by Jason Bodner

November 12, 2024

It’s finally over.

On the one hand, I am obviously talking about the election – it was hotly debated down to the wire, but like him or hate him, Trump won decisively. George Washington won every vote. We’ll never have another president voted in unanimously. That honor is now retired, going to our first president alone.

On the other (a bit less obvious) hand, I am talking about the end of uncertainty. A decisive election allows everyone to move on, if they can. I’m not into politics; I’m into data and investing. As an investor, all one hopes for is a decisive election. That’s what we got, and the market loved it.

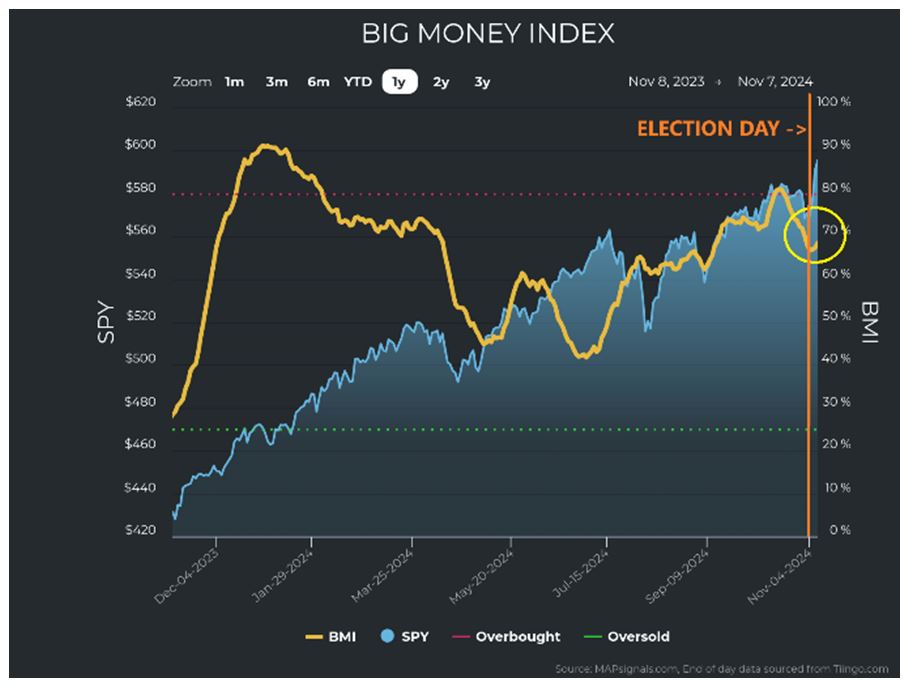

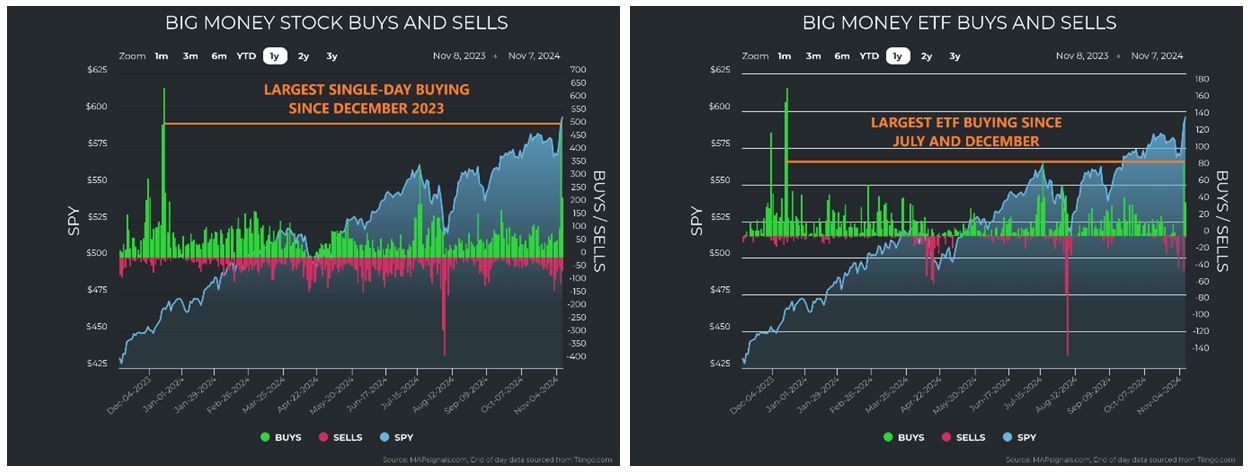

The Big Money Index (BMI) is still the best metric for revealing unusually large money flows in the stock market. In October, the BMI became overbought then dropped out of being overbought after only four days. As the election tightened, investors sidestepped risk, moving money out of stocks. Then, after election day (the orange vertical line), money gushed back into stocks:

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

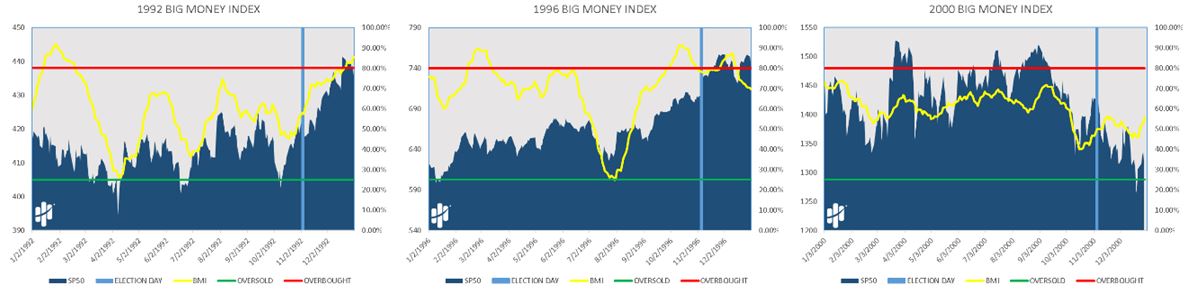

I told you this was likely, before the election, as this has been the pattern for every election since 1992:

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

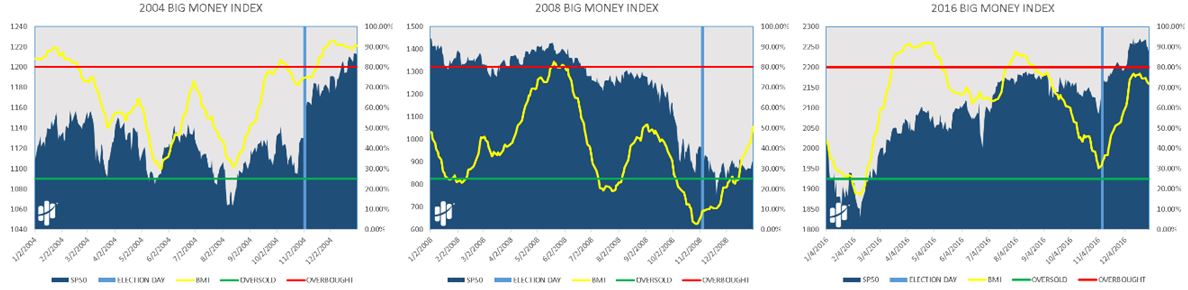

Now, with a clearer horizon, investors wasted no time placing their bets. In fact, the day after the election was the largest single day of unusually large buying since December of 2023 (left chart). ETFs also saw immense buying, equaling the huge buying spike in July, eclipsed only by December 2023 (right chart).

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

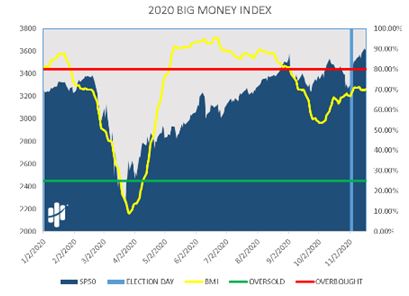

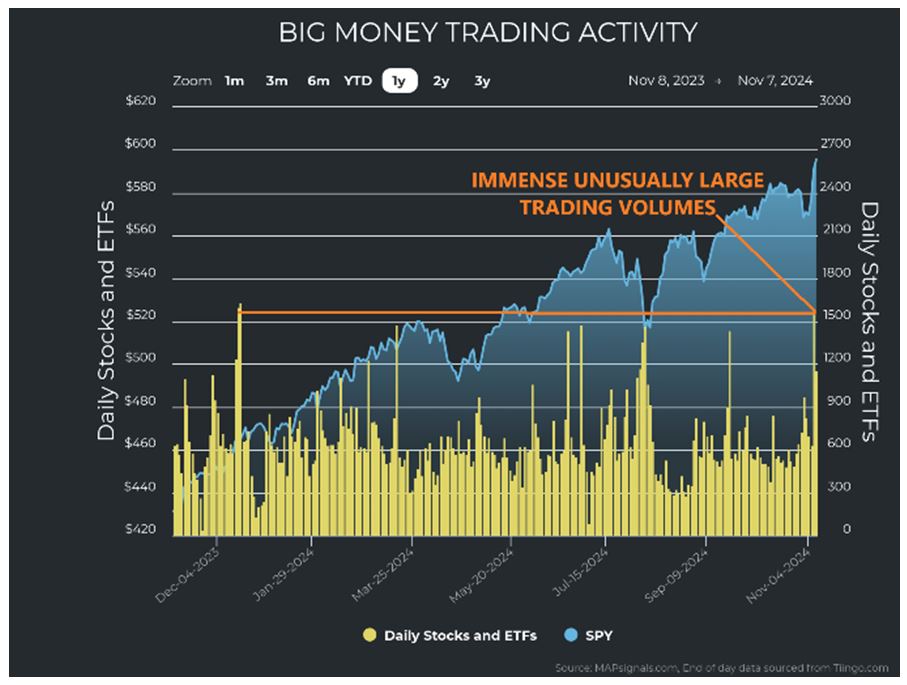

This buying decisively blasted stocks to new highs. In order to make a buy signal, stocks have to trade at new interim highs on unusually large volume. The amber lines below show stock trading on abnormally high volume alone without respect to highs or lows. You can see the big day of buying was major money moving in, also the highest since December last year:

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

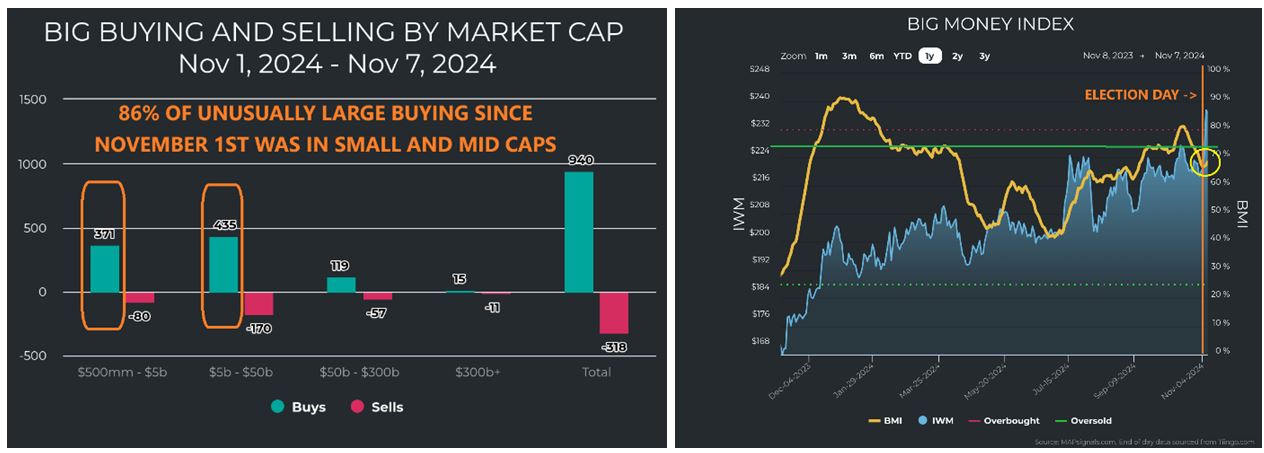

If you have been following me, you’ll know that I have been pounding the table for small- and mid-cap stocks since early last summer. I said that, regardless of which candidate wins, these groups would benefit. But should Trump win, that’s especially good for these stocks. Sure enough, when we look at the distribution of buying since November 1st, we see 86% of stocks bought unusually, were small and mid-cap companies. This launched the Russell 2000 (IWM) into the stratosphere last week:

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

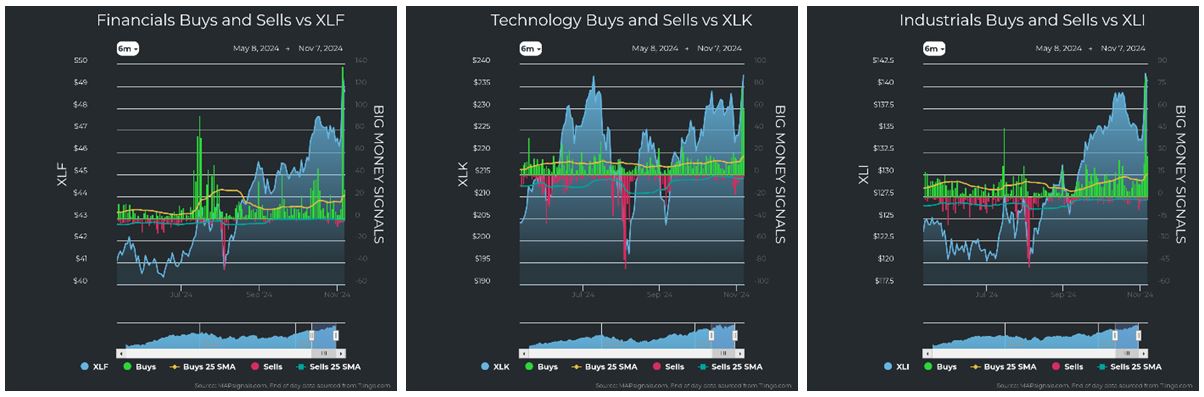

Out of 490 stocks that were gobbled up in an unusually large way last Wednesday, November 6th, a whopping 138 (28%) of them were financial stocks. In this chart of XLF, we can see that since October of 2023, XLF was looking to break out of a range. In January this year, it took off and never looked back:

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

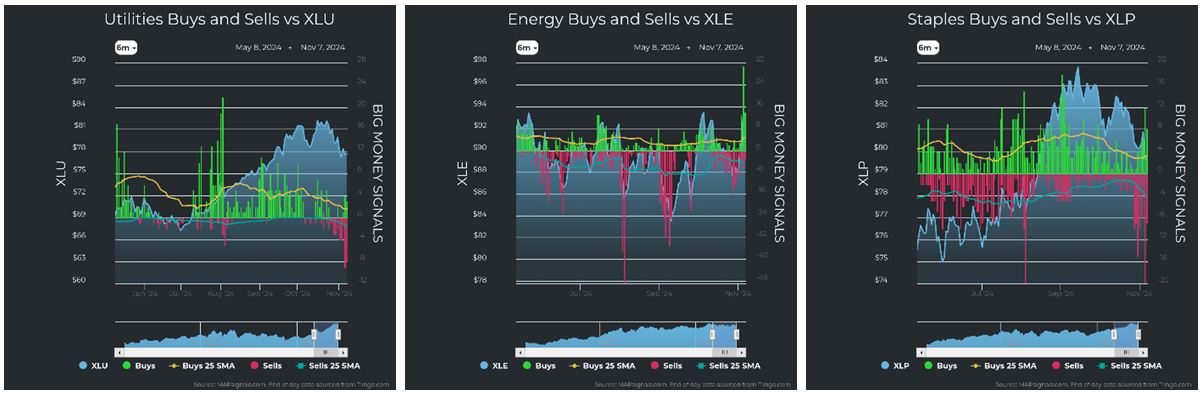

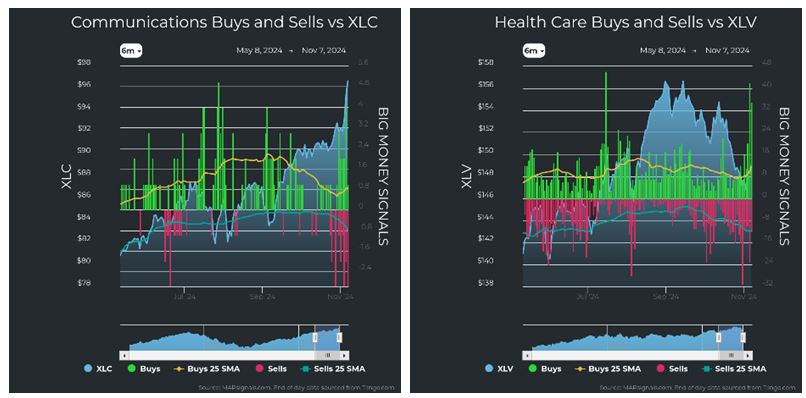

On November 6th, the financial ETF (XLF) blasted to all-time highs on immense buying. This helped solidify Financials as the top-ranked sector. We see that in the sector charts, below: Financials clearly had the most unusual buying, while Technology, Industrials, Discretionary, and Energy stocks also saw unusual buying, breaking new high counts set within the last six months.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Materials, Staples, Communications, and Health care sectors also saw meaningful buying, albeit without seeing new high counts. Only Utilities and Real Estate failed to see meaningful buying, but there’s a good explanation for that. Both sectors just recently retreated from highs as they vaulted with imminent rate cuts. As both pay hefty dividends, they are more in demand when rates fall.

So, now what?

For me, the playbook is always the same. I look for the highest quality stocks among those that are seeing unusually larger inflows. Last week, that pool just got bigger, making my job easier.

It’s paradoxical to find great stocks in a bad tape. On the one hand, the selection pool goes way down, but on the other hand the real leaders have trouble hiding in mediocrity. Vice versa, a strong market can make all stocks look good when they all aren’t. So suddenly, we have a lot more stocks rising, but not all have what it takes to make it into my pool of buy candidates.

When selecting my pool of candidates, I focus on using identifying stocks with soaring fundamentals, technicals and money flows. First, let me summarize some of what I look for in the fundamentals:

- Double-digit percent growth in sales and earnings over 1 and 3 years

- Double-digit percentages of profit margin

- Low debt-to-equity ratio (usually 25% or less)

- Strong forecasted sales and earnings growth

- Expanding profit margins

And here’s some of what I like to see in terms of technical strength:

- Stocks breaking new 11-week highs

- Stocks at 52- week highs

- Stocks at all-time highs

- Volume rising with price

Last, but not least, a magical trifecta comes when we get unusually large buy signals on one or more of these superior stocks. That indicates heavy accumulation of a stock. And, given that between 70% and 90% of all daily volume is institutional, according to J.P. Morgan and Morgan Stanley, we want to pay special attention when they are competing to buy the best stocks.

That stunningly simple formula has allowed me to amass a batting average of about 70% of my selections rising over time. The winners are bigger than the losers, so the aggregate outperforms the S&P 500 by 7-1 in one model portfolio strategy since 1990.

I know – it’s more fun to pick stocks when they ALL go up, but that is not realistic.

The good news is that we have a lot more candidates to look at now, as traders think a Trump presidency is good for small- and mid-sized businesses. If you add in falling interest rates removing some headwinds from capital- or borrow-intensive businesses, and we add more fuel to the fire.

I know that this election has made many people happy and many others unhappy. This election was never going to make all America happy, so I choose to focus on things I can control. I can control what stocks go into my portfolio. I suggest you do the same: Focus on how to position your investments to benefit from next year’s market realities, regardless of your feelings on the election results.

“What separates the winners from the losers is how a person reacts to each new twist of fate.”

–– Donald Trump on Twitter, December 2014, six months before announcing his first run for office.

All content above represents the opinion of Jason Bodner of Navellier & Associates, Inc.

Also In This Issue

A Look Ahead by Louis Navellier

Did We Just See the Fed’s Final Rate Cut?

Income Mail by Bryan Perry

A Compelling Case for Convertible Debt

Growth Mail by Gary Alexander

The Market Implications of a Republican Sweep

Global Mail by Ivan Martchev

What the Post-Election Collapse in Volatility Means

Sector Spotlight by Jason Bodner

We Got the Decisive Election the Market Craved

View Full Archive

Read Past Issues Here

Jason Bodner

MARKETMAIL EDITOR FOR SECTOR SPOTLIGHT

Jason Bodner writes Sector Spotlight in the weekly Marketmail publication and has authored several white papers for the company. He is also Co-Founder of Macro Analytics for Professionals which produces proprietary equity accumulation and distribution research for its clients. Previously, Mr. Bodner served as Director of European Equity Derivatives for Cantor Fitzgerald Europe in London, then moved to the role of Head of Equity Derivatives North America for the same company in New York. He also served as S.V.P. Equity Derivatives for Jefferies, LLC. He received a B.S. in business administration in 1996, with honors, from Skidmore College as a member of the Periclean Honors Society. All content of “Sector Spotlight” represents the opinion of Jason Bodner

Important Disclosures:

Jason Bodner is a co-founder and co-owner of Mapsignals. Mr. Bodner is an independent contractor who is occasionally hired by Navellier & Associates to write an article and or provide opinions for possible use in articles that appear in Navellier & Associates weekly Market Mail. Mr. Bodner is not employed or affiliated with Louis Navellier, Navellier & Associates, Inc., or any other Navellier owned entity. The opinions and statements made here are those of Mr. Bodner and not necessarily those of any other persons or entities. This is not an endorsement, or solicitation or testimonial or investment advice regarding the BMI Index or any statements or recommendations or analysis in the article or the BMI Index or Mapsignals or its products or strategies.

Although information in these reports has been obtained from and is based upon sources that Navellier believes to be reliable, Navellier does not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute Navellier’s judgment as of the date the report was created and are subject to change without notice. These reports are for informational purposes only and are not a solicitation for the purchase or sale of a security. Any decision to purchase securities mentioned in these reports must take into account existing public information on such securities or any registered prospectus.To the extent permitted by law, neither Navellier & Associates, Inc., nor any of its affiliates, agents, or service providers assumes any liability or responsibility nor owes any duty of care for any consequences of any person acting or refraining to act in reliance on the information contained in this communication or for any decision based on it.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any securities recommendations made by Navellier. in the future will be profitable or equal the performance of securities made in this report. Dividend payments are not guaranteed. The amount of a dividend payment, if any, can vary over time and issuers may reduce dividends paid on securities in the event of a recession or adverse event affecting a specific industry or issuer.

None of the stock information, data, and company information presented herein constitutes a recommendation by Navellier or a solicitation to buy or sell any securities. Any specific securities identified and described do not represent all of the securities purchased, sold, or recommended for advisory clients. The holdings identified do not represent all of the securities purchased, sold, or recommended for advisory clients and the reader should not assume that investments in the securities identified and discussed were or will be profitable.

Information presented is general information that does not take into account your individual circumstances, financial situation, or needs, nor does it present a personalized recommendation to you. Individual stocks presented may not be suitable for every investor. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. Investment in fixed income securities has the potential for the investment return and principal value of an investment to fluctuate so that an investor’s holdings, when redeemed, may be worth less than their original cost.

One cannot invest directly in an index. Index is unmanaged and index performance does not reflect deduction of fees, expenses, or taxes. Presentation of Index data does not reflect a belief by Navellier that any stock index constitutes an investment alternative to any Navellier equity strategy or is necessarily comparable to such strategies. Among the most important differences between the Indices and Navellier strategies are that the Navellier equity strategies may (1) incur material management fees, (2) concentrate its investments in relatively few stocks, industries, or sectors, (3) have significantly greater trading activity and related costs, and (4) be significantly more or less volatile than the Indices.

ETF Risk: We may invest in exchange traded funds (“ETFs”) and some of our investment strategies are generally fully invested in ETFs. Like traditional mutual funds, ETFs charge asset-based fees, but they generally do not charge initial sales charges or redemption fees and investors typically pay only customary brokerage fees to buy and sell ETF shares. The fees and costs charged by ETFs held in client accounts will not be deducted from the compensation the client pays Navellier. ETF prices can fluctuate up or down, and a client account could lose money investing in an ETF if the prices of the securities owned by the ETF go down. ETFs are subject to additional risks:

- ETF shares may trade above or below their net asset value;

- An active trading market for an ETF’s shares may not develop or be maintained;

- The value of an ETF may be more volatile than the underlying portfolio of securities the ETF is designed to track;

- The cost of owning shares of the ETF may exceed those a client would incur by directly investing in the underlying securities and;

- Trading of an ETF’s shares may be halted if the listing exchange’s officials deem it appropriate, the shares are delisted from the exchange, or the activation of market-wide “circuit breakers” (which are tied to large decreases in stock prices) halts stock trading generally.

Grader Disclosures: Investment in equity strategies involves substantial risk and has the potential for partial or complete loss of funds invested. The sample portfolio and any accompanying charts are for informational purposes only and are not to be construed as a solicitation to buy or sell any financial instrument and should not be relied upon as the sole factor in an investment making decision. As a matter of normal and important disclosures to you, as a potential investor, please consider the following: The performance presented is not based on any actual securities trading, portfolio, or accounts, and the reported performance of the A, B, C, D, and F portfolios (collectively the “model portfolios”) should be considered mere “paper” or pro forma performance results based on Navellier’s research.

Investors evaluating any of Navellier & Associates, Inc.’s, (or its affiliates’) Investment Products must not use any information presented here, including the performance figures of the model portfolios, in their evaluation of any Navellier Investment Products. Navellier Investment Products include the firm’s mutual funds and managed accounts. The model portfolios, charts, and other information presented do not represent actual funded trades and are not actual funded portfolios. There are material differences between Navellier Investment Products’ portfolios and the model portfolios, research, and performance figures presented here. The model portfolios and the research results (1) may contain stocks or ETFs that are illiquid and difficult to trade; (2) may contain stock or ETF holdings materially different from actual funded Navellier Investment Product portfolios; (3) include the reinvestment of all dividends and other earnings, estimated trading costs, commissions, or management fees; and, (4) may not reflect prices obtained in an actual funded Navellier Investment Product portfolio. For these and other reasons, the reported performances of model portfolios do not reflect the performance results of Navellier’s actually funded and traded Investment Products. In most cases, Navellier’s Investment Products have materially lower performance results than the performances of the model portfolios presented.

This report contains statements that are, or may be considered to be, forward-looking statements. All statements that are not historical facts, including statements about our beliefs or expectations, are “forward-looking statements” within the meaning of The U.S. Private Securities Litigation Reform Act of 1995. These statements may be identified by such forward-looking terminology as “expect,” “estimate,” “plan,” “intend,” “believe,” “anticipate,” “may,” “will,” “should,” “could,” “continue,” “project,” or similar statements or variations of such terms. Our forward-looking statements are based on a series of expectations, assumptions, and projections, are not guarantees of future results or performance, and involve substantial risks and uncertainty as described in Form ADV Part 2A of our filing with the Securities and Exchange Commission (SEC), which is available at www.adviserinfo.sec.gov or by requesting a copy by emailing info@navellier.com. All of our forward-looking statements are as of the date of this report only. We can give no assurance that such expectations or forward-looking statements will prove to be correct. Actual results may differ materially. You are urged to carefully consider all such factors.

FEDERAL TAX ADVICE DISCLAIMER: As required by U.S. Treasury Regulations, you are informed that, to the extent this presentation includes any federal tax advice, the presentation is not written by Navellier to be used, and cannot be used, for the purpose of avoiding federal tax penalties. Navellier does not advise on any income tax requirements or issues. Use of any information presented by Navellier is for general information only and does not represent tax advice either express or implied. You are encouraged to seek professional tax advice for income tax questions and assistance.

IMPORTANT NEWSLETTER DISCLOSURE:The hypothetical performance results for investment newsletters that are authored or edited by Louis Navellier, including Louis Navellier’s Growth Investor, Louis Navellier’s Breakthrough Stocks, Louis Navellier’s Accelerated Profits, and Louis Navellier’s Platinum Club, are not based on any actual securities trading, portfolio, or accounts, and the newsletters’ reported hypothetical performances should be considered mere “paper” or proforma hypothetical performance results and are not actual performance of real world trades. Navellier & Associates, Inc. does not have any relation to or affiliation with the owner of these newsletters. There are material differences between Navellier Investment Products’ portfolios and the InvestorPlace Media, LLC newsletter portfolios authored by Louis Navellier. The InvestorPlace Media, LLC newsletters contain hypothetical performance that do not include transaction costs, advisory fees, or other fees a client might incur if actual investments and trades were being made by an investor. As a result, newsletter performance should not be used to evaluate Navellier Investment services which are separate and different from the newsletters. The owner of the newsletters is InvestorPlace Media, LLC and any questions concerning the newsletters, including any newsletter advertising or hypothetical Newsletter performance claims, (which are calculated solely by Investor Place Media and not Navellier) should be referred to InvestorPlace Media, LLC at (800) 718-8289.

Please note that Navellier & Associates and the Navellier Private Client Group are managed completely independent of the newsletters owned and published by InvestorPlace Media, LLC and written and edited by Louis Navellier, and investment performance of the newsletters should in no way be considered indicative of potential future investment performance for any Navellier & Associates separately managed account portfolio. Potential investors should consult with their financial advisor before investing in any Navellier Investment Product.

Navellier claims compliance with Global Investment Performance Standards (GIPS). To receive a complete list and descriptions of Navellier’s composites and/or a presentation that adheres to the GIPS standards, please contact Navellier or click here. It should not be assumed that any securities recommendations made by Navellier & Associates, Inc. in the future will be profitable or equal the performance of securities made in this report.

FactSet Disclosure: Navellier does not independently calculate the statistical information included in the attached report. The calculation and the information are provided by FactSet, a company not related to Navellier. Although information contained in the report has been obtained from FactSet and is based on sources Navellier believes to be reliable, Navellier does not guarantee its accuracy, and it may be incomplete or condensed. The report and the related FactSet sourced information are provided on an “as is” basis. The user assumes the entire risk of any use made of this information. Investors should consider the report as only a single factor in making their investment decision. The report is for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of a security. FactSet sourced information is the exclusive property of FactSet. Without prior written permission of FactSet, this information may not be reproduced, disseminated or used to create any financial products. All indices are unmanaged and performance of the indices include reinvestment of dividends and interest income, unless otherwise noted, are not illustrative of any particular investment and an investment cannot be made in any index. Past performance is no guarantee of future results.