by Gary Alexander

December 24, 2024

I’ve been delivering these Top 10 book lists here each Christmas since 2018. These lists began as gift ideas for my college-age grandchildren in 2015 then I targeted the list toward investors in Growth Mail.

Even though these books were all published in 2024, I chose them with an eye toward how they can help investors understand the investing world better in 2025, by creating the perspective of where our nation is headed in a world of conflict, with an eye toward resource development (book #2), changing investment goals for youth (#4) at work (#7 and #1), at home (#3), with inflation (#5), or growth in 2025 (8-10), and a look at two Magnificent-7 companies (11-12), a tale of two types of monopolies. In publication order:

#1: Philip K. Howard’s “Everyday Freedom: Designing the Framework for a Flourishing Economy” (published January 23, 2024, 128 pages) is a delightfully short book released at the start of a controversial election year, in which neither party fronted an attractive candidate with a clear vision of growth or a plan for overcoming our growing national division. In describing this dilemma, author Philip Howard says, “In the workplace, we walk on eggshells. Big projects—say, modernizing infrastructure—get stalled in years of review. Endemic social problems, such as homelessness become, well, more endemic.” Americans have lost the freedom to be themselves, he said, keeping silent and avoiding social contact. His solution in “Everyday Freedom” is to use our skills, intuitions and values when confronting any daily challenges. I start with this book so you might also notice Howard’s first book, “The Death of Common Sense” (1995).

#2: Ernest Scheyder’s “The War Below: Lithium, Copper and the Global Battle to Power Our Lives” (January 30, 377 pages) is an important examination of the hidden costs – both monetary and environmental – of President Biden’s mandate to buy mostly electric vehicles and phase out fossil fuels. The costs and environmental dangers of mining copper, lithium and some key rare earth minerals are well known to miners and probably to environmental experts – who should know better than to ban all fossil fuels, which still power over 80% of our national energy needs. This book was wisely listed for the National Book Award for Nonfiction and a Financial Times’ and Schroder’s Business Book of the Year.

#3: Jonathan Haidt’s “The Anxious Generation: How the Great Rewiring of Childhood is Causing an Epidemic of Mental Illness” (March 26, 395 pages) is a very important book about the mental and psychological assault on an entire generation (Gen-Z, for the most part) with dismal, depressing messages on social media, mostly via their extremely dumb “smart phones,” which parents allow them to peruse, unsupervised, from a very young age. This mental poisoning began in earnest shortly after the debut of those ubiquitous hand-guides during the 2008 Great Recession. Haidt’s charts in the opening chapters demonstrate the cataclysmic decline in self-image, self-confidence, and hope for the future, along with a rise in suicide, drug addiction and other serious ills since then. Thankfully, this book gained immediate attention as an instant #1 New York Times bestseller, and a Wall Street Journal Top 10 pick. All parents should read this – and take action – by removing these mind-twisting devices until a responsible age.

#4: Scott Galloway’s “The Algebra of Wealth: A Simple Formula for Financial Security” (April 23, 302 pages) is a great gift to children or grandchildren. If you talk to grandchildren (I have six), you know they don’t believe they can invest like we grandparents did – work, save and invest for retirement. They don’t think Social Security or other benefits will be around in 2060 or later. They are not even sure the planet will be around. Even in 2025, they can’t buy or rent homes. Do any of our old investment realities still resonate? On the plus side, younger workers have more mobility (fewer children, fewer marriages, more mobile devices), but also lots more challenges, so Scott Galloway says it’s time for a new playbook. Young folk need to seek greater peace, along with financial security, he says, so Galloway focuses on finding your marketable talent; invest wisely, diversify and embrace stoicism. His best advice is to partner wisely (business and personal): “The most important economic decision you’ll make in your life is not what you major in, where you work, what stock you buy, or where you live. It’s who you partner with.”

#5: Carola Binder’s “Shock Values: Prices and Inflation in American Democracy” (May 22, 354 pages) traces inflation from Benjamin Franklin in the late 1720s to the colonial era, when General Washington said (of the cardboard Continental currency) “a wagon-load of currency won’t buy a wagonload of provisions,” while the British pound was sound, and most Americans preferred sterling over cardboard. The same sad story was repeated with Confederate dollars and Greenbacks. Then came the first peacetime inflationary surges in the 1970s and 2021-23. Binder examines political and monetary angles in tagging a variety of culprits, including today’s huge peacetime deficits impacting future inflation and interest rates.

#6: Jonathan Turley’s “The Indispensable Right: Free Speech in an Age of Rage” (June 18, 428 pages) undertakes a deep analysis of the First Amendment right to free speech, which has been severely attacked recently, under specious reasoning, especially over issues ranging from health information during Covid, crime statistics alleging police abuse, climate change views and economic data regarding race and gender equity, and more. Free speech has also been throttled by mob rule and rage erupting over some of these issues, amplified by flash mobs that pop up over the slightest provocation. Turley stresses that the First Amendment is not an archaic relic of powdered white males. It was written for times like these, IN a time like this. America was born in an age of rage and erupted in new rage soon after the Bill of Rights passed in 1791 – in the 1798 Sedition Laws, with President Adams jailing journalists who spoke out against him.

#7: Charlie Gasparino’s “Go Woke, Go Broke: The Inside Story of the Radicalization of Corporate America” (August 6, 288 pages) is a welcome antidote to the tedium of working for speech-police and their woke drills at major companies. I’ve always worked for conservative or libertarian entrepreneurs, but even those champions of free enterprise could not escape mandatory woke police. In the 1990s, we were required to sit through sensitivity training on race and gender bias and told to recycle our paper by color under penalty of law (prison and fine), so our concentration had to be derailed from thinking about corporate goals into thinking about paper colors. At any rate, that’s one reason why I started working remotely in 2002, not during Covid. Gasparino has captured the spirit of this nonsense, which the bulk of big corporations put their workers through – perhaps less so under Trump. Gasparino shares some examples here, including the checklist by advertisers about race, gender and sexuality in ads.

#8: Andrew Leigh’s “How Economics Explains the World: A Short History of Humanity” (September 3, 240 pages) is another “short history of the world” type of primer that is always welcome as a “starter kit” for those who ask, “What’s it all about, Alfie?” Although listed at 240 pages, its notes run 50 pages, so the text is under 200 pages. It begins with Agriculture in Africa, runs through the printing press and plagues, into Adam Smith and the wealth of nations, moving quickly to the modern era. Since he starts in Africa, he asks interesting questions, like “Why didn’t Africa colonize Europe instead of the other way around?” or: “Why did the Allies win World War II? This shows how the author desires to make economics fun and relevant. It is rightfully dubbed as one of The Economists’ “Best New Books About Finance.”

#9: Vivek Ramaswamy’s “Truths: The Future of America First” (September 24, 224 pages) is a follow-up to his 2021 book, “Woke, Inc: Inside Corporate America’s Social Justice Scam.” Charlie Gasparino’s book has covered that subject very well in this survey, but it bears mention here: Vivek’s “Woke” came out at the height of Biden’s early popularity and strength in passing his agenda, while “Truths” came out near the peak of Trump’s shocking political rebirth three years later. Vivek’s role, along with Elon Musk, is to cut government waste and fraud. In Truths he returns to foundational principles above politics, which he defines as merit over grievance, truth over lies and self-governance over surrendering rights to those who may seem to have our interest at heart but tend to overstep their boundaries once they gain power.

For Book #10 – It’s “Dealer’s Choice” (or All Three), Including Studies of Two Monopolies

#10: The 10th and final book is your choice. One title sounds political, although I selected it for its economic content, not for Trump’s controversial personality or politics. Art Laffer and Stephen Moore wrote “The Trump Economic Miracle and the Plan to Unleash Prosperity Again” September 24, 206 pages) to promote the now-President-elect, and they were there from the beginning, in 2015. I recall Steve Moore on my 2016 political panel at the New Orleans Investment Conference making some of these same points. Candidate Trump contacted Laffer and Moore in August 2023 to remind them of those “good old days” and asked them to write this tale of multiple “miracles,” including the rise of minority per capita wages with low inflation in 2019, and the little-noted rapid 2020 economic recovery from COVID.

10a: This late-year (#11) book option for Never-Trumpers out there, is more focused on investing: “The Nvidia Way: Jensen Huang the Making of a Tech Giant” by Tae Kim (December 10, 272 pages) came out last week, so I am still reading the early chapters, profiling the three founders. I find this level of personal journalism very satisfying. It’s not just about the heavy lifting of chip design but the early work ethic and imagination of the founders, and what kept them alive through many near-death blunders. Nvidia is one of Louis Navellier’s favorite stocks – I own some, too – so anyone considering whether to invest in Nvidia or other AI stocks should give this a careful read, especially for the story of CEO Jensen Huang’s vision.

10b (#12): I hesitated to pick Dana Mattioli’s “The Everything War: Amazon’s Ruthless Quest to Own the World and Remake Corporate Power” (April 23, 390 pages) because I favor positive books over corporate exposes, and I didn’t want to seem to endorse Federal Trade Commission’s head Lina Khan and her seeming “Everything War” and Ruthless Quest against any and all Corporate Powers during the Biden era – she never seemed to see any redeeming virtues in a monopoly – but now that Khan and Biden are on the fast track out of town, I can admit that I don’t care for Amazon’s practices and its eroding customer service over the years, though their low prices are seductive. In this book, Wall Street Journal reporter Dana Mattioli does a superb job of expressing my frustrations with the firm, as well as the sad way they seem to treat their employees and contracted sales “partners.” I trust Amazon executives will read this book and reform, perhaps prodded by worker walkouts in their Prime Christmas delivery week.

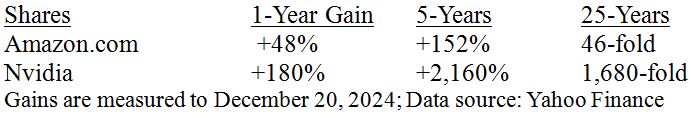

This column is way too long to get into the vagaries of monopoly law, but I intend to write a column on the virtues of a benign monopoly in January. Nvidia and Amazon are monopolies. To me, Nvidia does it right, and Amazon falls short. One clue is how stakeholders fare – customers, partners and employees, among others. Shareholder returns are also part of the story, and both companies delivered stellar returns.

- Amazon launched May 15, 1997, at $0.56 adjusted for splits: $10,000 has grown 400-fold, to $4 million.

- Nvidia launched January 22, 1999: $10,000 invested on that day would now be worth over $30 million.

Navellier & Associates owns Nvidia Corp (NVDA), and Amazon.com, Inc. (AMZN) in managed accounts Gary Alexander owns Nvidia Corp (NVDA), personally he does not own Amazon.com, Inc. (AMZN).

All content above represents the opinion of Gary Alexander of Navellier & Associates, Inc.

Also In This Issue

A Look Ahead by Louis Navellier

My Six Predictions for 2025 – Part 1 (of 2)

Income Mail by Bryan Perry

The Fed’s Favorite Inflation Gauge Spiked the Market’s Punch Bowl

Growth Mail by Gary Alexander

My Top 10 (or 12) Books From 2024 – For Profiting from 2025

Global Mail by Ivan Martchev

Jerome Powell was a Party Pooper – Once Again

Sector Spotlight by Jason Bodner

When Good Stocks Tumble, Relax! They Will Rise Again

View Full Archive

Read Past Issues Here

About The Author

Gary Alexander

SENIOR EDITOR

Gary Alexander has been Senior Writer at Navellier since 2009. He edits Navellier’s weekly Marketmail and writes a weekly Growth Mail column, in which he uses market history to support the case for growth stocks. For the previous 20-years before joining Navellier, he was Senior Executive Editor at InvestorPlace Media (formerly Phillips Publishing), where he worked with several leading investment analysts, including Louis Navellier (since 1997), helping launch Louis Navellier’s Blue Chip Growth and Global Growth newsletters.

Prior to that, Gary edited Wealth Magazine and Gold Newsletter and wrote various investment research reports for Jefferson Financial in New Orleans in the 1980s. He began his financial newsletter career with KCI Communications in 1980, where he served as consulting editor for Personal Finance newsletter while serving as general manager of KCI’s Alexandria House book division. Before that, he covered the economics beat for news magazines. All content of “Growth Mail” represents the opinion of Gary Alexander

Important Disclosures:

Although information in these reports has been obtained from and is based upon sources that Navellier believes to be reliable, Navellier does not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute Navellier’s judgment as of the date the report was created and are subject to change without notice. These reports are for informational purposes only and are not a solicitation for the purchase or sale of a security. Any decision to purchase securities mentioned in these reports must take into account existing public information on such securities or any registered prospectus.To the extent permitted by law, neither Navellier & Associates, Inc., nor any of its affiliates, agents, or service providers assumes any liability or responsibility nor owes any duty of care for any consequences of any person acting or refraining to act in reliance on the information contained in this communication or for any decision based on it.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any securities recommendations made by Navellier. in the future will be profitable or equal the performance of securities made in this report. Dividend payments are not guaranteed. The amount of a dividend payment, if any, can vary over time and issuers may reduce dividends paid on securities in the event of a recession or adverse event affecting a specific industry or issuer.

None of the stock information, data, and company information presented herein constitutes a recommendation by Navellier or a solicitation to buy or sell any securities. Any specific securities identified and described do not represent all of the securities purchased, sold, or recommended for advisory clients. The holdings identified do not represent all of the securities purchased, sold, or recommended for advisory clients and the reader should not assume that investments in the securities identified and discussed were or will be profitable.

Information presented is general information that does not take into account your individual circumstances, financial situation, or needs, nor does it present a personalized recommendation to you. Individual stocks presented may not be suitable for every investor. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. Investment in fixed income securities has the potential for the investment return and principal value of an investment to fluctuate so that an investor’s holdings, when redeemed, may be worth less than their original cost.

One cannot invest directly in an index. Index is unmanaged and index performance does not reflect deduction of fees, expenses, or taxes. Presentation of Index data does not reflect a belief by Navellier that any stock index constitutes an investment alternative to any Navellier equity strategy or is necessarily comparable to such strategies. Among the most important differences between the Indices and Navellier strategies are that the Navellier equity strategies may (1) incur material management fees, (2) concentrate its investments in relatively few stocks, industries, or sectors, (3) have significantly greater trading activity and related costs, and (4) be significantly more or less volatile than the Indices.

ETF Risk: We may invest in exchange traded funds (“ETFs”) and some of our investment strategies are generally fully invested in ETFs. Like traditional mutual funds, ETFs charge asset-based fees, but they generally do not charge initial sales charges or redemption fees and investors typically pay only customary brokerage fees to buy and sell ETF shares. The fees and costs charged by ETFs held in client accounts will not be deducted from the compensation the client pays Navellier. ETF prices can fluctuate up or down, and a client account could lose money investing in an ETF if the prices of the securities owned by the ETF go down. ETFs are subject to additional risks:

- ETF shares may trade above or below their net asset value;

- An active trading market for an ETF’s shares may not develop or be maintained;

- The value of an ETF may be more volatile than the underlying portfolio of securities the ETF is designed to track;

- The cost of owning shares of the ETF may exceed those a client would incur by directly investing in the underlying securities; and

- Trading of an ETF’s shares may be halted if the listing exchange’s officials deem it appropriate, the shares are delisted from the exchange, or the activation of market-wide “circuit breakers” (which are tied to large decreases in stock prices) halts stock trading generally.

Grader Disclosures: Investment in equity strategies involves substantial risk and has the potential for partial or complete loss of funds invested. The sample portfolio and any accompanying charts are for informational purposes only and are not to be construed as a solicitation to buy or sell any financial instrument and should not be relied upon as the sole factor in an investment making decision. As a matter of normal and important disclosures to you, as a potential investor, please consider the following: The performance presented is not based on any actual securities trading, portfolio, or accounts, and the reported performance of the A, B, C, D, and F portfolios (collectively the “model portfolios”) should be considered mere “paper” or pro forma performance results based on Navellier’s research.

Investors evaluating any of Navellier & Associates, Inc.’s, (or its affiliates’) Investment Products must not use any information presented here, including the performance figures of the model portfolios, in their evaluation of any Navellier Investment Products. Navellier Investment Products include the firm’s mutual funds and managed accounts. The model portfolios, charts, and other information presented do not represent actual funded trades and are not actual funded portfolios. There are material differences between Navellier Investment Products’ portfolios and the model portfolios, research, and performance figures presented here. The model portfolios and the research results (1) may contain stocks or ETFs that are illiquid and difficult to trade; (2) may contain stock or ETF holdings materially different from actual funded Navellier Investment Product portfolios; (3) include the reinvestment of all dividends and other earnings, estimated trading costs, commissions, or management fees; and, (4) may not reflect prices obtained in an actual funded Navellier Investment Product portfolio. For these and other reasons, the reported performances of model portfolios do not reflect the performance results of Navellier’s actually funded and traded Investment Products. In most cases, Navellier’s Investment Products have materially lower performance results than the performances of the model portfolios presented.

This report contains statements that are, or may be considered to be, forward-looking statements. All statements that are not historical facts, including statements about our beliefs or expectations, are “forward-looking statements” within the meaning of The U.S. Private Securities Litigation Reform Act of 1995. These statements may be identified by such forward-looking terminology as “expect,” “estimate,” “plan,” “intend,” “believe,” “anticipate,” “may,” “will,” “should,” “could,” “continue,” “project,” or similar statements or variations of such terms. Our forward-looking statements are based on a series of expectations, assumptions, and projections, are not guarantees of future results or performance, and involve substantial risks and uncertainty as described in Form ADV Part 2A of our filing with the Securities and Exchange Commission (SEC), which is available at www.adviserinfo.sec.gov or by requesting a copy by emailing info@navellier.com. All of our forward-looking statements are as of the date of this report only. We can give no assurance that such expectations or forward-looking statements will prove to be correct. Actual results may differ materially. You are urged to carefully consider all such factors.

FEDERAL TAX ADVICE DISCLAIMER: As required by U.S. Treasury Regulations, you are informed that, to the extent this presentation includes any federal tax advice, the presentation is not written by Navellier to be used, and cannot be used, for the purpose of avoiding federal tax penalties. Navellier does not advise on any income tax requirements or issues. Use of any information presented by Navellier is for general information only and does not represent tax advice either express or implied. You are encouraged to seek professional tax advice for income tax questions and assistance.

IMPORTANT NEWSLETTER DISCLOSURE:The hypothetical performance results for investment newsletters that are authored or edited by Louis Navellier, including Louis Navellier’s Growth Investor, Louis Navellier’s Breakthrough Stocks, Louis Navellier’s Accelerated Profits, and Louis Navellier’s Platinum Club, are not based on any actual securities trading, portfolio, or accounts, and the newsletters’ reported hypothetical performances should be considered mere “paper” or proforma hypothetical performance results and are not actual performance of real world trades. Navellier & Associates, Inc. does not have any relation to or affiliation with the owner of these newsletters. There are material differences between Navellier Investment Products’ portfolios and the InvestorPlace Media, LLC newsletter portfolios authored by Louis Navellier. The InvestorPlace Media, LLC newsletters contain hypothetical performance that do not include transaction costs, advisory fees, or other fees a client might incur if actual investments and trades were being made by an investor. As a result, newsletter performance should not be used to evaluate Navellier Investment services which are separate and different from the newsletters. The owner of the newsletters is InvestorPlace Media, LLC and any questions concerning the newsletters, including any newsletter advertising or hypothetical Newsletter performance claims, (which are calculated solely by Investor Place Media and not Navellier) should be referred to InvestorPlace Media, LLC at (800) 718-8289.

Please note that Navellier & Associates and the Navellier Private Client Group are managed completely independent of the newsletters owned and published by InvestorPlace Media, LLC and written and edited by Louis Navellier, and investment performance of the newsletters should in no way be considered indicative of potential future investment performance for any Navellier & Associates separately managed account portfolio. Potential investors should consult with their financial advisor before investing in any Navellier Investment Product.

Navellier claims compliance with Global Investment Performance Standards (GIPS). To receive a complete list and descriptions of Navellier’s composites and/or a presentation that adheres to the GIPS standards, please contact Navellier or click here. It should not be assumed that any securities recommendations made by Navellier & Associates, Inc. in the future will be profitable or equal the performance of securities made in this report.

FactSet Disclosure: Navellier does not independently calculate the statistical information included in the attached report. The calculation and the information are provided by FactSet, a company not related to Navellier. Although information contained in the report has been obtained from FactSet and is based on sources Navellier believes to be reliable, Navellier does not guarantee its accuracy, and it may be incomplete or condensed. The report and the related FactSet sourced information are provided on an “as is” basis. The user assumes the entire risk of any use made of this information. Investors should consider the report as only a single factor in making their investment decision. The report is for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of a security. FactSet sourced information is the exclusive property of FactSet. Without prior written permission of FactSet, this information may not be reproduced, disseminated or used to create any financial products. All indices are unmanaged and performance of the indices include reinvestment of dividends and interest income, unless otherwise noted, are not illustrative of any particular investment and an investment cannot be made in any index. Past performance is no guarantee of future results.