by Gary Alexander

November 12, 2024

Last Friday, after our regular weekly Market Mail conference call, I had the opportunity to join Louis Navellier and his daughter Crystal in a taping of Navellier Market Buzz. (Be sure to check out this new service each week on YouTube, select “like” and subscribe to it if you enjoy it).

In preparation for the interview, Crystal and Louis drafted five questions for me, and I tried to be brief in my “on air” answers, in order to give Louis plenty of airtime for his coverage of economic and stock-specific questions, which have more immediate impact to most of our subscribers. But in this column, I’ll list Crystal’s five questions to me and some more research, based on the data I referred to in my answers.

Question #1: Can you put into perspective what Tuesday’s election results mean for investors? Would you call this a political earthquake?

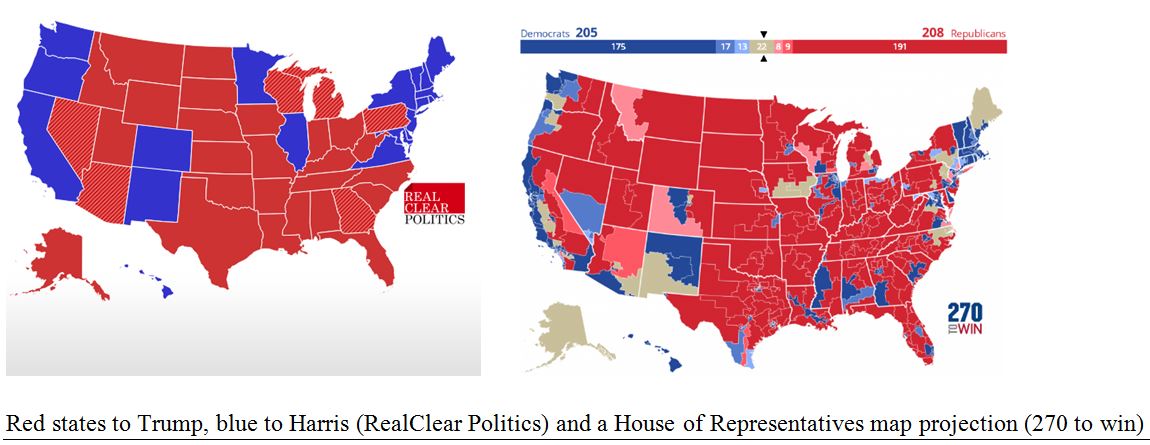

Yes, I would call this a political earthquake, since Trump not only won all seven “swing states” but Republicans also gained enough seats in both the Senate and (likely) the House to score the trifecta. The pollsters were mostly wrong, showing no gap in swing states and popular votes in Harris’s favor, when the popular vote was +3-4 million for Trump. Although media bias tilted blue, they did not influence many.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Another “earthquake” measure is that Trump gained a greater percentage of votes in all 50 states. Trump also gained in percentage of votes among black, Asian, Hispanic and youth, in some cases doubling his 2020 totals. The market likes certainty, and this election was “certainly certain.” Trump was declared the winner at 10:45 pm Tuesday (Pacific time), so I expected the markets would celebrate the next day.

Sure enough, the Dow gained over 1,500 points on Wednesday, its best single day since the COVID days of March and April of 2000. NASDAQ gained 544 points (+3%) and the more domestic-focused small-stock Russell 2000 did best, up 5.84% on Wednesday and setting a three-year high then, and on Friday.

Question #2: It appears that this was a low turnout election, since Donald Trump got almost the same number of votes that he did in 2020, but Kamala Harris only got 68.2 million votes, while Joe Biden got over 82.2 million back in 2020 … so how did 14 million Democratic votes disappear?

This is a premature assumption, so far, since (as of Sunday) California still has about 3.5 million votes left to count, and that is a heavily Democratic state. A few other blue states have a few hundred thousand votes uncounted, so Harris could reach 72 to 75 million votes – still 7-10 million short of Biden in 2020.

Harris earning far fewer votes than Biden underlines her weakness as a late appointment to replace Biden, but the Democrats didn’t use the full court press they staged in 2020, when the margin was “enhanced” (not stolen) by a well-funded campaign of vote harvesting among groups who seldom voted in the past. Consider this: Donald Trump gained 11.2 million more votes in 2020 than in 2016. Before 2020, no Republican candidate had ever received over 63 million votes, but he got 74 million in 2020 and lost.

That seemed a bit odd, at the time. Over the last century, every other incumbent that ran for re-election with such a huge gain in votes won in a landslide. The only incumbents running for re-election who lost had a huge (15% to 20%) loss in vote totals, for obvious reasons: (1) Herbert Hoover’s 1932 depression, (2) Jimmy Carter’s 1980 malaise and (3) George Bush, Sr., due mostly to Perot’s 20% vote grab in 1992.

So, how did incumbent Trump lose in 2020 with 11.2 million more votes than he earned in 2016? The obvious answer is funding by Mark Zuckerberg (“Zuckerbucks”) in key swing states, and poll harvesters passing out ballots to youth, retirement homes, inner cities and other concentrations of low-voting groups.

Since America has such low voter turnout (normally 50% of those over 18), it would be fairly easy to register and push voting on millions of those who normally don’t vote, if you have the manpower, desire and dollars, which Democrats clearly had in 2020 – powers they did not muster in 2024. Trump should have conceded 2020, in my view. The election wasn’t stolen, but perhaps it was “rigged” by this all-out blue blitz. Historians can debate this, but Mollie Hemingway’s book “Rigged” is a good starting point.

One final point: California’s slow vote count over the last week has held up decision time on eight House seats, putting House control in limbo, but the Republicans need only two more seats to gain a majority and four California districts and two in Alaska and Arizona (8 of 10 undecided seats) lean Republican.

Florida and Texas, the 2nd and 3rd most populous states after California, counted 99% of their votes last Tuesday night, but California allows itself the lazy luxury of a full week to deliver its vote count, since mailed ballots with a Tuesday, November 5th (or earlier) postmark are allowed a week to snail their way to a tabulation desk. This is simply poor management. My little island has a drop box at the fire station. There is no reason ballots need to remain in limbo for a week, if we can drop them in a local polling box.

Question #3: The U.S. dollar surged after the election and Treasury bond yields rose, but gold fell. Is that because investors have confidence in the U.S. economy? Do you expect gold prices to recover?

There were some immediate overreactions by traders with itchy online trading fingers, so we saw huge moves in many markets on Wednesday. While stocks generally held on to their gains, the initial surge in the 10-year Treasury rate, and the fall in gold, were reversed the next day, while the U.S. dollar held firm. To answer your first question, yes, that shows greater confidence in the United States after this election.

Last Wednesday, the 10-year Treasury rate shot up from 4.30% to 4.47% on day after the election, but it reverted back to 4.30% by Friday. Some of the fear of higher rates comes from President-elect Trump’s tariff rhetoric, but I expect that he will treat tariffs more like bargaining chips and threats in negotiations, mostly to reduce other nations’ super high tariffs (compared to ours), not as permanently high tariffs.

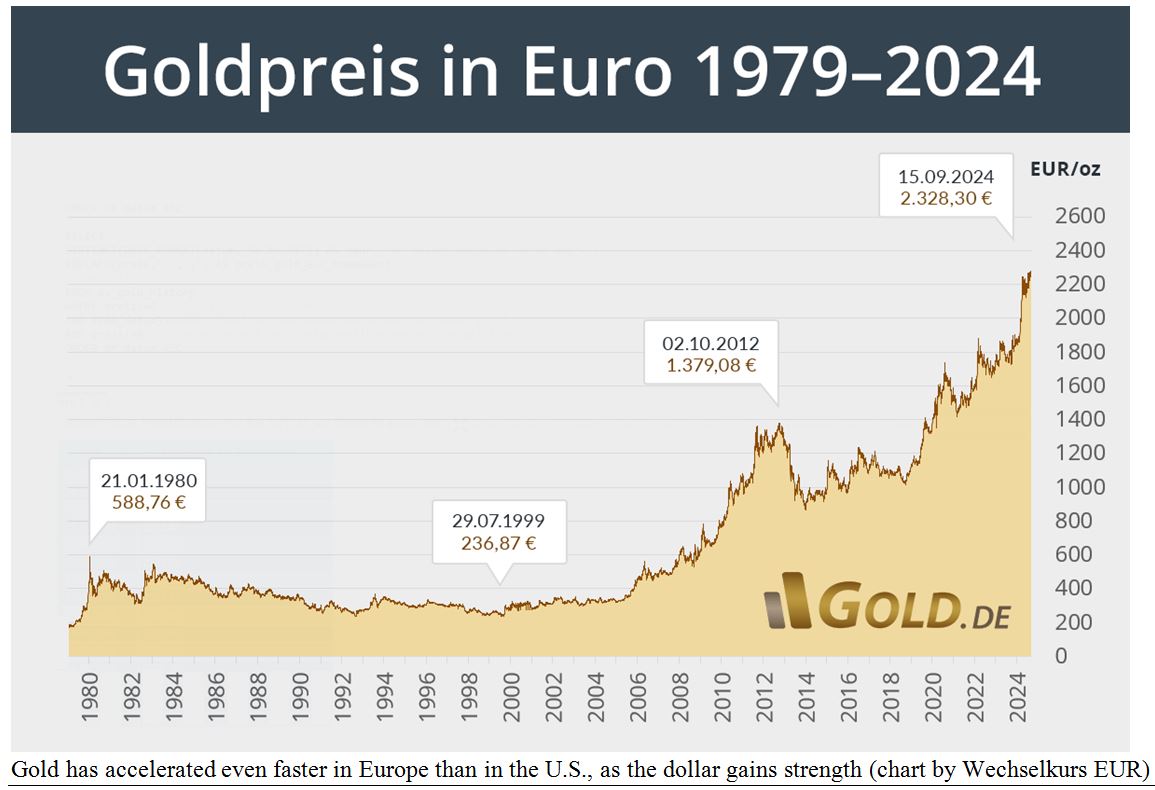

Gold has recovered, and I expect it will keep climbing, though more slowly, in 2025, unless all global tensions immediately end, the budget is suddenly balanced, and inflation is flat. Gold is historically an insurance policy, not only an inflation hedge but a crisis hedge, and currency hedge. Last week, gold futures closed Tuesday at $2,740 and dipped under $2,660 the next day, but recovered to $2,688 on Friday, for a net decline of 1.9%, not bad, considering the landslide “earthquake” you mentioned.

Gold has been setting new highs in U.S. dollar terms this year, even as inflation has receded and the dollar has strengthened, which means that gold is setting even higher highs in terms of many other currencies.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

As for the U.S. dollar, it should keep rising if the Fed stops cutting rates and the world pours more money into the dollar. However, central banks have loaded up on gold even faster than dollars. especially in the last three years, with over 1,000 metric tons per year (a metric ton is one million grams, or 32,150 Troy ounces, so 1,000 tons of gold is currently worth about $85 billion added to central bank holdings each year), supplanting the euro as the #2 holding (behind dollars) in central bank coffers. There will be no return to an official gold standard, but central banks prefer gold over paper.

Question #4: Assuming the Republicans gain control of both houses of Congress, how does the stock market perform when one party has control of both houses of Congress and the White House?

I have long championed the compromise of government “gridlock,” in which one party controls the White House and the other runs Congress, creating checks and balances against governmental overreach by either party. Historically, since 1950, the S&P 500 averages 14.5% gains per year in gridlock years.

A great example of positive effect of gridlock is the side-by-side comparison of Clinton in 1993-94, when Democrats had control: Hillary was trying to nationalize health care and the S&P 500 gained only 5.6% in those two years, but after the Republicans took over Congress in 1994, the S&P 500 enjoyed five straight years of mega-gains: +34.1%, +20.3%, +31.0%, +26.7% and +19.5% for a 5-year 220% gain (1995-99), and four balanced budgets at the end of the century, 1998-2001. (The birth of the Internet also helped).

When it comes to one-party monopolies, the Democrats have swept the House, Senate and White House in nine elections since 1950, with a tepid average S&P 500 gain of 6.7% per year, while four Republican sweeps (a smaller sample) have averaged +13.5%, double the all-Democrat sweeps, and nearly as good as gridlock. Here is a quick summary of those eight years (four elections) when Republican ruled the roost:

- 1953-54: Dwight Eisenhower’s first two years generated +35.4% in S&P 500 and +38.5% in the Dow.

- 2003-06: George W. Bush’s middle four years delivered +61.2% in S&P 500 and +49.4% in the Dow.

- 2017-18: Donald Trump’s first two years were more muted: +12% in the S&P 500 and +18% in the Dow.

This doesn’t guarantee any gains going forward, but the odds are better than in a Democratic sweep.

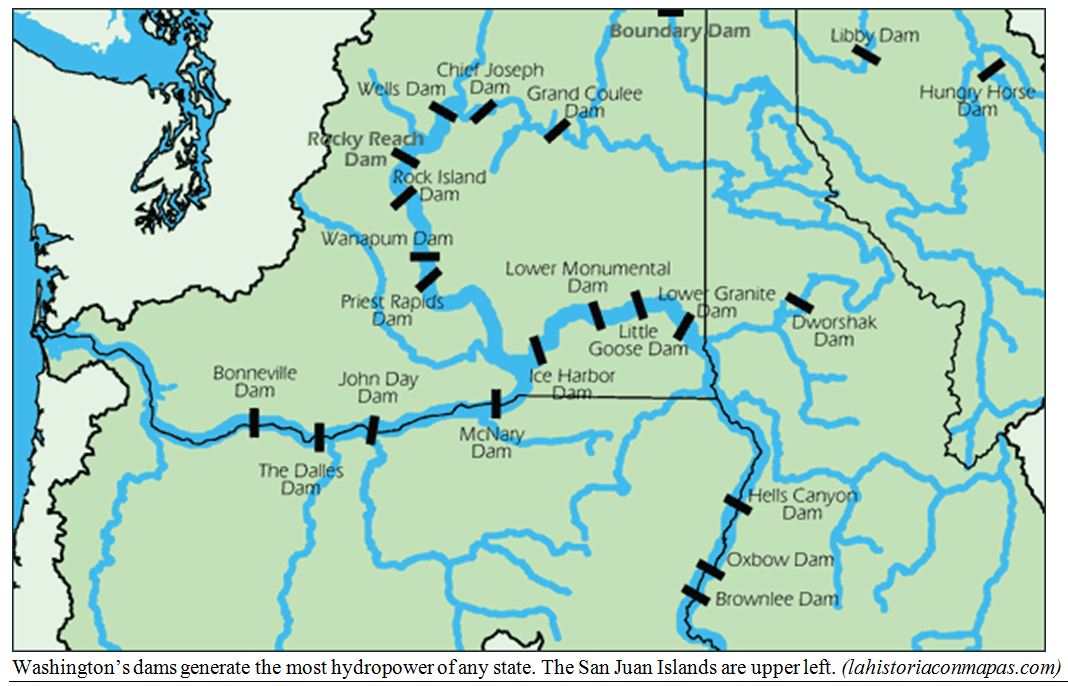

Question #5: Where is Lopez Island, where you live? I assume your electricity in Washington State is mostly hydroelectric. There are AI data centers that Oregon and Washington have on the Columbia River due to all the hydro-electric plants, so do you think it is possible that Trump can double the electric grid to power the AI expansion anticipated in the upcoming years?

Lopez Island is the first ferry stop in the San Juan Island chain. Our “Friendly Island” (like a small town, we mostly know one another, so every driver waves at every other driver) voted 75%+ for Kamala Harris, a greater share than any other Washington county, including the biggest county, King County (Seattle).

We are close to Canada (Victoria BC is 25 miles west). We are Americans because of the outcome of the Pig War (1859-72), when a Yankee squatter shot a British pig and made Canadian bacon, causing armies from both nations to set up camps here, preparing for a war that never happened. Finally, an arbitration panel headed by German Kaiser Wilhem awarded most of the islands to America. Thank you, Germany.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

To your point, 85% of our electric power is administered by our local collective and connected to the mainland by underwater cable, eventually coming from hydro-electric power generated by the multi-dam Columbia River system. We will have huge energy demands in the future, partly due to AI expansion, and I fear our river system won’t be able to meet those needs, as there is a Western drought which has reduced Columbia River volume lately. We will need new sources. In last week’s Statewide election, Washington voters narrowly overturned a natural gas ban by 51% to 49%, so that is a hopeful start. With Trump’s expansive energy development policies, he’ll likely tap other sources to help supply meet rising demands.

All content above represents the opinion of Gary Alexander of Navellier & Associates, Inc.

Also In This Issue

A Look Ahead by Louis Navellier

Did We Just See the Fed’s Final Rate Cut?

Income Mail by Bryan Perry

A Compelling Case for Convertible Debt

Growth Mail by Gary Alexander

The Market Implications of a Republican Sweep

Global Mail by Ivan Martchev

What the Post-Election Collapse in Volatility Means

Sector Spotlight by Jason Bodner

We Got the Decisive Election the Market Craved

View Full Archive

Read Past Issues Here

About The Author

Gary Alexander

SENIOR EDITOR

Gary Alexander has been Senior Writer at Navellier since 2009. He edits Navellier’s weekly Marketmail and writes a weekly Growth Mail column, in which he uses market history to support the case for growth stocks. For the previous 20-years before joining Navellier, he was Senior Executive Editor at InvestorPlace Media (formerly Phillips Publishing), where he worked with several leading investment analysts, including Louis Navellier (since 1997), helping launch Louis Navellier’s Blue Chip Growth and Global Growth newsletters.

Prior to that, Gary edited Wealth Magazine and Gold Newsletter and wrote various investment research reports for Jefferson Financial in New Orleans in the 1980s. He began his financial newsletter career with KCI Communications in 1980, where he served as consulting editor for Personal Finance newsletter while serving as general manager of KCI’s Alexandria House book division. Before that, he covered the economics beat for news magazines. All content of “Growth Mail” represents the opinion of Gary Alexander

Important Disclosures:

Although information in these reports has been obtained from and is based upon sources that Navellier believes to be reliable, Navellier does not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute Navellier’s judgment as of the date the report was created and are subject to change without notice. These reports are for informational purposes only and are not a solicitation for the purchase or sale of a security. Any decision to purchase securities mentioned in these reports must take into account existing public information on such securities or any registered prospectus.To the extent permitted by law, neither Navellier & Associates, Inc., nor any of its affiliates, agents, or service providers assumes any liability or responsibility nor owes any duty of care for any consequences of any person acting or refraining to act in reliance on the information contained in this communication or for any decision based on it.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any securities recommendations made by Navellier. in the future will be profitable or equal the performance of securities made in this report. Dividend payments are not guaranteed. The amount of a dividend payment, if any, can vary over time and issuers may reduce dividends paid on securities in the event of a recession or adverse event affecting a specific industry or issuer.

None of the stock information, data, and company information presented herein constitutes a recommendation by Navellier or a solicitation to buy or sell any securities. Any specific securities identified and described do not represent all of the securities purchased, sold, or recommended for advisory clients. The holdings identified do not represent all of the securities purchased, sold, or recommended for advisory clients and the reader should not assume that investments in the securities identified and discussed were or will be profitable.

Information presented is general information that does not take into account your individual circumstances, financial situation, or needs, nor does it present a personalized recommendation to you. Individual stocks presented may not be suitable for every investor. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. Investment in fixed income securities has the potential for the investment return and principal value of an investment to fluctuate so that an investor’s holdings, when redeemed, may be worth less than their original cost.

One cannot invest directly in an index. Index is unmanaged and index performance does not reflect deduction of fees, expenses, or taxes. Presentation of Index data does not reflect a belief by Navellier that any stock index constitutes an investment alternative to any Navellier equity strategy or is necessarily comparable to such strategies. Among the most important differences between the Indices and Navellier strategies are that the Navellier equity strategies may (1) incur material management fees, (2) concentrate its investments in relatively few stocks, industries, or sectors, (3) have significantly greater trading activity and related costs, and (4) be significantly more or less volatile than the Indices.

ETF Risk: We may invest in exchange traded funds (“ETFs”) and some of our investment strategies are generally fully invested in ETFs. Like traditional mutual funds, ETFs charge asset-based fees, but they generally do not charge initial sales charges or redemption fees and investors typically pay only customary brokerage fees to buy and sell ETF shares. The fees and costs charged by ETFs held in client accounts will not be deducted from the compensation the client pays Navellier. ETF prices can fluctuate up or down, and a client account could lose money investing in an ETF if the prices of the securities owned by the ETF go down. ETFs are subject to additional risks:

- ETF shares may trade above or below their net asset value;

- An active trading market for an ETF’s shares may not develop or be maintained;

- The value of an ETF may be more volatile than the underlying portfolio of securities the ETF is designed to track;

- The cost of owning shares of the ETF may exceed those a client would incur by directly investing in the underlying securities; and

- Trading of an ETF’s shares may be halted if the listing exchange’s officials deem it appropriate, the shares are delisted from the exchange, or the activation of market-wide “circuit breakers” (which are tied to large decreases in stock prices) halts stock trading generally.

Grader Disclosures: Investment in equity strategies involves substantial risk and has the potential for partial or complete loss of funds invested. The sample portfolio and any accompanying charts are for informational purposes only and are not to be construed as a solicitation to buy or sell any financial instrument and should not be relied upon as the sole factor in an investment making decision. As a matter of normal and important disclosures to you, as a potential investor, please consider the following: The performance presented is not based on any actual securities trading, portfolio, or accounts, and the reported performance of the A, B, C, D, and F portfolios (collectively the “model portfolios”) should be considered mere “paper” or pro forma performance results based on Navellier’s research.

Investors evaluating any of Navellier & Associates, Inc.’s, (or its affiliates’) Investment Products must not use any information presented here, including the performance figures of the model portfolios, in their evaluation of any Navellier Investment Products. Navellier Investment Products include the firm’s mutual funds and managed accounts. The model portfolios, charts, and other information presented do not represent actual funded trades and are not actual funded portfolios. There are material differences between Navellier Investment Products’ portfolios and the model portfolios, research, and performance figures presented here. The model portfolios and the research results (1) may contain stocks or ETFs that are illiquid and difficult to trade; (2) may contain stock or ETF holdings materially different from actual funded Navellier Investment Product portfolios; (3) include the reinvestment of all dividends and other earnings, estimated trading costs, commissions, or management fees; and, (4) may not reflect prices obtained in an actual funded Navellier Investment Product portfolio. For these and other reasons, the reported performances of model portfolios do not reflect the performance results of Navellier’s actually funded and traded Investment Products. In most cases, Navellier’s Investment Products have materially lower performance results than the performances of the model portfolios presented.

This report contains statements that are, or may be considered to be, forward-looking statements. All statements that are not historical facts, including statements about our beliefs or expectations, are “forward-looking statements” within the meaning of The U.S. Private Securities Litigation Reform Act of 1995. These statements may be identified by such forward-looking terminology as “expect,” “estimate,” “plan,” “intend,” “believe,” “anticipate,” “may,” “will,” “should,” “could,” “continue,” “project,” or similar statements or variations of such terms. Our forward-looking statements are based on a series of expectations, assumptions, and projections, are not guarantees of future results or performance, and involve substantial risks and uncertainty as described in Form ADV Part 2A of our filing with the Securities and Exchange Commission (SEC), which is available at www.adviserinfo.sec.gov or by requesting a copy by emailing info@navellier.com. All of our forward-looking statements are as of the date of this report only. We can give no assurance that such expectations or forward-looking statements will prove to be correct. Actual results may differ materially. You are urged to carefully consider all such factors.

FEDERAL TAX ADVICE DISCLAIMER: As required by U.S. Treasury Regulations, you are informed that, to the extent this presentation includes any federal tax advice, the presentation is not written by Navellier to be used, and cannot be used, for the purpose of avoiding federal tax penalties. Navellier does not advise on any income tax requirements or issues. Use of any information presented by Navellier is for general information only and does not represent tax advice either express or implied. You are encouraged to seek professional tax advice for income tax questions and assistance.

IMPORTANT NEWSLETTER DISCLOSURE:The hypothetical performance results for investment newsletters that are authored or edited by Louis Navellier, including Louis Navellier’s Growth Investor, Louis Navellier’s Breakthrough Stocks, Louis Navellier’s Accelerated Profits, and Louis Navellier’s Platinum Club, are not based on any actual securities trading, portfolio, or accounts, and the newsletters’ reported hypothetical performances should be considered mere “paper” or proforma hypothetical performance results and are not actual performance of real world trades. Navellier & Associates, Inc. does not have any relation to or affiliation with the owner of these newsletters. There are material differences between Navellier Investment Products’ portfolios and the InvestorPlace Media, LLC newsletter portfolios authored by Louis Navellier. The InvestorPlace Media, LLC newsletters contain hypothetical performance that do not include transaction costs, advisory fees, or other fees a client might incur if actual investments and trades were being made by an investor. As a result, newsletter performance should not be used to evaluate Navellier Investment services which are separate and different from the newsletters. The owner of the newsletters is InvestorPlace Media, LLC and any questions concerning the newsletters, including any newsletter advertising or hypothetical Newsletter performance claims, (which are calculated solely by Investor Place Media and not Navellier) should be referred to InvestorPlace Media, LLC at (800) 718-8289.

Please note that Navellier & Associates and the Navellier Private Client Group are managed completely independent of the newsletters owned and published by InvestorPlace Media, LLC and written and edited by Louis Navellier, and investment performance of the newsletters should in no way be considered indicative of potential future investment performance for any Navellier & Associates separately managed account portfolio. Potential investors should consult with their financial advisor before investing in any Navellier Investment Product.

Navellier claims compliance with Global Investment Performance Standards (GIPS). To receive a complete list and descriptions of Navellier’s composites and/or a presentation that adheres to the GIPS standards, please contact Navellier or click here. It should not be assumed that any securities recommendations made by Navellier & Associates, Inc. in the future will be profitable or equal the performance of securities made in this report.

FactSet Disclosure: Navellier does not independently calculate the statistical information included in the attached report. The calculation and the information are provided by FactSet, a company not related to Navellier. Although information contained in the report has been obtained from FactSet and is based on sources Navellier believes to be reliable, Navellier does not guarantee its accuracy, and it may be incomplete or condensed. The report and the related FactSet sourced information are provided on an “as is” basis. The user assumes the entire risk of any use made of this information. Investors should consider the report as only a single factor in making their investment decision. The report is for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of a security. FactSet sourced information is the exclusive property of FactSet. Without prior written permission of FactSet, this information may not be reproduced, disseminated or used to create any financial products. All indices are unmanaged and performance of the indices include reinvestment of dividends and interest income, unless otherwise noted, are not illustrative of any particular investment and an investment cannot be made in any index. Past performance is no guarantee of future results.