by Gary Alexander

January 3, 2024

We now begin 2024, the key year of the decade – like 1924 was to the Roaring 20s – the year when Cal Coolidge was re-elected and the stock market began to roar – or 1974, the year President Nixon resigned, the stock market cratered, and we had simultaneous inflation and recession, dubbed “stagflation.”

Which model will we emulate? By the end of 2024, maybe by March 19, we’ll need to decide:According to the 2024 Presidential Primary Schedule, more than half of state primaries will be decided by March 19.

1924 Began to Roar When “Silent Cal” Won Big

It’s fitting that the 1920s began to roar in 1924, since the film giant Metro-Goldwyn-Mayer (MGM) was first formed on April 17, 1924, and they used a roaring lion as their symbol, even in the silent film era:

Business was already booming in 1924 under the “benign neglect” of Silent Calvin Coolidge, who gave business leeway to grow, through low tax rates and low regulation. You name it – movies, music, cars, radio, manufacturing, services, construction. All were booming. Here are three mid-1924 benchmarks:

- Radio: On June 10, 1924, the first radio broadcast of a political convention was aired, the Republican National convention in Cleveland. Radio exposure was growing exponentially in the 1920s: The number of radio stations rose from 30 in 1922, to 556 in 1923, to over 1,000 in 1924, while the number of home radio sets grew from only 5,000 in 1920 to five million by 1926.

- Cars: On June 14, 1924, the 10 millionth Ford Model T came off the assembly line, and Ford was adding three million new Tin Lizzies each year. The first Ford Model T came out in 1908, costing $850 and seating only two. By 1924, the price had dropped to $290, seating five in most models.

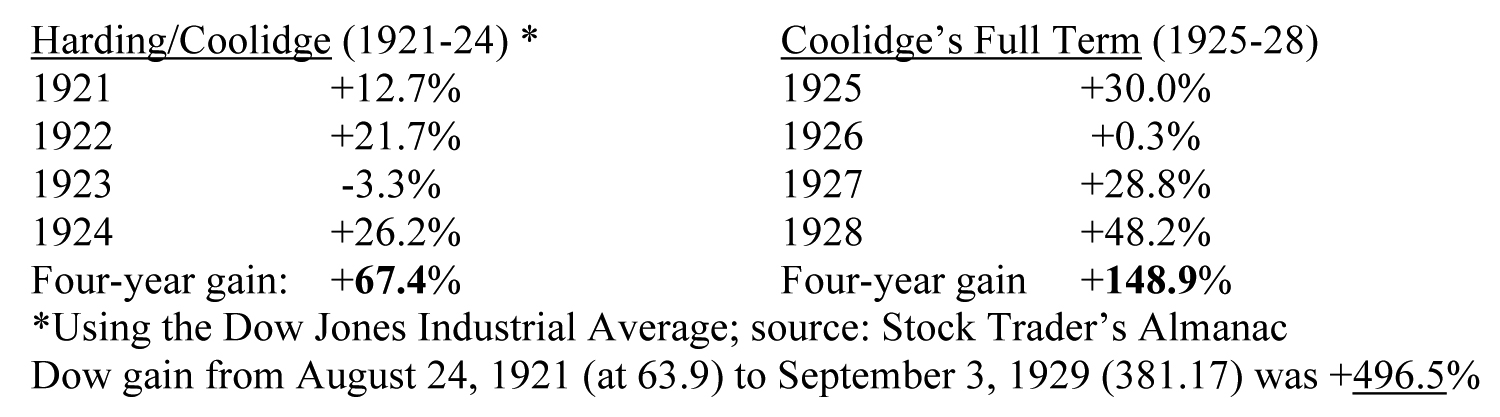

- Stocks: On July 26, 1924, the first “mutual fund” was invented. Mutual funds were one of the many popular by-products of the big bull market of the 1920s, when the Dow index rose by nearly 500%.

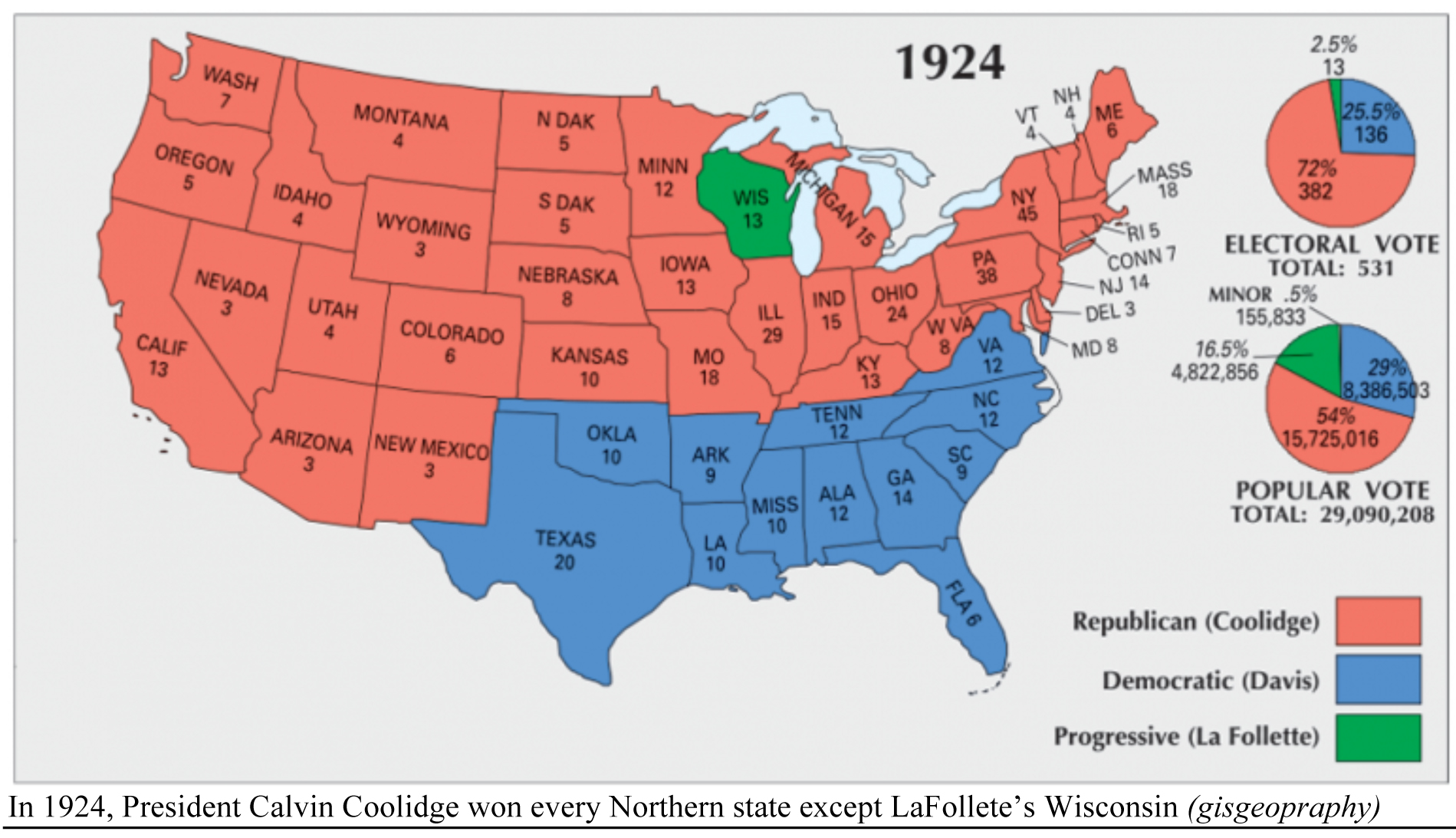

Shortly before the 1924 election, on October 23, the first radio network speech to the West Coast was broadcast on 23 large stations, a 45-minute talk by the supposedly “silent” Cal. Then, on November 4, Coolidge was re-elected with 54% of the vote in a six-man race. Democrat John Davis was next in votes (29%), Progressive Robert LaFollette got 16% and three others divided 1%. On the same day, Nellie Tayloe Ross and Miriam Ferguson became the first two female state governors (in Wyoming and Texas).

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

The stock market was already growing well between 1921 and 1924, but it took after Cal’s re-election:

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Now, here’s a mirror image from 50 years ago, when the Dow fell by 45% in a time of high inflation:

1974 – the Worst Market Year since the 1930s?

The worst bear market between the Great Depression of 1929-32 and the Great Financial Crisis of 2007-09 took place in 1973-74, when the Dow declined over 45%, from 1051.7 on January 11, 1973, to its lowest reading of the last 60 years, 577.6 on December 6, 1974. Since those were two years of double-digit inflation, the “real” loss was closer to 60%. 1974 wasn’t a Presidential election year, but it was perhaps the most dramatic political year of the decade – with the resignation of President Nixon and a Democratic landslide in November, gaining 43 House seats to reach a 291 to 144 majority (over 2-to-1). The Senate ratio was nearly as high, 61-37. Democrats also added four governorships, owning 36 of 50.

It took a series of huge blunders to cause Nixon’s abject political surrender and a year-end stock free-fall.

Maybe Nixon’s first mistake came on Day 1, when he signed a bill requiring all states (even Montana!) to “temporarily” lower their maximum speed limit to 55 miles per hour to increase fuel efficiency. Like our “transitory” inflation, that “temporary” ban lasted longer than expected, about 20 years. Two weeks later, Nixon’s team printed 4.8 billion gas-rationing coupons, costing $11 million, but they were never used.

That was all a silly side show, like Ford’s “WIN” buttons (below). The real problem was inflation amid stagnation, while most politicians and our Fed Chair (Arthur Burns) seemed clueless to solve either one.

The sickness was global. On January 7, the Japanese yen was devalued by 6.7%. The IMF called an emergency meeting in Rome to fight inflation, but the conference quickly broke up amid widespread dissension. The next day, the Department of Labor reported that wholesale prices (now called producer prices) had risen by 18.2% in 1973. In the next three days, the Dow fell 6.5% from 880 to 823.

Amid this global crisis, on January 18-20, 1974, the first gold-oriented investment conference opened in New Orleans under the sponsorship of the late Jim Blanchard. (Bunker Hunt attended that seminar, where he hatched his idea of cornering the silver market, though his plan took six years to reach fruition.)

The world entered crisis mode by mid-year, when Bankhaus Herstatt, one of Germany’s largest private banks, collapsed on June 26, the first major bank failure since Western currencies began to float in 1973.

Then came the market’s worst quarter of the postwar era. The Dow fell from 806 on July 1 to 584 on October 4th (down 27.5% in a quarter, plus a few days). In the midst of that quarter, President Nixon resigned, 10 days after three articles of impeachment were voted against him by the House Judiciary Committee. The Dow dropped 48.4 points (-6%) that week. (Also in that week, on August 14, the U.S. Congress authorized U.S. citizens to own gold for the first time in 41 years, as of year-end 1974).

On September 8 (a Sunday), President Gerald Ford pardoned former president Nixon for any crimes he may have committed while in office. On the next Monday morning, the stock market continued its free-fall. In the next week (September 9-13), the Dow fell by over 50 points (7.5%), while the S&P fell 8.7%.

The economy was cratering: Auto sales were off 20%, housing starts were down 40%, and unemployment hit 7.2% by year’s end. Inflation reached double digits for the second year. On September 28, President Ford concluded an emergency two-day summit on how to fix inflation and recession. His answer was unveiled on October 6, when Ford urged everyone to wear “WIN” buttons (Whip Inflation Now), but inflation continued into the 1980s. From September 20 to October 4, 1974, the Dow fell 13%+, from 674 to 584. and on October 8, America suffered its worst bank failure to date, the Franklin National Bank.

The week of December 2-6 brought the stock market’s absolute bottom in the 1970s. On Monday, December 2, 1974, President Ford addressed the nation in a televised speech, in which he sounded the alarm for three major economic crises at once – inflation, recession and the oil shortage. The Dow fell 41 points (-6.6%), to 577.60 that week. But there was a sort of new birth just two weeks later.

On December 19, the PC revolution was begotten, if not born, when the Altair 8800, a do-it-yourself computer kit, went on sale for $397. It made cover of the January 1975 issue of Popular Electronics, where it caught the attention of a Harvard student, Bill Gates. He and his high school buddy Paul Allen realized that the Altair would need a programming language, so Gates and Allen dropped out of Harvard and went to Albuquerque to sell their operating system to Ed Roberts, founder of Altair’s maker, Micro Instrumentation and Telemetry Systems (MITS). To give it a name, Gates and Allen established Micro-Soft (later Microsoft), in Albuquerque. They later moved to Seattle, where the two went to high school.

Their little start-up is now the second largest corporation on the Big Board, valued at $2.8 trillion. In fact, today’s two largest (#1 near $3 trillion) stocks did not even exist in 1974, but they were born in 1975-76.

We need more business ideas and less government. Where is Calvin Coolidge when we need him most?

Navellier & Associates owns Ford Motor Co. (F), in managed accounts. Gary Alexander does not own Ford Motor Co. (F) personally.

All content above represents the opinion of Gary Alexander of Navellier & Associates, Inc.

Also In This Issue

A Look Ahead by Louis Navellier

Will Guyana Become Britain’s Next “Falklands War”?

Income Mail by Bryan Perry

Rising Debt is Weighing Down King Dollar’s Reign

Growth Mail by Gary Alexander

It’s Decision Time: Roaring ‘20s or Stagnant ‘70s?

Global Mail by Ivan Martchev

Emerging Markets are Overdue to Outperform

Sector Spotlight by Jason Bodner

Comparing Rapid Recoveries: Late 2023 vs. Mid-2020

View Full Archive

Read Past Issues Here

About The Author

Gary Alexander

SENIOR EDITOR

Gary Alexander has been Senior Writer at Navellier since 2009. He edits Navellier’s weekly Marketmail and writes a weekly Growth Mail column, in which he uses market history to support the case for growth stocks. For the previous 20 years before joining Navellier, he was Senior Executive Editor at InvestorPlace Media (formerly Phillips Publishing), where he worked with several leading investment analysts, including Louis Navellier (since 1997), helping launch Louis Navellier’s Blue Chip Growth and Global Growth newsletters.

Prior to that, Gary edited Wealth Magazine and Gold Newsletter and wrote various investment research reports for Jefferson Financial in New Orleans in the 1980s. He began his financial newsletter career with KCI Communications in 1980, where he served as consulting editor for Personal Finance newsletter while serving as general manager of KCI’s Alexandria House book division. Before that, he covered the economics beat for news magazines. All content of “Growth Mail” represents the opinion of Gary Alexander

Important Disclosures:

Although information in these reports has been obtained from and is based upon sources that Navellier believes to be reliable, Navellier does not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute Navellier’s judgment as of the date the report was created and are subject to change without notice. These reports are for informational purposes only and are not a solicitation for the purchase or sale of a security. Any decision to purchase securities mentioned in these reports must take into account existing public information on such securities or any registered prospectus.To the extent permitted by law, neither Navellier & Associates, Inc., nor any of its affiliates, agents, or service providers assumes any liability or responsibility nor owes any duty of care for any consequences of any person acting or refraining to act in reliance on the information contained in this communication or for any decision based on it.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any securities recommendations made by Navellier. in the future will be profitable or equal the performance of securities made in this report. Dividend payments are not guaranteed. The amount of a dividend payment, if any, can vary over time and issuers may reduce dividends paid on securities in the event of a recession or adverse event affecting a specific industry or issuer.

None of the stock information, data, and company information presented herein constitutes a recommendation by Navellier or a solicitation to buy or sell any securities. Any specific securities identified and described do not represent all of the securities purchased, sold, or recommended for advisory clients. The holdings identified do not represent all of the securities purchased, sold, or recommended for advisory clients and the reader should not assume that investments in the securities identified and discussed were or will be profitable.

Information presented is general information that does not take into account your individual circumstances, financial situation, or needs, nor does it present a personalized recommendation to you. Individual stocks presented may not be suitable for every investor. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. Investment in fixed income securities has the potential for the investment return and principal value of an investment to fluctuate so that an investor’s holdings, when redeemed, may be worth less than their original cost.

One cannot invest directly in an index. Index is unmanaged and index performance does not reflect deduction of fees, expenses, or taxes. Presentation of Index data does not reflect a belief by Navellier that any stock index constitutes an investment alternative to any Navellier equity strategy or is necessarily comparable to such strategies. Among the most important differences between the Indices and Navellier strategies are that the Navellier equity strategies may (1) incur material management fees, (2) concentrate its investments in relatively few stocks, industries, or sectors, (3) have significantly greater trading activity and related costs, and (4) be significantly more or less volatile than the Indices.

ETF Risk: We may invest in exchange traded funds (“ETFs”) and some of our investment strategies are generally fully invested in ETFs. Like traditional mutual funds, ETFs charge asset-based fees, but they generally do not charge initial sales charges or redemption fees and investors typically pay only customary brokerage fees to buy and sell ETF shares. The fees and costs charged by ETFs held in client accounts will not be deducted from the compensation the client pays Navellier. ETF prices can fluctuate up or down, and a client account could lose money investing in an ETF if the prices of the securities owned by the ETF go down. ETFs are subject to additional risks:

- ETF shares may trade above or below their net asset value;

- An active trading market for an ETF’s shares may not develop or be maintained;

- The value of an ETF may be more volatile than the underlying portfolio of securities the ETF is designed to track;

- The cost of owning shares of the ETF may exceed those a client would incur by directly investing in the underlying securities; and

- Trading of an ETF’s shares may be halted if the listing exchange’s officials deem it appropriate, the shares are delisted from the exchange, or the activation of market-wide “circuit breakers” (which are tied to large decreases in stock prices) halts stock trading generally.

Grader Disclosures: Investment in equity strategies involves substantial risk and has the potential for partial or complete loss of funds invested. The sample portfolio and any accompanying charts are for informational purposes only and are not to be construed as a solicitation to buy or sell any financial instrument and should not be relied upon as the sole factor in an investment making decision. As a matter of normal and important disclosures to you, as a potential investor, please consider the following: The performance presented is not based on any actual securities trading, portfolio, or accounts, and the reported performance of the A, B, C, D, and F portfolios (collectively the “model portfolios”) should be considered mere “paper” or pro forma performance results based on Navellier’s research.

Investors evaluating any of Navellier & Associates, Inc.’s, (or its affiliates’) Investment Products must not use any information presented here, including the performance figures of the model portfolios, in their evaluation of any Navellier Investment Products. Navellier Investment Products include the firm’s mutual funds and managed accounts. The model portfolios, charts, and other information presented do not represent actual funded trades and are not actual funded portfolios. There are material differences between Navellier Investment Products’ portfolios and the model portfolios, research, and performance figures presented here. The model portfolios and the research results (1) may contain stocks or ETFs that are illiquid and difficult to trade; (2) may contain stock or ETF holdings materially different from actual funded Navellier Investment Product portfolios; (3) include the reinvestment of all dividends and other earnings, estimated trading costs, commissions, or management fees; and, (4) may not reflect prices obtained in an actual funded Navellier Investment Product portfolio. For these and other reasons, the reported performances of model portfolios do not reflect the performance results of Navellier’s actually funded and traded Investment Products. In most cases, Navellier’s Investment Products have materially lower performance results than the performances of the model portfolios presented.

This report contains statements that are, or may be considered to be, forward-looking statements. All statements that are not historical facts, including statements about our beliefs or expectations, are “forward-looking statements” within the meaning of The U.S. Private Securities Litigation Reform Act of 1995. These statements may be identified by such forward-looking terminology as “expect,” “estimate,” “plan,” “intend,” “believe,” “anticipate,” “may,” “will,” “should,” “could,” “continue,” “project,” or similar statements or variations of such terms. Our forward-looking statements are based on a series of expectations, assumptions, and projections, are not guarantees of future results or performance, and involve substantial risks and uncertainty as described in Form ADV Part 2A of our filing with the Securities and Exchange Commission (SEC), which is available at www.adviserinfo.sec.gov or by requesting a copy by emailing info@navellier.com. All of our forward-looking statements are as of the date of this report only. We can give no assurance that such expectations or forward-looking statements will prove to be correct. Actual results may differ materially. You are urged to carefully consider all such factors.

FEDERAL TAX ADVICE DISCLAIMER: As required by U.S. Treasury Regulations, you are informed that, to the extent this presentation includes any federal tax advice, the presentation is not written by Navellier to be used, and cannot be used, for the purpose of avoiding federal tax penalties. Navellier does not advise on any income tax requirements or issues. Use of any information presented by Navellier is for general information only and does not represent tax advice either express or implied. You are encouraged to seek professional tax advice for income tax questions and assistance.

IMPORTANT NEWSLETTER DISCLOSURE:The hypothetical performance results for investment newsletters that are authored or edited by Louis Navellier, including Louis Navellier’s Growth Investor, Louis Navellier’s Breakthrough Stocks, Louis Navellier’s Accelerated Profits, and Louis Navellier’s Platinum Club, are not based on any actual securities trading, portfolio, or accounts, and the newsletters’ reported hypothetical performances should be considered mere “paper” or proforma hypothetical performance results and are not actual performance of real world trades. Navellier & Associates, Inc. does not have any relation to or affiliation with the owner of these newsletters. There are material differences between Navellier Investment Products’ portfolios and the InvestorPlace Media, LLC newsletter portfolios authored by Louis Navellier. The InvestorPlace Media, LLC newsletters contain hypothetical performance that do not include transaction costs, advisory fees, or other fees a client might incur if actual investments and trades were being made by an investor. As a result, newsletter performance should not be used to evaluate Navellier Investment services which are separate and different from the newsletters. The owner of the newsletters is InvestorPlace Media, LLC and any questions concerning the newsletters, including any newsletter advertising or hypothetical Newsletter performance claims, (which are calculated solely by Investor Place Media and not Navellier) should be referred to InvestorPlace Media, LLC at (800) 718-8289.

Please note that Navellier & Associates and the Navellier Private Client Group are managed completely independent of the newsletters owned and published by InvestorPlace Media, LLC and written and edited by Louis Navellier, and investment performance of the newsletters should in no way be considered indicative of potential future investment performance for any Navellier & Associates separately managed account portfolio. Potential investors should consult with their financial advisor before investing in any Navellier Investment Product.

Navellier claims compliance with Global Investment Performance Standards (GIPS). To receive a complete list and descriptions of Navellier’s composites and/or a presentation that adheres to the GIPS standards, please contact Navellier or click here. It should not be assumed that any securities recommendations made by Navellier & Associates, Inc. in the future will be profitable or equal the performance of securities made in this report.

FactSet Disclosure: Navellier does not independently calculate the statistical information included in the attached report. The calculation and the information are provided by FactSet, a company not related to Navellier. Although information contained in the report has been obtained from FactSet and is based on sources Navellier believes to be reliable, Navellier does not guarantee its accuracy, and it may be incomplete or condensed. The report and the related FactSet sourced information are provided on an “as is” basis. The user assumes the entire risk of any use made of this information. Investors should consider the report as only a single factor in making their investment decision. The report is for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of a security. FactSet sourced information is the exclusive property of FactSet. Without prior written permission of FactSet, this information may not be reproduced, disseminated or used to create any financial products. All indices are unmanaged and performance of the indices include reinvestment of dividends and interest income, unless otherwise noted, are not illustrative of any particular investment and an investment cannot be made in any index. Past performance is no guarantee of future results.