By Gary Alexander

May 16, 2023

Two weeks ago, I called the 20th century an era of Growth, and the 21st century an era of Debt, since over 80% of our national debt was added in the last 20 years, while our growth rate was cut in half. Now, the situation is about to worsen. In the short term, we face an 11th hour debt ceiling debate with little or no thought of long-term debt reduction or tending that abandoned orphan in this drama: Prosperity – Growth!

Looking at debt first, April is generally a big tax-income month due to the major April 15 tax deadline, but not this year. April 2023 saw the monthly budget surplus fall 73% from April 2022, according to The Wall Street Journal in an editorial (“Spending Soars, Revenue Falls”). The Journal added these details:

“The deficit for the first seven months [of FY’23] is already $928 billion, or 236% higher than in 2022 with timing adjustments. Keep in mind that this is happening when the economy is still growing, and the unemployment rate is still low. The big culprit is spending, which is up 12% in the first seven months, or nearly $400 billion…Entitlements are up 11% and education spending owing to student-loan changes is up 56% …. Interest on the national debt rose 40%, or $107 billion, and is already $374 billion for the first seven months” (Wall Street Journal, May 8, 2023).

Nobody likes to wade through 18 column inches (half a meter) of statistics, so I usually try to place these columns in a broader historical perspective. Today, this column happens to fall on the 272nd birthday of that vertically challenged (5’4”) but brilliant Virginia statesman, James Madison, who drafted that most brilliant compromise ever struck between freedom and order, The United States Constitution (1787).

Madison also had to fight for the Constitution’s ratification in The Federalist Papers, along with John Jay and Alexander Hamilton, in what amounted to 85 intelligent newspaper Op-Ed pieces within a 7-month window. In Article I, Madison defended giving primary authority to a bi-cameral Congress with limited enumerated duties. Then, in a shorter Article II, he assigned very few duties to the Chief Executive.

Section 1 of Article II is about the election process, and Section 4 covers impeachment. Just to show you how limited the President’s role is, his entire duties in Sections 2 and 3 can be summarized in 150 words:

Article II, Section 2: “The President shall be Commander in Chief of the Army and Navy of the United States…and he shall have Power to grant Reprieves and Pardons for Offences against the United States, except in Cases of Impeachment. He shall have Power, by and with the Advice and Consent of the Senate, to make Treaties, provided two thirds of the Senators present concur; and he shall nominate, and by and with the Advice and Consent of the Senate, shall appoint Ambassadors, other public Ministers …

Article II, Section 3: “He shall from time to time give to the Congress Information of the State of the Union, and recommend to their Consideration such Measures as he shall judge necessary and expedient; he may, on extraordinary Occasions, convene both Houses, or either of them, and … he shall take Care that the Laws be faithfully executed, and shall Commission all the Officers of the United States.”

That final and most time-consuming duty – executing the laws Congress passes – implies that Congress must pass those laws first. The President does not pass laws by Executive Order or any other shortcut or sly skullduggery. There’s nothing in Madison’s masterpiece authorizing about 95% of what most modern Presidents do, or about 98% of what President Biden is doing now, most notably the power to bypass the free choice of most citizens, corporations, and Congress by forcing the remaking of all automobiles within a decade, or outlawing fossil fuels and remaking all utilities – virtually killing the world’s growth engine.

Taking Over the Auto Industry and Utilities by Presidential Fiat

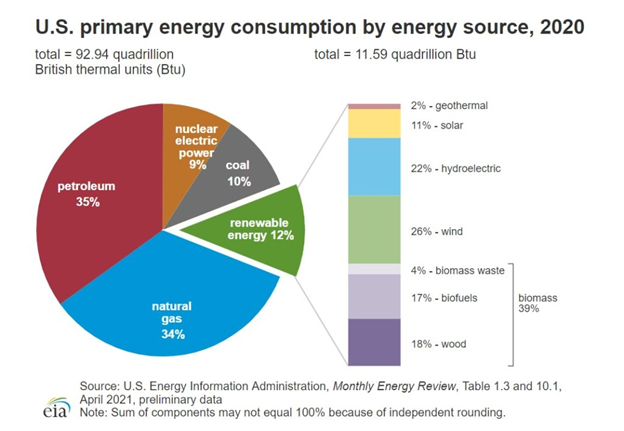

Last week, the Biden EPA unveiled a massive new rule book to mandate that most U.S. coal- and natural gas-fired power plants reduce their carbon dioxide emissions by 90% in the five years after 2035 or be closed by federal regulators. According to Energy Information Administration (EIA) data, this new rule would target 60% of all U.S. power plants. Congress was not consulted, as is required by Madison’s rule book. The dates may seem far away, but plants would need to retool very soon to meet these deadlines.

These transitions are very expensive, and likely would have little or no impact on the climate, yet they will likely result in the bankruptcy of some profitable (as well as many marginal) businesses. Politicians who make these decisions have seldom run a business and don’t understand cost tradeoffs. Maybe the Congress (Article I) or Supreme Court (Article III) or voters will veto these abuses of power before 2025.

You could argue that the omnibus “Inflation Reduction Act” gave the President scope to regulate fossil fuels, and the Supreme Court may decide that, years from now; but a cleaner way to draft laws is to simply outlaw the internal combustion engine or fossil fuels, if that is your intent, not use weasel words.

This nationalization of the automotive industry is something like what the totalitarians of Europe tried to do in the 1930s, and FDR tried to emulate with his National Industrial Recovery Act (NIRA) of 1933, struck down by the Supreme Court in 1935 when some Kosher butchers refused to put the NRA Eagle above their religious dietary codes (I simplify, but it’s not much different than today’s ban on gas stoves).

Whether or not climate change is an “existential crisis,” many scientists, engineers, and economists know of far better and sounder ways of getting from point “A” to point “B” than banning one form of energy and enforcing another by fiat and expensive mandates. In today’s world, reliance on electricity alone for all power in homes, vehicles, and power grids for our expanding array of electronics and power needs is a national security risk of immense proportions. Even today, our electricity grid cannot support our needs.

What about weather disruptions? Last week there was an earthquake that cut off power in San Francisco for large portions of the population. What if electricity is our ONLY source of power? What happens when an earthquake hits the Gulf of Mexico region, and millions are mandated to evacuate in hundreds of thousands of electric cars on stalled Interstate highways with no electric charging stations that work and cars with an effective six-hour charge? What happens on the West Coast when a quake in the Cascadia or San Andreas fault shuts off electricity for a week? Or in the East Coast in winter during an arctic blizzard storm when all electricity is cut off? Today, we have our automobiles, trains, and trucks to help those in need, to deliver food and supplies by gasoline-powered vehicles in a pinch. What will he have tomorrow?

The Costs of This Transition Will Be Astronomical –

Limiting Future Growth and Fueling Massive Debts

We can’t grow or profit when we force losses on major corporations. Ford is losing more than $66,000 on every EV unit sold, according to energy economist Robert Bryce, and GM is losing $58,000 per EV. The average income of an EV buyer is twice the national average, as EVs are currently mostly being bought by consumers who drive short distances, can charge them easily, and are wealthy enough to afford them; but a huge portion of America lives in rural states, subject to weather disruptions and heavy usage.

A second theme I have often covered here is – “Who will rule the 21st Century: China or the U.S.?” While the U.S. is incurring voluntary hamstring injuries to its biggest growth muscles, China has no conscience. Energy data organizations like Global Energy Monitor and the Centre for Research on Energy and Clean Air report that China has quadrupled the number of its new coal-powered plant approvals in 2022 vs. 2021, and “China has six times as many plants starting construction as the rest of the world combined.”

India and China, with 35% of the world’s population, have the dirtiest air and don’t seem to be doing much about it, making our Herculean efforts to clean up our already-clean air noble but pointless.

Heartland Institute President James Taylor reminded us: “This proposed rule would be the death knell of America’s global economic competitiveness and a dream come true for a hostile China …. We simply cannot remain globally competitive if we eliminate the utilization of America’s most affordable, reliable energy sources — which this regulation would do — while China, India, and most of the rest of the world wisely continue to power their economies on affordable coal and other conventional energy sources.”

We’re driving into an unknown world. Engineer Ken Gregory estimates that “the total capital cost of electrifying the U.S. economy via wind and solar power is estimated at $290 trillion,” or 13.5 times the 2019 (pre-COVID) GDP. Can we afford this, much less the risk of a coming total energy failure?

Navellier & Associates does not own Ford Motor Co. (F), or General Motors (GM), in managed accounts. Gary Alexander does not own General Motors (GM), or Ford Motor Co. (F) personally.

All content above represents the opinion of Gary Alexander of Navellier & Associates, Inc.

Also In This Issue

A Look Ahead by Louis Navellier

Countdown to the Debt Ceiling Deadline

Income Mail by Bryan Perry

Business Development Companies to Benefit from a Credit Crunch

Growth Mail by Gary Alexander

On James Madison’s Birthday, Let’s Review His Rule Book

Global Mail by Ivan Martchev

Real-Time Inflation Indicators are Quite Weak

Sector Spotlight by Jason Bodner

To Find Big Treasures, You May Need Ballast

View Full Archive

Read Past Issues Here

About The Author

Gary Alexander

SENIOR EDITOR

Gary Alexander has been Senior Writer at Navellier since 2009. He edits Navellier’s weekly Marketmail and writes a weekly Growth Mail column, in which he uses market history to support the case for growth stocks. For the previous 20 years before joining Navellier, he was Senior Executive Editor at InvestorPlace Media (formerly Phillips Publishing), where he worked with several leading investment analysts, including Louis Navellier (since 1997), helping launch Louis Navellier’s Blue Chip Growth and Global Growth newsletters.

Prior to that, Gary edited Wealth Magazine and Gold Newsletter and wrote various investment research reports for Jefferson Financial in New Orleans in the 1980s. He began his financial newsletter career with KCI Communications in 1980, where he served as consulting editor for Personal Finance newsletter while serving as general manager of KCI’s Alexandria House book division. Before that, he covered the economics beat for news magazines. All content of “Growth Mail” represents the opinion of Gary Alexander

Important Disclosures:

Although information in these reports has been obtained from and is based upon sources that Navellier believes to be reliable, Navellier does not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute Navellier’s judgment as of the date the report was created and are subject to change without notice. These reports are for informational purposes only and are not a solicitation for the purchase or sale of a security. Any decision to purchase securities mentioned in these reports must take into account existing public information on such securities or any registered prospectus.To the extent permitted by law, neither Navellier & Associates, Inc., nor any of its affiliates, agents, or service providers assumes any liability or responsibility nor owes any duty of care for any consequences of any person acting or refraining to act in reliance on the information contained in this communication or for any decision based on it.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any securities recommendations made by Navellier. in the future will be profitable or equal the performance of securities made in this report. Dividend payments are not guaranteed. The amount of a dividend payment, if any, can vary over time and issuers may reduce dividends paid on securities in the event of a recession or adverse event affecting a specific industry or issuer.

None of the stock information, data, and company information presented herein constitutes a recommendation by Navellier or a solicitation to buy or sell any securities. Any specific securities identified and described do not represent all of the securities purchased, sold, or recommended for advisory clients. The holdings identified do not represent all of the securities purchased, sold, or recommended for advisory clients and the reader should not assume that investments in the securities identified and discussed were or will be profitable.

Information presented is general information that does not take into account your individual circumstances, financial situation, or needs, nor does it present a personalized recommendation to you. Individual stocks presented may not be suitable for every investor. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. Investment in fixed income securities has the potential for the investment return and principal value of an investment to fluctuate so that an investor’s holdings, when redeemed, may be worth less than their original cost.

One cannot invest directly in an index. Index is unmanaged and index performance does not reflect deduction of fees, expenses, or taxes. Presentation of Index data does not reflect a belief by Navellier that any stock index constitutes an investment alternative to any Navellier equity strategy or is necessarily comparable to such strategies. Among the most important differences between the Indices and Navellier strategies are that the Navellier equity strategies may (1) incur material management fees, (2) concentrate its investments in relatively few stocks, industries, or sectors, (3) have significantly greater trading activity and related costs, and (4) be significantly more or less volatile than the Indices.

ETF Risk: We may invest in exchange traded funds (“ETFs”) and some of our investment strategies are generally fully invested in ETFs. Like traditional mutual funds, ETFs charge asset-based fees, but they generally do not charge initial sales charges or redemption fees and investors typically pay only customary brokerage fees to buy and sell ETF shares. The fees and costs charged by ETFs held in client accounts will not be deducted from the compensation the client pays Navellier. ETF prices can fluctuate up or down, and a client account could lose money investing in an ETF if the prices of the securities owned by the ETF go down. ETFs are subject to additional risks:

- ETF shares may trade above or below their net asset value;

- An active trading market for an ETF’s shares may not develop or be maintained;

- The value of an ETF may be more volatile than the underlying portfolio of securities the ETF is designed to track;

- The cost of owning shares of the ETF may exceed those a client would incur by directly investing in the underlying securities; and

- Trading of an ETF’s shares may be halted if the listing exchange’s officials deem it appropriate, the shares are delisted from the exchange, or the activation of market-wide “circuit breakers” (which are tied to large decreases in stock prices) halts stock trading generally.

Grader Disclosures: Investment in equity strategies involves substantial risk and has the potential for partial or complete loss of funds invested. The sample portfolio and any accompanying charts are for informational purposes only and are not to be construed as a solicitation to buy or sell any financial instrument and should not be relied upon as the sole factor in an investment making decision. As a matter of normal and important disclosures to you, as a potential investor, please consider the following: The performance presented is not based on any actual securities trading, portfolio, or accounts, and the reported performance of the A, B, C, D, and F portfolios (collectively the “model portfolios”) should be considered mere “paper” or pro forma performance results based on Navellier’s research.

Investors evaluating any of Navellier & Associates, Inc.’s, (or its affiliates’) Investment Products must not use any information presented here, including the performance figures of the model portfolios, in their evaluation of any Navellier Investment Products. Navellier Investment Products include the firm’s mutual funds and managed accounts. The model portfolios, charts, and other information presented do not represent actual funded trades and are not actual funded portfolios. There are material differences between Navellier Investment Products’ portfolios and the model portfolios, research, and performance figures presented here. The model portfolios and the research results (1) may contain stocks or ETFs that are illiquid and difficult to trade; (2) may contain stock or ETF holdings materially different from actual funded Navellier Investment Product portfolios; (3) include the reinvestment of all dividends and other earnings, estimated trading costs, commissions, or management fees; and, (4) may not reflect prices obtained in an actual funded Navellier Investment Product portfolio. For these and other reasons, the reported performances of model portfolios do not reflect the performance results of Navellier’s actually funded and traded Investment Products. In most cases, Navellier’s Investment Products have materially lower performance results than the performances of the model portfolios presented.

This report contains statements that are, or may be considered to be, forward-looking statements. All statements that are not historical facts, including statements about our beliefs or expectations, are “forward-looking statements” within the meaning of The U.S. Private Securities Litigation Reform Act of 1995. These statements may be identified by such forward-looking terminology as “expect,” “estimate,” “plan,” “intend,” “believe,” “anticipate,” “may,” “will,” “should,” “could,” “continue,” “project,” or similar statements or variations of such terms. Our forward-looking statements are based on a series of expectations, assumptions, and projections, are not guarantees of future results or performance, and involve substantial risks and uncertainty as described in Form ADV Part 2A of our filing with the Securities and Exchange Commission (SEC), which is available at www.adviserinfo.sec.gov or by requesting a copy by emailing info@navellier.com. All of our forward-looking statements are as of the date of this report only. We can give no assurance that such expectations or forward-looking statements will prove to be correct. Actual results may differ materially. You are urged to carefully consider all such factors.

FEDERAL TAX ADVICE DISCLAIMER: As required by U.S. Treasury Regulations, you are informed that, to the extent this presentation includes any federal tax advice, the presentation is not written by Navellier to be used, and cannot be used, for the purpose of avoiding federal tax penalties. Navellier does not advise on any income tax requirements or issues. Use of any information presented by Navellier is for general information only and does not represent tax advice either express or implied. You are encouraged to seek professional tax advice for income tax questions and assistance.

IMPORTANT NEWSLETTER DISCLOSURE:The hypothetical performance results for investment newsletters that are authored or edited by Louis Navellier, including Louis Navellier’s Growth Investor, Louis Navellier’s Breakthrough Stocks, Louis Navellier’s Accelerated Profits, and Louis Navellier’s Platinum Club, are not based on any actual securities trading, portfolio, or accounts, and the newsletters’ reported hypothetical performances should be considered mere “paper” or proforma hypothetical performance results and are not actual performance of real world trades. Navellier & Associates, Inc. does not have any relation to or affiliation with the owner of these newsletters. There are material differences between Navellier Investment Products’ portfolios and the InvestorPlace Media, LLC newsletter portfolios authored by Louis Navellier. The InvestorPlace Media, LLC newsletters contain hypothetical performance that do not include transaction costs, advisory fees, or other fees a client might incur if actual investments and trades were being made by an investor. As a result, newsletter performance should not be used to evaluate Navellier Investment services which are separate and different from the newsletters. The owner of the newsletters is InvestorPlace Media, LLC and any questions concerning the newsletters, including any newsletter advertising or hypothetical Newsletter performance claims, (which are calculated solely by Investor Place Media and not Navellier) should be referred to InvestorPlace Media, LLC at (800) 718-8289.

Please note that Navellier & Associates and the Navellier Private Client Group are managed completely independent of the newsletters owned and published by InvestorPlace Media, LLC and written and edited by Louis Navellier, and investment performance of the newsletters should in no way be considered indicative of potential future investment performance for any Navellier & Associates separately managed account portfolio. Potential investors should consult with their financial advisor before investing in any Navellier Investment Product.

Navellier claims compliance with Global Investment Performance Standards (GIPS). To receive a complete list and descriptions of Navellier’s composites and/or a presentation that adheres to the GIPS standards, please contact Navellier or click here. It should not be assumed that any securities recommendations made by Navellier & Associates, Inc. in the future will be profitable or equal the performance of securities made in this report.

FactSet Disclosure: Navellier does not independently calculate the statistical information included in the attached report. The calculation and the information are provided by FactSet, a company not related to Navellier. Although information contained in the report has been obtained from FactSet and is based on sources Navellier believes to be reliable, Navellier does not guarantee its accuracy, and it may be incomplete or condensed. The report and the related FactSet sourced information are provided on an “as is” basis. The user assumes the entire risk of any use made of this information. Investors should consider the report as only a single factor in making their investment decision. The report is for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of a security. FactSet sourced information is the exclusive property of FactSet. Without prior written permission of FactSet, this information may not be reproduced, disseminated or used to create any financial products. All indices are unmanaged and performance of the indices include reinvestment of dividends and interest income, unless otherwise noted, are not illustrative of any particular investment and an investment cannot be made in any index. Past performance is no guarantee of future results.