by Gary Alexander

November 26, 2024

I’ve just returned from the 50th anniversary edition of the New Orleans Investment Conference (NOIC), my 41st consecutive as speaker, panel moderator and/or MC. In summary, the attendees and speakers were celebrating a decisive election, a superb year for gold and stocks and especially the quick recovery of gold after its initial post-election dip. They also eagerly anticipated the promise of an aggressive reduction in waste, fraud and abuse in government spending by the Department of Government Efficiency (DOGE), co-chaired by stellar business leaders Elon Musk and Vivek Ramaswamy, but in last Thursday’s economy panel, James Grant, venerable editor of “Grant’s Interest Rate Observer,” also in its 41st year, reminded attendees that the first thing you do to bury an idea is to “appoint a panel.” Then he asked if anyone could recall a successful company headed by two CEOs. You generally must select one CEO and let him run.

In my closing geopolitical panel, I also reminded attendees that I was present for the announcement of the first such cost-cutting mega-committee by J. Peter Grace at the 1984 New Orleans conference, including a super-summit of leading businessmen. That was a time of peak pro-capitalist sentiment after Reagan’s 1984 landslide win (49 states to one), yet Grace could only get a few cost-cutting measures passed in DC.

Others were more hopeful – saying that Musk and Ramaswamy wanted to “cut the Gordian knot” rather than nickel-and-dime the departments to death. They specifically promised to abolish whole Departments, starting with the Department of Education, or force workers to work in Siberia, by moving Departments to flyover states and say, “move or lose your job,” which would force change in a more dramatic manner.

Money manager Adrian Day was MC of the economics panel this year and last year, when he promised to “eat Mark Skousen’s hat” if gold were not over $2,000 at this year’s conference. Well, Dr. Skousen’s hat remained firmly on his bald head as gold soared to over $2,700. Several panelists said gold soared due to the fact that inflation is not dead. Jim Grant said inflation is a fire, banked but still burning, like an underground coal fire, fueled by bond vigilantes, who keep bidding long-term rate up to fuel our deficits.

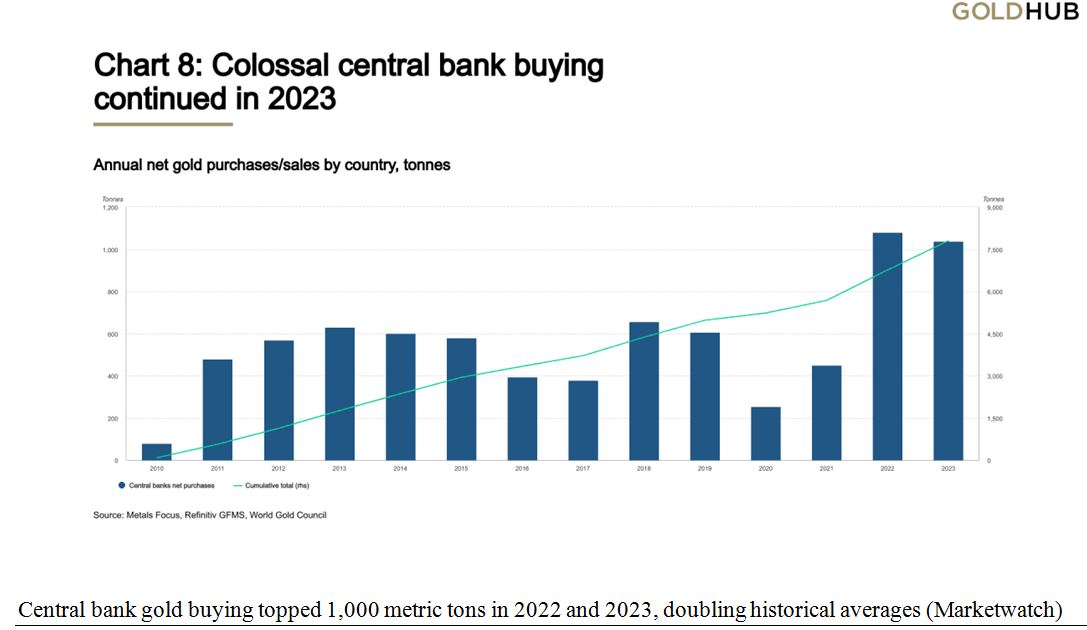

In his own talk, just an hour later, called “The Ring of Truth,” Adrian Day used Wagner’s Ring to remind us that gold was there at the beginning of the opera and continued through the 16-hour saga, prevailing at the end, when the gold Ring was engulfed in flames in the Twilight of the Gods, but gold survived the flames. That is one reason gold survived thousands of years as a symbol of wealth. He pointed out that gold is up over 70% in the last two years based on a huge increase in central bank buying, two new wars, inflation, Chinese buying and (finally) U.S. buying since July 2024, but U.S. buyers (as usual) were the last to buy.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

The Rising Debt Time Bomb – A Recurring Theme

“We must not let our rulers load us with perpetual debt.” – Thomas Jefferson

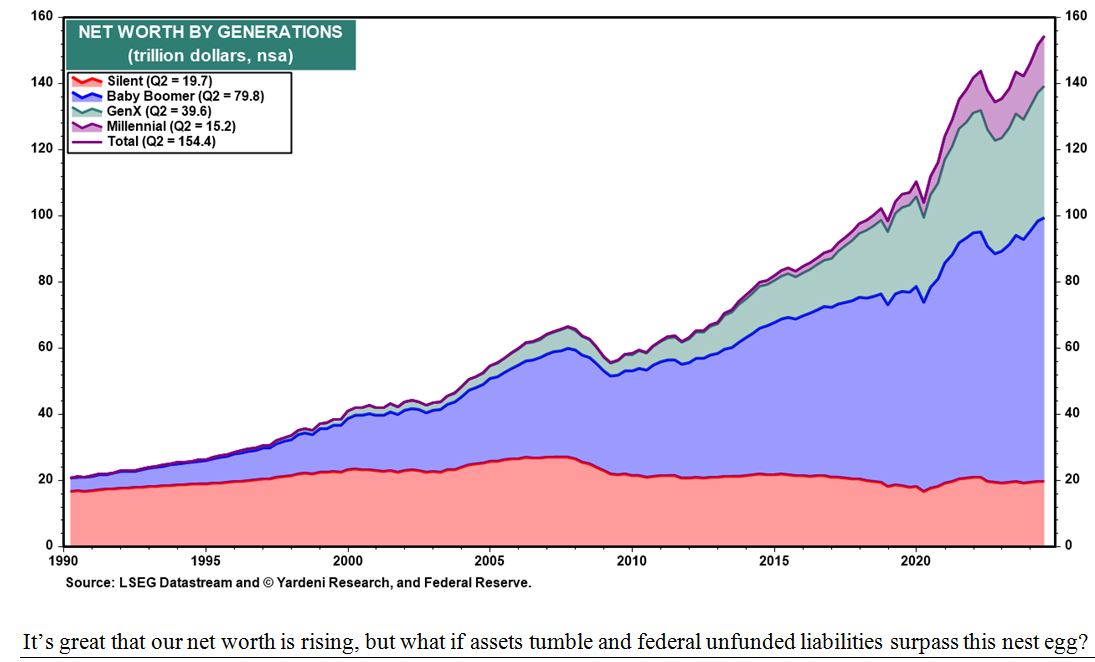

Several speakers – too many to single out one in particular – pointed to our mountain of federal debt on the books, with more to come, plus the hidden burden of unfunded liabilities, with fewer children and likely fewer immigrants to fund our draining Social Security and Medicare accounts, which are transfer payments from the young to the old (not savings accounts). It’s a demographic time bomb. The current liabilities of the U.S. federal government are $36 trillion, and the net present value of unfunded liabilities are over $100 trillion. That’s the bill young folks must pay to grandma and grandpa. As this chart shows, our heirs may inherit $100 trillion from Baby Boomers and older generations, but we’re going to spend some of that first, so if you subtract $136+ trillion in debts, there’s nothing left in the till for young ‘uns.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Each number gets bigger each year – the annual deficit grows by $2 trillion, and unfunded liabilities by another $3 trillion. Usually, net wealth also grows, but that’s due to a huge infusion of M2 money supply and stimulus spending creating “sugar high” asset bull markets in stocks, gold, bitcoin and other markets. What if that number starts shrinking? (This is why the bond vigilantes keep bidding up long-term yields).

This is what happened when the New Orleans conferences began – and WHY they began. In the 1970s, nothing on Wall Street worked – not stocks, not bonds, not our dollars in the bank. In the 1970s, a dollar became a quarter in purchasing power and gold rose 24-fold. The dollar fell 3- to 4-fold to the mark, yen and Swiss franc. We couldn’t earn more than 5% on cash during a time of 12% inflation, 15% mortgages and 20% prime rates. Those times won’t likely come again, but they are a warning of what could happen if a future political opportunist decides the only way to pay off this debt is to inflate it out of existence.

Ed Yardeni opined last week that, “A fundamental flaw in the Constitution is that it doesn’t provide for any limit on our national debt. A balanced budget requirement would have forced Congress to raise taxes to pay for more spending. Politicians long ago recognized that raising taxes is not a good way to get re-elected, while spending more on their constituencies is a winning strategy for sure. In other words, they discovered the magic of deficit financing their ever-increasing spending to win the next election.”

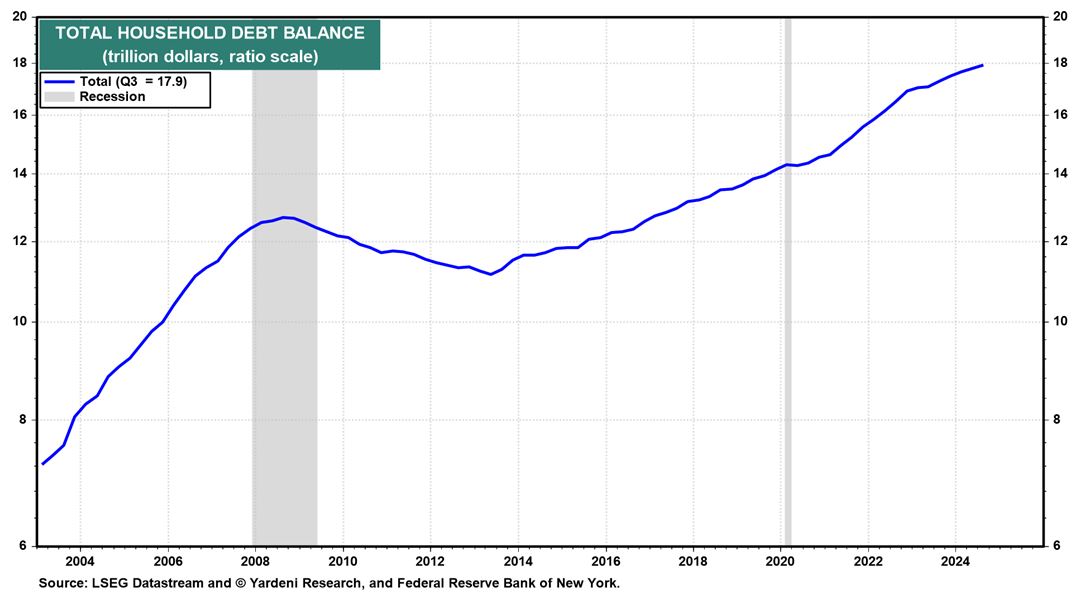

One of Ed’s charts also shows that household debt has also risen from $14 trillion to $18 trillion since COVID, despite trillions poured into financial assets. Credit card debt has also soared in the Biden era.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Another major theme of this year’s conference is buying industrial metals – things that run what we need most – since there are eight billion humans who will always vote for their needs, regardless of ideology.

We have made great strides against poverty, but one billion humans still don’t have electricity, and two billion more are well below the poverty line. Industrial commodities – most notably oil and copper – will fuel our need for more electrical plants. The stuff to power energy is what most humans buy first, and in the last 40 years (when I have come to the New Orleans conference), after 40 years of investing $5 trillion in alternative sources of energy, we have reduced our percentage of reliance on fossil fuels from a high of 82% in the mid-1980s all the way down to a low this year of …. wait for it… 81% in fossil-fuel reliance.

We will also need more nuclear power plants. Five years ago, speakers at this conference were begging investors to buy uranium at $20 a pound; then it surpassed $80 last year and was an “easy sell’ in a bull market (it’s now $65). Natural resources may be unpopular at times, but they fuel the energy we need.

I’ve always recommended this conference for its ambience in a city of great food and music, but mostly for its exceptional presentations of alternative investments and forward-looking thinking for 50 years.

All content above represents the opinion of Gary Alexander of Navellier & Associates, Inc.

Also In This Issue

A Look Ahead by Louis Navellier

Super News on Super Micro Computer and Nvidia

Income Mail by Bryan Perry

The U.S. Dollar Is Retaking Its Kingly Throne

Growth Mail by Gary Alexander

Celebrations, Cautions and Calculations in the Crescent City

Global Mail by Ivan Martchev

Shortened Trading Weeks Tend to be Positive

Sector Spotlight by Jason Bodner

Polishing My Crystal Ball for the Holidays

View Full Archive

Read Past Issues Here

About The Author

Gary Alexander

SENIOR EDITOR

Gary Alexander has been Senior Writer at Navellier since 2009. He edits Navellier’s weekly Marketmail and writes a weekly Growth Mail column, in which he uses market history to support the case for growth stocks. For the previous 20-years before joining Navellier, he was Senior Executive Editor at InvestorPlace Media (formerly Phillips Publishing), where he worked with several leading investment analysts, including Louis Navellier (since 1997), helping launch Louis Navellier’s Blue Chip Growth and Global Growth newsletters.

Prior to that, Gary edited Wealth Magazine and Gold Newsletter and wrote various investment research reports for Jefferson Financial in New Orleans in the 1980s. He began his financial newsletter career with KCI Communications in 1980, where he served as consulting editor for Personal Finance newsletter while serving as general manager of KCI’s Alexandria House book division. Before that, he covered the economics beat for news magazines. All content of “Growth Mail” represents the opinion of Gary Alexander

Important Disclosures:

Although information in these reports has been obtained from and is based upon sources that Navellier believes to be reliable, Navellier does not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute Navellier’s judgment as of the date the report was created and are subject to change without notice. These reports are for informational purposes only and are not a solicitation for the purchase or sale of a security. Any decision to purchase securities mentioned in these reports must take into account existing public information on such securities or any registered prospectus.To the extent permitted by law, neither Navellier & Associates, Inc., nor any of its affiliates, agents, or service providers assumes any liability or responsibility nor owes any duty of care for any consequences of any person acting or refraining to act in reliance on the information contained in this communication or for any decision based on it.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any securities recommendations made by Navellier. in the future will be profitable or equal the performance of securities made in this report. Dividend payments are not guaranteed. The amount of a dividend payment, if any, can vary over time and issuers may reduce dividends paid on securities in the event of a recession or adverse event affecting a specific industry or issuer.

None of the stock information, data, and company information presented herein constitutes a recommendation by Navellier or a solicitation to buy or sell any securities. Any specific securities identified and described do not represent all of the securities purchased, sold, or recommended for advisory clients. The holdings identified do not represent all of the securities purchased, sold, or recommended for advisory clients and the reader should not assume that investments in the securities identified and discussed were or will be profitable.

Information presented is general information that does not take into account your individual circumstances, financial situation, or needs, nor does it present a personalized recommendation to you. Individual stocks presented may not be suitable for every investor. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. Investment in fixed income securities has the potential for the investment return and principal value of an investment to fluctuate so that an investor’s holdings, when redeemed, may be worth less than their original cost.

One cannot invest directly in an index. Index is unmanaged and index performance does not reflect deduction of fees, expenses, or taxes. Presentation of Index data does not reflect a belief by Navellier that any stock index constitutes an investment alternative to any Navellier equity strategy or is necessarily comparable to such strategies. Among the most important differences between the Indices and Navellier strategies are that the Navellier equity strategies may (1) incur material management fees, (2) concentrate its investments in relatively few stocks, industries, or sectors, (3) have significantly greater trading activity and related costs, and (4) be significantly more or less volatile than the Indices.

ETF Risk: We may invest in exchange traded funds (“ETFs”) and some of our investment strategies are generally fully invested in ETFs. Like traditional mutual funds, ETFs charge asset-based fees, but they generally do not charge initial sales charges or redemption fees and investors typically pay only customary brokerage fees to buy and sell ETF shares. The fees and costs charged by ETFs held in client accounts will not be deducted from the compensation the client pays Navellier. ETF prices can fluctuate up or down, and a client account could lose money investing in an ETF if the prices of the securities owned by the ETF go down. ETFs are subject to additional risks:

- ETF shares may trade above or below their net asset value;

- An active trading market for an ETF’s shares may not develop or be maintained;

- The value of an ETF may be more volatile than the underlying portfolio of securities the ETF is designed to track;

- The cost of owning shares of the ETF may exceed those a client would incur by directly investing in the underlying securities; and

- Trading of an ETF’s shares may be halted if the listing exchange’s officials deem it appropriate, the shares are delisted from the exchange, or the activation of market-wide “circuit breakers” (which are tied to large decreases in stock prices) halts stock trading generally.

Grader Disclosures: Investment in equity strategies involves substantial risk and has the potential for partial or complete loss of funds invested. The sample portfolio and any accompanying charts are for informational purposes only and are not to be construed as a solicitation to buy or sell any financial instrument and should not be relied upon as the sole factor in an investment making decision. As a matter of normal and important disclosures to you, as a potential investor, please consider the following: The performance presented is not based on any actual securities trading, portfolio, or accounts, and the reported performance of the A, B, C, D, and F portfolios (collectively the “model portfolios”) should be considered mere “paper” or pro forma performance results based on Navellier’s research.

Investors evaluating any of Navellier & Associates, Inc.’s, (or its affiliates’) Investment Products must not use any information presented here, including the performance figures of the model portfolios, in their evaluation of any Navellier Investment Products. Navellier Investment Products include the firm’s mutual funds and managed accounts. The model portfolios, charts, and other information presented do not represent actual funded trades and are not actual funded portfolios. There are material differences between Navellier Investment Products’ portfolios and the model portfolios, research, and performance figures presented here. The model portfolios and the research results (1) may contain stocks or ETFs that are illiquid and difficult to trade; (2) may contain stock or ETF holdings materially different from actual funded Navellier Investment Product portfolios; (3) include the reinvestment of all dividends and other earnings, estimated trading costs, commissions, or management fees; and, (4) may not reflect prices obtained in an actual funded Navellier Investment Product portfolio. For these and other reasons, the reported performances of model portfolios do not reflect the performance results of Navellier’s actually funded and traded Investment Products. In most cases, Navellier’s Investment Products have materially lower performance results than the performances of the model portfolios presented.

This report contains statements that are, or may be considered to be, forward-looking statements. All statements that are not historical facts, including statements about our beliefs or expectations, are “forward-looking statements” within the meaning of The U.S. Private Securities Litigation Reform Act of 1995. These statements may be identified by such forward-looking terminology as “expect,” “estimate,” “plan,” “intend,” “believe,” “anticipate,” “may,” “will,” “should,” “could,” “continue,” “project,” or similar statements or variations of such terms. Our forward-looking statements are based on a series of expectations, assumptions, and projections, are not guarantees of future results or performance, and involve substantial risks and uncertainty as described in Form ADV Part 2A of our filing with the Securities and Exchange Commission (SEC), which is available at www.adviserinfo.sec.gov or by requesting a copy by emailing info@navellier.com. All of our forward-looking statements are as of the date of this report only. We can give no assurance that such expectations or forward-looking statements will prove to be correct. Actual results may differ materially. You are urged to carefully consider all such factors.

FEDERAL TAX ADVICE DISCLAIMER: As required by U.S. Treasury Regulations, you are informed that, to the extent this presentation includes any federal tax advice, the presentation is not written by Navellier to be used, and cannot be used, for the purpose of avoiding federal tax penalties. Navellier does not advise on any income tax requirements or issues. Use of any information presented by Navellier is for general information only and does not represent tax advice either express or implied. You are encouraged to seek professional tax advice for income tax questions and assistance.

IMPORTANT NEWSLETTER DISCLOSURE:The hypothetical performance results for investment newsletters that are authored or edited by Louis Navellier, including Louis Navellier’s Growth Investor, Louis Navellier’s Breakthrough Stocks, Louis Navellier’s Accelerated Profits, and Louis Navellier’s Platinum Club, are not based on any actual securities trading, portfolio, or accounts, and the newsletters’ reported hypothetical performances should be considered mere “paper” or proforma hypothetical performance results and are not actual performance of real world trades. Navellier & Associates, Inc. does not have any relation to or affiliation with the owner of these newsletters. There are material differences between Navellier Investment Products’ portfolios and the InvestorPlace Media, LLC newsletter portfolios authored by Louis Navellier. The InvestorPlace Media, LLC newsletters contain hypothetical performance that do not include transaction costs, advisory fees, or other fees a client might incur if actual investments and trades were being made by an investor. As a result, newsletter performance should not be used to evaluate Navellier Investment services which are separate and different from the newsletters. The owner of the newsletters is InvestorPlace Media, LLC and any questions concerning the newsletters, including any newsletter advertising or hypothetical Newsletter performance claims, (which are calculated solely by Investor Place Media and not Navellier) should be referred to InvestorPlace Media, LLC at (800) 718-8289.

Please note that Navellier & Associates and the Navellier Private Client Group are managed completely independent of the newsletters owned and published by InvestorPlace Media, LLC and written and edited by Louis Navellier, and investment performance of the newsletters should in no way be considered indicative of potential future investment performance for any Navellier & Associates separately managed account portfolio. Potential investors should consult with their financial advisor before investing in any Navellier Investment Product.

Navellier claims compliance with Global Investment Performance Standards (GIPS). To receive a complete list and descriptions of Navellier’s composites and/or a presentation that adheres to the GIPS standards, please contact Navellier or click here. It should not be assumed that any securities recommendations made by Navellier & Associates, Inc. in the future will be profitable or equal the performance of securities made in this report.

FactSet Disclosure: Navellier does not independently calculate the statistical information included in the attached report. The calculation and the information are provided by FactSet, a company not related to Navellier. Although information contained in the report has been obtained from FactSet and is based on sources Navellier believes to be reliable, Navellier does not guarantee its accuracy, and it may be incomplete or condensed. The report and the related FactSet sourced information are provided on an “as is” basis. The user assumes the entire risk of any use made of this information. Investors should consider the report as only a single factor in making their investment decision. The report is for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of a security. FactSet sourced information is the exclusive property of FactSet. Without prior written permission of FactSet, this information may not be reproduced, disseminated or used to create any financial products. All indices are unmanaged and performance of the indices include reinvestment of dividends and interest income, unless otherwise noted, are not illustrative of any particular investment and an investment cannot be made in any index. Past performance is no guarantee of future results.