index case (“patient zero”) began on December 1, 2019. This poor fellow had never been to the seafood market that was initially blamed for the disease, but there were 40 infected people in that first week of December, as reported by the Wuhan City Health Committee.

This lab bug resulted in the worst pandemic in a century, since the “Spanish flu” (no connection to Spain) of 1918-19, which killed 17 to 50 million in a world of 1.8 billion (i.e., 1% to 3% of the population at that time). COVID killed an estimated seven million out of more than seven billion people, or just 0.1% of us.

Since that first COVID-19 case, the S&P 500 is up 94%, the Dow is up 62% and NASDAQ is up 124%.

Today’s situation may not look so bad in the headlines, but the debt/demographic time bomb is ticking…. Either way, don’t let bad news fool you. When times are darkest, the profit opportunity is often brightest.

Navellier & Associates owns Microsoft (MSFT), in some managed accounts. Gary Alexander does not own Microsoft (MSFT) personally.

All content above represents the opinion of Gary Alexander of Navellier & Associates, Inc.

Also In This Issue

A Look Ahead by Louis Navellier

Don’t Fear Tariff Wars – Fear the Escalation of Real Wars

Income Mail by Bryan Perry

The Bond Market is Back on Track

Growth Mail by Gary Alexander

Seeds of Great Fortunes are Often Sown in Times of Great Trouble

Global Mail by Ivan Martchev

The Biggest Move Last Week Was in Bonds

Sector Spotlight by Jason Bodner

A 50-Year-Old Investor’s Thanksgiving Checklist

View Full Archive

Read Past Issues Here

About The Author

Gary Alexander

SENIOR EDITOR

Gary Alexander has been Senior Writer at Navellier since 2009. He edits Navellier’s weekly Marketmail and writes a weekly Growth Mail column, in which he uses market history to support the case for growth stocks. For the previous 20-years before joining Navellier, he was Senior Executive Editor at InvestorPlace Media (formerly Phillips Publishing), where he worked with several leading investment analysts, including Louis Navellier (since 1997), helping launch Louis Navellier’s Blue Chip Growth and Global Growth newsletters.

Prior to that, Gary edited Wealth Magazine and Gold Newsletter and wrote various investment research reports for Jefferson Financial in New Orleans in the 1980s. He began his financial newsletter career with KCI Communications in 1980, where he served as consulting editor for Personal Finance newsletter while serving as general manager of KCI’s Alexandria House book division. Before that, he covered the economics beat for news magazines. All content of “Growth Mail” represents the opinion of Gary Alexander

Important Disclosures:

Although information in these reports has been obtained from and is based upon sources that Navellier believes to be reliable, Navellier does not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute Navellier’s judgment as of the date the report was created and are subject to change without notice. These reports are for informational purposes only and are not a solicitation for the purchase or sale of a security. Any decision to purchase securities mentioned in these reports must take into account existing public information on such securities or any registered prospectus.To the extent permitted by law, neither Navellier & Associates, Inc., nor any of its affiliates, agents, or service providers assumes any liability or responsibility nor owes any duty of care for any consequences of any person acting or refraining to act in reliance on the information contained in this communication or for any decision based on it.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any securities recommendations made by Navellier. in the future will be profitable or equal the performance of securities made in this report. Dividend payments are not guaranteed. The amount of a dividend payment, if any, can vary over time and issuers may reduce dividends paid on securities in the event of a recession or adverse event affecting a specific industry or issuer.

None of the stock information, data, and company information presented herein constitutes a recommendation by Navellier or a solicitation to buy or sell any securities. Any specific securities identified and described do not represent all of the securities purchased, sold, or recommended for advisory clients. The holdings identified do not represent all of the securities purchased, sold, or recommended for advisory clients and the reader should not assume that investments in the securities identified and discussed were or will be profitable.

Information presented is general information that does not take into account your individual circumstances, financial situation, or needs, nor does it present a personalized recommendation to you. Individual stocks presented may not be suitable for every investor. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. Investment in fixed income securities has the potential for the investment return and principal value of an investment to fluctuate so that an investor’s holdings, when redeemed, may be worth less than their original cost.

One cannot invest directly in an index. Index is unmanaged and index performance does not reflect deduction of fees, expenses, or taxes. Presentation of Index data does not reflect a belief by Navellier that any stock index constitutes an investment alternative to any Navellier equity strategy or is necessarily comparable to such strategies. Among the most important differences between the Indices and Navellier strategies are that the Navellier equity strategies may (1) incur material management fees, (2) concentrate its investments in relatively few stocks, industries, or sectors, (3) have significantly greater trading activity and related costs, and (4) be significantly more or less volatile than the Indices.

ETF Risk: We may invest in exchange traded funds (“ETFs”) and some of our investment strategies are generally fully invested in ETFs. Like traditional mutual funds, ETFs charge asset-based fees, but they generally do not charge initial sales charges or redemption fees and investors typically pay only customary brokerage fees to buy and sell ETF shares. The fees and costs charged by ETFs held in client accounts will not be deducted from the compensation the client pays Navellier. ETF prices can fluctuate up or down, and a client account could lose money investing in an ETF if the prices of the securities owned by the ETF go down. ETFs are subject to additional risks:

- ETF shares may trade above or below their net asset value;

- An active trading market for an ETF’s shares may not develop or be maintained;

- The value of an ETF may be more volatile than the underlying portfolio of securities the ETF is designed to track;

- The cost of owning shares of the ETF may exceed those a client would incur by directly investing in the underlying securities; and

- Trading of an ETF’s shares may be halted if the listing exchange’s officials deem it appropriate, the shares are delisted from the exchange, or the activation of market-wide “circuit breakers” (which are tied to large decreases in stock prices) halts stock trading generally.

Grader Disclosures: Investment in equity strategies involves substantial risk and has the potential for partial or complete loss of funds invested. The sample portfolio and any accompanying charts are for informational purposes only and are not to be construed as a solicitation to buy or sell any financial instrument and should not be relied upon as the sole factor in an investment making decision. As a matter of normal and important disclosures to you, as a potential investor, please consider the following: The performance presented is not based on any actual securities trading, portfolio, or accounts, and the reported performance of the A, B, C, D, and F portfolios (collectively the “model portfolios”) should be considered mere “paper” or pro forma performance results based on Navellier’s research.

Investors evaluating any of Navellier & Associates, Inc.’s, (or its affiliates’) Investment Products must not use any information presented here, including the performance figures of the model portfolios, in their evaluation of any Navellier Investment Products. Navellier Investment Products include the firm’s mutual funds and managed accounts. The model portfolios, charts, and other information presented do not represent actual funded trades and are not actual funded portfolios. There are material differences between Navellier Investment Products’ portfolios and the model portfolios, research, and performance figures presented here. The model portfolios and the research results (1) may contain stocks or ETFs that are illiquid and difficult to trade; (2) may contain stock or ETF holdings materially different from actual funded Navellier Investment Product portfolios; (3) include the reinvestment of all dividends and other earnings, estimated trading costs, commissions, or management fees; and, (4) may not reflect prices obtained in an actual funded Navellier Investment Product portfolio. For these and other reasons, the reported performances of model portfolios do not reflect the performance results of Navellier’s actually funded and traded Investment Products. In most cases, Navellier’s Investment Products have materially lower performance results than the performances of the model portfolios presented.

This report contains statements that are, or may be considered to be, forward-looking statements. All statements that are not historical facts, including statements about our beliefs or expectations, are “forward-looking statements” within the meaning of The U.S. Private Securities Litigation Reform Act of 1995. These statements may be identified by such forward-looking terminology as “expect,” “estimate,” “plan,” “intend,” “believe,” “anticipate,” “may,” “will,” “should,” “could,” “continue,” “project,” or similar statements or variations of such terms. Our forward-looking statements are based on a series of expectations, assumptions, and projections, are not guarantees of future results or performance, and involve substantial risks and uncertainty as described in Form ADV Part 2A of our filing with the Securities and Exchange Commission (SEC), which is available at www.adviserinfo.sec.gov or by requesting a copy by emailing info@navellier.com. All of our forward-looking statements are as of the date of this report only. We can give no assurance that such expectations or forward-looking statements will prove to be correct. Actual results may differ materially. You are urged to carefully consider all such factors.

FEDERAL TAX ADVICE DISCLAIMER: As required by U.S. Treasury Regulations, you are informed that, to the extent this presentation includes any federal tax advice, the presentation is not written by Navellier to be used, and cannot be used, for the purpose of avoiding federal tax penalties. Navellier does not advise on any income tax requirements or issues. Use of any information presented by Navellier is for general information only and does not represent tax advice either express or implied. You are encouraged to seek professional tax advice for income tax questions and assistance.

IMPORTANT NEWSLETTER DISCLOSURE:The hypothetical performance results for investment newsletters that are authored or edited by Louis Navellier, including Louis Navellier’s Growth Investor, Louis Navellier’s Breakthrough Stocks, Louis Navellier’s Accelerated Profits, and Louis Navellier’s Platinum Club, are not based on any actual securities trading, portfolio, or accounts, and the newsletters’ reported hypothetical performances should be considered mere “paper” or proforma hypothetical performance results and are not actual performance of real world trades. Navellier & Associates, Inc. does not have any relation to or affiliation with the owner of these newsletters. There are material differences between Navellier Investment Products’ portfolios and the InvestorPlace Media, LLC newsletter portfolios authored by Louis Navellier. The InvestorPlace Media, LLC newsletters contain hypothetical performance that do not include transaction costs, advisory fees, or other fees a client might incur if actual investments and trades were being made by an investor. As a result, newsletter performance should not be used to evaluate Navellier Investment services which are separate and different from the newsletters. The owner of the newsletters is InvestorPlace Media, LLC and any questions concerning the newsletters, including any newsletter advertising or hypothetical Newsletter performance claims, (which are calculated solely by Investor Place Media and not Navellier) should be referred to InvestorPlace Media, LLC at (800) 718-8289.

Please note that Navellier & Associates and the Navellier Private Client Group are managed completely independent of the newsletters owned and published by InvestorPlace Media, LLC and written and edited by Louis Navellier, and investment performance of the newsletters should in no way be considered indicative of potential future investment performance for any Navellier & Associates separately managed account portfolio. Potential investors should consult with their financial advisor before investing in any Navellier Investment Product.

Navellier claims compliance with Global Investment Performance Standards (GIPS). To receive a complete list and descriptions of Navellier’s composites and/or a presentation that adheres to the GIPS standards, please contact Navellier or click here. It should not be assumed that any securities recommendations made by Navellier & Associates, Inc. in the future will be profitable or equal the performance of securities made in this report.

FactSet Disclosure: Navellier does not independently calculate the statistical information included in the attached report. The calculation and the information are provided by FactSet, a company not related to Navellier. Although information contained in the report has been obtained from FactSet and is based on sources Navellier believes to be reliable, Navellier does not guarantee its accuracy, and it may be incomplete or condensed. The report and the related FactSet sourced information are provided on an “as is” basis. The user assumes the entire risk of any use made of this information. Investors should consider the report as only a single factor in making their investment decision. The report is for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of a security. FactSet sourced information is the exclusive property of FactSet. Without prior written permission of FactSet, this information may not be reproduced, disseminated or used to create any financial products. All indices are unmanaged and performance of the indices include reinvestment of dividends and interest income, unless otherwise noted, are not illustrative of any particular investment and an investment cannot be made in any index. Past performance is no guarantee of future results.