by Bryan Perry

January 6, 2026

For a little background, I started working as a rookie broker at Smith Barney in a bull-market, in 1984, when our advertising slogan was: “We make money the old-fashioned way, we earn it.” Many readers and investors that we serve remember that famous tag line, uttered by actor John Houseman, and having spent time in that firm, it was truly a roll-up-shirtsleeves atmosphere that demanded hard work and long hours.

Guess what? It still does. Nothing has changed about staying ahead of the “crowd sentiment” and trying to time when to step on the gas with investor capital – or hit the brakes because few key advisors see a correction as a forthcoming risk. As we enter 2026, it seems as if everyone is “all in” for a fourth-year of solidly bullish gains for stocks.

All the catalysts seem to be in place. In 2026, many Americans will see lower taxes and higher refunds due to the One Big Beautiful Bill Act (OBBBA). This legislation, passed last July, made the once-temporary 2017 Trump tax cuts permanent and introduced several new targeted deductions.

On-shoring also gets a lot of attention. In 2026, the revenue impact of re-shoring is a “push and pull” between the money coming in from new domestic activity and tax breaks used to lure those companies back, but the government is essentially betting that the hundreds of billions earned from tariffs and new payroll taxes will eventually outweigh the trillions in tax-cuts for moving factories back to U.S. soil.

The world is also awash in crude oil, and the U.S. is the largest producer of natural gas, which is the primary source of supply for the expansion of the electric grid, and to meet the insatiable demand for AI data-center operations. This electrical supply and demand equation runs the risk of being a boogie man if all these data-centers are built without the electrical power for running them. Currently, the market trusts in the ability of those building out the grid to meet that demand. It is a tall order – for a regulated business.

On the geopolitical front, let’s be honest – and this is a hard reality – Wall Street does not care about Russia, Ukraine, Venezuela, a potential breakdown of the EU, rising protests in Iran, or any global threat, other than the potential takeover of Taiwan by China. The U.S. drives the global bus – accounting for 30% of total global GDP, so as long as the U.S. economy is performing well, and it most certainly is, nothing much else matters when it comes to stock market gains – as long as sales and earnings are rising.

I, too, am optimistic about another up year for equities. The S&P is trading at a top-heavy P/E ratio due to magnificent growth from the AI trade. And, based on capex projections, there is more upside potential.

The AI trade is moving from the $20 to $30 per-month user Large Language Model (LLM) to the “Agentic AI” phase, where monumental corporate changeovers in productivity will be charged “by the task.” We are entering the next phase, or the fourth inning of the AI disruptive transformational ball game. And this is where gigantic capex investments are likely to pay-off, and I believe they will. So, with everyone reading the same sheet of music, where is the potential trip wire for the market’s bullish inertia?

Unfortunately, there remains a “bull in the China shop” at the long end of the yield curve – something the Fed has no control over, unless they actually buy 10, 20 and 30-year bonds “as if there is no tomorrow.”

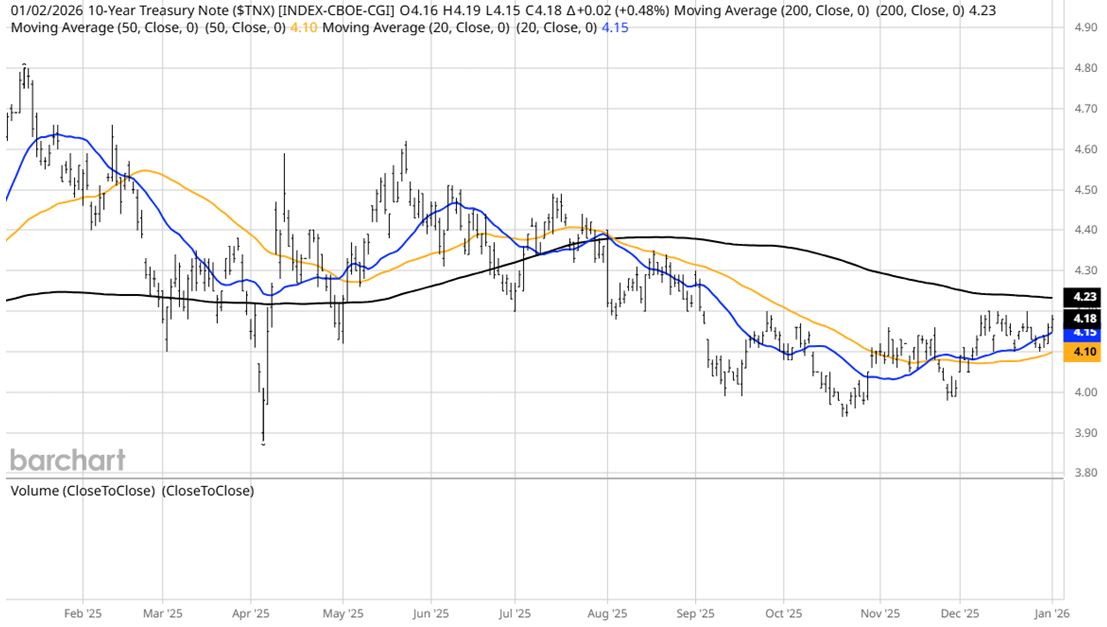

As 2026 gets under way, the long end of the yield curve (specifically, 10-year and 30-year Treasury yields) has become the ultimate “pain trade,” because it is moving in the opposite direction of what the stock market needs to see in order to sustain its current high valuations. As we start the new year, we are seeing a bearish steepening scenario in which the Federal Reserve is cutting short-term rates to support the economy while long-term rates are actually rising due to inflation and debt concerns.

The stock market is currently trading at an elevated forward P/E ratio (of approximately 21-to-1). To justify such valuations, investors need the discount rate to stay low. When the 10-year yield rises, the present value of future corporate earnings drops. In early 2026, the 10-year yield is hovering near 4.2%, with technical analysts warning that a break above this level could target 4.5% to 4.8%. If that happens, stock multiples would almost certainly contract, leading to a valuation reset even if earnings remain good.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

For the housing market to reset to where most Americans can actually afford a home, both mortgage rates and prices must come down from their post-Covid elevated levels. America needs way more low-priced housing, lower mortgage rates and more regulation of what percentage of homes corporations can own.

Corporate housing ownership within suburbs destroys any sense of community, so it would help if the government capped how much private equity could corner neighborhoods, pricing most out of the market.

To be fair, 30‑year fixed mortgage rates are not priced off the 30‑year Treasury rate. Instead, they are primarily bench-marked to the 10‑year U.S. Treasury yield, even though the mortgage itself is usually a 30‑year product. Because the average life of a 30‑year mortgage is just 7 to 10-years, due to refinancing, moving, or selling, lenders hedge the price risk based on the 10‑year duration, not the full 30-years.

This “pain trade” is about managing the long end of the yield curve. To address the federal debt in 2026, President Trump and Treasury Secretary Scott Bessent are moving away from traditional austerity in favor of a strategy known as the “3-3-3 Rule.” This plan is modeled after Japan’s ‘Three Arrows of Abenomics’ and relies on the idea that the U.S. can grow its way out of debt by boosting GDP growth.

Secretary Bessent’s primary fiscal anchor is a specific set of targets to be achieved by the end of 2028:

- Consistent 3% GDP Growth through deregulation and tax incentives in the Big Beautiful Bill.

- 3% Budget Deficit: Cutting the annual deficit from its current level of approximately 6% of GDP.

- 3 Million More Barrels of oil equivalents per day to lower energy costs and drive industrial revenue.

Another cornerstone of the Bessent plan is to slash the $38-trillion federal debt by the use of tariffs as a primary revenue generator rather than just a trade tool. The administration expects tariffs to generate $2 to $3-trillion over the next decade. In the first two-months of Fiscal Year 2026 alone (that’s October and November 2025), customs duties surged by 287% ($48-billion) due to the new universal baseline tariffs.

As a former hedge fund manager, Bessent is focused on the interest expense of the debt, which is now one of the largest items in the federal budget. As Treasury Secretary, Bessent has said, his job is to be the “nation’s top bond salesman.” By providing forward guidance on deficit reduction, he aims to keep the 10-year Treasury yield low. If the administration can lower the average interest rate the U.S. pays on its debt by even 0.5%, it saves hundreds of billions of dollars in annual outlays without cutting any program.

The success of this plan hinges on whether the 3% growth and tariff revenue materialize fast enough to outpace the interest on the existing $38-trillion in debt. Critics argue that the tax-cuts may add to the debt in the short-term, while the administration maintains that the “refund shock” of early 2026 will jump-start the economy into self-sustaining surplus territory by 2030. For now, the market wants to believe this.

All content above represents the opinion of Bryan Perry of Navellier & Associates, Inc.

Also In This Issue

A Look Ahead by Louis Navellier

Lower Threats of Prolonged Wars Will Be Bullish for the Stock Market

Income Mail by Bryan Perry

Identifying the “Pain Trade” for Early 2026

Growth Mail by Gary Alexander

The First Quarter of the 21st Century – in Review

Global Mail by Ivan Martchev

Talking Markets with ChatGPT

Sector Spotlight by Jason Bodner

When Should a New Year Start – and Does it Matter?

View Full Archive

Read Past Issues Here

Bryan Perry

SENIOR DIRECTOR

Bryan Perry is a Senior Director with Navellier Private Client Group, advising and facilitating high net worth investors in the pursuit of their financial goals.

Bryan’s financial services career spanning the past three decades includes over 20-years of wealth management experience with Wall Street firms that include Bear Stearns, Lehman Brothers and Paine Webber, working with both retail and institutional clients. Bryan earned a B.A. in Political Science from Virginia Polytechnic Institute & State University and currently holds a Series 65 license. All content of “Income Mail” represents the opinion of Bryan Perry

Important Disclosures:

Although information in these reports has been obtained from and is based upon sources that Navellier believes to be reliable, Navellier does not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute Navellier’s judgment as of the date the report was created and are subject to change without notice. These reports are for informational purposes only and are not a solicitation for the purchase or sale of a security. Any decision to purchase securities mentioned in these reports must take into account existing public information on such securities or any registered prospectus.To the extent permitted by law, neither Navellier & Associates, Inc., nor any of its affiliates, agents, or service providers assumes any liability or responsibility nor owes any duty of care for any consequences of any person acting or refraining to act in reliance on the information contained in this communication or for any decision based on it.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any securities recommendations made by Navellier. in the future will be profitable or equal the performance of securities made in this report. Dividend payments are not guaranteed. The amount of a dividend payment, if any, can vary over time and issuers may reduce dividends paid on securities in the event of a recession or adverse event affecting a specific industry or issuer.

None of the stock information, data, and company information presented herein constitutes a recommendation by Navellier or a solicitation to buy or sell any securities. Any specific securities identified and described do not represent all of the securities purchased, sold, or recommended for advisory clients. The holdings identified do not represent all of the securities purchased, sold, or recommended for advisory clients and the reader should not assume that investments in the securities identified and discussed were or will be profitable.

Information presented is general information that does not take into account your individual circumstances, financial situation, or needs, nor does it present a personalized recommendation to you. Individual stocks presented may not be suitable for every investor. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. Investment in fixed income securities has the potential for the investment return and principal value of an investment to fluctuate so that an investor’s holdings, when redeemed, may be worth less than their original cost.

One cannot invest directly in an index. Index is unmanaged and index performance does not reflect deduction of fees, expenses, or taxes. Presentation of Index data does not reflect a belief by Navellier that any stock index constitutes an investment alternative to any Navellier equity strategy or is necessarily comparable to such strategies. Among the most important differences between the Indices and Navellier strategies are that the Navellier equity strategies may (1) incur material management fees, (2) concentrate its investments in relatively few stocks, industries, or sectors, (3) have significantly greater trading activity and related costs, and (4) be significantly more or less volatile than the Indices.

ETF Risk: We may invest in exchange traded funds (“ETFs”) and some of our investment strategies are generally fully invested in ETFs. Like traditional mutual funds, ETFs charge asset-based fees, but they generally do not charge initial sales charges or redemption fees and investors typically pay only customary brokerage fees to buy and sell ETF shares. The fees and costs charged by ETFs held in client accounts will not be deducted from the compensation the client pays Navellier. ETF prices can fluctuate up or down, and a client account could lose money investing in an ETF if the prices of the securities owned by the ETF go down. ETFs are subject to additional risks:

- ETF shares may trade above or below their net asset value;

- An active trading market for an ETF’s shares may not develop or be maintained;

- The value of an ETF may be more volatile than the underlying portfolio of securities the ETF is designed to track;

- The cost of owning shares of the ETF may exceed those a client would incur by directly investing in the underlying securities; and

- Trading of an ETF’s shares may be halted if the listing exchange’s officials deem it appropriate, the shares are delisted from the exchange, or the activation of market-wide “circuit breakers” (which are tied to large decreases in stock prices) halts stock trading generally.

Grader Disclosures: Investment in equity strategies involves substantial risk and has the potential for partial or complete loss of funds invested. The sample portfolio and any accompanying charts are for informational purposes only and are not to be construed as a solicitation to buy or sell any financial instrument and should not be relied upon as the sole factor in an investment making decision. As a matter of normal and important disclosures to you, as a potential investor, please consider the following: The performance presented is not based on any actual securities trading, portfolio, or accounts, and the reported performance of the A, B, C, D, and F portfolios (collectively the “model portfolios”) should be considered mere “paper” or pro forma performance results based on Navellier’s research.

Investors evaluating any of Navellier & Associates, Inc.’s, (or its affiliates’) Investment Products must not use any information presented here, including the performance figures of the model portfolios, in their evaluation of any Navellier Investment Products. Navellier Investment Products include the firm’s mutual funds and managed accounts. The model portfolios, charts, and other information presented do not represent actual funded trades and are not actual funded portfolios. There are material differences between Navellier Investment Products’ portfolios and the model portfolios, research, and performance figures presented here. The model portfolios and the research results (1) may contain stocks or ETFs that are illiquid and difficult to trade; (2) may contain stock or ETF holdings materially different from actual funded Navellier Investment Product portfolios; (3) include the reinvestment of all dividends and other earnings, estimated trading costs, commissions, or management fees; and, (4) may not reflect prices obtained in an actual funded Navellier Investment Product portfolio. For these and other reasons, the reported performances of model portfolios do not reflect the performance results of Navellier’s actually funded and traded Investment Products. In most cases, Navellier’s Investment Products have materially lower performance results than the performances of the model portfolios presented.

This report contains statements that are, or may be considered to be, forward-looking statements. All statements that are not historical facts, including statements about our beliefs or expectations, are “forward-looking statements” within the meaning of The U.S. Private Securities Litigation Reform Act of 1995. These statements may be identified by such forward-looking terminology as “expect,” “estimate,” “plan,” “intend,” “believe,” “anticipate,” “may,” “will,” “should,” “could,” “continue,” “project,” or similar statements or variations of such terms. Our forward-looking statements are based on a series of expectations, assumptions, and projections, are not guarantees of future results or performance, and involve substantial risks and uncertainty as described in Form ADV Part 2A of our filing with the Securities and Exchange Commission (SEC), which is available at www.adviserinfo.sec.gov or by requesting a copy by emailing info@navellier.com. All of our forward-looking statements are as of the date of this report only. We can give no assurance that such expectations or forward-looking statements will prove to be correct. Actual results may differ materially. You are urged to carefully consider all such factors.

FEDERAL TAX ADVICE DISCLAIMER: As required by U.S. Treasury Regulations, you are informed that, to the extent this presentation includes any federal tax advice, the presentation is not written by Navellier to be used, and cannot be used, for the purpose of avoiding federal tax penalties. Navellier does not advise on any income tax requirements or issues. Use of any information presented by Navellier is for general information only and does not represent tax advice either express or implied. You are encouraged to seek professional tax advice for income tax questions and assistance.

IMPORTANT NEWSLETTER DISCLOSURE:The hypothetical performance results for investment newsletters that are authored or edited by Louis Navellier, including Louis Navellier’s Growth Investor, Louis Navellier’s Breakthrough Stocks, Louis Navellier’s Accelerated Profits, and Louis Navellier’s Platinum Club, are not based on any actual securities trading, portfolio, or accounts, and the newsletters’ reported hypothetical performances should be considered mere “paper” or proforma hypothetical performance results and are not actual performance of real world trades. Navellier & Associates, Inc. does not have any relation to or affiliation with the owner of these newsletters. There are material differences between Navellier Investment Products’ portfolios and the InvestorPlace Media, LLC newsletter portfolios authored by Louis Navellier. The InvestorPlace Media, LLC newsletters contain hypothetical performance that do not include transaction costs, advisory fees, or other fees a client might incur if actual investments and trades were being made by an investor. As a result, newsletter performance should not be used to evaluate Navellier Investment services which are separate and different from the newsletters. The owner of the newsletters is InvestorPlace Media, LLC and any questions concerning the newsletters, including any newsletter advertising or hypothetical Newsletter performance claims, (which are calculated solely by Investor Place Media and not Navellier) should be referred to InvestorPlace Media, LLC at (800) 718-8289.

Please note that Navellier & Associates and the Navellier Private Client Group are managed completely independent of the newsletters owned and published by InvestorPlace Media, LLC and written and edited by Louis Navellier, and investment performance of the newsletters should in no way be considered indicative of potential future investment performance for any Navellier & Associates separately managed account portfolio. Potential investors should consult with their financial advisor before investing in any Navellier Investment Product.

Navellier claims compliance with Global Investment Performance Standards (GIPS). To receive a complete list and descriptions of Navellier’s composites and/or a presentation that adheres to the GIPS standards, please contact Navellier or click here. It should not be assumed that any securities recommendations made by Navellier & Associates, Inc. in the future will be profitable or equal the performance of securities made in this report.

FactSet Disclosure: Navellier does not independently calculate the statistical information included in the attached report. The calculation and the information are provided by FactSet, a company not related to Navellier. Although information contained in the report has been obtained from FactSet and is based on sources Navellier believes to be reliable, Navellier does not guarantee its accuracy, and it may be incomplete or condensed. The report and the related FactSet sourced information are provided on an “as is” basis. The user assumes the entire risk of any use made of this information. Investors should consider the report as only a single factor in making their investment decision. The report is for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of a security. FactSet sourced information is the exclusive property of FactSet. Without prior written permission of FactSet, this information may not be reproduced, disseminated or used to create any financial products. All indices are unmanaged and performance of the indices include reinvestment of dividends and interest income, unless otherwise noted, are not illustrative of any particular investment and an investment cannot be made in any index. Past performance is no guarantee of future results.